CapitaMall Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaMall Trust Bundle

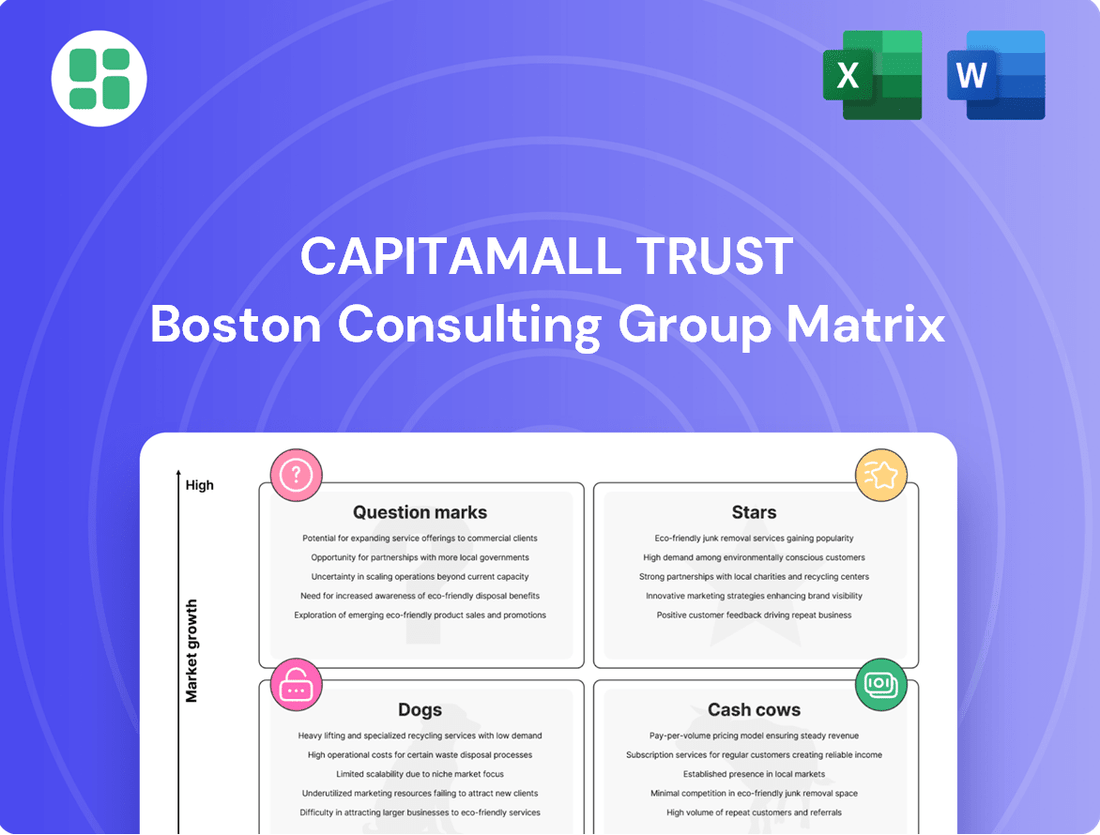

Curious about CapitaMall Trust's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand which assets are driving growth and which might require a strategic rethink.

Don't settle for a partial view. Purchase the full CapitaMall Trust BCG Matrix report for a comprehensive breakdown of each asset's market share and growth rate. Gain data-driven insights and actionable recommendations to optimize your investment strategy and unlock CapitaMall Trust's full potential.

This is your opportunity to gain a competitive edge. The complete BCG Matrix provides the clarity needed to make informed decisions about resource allocation and future growth initiatives for CapitaMall Trust. Secure your copy today and transform your strategic planning.

Stars

The acquisition of a 50% stake in ION Orchard in October 2024 was a pivotal moment for CapitaLand Integrated REIT (CICT), significantly enhancing its standing in Singapore's high-end retail sector. This move positions ION Orchard as a Star in CICT's portfolio, given its prime location, prestigious tenant mix, and anticipated robust performance in a thriving luxury market.

ION Orchard's classification as a Star is supported by its iconic status and premium positioning, which are expected to drive sustained high shopper traffic and strong tenant sales. This strategic acquisition reinforces CICT's leadership in the luxury retail segment, a market segment demonstrating consistent growth and resilience.

The financial backing for this significant acquisition came partly from an equity fundraising exercise that was oversubscribed, a clear indicator of strong investor confidence in CICT's strategic direction and the value proposition of ION Orchard. This successful fundraising underscores the market's positive reception to CICT's expansion into prime retail assets.

Prime Singapore retail assets within CapitaMall Trust (CICT) represent strong stars in the BCG matrix. These properties, benefiting from Singapore's robust domestic consumption and a rebound in tourism, consistently show positive rental reversions and high occupancy rates, reaching 99.3% for retail in FY2024.

This performance underscores their market leadership and potential for continued growth, further bolstered by CICT's strategic tenant mix rejuvenation efforts.

Integrated developments like Raffles City Singapore and Funan, which blend retail, office, and other functionalities, can be considered stars in the BCG matrix. These assets are situated in prime urban locations with robust growth prospects. For instance, CapitaLand Integrated REIT (CLIR), which includes these properties, reported a distributable income of S$105.7 million for the first quarter of 2024, indicating strong operational performance.

Strategic Asset Enhancement Initiatives (AEIs)

CapitaMall Trust's Strategic Asset Enhancement Initiatives (AEIs) are crucial for maintaining and improving its market position. Investments in key properties, like the ongoing phases 3 and 4 at IMM Building, expected to finish in the third quarter of 2025, and the Tampines Mall AEI starting in the fourth quarter of 2025, are designed to make these malls leaders in their respective categories. These projects focus on upgrading the tenant mix and overall attractiveness, aiming for substantial rental income growth and enhanced competitiveness.

The goal of these AEIs is to transform existing assets into premier destinations. By strategically enhancing tenant offerings and improving the customer experience, CapitaMall Trust anticipates significant rental reversions. For instance, the IMM Building's AEI is projected to boost its net property income. This proactive approach ensures that the REIT's portfolio remains relevant and high-performing in a dynamic retail landscape.

- IMM Building AEI: Phases 3 and 4 completion by 3Q25, targeting market leadership through improved tenant mix.

- Tampines Mall AEI: Commencing 4Q25, focusing on rental uplift and increased competitiveness.

- Strategic Objective: Position properties as future market leaders, driving rental growth and asset value.

Future-Proofed Office Assets in Singapore CBD

Prime Grade A office assets in Singapore's Central Business District (CBD) that are actively being upgraded or securing premium tenants are positioned for resilience. For instance, CapitaSpring, boasting tenants like JPMorgan Chase, exemplifies this trend, demonstrating strong rental reversions and high occupancy rates.

This performance is driven by a clear flight to quality and Singapore's enduring position as a key regional business hub. These factors contribute to a sustained high market share within a competitive yet expanding segment of the office market.

- CapitaSpring's Tenant Profile: Attracts high-caliber tenants such as JPMorgan Chase, signaling strong demand for premium office space.

- Rental Reversions and Occupancy: These future-proofed assets command high rental reversions and maintain robust occupancy levels.

- Flight to Quality: The ongoing trend of companies seeking superior office environments benefits these prime CBD locations.

- Singapore's Hub Status: The city-state's continued strength as a regional business hub underpins demand for quality office assets.

Stars in CapitaMall Trust's portfolio, like prime retail assets in Singapore, benefit from strong market demand and strategic enhancements. These properties, including ION Orchard acquired in October 2024, exhibit high occupancy rates, reaching 99.3% for retail in FY2024, and positive rental reversions. Integrated developments such as Raffles City Singapore and Funan also represent stars, contributing to a distributable income of S$105.7 million for CapitaLand Integrated REIT (CLIR) in Q1 2024.

| Asset Category | Example Asset | Key Performance Indicators | Strategic Initiatives |

|---|---|---|---|

| Prime Retail | ION Orchard | High shopper traffic, strong tenant sales, premium positioning | Acquisition in Oct 2024, equity fundraising oversubscribed |

| Integrated Developments | Raffles City Singapore | Robust growth prospects, strong operational performance | Part of CLIR's portfolio, Q1 2024 distributable income S$105.7 million |

| Prime Office | CapitaSpring | High rental reversions, robust occupancy, premium tenant mix | Flight to quality, Singapore's hub status |

What is included in the product

The CapitaMall Trust BCG Matrix offers a strategic overview of its retail assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which malls to nurture, harvest, or divest for optimal portfolio performance.

The CapitaMall Trust BCG Matrix offers a clear, actionable overview, simplifying complex portfolio decisions for stakeholders.

Cash Cows

CapitaLand Integrated REIT (CICT) boasts mature, high-occupancy suburban malls in Singapore, acting as strong Cash Cows. These properties, often exceeding 99% occupancy, benefit from established residential catchments and loyal customer bases, ensuring stable rental income and predictable cash flows. For instance, in 2024, CICT's Singapore retail portfolio maintained robust performance, contributing significantly to its distributable income.

Prime Singapore office buildings, situated in the heart of the Central Business District, are the bedrock of CapitaLand Mall Trust's portfolio, acting as classic Cash Cows. These mature assets boast exceptional locations and benefit from consistent tenant demand, evidenced by strong retention rates and lengthy lease agreements.

In 2024, these prime Singapore office buildings continued to demonstrate resilience, with occupancy rates for Grade A office space in the CBD remaining robust, often exceeding 90%. This stability translates into predictable and substantial net property income, a hallmark of a Cash Cow. For instance, properties like CapitaGreen and Six Battery Road are known for their long-term anchor tenants, ensuring a steady revenue stream.

The consistent cash flow generated by these prime office assets is crucial for CapitaLand Mall Trust. It provides the financial muscle to support newer, growth-oriented ventures within the trust's broader portfolio, while also enabling consistent distributions to unitholders. Their established market presence means minimal expenditure is required for marketing or tenant acquisition, further enhancing their profitability.

CapitaLand Integrated REIT (CICT) boasts a remarkably stable income stream, with a substantial 94.5% of its property value concentrated in Singapore as of the first half of 2024. This heavy Singapore weighting acts as a significant Cash Cow, providing a bedrock of consistent returns.

This strong domestic focus shields CICT from the unpredictable swings often seen in international property markets. It allows the trust to generate reliable rental income, contributing positively to its overall financial health and stability for unitholders.

Effective Capital Management

CapitaMall Trust's (CICT) approach to capital management is a cornerstone of its Cash Cow strategy. A healthy aggregate leverage ratio of 38.5% as of December 2024 demonstrates prudent financial stewardship, ensuring stability.

Furthermore, CICT's commitment to a high percentage of fixed-rate debt, standing at 81%, significantly mitigates exposure to fluctuating interest rates. This financial discipline is crucial for maintaining predictable and stable cash flows.

This robust capital structure allows CICT's mature assets, its Cash Cows, to consistently generate reliable distributions and provide a solid foundation for future growth initiatives.

- Aggregate Leverage Ratio: 38.5% (December 2024)

- Fixed-Rate Debt Percentage: 81%

- Impact: Stable cash flow generation and reduced interest rate risk

- Benefit: Supports reliable distributions and growth funding

Consistent Distribution Per Unit (DPU)

CapitaMall Trust's (CICT) consistent and slightly increasing Distribution Per Unit (DPU) is a strong indicator of its Cash Cow status. In FY2024, CICT reported a DPU of 10.88 cents, representing a 1.2% year-on-year increase. This steady growth, even with economic headwinds and a larger unit base, highlights the robust cash-generating capabilities of its established retail assets.

The reliable DPU performance signifies that CICT's core properties are mature, well-performing assets that consistently produce strong cash flows. This stability is a hallmark of Cash Cows within the BCG Matrix, demonstrating their ability to generate more cash than they require for maintenance and reinvestment, thus providing dependable returns to unitholders.

- FY2024 DPU: 10.88 cents

- Year-on-Year DPU Growth: 1.2%

- Asset Performance: Indicates strong cash generation from core retail assets.

- Investor Returns: Demonstrates reliable value delivery to unitholders.

The mature, high-occupancy suburban malls and prime Singapore office buildings within CapitaMall Trust (CICT) are its Cash Cows. These assets generate stable, predictable income streams due to their established locations and strong tenant demand, as seen in their consistently high occupancy rates. For example, in the first half of 2024, CICT's Singapore retail portfolio maintained strong performance, contributing significantly to its distributable income.

| Asset Type | Key Characteristics | 2024 Performance Indicator | BCG Matrix Role |

|---|---|---|---|

| Suburban Malls (Singapore) | High occupancy, established residential catchments | Robust performance, stable rental income | Cash Cow |

| Prime CBD Office Buildings (Singapore) | Exceptional locations, strong tenant retention | Occupancy often >90% (Grade A CBD) | Cash Cow |

| Financial Stability | Prudent capital management | Aggregate Leverage: 38.5% (Dec 2024) | Supports Cash Cow stability |

| Distributions | Consistent and growing DPU | FY2024 DPU: 10.88 cents (1.2% YoY growth) | Demonstrates strong cash generation |

Delivered as Shown

CapitaMall Trust BCG Matrix

The CapitaMall Trust BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This means the exact same professionally formatted report, rich with insights into CapitaMall Trust's portfolio, will be delivered to you instantly. You can confidently use this preview as a direct representation of the high-quality, actionable BCG Matrix analysis that will be yours to download and implement. Expect a ready-to-use file designed for immediate strategic application, without any demo content or hidden surprises.

Dogs

Certain overseas office assets within CapitaLand Investment's portfolio, like 100 Arthur Street in Sydney, are facing challenges. In fiscal year 2024, this property saw a decline in its occupancy rate, a trend that is expected to persist as the recovery from return-to-office mandates proves slower than anticipated.

These underperforming assets can be categorized as Dogs in a BCG Matrix analysis. They demand substantial investment and strategic attention to improve their financial standing, yet the potential for high returns remains uncertain, posing a risk of capital being tied up in assets with limited growth prospects.

Divested non-core assets, such as CapitaLand Integrated REIT (CICT) selling 21 Collyer Quay in November 2024 for S$310 million, represent a strategic move away from properties with lower growth potential or those not central to the REIT's core portfolio. This divestment aligns with the concept of 'Dogs' in the BCG Matrix, where assets are characterized by low market share and low growth.

Properties within CapitaLand Integrated REIT (CICT) that consistently show low occupancy, even as the market bounces back, would be classified as Dogs in a BCG Matrix analysis. These could be older malls or those in less desirable locations. For instance, if a mall’s occupancy rate hovers significantly below the REIT’s overall average, say below 85% while the REIT boasts 92% occupancy as of early 2024, it signals a potential Dog.

Such underperforming assets can become cash traps, meaning their operating expenses are disproportionately high compared to the rental income they generate. This drags down the entire portfolio's profitability and efficiency. While CICT has demonstrated strong overall portfolio performance, it's crucial to identify and address any specific assets that consistently fail to attract tenants.

Properties Requiring Extensive, Unjustified AEIs

Properties requiring disproportionately high capital expenditure for asset enhancement initiatives (AEIs) with uncertain or low expected returns are considered dogs within the CapitaMall Trust (CICT) BCG Matrix. The cost-benefit analysis for these assets may not justify the investment, indicating a lack of inherent growth potential in their current market positioning.

CICT's disciplined approach to AEIs is designed to steer clear of such capital-intensive projects with questionable returns. For instance, a property might necessitate significant upgrades to meet evolving tenant demands or regulatory standards, but if the projected rental yield or occupancy uplift doesn't sufficiently cover the substantial AEI costs, it would fall into this category.

- Unjustified AEI Costs: High expenditure on enhancements without a clear path to commensurate revenue growth.

- Low Expected Returns: The potential financial upside from asset enhancement is insufficient to justify the capital outlay.

- Uncertain Market Potential: The property's location or current market conditions offer limited prospects for significant future performance improvement.

- Risk of Capital Misallocation: Investing in these properties could divert resources from more promising opportunities within CICT's portfolio.

Assets with Declining Rental Reversions

While CapitaLand Integrated Commercial Trust (CICT) generally saw positive rental reversions across its portfolio in FY2024, certain properties or sub-markets might be experiencing headwinds. For instance, if a specific mall within CICT's portfolio faces declining foot traffic and a surplus of competing retail spaces, its rental reversions could turn negative. This would place it in the Dogs quadrant of the BCG Matrix.

Assets classified as Dogs typically exhibit low growth and low market share within their segment. For CICT, this would translate to properties that are not only struggling to achieve positive rental reversions but are also underperforming relative to their peers. For example, if a particular office building experiences high vacancy rates and declining rental rates due to a shift in tenant demand towards newer, more modern spaces, it could be considered a Dog.

- Declining Market Demand: Properties in locations with reduced consumer spending or a shift in retail preferences could see negative rental reversions.

- Oversupply: An increase in competing retail or office spaces in a specific sub-market can put downward pressure on rents.

- Asset Underperformance: Older properties that require significant capital expenditure to remain competitive may also fall into this category.

Properties within CapitaMall Trust (CICT) that consistently struggle with low occupancy and negative rental reversions, even amidst a generally recovering market, are categorized as Dogs. These assets often require significant capital investment for enhancements with uncertain returns, making them potential cash traps. For instance, if a specific mall's occupancy rate falls below 85% while the REIT's average is 92% as of early 2024, it signals a Dog.

These underperforming assets can be characterized by high operating expenses relative to their rental income, negatively impacting overall portfolio profitability. Divesting non-core assets, such as CICT's sale of 21 Collyer Quay in November 2024 for S$310 million, aligns with managing these 'Dog' assets by moving away from properties with low growth potential.

Assets requiring disproportionately high capital expenditure for asset enhancement initiatives (AEIs) with low expected returns are also considered Dogs. A property needing substantial upgrades without a clear path to commensurate revenue growth, or facing uncertain market potential due to location or competition, would fall into this category, posing a risk of capital misallocation.

In fiscal year 2024, certain overseas office assets like 100 Arthur Street in Sydney experienced declining occupancy, a trend expected to continue due to slower return-to-office mandates, thus classifying them as Dogs. These assets demand attention but offer uncertain high returns, risking tied-up capital.

Question Marks

Gallileo in Frankfurt, Germany, is currently categorized as a Question Mark within the CapitaMall Trust BCG Matrix. This classification stems from its ongoing asset enhancement initiatives, which commenced in February 2024.

The property exhibits high growth potential, significantly boosted by the upcoming occupancy of the European Central Bank (ECB) from the second half of 2025. This new anchor tenant is expected to drive future revenue streams and enhance the asset's market position.

However, the full financial impact, particularly on distributable income per unit (DPU), is not anticipated until fiscal year 2026. Consequently, Gallileo is currently a cash consumer, as it invests in upgrades and awaits the full realization of its enhanced income-generating capacity.

The Main Airport Center (MAC) in Frankfurt, with its occupancy rate dipping to 81.8% in 2024, is categorized as a Question Mark within the BCG Matrix. This designation stems from its position as an overseas asset located in a significant financial center, yet its current occupancy levels indicate it's not yet a star performer.

The ongoing efforts by management to backfill the vacant spaces at MAC highlight the substantial investment and strategic focus required to unlock its full potential. This situation demands careful consideration of whether to invest further to improve its market share or divest if returns are not expected to materialize.

CapitaLand Investment Limited (CIL), the parent entity of CapitaMalls Trust (CMT), actively explores strategic acquisitions in emerging markets and property segments to diversify its portfolio beyond its established Singapore retail and office presence, as well as its German and Australian assets. These ventures, while offering significant growth prospects, inherently involve higher risk profiles and a nascent market position, necessitating considerable capital outlay to build competitive advantage.

For instance, CIL's recent foray into the logistics and data center sectors, exemplified by its acquisition of a portfolio of logistics properties in Australia for approximately S$300 million in early 2024, signals a strategic pivot towards high-growth areas. These sectors, though less established for CMT compared to its core retail assets, represent opportunities with strong secular tailwinds, aligning with the 'question mark' quadrant of the BCG matrix.

New Development Projects (if any)

New development projects for CapitaLand Integrated REIT (CICT) would fall into the Question Marks category of the BCG Matrix. These ventures require substantial investment, offering potential for future growth but generating no immediate revenue.

Such undertakings carry high market risk, necessitating the successful acquisition of tenants and the establishment of a market position before they can transition to Stars or Cash Cows. For instance, CICT's development pipeline, while not exclusively ground-up, often involves significant capital allocation for asset enhancement and new projects, reflecting this inherent risk-reward profile.

- Significant Capital Outlay: Ground-up developments demand considerable upfront investment.

- Future Growth Prospects: These projects aim to expand CICT's portfolio and revenue streams over the long term.

- No Immediate Income: During the development phase, these assets do not contribute to rental income.

- High Market Risk: Success hinges on tenant demand, construction timelines, and prevailing market conditions.

Assets Undergoing Major Repositioning

Properties undergoing extensive repositioning efforts, such as Tampines Mall with its planned conversion of the Isetan departmental store into smaller specialty units (commencing 4Q25), are prime examples of assets in the 'Question Marks' category of the BCG Matrix. These initiatives aim for significant rental uplift and market share gain, but involve disruption and investment before the new concept is proven and widely adopted by the market.

The repositioning of Tampines Mall, for instance, involves a substantial capital expenditure. While specific figures for the 4Q25 project are not yet fully disclosed, similar large-scale retail asset upgrades in Singapore have seen investments ranging from tens of millions to over a hundred million Singapore dollars. This strategic move is designed to enhance CapitaMall Trust's overall portfolio value and tenant mix, moving away from a traditional department store model towards a more diversified and potentially higher-yielding specialty retail offering.

- Tampines Mall Repositioning: Conversion of Isetan departmental store into smaller specialty units, starting Q4 2025.

- Strategic Goal: Achieve significant rental uplift and gain market share.

- Investment Required: Substantial capital expenditure, typical of large-scale retail asset upgrades.

- Risk Factor: Disruption and investment precede proven market adoption of the new retail concept.

Question Marks represent assets with low market share but high growth potential, requiring significant investment to capture market opportunities. These are often new ventures or underperforming assets undergoing strategic repositioning.

CapitaLand Investment Limited's (CIL) expansion into new sectors like logistics and data centers, alongside new development projects for CapitaLand Integrated REIT (CICT), fits this description. These initiatives demand substantial capital and carry inherent market risks, with success dependent on future market adoption and tenant acquisition.

Assets like Gallileo in Frankfurt, undergoing enhancement and awaiting anchor tenants like the ECB from late 2025, and the Main Airport Center (MAC) with its current occupancy challenges, exemplify Question Marks. Their future performance hinges on successful repositioning and leasing efforts.

Tampines Mall's conversion of its Isetan store into specialty units, commencing in late 2025, also falls into this category. This strategic move requires considerable investment and faces the risk of market acceptance for the new retail concept.

| Asset/Initiative | Market Share | Market Growth | Investment Needs | Current Status/Outlook |

|---|---|---|---|---|

| Gallileo, Frankfurt | Low | High (ECB occupancy from H2 2025) | High (Asset enhancement) | Cash consumer, awaiting full revenue realization (FY26) |

| Main Airport Center (MAC), Frankfurt | Low | Moderate to High (Financial center location) | High (Backfilling vacant spaces) | 81.8% occupancy in 2024, strategic focus on leasing |

| CIL's New Sector Ventures (Logistics, Data Centers) | Low | High (Secular tailwinds) | High (Acquisition of Australian logistics portfolio ~S$300m in early 2024) | Nascent market position, significant capital outlay |

| CICT New Development Projects | Low | High (Potential for portfolio expansion) | High (Capital allocation for enhancement/projects) | No immediate income, high market risk |

| Tampines Mall Repositioning | Low to Moderate | High (Specialty retail potential) | High (Capital expenditure for conversion) | Conversion of Isetan store (from Q4 2025), aiming for rental uplift |

BCG Matrix Data Sources

Our CapitaMall Trust BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.