CapitaMall Trust Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaMall Trust Bundle

Unlock the strategic blueprint behind CapitaMall Trust's success with our comprehensive Business Model Canvas. This in-depth analysis details their customer segments, value propositions, and revenue streams, offering a clear view of their operational excellence. Ideal for investors and strategists seeking to understand market-leading retail real estate management.

Partnerships

CapitaLand Integrated Commercial Trust (CICT) actively pursues strategic joint ventures for both property acquisitions and ongoing asset enhancements. A prime example is its 50.0% interest acquisition in ION Orchard, finalized in October 2024. This move underscores CICT's strategy to solidify its market footprint and harness collective expertise for the development and management of high-profile, iconic properties.

These collaborative ventures are instrumental in diversifying investment risks, a crucial aspect of managing a large real estate portfolio. Furthermore, they provide access to substantial capital pools, which is essential for undertaking significant and often transformative investment projects that might be challenging to finance independently.

CapitaMall Trust, known as CICT, cultivates robust relationships with a variety of banks and financial institutions. This ensures access to a diverse range of funding sources and promotes sustainable financing for its operations.

A key aspect of CICT's strategy involves actively seeking green financing options. For instance, in July 2024, the Trust successfully issued S$300 million in fixed rate notes, followed by another S$200 million in October 2024, all structured under its Green Finance Framework.

These green financing initiatives are crucial for maintaining financial flexibility and demonstrating CICT's commitment to environmental, social, and governance (ESG) principles.

CapitaLand Investment Limited (CLI) acts as CapitaLand Integrated REIT (CICT)'s sponsor, offering comprehensive capabilities and ecosystem support, especially within Singapore. This partnership grants CICT access to CLI's deep real estate knowledge, operational infrastructure, and a steady stream of potential investment opportunities.

CLI's sponsorship is crucial for CICT, reinforcing its leading position in the market and fueling its strategic expansion plans. For instance, in 2024, CLI's robust development pipeline continues to be a key source of potential acquisitions for CICT, bolstering its portfolio and offering diversified income streams.

Property Management and Service Providers

CapitaLand Integrated Commercial Trust (CICT) relies on a network of key partnerships with property management firms and specialized service providers to ensure the smooth operation of its extensive portfolio. These collaborations extend to managing its international assets, including those located in Australia and Germany, leveraging external expertise for optimal performance.

These strategic alliances are fundamental to maintaining high occupancy rates and fostering tenant satisfaction across CICT's diverse retail and commercial properties. For instance, efficient maintenance and proactive service delivery are direct outcomes of these robust partnerships, contributing significantly to the overall asset value and rental income.

- Property Management Expertise: CICT partners with specialized property management companies to oversee day-to-day operations, tenant relations, and leasing activities, ensuring assets are well-maintained and performing optimally.

- Service Provider Network: Collaborations with a broad range of service providers, from maintenance and security to marketing and digital solutions, are essential for enhancing the tenant experience and operational efficiency.

- International Asset Management: For its overseas holdings, CICT engages third-party property managers with local market knowledge, crucial for navigating regulatory environments and maximizing returns in markets like Australia and Germany.

- Operational Efficiency: These partnerships are vital for cost-effective management, ensuring that services are delivered efficiently, which in turn supports strong financial performance and tenant retention.

Government Agencies and Regulatory Bodies

CapitaMall Trust (CMT) actively engages with government agencies and regulatory bodies across its operating regions, including Singapore, Germany, and Australia. This engagement is crucial for navigating property development, securing necessary licenses, and ensuring ongoing compliance with local laws and REIT-specific regulations. For instance, in Singapore, CMT works with bodies like the Urban Redevelopment Authority (URA) for planning approvals and the Monetary Authority of Singapore (MAS) for REIT governance.

These relationships are foundational to maintaining a stable operating environment and fostering long-term growth. Adherence to urban planning, environmental standards, and financial regulations is paramount. In 2024, for example, REITs in Singapore continued to operate under guidelines set by MAS, ensuring investor protection and market integrity.

CMT's proactive dialogue with these entities helps to anticipate and adapt to evolving regulatory landscapes. This collaborative approach ensures that CMT's portfolio remains compliant and well-positioned for sustainable development and value creation.

- Singapore: Collaboration with URA for urban planning and MAS for REIT regulations.

- Germany: Adherence to federal and state building codes and environmental laws.

- Australia: Compliance with Foreign Investment Review Board (FIRB) guidelines and state planning authorities.

- General: Ensuring compliance with tax laws and REIT-specific financial reporting standards across all jurisdictions.

CapitaMall Trust (CMT), now known as CapitaLand Integrated Commercial Trust (CICT), leverages strategic alliances with financial institutions to secure diverse funding streams. In 2024, CICT's commitment to sustainability was evident through its successful issuance of green financing, including S$300 million in fixed rate notes in July and an additional S$200 million in October, all aligned with its Green Finance Framework. This focus on green finance not only provides financial flexibility but also reinforces CICT's dedication to environmental, social, and governance (ESG) principles, ensuring continued access to capital for growth and development.

What is included in the product

CapitaMall Trust's business model focuses on acquiring, owning, and managing a portfolio of prime shopping malls, primarily in Singapore, to generate stable rental income and capital appreciation.

It leverages strong tenant relationships, strategic mall locations, and effective asset management to deliver value to unitholders.

CapitaMall Trust's Business Model Canvas offers a clear, one-page snapshot of its operational strategy, simplifying complex retail property management into easily digestible components for stakeholders.

This structured approach allows for rapid identification of key value propositions and customer segments, effectively alleviating the pain point of understanding intricate real estate investment strategies.

Activities

CapitaMall Trust, or CICT, actively manages its assets with a focus on enhancement. This includes projects like the one at Gallileo, which began in February 2024. These initiatives aim to boost property performance and overall value.

The strategy involves reconfiguring spaces and rejuvenating properties to stay competitive. For instance, CICT's asset enhancement initiatives are designed to improve net property income. This proactive approach ensures its retail spaces remain appealing to tenants and shoppers alike.

CapitaMall Trust actively shapes its portfolio through strategic moves, including acquiring a 50.0% stake in ION Orchard in October 2024. This is balanced by timely divestments, such as the sale of 21 Collyer Quay in November 2024.

These key activities focus on strengthening the trust's resilience and maximizing returns by capitalizing on market opportunities. The decision-making process carefully weighs factors like a property's market standing and efficient capital deployment.

CapitaMall Trust, now known as CapitaLand Integrated Commercial Trust (CICT), focuses on proactive leasing to keep its malls and offices full. This involves actively working with current tenants and finding new ones to ensure spaces are always occupied.

In fiscal year 2024, CICT achieved a strong committed occupancy rate of 96.7% across its portfolio. This high occupancy demonstrates the success of their leasing strategies and their ability to attract and retain tenants.

Furthermore, CICT experienced positive rent reversions for both its Singapore retail and office segments in FY 2024. This means they were able to increase rents on renewed leases, contributing to stable and growing rental income.

A key objective for CICT is maintaining high tenant retention rates, aiming for figures above 80%. This focus on keeping existing tenants happy is crucial for ensuring a consistent and predictable stream of rental revenue.

Capital Management and Fundraising

Capital Management and Fundraising is a crucial activity for CapitaLand Integrated Commercial Trust (CICT). A key focus is on maintaining a robust capital structure through prudent management and securing diverse funding avenues. This includes actively managing debt maturity profiles to ensure financial stability and flexibility.

CICT prioritizes sustainable financing, demonstrated by its commitment to fixed-interest rate borrowings. As of December 31, 2024, a significant 81% of its total borrowings were on fixed interest rates. This strategic approach helps mitigate interest rate volatility and enhances the trust's financial resilience, positioning it well for sustained growth and future opportunities.

- Prudent Capital Structure: Maintaining a healthy balance of debt and equity to support operations and growth.

- Diversified Funding Sources: Accessing various capital markets and instruments to secure necessary funds.

- Debt Maturity Management: Strategically staggering debt repayment dates to avoid large, concentrated refinancing needs.

- Sustainable Financing: Utilizing instruments that align with environmental, social, and governance principles, such as fixed-rate borrowings to manage interest rate risk.

Sustainability and ESG Integration

CapitaMall Trust (CICT) actively integrates Environmental, Social, and Governance (ESG) principles into its core business. This commitment is a direct reflection of its alignment with CapitaLand Investment's (CLI) overarching 2030 Sustainability Master Plan, which targets Net Zero emissions for Scope 1 and 2 by 2050.

Key activities in this domain include robust tracking of environmental performance metrics across its portfolio. CICT also focuses on raising capital through green finance instruments, demonstrating a proactive approach to funding sustainable initiatives. Furthermore, the trust cultivates a strong internal culture that champions sustainability at all levels of operation.

- Environmental Performance Tracking: CICT monitors key environmental indicators to identify areas for improvement and ensure progress towards its sustainability goals.

- Green Finance: The trust leverages green financing options to fund projects that contribute to environmental sustainability, such as energy efficiency upgrades.

- Culture of Sustainability: CICT fosters an organizational culture where sustainability is a shared responsibility, encouraging employee engagement and innovation in ESG practices.

- Net Zero Commitment: CICT's efforts are geared towards supporting CLI's ambition to achieve Net Zero for Scope 1 and 2 emissions by 2050, a significant undertaking in the real estate sector.

CapitaLand Integrated Commercial Trust (CICT) actively manages its portfolio through strategic asset enhancement, leasing, and capital management. Key activities include property upgrades, maintaining high occupancy through proactive leasing, and ensuring a stable financial structure with a focus on fixed-rate borrowings. CICT also embeds ESG principles into its operations, supporting broader sustainability goals.

| Key Activity | FY 2024 Performance/Focus | Key Metric/Data Point |

|---|---|---|

| Asset Enhancement | Initiatives like Gallileo project (started Feb 2024) | Aim to boost property performance |

| Proactive Leasing | Achieved 96.7% committed occupancy | Positive rent reversions in retail and office segments |

| Capital Management | 81% of borrowings on fixed interest rates (as of Dec 31, 2024) | Focus on robust capital structure and diversified funding |

| ESG Integration | Aligns with CLI's 2030 Sustainability Master Plan | Supporting Net Zero Scope 1 & 2 by 2050 |

What You See Is What You Get

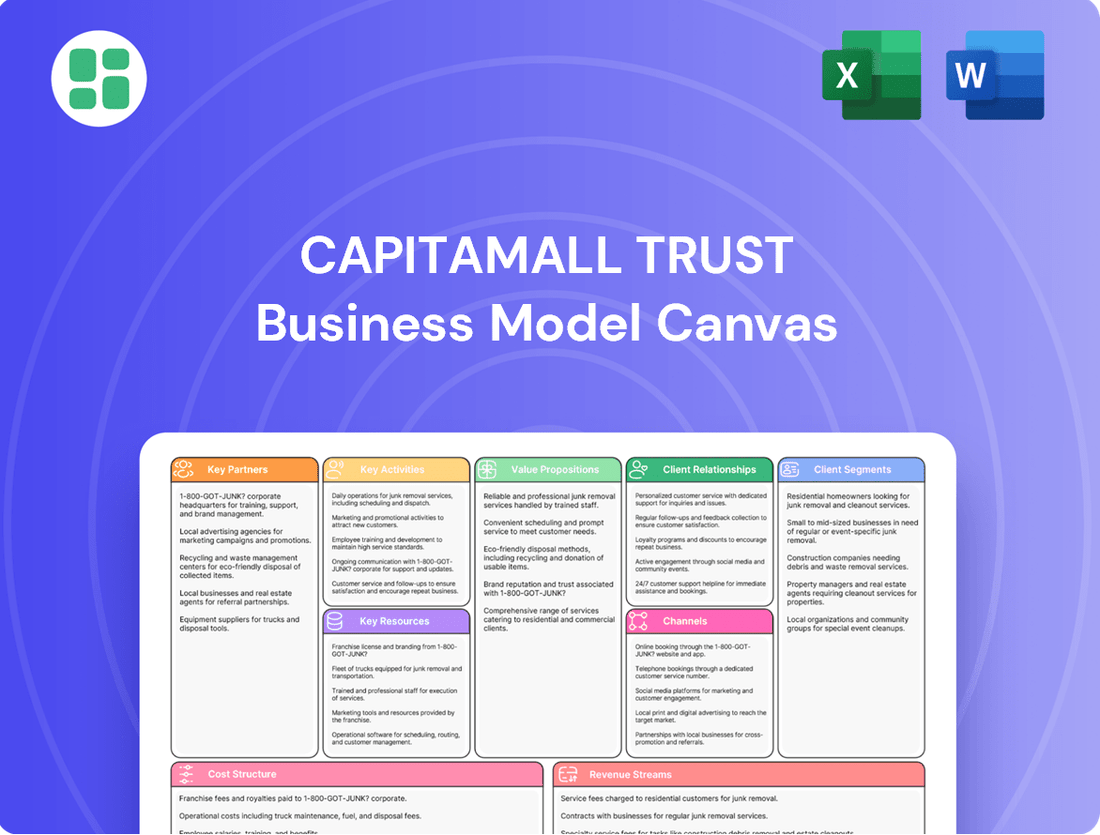

Business Model Canvas

The CapitaMall Trust Business Model Canvas preview you're viewing is the authentic document you will receive upon purchase. This isn't a sample; it's a direct, unedited section of the complete Business Model Canvas, showcasing the exact structure and content you'll gain access to. Once your order is complete, you'll download this identical file, ready for immediate use and analysis of CapitaMall Trust's strategic framework.

Resources

CapitaLand Investment Trust's (CICT) key resource is its substantial and diversified property portfolio, valued at S$26.0 billion as of December 31, 2024. This portfolio includes 21 properties strategically located across Singapore, alongside two assets in Frankfurt, Germany, and three in Sydney, Australia.

These income-generating assets primarily consist of retail and office spaces, with a strong emphasis on prime locations within Singapore. The quality and accessibility of these properties are fundamental to CICT's ability to generate consistent revenue streams and maintain its market position.

CapitaMall Trust's strong financial capital is a cornerstone of its business model, enabling strategic growth and operational resilience. As of December 31, 2024, the trust maintained a healthy balance sheet with an aggregate leverage of 38.5%. This robust financial position is further bolstered by S$4.8 billion in sustainability-linked and green loans and bonds, demonstrating a commitment to responsible financing.

This significant financial firepower directly supports CapitaMall Trust's ability to pursue strategic acquisitions, undertake value-enhancing asset improvements, and ensure consistent operational stability. The trust benefits from access to a diverse range of funding avenues and enjoys a notably low cost of debt, reinforcing its financial strengths and competitive advantage in the market.

The expertise of CapitaLand Integrated Commercial Trust Management Limited's (CICTML) management team and skilled employees is a vital resource for CapitaMall Trust. Their capabilities in asset management, leasing, capital management, and sustainability directly drive the Trust's performance and growth.

This dedicated human capital enables proactive portfolio management and effective tenant engagement, ensuring the Trust remains competitive and resilient. For instance, as of December 31, 2023, CapitaLand Investment, the parent company, reported a strong pipeline of development projects, underscoring the management's strategic foresight.

Brand Reputation and Market Leadership

As Singapore's inaugural and largest REIT, CapitaLand Integrated Commercial Trust (CICT) commanded a substantial market capitalization of US$10.3 billion as of December 31, 2024. This market leadership fosters a robust brand reputation, granting CICT privileged access to prime investment opportunities and attracting high-caliber tenants.

This strong market position translates into significant competitive advantages, including enhanced tenant retention and a greater ability to negotiate favorable lease terms.

The established presence of CICT across key commercial hubs in Singapore not only solidifies its market leadership but also instills a high degree of investor confidence, a crucial element for sustained growth and access to capital.

- Market Capitalization: US$10.3 billion (as of December 31, 2024)

- Market Position: Singapore's first and largest REIT

- Brand Benefit: Preferential access to deals and attraction of quality tenants

- Investor Confidence: Bolstered by established market presence and leadership

Technology and Data Analytics

CapitaMall Trust leverages technology and data analytics to enhance its operations. This includes using data to refine leasing strategies and improve tenant experiences. For instance, in 2024, CapitaLand Investment, CapitaMall Trust's manager, continued to invest in digital solutions to drive operational efficiency across its portfolio.

Data analytics plays a crucial role in optimizing property management. This resource supports smart building initiatives, leading to better energy efficiency and predictive maintenance. By analyzing data, the trust can identify trends and make informed decisions to reduce costs and improve asset performance.

- Data-Driven Leasing: Utilizing analytics to understand shopper behavior and optimize tenant mix.

- Smart Building Technology: Implementing IoT sensors for real-time monitoring of energy consumption and building systems.

- Predictive Maintenance: Employing data to forecast equipment failures and schedule maintenance proactively.

- Tenant Experience Enhancement: Analyzing feedback and usage patterns to personalize services and improve engagement.

CapitaMall Trust's key resources extend beyond its physical properties to include its robust financial standing and access to capital. As of December 31, 2024, the trust maintained an aggregate leverage of 38.5%, supported by S$4.8 billion in sustainability-linked and green loans. This strong financial foundation allows for strategic acquisitions and operational stability.

The expertise of its management team and employees is another critical resource, driving performance in asset management, leasing, and sustainability initiatives. This human capital ensures proactive portfolio management and effective tenant engagement, contributing to the trust's resilience and competitive edge.

Furthermore, CICT's market leadership, evidenced by a US$10.3 billion market capitalization as of December 31, 2024, provides preferential access to prime investment opportunities and attracts high-quality tenants, solidifying investor confidence.

The trust also leverages technology and data analytics for operational efficiency and enhanced tenant experiences, utilizing data for leasing strategies and smart building initiatives.

| Key Resource | Description | Supporting Data (as of Dec 31, 2024) |

|---|---|---|

| Property Portfolio | Substantial and diversified income-generating assets | Valued at S$26.0 billion; 21 properties in Singapore, 2 in Germany, 3 in Australia |

| Financial Capital | Strong balance sheet and access to funding | Aggregate leverage of 38.5%; S$4.8 billion in green/sustainability-linked loans |

| Management Expertise | Skilled team in asset, leasing, and capital management | Drives performance and growth; supports strategic foresight |

| Market Position & Brand | Singapore's first and largest REIT | Market capitalization of US$10.3 billion; preferential access to deals, attracts quality tenants |

| Technology & Data Analytics | Tools for operational efficiency and tenant engagement | Investment in digital solutions; data used for leasing, smart buildings, and predictive maintenance |

Value Propositions

CapitaMall Trust (CICT) is focused on delivering stable and sustainable returns to its unitholders. This commitment is reflected in its financial performance, with a distributable income growth of 6.4% year-on-year for the second half of 2024, and a distribution per unit (DPU) of 10.88 cents for the full year 2024.

These consistent distributions are a direct result of CICT's active asset management strategies, which include identifying and executing strategic acquisitions and maintaining a disciplined approach to cost management. This dual focus ensures that unitholders can expect reliable income streams and potential for long-term capital appreciation.

CapitaMall Trust, now known as CapitaLand Investment Limited (CLI) after a significant restructuring, offers tenants prime locations and high-quality properties across Singapore, Germany, and Australia. This extensive portfolio includes sought-after retail malls and strategically positioned office buildings, ensuring excellent visibility and accessibility for businesses.

Tenants benefit directly from these prime locations through high footfall in retail spaces and robust business environments in office properties. For example, in 2024, CLI's retail assets continued to demonstrate resilience, with key malls like JCube and Tampines Mall attracting significant shopper traffic, contributing to strong sales performance for tenants.

CapitaMall Trust, now known as CapitaLand Integrated Commercial Trust (CICT), actively enhances its properties through strategic asset enhancement initiatives. This involves modernizing spaces to align with current tenant and shopper demands, ensuring properties remain competitive. For instance, CICT's ongoing efforts to upgrade its retail portfolio contribute to sustained rental income and occupancy rates, which stood at 96.4% as of December 31, 2023, demonstrating the effectiveness of these value-enhancement strategies.

These proactive improvements directly translate to increased property value for unitholders. Tenants, in turn, benefit from upgraded infrastructure and enhanced amenities, fostering a more attractive leasing environment. This focus on active management and value creation is a cornerstone of CICT's business model, aiming to deliver consistent returns and long-term growth.

Commitment to Sustainability and ESG Practices

CapitaMall Trust’s (CICT) dedication to sustainability, deeply integrated with CapitaLand Investment's (CLI) 2030 Sustainability Master Plan, resonates strongly with investors and tenants prioritizing environmental, social, and governance (ESG) factors.

This commitment translates into tangible value by attracting capital from environmentally conscious investors and securing tenants who align with green building principles. CICT's adoption of a green finance framework, including sustainability-linked loans, underscores its proactive approach to financing sustainable operations. Furthermore, its ambitious target of achieving Net Zero by 2050 showcases a forward-thinking strategy focused on long-term resilience and responsible corporate citizenship.

- Attracting ESG-focused Capital: CICT's sustainability initiatives appeal to a growing segment of investors seeking to align their portfolios with responsible investment principles.

- Tenant Engagement: The focus on green practices enhances CICT's attractiveness to tenants who are increasingly prioritizing sustainability in their operational decisions.

- Green Finance Framework: The implementation of a green finance framework, including sustainability-linked loans, demonstrates a commitment to financing growth through environmentally responsible means.

- Net Zero Ambition: CICT's objective to reach Net Zero by 2050 positions it as a leader in corporate environmental responsibility and contributes to its long-term value proposition.

Diversified Portfolio for Risk Mitigation

CapitaMall Trust's diversified portfolio across retail and office sectors, coupled with its geographical spread in Singapore, Germany, and Australia, is a cornerstone of its risk mitigation strategy for unitholders. This multi-sector and multi-country approach helps to buffer against downturns in any single market segment or region. For instance, as of early 2024, while retail might face specific consumer spending challenges, the stable income from office properties in key global cities can provide a counterbalance.

This diversification directly translates into smoother income streams. By not relying solely on one property type or one economic environment, CapitaMall Trust can offer a more consistent return profile to its investors. This resilience is crucial in navigating the inherent volatility of real estate markets, offering a more stable investment compared to more concentrated portfolios.

The strategic advantage of this diversification is clear: it reduces the dependence on any single market segment or region. This means that even if the retail sector in Singapore experiences a slowdown, the performance of its German office assets, for example, can help maintain overall portfolio stability. This broadens the investment appeal by offering a more predictable and robust investment profile against market fluctuations.

- Diversified Asset Classes: Exposure to both retail and office properties reduces sector-specific risk.

- Geographical Spread: Presence in Singapore, Germany, and Australia mitigates country-specific economic risks.

- Income Stability: Diversification aims to smooth out rental income streams, enhancing predictability for unitholders.

- Market Resilience: The strategy builds a more robust investment profile capable of withstanding varied market conditions.

CapitaMall Trust, now CapitaLand Integrated Commercial Trust (CICT), offers a compelling value proposition through its prime, well-located assets and a commitment to enhancing property value. This focus ensures attractive leasing environments for tenants and stable, growing returns for unitholders.

CICT's strategic asset enhancement initiatives, such as property upgrades, directly contribute to sustained rental income and high occupancy rates, exemplified by a 96.4% occupancy as of December 31, 2023. This proactive management strategy solidifies its position as a reliable income-generating investment.

The trust's commitment to sustainability, aligned with CapitaLand Investment's 2030 Sustainability Master Plan, attracts ESG-focused capital and tenants. Its Net Zero ambition by 2050 and green finance framework further bolster its long-term value and responsible corporate image.

CICT's diversified portfolio across retail and office sectors, spread across Singapore, Germany, and Australia, provides significant risk mitigation. This geographical and sectoral diversification ensures smoother income streams and a more resilient investment profile against market volatility.

| Value Proposition | Key Benefit | Supporting Data (2024/Late 2023) |

|---|---|---|

| Prime Asset Locations | High footfall and robust business environments for tenants | Strong tenant sales performance in key malls (e.g., JCube, Tampines Mall) |

| Active Asset Enhancement | Increased property value and sustained rental income | 96.4% occupancy rate (Dec 2023); ongoing modernization of retail portfolio |

| Sustainability Focus | Attracts ESG capital and green-aligned tenants | Net Zero by 2050 target; adoption of green finance framework |

| Portfolio Diversification | Smoother income streams and market resilience | Presence in Singapore, Germany, Australia; balanced retail/office exposure |

Customer Relationships

CapitaMall Trust, now known as CapitaLand Integrated REIT (CICT), actively engages with its tenants. This proactive approach, which includes understanding their evolving needs and offering responsive property management, has been a cornerstone of their strategy. This focus is reflected in their impressive tenant retention rate, consistently above 80%, and positive rent reversions, demonstrating the value of these strong relationships.

CapitaLand Integrated REIT (CICT) prioritizes clear and consistent communication with its unitholders. This includes timely releases of financial results, comprehensive annual reports, and engaging investor presentations. For instance, CICT's 2023 Annual Report details its strategic initiatives and financial performance, providing a transparent overview for its investors.

The Trust actively engages with its unitholders through Annual General Meetings (AGMs). These forums allow management to directly address investor questions and concerns, fostering a strong sense of trust and accountability. This direct interaction ensures investors remain well-informed about CICT's operational progress and future strategic direction.

CapitaMall Trust (CMT) emphasizes dedicated property management teams at each of its retail assets. These teams are the frontline for daily operations, ensuring everything runs smoothly, from maintenance to addressing tenant needs. Their focus is on maintaining high property standards and quickly resolving any tenant concerns, which is vital for keeping shoppers happy and the malls running efficiently.

Community Engagement Initiatives

CapitaMall Trust actively cultivates strong community ties through various engagement initiatives. These efforts aim to build goodwill and enhance its public perception, often leveraging platforms like the CapitaLand Hope Foundation for corporate social responsibility activities.

While specific 2024 figures for community engagement are not directly provided, CapitaLand's broader CSR reporting indicates a consistent focus on social impact. For instance, in 2023, CapitaLand Group supported over 100 community projects globally, demonstrating a commitment to local development that likely extends to CapitaMall Trust's operational areas.

- Local Partnerships: Collaborating with local businesses and organizations for mall events and promotions.

- Community Events: Hosting or sponsoring events that cater to the interests of residents in the vicinity of its properties.

- CSR Activities: Participating in and leading initiatives that contribute to social welfare and environmental sustainability, often channeled through the CapitaLand Hope Foundation.

Digital Platforms for Tenant and Unitholder Interaction

CapitaMall Trust (CICT) likely leverages sophisticated digital platforms to streamline interactions with its diverse stakeholders. These platforms serve as crucial touchpoints for both tenants and unitholders, fostering engagement and operational efficiency.

For tenants, CICT's digital infrastructure probably includes online portals where they can manage lease agreements, submit service requests, and access important building information. This digital approach enhances convenience and provides a centralized hub for all tenant-related activities.

Investor relations are also significantly supported by these digital channels. Unitholders can access financial reports, company announcements, and other essential information through dedicated investor websites. This ensures transparency and easy access to crucial data for informed decision-making.

- Tenant Portals: Facilitate online lease management, service requests, and communication for retail partners.

- Investor Relations Websites: Provide unitholders with direct access to financial statements, annual reports, and corporate governance information.

- Digital Communication Channels: Enable efficient dissemination of updates and information to both tenant and unitholder communities.

CapitaLand Integrated REIT (CICT) maintains robust relationships with its tenants through dedicated property management teams and digital platforms for seamless communication and service requests. This focus on tenant satisfaction is a key driver of their consistent tenant retention rates, which have historically remained above 80%, and positive rent reversions, underscoring the value placed on these partnerships.

CICT also prioritizes transparency and engagement with its unitholders, utilizing investor relations websites and regular communication channels like annual reports and AGMs to provide comprehensive financial performance data and strategic updates. This commitment to open dialogue ensures investors are well-informed and fosters trust.

Community engagement is another vital aspect of CICT's customer relationships, with initiatives often channeled through the CapitaLand Hope Foundation to contribute to social welfare and local development. In 2023, CapitaLand Group supported over 100 community projects globally, reflecting a broader commitment that likely extends to CICT's operational areas.

| Relationship Aspect | Key Activities | Impact/Data Point |

|---|---|---|

| Tenant Engagement | Dedicated property management teams, online tenant portals | Tenant retention consistently above 80% |

| Unitholder Communication | Annual reports, investor presentations, AGMs | Transparent financial reporting and strategic updates |

| Community Involvement | CSR activities via CapitaLand Hope Foundation | Support for over 100 community projects globally (2023) |

Channels

CapitaMall Trust's (CICT) direct leasing and property management teams are the frontline for tenant engagement. These internal units are responsible for everything from attracting new businesses to ensuring existing tenants are happy and renew their leases, which is vital for maintaining high occupancy rates across their malls.

In 2024, CICT's focus on these direct relationships paid off. Their efforts in securing new leases and managing renewals directly contributed to a strong portfolio performance, with occupancy rates generally remaining robust throughout the year, reflecting the effectiveness of their hands-on approach in a competitive retail landscape.

The advantage of having these teams in-house is the ability to offer personalized service and build lasting relationships with tenants. This direct interaction allows CICT to quickly understand and respond to tenant needs, fostering a collaborative environment that supports both the tenant's business and the mall's overall success.

CapitaMall Trust's (CICT) official corporate website and dedicated investor relations portal are crucial digital touchpoints. These platforms are the primary source for unitholders and the public to access vital information, including financial results, annual reports, and strategic developments.

These digital channels ensure transparency by providing easy access to details about CICT's extensive property portfolio, encompassing prominent malls and office buildings. They also highlight the trust's commitment to sustainability initiatives, offering insights into environmental, social, and governance practices.

For instance, in 2024, CICT's investor portal would have featured comprehensive updates on its performance, potentially including figures like its Net Property Income (NPI) or Distribution Per Unit (DPU) for the latest reporting periods, underscoring the platforms' role in accessibility and informed decision-making.

CapitaLand Integrated REIT (CICT) units are primarily traded on the Singapore Exchange Securities Trading Limited (SGX-ST). This listing serves as the main channel for investors to buy and sell their holdings, ensuring liquidity and broad accessibility. As of early 2024, the SGX-ST remains the central marketplace for CICT unitholders.

Beyond direct trading, financial news outlets and various investment platforms act as crucial channels for disseminating market information and analysis related to CICT. These channels help investors stay informed about the trust's performance and market sentiment, influencing trading activity.

Investor Briefings and Annual General Meetings

CapitaMall Trust (CMT) leverages investor briefings and Annual General Meetings (AGMs) as crucial communication channels. These events allow management to present financial results, discuss strategic initiatives, and provide updates on portfolio performance directly to unitholders and financial analysts. For instance, during the 2024 AGM season, CMT provided detailed breakdowns of its rental reversions and occupancy rates across its Singaporean malls.

These engagements are vital for fostering transparency and building investor confidence. They offer a platform for direct dialogue, enabling management to address queries regarding market trends, sustainability efforts, and future growth prospects. In 2024, CMT highlighted its focus on enhancing tenant sales and improving shopper traffic through targeted asset enhancements.

- Direct Engagement: Investor briefings and AGMs facilitate face-to-face interactions with stakeholders.

- Information Dissemination: Key financial results and operational updates are shared.

- Transparency and Confidence: Open communication builds trust and understanding among investors.

- Feedback Mechanism: These forums allow for direct questioning and feedback to management.

Real Estate Brokers and Agencies

CapitaMall Trust (CICT) likely collaborates with a network of commercial real estate brokers and agencies to broaden its marketing efforts for retail and office spaces. These partnerships are crucial for reaching a wider audience of potential tenants.

These external agencies act as an extension of CICT's internal leasing teams, particularly effective in securing tenants for larger or more specialized properties. For instance, in 2024, the Singapore office leasing market saw a vacancy rate of around 12.5%, highlighting the competitive landscape where brokers can be instrumental in filling spaces.

- Brokerage Partnerships: CICT engages with established real estate firms to leverage their market knowledge and tenant databases.

- Expanded Reach: Brokers provide access to a broader spectrum of prospective tenants than CICT might reach independently.

- Specialized Leasing: For unique or large-scale spaces, brokers offer specialized expertise to find suitable occupants.

CapitaMall Trust (CICT) utilizes its corporate website and investor relations portal as key digital channels. These platforms provide essential information such as financial reports and strategic updates to unitholders and the public, ensuring transparency regarding its property portfolio and sustainability efforts. In 2024, these sites would have been updated with crucial performance metrics, reinforcing their role in informed decision-making.

Customer Segments

Retail tenants, encompassing both beloved local businesses and globally recognized brands, are the lifeblood of CapitaMall Trust's (CICT) shopping malls. These diverse businesses are drawn to CICT's prime locations and well-maintained properties, recognizing the significant footfall and brand visibility these malls offer. In 2024, CICT demonstrated its appeal to this segment, achieving a robust 99.3% occupancy rate across its retail portfolio, underscoring the strong demand from retailers.

Office tenants, encompassing both multinational corporations and small and medium-sized enterprises (SMEs), represent a core customer segment. These businesses are actively seeking prime office locations and modern, well-equipped facilities to facilitate their operations and attract talent.

These businesses primarily operate within Singapore, Germany, and Australia, indicating a geographical focus for CapitaLand Integrated Commercial Trust's (CICT) office leasing strategy. They value flexibility in lease terms, allowing them to adapt to changing business needs and market conditions.

CICT's office portfolio demonstrated strong performance, achieving a high occupancy rate of 94.8% as of December 31, 2024. This statistic underscores the attractiveness of CICT's office spaces to a diverse range of corporate tenants.

Institutional investors, including large investment funds, pension funds, and asset managers, represent a crucial segment for CapitaMall Trust. These entities are primarily driven by the pursuit of stable income streams, long-term capital appreciation, and a desire for diversified exposure to high-quality commercial real estate assets. For instance, as of the first quarter of 2024, CapitaLand Ascendas REIT, a comparable REIT in the region, reported that institutional investors held a substantial portion of its units, underscoring their significant influence.

These sophisticated investors meticulously evaluate REITs based on a trifecta of critical factors: consistent financial performance, demonstrating a track record of profitability and operational efficiency; prudent capital management, ensuring responsible debt levels and effective deployment of capital; and strong Environmental, Social, and Governance (ESG) credentials, reflecting a commitment to sustainable and ethical practices. Their investment decisions are often guided by rigorous due diligence and a focus on entities that align with their long-term investment objectives and risk appetites.

Individual Investors (Retail Unitholders)

Individual investors, from those just starting out to seasoned market participants, are drawn to CapitaLand Integrated REIT (CICT) for its consistent income streams and the possibility of their investment growing over time. Many see CICT as a way to diversify their portfolios with an asset that generates regular cash flow.

For this segment, CICT's commitment to clear financial reporting and readily available investor relations support are crucial for building trust and encouraging ongoing investment. As of the first quarter of 2024, CICT reported a distributable income of S$257.5 million, highlighting its income-generating capacity for unitholders.

- Attracts both novice and experienced investors seeking steady income.

- Values transparency and accessible investor relations for engagement.

- Motivated by regular distributions and potential capital appreciation.

- Utilizes CICT as a diversified, income-producing asset class.

Service Providers and Commercial Partners

Service providers and commercial partners are essential for CapitaLand Integrated Commercial Trust (CICT) to cultivate dynamic environments within its retail and office spaces. This segment encompasses a wide array of businesses, from food and beverage operators and fitness centers to entertainment venues and essential service providers. For instance, in 2024, CICT's portfolio continued to attract diverse tenants, enhancing the overall tenant mix and customer experience. These partnerships are fundamental to creating vibrant retail ecosystems that drive foot traffic and sales.

Joint venture partners and financial institutions also form a crucial part of this customer segment. These collaborations enable CICT to undertake larger-scale developments and manage its portfolio more effectively. In 2024, CICT maintained strategic partnerships that supported its ongoing asset enhancement initiatives and capital recycling strategies. These relationships are key to securing financing and sharing risks in significant real estate ventures.

- Tenant Mix Enhancement: In 2024, CICT focused on optimizing its tenant mix across its malls, with a particular emphasis on attracting experiential retail and F&B concepts.

- Partnership Value: Joint ventures and financial partnerships are vital for CICT's capital deployment and portfolio growth, as seen in ongoing project developments throughout 2024.

- Operational Support: Service providers, including facility management and maintenance companies, ensure the smooth operation of CICT's properties, contributing to tenant satisfaction.

- Ecosystem Creation: The synergy between various commercial partners, from anchor tenants to niche service providers, creates a comprehensive offering that appeals to a broad customer base.

CapitaMall Trust (CICT) serves a diverse clientele, including retail tenants, office occupiers, institutional investors, individual investors, and various service providers and commercial partners. Each segment is attracted by CICT's prime locations, stable income potential, and operational excellence. The trust's ability to maintain high occupancy rates across its portfolio, such as 99.3% for retail and 94.8% for office spaces in 2024, highlights its strong appeal to these varied customer groups.

| Customer Segment | Key Motivations | 2024 Performance Indicator |

|---|---|---|

| Retail Tenants | Brand visibility, high footfall, prime locations | 99.3% Occupancy Rate |

| Office Tenants | Modern facilities, strategic locations, talent attraction | 94.8% Occupancy Rate |

| Institutional Investors | Stable income, capital appreciation, ESG credentials | Significant unitholder base (comparable REIT data) |

| Individual Investors | Regular distributions, capital growth, portfolio diversification | S$257.5 million distributable income (Q1 2024) |

| Service Providers & Partners | Synergistic opportunities, enhanced tenant mix, operational support | Ongoing asset enhancement and strategic partnerships |

Cost Structure

Property operating expenses represent a significant cost for CapitaMall Trust (CICT), encompassing utilities like electricity and water, property taxes, and essential maintenance for its diverse property portfolio. These costs are inherently variable, fluctuating with property usage and external economic conditions.

In the first half of 2024, CICT demonstrated a commitment to prudent cost management, notably achieving lower utility expenses. This focus on operational efficiency is crucial for maintaining profitability amidst fluctuating market dynamics.

Property management fees and administrative costs are significant components of CapitaMall Trust's expenses. These encompass payments to CapitaLand Integrated Commercial Trust Management Limited, the REIT manager, along with salaries, office overheads, and corporate governance expenses necessary for the trust's operation.

In the first half of 2024, CapitaMall Trust reported savings from property management reimbursements, indicating efforts to optimize these operational costs. These savings contribute to the overall efficiency of the trust's financial management.

Financing costs, primarily interest expenses on loans and bonds, represent a significant outlay for CapitaLand Integrated REIT (CICT). As of December 31, 2024, CICT's average cost of debt stood at 3.6%.

To mitigate the impact of fluctuating interest rates on its distributable income, CICT strategically maintains a substantial portion of its debt. Approximately 81% of its total borrowings are on fixed interest rates, providing a degree of predictability and stability in its financing expenses.

Asset Enhancement and Capital Expenditure

Investments in asset enhancement initiatives (AEIs) and other capital expenditures for property upgrades and redevelopments are substantial components of CapitaMall Trust's cost structure. These expenditures are strategic, aiming to boost property value and rental income. For instance, the Gallileo property commenced an AEI in February 2024, reflecting ongoing commitment to portfolio improvement.

These capital outlays are crucial for maintaining and elevating the competitiveness of CapitaMall Trust's retail portfolio. The trust's 2024 financial reports will provide detailed figures on these investments, which are essential for long-term growth and tenant attraction.

- Asset Enhancement Initiatives (AEIs): Direct costs associated with upgrading and modernizing existing properties.

- Capital Expenditures (CapEx): Funds allocated for significant property improvements, expansions, or major refurbishments.

- Strategic Investment: AEIs and CapEx are viewed as investments to enhance asset value and rental yields.

- Ongoing Projects: Examples like the Gallileo AEI, started in February 2024, illustrate the continuous nature of these expenditures.

Acquisition-Related Costs

Acquisition-related costs are a significant part of CapitaMall Trust's expense structure when it aims to grow its property portfolio. These expenses include outlays for legal services, thorough due diligence processes to assess potential acquisitions, and various transaction fees that are incurred during the purchase of new assets.

For instance, the acquisition of a 50.0% stake in ION Orchard in October 2024 would have generated these types of costs. While not recurring monthly expenses, these are typically substantial, one-off expenditures that impact the trust's financial outlay during periods of expansion.

- Legal Fees: Costs associated with legal counsel for contract negotiation and review.

- Due Diligence: Expenses for property inspections, financial audits, and market analysis.

- Transaction Costs: Fees related to stamp duties, transfer taxes, and agent commissions.

- Valuation Expenses: Costs incurred for independent property valuations.

CapitaMall Trust's cost structure is primarily driven by property operating expenses, which include utilities and maintenance, and financing costs, notably interest on debt. In the first half of 2024, CICT saw reduced utility expenses due to efficiency efforts. The trust also incurs significant costs for property management and administrative functions, with savings noted in reimbursements during the same period.

Strategic investments in asset enhancement initiatives (AEIs) and capital expenditures are crucial for portfolio growth and competitiveness. For example, the Gallileo property began an AEI in February 2024. Furthermore, acquisition costs, such as legal fees and due diligence, are incurred during portfolio expansion, like the 50.0% stake acquisition in ION Orchard in October 2024.

| Cost Category | Description | H1 2024 Impact/Example | As of Dec 31, 2024 |

|---|---|---|---|

| Property Operating Expenses | Utilities, property taxes, maintenance | Lower utility expenses achieved | N/A |

| Property Management & Admin | REIT manager fees, salaries, overheads | Savings from property management reimbursements | N/A |

| Financing Costs | Interest on loans and bonds | N/A | Average cost of debt: 3.6% |

| AEIs & CapEx | Property upgrades, refurbishments | Gallileo AEI commenced Feb 2024 | N/A |

| Acquisition Costs | Legal, due diligence, transaction fees | ION Orchard stake acquisition (Oct 2024) | N/A |

Revenue Streams

CapitaMall Trust's primary revenue driver is rental income from its expansive portfolio of retail properties. These include well-known Singaporean malls such as ION Orchard, Raffles City, and Bugis Junction. In fiscal year 2024, the trust experienced positive rental reversions in Singapore, indicating a healthy leasing market.

The success of this revenue stream hinges on several key factors: maintaining high occupancy rates across its properties, negotiating competitive rental rates with tenants, and curating an attractive tenant mix that draws consistent foot traffic and spending.

CapitaMall Trust generates substantial revenue from its office properties located across Singapore, Germany, and Australia. Key assets contributing to this stream include prominent Singaporean buildings like CapitaGreen and Six Battery Road.

The performance of this revenue stream is directly tied to factors such as property occupancy rates, prevailing rental rates, and the duration of lease agreements. Notably, office rents in Singapore demonstrated positive reversions in Fiscal Year 2024, indicating a healthy demand and rental growth environment.

Beyond rental income, CapitaMall Trust taps into car park operations, generating a significant S$40.0 million in FY 2024. This revenue stream highlights the trust's ability to monetize ancillary services within its retail portfolio.

Further diversifying its income, CapitaMall Trust also offers advertising spaces and event venue rentals across its properties. These additional services contribute to the overall gross revenue, enhancing the financial performance of its assets.

Asset Enhancement Initiative (AEI) Upside

Revenue growth is also driven by successful Asset Enhancement Initiatives (AEIs). These projects are designed to boost net property income by improving rental yields or increasing the space available for rent. For instance, the Gallileo AEI, upon its completion, is anticipated to contribute to the trust's future income expansion.

- AEI Contribution to NPI: AEIs directly enhance Net Property Income (NPI) through better rental rates and increased leasable area.

- Gallileo AEI Impact: The Gallileo AEI is a key project expected to drive future income growth once finalized.

- Yield Improvement: Successful AEIs typically lead to higher rental yields on the enhanced assets.

Acquisition Contributions

New acquisitions immediately contribute to revenue streams, effectively expanding the trust's income-generating capacity. This is a cornerstone of CapitaMall Trust's growth strategy.

The acquisition of a 50.0% interest in ION Orchard in October 2024 is a prime example, directly boosting CICT's distributable income for the second half of 2024. This strategic move demonstrates the immediate financial impact of such ventures.

Strategic acquisitions are a key driver for expanding the revenue base, allowing CapitaMall Trust to diversify its portfolio and tap into new markets. This proactive approach ensures a robust and growing income stream.

- Immediate Revenue Boost: Acquisitions directly add to existing revenue streams upon completion.

- Example: ION Orchard Acquisition: The 50.0% stake acquired in October 2024 positively impacted distributable income in 2H 2024.

- Strategic Expansion: Acquisitions are crucial for broadening the trust's overall revenue base and market presence.

CapitaMall Trust's revenue is primarily generated through rental income from its diverse portfolio of retail and office properties. In fiscal year 2024, the trust reported strong performance with positive rental reversions in its Singaporean retail segment, underscoring a healthy leasing environment. The trust also benefits from car park operations, which contributed S$40.0 million to its revenue in FY 2024, alongside income from advertising spaces and event venue rentals, demonstrating a multifaceted approach to income generation.

| Revenue Stream | FY 2024 Contribution (S$ million) | Key Drivers |

|---|---|---|

| Retail Rental Income | Significant portion of total revenue | Occupancy rates, rental rates, tenant mix |

| Office Rental Income | Substantial contribution from Singapore, Germany, Australia | Occupancy, lease terms, market rental rates |

| Car Park Operations | 40.0 | Property footfall, parking rates |

| Advertising & Event Rentals | Ancillary income | Property visibility, event demand |

Business Model Canvas Data Sources

The CapitaMall Trust Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of revenue streams, cost structures, and customer segments.