CapitaMall Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaMall Trust Bundle

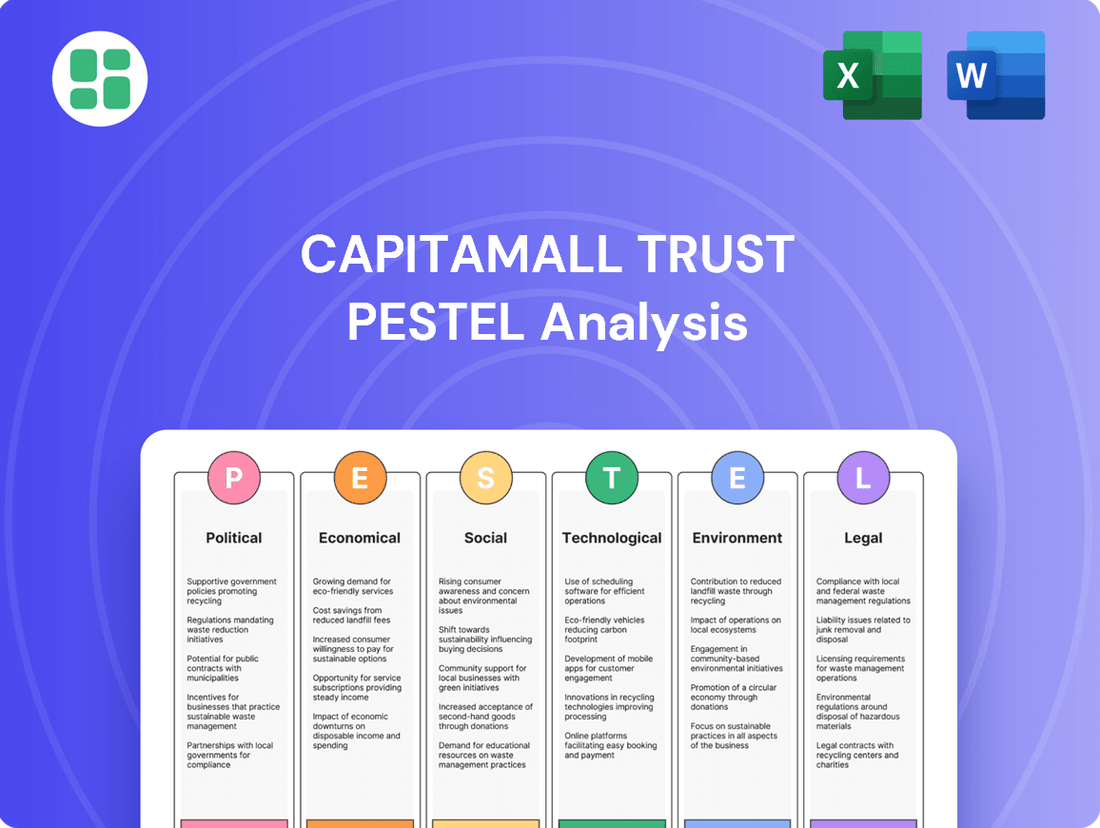

Unlock the strategic advantages of understanding CapitaMall Trust's external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are actively shaping its future. Armed with this knowledge, you can anticipate challenges and capitalize on emerging opportunities.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for CapitaMall Trust. This comprehensive report provides actionable intelligence on the macro-environmental forces impacting its operations and strategic direction. Don't miss out on critical insights – download the full version now.

Political factors

Government policies significantly shape CapitaLand Integrated Commercial Trust's (CICT) operational landscape. In Singapore, the Urban Redevelopment Authority's (URA) master plans and land use zoning directly impact property acquisition and development potential, influencing CICT's portfolio expansion. For instance, the URA's focus on creating vibrant mixed-use precincts and enhancing connectivity in areas like the Central Business District can unlock new investment opportunities for CICT.

In Germany, CICT's real estate ventures are subject to federal and state-level regulations concerning property development, environmental standards, and foreign ownership. Changes in building codes or urban planning directives, such as those promoting sustainable development or revitalizing specific urban areas, necessitate strategic adjustments in CICT's German property management and development strategies. These policy shifts can affect project timelines and costs.

Singapore's robust political framework fosters a stable environment for CapitaLand Integrated REIT (CICT), a key advantage for long-term real estate ventures. This stability, coupled with Germany's own predictable political landscape, offers a reliable operational backdrop.

Despite this domestic strength, global geopolitical shifts present indirect risks. For instance, escalating trade disputes or regional conflicts could dampen overall economic sentiment, potentially affecting CICT's tenant demand and overall portfolio valuation.

The Monetary Authority of Singapore (MAS) sets specific rules for REITs, including distribution requirements, leverage limits, and investment guidelines. For instance, REITs must distribute at least 90% of their taxable income to unitholders annually. Leverage is capped at 45% of deposited property value, a limit that has been in place since 2015, offering a degree of stability but also constraining aggressive debt-funded growth.

Any shifts in these MAS regulations could significantly influence CapitaLand Integrated REIT (CICT). For example, a tightening of leverage limits might necessitate asset disposals or slower expansion, while changes to distribution rules could affect unitholder returns and the trust's attractiveness. The current regulatory framework aims to ensure stability and investor protection, but future adjustments remain a key political consideration.

Bilateral Relations and Trade Agreements

CapitaMall Trust's operations are significantly shaped by bilateral relations and trade agreements, particularly between Singapore and its key markets like Germany. For instance, the EU-Singapore Free Trade Agreement (EUSFTA), which entered into force in November 2019, has facilitated smoother trade flows and investment. This can indirectly boost demand for commercial real estate by fostering economic activity and cross-border business expansion.

Changes in these trade dynamics directly impact the trust's performance. Strong trade ties can lead to increased tenant demand, supporting higher occupancy rates and rental income for CapitaMall Trust's properties. Conversely, geopolitical tensions or the breakdown of trade agreements could dampen economic sentiment, potentially leading to reduced consumer spending and business investment, which in turn could negatively affect tenant occupancy and rental revenue.

- EUSFTA Impact: The EUSFTA aims to eliminate tariffs and reduce non-tariff barriers, potentially stimulating trade between Singapore and the EU by an estimated S$10 billion annually.

- Investment Flows: Singapore's position as a gateway to Southeast Asia, coupled with Germany's strong economic ties within the EU, can influence investment decisions that might include commercial property acquisitions or leases.

- Economic Sensitivity: A downturn in global trade, perhaps due to protectionist policies or trade disputes involving major partners like Germany, could lead to a slowdown in retail sales, impacting tenants within CapitaMall Trust's portfolio.

Taxation Policies

Changes in corporate tax rates, property taxes, or other real estate-related levies in Singapore and Germany directly impact CapitaLand Investment Limited's (CICT) profitability and cash flow. For instance, Singapore's corporate tax rate remained at 17% in 2024, a figure that has been stable. Favorable tax incentives, such as those potentially related to green building certifications or specific investment zones, can enhance returns, whereas increased taxation might reduce distributable income to unitholders and impact asset valuations.

In Germany, property transfer taxes (Grunderwerbsteuer) vary by state, with rates typically ranging from 3.5% to 6.5%. These taxes are a significant cost for real estate transactions, affecting CICT's acquisition and divestment strategies. For example, a 6.5% property transfer tax on a €100 million acquisition would add €6.5 million in upfront costs. Understanding these varying tax landscapes is crucial for managing CICT's financial performance across its international portfolio.

- Singapore's stable corporate tax rate of 17% (as of 2024) provides a predictable operating environment for CICT.

- German property transfer taxes, ranging from 3.5% to 6.5% depending on the state, can significantly influence the cost of real estate acquisitions and disposals for CICT.

- Potential tax incentives for sustainable development could offer financial benefits to CICT's portfolio.

- Increases in property-related taxes in either market could directly reduce CICT's net operating income and affect unitholder distributions.

Government stability in Singapore and Germany provides a predictable operating environment for CapitaMall Trust (CMT), reducing political risk. However, global geopolitical tensions can indirectly impact tenant demand and portfolio valuations by affecting overall economic sentiment.

Regulatory frameworks, such as those set by the Monetary Authority of Singapore (MAS) for REITs, directly influence CMT's financial strategies, including leverage limits and distribution requirements. For instance, the 45% leverage cap, in place since 2015, constrains aggressive debt-funded expansion.

Trade agreements like the EU-Singapore Free Trade Agreement (EUSFTA) can stimulate economic activity, potentially boosting demand for CMT's retail spaces. Conversely, trade disputes could negatively impact tenant performance and rental income.

Changes in tax policies, including corporate and property taxes in Singapore and Germany, directly affect CMT's profitability. Singapore's stable 17% corporate tax rate in 2024 offers predictability, while varying German property transfer taxes (3.5%-6.5%) impact acquisition costs.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting CapitaMall Trust, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

The CapitaMall Trust PESTLE analysis offers a clear, summarized version of external factors for easy referencing during meetings, alleviating the pain of sifting through raw data.

This analysis, segmented by PESTEL categories, provides quick interpretation at a glance, relieving the pain of complex market assessments.

Economic factors

Interest rate fluctuations, especially for benchmarks like the Singapore Overnight Rate Average (SORA) and Euribor, directly affect CapitaLand Investment Limited (CICT)'s expenses. Higher rates mean CICT pays more to borrow money for new properties or to refinance existing loans. For instance, if SORA, which averaged around 2.6% in early 2024, were to climb significantly, CICT’s financing costs would rise, potentially squeezing its net property income and the distributions it can make to investors.

Singapore's Gross Domestic Product (GDP) saw a moderate expansion in 2023, with projections for 2024 indicating continued, albeit potentially slower, growth. This stability is crucial for CapitaLand Integrated REIT (CICT), as a robust economy generally fuels consumer spending and business confidence, directly impacting demand for retail and office spaces within its portfolio.

Germany, a key market for CICT, experienced a contraction in its GDP in 2023, with forecasts for 2024 suggesting a challenging economic environment. This slowdown could translate to weaker tenant demand and potentially put pressure on rental income for CICT's German properties, necessitating a focus on tenant retention and operational efficiency.

The interplay between Singapore's steady economic performance and Germany's more subdued outlook presents a mixed economic backdrop for CICT. For instance, Singapore's GDP growth, estimated around 1.1% for 2023 according to the Ministry of Trade and Industry, supports its domestic retail sector, while Germany's economic challenges, with a GDP contraction of 0.3% in 2023 as reported by Destatis, require careful navigation in its office segment.

Inflationary pressures in 2024 and early 2025 are directly impacting CapitaLand Integrated REIT (CICT) by increasing its operational expenses. Costs for utilities, essential maintenance, and staffing have seen noticeable upticks, squeezing net property income.

While CICT's leases typically incorporate rental escalation clauses to counter inflation, the speed and magnitude of recent price hikes mean that cost increases can sometimes outpace these adjustments. This dynamic poses a risk to the REIT's profit margins, potentially affecting overall profitability.

Consumer Spending and Retail Sales

Consumer spending and retail sales are fundamental to CapitaLand Integrated REIT (CICT)'s retail portfolio. In 2024, Singapore's retail sales continued to show resilience, with projections indicating moderate growth driven by domestic demand and tourism recovery. For instance, retail sales excluding motor vehicles saw a year-on-year increase of 2.1% in the first quarter of 2024, signaling a healthy environment for mall performance.

Strong consumer confidence directly translates to higher footfall and increased tenant sales within CICT's malls. This not only secures stable rental income but also opens avenues for higher turnover rents, benefiting both the REIT and its tenants. As of mid-2024, consumer sentiment surveys indicated a positive outlook, with many households reporting stable or improved financial situations, supporting discretionary spending.

Conversely, economic headwinds or a dip in consumer confidence can significantly impact CICT's retail segment. A slowdown in spending can lead to reduced tenant sales, potentially increasing vacancy rates and pressuring rental yields. For example, if inflation were to accelerate unexpectedly in late 2024 or early 2025, it could dampen consumer purchasing power, posing a challenge to the REIT's retail property performance.

- Retail Sales Growth: Singapore's retail sales (excluding motor vehicles) grew by 2.1% year-on-year in Q1 2024, indicating a positive trend for CICT's retail assets.

- Consumer Confidence: Mid-2024 surveys showed a generally positive consumer sentiment, supporting increased spending in malls.

- Impact of Economic Downturns: Reduced consumer spending due to economic slowdowns or inflation can negatively affect tenant sales and rental income for CICT.

- Turnover Rents: Healthy retail sales volumes allow for higher turnover rents, boosting CICT's overall revenue from its mall tenants.

Employment Rates and Business Confidence

High employment rates and robust business confidence in key markets like Singapore and Germany directly fuel demand for office spaces. When businesses are thriving and hiring, they naturally seek out more or larger office premises, which is a positive sign for CapitaLand Integrated Commercial Trust (CICT). This increased demand translates into higher occupancy rates and the potential for rental growth across CICT's commercial properties.

For instance, Singapore's unemployment rate remained low, hovering around 1.9% in Q1 2024, indicating a healthy labor market. Similarly, Germany's business sentiment, as measured by the Ifo Business Climate Index, showed resilience in early 2024, suggesting companies were optimistic about future conditions. These economic indicators are crucial for CICT as they signal a sustained need for commercial real estate.

- Singapore's Low Unemployment: A sustained low unemployment rate in Singapore, as seen in early 2024, indicates a strong economy where businesses are likely expanding and requiring more office space.

- German Business Confidence: Positive business sentiment in Germany suggests that German companies are confident in their economic outlook, potentially leading to increased office leasing activity.

- Impact on Occupancy: Higher employment and confidence directly correlate with increased demand for office spaces, leading to better occupancy rates for CICT's portfolio.

- Rental Growth Potential: As demand outstrips supply, businesses may be willing to pay higher rents, benefiting CICT's rental income.

Economic factors significantly influence CapitaLand Integrated REIT (CICT)'s performance. Interest rate hikes, like potential increases in SORA, directly raise CICT's borrowing costs, impacting net property income. While Singapore's economy showed resilience in 2023 with modest GDP growth, Germany's contraction in the same year poses challenges for CICT's German assets, potentially affecting rental income.

Inflation in 2024 and early 2025 increases CICT's operational expenses, such as utilities and maintenance. Although lease agreements often include rental escalations, rapid cost increases can outpace these clauses, squeezing profit margins. Consumer spending is vital for CICT's retail portfolio; Singapore's retail sales saw a 2.1% year-on-year increase in Q1 2024, supported by positive consumer sentiment, which boosts mall performance and turnover rents.

Conversely, a downturn in consumer confidence or spending could negatively impact tenant sales and increase vacancies. High employment rates and business confidence are critical for CICT's office segment. Singapore's low unemployment rate (around 1.9% in Q1 2024) and Germany's early 2024 business sentiment suggest sustained demand for office spaces, benefiting occupancy and rental growth potential.

| Economic Indicator | 2023/Early 2024 Data | Impact on CICT |

|---|---|---|

| Singapore GDP Growth | Moderate expansion (e.g., 1.1% in 2023) | Supports retail demand and office space needs. |

| Germany GDP Growth | Contraction (e.g., -0.3% in 2023) | May weaken tenant demand and rental income in German properties. |

| Singapore Interest Rates (SORA) | Averaged ~2.6% in early 2024 | Higher rates increase financing costs for CICT. |

| Singapore Retail Sales Growth | +2.1% YoY in Q1 2024 (excl. motor vehicles) | Positive for mall performance and turnover rents. |

| Singapore Unemployment Rate | ~1.9% in Q1 2024 | Indicates strong labor market, supporting office demand. |

| German Business Climate Index (Ifo) | Resilient in early 2024 | Suggests optimism, potentially boosting office leasing. |

| Inflation | Pressures noted in 2024/early 2025 | Increases operational expenses, potentially impacting margins. |

Preview Before You Purchase

CapitaMall Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CapitaMall Trust delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategy.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of the external forces that shape CapitaMall Trust's market position and future growth prospects.

What you’re previewing here is the actual file—fully formatted and professionally structured. This analysis offers valuable insights for stakeholders seeking to understand the dynamic landscape in which CapitaMall Trust operates.

Sociological factors

Singapore's continued urbanization, with a projected population of 6.9 million by 2025, directly fuels demand for CapitaLand Integrated Commercial Trust's (CICT) prime retail and office spaces in central business districts. This trend means more people living and working closer together, boosting foot traffic in malls like JEM and Tampines Mall and increasing the attractiveness of office buildings for businesses seeking talent.

Higher population density in areas like the Central Business District, where CICT's properties are concentrated, directly translates to a stronger customer base for retail tenants and a wider pool of potential employees for office occupants. For instance, the residential population in the Downtown Core planning area has seen steady growth, supporting sustained rental demand and property values for CICT's commercial assets.

The shift towards hybrid work models significantly influences the demand for traditional office spaces. CapitaLand Integrated REIT (CICT) needs to adjust its office portfolio to cater to this trend.

CICT's strategy must focus on creating flexible, collaborative, and amenity-rich environments. This is crucial for attracting and retaining tenants as companies re-evaluate their physical office needs and employee preferences evolve.

For instance, in Singapore, a significant portion of the workforce has embraced hybrid arrangements, with surveys in late 2024 indicating that over 70% of companies offered some form of flexible work. This necessitates CICT to invest in spaces that support both focused work and team interaction, potentially increasing demand for well-located, modern office buildings with enhanced facilities.

Consumer preferences are rapidly evolving, with a growing demand for experiential retail. This means malls need to offer more than just shops; they need to become destinations for entertainment, dining, and lifestyle. For instance, CapitaLand Integrated Commercial Trust (CICT) has seen success with its integrated developments that blend retail with residential and office spaces, catering to a desire for convenience and diverse experiences.

The push towards sustainable shopping is also a significant trend. Consumers are increasingly conscious of the environmental impact of their purchases, favoring brands and retailers that demonstrate ethical practices. This shift requires CICT to consider sustainability in its tenant mix and mall operations, potentially incorporating green building features and promoting eco-friendly retailers to attract this segment of shoppers.

Omnichannel integration is no longer a luxury but a necessity. Shoppers expect a seamless experience between online and offline channels, from browsing and purchasing to click-and-collect services. CICT's malls must support retailers in providing these integrated solutions, ensuring that physical spaces complement digital platforms to meet modern consumer expectations and drive footfall.

Demographic Shifts

Demographic shifts significantly shape CapitaLand Integrated REIT (CICT)'s retail strategy. For instance, Singapore, CICT's primary market, has an aging population, with the proportion of residents aged 65 and above projected to reach 23% by 2030. This trend necessitates a focus on accessibility and services catering to seniors within CICT malls, alongside adapting to the evolving preferences of younger, digitally-native consumers.

Understanding these demographic dynamics is crucial for optimizing tenant mix and retail offerings. CICT must balance catering to the needs of an older demographic, who may prioritize convenience and health-related services, with attracting younger shoppers who are drawn to experiential retail, technology integration, and sustainable brands. This ensures malls remain relevant and appealing across a broad customer base.

- Aging Population: Singapore's 65+ population is growing, impacting demand for specific retail categories and mall accessibility features.

- Youthful Demographics: Younger generations, with their distinct spending habits and preference for digital engagement, require tailored marketing and tenant curation.

- Consumption Patterns: Shifts in how different age groups spend their disposable income directly influence the types of retailers and services that thrive in CICT's portfolio.

Health and Wellness Consciousness

Growing public focus on health and wellness is directly impacting how commercial properties are designed and managed. This trend means CapitaLand Integrated Commercial Trust (CICT) needs to consider incorporating features that promote tenant and visitor well-being.

To align with these evolving societal expectations, CICT's properties might see a greater emphasis on integrating green spaces, offering fitness facilities, and ensuring superior indoor air quality. For instance, a significant portion of the Singapore population, around 85% in 2024, reported actively seeking healthier lifestyle options, suggesting a strong market demand for such amenities.

This shift towards prioritizing well-being translates into tangible changes in real estate strategies:

- Enhanced Green Spaces: Increasing the presence of natural elements within retail and office environments.

- Fitness and Recreation: Integrating gyms, yoga studios, or even outdoor exercise areas.

- Improved Air Quality: Investing in advanced HVAC systems and air purification technologies.

- Wellness Programs: Potentially offering or facilitating access to wellness workshops and healthy food options within malls and office buildings.

Societal shifts towards health and wellness are reshaping commercial property expectations. CapitaLand Integrated Commercial Trust (CICT) is adapting by integrating more green spaces and wellness amenities, reflecting a strong public demand for healthier environments. This focus on well-being is becoming a key differentiator in attracting tenants and visitors.

The aging demographic in Singapore, projected to constitute 23% of the population by 2030, influences CICT's tenant mix and mall accessibility. Simultaneously, younger consumers' preferences for experiential retail and digital integration require a dynamic approach to tenant curation and marketing strategies.

Hybrid work models continue to impact office space demand, pushing CICT to create flexible, amenity-rich environments. Over 70% of Singaporean companies offered flexible work arrangements in late 2024, underscoring the need for adaptable office solutions that foster collaboration and employee well-being.

Consumer demand for experiential retail and omnichannel integration is rising. CICT's success hinges on malls becoming destinations for dining, entertainment, and lifestyle, seamlessly blending online and offline shopping experiences to meet evolving consumer expectations.

| Sociological Factor | Impact on CICT | Key Data/Trend |

|---|---|---|

| Aging Population | Demand for accessible facilities, specific retail categories (e.g., health, convenience) | Singapore's 65+ population projected at 23% by 2030 |

| Hybrid Work Models | Need for flexible, collaborative office spaces with enhanced amenities | Over 70% of Singaporean companies offered flexible work in late 2024 |

| Health & Wellness Focus | Integration of green spaces, fitness facilities, improved air quality | ~85% of Singapore population sought healthier lifestyle options in 2024 |

| Experiential Retail Demand | Transformation of malls into lifestyle destinations, blending retail with F&B and entertainment | Growing consumer preference for integrated experiences |

Technological factors

The ongoing surge in e-commerce, projected to reach over $2.3 trillion globally by the end of 2024, compels CapitaMall Trust (CICT) to deeply embed digital strategies within its physical retail spaces. This means enhancing offerings like click-and-collect services, creating immersive online-to-offline (O2O) experiences, and ensuring dependable, high-speed Wi-Fi is readily available throughout its malls.

By embracing these digital integrations, CICT's properties can effectively counter the competitive pressures from online retail. For instance, malls that facilitate seamless omnichannel journeys, allowing customers to browse online and pick up in-store, or return online purchases at a physical location, are better positioned to retain shopper loyalty and remain relevant in the evolving retail landscape.

CapitaLand Investment Trust (CICT) is increasingly integrating smart building technologies and the Internet of Things (IoT) across its portfolio. These advancements are designed to boost operational efficiency and cut down on energy usage. For instance, by 2024, many of CICT's properties are expected to feature IoT sensors that monitor everything from occupancy levels to air quality, leading to more responsive and resource-efficient building management.

The adoption of advanced building management systems, powered by IoT data, directly translates into improved tenant experiences. By optimizing environmental controls and providing data-driven insights, CICT can create more comfortable and productive spaces. This focus on innovation is crucial for tenant retention and attracting new occupants seeking modern, sustainable, and technologically advanced environments, contributing to higher tenant satisfaction rates.

CapitaMall Trust (CICT) is increasingly leveraging big data analytics and artificial intelligence (AI) to sharpen its property management. These technologies offer deeper insights into how tenants behave, when people visit the malls, and how efficiently operations are running. For instance, by analyzing footfall data, CICT can better understand peak hours and popular zones within its properties.

This data-driven strategy directly supports optimizing how space is used, tailoring marketing to specific customer segments, and even predicting when equipment might need maintenance. In 2023, CICT reported a 6.2% increase in shopper traffic compared to the previous year, a figure likely influenced by data-informed decisions about tenant mix and promotional activities.

Cybersecurity Risks and Data Privacy

CapitaMall Trust (CICT), like many real estate investment trusts, faces escalating cybersecurity risks as it enhances its digital infrastructure for tenant engagement and operational efficiency. A significant data breach could expose sensitive tenant and customer information, leading to substantial financial penalties and a severe blow to its reputation. For instance, in 2023, the global average cost of a data breach reached an all-time high of USD 4.45 million, according to IBM's Cost of a Data Breach Report.

Adherence to evolving data privacy regulations, such as the Personal Data Protection Act (PDPA) in Singapore, is non-negotiable for CICT. Non-compliance can result in hefty fines and legal challenges, impacting investor confidence. The increasing sophistication of cyber threats, including ransomware and phishing attacks, necessitates continuous investment in advanced security protocols and employee training to safeguard CICT's digital assets and maintain stakeholder trust.

- Escalating threat landscape: Cyberattacks are becoming more frequent and sophisticated, targeting digital platforms used by CICT for operations and tenant services.

- Regulatory compliance: Strict adherence to data privacy laws like Singapore's PDPA is critical to avoid significant fines and reputational damage.

- Financial and reputational impact: Data breaches can lead to direct financial losses from remediation and fines, alongside long-term damage to CICT's brand image and investor trust.

Proptech Innovation and Digital Twin Technology

Proptech innovations, particularly digital twin technology, are transforming property management. These virtual replicas allow for enhanced asset lifecycle management and detailed real-time visualization, offering CapitaMall Trust (CICT) significant opportunities for improved planning and operational efficiency. For instance, by 2024, the global Proptech market was projected to reach over $20 billion, highlighting the rapid adoption of these technologies.

The application of digital twins can streamline maintenance schedules, reduce design errors during renovations, and foster better collaboration among stakeholders. This leads to more efficient operations and potentially lower operating costs. A study by Gartner in 2023 suggested that companies utilizing digital twins could see up to a 10% reduction in operational expenses.

- Enhanced Asset Lifecycle Management: Digital twins provide a comprehensive virtual model of CICT's properties, enabling better tracking of maintenance, upgrades, and performance over time.

- Improved Operational Efficiency: Real-time data integration allows for proactive issue identification and resolution, minimizing downtime and optimizing resource allocation.

- Reduced Design and Construction Risks: Virtual prototyping and simulation capabilities inherent in digital twins can significantly lower the risk of costly errors during development or refurbishment projects.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into retail operations presents a significant opportunity for CapitaMall Trust (CICT) to personalize tenant experiences and optimize mall management. By 2025, AI-powered analytics are expected to drive more targeted marketing campaigns and enhance customer engagement within CICT's properties. For example, AI can analyze shopper behavior to predict future trends and tailor promotions, potentially boosting sales for tenants.

Furthermore, the adoption of advanced robotics and automation in areas like cleaning, security, and logistics can lead to greater operational efficiency and cost savings for CICT. These technologies are becoming more sophisticated, offering solutions that can improve the overall functionality and appeal of its retail spaces, contributing to a more seamless and modern shopping environment for visitors.

The ongoing digital transformation necessitates robust cybersecurity measures, as the cost of data breaches continues to rise. In 2024, the average cost of a data breach globally was projected to exceed $4.5 million, underscoring the critical need for CICT to invest in advanced security protocols to protect tenant and customer data.

CapitaMall Trust (CICT) is actively exploring and implementing smart building technologies, including the Internet of Things (IoT), to enhance sustainability and tenant comfort. These technologies allow for real-time monitoring and control of energy consumption and environmental conditions, aiming to reduce operational costs and improve the overall tenant experience.

Legal factors

CapitaLand Integrated Commercial Trust (CICT) must navigate a complex web of property and land use regulations in both Singapore and Germany. These laws dictate everything from zoning restrictions and building safety codes to the crucial development approval processes. For instance, in Singapore, the Urban Redevelopment Authority (URA) sets stringent guidelines for land use and development, impacting CICT's ability to redevelop or repurpose its retail and office spaces.

Failure to comply with these legal frameworks can lead to significant penalties, project delays, and even the invalidation of property rights, directly impacting CICT's operational efficiency and the value of its assets. In 2024, Singapore's government continued to emphasize sustainable development and urban planning, requiring developers like CICT to integrate green building standards and community impact assessments into their projects, adding another layer of compliance.

CapitaLand Invest Trust (CICT) operates under a complex web of tenancy and leasehold regulations that vary significantly by jurisdiction. These laws dictate crucial aspects of commercial and retail leases, including rent review mechanisms, tenant protections against arbitrary eviction, and the enforceability of lease covenants. For instance, in Singapore, where CICT has a substantial portfolio, the Landlord and Tenant Act governs many aspects of these relationships, ensuring fair practices for both parties.

Navigating these legal frameworks is paramount for CICT's operational success. The trust must ensure all lease agreements are legally compliant, thereby mitigating risks associated with disputes or regulatory challenges. Effective management of tenant relations, including timely rent collection and adherence to lease terms, is directly influenced by the clarity and enforceability of these regulations. As of early 2024, CICT's robust portfolio, comprising 22 properties in Singapore valued at approximately S$11.7 billion, underscores the scale of its exposure to these diverse legal requirements.

As a listed Real Estate Investment Trust (REIT), CapitaLand Integrated Commercial Trust (CICT) operates under a strict regulatory framework. This includes compliance with the Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX) listing rules, which mandate specific disclosure requirements, robust governance standards, and adherence to investment mandates. For instance, REITs in Singapore are generally required to distribute at least 90% of their distributable income to unitholders annually. Failure to comply can jeopardize its REIT status and erode investor trust.

Competition Law and Market Dominance

CapitaMall Trust (CICT) must navigate competition law closely, especially concerning its acquisitions and tenant agreements. These activities are scrutinized to prevent anti-competitive practices or the establishment of undue market dominance, ensuring a level playing field for all market participants.

Adherence to fair competition principles shields CICT from regulatory intervention, potential penalties, and legal disputes. For instance, the Competition and Consumer Commission of Singapore (CCCS) actively monitors market conduct to safeguard consumer interests and promote healthy market competition.

- Merger Control: CICT's acquisitions are subject to merger control reviews by competition authorities if they meet certain turnover thresholds, ensuring that significant market share gains do not stifle competition.

- Abuse of Dominance: CICT must avoid exploiting any dominant position it might hold in specific retail segments or geographic locations, which could involve unfair pricing or discriminatory tenant terms.

- Tenant Agreements: Lease agreements must be structured to avoid exclusivity clauses that could restrict tenants from engaging with competing malls or suppliers, thereby promoting tenant choice and market dynamism.

- Regulatory Scrutiny: Non-compliance can lead to investigations, substantial fines, and mandated changes to business practices, as seen in past cases where competition authorities have intervened to prevent market distortion.

Data Protection and Privacy Laws (e.g., PDPA, GDPR)

CapitaLand Investment Management (CIM), which manages CapitaLand Ascendas REIT (CICT), must navigate a complex web of data protection and privacy regulations. The collection and processing of personal data, from tenant details to visitor analytics gathered through mall operations, are strictly governed by laws such as Singapore's Personal Data Protection Act (PDPA) and the European Union's General Data Protection Regulation (GDPR). Failure to comply can result in substantial fines and damage to stakeholder trust.

CICT's commitment to data privacy is paramount for maintaining its reputation and operational integrity. For instance, the PDPA mandates that organizations obtain consent for collecting, using, or disclosing personal data, and ensure its accuracy and security. In 2023, the Monetary Authority of Singapore (MAS) continued to emphasize robust data governance and cybersecurity, impacting how REITs like CICT handle sensitive information.

- PDPA Compliance: CICT must adhere to the PDPA's requirements for consent, purpose limitation, and data security when handling tenant and visitor information.

- GDPR Considerations: While primarily operating in Singapore, any data processing involving EU residents would necessitate GDPR compliance, a high standard for data protection.

- Reputational Risk: Data breaches or non-compliance can lead to significant financial penalties, estimated to be up to S$1 million per offense under the PDPA, and severe reputational damage.

- Stakeholder Trust: Demonstrating strong data protection practices is crucial for maintaining the confidence of tenants, investors, and mall visitors.

CapitaLand Integrated Commercial Trust (CICT) must adhere to stringent property development and land use regulations, particularly in Singapore where the Urban Redevelopment Authority (URA) dictates zoning and building standards. Non-compliance can lead to project delays and financial penalties, impacting asset value.

The trust also navigates complex tenancy and leasehold laws, ensuring fair practices and mitigating risks in rent collection and lease enforcement. For instance, Singapore's Landlord and Tenant Act governs many aspects of these relationships.

As a listed REIT, CICT faces strict oversight from the Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX), requiring transparency in disclosures and adherence to governance standards, including distributing at least 90% of distributable income annually.

CICT must also comply with competition laws to prevent anti-competitive practices, particularly during acquisitions and in tenant agreements, avoiding undue market dominance as monitored by bodies like the Competition and Consumer Commission of Singapore (CCCS).

Environmental factors

CapitaLand Investment Limited (CICT) faces significant risks from climate change, particularly the increasing frequency and intensity of extreme weather events like floods and heatwaves. These events can directly damage property infrastructure, disrupt operations, and impact tenant occupancy, as seen in various retail and commercial properties globally. For example, a severe flood in 2024 in Southeast Asia caused temporary closures and significant repair costs for several retail centers.

To counter these physical risks, CICT is actively investing in climate-resilient designs and infrastructure upgrades. This includes enhancing building materials to withstand extreme weather, improving drainage systems, and incorporating green building technologies. Their 2025 sustainability report highlights a S$50 million allocation towards climate adaptation measures across their portfolio, aiming to safeguard asset value and ensure operational continuity.

The push for greener structures is intensifying, with regulatory bodies and the market increasingly favoring sustainable properties. CapitaLand Integrated Commercial Trust (CICT) must align with green building benchmarks like Singapore Green Mark and LEED to meet these evolving expectations.

Achieving certifications such as Green Mark Platinum for its properties, like JEM and Westgate, not only elevates their market value but also attracts tenants who prioritize environmental responsibility. This commitment signals CICT's dedication to sustainability, a key factor in today's investment climate.

CapitaLand Integrated REIT (CICT) faces significant environmental challenges in managing resource consumption, particularly water and energy, across its extensive retail and commercial property portfolio. For instance, in 2023, CICT reported a total energy consumption of 385,500 MWh, highlighting the ongoing need for efficiency improvements.

Implementing robust waste management strategies is also crucial. By focusing on reducing waste generation and increasing recycling rates, CICT can mitigate its environmental footprint. This proactive approach not only supports sustainability objectives but also offers potential for operational cost savings through reduced utility and disposal expenses.

Carbon Emissions and Energy Efficiency

CapitaMall Trust (CICT) faces increasing pressure to curb its carbon footprint, driving investments in energy-efficient upgrades and renewable energy solutions across its retail portfolio. This strategic shift is crucial for meeting climate targets and also offers tangible financial benefits by lowering operational costs. For instance, by implementing smart building technologies and exploring solar power installations, CICT can reduce its reliance on conventional energy sources, leading to significant savings. This focus on sustainability also makes its properties more appealing to a growing segment of tenants prioritizing environmental responsibility.

The drive towards net-zero emissions is reshaping the real estate landscape. In 2024, Singapore's Green Building Masterplan continues to emphasize energy efficiency, with targets for all new and existing buildings to be significantly greener. CICT's proactive approach in adopting these standards is not just about compliance; it's about future-proofing its assets. By enhancing energy efficiency, CICT can expect to see a reduction in utility expenses, potentially saving millions annually. For example, a 10% improvement in energy efficiency across a large retail mall could translate to substantial operational cost savings, directly impacting the bottom line and increasing the asset's valuation.

- Enhanced Tenant Appeal: Properties with strong sustainability credentials attract and retain environmentally conscious tenants, a growing demographic in the retail sector.

- Reduced Operating Expenses: Investments in energy efficiency directly translate to lower utility bills, improving CICT's profitability.

- Regulatory Compliance: Meeting evolving environmental regulations and targets is essential to avoid penalties and maintain a positive corporate image.

- Improved Asset Valuation: Greener buildings are increasingly valued higher by investors and are more resilient to future regulatory changes.

ESG Investor Pressure and Reporting

Investors are increasingly demanding robust Environmental, Social, and Governance (ESG) performance from real estate investment trusts like CapitaLand Integrated REIT (CICT). This pressure necessitates CICT to not only improve its ESG disclosures but also to deeply embed sustainability principles into its fundamental business operations and strategies.

Enhanced ESG reporting is crucial for attracting capital from a growing pool of responsible investors. For instance, as of early 2024, global sustainable investment assets under management were projected to exceed $50 trillion, highlighting the significant capital allocation shift towards ESG-compliant entities. This focus on sustainability directly influences CICT's reputation and can positively impact its overall valuation.

- Investor Demand: Growing investor preference for sustainable assets, with a significant portion of institutional capital now allocated based on ESG criteria.

- Disclosure Enhancement: The need for CICT to provide detailed and transparent reporting on its environmental impact, social responsibility, and governance practices.

- Strategic Integration: Embedding sustainability into CICT's core business strategy, from property development and management to tenant engagement.

- Valuation Impact: Strong ESG performance can lead to improved access to capital, lower cost of capital, and a higher market valuation for CICT.

CapitaMall Trust (CICT) faces growing scrutiny regarding its environmental impact, particularly its carbon footprint and resource consumption. Driven by climate change concerns and evolving regulations, CICT is investing in energy efficiency and renewable energy solutions to reduce operational costs and enhance property appeal. For example, in 2023, CICT's energy consumption was 385,500 MWh, underscoring the need for continuous improvement in this area.

The real estate sector is increasingly prioritizing sustainability, with green building certifications becoming a key differentiator. CICT's commitment to standards like Singapore Green Mark, as evidenced by certifications for JEM and Westgate, not only aligns with regulatory expectations but also attracts environmentally conscious tenants and investors. This strategic focus on sustainability is crucial for maintaining asset value and ensuring long-term competitiveness in the market.

Investor demand for strong Environmental, Social, and Governance (ESG) performance is a significant driver for CICT. With global sustainable investment assets projected to exceed $50 trillion by early 2024, CICT must enhance its ESG disclosures and integrate sustainability into its core operations to attract capital and improve its market valuation.

| Metric | 2023 Data | Target/Trend |

| Total Energy Consumption (MWh) | 385,500 | Reduction through efficiency upgrades |

| Green Building Certifications | Multiple properties certified (e.g., JEM, Westgate) | Increase in certified properties |

| ESG Investment Trend | Global assets > $50 trillion (projected early 2024) | Growing investor preference for ESG |

PESTLE Analysis Data Sources

Our CapitaMall Trust PESTLE Analysis is informed by a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. We integrate data on economic indicators, regulatory changes, and consumer sentiment from trusted sources to provide a robust overview.