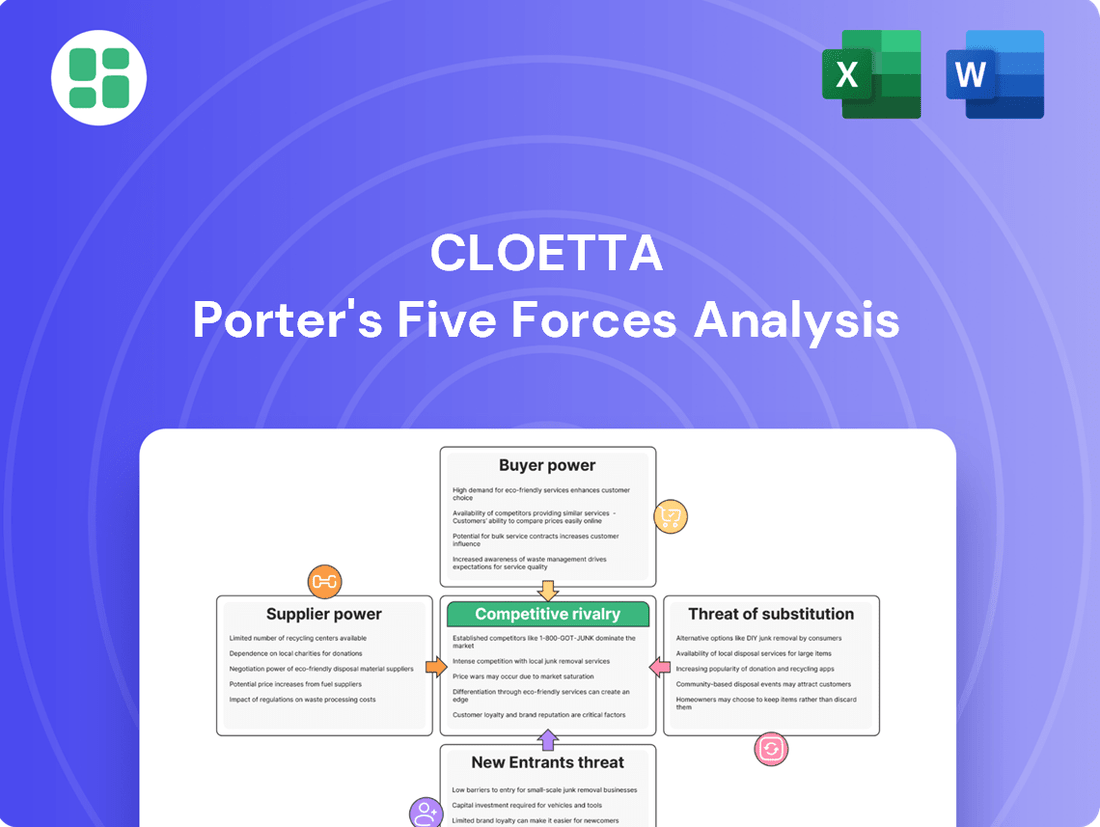

Cloetta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Cloetta's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of buyers. Understanding these dynamics is crucial for any stakeholder looking to navigate the confectionery market.

The complete report reveals the real forces shaping Cloetta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The confectionery industry, including companies like Cloetta, relies heavily on agricultural commodities such as cocoa, sugar, and dairy. These raw materials are prone to significant price swings. For instance, cocoa prices experienced historic highs in 2024, a trend that directly squeezes the profit margins of chocolate producers.

This inherent volatility in raw material prices creates a substantial bargaining power for suppliers. When commodity prices surge, as seen with cocoa in 2024, it directly increases Cloetta's production costs. This vulnerability means suppliers can often dictate higher prices, impacting Cloetta's overall profitability and financial flexibility.

While sugar and other basic commodities might have many suppliers, Cloetta, like many confectioners, may rely on a concentrated group for specialized ingredients. For instance, certain high-quality cocoa beans or unique flavorings could be sourced from a handful of producers. This concentration means these suppliers hold significant sway, potentially dictating terms and pricing for Cloetta.

Global events like climate change and geopolitical tensions are significantly impacting agricultural supply chains. For instance, droughts in key cocoa-producing regions, like West Africa, have led to reduced yields. In 2024, cocoa prices surged to record highs, exceeding $10,000 per metric ton, directly increasing raw material costs for confectionery companies like Cloetta and strengthening supplier leverage.

Switching Costs for Raw Materials

Switching suppliers for core ingredients can indeed be a costly endeavor for a company like Cloetta. These costs often stem from the need to reformulate products, which involves extensive research and development, as well as rigorous re-testing to ensure quality and safety standards are met. Furthermore, re-certifying production processes with new raw materials adds another layer of expense and time. In 2024, the global food ingredient market saw significant price volatility, with some key raw materials experiencing increases of up to 15-20% due to geopolitical factors and climate-related supply disruptions, making the decision to switch even more scrutinized.

These substantial switching costs act as a barrier, potentially giving existing suppliers more leverage. While Cloetta actively works to build a resilient supply chain, the financial and operational implications of changing a long-term ingredient provider can deter them from making such shifts readily. This reliance on established relationships, driven by the desire for consistency and the avoidance of these switching costs, can empower suppliers.

The imperative to maintain consistent product quality and taste is a critical factor that binds Cloetta to its established supplier relationships. Consumers expect the familiar flavors and textures of their favorite confectionery products, and any deviation can negatively impact brand loyalty and sales. For instance, a slight change in the cocoa bean sourcing or sugar refining process could alter the taste profile of a popular chocolate bar, leading to customer dissatisfaction. This focus on product integrity reinforces the bargaining power of suppliers who can reliably deliver the required specifications.

- High Reformulation Costs: Re-developing recipes and conducting extensive sensory evaluations can cost tens of thousands of euros per product.

- Quality and Safety Re-certification: New supplier materials require rigorous testing, potentially adding weeks or months to product launch timelines.

- Production Process Adjustments: Adapting manufacturing lines for new ingredients can involve capital expenditure and retraining of staff.

- Brand Consistency: Maintaining a consistent taste and quality across all products is paramount for consumer trust and brand equity.

Supplier's Ability to Forward Integrate

Suppliers' ability to forward integrate, meaning they could start manufacturing confectionery themselves, presents a potential challenge. If a key ingredient supplier were to enter Cloetta's market, they could potentially bypass Cloetta and sell directly to retailers or even consumers. This would fundamentally alter the supply chain and increase the supplier's leverage.

While this threat is theoretically present, particularly for specialized ingredient processors, it's generally considered less likely in the confectionery sector. The significant capital investment required for manufacturing facilities, coupled with the substantial effort and cost involved in building a recognized brand and distribution network, acts as a considerable deterrent for most suppliers. For instance, establishing a new confectionery brand capable of competing with established players like Cloetta, which has brands like Läkerol and Kex, demands extensive marketing budgets and long-term commitment.

- Supplier Forward Integration Threat: Suppliers entering confectionery manufacturing to bypass companies like Cloetta and sell directly to retailers or consumers.

- Mitigating Factors: High capital intensity and brand-building requirements in confectionery production generally limit this threat.

- Industry Realities: While theoretically possible for ingredient processors, the practicalities of entering a competitive, brand-driven market are substantial.

The bargaining power of suppliers for Cloetta is significant, driven by the concentration of key ingredient sources and the high costs associated with switching. For example, cocoa prices in 2024 reached unprecedented levels, exceeding $10,000 per metric ton, directly increasing raw material expenses for confectionery manufacturers and bolstering supplier leverage. This reliance on a limited number of suppliers for specialized ingredients, such as specific cocoa bean varieties, means these providers can often dictate terms and pricing, impacting Cloetta's profitability.

| Factor | Impact on Cloetta | 2024 Data/Example |

|---|---|---|

| Commodity Price Volatility | Increased production costs, reduced profit margins | Cocoa prices surged over 100% in early 2024 |

| Supplier Concentration | Limited alternatives for specialized ingredients | Reliance on a few key cocoa bean producers |

| Switching Costs | High reformulation, re-certification, and process adjustment expenses | Potential 15-20% increase in raw material costs for some ingredients in 2024 |

| Brand Consistency Needs | Necessity to maintain established ingredient quality and taste profiles | Consumer dissatisfaction with altered product flavors can impact sales |

What is included in the product

Analyzes the competitive intensity within the confectionery market for Cloetta, detailing the threat of new entrants, bargaining power of buyers and suppliers, and the impact of substitutes and existing rivals.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model for Cloetta.

Customers Bargaining Power

Consumers in the confectionery sector are becoming more attuned to pricing, particularly when economic conditions tighten. In 2024, with inflation impacting household budgets, many shoppers are actively seeking out more affordable options or simply cutting back on discretionary purchases like sweets. This heightened price sensitivity directly translates into increased bargaining power for customers.

The sheer volume of available alternatives in the confectionery market further amplifies this customer power. Shoppers can easily switch between brands or opt for private-label products if Cloetta's pricing is perceived as too high. For instance, the market share of private-label confectionery has seen steady growth, indicating consumers' willingness to explore less premium, more budget-friendly choices.

Consumers are increasingly seeking confectionery options that align with health and sustainability values. This includes a strong preference for reduced-sugar, natural, organic, and plant-based products. For instance, the global healthy snacks market, which encompasses healthier confectionery, was projected to reach over $150 billion by 2024, indicating a significant and growing demand.

This evolving consumer mindset grants them considerable bargaining power. They can effectively demand that companies like Cloetta offer specific product attributes, such as transparent ingredient lists and ethically sourced materials. This pressure compels manufacturers to invest in research and development to adapt their product portfolios and meet these rising expectations.

Cloetta's main customers are major retailers such as supermarkets and hypermarkets, especially in its key markets like the Nordic region, Netherlands, and Italy. In 2024, the retail landscape continued to show a trend towards consolidation, with larger chains acquiring smaller ones, thereby increasing their market share and collective bargaining might.

This growing concentration among retailers means they possess significant purchasing power. Consequently, these consolidated entities are better positioned to negotiate more favorable pricing, demand extensive promotional support, and secure prime shelf space, directly impacting Cloetta's margins and market access.

Brand Loyalty vs. Private Labels

Cloetta's brand loyalty faces a significant challenge from private label offerings. Retailers increasingly push their own confectionery brands, often at lower price points. This forces Cloetta to invest heavily in marketing and maintain competitive pricing to prevent customer migration.

For instance, in 2023, private label penetration in the UK confectionery market reached approximately 25%, a figure that continues to grow. This trend directly impacts Cloetta by increasing price sensitivity among consumers and potentially eroding market share if brand differentiation isn't effectively communicated.

- Brand Strength: Cloetta's established brands like Kexchoklad and Lakerol are key assets, but their dominance can be threatened by aggressive private label strategies.

- Price Sensitivity: The availability of cheaper private label alternatives makes consumers more price-conscious, pressuring Cloetta's profit margins.

- Retailer Power: Retailers can leverage their private labels to gain shelf space and customer attention, diminishing the bargaining power of branded manufacturers like Cloetta.

- Marketing Investment: To combat this, Cloetta must sustain substantial marketing expenditures to reinforce brand value and justify premium pricing.

Influence of E-commerce and Digital Platforms

The rise of e-commerce and digital platforms significantly amplifies customer bargaining power in the confectionery sector. Consumers now have unprecedented access to a vast array of products and can effortlessly compare prices across numerous retailers. This heightened transparency means Cloetta must remain competitive on pricing and product availability to retain customers.

In 2024, the global e-commerce market for food and beverages, including confectionery, continued its robust growth, with online sales becoming an increasingly dominant channel. This shift means customers can readily identify the cheapest options or niche products not readily available in traditional brick-and-mortar stores. Cloetta's ability to engage customers directly online and offer competitive digital pricing is crucial.

- Increased Price Transparency: Online comparison tools allow consumers to easily find the lowest prices for specific confectionery items.

- Broader Product Access: E-commerce opens up a wider selection of brands and specialty products than typically found in physical stores.

- Convenience of Shopping: Digital platforms offer 24/7 purchasing convenience, further empowering consumer choice.

- Direct-to-Consumer (DTC) Channels: Companies like Cloetta are increasingly investing in their own online sales channels to capture more of the value chain and build direct customer relationships.

Customers wield considerable power in the confectionery market due to increased price sensitivity, the proliferation of alternatives including private labels, and a growing demand for health and sustainability attributes. This forces companies like Cloetta to focus on competitive pricing and product differentiation.

Major retailers, Cloetta's primary customers, are consolidating, thereby amplifying their collective bargaining strength. This allows them to negotiate better terms, demand promotional support, and secure prime shelf space, directly impacting Cloetta's profitability.

The digital marketplace further empowers consumers by offering unparalleled price transparency and access to a wider product selection. Cloetta must therefore maintain competitive online pricing and availability to retain its customer base.

| Factor | Impact on Cloetta | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Increased pressure on margins | Inflationary environment leads to greater consumer focus on affordability. |

| Availability of Alternatives | Need for strong brand differentiation | Growing market share of private labels, e.g., ~25% in UK confectionery (2023). |

| Retailer Consolidation | Enhanced retailer negotiation power | Larger retail chains gain more influence over pricing and shelf placement. |

| E-commerce Growth | Need for competitive online presence | Online sales channels for food and beverages continue to expand rapidly. |

Same Document Delivered

Cloetta Porter's Five Forces Analysis

This preview showcases the complete Cloetta Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the confectionery industry. The document you see here is precisely what you will receive instantly after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The global confectionery market is incredibly crowded, with big international companies and many smaller, local businesses all vying for attention. This means Cloetta is up against some serious players.

Companies like Mondelēz, Nestlé, Mars, Ferrero, and Haribo are major forces in the confectionery world and operate in the same markets as Cloetta. Their established brand recognition and vast distribution networks present a significant challenge.

In 2024, the confectionery sector continues to see this intense rivalry. For instance, the global confectionery market size was estimated to be around $230 billion in 2023, with projections showing continued growth, underscoring the high stakes and the need for constant effort to capture market share.

Competitive rivalry in the confectionery sector is fierce, fueled by a relentless drive for product differentiation. Companies constantly innovate with new flavors, textures, formats, and even functional benefits to grab consumer attention. This means brands are always rolling out new products and special limited editions, pushing players like Cloetta to maintain a strong research and development pipeline and sharp marketing.

Cloetta's own strategic focus highlights this intensity. The company is prioritizing accelerating its new product development cycles and boosting the effectiveness of its marketing efforts to stay ahead. For instance, in 2023, Cloetta reported a net sales increase of 8% in local currencies, partly driven by successful new product introductions and strong marketing campaigns, demonstrating the direct impact of innovation pace on market performance.

The global confectionery market is expected to see continued growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2027. However, Cloetta's established European markets, such as Sweden and Denmark, are considered mature. In these regions, growth rates are more modest, often in the low single digits, meaning competition is fierce as companies fight for existing market share rather than capitalizing on rapid expansion.

This mature market environment intensifies competitive rivalry. Companies like Cloetta must differentiate themselves through product innovation, marketing, and efficiency to capture or retain customers. For instance, during 2024, intense promotional activities were observed across major European retailers, highlighting the pressure on pricing and margins in these developed markets.

To counter this, Cloetta is strategically targeting expansion into less saturated markets like Germany, the UK, and North America. These territories often offer higher growth potential, allowing the company to pursue market share gains in a more dynamic environment. This geographic diversification is a key strategy to offset the slower growth and heightened competition in its traditional strongholds.

High Fixed Costs and Capacity Utilization

The confectionery industry, including players like Cloetta, is characterized by substantial fixed costs. These are tied to maintaining advanced production facilities, specialized machinery, and extensive distribution logistics. For instance, the capital expenditure for a modern confectionery plant can run into tens of millions of Euros, requiring significant upfront investment.

To offset these high fixed costs, companies aim for high capacity utilization. When production capacity exceeds demand, this can trigger intense price competition as firms attempt to cover their overheads. This dynamic often leads to promotional activities and price cuts, especially during periods of market oversupply.

- High Capital Investment: Setting up confectionery manufacturing requires significant investment in specialized equipment and infrastructure.

- Efficiency Drive: Companies like Cloetta focus on optimizing their operating structures and supply chains to achieve better cost absorption through high capacity utilization.

- Pricing Pressure: Overcapacity in the market can force companies to engage in aggressive pricing to maintain sales volumes and cover fixed expenses.

Brand Strength and Marketing Investment

Cloetta benefits from a strong stable of well-recognized consumer brands, a key factor in building customer loyalty and securing its market standing. This brand equity acts as a significant barrier to entry for new players and strengthens its competitive position against existing rivals.

However, the confectionery market is characterized by substantial marketing expenditures from competitors, especially for their flagship products or 'superbrands'. For instance, in 2024, major players like Mondelez and Mars continued to allocate significant portions of their revenue to advertising and promotional activities, aiming to capture consumer attention and preference.

- Cloetta's Brand Portfolio: Strong brands like Kexchoklad and Malaco drive consumer loyalty.

- Competitor Marketing Spend: Major rivals in 2024 invested heavily in "superbrand" promotion, with figures often reaching hundreds of millions of Euros across the industry.

- Sustained Investment Need: Cloetta must maintain or increase its marketing investment to counter competitor efforts and preserve its market share.

The confectionery market is highly competitive, with numerous global and local players. This intense rivalry means companies like Cloetta must constantly innovate and market effectively to stand out. In 2024, the global confectionery market was valued at approximately $230 billion, highlighting the significant scale of competition.

Major competitors such as Mondelēz, Nestlé, and Mars possess strong brand recognition and extensive distribution, posing a constant challenge. Cloetta's strategy involves accelerating new product development and enhancing marketing, as evidenced by its 8% net sales increase in local currencies in 2023, driven by successful product launches.

Mature European markets, where Cloetta has a strong presence, experience even fiercer competition due to slower growth rates, often in the low single digits. This forces companies to focus on differentiation through innovation and promotions, as seen in widespread retail promotional activities throughout 2024.

| Key Competitors | Market Share (Approx. 2024) | Key Strategies |

| Mondelēz International | ~10-12% | Brand portfolio strength, innovation, global reach |

| Nestlé | ~8-10% | Diversified product offerings, strong R&D, emerging market focus |

| Mars, Incorporated | ~8-10% | Iconic brands, significant marketing investment, petcare synergy |

| Ferrero Group | ~5-7% | Premiumization, strong seasonal offerings, strategic acquisitions |

| Cloetta | ~1-2% (Global) | Focus on core European markets, new product development, targeted expansion |

SSubstitutes Threaten

Consumers' desire for quick, convenient indulgence isn't limited to confectionery. They can easily reach for alternatives like savory snacks, baked goods, or even fresh fruit, all of which vie for the same snacking moments and consumer dollars. This broad availability means that a significant portion of the global snack market, valued at over $600 billion in 2024, is a potential substitute for traditional sweets.

The growing consumer demand for healthier food alternatives presents a significant threat of substitutes for confectionery products. Consumers are increasingly choosing options like fresh fruits, nuts, and yogurt, driven by rising health consciousness. This shift means fewer consumers might reach for traditional sugary treats.

This trend is reflected in market data. For instance, the global healthy snacks market was valued at approximately $114.7 billion in 2023 and is projected to grow substantially. This indicates a substantial portion of consumer spending is moving away from traditional confectionery towards these healthier substitutes, directly impacting sales potential for companies like Cloetta.

The growing trend of functional confectionery presents a significant threat of substitutes for traditional candy makers like Cloetta. These products, which might be sugar-free, fortified with vitamins, or even contain ingredients purported to boost mood, appeal to consumers seeking health benefits alongside their treats. For instance, the global functional food market, which includes confectionery, was projected to reach over $300 billion by 2024, indicating a substantial shift in consumer preferences.

Beverages and Other Indulgences

The threat of substitutes for confectionery is significant, as consumers often view beverages like specialty coffees or juices, and other indulgent treats such as ice cream or desserts, as alternatives. These products compete directly for a share of the consumer's discretionary spending allocated to treats and moments of indulgence. For instance, in 2024, the global coffee market was valued at approximately $120 billion, showcasing a substantial alternative for consumers seeking a treat. Similarly, the global ice cream market reached an estimated $80 billion in 2023, highlighting another strong substitute category.

The wide array of available options means consumers can readily shift their spending from confectionery to these other indulgent categories. This ease of substitution is amplified by the fact that both confectionery and these alternative treats often satisfy a similar psychological need for a reward or a pleasant sensory experience. The perceived value and immediate gratification offered by a premium coffee or a decadent dessert can easily sway a consumer's choice away from a chocolate bar, especially when budgets are tight.

Consider the following:

- Beverage Alternatives: Specialty coffees, teas, and premium juices offer a different, yet comparable, indulgence experience.

- Dessert & Ice Cream Competition: Ice cream, cakes, and pastries directly vie for the same consumer treat budget.

- Discretionary Spending Reallocation: Consumers can easily shift their spending from confectionery to other indulgences based on price, availability, or changing preferences.

- Market Size Comparison: The substantial global markets for coffee (est. $120 billion in 2024) and ice cream (est. $80 billion in 2023) underscore the significant competitive pressure from substitutes.

Changing Dietary Trends and Preferences

Broader dietary shifts, like the increasing popularity of plant-based or vegan lifestyles, can steer consumers away from conventional sweets that might include dairy or other animal products. This trend requires companies like Cloetta to actively reformulate and innovate their product lines to align with these evolving consumer tastes.

For instance, the global plant-based food market was valued at approximately USD 27.0 billion in 2023 and is projected to grow significantly. Cloetta has responded to this by introducing vegan confectionery options, aiming to capture a share of this expanding market segment and mitigate the threat of substitutes.

- Dietary Trend Impact: Growth in veganism and plant-based diets directly reduces demand for traditional confectionery.

- Innovation Necessity: Companies must innovate with new formulations and ingredients to cater to these changing preferences.

- Cloetta's Response: Introduction of vegan product lines is a strategic move to address this substitution threat.

- Market Context: The substantial growth of the plant-based market underscores the importance of adapting to these dietary trends.

The threat of substitutes for confectionery is substantial, encompassing a wide range of products that satisfy similar consumer desires for indulgence and convenience. Consumers can easily opt for savory snacks, baked goods, or even fresh fruit, all competing for the same snacking occasions and discretionary spending. The global snack market, exceeding $600 billion in 2024, highlights the vastness of these alternative options.

Furthermore, growing health consciousness drives consumers towards healthier alternatives like fruits, nuts, and yogurt, directly impacting traditional confectionery sales. The healthy snacks market, valued at approximately $114.7 billion in 2023, demonstrates this significant shift. Even functional confectionery, offering added health benefits, poses a substitute threat, with the functional food market projected to surpass $300 billion by 2024.

Beverages like specialty coffees and juices, along with desserts and ice cream, also represent strong substitutes. The coffee market alone was valued at around $120 billion in 2024, while the ice cream market reached an estimated $80 billion in 2023. These categories compete for consumer indulgence budgets, offering comparable sensory experiences and immediate gratification.

| Substitute Category | Estimated Market Value (USD Billion) | Year |

|---|---|---|

| Global Snack Market | > 600 | 2024 |

| Healthy Snacks Market | 114.7 | 2023 |

| Functional Food Market | > 300 | 2024 (projected) |

| Global Coffee Market | ~ 120 | 2024 |

| Global Ice Cream Market | ~ 80 | 2023 |

Entrants Threaten

Establishing a new confectionery company aiming for significant market share, similar to Cloetta's operational scale, demands substantial upfront capital. This includes investment in advanced production machinery, state-of-the-art manufacturing plants, and the development of an extensive distribution network. For instance, setting up a modern confectionery production line can easily cost millions of euros, a considerable hurdle for aspiring competitors.

The financial barrier presented by high initial investment makes it challenging for many potential new entrants to enter the market and compete effectively. Beyond production, building a comprehensive supply chain, including sourcing raw materials and establishing logistics for widespread product delivery, represents another significant financial undertaking.

Cloetta's significant advantage lies in its strong portfolio of well-established consumer brands, such as Kexchoklad and Lakerol, which have cultivated deep loyalty over decades in its primary markets. This brand equity presents a substantial barrier for any potential new entrants aiming to gain market share.

Newcomers must invest heavily in marketing and product development to even begin to challenge Cloetta's established brand recognition and consumer trust. For instance, in 2023, Cloetta's marketing investments were a key component of its strategy to maintain and grow its market position, demonstrating the ongoing commitment required in this competitive landscape.

Securing shelf space in dominant retail outlets, like major supermarket chains, presents a formidable barrier for newcomers. These established players often prioritize suppliers with a history of reliability and efficient logistics, making it tough for new brands to break in. For instance, in 2024, the top five grocery retailers in the US controlled over 60% of the market share, illustrating the concentration of distribution power.

Regulatory Compliance and Food Safety Standards

The confectionery sector faces significant hurdles for newcomers due to rigorous food safety regulations and evolving ethical sourcing mandates. For instance, the EU Deforestation Regulation (EUDR) and the upcoming Corporate Sustainability Due Diligence Directive (CSDDD) impose substantial compliance burdens, requiring extensive traceability and due diligence throughout the supply chain. These complex requirements translate into considerable upfront investment and ongoing operational costs, acting as a strong deterrent for potential new entrants looking to establish a foothold in the market.

New entrants must navigate a landscape of stringent labeling laws, which demand detailed ingredient disclosure, allergen information, and nutritional facts. Furthermore, the increasing consumer demand for transparency regarding sustainability and ethical practices, such as fair labor and environmentally responsible production, adds another layer of complexity. Companies failing to meet these evolving standards risk reputational damage and market exclusion, making the initial investment in compliance a critical, albeit costly, factor.

The financial implications of adhering to these regulations are substantial. For example, establishing robust supply chain monitoring systems to comply with the EUDR can cost millions of Euros, depending on the scale of operations. These costs, coupled with the need for specialized expertise in regulatory affairs and quality assurance, create a high barrier to entry.

- Regulatory Compliance Costs: New entrants face significant expenses in ensuring adherence to food safety laws, labeling requirements, and ethical sourcing directives.

- Supply Chain Complexity: Regulations like the EUDR necessitate sophisticated traceability systems, increasing operational complexity and investment for newcomers.

- Sustainability Mandates: Growing pressure for ethical sourcing and environmental responsibility, exemplified by CSDDD, requires upfront investment in due diligence and sustainable practices.

- Market Access Barriers: Failure to meet stringent regulatory and ethical standards can lead to exclusion from key markets and damage brand reputation, deterring new entrants.

Economies of Scale and Cost Advantages

Established players like Cloetta enjoy significant cost advantages due to economies of scale in areas such as raw material purchasing, manufacturing processes, and widespread marketing campaigns. For instance, in 2024, major confectionery manufacturers often operate with production facilities capable of handling very large volumes, thereby spreading fixed costs over more units and reducing the per-unit cost. This scale allows them to negotiate better terms with suppliers and invest more heavily in efficient production technologies.

New entrants typically begin with smaller production volumes, which inherently leads to higher per-unit costs. They lack the established distribution networks and brand recognition that allow incumbents to achieve greater market penetration and efficiency. This cost disadvantage makes it challenging for newcomers to match the pricing strategies of established firms or to achieve the same level of profitability without substantial initial investment.

Cloetta's strategic emphasis on optimizing its supply chain and production efficiency in 2024 is designed to further solidify these cost advantages. By continuously seeking ways to streamline operations and reduce waste, the company aims to maintain its competitive edge against potential new market entrants.

- Economies of Scale: Lower per-unit costs through large-volume procurement and production.

- Cost Disadvantage for Entrants: Newcomers face higher initial operating expenses.

- Marketing and Distribution Efficiencies: Established firms benefit from wider reach and brand leverage.

- Operational Optimization: Cloetta's ongoing efforts to enhance efficiency reinforce its cost leadership.

The threat of new entrants in the confectionery market is moderate, primarily due to substantial capital requirements for production, distribution, and brand building. For example, establishing a single, modern confectionery production line can cost several million euros, a significant barrier for smaller players. Furthermore, navigating complex regulatory landscapes, such as the EUDR and CSDDD, adds considerable compliance costs, requiring extensive due diligence and traceability systems.

Established brands like Cloetta benefit from strong brand loyalty and extensive distribution networks, demanding significant marketing investment from newcomers to gain traction. In 2023, Cloetta's marketing expenditure was a key strategy to maintain its market position. Securing prime retail shelf space is also challenging, as major retailers often favor established suppliers with proven reliability, a trend evident in 2024 where the top five US grocers held over 60% of market share.

New entrants face a cost disadvantage compared to incumbents like Cloetta, which leverage economies of scale in procurement and production. This allows established firms to negotiate better supplier terms and achieve lower per-unit costs. For instance, in 2024, large confectionery manufacturers often operate at volumes that significantly spread fixed costs, making it difficult for smaller, newer operations to compete on price.

Regulatory hurdles, including stringent food safety laws and evolving ethical sourcing mandates, present another significant challenge. Compliance with regulations like the EU Deforestation Regulation can necessitate millions of Euros in investment for supply chain monitoring. These combined factors, from capital investment to regulatory compliance and brand building, collectively moderate the threat of new entrants.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment needed for production facilities and distribution networks. | Setting up a modern confectionery production line can cost millions of euros. |

| Brand Loyalty & Marketing | Established brands require substantial marketing spend to challenge. | Cloetta's 2023 marketing investments aimed to maintain market position. |

| Distribution Access | Difficulty securing shelf space in dominant retail channels. | In 2024, the top 5 US grocers controlled over 60% of market share. |

| Regulatory Compliance | Costs associated with food safety, labeling, and ethical sourcing. | EUDR compliance can cost millions of Euros for supply chain traceability. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large-scale operations. | Large manufacturers in 2024 spread fixed costs over high production volumes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cloetta leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.