Cloetta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Cloetta's strong brand portfolio and established market presence are key strengths, but they also face challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating the confectionery landscape.

Want the full story behind Cloetta's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cloetta boasts a powerful collection of well-recognized brands, a significant asset in its competitive landscape. Over half of its total sales come from its top ten 'Superbrands,' demonstrating the strength and consumer trust in these key offerings. This brand strength is particularly evident in its primary markets, Northern Europe, where it translates into a distinct advantage and cultivates lasting customer loyalty.

Cloetta holds a leading market position in key European regions, including the Nordics, the Netherlands, and Italy. This strong regional presence translates to substantial market share and well-established distribution channels, facilitating efficient product reach and deep retailer relationships. For instance, in 2023, Cloetta reported net sales of SEK 7,036 million, with a significant portion stemming from these core markets, highlighting their ongoing importance to the company's financial performance.

Cloetta's extensive operating history, dating back to 1862, signifies over 160 years of accumulated expertise in the confectionery sector. This deep-rooted experience translates into a profound understanding of consumer preferences, refined manufacturing techniques, and a demonstrated resilience in navigating market shifts and evolving tastes.

Diversified Product Offering

Cloetta boasts a robust and varied product assortment, encompassing popular categories like chocolate, sugar confectionery, and pastilles. This broad offering mitigates risk by lessening dependence on any solitary product line, enabling the company to appeal to a wider consumer base and enhance its market stability.

The company's diversified product strategy is a significant strength, allowing it to capture different market segments and consumer needs. For example, in 2023, Cloetta reported net sales of SEK 6,969 million, with its confectionery segment, which includes both chocolate and sugar products, forming the core of its revenue.

- Broad Product Categories: Cloetta's portfolio covers chocolate, sugar confectionery, and pastilles, catering to diverse tastes.

- Reduced Market Risk: Diversification limits reliance on single product types, strengthening business resilience.

- Consumer Appeal: The wide range allows Cloetta to meet varied consumer preferences effectively.

- Revenue Contribution: Confectionery products, a key part of the diversified offering, are central to Cloetta's financial performance, as seen in its 2023 net sales of SEK 6,969 million.

Commitment to Sustainability and Responsible Practices

Cloetta's dedication to sustainability is a significant strength, particularly evident in its early adoption of the Corporate Sustainability Reporting Directive (CSRD) in 2024, a full year before it was mandatory. This forward-thinking approach to environmental, social, and governance (ESG) matters not only bolsters its brand image but also resonates strongly with a growing segment of consumers and investors who prioritize responsible business operations. This commitment is increasingly translating into tangible benefits, as companies with strong ESG profiles often see improved access to capital and greater investor loyalty.

Cloetta's brand portfolio is a cornerstone of its success, featuring many well-loved names that drive significant sales. The company's top ten 'Superbrands' account for over half of its total revenue, underscoring their market penetration and consumer loyalty, particularly within its core Northern European markets.

The company holds leading positions in several key European markets, including the Nordics, Netherlands, and Italy. This strong regional presence is supported by efficient distribution networks and established retailer relationships, contributing to its robust market share.

Cloetta's extensive history, spanning over 160 years, has cultivated deep expertise in the confectionery industry. This long-standing presence allows for a nuanced understanding of consumer trends and refined operational capabilities.

A diverse product range, covering chocolate, sugar confectionery, and pastilles, minimizes reliance on any single category. This broad offering enhances market stability and appeals to a wider customer base, as evidenced by its 2023 net sales of SEK 6,969 million, largely driven by its confectionery segment.

Cloetta's proactive approach to sustainability, including early adoption of the CSRD in 2024, enhances its brand reputation and appeals to ESG-conscious consumers and investors.

| Metric | 2023 Value (SEK million) | Significance |

|---|---|---|

| Net Sales | 7,036 | Indicates overall market performance and revenue generation. |

| Top Ten 'Superbrands' Contribution | >50% of total sales | Highlights the strength and consumer trust in key brands. |

| Confectionery Segment Sales | Core contributor to SEK 6,969 million net sales | Demonstrates the importance of its diversified product strategy. |

What is included in the product

Analyzes Cloetta’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Cloetta's strategic challenges and opportunities.

Weaknesses

Cloetta's reliance on commodities like cocoa and sugar makes it susceptible to price swings. For instance, cocoa prices surged by over 100% in early 2024, reaching record highs. This volatility directly affects Cloetta's cost of goods sold, potentially squeezing profit margins if these increases cannot be passed on to consumers.

Cloetta's significant reliance on traditional chocolate and sugar confectionery, while historically a strength, presents a notable weakness. This segment, which formed the bulk of its revenue, is increasingly challenged by growing consumer health consciousness and a demand for healthier alternatives. For instance, the global confectionery market, while robust, sees a rising trend in reduced-sugar and plant-based options, areas where Cloetta's core offerings may not fully align.

Cloetta's significant weakness lies in its limited market penetration within high-growth regions. Despite its leadership in established European markets, the company's presence in the United States, a major consumer market, is notably small, representing only 3% of its total turnover as of early 2024. This under-representation signifies a substantial missed opportunity for expansion and revenue diversification.

Ongoing Organizational Restructuring

Cloetta's ongoing organizational restructuring, including the planned reduction of up to 100 positions across Europe by the end of 2025, presents a significant weakness. This process, while intended to boost efficiency, can introduce temporary operational disruptions and negatively affect employee morale during the transition period. Furthermore, these changes are likely to incur one-time costs associated with severance packages and integration efforts before any anticipated savings are realized.

The restructuring initiative, targeting efficiency gains, could lead to:

- Short-term operational inefficiencies as teams adapt to new structures and potential staff reductions.

- A decline in employee morale and productivity due to uncertainty and the impact of job cuts.

- One-time restructuring costs that may temporarily impact financial performance before long-term benefits materialize.

Uncertainty Regarding Manufacturing Strategy

Cloetta’s manufacturing strategy faces uncertainty following the September 2024 decision to pause its greenfield investment. This pause indicates a potential need to re-evaluate its entire production setup, which could lead to delays in expanding capacity or optimizing costs.

The reassessment of the manufacturing structure suggests that current production capabilities might not be as efficient or strategically aligned as initially planned. This could impact Cloetta's ability to meet future demand effectively or maintain competitive production costs, a critical factor in the confectionery market.

Specifically, the company’s ongoing review of its manufacturing footprint, announced in late 2024, highlights potential challenges in its existing operational model. This strategic pause could translate into higher capital expenditure or longer lead times for new product introductions if not resolved efficiently.

- Manufacturing Reassessment: Greenfield investment put on hold in September 2024.

- Strategic Uncertainty: Potential inefficiencies driving a review of the manufacturing structure.

- Future Impact: Possible delays in capacity expansion and cost-effectiveness improvements.

Cloetta's vulnerability to commodity price fluctuations, particularly for cocoa and sugar, poses a significant risk. For example, cocoa prices saw a dramatic increase of over 100% by early 2024, reaching unprecedented levels. This volatility directly impacts Cloetta's cost of goods, potentially eroding profit margins if these rising costs cannot be effectively passed on to consumers.

Preview Before You Purchase

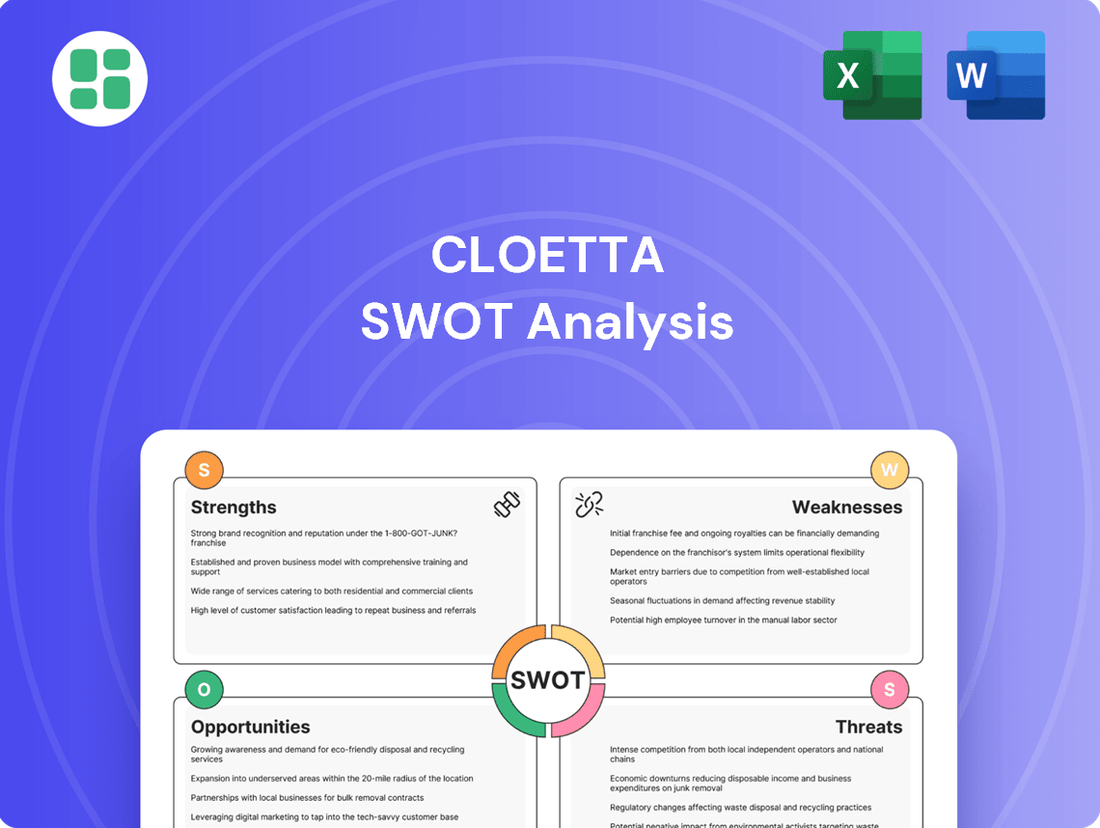

Cloetta SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can see the detailed breakdown of Cloetta's Strengths, Weaknesses, Opportunities, and Threats right here. Purchase now to access the complete, in-depth analysis.

Opportunities

Cloetta has a clear opportunity to expand into high-growth geographic markets, with a particular focus on Germany, the UK, and North America, especially the United States. The US candy market alone is substantial, representing the largest globally, offering significant potential for new revenue. By leveraging its strong Swedish heritage and the established 'Candyking' concept, Cloetta can tap into these lucrative markets.

Consumers are increasingly seeking confectionery options that cater to health and wellness, driving a significant shift in the market. This includes a growing preference for products with lower sugar content, natural sweeteners, and plant-based ingredients. For instance, the global sugar-free confectionery market was valued at approximately USD 26.5 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2030, indicating substantial consumer interest.

Cloetta has a prime opportunity to capitalize on this trend by developing and promoting healthier alternatives within its product portfolio. By innovating with reduced sugar formulations, incorporating natural ingredients, and exploring plant-based confectionery, the company can attract a broader consumer base. This strategic alignment with evolving consumer demands for functional and healthier treats can lead to increased market share and brand loyalty in the competitive confectionery landscape.

The e-commerce boom offers Cloetta a prime chance to broaden its reach. In 2024, the global online grocery market is projected to hit $1.5 trillion, a testament to shifting consumer habits. By boosting its digital presence and online sales platforms, Cloetta can tap into this expanding market, reaching more consumers directly and increasing brand loyalty through personalized digital experiences.

Strategic Acquisitions and Partnerships

Cloetta's updated financial targets reveal a strategic openness to increasing its net debt ratio to pursue attractive merger and acquisition (M&A) opportunities. This indicates a proactive approach to inorganic growth, aiming to bolster market position and expand its portfolio through strategic integration.

Partnerships offer another significant avenue for growth. The recent global agreement with IKEA, for instance, allows Cloetta to expand its reach and leverage shared values to tap into new customer segments and markets. These collaborations are crucial for extending brand presence and operational capabilities.

Key opportunities in this area include:

- Targeted M&A: Pursuing acquisitions that align with strategic goals, potentially in emerging markets or complementary product categories, to accelerate growth and market share.

- Strategic Alliances: Forging partnerships with retailers and other consumer-facing brands to enhance distribution networks and co-create value, similar to the IKEA collaboration.

- Synergistic Integration: Focusing on acquiring or partnering with companies that offer significant operational or market synergies, enabling cost efficiencies and revenue enhancement post-integration.

Product Innovation in Flavors and Customization

Consumers are actively seeking out novel and personalized taste experiences, driving demand for unique and exotic flavors in the confectionery market. This trend presents a significant opportunity for Cloetta to innovate.

Cloetta can leverage this by introducing a range of new, exciting flavors, potentially drawing inspiration from global culinary trends. Furthermore, offering customization options, such as allowing consumers to create their own candy mixes or personalize packaging, can foster deeper engagement and brand loyalty.

The confectionery market in Europe, a key region for Cloetta, saw steady growth leading up to 2024, with consumer spending on treats remaining robust. For instance, the European confectionery market was valued at approximately €45 billion in 2023 and is projected to continue its upward trajectory, with innovation being a key growth driver.

- Novel Flavor Introduction: Launching limited-edition flavors inspired by global cuisines or seasonal ingredients.

- Customization Platforms: Developing online tools or in-store experiences for personalized candy creation.

- Format Exploration: Experimenting with new confectionery formats that offer unique textures or consumption methods.

- Partnerships: Collaborating with food influencers or brands to co-create unique flavor profiles.

Cloetta has a clear opportunity to expand into high-growth geographic markets, with a particular focus on Germany, the UK, and North America, especially the United States. The US candy market alone is substantial, representing the largest globally, offering significant potential for new revenue. By leveraging its strong Swedish heritage and the established 'Candyking' concept, Cloetta can tap into these lucrative markets.

Consumers are increasingly seeking healthier confectionery options, a trend projected to continue. The global sugar-free confectionery market was valued at approximately USD 26.5 billion in 2023 and is expected to grow at a CAGR of 5.8% through 2030. Cloetta can capitalize on this by developing and promoting reduced-sugar and plant-based alternatives.

The booming e-commerce sector presents a significant avenue for growth. The global online grocery market is projected to reach $1.5 trillion in 2024, indicating a substantial shift in consumer purchasing habits. Enhancing its digital presence allows Cloetta to reach more consumers directly and foster brand loyalty through personalized online experiences.

Cloetta's updated financial targets signal a willingness to increase its net debt ratio to pursue attractive merger and acquisition (M&A) opportunities, indicating a strategy for inorganic growth. Furthermore, strategic alliances, such as the recent collaboration with IKEA, offer avenues to expand reach and tap into new customer segments, leveraging shared values and enhancing brand presence.

Threats

Cloetta faces a significant threat from escalating regulatory pressure, particularly the widespread adoption of sugar taxes. By 2025, several countries are expected to have sugar taxes reaching up to 20% on confectionery products. This trend directly impacts pricing strategies and consumer purchasing behavior, potentially leading to reduced sales volumes and lower profit margins for companies like Cloetta.

Consumers are increasingly prioritizing health and wellness, leading to a notable decrease in the demand for sugary and high-fat treats. This fundamental shift in dietary habits presents a significant long-term challenge for companies like Cloetta, whose core business relies on traditional confectionery.

For instance, a 2024 report indicated that 65% of consumers globally are actively seeking healthier food options, which directly impacts the confectionery market. This trend suggests a need for Cloetta to adapt its product portfolio to align with evolving consumer preferences, potentially by offering reduced-sugar or alternative ingredient options to mitigate this threat.

Persistent and unpredictable fluctuations in the prices of key ingredients like cocoa and sugar, driven by factors such as weather patterns and geopolitical events, represent a continuous threat to Cloetta. For instance, cocoa futures on the ICE exchange saw significant spikes in early 2024, reaching record highs, directly impacting confectionery production costs. This volatility can lead to higher production expenses, potentially squeezing profit margins, and necessitate frequent price adjustments for consumers.

Intense Competition in the Confectionery Market

The confectionery market is a crowded space, with giants like Mars and Nestlé alongside nimble newcomers constantly vying for consumer attention. This intense rivalry puts significant pressure on companies like Cloetta, often forcing them into price wars and escalating marketing budgets. For instance, the global confectionery market was valued at approximately USD 210 billion in 2023 and is projected to grow, but this growth is contested.

This competitive landscape directly impacts Cloetta's ability to maintain and grow its market share and profitability.

- Global confectionery market valued at around USD 210 billion in 2023.

- Key competitors include Mars, Nestlé, Mondelez, and Ferrero.

- Increased marketing expenditure is a common response to competitive pressures.

- Price sensitivity among consumers can lead to margin erosion.

Economic Pressures and Inflation Impact on Consumer Spending

Ongoing economic pressures, particularly persistent inflation, are expected to continue to squeeze household budgets throughout 2024 and into 2025. This trend directly impacts consumer spending, potentially leading individuals to reduce discretionary purchases, including confectionery items. For instance, if inflation continues to outpace wage growth as it did in many regions during 2023, consumers might prioritize essential goods over treats.

This shift in consumer behavior can suppress sales volumes for companies like Cloetta. Furthermore, it may drive a migration towards more value-oriented or private-label options, directly challenging the sales of premium confectionery products. For example, a recent report indicated that in early 2024, a significant percentage of consumers were actively seeking out promotions and discounts when purchasing non-essential food items.

- Inflationary Headwinds: Continued high inflation in 2024-2025 could erode disposable income, making discretionary spending on confectionery less likely.

- Value-Seeking Consumers: Shoppers may increasingly opt for lower-priced alternatives or private-label brands, impacting Cloetta's market share in premium segments.

- Reduced Sales Volumes: Economic uncertainty and reduced purchasing power can lead to a general decline in the quantity of confectionery sold.

Cloetta faces significant headwinds from evolving consumer preferences towards healthier options, with a notable portion of consumers actively seeking reduced-sugar or alternative ingredient products. This trend is amplified by increasing regulatory pressure, including the potential for wider adoption of sugar taxes, which could impact pricing and sales volumes. Additionally, volatile ingredient costs, particularly for cocoa and sugar, present a continuous challenge to maintaining profitability, as seen with record-high cocoa futures in early 2024.

| Threat Factor | Description | Impact on Cloetta | Relevant Data/Trend |

|---|---|---|---|

| Health & Wellness Shift | Growing consumer demand for healthier food options. | Reduced demand for traditional confectionery. | 65% of global consumers sought healthier options in 2024. |

| Regulatory Pressure | Increased implementation of sugar taxes. | Higher pricing, potential sales volume decrease. | Sugar taxes up to 20% expected in several countries by 2025. |

| Ingredient Price Volatility | Fluctuations in cocoa and sugar prices. | Increased production costs, squeezed profit margins. | Cocoa futures reached record highs in early 2024. |

| Intense Competition | Presence of major global players and new entrants. | Pressure on pricing, increased marketing spend. | Global confectionery market valued at ~$210 billion in 2023. |

| Economic Pressures | Persistent inflation impacting disposable income. | Reduced discretionary spending on treats. | Inflation outpaced wage growth in many regions during 2023. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Cloetta's official financial reports, comprehensive market research, and valuable expert commentary to provide a thorough and accurate SWOT assessment.