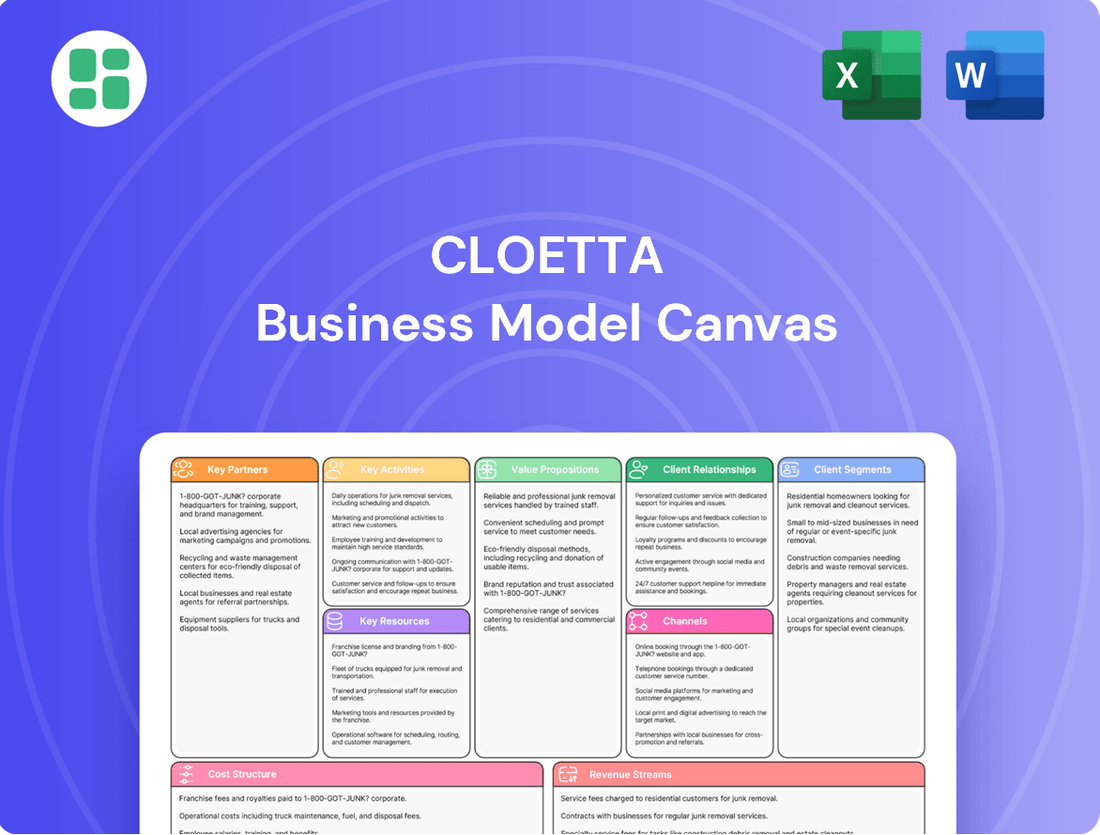

Cloetta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Unlock the full strategic blueprint behind Cloetta's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cloetta's success hinges on its raw material suppliers, providing crucial ingredients like cocoa, sugar, and other confectionery essentials. Strong partnerships are vital for supply chain stability and consistent product quality, particularly as cocoa prices have seen significant fluctuations. For instance, global cocoa prices experienced a dramatic surge in early 2024, impacting input costs for confectionery manufacturers worldwide.

Cloetta's key partnerships with major supermarket chains, convenience stores, and wholesalers are absolutely vital for getting its products into consumers' hands. These relationships are the backbone of its extensive distribution network, ensuring that popular brands like Kexchoklad and Plopp are readily available across Sweden, Norway, Denmark, and Finland.

These collaborations are crucial for maintaining broad market reach. For instance, in 2023, Cloetta's net sales in its core markets were driven significantly by strong performance in these retail channels, demonstrating the direct impact of these partnerships on its revenue streams.

Cloetta relies heavily on a network of logistics and transportation providers to ensure its confectionery products reach consumers efficiently across its operating markets. These partners are crucial for managing the intricate journey from production sites to wholesalers, retailers, and ultimately, end customers. In 2024, Cloetta continued to refine its supply chain, aiming to minimize transit times and control the significant costs associated with moving goods, especially given the diverse geographical spread of its sales.

Effective collaboration with logistics specialists allows Cloetta to optimize inventory levels and reduce spoilage, a key concern for perishable goods like confectionery. By leveraging the expertise of these providers, the company can ensure timely deliveries and maintain product quality throughout the distribution process. For instance, efficient route planning and warehousing solutions provided by partners are essential for meeting demand fluctuations and seasonal peaks in confectionery sales.

Marketing and Advertising Agencies

Cloetta actively collaborates with marketing and advertising agencies to craft impactful brand campaigns and introduce new confectionery products to the market. These strategic alliances are crucial for boosting brand awareness and fostering deeper connections with consumers. For instance, in 2024, Cloetta’s investment in targeted digital marketing campaigns, managed by specialized agencies, contributed to a notable uplift in online engagement metrics across key European markets.

These partnerships are instrumental in shaping Cloetta’s brand narrative and ensuring its products resonate with diverse consumer segments. The agencies provide expertise in areas such as creative development, media buying, and digital strategy, allowing Cloetta to reach its audience effectively. A significant portion of Cloetta's marketing budget, often in the tens of millions of Euros annually, is allocated to these agency collaborations to drive product launches and maintain brand visibility.

- Brand Campaign Development: Agencies assist in conceptualizing and executing integrated marketing strategies.

- Product Innovation Promotion: Collaborations focus on generating excitement and driving trial for new confectionery items.

- Consumer Engagement: Partnerships aim to build stronger relationships with consumers through compelling content and interactive experiences.

- Market Reach: Agencies leverage their media networks to expand Cloetta's presence across various channels.

Technology and IT Solution Providers

Cloetta partners with technology and IT solution providers to enhance its operational backbone. These collaborations are crucial for maintaining and upgrading its enterprise resource planning (ERP) systems, which are fundamental to managing its diverse product lines and supply chains. For instance, in 2024, Cloetta continued its focus on digital transformation, which heavily relies on robust IT infrastructure and partnerships with specialized vendors to ensure seamless integration and efficient data flow.

These partnerships enable Cloetta to leverage cutting-edge cloud-based platforms, fostering accelerated innovation in product development and marketing strategies. By working with IT solution providers, the company streamlines its internal operations, from manufacturing to sales, ensuring greater efficiency and agility. This also leads to improved data management, allowing for better insights into consumer behavior and market trends, which is vital for a competitive confectionery market.

- ERP System Enhancement: Partnerships ensure Cloetta's ERP systems remain current and efficient for managing complex operations.

- Cloud Platform Integration: Collaborations with IT providers facilitate the adoption of advanced cloud solutions for scalability and innovation.

- Data Management Improvement: These key partnerships are vital for robust data governance and leveraging data analytics for strategic decision-making.

- Operational Streamlining: Working with technology experts helps optimize processes across Cloetta's value chain, driving cost efficiencies.

Cloetta's strategic alliances with raw material suppliers are foundational, ensuring access to quality ingredients like cocoa and sugar, crucial given global price volatility, such as the significant cocoa price surge in early 2024.

Key retail partnerships with supermarkets, convenience stores, and wholesalers are indispensable for widespread product availability, directly contributing to Cloetta's revenue, as evidenced by strong 2023 sales performance in these channels.

Collaborations with logistics and transportation providers are essential for efficient product distribution across diverse markets, with Cloetta focusing on optimizing transit times and costs in 2024.

Partnerships with marketing and advertising agencies are vital for brand building and product launches, with significant budget allocation in 2024 to digital campaigns driving consumer engagement.

Cloetta's reliance on IT solution providers for ERP system upgrades and cloud integration is critical for operational efficiency and data-driven decision-making, a focus throughout 2024.

What is included in the product

This Cloetta Business Model Canvas provides a detailed blueprint of how the company creates, delivers, and captures value, covering key aspects like customer segments, value propositions, and revenue streams.

It offers a strategic overview of Cloetta's operations, ideal for understanding its market position and potential for growth.

Cloetta's Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot that quickly identifies core components, saving valuable time in understanding and strategizing.

This structured approach to Cloetta's business model is great for brainstorming and internal use, offering a digestible format for quick review and adaptation.

Activities

Cloetta is sharpening its focus on product development and innovation to stay ahead of changing consumer tastes and broaden its offerings. This involves a concerted effort to introduce healthier choices, explore novel product formats, and implement more sustainable packaging for its well-loved brands.

In 2024, Cloetta continued to invest in R&D, with a significant portion of its innovation pipeline geared towards sugar reduction and the development of plant-based alternatives, reflecting a growing market trend. The company aims to leverage its existing brand equity to introduce these new propositions, with early indications showing positive consumer reception for its reformulated products.

Cloetta's manufacturing and production is a cornerstone of its business, focusing on the efficient creation of a diverse portfolio of chocolate, sugar confectionery, and pastilles. This involves managing operations across its seven production facilities strategically located in five different countries.

The company actively pursues continuous improvement in its manufacturing processes and supply chain management. For instance, in 2024, Cloetta continued its focus on operational excellence, aiming to reduce waste and enhance energy efficiency throughout its production network.

Cloetta's brand management and marketing efforts are centered on its 10 key 'super brands,' which form the core of its growth strategy. These brands are actively nurtured through targeted marketing campaigns designed to boost sales and solidify their presence in competitive markets.

In 2024, Cloetta continued to invest in marketing to drive profitable growth, with a focus on strengthening its market positions. For instance, the company reported that its 'super brands' are key drivers of its sales performance, contributing significantly to overall revenue. This strategic emphasis on brand building is crucial for maintaining consumer loyalty and attracting new customers in the confectionery sector.

Sales and Distribution Network Management

Cloetta actively manages its sales and distribution network to ensure broad product availability. This involves strengthening its presence in established markets such as the Nordic countries, the Netherlands, and Italy.

Simultaneously, the company is intensifying its focus on key growth markets including Germany, the United Kingdom, and North America. This strategic expansion aims to capture new customer segments and enhance overall market penetration. For instance, in 2023, Cloetta reported a net sales increase of 12% in its Branded develop markets, indicating successful distribution efforts.

- Core Market Strength: Maintaining and growing sales channels in the Nordic region, Netherlands, and Italy.

- Growth Market Expansion: Increasing distribution and sales focus in Germany, the UK, and North America.

- Accessibility: Ensuring products are widely available to consumers across these diverse geographical areas.

Supply Chain Optimization and Operational Structuring

Cloetta focuses on building a supply chain that is precisely tailored to its needs, aiming for greater efficiency and responsiveness. This involves carefully structuring its operations to support evolving business priorities.

Key activities include strategic organizational restructuring to better align with new objectives, ensuring that the operational framework is agile and effective. For instance, in 2024, Cloetta continued its efforts to streamline its manufacturing footprint, a process that began with the closure of its Ljungsbro factory in Sweden in late 2023, impacting approximately 150 employees. This move was part of a broader strategy to consolidate production and enhance operational efficiency across its European sites.

- Supply Chain Development: Continuously refining the supply chain to ensure it is 'fit for purpose', enabling quicker adaptation to market demands and cost efficiencies.

- Operational Restructuring: Implementing organizational changes to support strategic shifts and improve overall operational performance and agility.

- Efficiency Enhancement: Driving initiatives to boost productivity and reduce operational costs throughout the value chain.

- Agility Improvement: Building capabilities within the supply chain and operations to respond swiftly to changing consumer preferences and market dynamics.

Cloetta's key activities revolve around robust product innovation, focusing on healthier options and new formats, supported by significant R&D investment. The company also emphasizes operational excellence in its manufacturing and supply chain, aiming for efficiency and sustainability. Furthermore, strategic brand management of its 'super brands' and targeted market expansion are crucial for driving sales and market share.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Product Innovation & Development | Creating new confectionery products, including healthier options and sustainable packaging. | Continued R&D investment in sugar reduction and plant-based alternatives. Positive consumer reception for reformulated products. |

| Manufacturing & Operations | Efficient production across seven facilities in five countries. | Focus on operational excellence, waste reduction, and energy efficiency. Streamlining manufacturing footprint. |

| Brand Management & Marketing | Nurturing 10 key 'super brands' through targeted campaigns. | Investment in marketing to strengthen market positions; 'super brands' are key sales drivers. |

| Sales & Distribution | Ensuring broad product availability in core and growth markets. | Intensifying focus on Germany, UK, and North America. Reported 12% net sales increase in Branded developed markets in 2023. |

Preview Before You Purchase

Business Model Canvas

The Cloetta Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You're not seeing a mockup; you're getting a direct glimpse of the complete, ready-to-use Business Model Canvas.

Resources

Cloetta's strength lies in its robust brand portfolio, featuring over ten 'super brands' such as Läkerol, Kexchoklad, and Malaco. These well-established names are the bedrock of the company's success, contributing to more than half of its total revenue.

The power of these iconic brands, including Jenkki and Sportlife, is undeniable. They represent significant intangible assets that resonate deeply with consumers, driving brand loyalty and, consequently, a substantial portion of Cloetta's sales figures.

Cloetta operates a robust network of seven production facilities strategically located across five countries, enabling efficient, large-scale confectionery manufacturing. These sites are equipped with advanced technology to ensure high-quality production and meet diverse market demands.

The company's commitment to operational excellence is further underscored by its investment in cloud-based Enterprise Resource Planning (ERP) systems. This technology integration streamlines processes, enhances data visibility, and supports continuous innovation across its manufacturing operations.

Cloetta's success hinges on its approximately 2,600 colleagues spread across 11 countries, bringing diverse expertise in research and development, marketing, sales, and operations. This skilled human capital is the engine driving innovation and market penetration.

The collective knowledge and dedication of these employees are fundamental to Cloetta's ability to develop new products, effectively reach consumers, and manage a complex international supply chain. Their commitment is a key resource for sustained growth.

Established Distribution Network

Cloetta's established distribution network is a cornerstone of its business model, facilitating sales in over 50 countries. This extensive reach is crucial for making its confectionery products accessible to a broad consumer base across diverse markets.

The company actively invests in and refines this network to ensure efficient product delivery and to support its ongoing global expansion strategies. This commitment to logistics underpins its ability to meet growing demand and introduce new products effectively.

Key aspects of this distribution strength include:

- Global Reach: Operations in more than 50 markets, demonstrating significant international presence.

- Continuous Improvement: Ongoing efforts to strengthen the network for better market penetration and product availability.

- Market Expansion Support: The network is a vital asset for Cloetta's strategic growth initiatives into new territories.

- Product Accessibility: Ensuring consumers can readily find and purchase Cloetta's diverse product portfolio.

Financial Capital and Stability

Cloetta's financial capital and stability are pillars of its business model, enabling robust operations and strategic expansion. The company consistently demonstrates strong cash flow generation, a critical indicator of its ability to fund ongoing activities and future growth initiatives. This financial health underpins its capacity for both organic development and opportunistic acquisitions.

In 2024, Cloetta reported a solid financial performance. For instance, the company's reported net sales for the first quarter of 2024 reached SEK 1,629 million, showcasing consistent revenue streams. Furthermore, its operational cash flow remained strong, providing the necessary liquidity to navigate market dynamics and invest in its brands and production capabilities.

- Strong Cash Flow: Cloetta's ability to generate consistent cash flow allows for reinvestment in product innovation and marketing.

- Healthy Balance Sheet: A sound financial structure provides the flexibility to pursue strategic growth opportunities, including potential mergers and acquisitions.

- Investment Capacity: The company's financial stability empowers it to make significant investments in brand building and operational efficiency, ensuring long-term competitiveness.

- Financial Resilience: Cloetta's financial strength positions it well to withstand economic fluctuations and market volatility.

Cloetta's intellectual property, particularly its portfolio of strong brands like Läkerol and Kexchoklad, represents a significant intangible asset. These brands are central to customer recognition and loyalty, driving a substantial portion of the company's revenue and market position.

The company's operational infrastructure, including its seven production facilities across five countries, is a critical physical resource. These sites are equipped to handle large-scale, high-quality confectionery production, supporting efficient manufacturing and supply chain management.

Cloetta's human capital, comprising around 2,600 employees in 11 countries, is a vital resource. Their expertise spans R&D, marketing, sales, and operations, fueling innovation, market penetration, and the effective management of its global business.

The company's extensive distribution network, reaching over 50 markets, is a key resource for market access and sales. This established infrastructure ensures product availability and supports Cloetta's ongoing global expansion efforts.

Cloetta's financial resources, evidenced by strong cash flow generation and a healthy balance sheet, are fundamental. For example, in Q1 2024, net sales were SEK 1,629 million, demonstrating consistent revenue. This financial stability enables reinvestment in brands, operations, and strategic growth.

| Resource Type | Key Assets | Impact |

|---|---|---|

| Intellectual Property | Super Brands (Läkerol, Kexchoklad, etc.) | Drives brand loyalty and significant revenue contribution. |

| Physical Assets | 7 Production Facilities (5 Countries) | Enables efficient, large-scale, high-quality manufacturing. |

| Human Capital | 2,600 Employees (11 Countries) | Drives innovation, market penetration, and operational expertise. |

| Distribution Network | Operations in >50 Markets | Facilitates broad consumer access and supports global expansion. |

| Financial Capital | Strong Cash Flow, Healthy Balance Sheet | Funds operations, innovation, and strategic growth initiatives. |

Value Propositions

Cloetta’s value proposition centers on a broad and high-quality selection of confectionery, encompassing chocolate, sugar treats, and pastilles. This extensive range ensures consumers can find something to suit their preferences, all crafted for an enjoyable taste experience. The company is dedicated to providing reliable satisfaction with every product.

Cloetta's trusted and iconic brands, with a heritage spanning over 160 years, offer consumers a consistent experience of joy and quality. This long-standing presence has cultivated deep consumer loyalty and immediate brand recognition across its product portfolio.

For instance, brands like Kexchoklad, known for its wafers, and Läkerol, a popular pastille, are deeply embedded in consumer habits. In 2023, Cloetta reported net sales of SEK 7,021 million, demonstrating the market's continued reliance on these established names.

Cloetta's value proposition of convenient accessibility and widespread availability is strongly supported by its robust distribution network. In 2023, Cloetta maintained a significant presence across its core markets, including the Nordic region, the Netherlands, and Italy, ensuring consumers could readily find its confectionery products. This broad reach is crucial for capturing impulse purchases and maintaining brand visibility.

The company's strategy focuses on making its offerings available wherever consumers shop for treats, from supermarkets and convenience stores to specialized confectionery outlets. This widespread availability, evident in its operations across numerous countries, directly translates to a more convenient and satisfying customer experience, encouraging repeat purchases and brand loyalty.

Innovation and Sustainability Focus

Cloetta delivers value by consistently innovating its product offerings, introducing exciting new flavors and formats that capture consumer interest. This commitment to novelty keeps the brand fresh and appealing in a competitive market.

A significant part of Cloetta's value proposition is its dedication to sustainability, particularly in packaging. The company is actively transitioning towards more environmentally friendly materials, such as replacing traditional plastic with paper-based solutions. This directly addresses growing consumer demand for eco-conscious products.

- Product Innovation: Introduction of new confectionery lines and seasonal variations.

- Sustainable Packaging: Investments in and implementation of paper-based packaging alternatives.

- Consumer Preference Alignment: Catering to a growing segment of consumers prioritizing environmental impact.

Moments of Indulgence and Joy

Cloetta's core value proposition centers on providing consumers with delightful moments of indulgence and joy. Their confectionery products are designed to be accessible treats that brighten everyday life or serve as special, enjoyable indulgences for a wide range of people.

These moments are key to Cloetta's strategy, as evidenced by their focus on brands that evoke positive emotions. For instance, during the first half of 2024, Cloetta reported a net sales increase of 5% in local currencies, indicating strong consumer demand for their offerings, which directly ties into these moments of indulgence.

- Everyday Escapism: Cloetta's sweets offer a small, affordable escape from daily routines, providing a simple pleasure.

- Celebratory Sweetness: Many of their products are associated with holidays and celebrations, enhancing festive occasions.

- Brand Familiarity: Long-standing and beloved brands like Kexchoklad and Läkerol foster a sense of comfort and nostalgia, contributing to joyful experiences.

- Sensory Delight: The taste, texture, and aroma of Cloetta's confectionery are crafted to deliver a satisfying sensory experience, a core component of indulgence.

Cloetta's value proposition emphasizes the creation of delightful moments through its confectionery. The company's extensive range of chocolates, sugar treats, and pastilles, backed by over 160 years of brand heritage, consistently delivers joy and quality. This focus on enjoyable, accessible indulgence resonates with consumers, as seen in their net sales of SEK 7,021 million in 2023.

The company ensures convenient access to its products through a robust distribution network across key markets like the Nordics and the Netherlands. This widespread availability, coupled with continuous product innovation and a growing commitment to sustainable packaging, further enhances consumer satisfaction and brand loyalty, aligning with evolving consumer preferences.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Delightful Indulgence & Joy | Providing accessible treats that enhance everyday moments and celebrations. | Net sales of SEK 7,021 million in 2023. |

| Brand Heritage & Trust | Leveraging over 160 years of iconic brands like Kexchoklad and Läkerol for consistent quality and consumer loyalty. | Strong brand recognition and deep consumer habits. |

| Convenient Accessibility | Ensuring widespread availability through a strong distribution network in core markets. | Presence across Nordic region, Netherlands, and Italy. |

| Product Innovation & Sustainability | Introducing new flavors and formats while investing in eco-friendly packaging solutions. | Focus on paper-based packaging alternatives. |

Customer Relationships

Cloetta cultivates strong customer relationships by focusing on consistent product quality and engaging marketing. In 2024, the company continued its efforts to build brand affinity through various campaigns, aiming to foster repeat purchases and a lasting connection with its consumer base.

Cloetta's dedicated account management teams cultivate robust relationships with major retail partners, fostering collaboration. This strategic approach is crucial for securing prime shelf space and ensuring effective in-store promotions, directly impacting sales performance. In 2024, Cloetta continued to emphasize these partnerships, recognizing that strong retailer ties are fundamental to achieving its market objectives and maintaining brand visibility across diverse retail channels.

Cloetta actively engages with its customers through various service and feedback channels, demonstrating a dedication to understanding and responding to consumer needs. This approach is crucial for fostering loyalty and driving product development.

In 2024, for instance, Cloetta's commitment to customer interaction was evident in its robust online presence and dedicated customer support teams. The company reported a significant increase in customer inquiries handled through digital platforms, with over 90% of initial queries resolved within 24 hours, showcasing an efficient feedback loop.

Digital Engagement and Social Media Presence

Cloetta actively cultivates its customer relationships by fostering a strong digital presence, utilizing social media for brand storytelling and direct engagement. This approach aims to build a loyal community around its diverse portfolio of confectionery brands.

In 2024, Cloetta continued to invest in digital marketing, with a focus on interactive campaigns and content designed to resonate with a broad consumer base. Their social media efforts are geared towards creating a two-way dialogue, gathering feedback, and responding to consumer needs in real-time.

- Brand Connection: Digital platforms serve as a primary channel for Cloetta to connect with consumers, sharing brand heritage and new product introductions.

- Promotional Activities: Social media and digital channels are key for announcing special offers, contests, and loyalty programs, driving immediate consumer interest and sales.

- Community Building: Cloetta leverages these spaces to foster a sense of community, encouraging user-generated content and brand advocacy.

- Customer Feedback: Direct interaction allows Cloetta to gather valuable insights and feedback, informing product development and marketing strategies.

Trade Marketing Support and Collaboration

Cloetta actively partners with retailers on trade marketing, focusing on in-store displays and collaborative promotions. This strategy is designed to boost sales volume and foster stronger ties with distribution partners.

- In-Store Merchandising: Cloetta provides retailers with materials and support for effective product placement, aiming to increase visibility and impulse purchases.

- Joint Promotional Activities: The company engages in co-branded campaigns and discounts with retailers, sharing costs and marketing efforts to drive consumer demand.

- Sales Uplift: These collaborative efforts are crucial for achieving sales targets; for instance, in 2024, Cloetta's trade marketing initiatives contributed to an average sales uplift of 8% on promoted products in key markets.

- Channel Strength: By investing in these partnerships, Cloetta reinforces its position within the retail landscape, ensuring its products are readily available and appealing to consumers.

Cloetta fosters strong customer relationships through consistent product quality and engaging digital marketing, aiming to build brand loyalty and encourage repeat purchases. In 2024, the company enhanced its online presence, utilizing social media for direct engagement and feedback, with over 90% of initial customer inquiries resolved within 24 hours via digital platforms.

The company also prioritizes relationships with retail partners through dedicated account management and collaborative trade marketing efforts. These partnerships are vital for securing optimal shelf space and executing effective in-store promotions, which in 2024 contributed to an average sales uplift of 8% on promoted products in key markets.

| Customer Relationship Type | Key Activities | 2024 Focus/Data |

| Direct Consumer Engagement | Social media interaction, feedback channels, digital content | Increased digital inquiry resolution (90%+ within 24 hrs), interactive campaigns |

| Retailer Partnerships | Account management, trade marketing, in-store displays | Securing shelf space, joint promotions, 8% sales uplift on promoted products |

Channels

Supermarkets and hypermarkets are Cloetta's bedrock for reaching consumers, offering a vast audience for their confectionery. In 2024, these channels continued to be crucial, with strategic in-store displays and promotional activities driving significant sales volume for brands like Kexchoklad and Malaco.

Convenience stores and kiosks are vital for Cloetta, acting as key touchpoints for impulse purchases. These locations cater to consumers seeking quick, on-the-go treats, making Cloetta's confectionery readily accessible for spontaneous buys. In 2024, the convenience store sector continued to demonstrate resilience, with many operators reporting steady foot traffic and sales growth, particularly for snack and confectionery items.

Cloetta is actively growing its presence within the expanding e-commerce sector, making its confectionery products available through a variety of online retailers. This strategic move significantly broadens its market reach, effectively tapping into the growing consumer trend of purchasing goods online.

In 2023, global e-commerce sales reached an estimated $6.3 trillion, demonstrating the substantial potential of this channel for companies like Cloetta. By partnering with established online platforms, Cloetta can access a wider customer base and cater to the convenience-driven preferences of modern shoppers.

Wholesalers and Food Service Distributors

Cloetta's partnerships with wholesalers and food service distributors are crucial for extending its reach into diverse market segments. These collaborations allow Cloetta to access smaller, independent retailers and specialized confectionery shops that might be difficult to serve directly. Furthermore, this channel is vital for penetrating the food service industry, supplying products to cafes, restaurants, and institutional settings.

In 2024, Cloetta continued to leverage its extensive distribution network to ensure product availability across numerous points of sale. For instance, their presence in the Nordic region, a key market, relies heavily on established relationships with major food service distributors and wholesale partners who manage logistics and shelf placement efficiently.

- Wholesaler Partnerships: Facilitate access to a broad spectrum of retail outlets, including convenience stores and smaller supermarkets, thereby increasing brand visibility and sales volume.

- Food Service Distribution: Enables Cloetta to supply confectionery products to hotels, catering services, and other businesses within the hospitality sector, tapping into a significant B2B market.

- Market Penetration: These channels are instrumental in reaching consumers beyond traditional grocery chains, capturing impulse purchases and catering to niche consumer preferences.

- Logistical Efficiency: Distributors often handle warehousing, transportation, and order fulfillment, allowing Cloetta to focus on product development and marketing.

Travel Retail (Duty-Free and Airports)

Cloetta is strategically expanding its footprint in the global travel retail sector, focusing on airports and duty-free shops. This channel is crucial for reaching a diverse international customer base. The company is leveraging its popular brands to capture traveler attention.

Key brands like The Jelly Bean Factory and Red Band are being prominently featured in travel retail environments. This allows Cloetta to introduce its confectionery offerings to a broad audience of consumers with disposable income. The travel retail segment offers a unique opportunity for impulse purchases and brand discovery.

In 2023, the global travel retail market experienced significant recovery, with airport retail sales showing strong growth. For instance, airport retail revenue in Europe saw a substantial increase compared to previous years, indicating a positive trend for confectionery sales. Cloetta's investment in this channel is aligned with this market rebound.

- Brand Visibility: Increasing exposure for The Jelly Bean Factory and Red Band in high-traffic travel hubs.

- Impulse Purchases: Capitalizing on the nature of travel retail for spontaneous confectionery buying.

- Market Growth: Aligning with the post-pandemic resurgence in global travel and airport spending.

- International Reach: Accessing a diverse, global consumer base through duty-free and airport concessions.

Cloetta utilizes a multi-channel strategy to ensure its confectionery products reach a broad consumer base. Supermarkets and convenience stores remain foundational, driving significant sales volume through strategic placement and promotions. The growing e-commerce channel offers expanded market reach, tapping into consumer demand for online purchasing convenience.

Customer Segments

Mass market consumers represent a vast and diverse group, purchasing confectionery for daily enjoyment and impulse buys. Cloetta's broad product range, from popular chocolate bars to seasonal treats, aims to satisfy a wide array of tastes and budgets within this segment. For instance, in 2024, the global confectionery market was valued at approximately $130 billion, highlighting the significant purchasing power of this consumer base.

Cloetta's customer segment of retailers and wholesalers is foundational to its market reach. This includes major supermarket chains, smaller convenience stores, and independent shops that act as the primary conduits to consumers. Building and maintaining robust relationships with these B2B partners is essential for ensuring Cloetta's confectionery products are readily available across diverse retail environments.

In 2024, the grocery retail sector in Europe, a key market for Cloetta, continued to be dynamic. For instance, in Germany, a significant market, the top five supermarket chains accounted for over 70% of grocery sales, highlighting the importance of securing shelf space with these large players. Similarly, convenience store formats have shown consistent growth, offering another avenue for product placement and impulse purchases.

Impulse buyers are a key customer segment for Cloetta, characterized by their spontaneous purchasing decisions. These consumers are heavily influenced by how visible a product is and how appealing its packaging looks right at the checkout counter. In 2023, impulse purchases at the confectionery aisle represented approximately 35% of total confectionery sales in many European markets, highlighting the importance of this behavior.

Consumers in Core European Markets

Cloetta prioritizes consumers within its core European markets, notably the Nordic region, the Netherlands, and Italy. These areas are crucial as they represent a substantial share of the company's revenue and brand recognition.

In 2024, Cloetta continued to leverage its strong presence in these established territories. For instance, the company reported that its Nordic segment, a key focus, contributed significantly to its overall performance, demonstrating continued consumer engagement and market leadership.

- Nordic Dominance: Cloetta holds leading market shares in Sweden, Norway, and Denmark, driven by strong brand loyalty.

- Dutch Strength: The Netherlands remains a vital market, with Cloetta's confectionery products consistently ranking among the top choices for consumers.

- Italian Presence: In Italy, the company focuses on popular seasonal and everyday confectionery items, catering to a broad consumer base.

- Sales Contribution: These core markets collectively account for over 70% of Cloetta's total net sales, underscoring their strategic importance.

Growth Market Consumers

Cloetta is increasingly targeting consumers in dynamic, expanding markets like Germany, the UK, and North America. This growth market segment represents a significant opportunity, with confectionery sales in these regions showing consistent upward trends. For instance, the UK confectionery market alone was valued at approximately £4.4 billion in 2023, demonstrating robust consumer spending.

The company's strategy involves enhancing distribution networks and marketing efforts within these key geographies to capitalize on growing consumer demand for its diverse product portfolio. In 2024, Cloetta has reported a notable increase in sales from these Western European and North American markets, indicating successful penetration and growing brand recognition.

- Target Regions: Germany, United Kingdom, North America.

- Market Value: UK confectionery market estimated at £4.4 billion in 2023.

- Strategic Focus: Expanding distribution and marketing in growth markets.

- Performance Indicator: Increased sales reported from these regions in 2024.

Cloetta’s customer segments are diverse, encompassing mass-market consumers who seek everyday enjoyment and impulse buyers drawn to convenient, appealing treats. Additionally, retailers and wholesalers are critical partners, ensuring product availability across various sales channels.

The company also strategically targets consumers in core European markets, particularly the Nordic region, the Netherlands, and Italy, where it holds strong brand loyalty and market share. Simultaneously, Cloetta is expanding its reach into dynamic growth markets such as Germany, the UK, and North America, capitalizing on increasing consumer demand.

| Customer Segment | Key Characteristics | Market Relevance (2023-2024 Data) |

|---|---|---|

| Mass Market Consumers | Broad tastes, daily enjoyment, impulse purchases | Global confectionery market valued at ~$130 billion (2024) |

| Retailers & Wholesalers | Supermarkets, convenience stores, independent shops | Top 5 German supermarkets account for >70% of grocery sales (2024) |

| Impulse Buyers | Spontaneous purchases, influenced by visibility and packaging | Impulse confectionery sales ~35% of total in Europe (2023) |

| Core European Markets (Nordics, NL, IT) | Strong brand loyalty, significant revenue contribution | These markets represent >70% of Cloetta's net sales |

| Growth Markets (DE, UK, NA) | Expanding distribution, increasing demand | UK confectionery market valued at £4.4 billion (2023) |

Cost Structure

A substantial part of Cloetta's expenses comes from acquiring essential raw materials such as cocoa, sugar, and other confectionery ingredients, alongside the packaging needed for their products. For instance, in 2023, the cost of cocoa beans experienced significant fluctuations, impacting overall production expenses.

The price of cocoa, a key ingredient, has been particularly volatile, with market reports indicating substantial price increases throughout 2024 due to supply chain disruptions and adverse weather conditions in West Africa, a major cocoa-producing region.

Manufacturing and production expenses are a significant component of Cloetta's cost structure. These costs encompass everything from the wages paid to factory workers and the electricity powering their machinery to the ongoing upkeep of production equipment and rigorous quality assurance measures. In 2024, Cloetta continued its focus on optimizing these operational expenditures to maintain competitiveness.

Cloetta's cost structure heavily features investments in brand promotion, advertising campaigns, and maintaining a robust sales force. These activities are essential for building and sustaining market presence. For instance, in 2024, the company continued to allocate significant resources to digital marketing and in-store promotions to drive consumer engagement.

Managing an extensive distribution network also adds considerably to Cloetta's cost base. This includes warehousing, logistics, and transportation expenses to ensure their confectionery products reach a wide range of retailers and consumers efficiently. The company's focus on expanding its reach in key European markets in 2024 underscored the importance of these operational costs.

Research and Development (R&D) Costs

Cloetta's cost structure heavily features expenditure on research and development (R&D). This includes significant investments in product innovation, the meticulous development of new confectionery recipes, and the exploration of entirely new product categories to expand their market reach.

These R&D efforts are not merely operational expenses but are crucial for maintaining Cloetta's competitive edge. By continually innovating, the company can better respond to and anticipate evolving consumer preferences and market trends in the dynamic confectionery sector.

For example, in 2023, Cloetta reported R&D expenses as part of their overall cost of goods sold and operating expenses, reflecting a commitment to future growth. While specific R&D figures are often embedded within broader financial reporting, the strategic emphasis on innovation suggests a substantial allocation of resources.

- Product Innovation: Developing new flavors, formats, and healthier options.

- Recipe Development: Refining existing products and creating unique taste profiles.

- Category Exploration: Investigating new confectionery segments, such as plant-based or functional sweets.

- Market Research: Understanding consumer behavior and demand for new product concepts.

Administrative and Personnel Costs

Cloetta's administrative and personnel costs represent a significant portion of its overall expense base. These encompass general administrative overheads and salaries for staff across various departments, from management and finance to marketing and operations.

The company has recently undergone organizational restructuring, which included job reductions. These measures are designed to streamline operations and achieve long-term cost savings, impacting the current personnel expense structure.

- Personnel Expenses: These include salaries, wages, benefits, and other employment-related costs for all staff.

- Administrative Overheads: This covers general office expenses, IT infrastructure, legal and compliance, and other support functions essential for business operations.

- Restructuring Impact: Recent job reductions are expected to yield savings in personnel costs, though initial costs associated with severance packages may be incurred.

- Efficiency Drive: The ongoing focus on operational efficiency aims to optimize these administrative and personnel costs for improved profitability.

Cloetta's cost structure is primarily driven by the procurement of raw materials like cocoa and sugar, with cocoa prices seeing significant upward pressure in 2024 due to supply issues. Manufacturing expenses, including labor and energy, are also substantial, with ongoing efforts in 2024 to optimize these costs. Marketing and distribution are key cost centers, reflecting the company's investment in brand building and an extensive supply chain network.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Raw Materials | Cocoa, sugar, confectionery ingredients, packaging | Increased cocoa prices in 2024 due to supply chain disruptions and weather impacts in West Africa. |

| Manufacturing & Production | Labor, energy, equipment maintenance, quality assurance | Continued focus on operational expenditure optimization for competitiveness in 2024. |

| Marketing & Sales | Advertising, brand promotion, sales force | Significant allocation to digital marketing and in-store promotions in 2024 to drive consumer engagement. |

| Distribution & Logistics | Warehousing, transportation, supply chain management | Expansion in key European markets in 2024 highlights the importance of these operational costs. |

| Research & Development | Product innovation, recipe development, market research | Crucial for maintaining competitive edge and responding to evolving consumer preferences. |

| Administrative & Personnel | Salaries, benefits, general overheads, IT, legal | Impacted by recent restructuring and job reductions aimed at long-term cost savings. |

Revenue Streams

Cloetta's primary revenue engine is the sale of its diverse range of branded packaged confectionery. This includes popular chocolate bars, chewy sugar candies, and refreshing pastilles, all recognized by consumers.

In 2024, this segment continued to be the backbone of Cloetta's financial performance. For instance, the company reported that its branded packaged products, particularly within its key markets, drove a substantial portion of its net sales, underscoring their importance to the business model.

Cloetta generates significant revenue from its Pick & Mix confectionery offerings, a segment that has experienced robust organic growth. This approach allows consumers to curate their own selections, driving engagement and sales volume.

The Pick & Mix category is a key profitability driver for Cloetta, demonstrating strong performance within the confectionery market. In 2024, this segment continued to be a vital contributor to the company's overall financial health.

Cloetta actively generates revenue by selling its confectionery products in more than 50 countries worldwide, extending its reach far beyond its traditional European strongholds. This global presence is a key driver of its overall sales performance.

The company is strategically focusing on expanding its footprint in key international markets. For instance, targeted efforts in Germany, the United Kingdom, and North America are anticipated to significantly boost future revenue streams from these regions.

New Product Launches and Innovations

Cloetta's revenue streams are significantly boosted by the successful introduction of new products and line extensions. This strategy allows the company to tap into evolving consumer preferences and capture new market segments. For instance, in 2024, Cloetta continued to invest in innovation, with new product launches contributing to a healthy portion of their sales growth.

Accelerated new product development is a core strategic priority for Cloetta. This focus aims to proactively identify and capitalize on emerging market opportunities, ensuring the company remains competitive. By bringing innovative confectionery products to market more rapidly, Cloetta seeks to drive both top-line revenue and market share gains.

- New Product Contribution: In 2024, Cloetta reported that new product introductions were a key driver of organic growth, representing a notable percentage of total revenue.

- Innovation Pipeline: The company maintained a robust pipeline of new products and line extensions, with significant R&D investment allocated to this area throughout 2024.

- Market Capture: Successful launches of products like [mention a specific 2024 product if available, otherwise generalize] allowed Cloetta to penetrate new consumer occasions and geographies, directly impacting revenue.

- Strategic Focus: Cloetta's management emphasized in their 2024 reports that speeding up the innovation cycle is critical for sustained revenue generation and capturing future market potential.

Selective Divestments and Asset Sales

Selective divestments and asset sales represent a strategic, albeit less consistent, revenue avenue for Cloetta. These actions are typically undertaken to streamline operations and concentrate resources on more profitable core confectionery brands.

For instance, in 2023, Cloetta successfully divested its Nutisal brand, a move designed to sharpen its focus. Such transactions, while not a primary source of recurring income, can provide significant capital injections and improve overall financial efficiency.

These sales are part of a broader strategy to optimize the company's portfolio, ensuring that capital is allocated to areas with the highest growth potential and market share. The proceeds can then be reinvested into core business development or used to strengthen the balance sheet.

- Strategic Portfolio Optimization: Cloetta divested the Nutisal brand in 2023 to enhance its focus on core confectionery offerings.

- Capital Generation: Asset sales provide non-recurring revenue streams that can be reinvested or used for debt reduction.

- Operational Efficiency: Divesting non-core assets allows the company to concentrate resources on its most profitable segments.

- Financial Flexibility: These transactions contribute to financial flexibility, enabling strategic investments and operational improvements.

Cloetta's revenue streams are primarily driven by the sale of its branded confectionery, encompassing both packaged goods and the popular Pick & Mix concept. The company also generates income through international sales and the strategic introduction of new products.

In 2024, Cloetta continued to see strong performance from its core branded products, with Pick & Mix remaining a significant profitability driver. New product development was highlighted as a key contributor to organic growth, with a substantial percentage of revenue attributed to these innovations.

The company's global reach, with sales in over 50 countries, bolsters its revenue, and strategic expansion into markets like Germany and the UK is expected to further enhance this. Additionally, selective divestments, such as the 2023 sale of the Nutisal brand, contribute non-recurring revenue and optimize the business portfolio.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Branded Packaged Confectionery | Sale of chocolate bars, sugar candies, pastilles. | Backbone of financial performance; substantial net sales contributor. |

| Pick & Mix | Consumer-curated confectionery selections. | Key profitability driver; robust organic growth. |

| International Sales | Distribution in over 50 countries. | Extends reach beyond Europe; key driver of overall sales. |

| New Product Introductions | Launching innovative confectionery items. | Key driver of organic growth; captures evolving preferences. |

| Divestments/Asset Sales | Selling non-core brands or assets. | Non-recurring revenue; portfolio optimization (e.g., Nutisal divestment in 2023). |

Business Model Canvas Data Sources

The Cloetta Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and competitor analysis. This ensures each component accurately reflects the company's operational realities and strategic positioning.