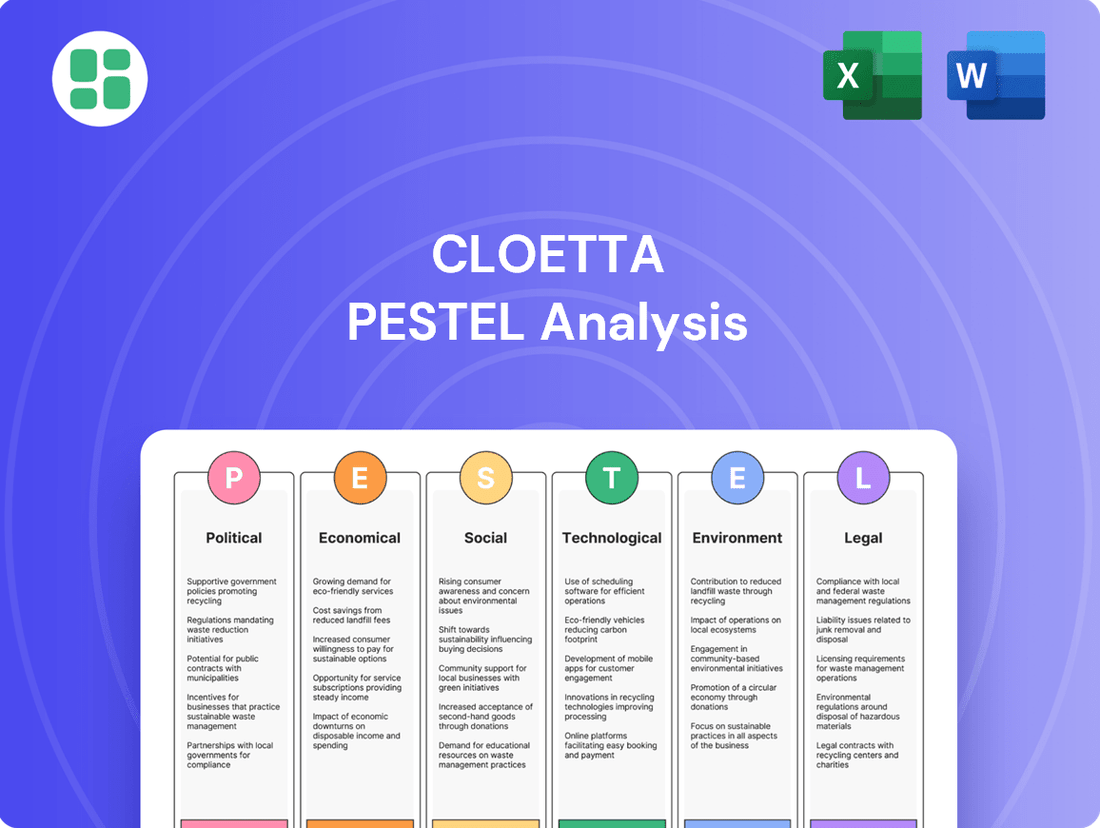

Cloetta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cloetta's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate these complex external forces. Gain a competitive advantage and make informed strategic decisions. Download the full report now and unlock a deeper understanding of Cloetta's market landscape.

Political factors

Governments in Cloetta's primary markets, especially within the European Union, are progressively enforcing more stringent rules regarding food labeling. This includes a heightened focus on sugar content, allergen declarations, and overall nutritional transparency for consumers. For example, new EU directives are set to implement stricter labeling requirements for certain foods by June 2026, specifically targeting the identification of 'hidden' sugars.

Changes in international trade policies and tariffs, especially within the EU and with global partners, directly influence Cloetta's supply chain costs for key ingredients like cocoa and sugar. For instance, a potential increase in EU tariffs on imported cocoa beans could raise production expenses, impacting profit margins. Similarly, shifts in trade agreements with countries like the United States or China could alter the cost competitiveness of Cloetta's confectionery products in those export markets.

Political stability in Cloetta's key markets, such as Sweden and the Netherlands, directly impacts consumer confidence. When political environments are stable, consumers tend to feel more secure about their economic future, leading to increased spending on non-essential goods like confectionery. Conversely, political instability can dampen consumer sentiment and reduce purchasing power, affecting demand for Cloetta's products.

Cloetta's financial performance is closely tied to economic stability and consumer sentiment. The company's interim report for the period ending March 31, 2024, indicated that it had largely navigated the prevailing geopolitical uncertainties without significant negative impacts on its operations or sales volumes. This suggests a degree of resilience in its business model against broader political and economic turbulence.

Government Subsidies or Taxes on Confectionery

Government policies, particularly taxes on sugar-sweetened products and subsidies for healthier alternatives, present a significant variable for Cloetta. For instance, the UK's sugar tax, implemented in 2018, has already influenced product formulations across the industry. As of early 2024, discussions continue in several European nations about similar levies or incentives, potentially impacting Cloetta's pricing and innovation pipeline.

The potential for new or increased taxes on sugar-sweetened products or subsidies for healthier alternatives in European markets could significantly impact Cloetta's pricing strategies, product development, and overall profitability. Several EU countries already have or are considering such taxes to address public health concerns related to sugar intake.

- Impact on Pricing: New taxes could force Cloetta to raise prices, potentially affecting consumer demand for its products.

- Product Reformulation: Subsidies for healthier options might incentivize Cloetta to invest more in developing and marketing lower-sugar or sugar-free confectionery.

- Market Competitiveness: Countries with favorable tax policies for healthier snacks could see increased competition from companies focusing on those segments.

- Regulatory Uncertainty: The evolving landscape of health-related taxation and subsidies creates a degree of regulatory uncertainty for Cloetta's long-term planning.

International Trade Agreements and Sourcing Regulations

Evolving international trade agreements are significantly reshaping how companies like Cloetta source their raw materials. For instance, the EU Regulation on Deforestation-free Products (EUDR), with key implementation phases kicking off in late 2024 and continuing into 2025 and 2026, mandates stringent traceability for commodities such as cocoa. This means Cloetta must ensure its supply chain can verify that ingredients are not linked to deforestation, a complex undertaking that requires substantial investment in data management and supplier verification systems.

Compliance with these new sourcing regulations directly impacts Cloetta's operational costs and strategic sourcing decisions. Failure to meet these requirements, which include providing detailed geolocation data and due diligence statements, could result in products being barred from the EU market, a critical region for confectionery sales. The need for enhanced transparency and sustainability verification, especially with deadlines looming, places a premium on robust supply chain management capabilities.

- EUDR Implementation: Key dates for EUDR compliance are set for late 2024 and 2025, impacting imported commodities like cocoa.

- Traceability Demands: Regulations require detailed geolocation data and due diligence statements for sourced products.

- Supply Chain Adaptation: Companies like Cloetta must invest in enhanced traceability systems and supplier audits to ensure compliance.

Governments are increasingly focusing on public health, leading to stricter food labeling laws, particularly concerning sugar content and allergens. For instance, new EU directives by June 2026 will mandate clearer identification of 'hidden' sugars in food products, directly affecting how Cloetta communicates product information to consumers.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Cloetta, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats for Cloetta.

Provides a concise version of the Cloetta PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

High inflation rates and the fluctuating prices of essential raw materials like cocoa, sugar, and packaging directly squeeze Cloetta's production costs and, consequently, its profit margins. For instance, global cocoa prices saw significant increases in early 2024, with futures reaching record highs due to supply concerns in West Africa.

The confectionery sector, including Cloetta, has been grappling with persistently elevated raw material expenses throughout 2024. Cloetta's strategy to mitigate these impacts relies heavily on its diverse product range, allowing it to absorb some of these cost pressures by shifting focus or adjusting pricing across different segments.

Consumer purchasing power is a critical driver for Cloetta. In 2024, several European economies are experiencing moderate wage growth, which could bolster disposable income. For instance, Germany saw a 3.5% average wage increase in early 2024, potentially boosting spending on non-essential goods like confectionery.

However, persistent inflation in 2024, with some Eurozone countries still hovering around 3-4% year-on-year inflation in early 2024, can erode real purchasing power. This might lead consumers to trade down to more affordable confectionery options or reduce overall spending in the category, impacting Cloetta's sales of premium products.

Cloetta's international operations, spanning the Nordic region, Netherlands, and Italy, expose it to currency exchange rate fluctuations. Changes in rates for currencies like the Swedish Krona (SEK) and the Euro (EUR) directly affect reported revenues and the cost of imported raw materials. Furthermore, these shifts influence the price competitiveness of Cloetta's products in its export markets.

The company's financial performance can be significantly impacted by these currency movements. For instance, Cloetta's Q2 2025 interim report highlighted negative impacts stemming from foreign exchange rate movements, underscoring the sensitivity of its profitability to these external economic factors.

Competition and Pricing Pressure

The confectionery sector is a crowded arena, featuring a multitude of both local and global brands, which inevitably translates into significant pricing pressure. Cloetta faces the constant challenge of staying ahead by innovating its product offerings and streamlining its operational costs to defend its market position and profitability against competitors.

Despite a positive market growth outlook, the intensity of competition shows no signs of abating. For instance, the European confectionery market, a key region for Cloetta, is expected to see continued growth, with projections indicating a compound annual growth rate (CAGR) of around 3-4% through 2025. However, this growth is being pursued by a wide array of established players and emerging brands, all vying for consumer attention and spending.

- Intense Competition: The presence of major global players like Nestlé, Mars, and Mondelez, alongside numerous regional and private-label brands, creates a highly competitive landscape.

- Pricing Pressure: Aggressive promotional activities and the availability of private-label alternatives often force manufacturers to maintain competitive pricing, impacting profit margins.

- Innovation as a Differentiator: Companies like Cloetta must invest in new product development, unique flavors, and healthier options to stand out and command premium pricing.

- Cost Optimization: Efficient supply chain management, manufacturing processes, and marketing spend are crucial for maintaining profitability in a price-sensitive market.

Growth of E-commerce Channels

The expanding e-commerce landscape offers Cloetta significant opportunities to broaden its market presence beyond traditional brick-and-mortar stores. Online sales are increasingly vital for the confectionery sector's growth, necessitating strategic investments in digital infrastructure and online marketing efforts. For instance, global e-commerce sales were projected to reach over $6.3 trillion in 2024, highlighting the immense potential for companies to leverage these channels.

Cloetta must adapt its distribution and marketing strategies to effectively capitalize on this shift. This includes enhancing its direct-to-consumer capabilities and optimizing its presence on major online retail platforms.

- E-commerce growth provides expanded market reach for confectionery products.

- Online sales are a key driver for the confectionery market's expansion.

- Companies like Cloetta need to invest in digital platforms and online marketing.

- Global e-commerce sales are a substantial and growing market.

Persistent inflation in 2024, with some Eurozone countries still experiencing inflation rates around 3-4% year-on-year in early 2024, continues to impact consumer purchasing power. While wage growth in economies like Germany, which saw an average increase of 3.5% in early 2024, offers some support, the erosion of real income may lead consumers to opt for more affordable confectionery choices or reduce discretionary spending, affecting Cloetta's premium product sales.

Cloetta's international presence exposes it to currency fluctuations, with changes in exchange rates for currencies like the Swedish Krona and the Euro directly influencing reported revenues and the cost of imported raw materials. For instance, Cloetta's Q2 2025 interim report indicated negative impacts from foreign exchange movements, highlighting the sensitivity of its profitability to these economic variables.

The confectionery market remains highly competitive, with significant pricing pressure from global brands, regional players, and private labels. Despite a projected growth rate of around 3-4% CAGR for the European confectionery market through 2025, companies like Cloetta must focus on innovation and cost optimization to maintain market share and profitability amidst intense rivalry.

| Economic Factor | Impact on Cloetta | Supporting Data (2024/2025) |

| Inflation & Raw Material Costs | Increased production expenses, squeezed profit margins. | Global cocoa prices reached record highs in early 2024; persistent elevated raw material costs throughout 2024. |

| Consumer Purchasing Power | Potential shift to lower-priced products or reduced spending. | Germany's average wage increase of 3.5% in early 2024 vs. Eurozone inflation around 3-4% in early 2024. |

| Currency Exchange Rates | Fluctuations affect revenues and raw material costs. | Q2 2025 interim report noted negative impacts from foreign exchange rate movements. |

Same Document Delivered

Cloetta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cloetta PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the confectionery company, providing valuable strategic insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a complete PESTLE analysis of Cloetta, detailing key external influences critical for informed business decisions.

The content and structure shown in the preview is the same document you’ll download after payment. This Cloetta PESTLE analysis is meticulously researched and presented, offering a clear overview of the external landscape.

Sociological factors

Consumers are increasingly seeking healthier confectionery choices, favoring products with less sugar, natural ingredients, and even added health benefits. This shift, often termed permissible indulgence, is fueling a demand for functional and fortified confectioneries, impacting product development in the industry.

Consumers are increasingly adopting plant-based and vegan lifestyles, a trend that profoundly impacts the confectionery market. This shift is fueled by growing awareness of health benefits, environmental sustainability, and animal welfare concerns.

Cloetta has proactively responded to this evolving preference by expanding its vegan product offerings. In 2024, the company saw its vegan candy portfolio grow to represent 37% of its total offerings, a significant increase from 23% in the prior year, demonstrating a clear strategic alignment with market demands.

Consumers are increasingly prioritizing ethical sourcing, with a significant portion of global consumers willing to pay more for products from brands committed to sustainability. For Cloetta, this means heightened scrutiny on cocoa sourcing, demanding verifiable efforts in fair trade practices and living wages for farmers. Reports from 2024 indicate growing consumer demand for transparency regarding child labor prevention within the supply chain, directly impacting brand reputation and purchasing decisions.

Demographic Shifts and Lifestyle Changes

Urbanization and increasingly busy lifestyles are directly fueling a demand for convenient, easily consumable confectionery. Consumers are looking for products they can enjoy on the go, often opting for smaller, more manageable pack sizes. This trend is particularly evident in major urban centers across Europe.

Demographic shifts, such as the aging population in many Western European countries, are also shaping consumer preferences. For instance, while younger demographics might favor novelty and intense flavors, older consumers may gravitate towards more traditional tastes and products perceived as having higher quality ingredients. In 2024, over 20% of the population in the EU was aged 65 or over, a figure projected to rise.

- Urbanization: Increased city living drives demand for portable snacks.

- Busy Lifestyles: Consumers seek quick, convenient confectionery solutions.

- Aging Populations: Demographic shifts influence preferences towards traditional or perceived higher-quality products.

- Pack Size Demand: A growing preference for smaller, single-serving packs is observed.

Cultural Preferences and Traditions

Cultural preferences deeply influence confectionery consumption, making them central to traditions and celebrations across Cloetta's operating regions. For instance, in Northern Europe, specific candies are often associated with holidays like Christmas and Easter, driving seasonal sales spikes. Cloetta's success hinges on adapting its product portfolio and marketing to align with these deeply ingrained cultural practices.

Understanding and respecting these traditions is paramount for effective product development and marketing. For example, the demand for darker chocolates in some Nordic countries contrasts with a preference for milk chocolate in others, requiring tailored product offerings. Cloetta's 2024 strategy likely involves leveraging market research to identify and capitalize on these nuanced cultural preferences, ensuring relevance and driving sales.

The company must remain agile in responding to evolving cultural trends and consumer tastes. As of early 2025, there's a growing interest in healthier indulgence options across many European markets, a trend that could impact traditional confectionery sales if not addressed. Cloetta's ability to innovate while respecting cultural heritage will be key to sustained growth.

- Holiday Association: Confectionery plays a vital role in festive occasions, such as Easter and Christmas, with specific product types often linked to these celebrations.

- Regional Taste Variations: Preferences for sweetness, texture, and flavor profiles can differ significantly between countries and even within regions, necessitating localized product development.

- Health and Wellness Trends: Growing consumer awareness regarding health is influencing demand for products with reduced sugar or natural ingredients, a trend that impacts traditional confectionery markets.

- Seasonal Demand: Sales volumes for many confectionery items are heavily influenced by seasonal demand, particularly around major holidays and school breaks.

Sociological factors significantly shape consumer behavior in the confectionery market, influencing everything from ingredient preferences to purchasing habits. Trends like the rise of plant-based diets and a growing demand for healthier options are directly impacting product development and market penetration for companies like Cloetta. Furthermore, evolving demographic profiles, such as aging populations in Europe, necessitate tailored product strategies that cater to different taste preferences and perceived quality standards.

Cloetta's response to these sociological shifts is evident in its strategic product expansion. By 2024, the company had increased its vegan candy offerings to 37% of its total portfolio, a substantial rise from 23% the previous year, directly addressing the growing vegan and plant-based consumer base. This proactive approach highlights the company's understanding of consumer demand for healthier and ethically aligned products.

| Sociological Factor | Impact on Confectionery Market | Cloetta's Response/Observation (2024/2025) |

|---|---|---|

| Health Consciousness | Demand for low-sugar, natural ingredients, and functional confectionery. | Growing consumer preference for "permissible indulgence" and fortified options. |

| Dietary Trends | Increased adoption of plant-based and vegan lifestyles. | Expansion of vegan product lines; 37% of Cloetta's portfolio vegan in 2024. |

| Ethical Sourcing Awareness | Consumer willingness to pay more for sustainably and ethically sourced products. | Heightened scrutiny on cocoa sourcing, fair trade, and child labor prevention. |

| Lifestyle Changes | Urbanization and busy schedules drive demand for convenient, on-the-go snacks. | Preference for smaller, single-serving pack sizes observed in urban centers. |

| Demographic Shifts | Aging populations influence preferences towards traditional tastes and perceived quality. | Over 20% of the EU population aged 65+ in 2024, impacting product targeting. |

Technological factors

Advancements in food automation, particularly in robotics and AI, are significantly boosting manufacturing efficiency. These technologies are streamlining production, enhancing productivity, and notably reducing labor costs for companies like Cloetta. For instance, by 2024, the global food robotics market is projected to reach $3.3 billion, indicating a substantial investment in these areas.

Cloetta can strategically adopt these sophisticated automation solutions to fine-tune its production lines. This integration not only promises to elevate overall operational efficiency but also ensures a higher degree of product consistency and quality, a critical factor in the competitive confectionery market.

Technological innovation is a major driver for Cloetta, allowing for the creation of novel confectionery products. This includes advancements in developing new formulations, unique textures, and exciting flavors, catering to shifting consumer preferences. For instance, the integration of functional ingredients and the exploration of alternative proteins are becoming increasingly important in product development, reflecting a growing demand for healthier and more sustainable options.

Cloetta can leverage technologies like precision fermentation and biochemical processes to create innovative ingredients and product attributes. These technologies enable the company to respond proactively to evolving consumer tastes and health trends, such as the demand for reduced sugar or plant-based alternatives. This strategic adoption of new tech ensures Cloetta remains competitive in a dynamic market.

The surge in e-commerce, projected to reach over $7 trillion globally by 2025, offers Cloetta significant opportunities. Sophisticated digital marketing tools allow for highly targeted campaigns, enabling personalized consumer engagement and direct sales channels. This shift means Cloetta can bypass traditional retail gatekeepers, fostering stronger brand loyalty and potentially improving profit margins through direct-to-consumer models.

Data Analytics for Consumer Insights

Cloetta can leverage big data and real-time analytics to gain a profound understanding of consumer preferences and behaviors. This allows for highly personalized marketing campaigns and more effective product innovation, directly addressing evolving tastes in the confectionery market.

The integration of Artificial Intelligence (AI) and machine learning is becoming crucial for predicting emerging trends and streamlining supply chain operations within the food sector. For instance, AI can analyze vast datasets to forecast demand for specific products, optimizing inventory and reducing waste for companies like Cloetta.

- Enhanced Consumer Understanding: Data analytics provides granular insights into purchasing patterns, enabling Cloetta to tailor product offerings and marketing messages.

- Predictive Trend Analysis: AI can identify nascent consumer trends, allowing Cloetta to proactively develop and launch relevant products, staying ahead of competitors.

- Supply Chain Efficiency: Machine learning algorithms can optimize logistics, inventory management, and demand forecasting, leading to cost savings and improved operational agility.

- Personalized Marketing: Real-time data allows for dynamic segmentation and personalized promotions, increasing engagement and conversion rates.

Food Safety and Quality Control Technologies

Cloetta leverages advanced technologies for food safety and quality control, crucial for meeting strict regulations and consumer expectations. Smart sensors and the Internet of Things (IoT) are increasingly deployed for real-time monitoring of production processes and storage conditions. This ensures product integrity from raw material sourcing to the final packaged good.

These technological advancements are vital for maintaining Cloetta's brand reputation and complying with global food safety standards. For instance, advancements in spectral analysis and rapid microbiological testing allow for quicker identification of potential contaminants, reducing the risk of recalls. The ability to trace ingredients and finished products through the supply chain is also significantly enhanced.

The integration of these technologies supports Cloetta's commitment to quality and safety. For example, by 2024, many food manufacturers are investing heavily in AI-powered visual inspection systems that can detect even minor defects invisible to the human eye. Furthermore, blockchain technology is being explored to provide immutable records of supply chain movements, bolstering transparency and traceability.

Key technological factors impacting Cloetta include:

- Smart Sensors and IoT: Enabling real-time monitoring of temperature, humidity, and other critical parameters throughout the supply chain, ensuring product freshness and safety.

- AI-Powered Quality Inspection: Utilizing machine learning for automated visual inspection of products, identifying defects with high accuracy and consistency.

- Advanced Traceability Systems: Implementing digital solutions, potentially including blockchain, to track ingredients and products from origin to consumer, enhancing transparency and recall management.

- Rapid Testing Technologies: Employing faster and more accurate methods for detecting pathogens and allergens, reducing laboratory turnaround times and improving response to potential safety issues.

Technological advancements are reshaping how Cloetta operates, from production to consumer engagement. Automation, including robotics and AI in food manufacturing, is a significant trend, projected to see the global food robotics market reach $3.3 billion by 2024, boosting efficiency and reducing labor costs.

Innovation in product development is also key, with technologies enabling new formulations and textures, responding to consumer demand for healthier options. E-commerce growth, expected to exceed $7 trillion globally by 2025, presents direct-to-consumer opportunities, supported by sophisticated digital marketing tools.

AI and machine learning are crucial for trend prediction and supply chain optimization, with companies increasingly using AI for visual inspection and advanced traceability systems like blockchain to ensure food safety and quality.

These technologies allow Cloetta to gain deeper consumer insights through data analytics, personalize marketing efforts, and maintain high product standards through rapid testing and real-time monitoring.

| Technological Area | Impact on Cloetta | Key Statistics/Projections |

| Automation & Robotics | Increased manufacturing efficiency, reduced labor costs, enhanced product consistency. | Global food robotics market projected to reach $3.3 billion by 2024. |

| Product Innovation | Development of novel formulations, textures, and healthier options (e.g., reduced sugar, plant-based). | Growing consumer demand for functional ingredients and alternative proteins. |

| E-commerce & Digital Marketing | Direct-to-consumer sales channels, personalized marketing, stronger brand loyalty. | Global e-commerce projected to exceed $7 trillion by 2025. |

| AI & Data Analytics | Predictive trend analysis, supply chain optimization, enhanced consumer understanding. | AI-powered visual inspection systems becoming common in food manufacturing. |

| Food Safety & Quality Control | Real-time monitoring, rapid testing, enhanced traceability (e.g., blockchain). | Increased investment in spectral analysis and rapid microbiological testing. |

Legal factors

Cloetta operates under stringent food safety and hygiene regulations, a critical legal factor impacting its business. These rules, including comprehensive EU food laws, dictate everything from how products are made and where ingredients come from to how they are handled. For instance, the EU's General Food Law Regulation (EC) No 178/2002 sets out the foundational principles for food safety, requiring traceability throughout the supply chain. This means Cloetta must maintain meticulous records and quality control at every stage to ensure consumer protection and compliance.

Advertising and marketing regulations are critical for confectionery companies like Cloetta. Strict rules govern claims, especially for products marketed to children or those making health-related assertions. For instance, in the EU, the "on-pack nutrition labelling" regulations, like the Nutri-Score system, influence how products can be presented, potentially affecting marketing strategies for high-sugar items.

Cloetta must navigate a complex web of labor laws across its operating regions, including the Nordic countries, Netherlands, and Italy. These regulations dictate everything from minimum wage requirements and working hours to employee benefits and collective bargaining agreements, impacting operational costs and flexibility.

For instance, in Sweden, a significant market for Cloetta, the Employment Protection Act (LAS) provides strong protections for employees, influencing hiring and firing practices. In 2024, ongoing discussions around labor reforms in several European countries continue to shape the employment landscape, potentially affecting wage structures and contract types.

Compliance with these diverse and sometimes stringent employment regulations is critical for maintaining smooth operations and avoiding legal repercussions. Failure to adhere to these laws could lead to fines, labor disputes, and damage to Cloetta's reputation as an employer.

Intellectual Property Rights and Brand Protection

Cloetta heavily relies on its intellectual property rights, particularly trademarks, to protect its diverse portfolio of confectionery brands like Läkerol and Malaco. Safeguarding these brand assets is paramount for maintaining market share and preventing unauthorized use or counterfeiting, which could dilute brand value and consumer trust. The company actively pursues legal avenues to defend its trademarks and any relevant patents, ensuring its unique product formulations and branding remain exclusive.

In 2023, Cloetta reported that its brand portfolio continued to be a core asset, with significant investment allocated to marketing and brand building. While specific figures for IP defense spending aren't publicly detailed, the company’s consistent revenue growth, with net sales reaching SEK 7.2 billion in 2023, underscores the effectiveness of its brand protection strategies in a competitive market. This legal framework is essential for preventing competitors from unfairly benefiting from Cloetta's established brand recognition and reputation.

Key aspects of Cloetta's legal strategy for brand protection include:

- Trademark Registration and Enforcement: Actively registering and defending trademarks for all its brands across key operating markets to prevent infringement.

- Patent Protection: Securing patents for any innovative product formulations or manufacturing processes to maintain a competitive edge.

- Anti-Counterfeiting Measures: Implementing legal and operational strategies to identify and combat counterfeit products that could harm consumers and the brand.

- Licensing Agreements: Managing licensing agreements to ensure controlled expansion of brand presence and prevent unauthorized distribution.

Competition Law and Anti-Trust Regulations

Cloetta must navigate a complex landscape of competition laws and anti-trust regulations across its operating regions to ensure fair market practices and prevent monopolistic behavior. These regulations are crucial, especially when considering strategic moves like mergers, acquisitions, or when a company achieves significant market share, as they aim to protect consumer choice and market dynamism.

For instance, in the European Union, the European Commission actively monitors mergers and acquisitions to prevent concentrations that could significantly impede competition. In 2023, the Commission reviewed numerous deals, imposing remedies or blocking transactions that raised competition concerns. While specific Cloetta-related enforcement actions are not publicly detailed for 2024/2025, the underlying regulatory framework remains stringent.

- Regulatory Scrutiny: Competition authorities in key markets such as Sweden, Denmark, Norway, Finland, and the Netherlands scrutinize market conduct to prevent abuse of dominant positions.

- Merger Control: Any significant acquisition by Cloetta would require pre-notification and approval from relevant competition authorities, ensuring no adverse impact on market competition.

- Anti-Competitive Practices: Cloetta must avoid practices like price-fixing, market sharing, or predatory pricing, which are strictly prohibited and carry substantial penalties.

- Market Share Monitoring: Continuous monitoring of market shares is essential, as exceeding certain thresholds can trigger closer regulatory attention and potential investigations into dominance.

Cloetta's legal environment mandates strict adherence to food safety standards across its European operations, particularly concerning ingredient sourcing and product handling as dictated by EU General Food Law. Furthermore, advertising and marketing are heavily regulated, influencing how products, especially those with high sugar content, can be presented to consumers, with systems like Nutri-Score impacting packaging and promotional strategies.

Labor laws in countries like Sweden, the Netherlands, and Italy significantly impact Cloetta's operational costs and employment practices, with regulations such as Sweden's Employment Protection Act (LAS) offering substantial employee protections. These legal frameworks require careful management to ensure compliance and avoid disputes.

Intellectual property protection is vital for Cloetta's brand portfolio, with trademarks for brands like Läkerol and Malaco requiring active defense against counterfeiting and infringement. The company's 2023 net sales of SEK 7.2 billion highlight the importance of these brand assets and the legal strategies employed to safeguard them.

Cloetta must also navigate competition laws and anti-trust regulations, particularly concerning mergers and acquisitions, to ensure fair market practices. The European Commission's scrutiny of deals in 2023 underscores the need for compliance to prevent anti-competitive behavior and maintain market dynamism.

Environmental factors

The environmental impact of sourcing key raw materials like cocoa and palm oil is a major concern, with deforestation and biodiversity loss being significant issues. Cloetta is actively engaged in sustainable cocoa sourcing, participating in industry-wide efforts to create deforestation-free supply chains and ensure fair living incomes for farmers.

New EU regulations, like the proposed Packaging and Packaging Waste Regulation (PPWR), are significantly impacting the confectionery industry. These rules aim to drastically reduce packaging waste, boost recyclability, and mandate increased use of recycled materials, with ambitious targets set for 2030 and beyond. Cloetta, which has historically maintained over 90% recyclable packaging, must now proactively adapt its strategies to meet these increasingly stringent environmental demands.

Cloetta is actively working to lower its energy use and carbon emissions across its production and delivery networks, recognizing the environmental impact of these activities.

A significant commitment is the company's target to cut greenhouse gas emissions, covering scopes 1, 2, and 3, by 46% by 2030, using 2019 as the benchmark year.

This climate action plan is already showing results, with Cloetta reporting a 16% reduction in its absolute Scope 1 and 2 emissions by the end of 2023 compared to its 2019 baseline.

Water Usage and Waste Management

Cloetta's commitment to efficient water usage and responsible waste management is paramount for its environmental footprint. The food industry, including confectionery, faces growing scrutiny regarding resource consumption and waste generation.

New European Union targets, set to take effect in March 2025, will further emphasize the need for companies like Cloetta to adopt robust strategies for waste minimization and food surplus redistribution. This aligns with a broader industry trend towards sustainability and circular economy principles.

- Water Efficiency: Implementing advanced technologies in production to reduce water consumption per unit of output.

- Waste Reduction: Focusing on minimizing production waste through process optimization and material sourcing.

- Food Surplus: Developing partnerships for the redistribution of edible surplus food to combat food waste.

- Circular Economy: Exploring opportunities for recycling and repurposing packaging materials and by-products.

Climate Change Impact on Agricultural Supply Chains

Climate change poses a significant threat to Cloetta's agricultural supply chains. Altered weather patterns, including increased frequency of extreme events like droughts and floods, directly impact the availability and quality of key raw materials such as cocoa. For instance, projections suggest that by 2050, cocoa-growing regions in West Africa, a primary source for many chocolate manufacturers, could see a significant reduction in suitable land due to rising temperatures.

This volatility necessitates a proactive approach. Cloetta, like many in the industry, is increasingly focusing on promoting regenerative agriculture practices and supporting climate-neutral sourcing initiatives. These efforts aim to build resilience within the supply chain, ensuring a more stable and sustainable supply of raw materials for future production. The growing consumer demand for ethically and sustainably sourced products further underscores the importance of these environmental considerations.

The financial implications of climate-related disruptions are substantial. Increased costs associated with securing raw materials due to scarcity or the need for alternative sourcing can impact profit margins. Furthermore, investments in climate adaptation and mitigation strategies within the supply chain are becoming essential to safeguard long-term business operations. For example, the global food industry is estimated to face billions in losses annually due to climate-related agricultural shocks.

- Climate Change Impact: Rising global temperatures and unpredictable weather patterns threaten crop yields and quality for essential ingredients like cocoa.

- Supply Chain Volatility: Reduced availability and fluctuating prices of agricultural raw materials due to climate events can lead to significant operational and financial instability.

- Regenerative Agriculture: Growing emphasis on sustainable farming methods to enhance soil health, biodiversity, and water conservation, creating more resilient supply chains.

- Climate-Neutral Sourcing: Initiatives to reduce carbon footprints across the supply chain, from farm to factory, aligning with environmental goals and consumer expectations.

Cloetta is actively addressing environmental concerns, particularly those related to its supply chain and packaging. The company is committed to reducing its carbon footprint, with a target of a 46% reduction in Scope 1, 2, and 3 greenhouse gas emissions by 2030 from a 2019 baseline. By the close of 2023, Cloetta had already achieved a 16% reduction in absolute Scope 1 and 2 emissions.

New EU regulations, such as the Packaging and Packaging Waste Regulation (PPWR), are pushing for significant reductions in packaging waste and increased use of recycled materials, impacting Cloetta's operational strategies. The company is also focusing on water efficiency and waste reduction, aiming to minimize production waste and explore circular economy principles for packaging and by-products.

Climate change poses a direct risk to Cloetta's raw material sourcing, with altered weather patterns affecting crops like cocoa. In response, Cloetta is investing in regenerative agriculture and climate-neutral sourcing to build supply chain resilience and meet growing consumer demand for sustainable products.

| Environmental Factor | Cloetta's Response/Action | Key Data/Target |

| Greenhouse Gas Emissions | Reducing emissions across scopes 1, 2, and 3. | Target: 46% reduction by 2030 (vs. 2019). Achieved 16% reduction in Scope 1 & 2 by end of 2023. |

| Packaging Waste | Adapting to stricter EU regulations (e.g., PPWR) for reduced waste and increased recyclability. | Aiming to meet ambitious targets for recyclability and recycled content. |

| Water Usage & Waste Management | Implementing efficient water technologies and minimizing production waste. | Focus on waste minimization and exploring circular economy models. |

| Climate Change Impact on Supply Chain | Promoting regenerative agriculture and climate-neutral sourcing for raw materials like cocoa. | Building supply chain resilience against climate volatility. |

PESTLE Analysis Data Sources

Our Cloetta PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and leading economic institutions. We incorporate insights from industry-specific reports and global trend analyses to ensure comprehensive coverage.