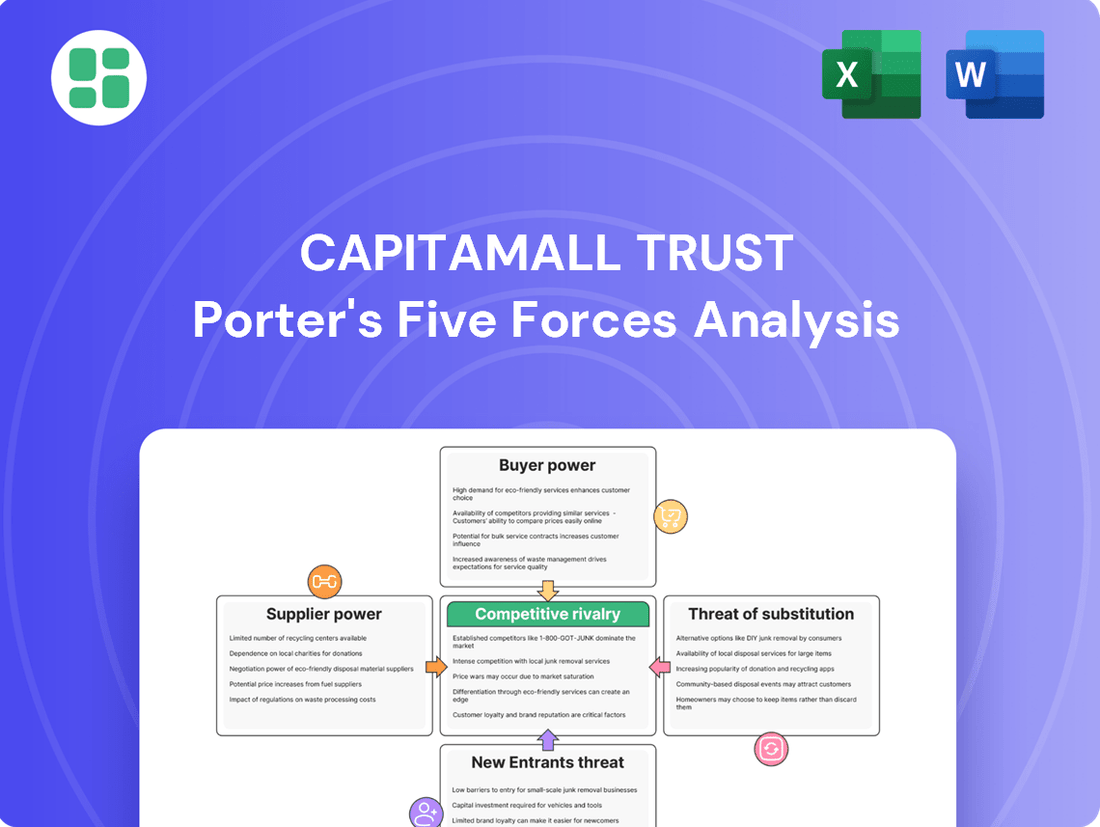

CapitaMall Trust Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaMall Trust Bundle

CapitaMall Trust faces moderate bargaining power from its retail tenants, as well as significant competition from other shopping malls and e-commerce platforms. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping CapitaMall Trust’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CapitaLand Integrated Commercial Trust (CICT), managing a substantial S$26.0 billion portfolio as of December 2024, frequently encounters a limited number of highly specialized suppliers for critical services like advanced construction materials, bespoke property management software, and cutting-edge building technology. This scarcity of specialized providers inherently grants them a degree of bargaining power.

However, CICT's immense scale as a leading REIT, coupled with its consistent, long-term demand for these specialized services, positions it as a highly valuable client for many of these suppliers. This symbiotic relationship can help to temper the suppliers' leverage by making CICT an indispensable revenue stream for them.

The real estate sector, including commercial properties, has experienced a notable increase in construction and labor expenses. This trend directly bolsters the bargaining power of both material suppliers and contractors. For instance, in Germany, despite a stabilization of commercial property prices during 2024, the persistent rise in input costs remains a significant consideration.

These escalating costs can compress margins for entities like CapitaLand Integrated REIT (CICT) when undertaking asset enhancement initiatives or new development projects. Consequently, this situation amplifies the leverage that suppliers and contractors hold within these crucial segments of the real estate development process.

Suppliers of capital, like banks and bondholders, hold considerable sway, particularly when interest rates are volatile. Rising interest rates directly translate to higher borrowing expenses for real estate investment trusts (REITs), which can squeeze profits and affect their overall market value.

While CapitaLand Integrated REIT (CICT) demonstrated a degree of resilience by having 81% of its debt on fixed rates as of December 2024, thereby insulating itself from immediate rate hikes, the prevailing conditions in the broader financial markets still shape the cost and accessibility of future funding for all entities.

CICT's Scale and Long-Term Relationships

CICT's stature as Singapore's inaugural and largest listed REIT grants it considerable leverage in negotiations with suppliers. This scale allows CICT to secure more advantageous terms across its diverse supplier base, effectively diminishing individual supplier bargaining power. For instance, in 2024, CICT's robust portfolio and ongoing development projects underscore its consistent demand for a wide array of goods and services, from property maintenance to construction materials.

The REIT's commitment to fostering stable, long-term relationships within its supplier network further solidifies its position. These enduring partnerships often translate into more predictable cost structures and a higher degree of reliability in service provision. This strategic approach to supplier management, exemplified by CICT's continuous expansion, inherently reduces the bargaining power of any single supplier looking to exploit short-term market fluctuations.

- Significant Purchasing Power: CICT's status as the largest listed REIT in Singapore translates to substantial buying power, enabling favorable negotiations.

- Long-Term Supplier Relationships: Established partnerships ensure cost predictability and reliable service delivery, mitigating supplier leverage.

- Reduced Supplier Dependence: Continuous expansion and a broad supplier network limit the impact of any single supplier's bargaining power.

Availability of Alternative Suppliers

For CapitaLand Integrated REIT (CICT), the availability of alternative suppliers for general building materials, equipment, and standard services is a significant factor. In 2024, the construction and property management sectors continue to see a robust supply chain for these essential inputs, meaning CICT can readily source from multiple vendors. This broad availability generally keeps the bargaining power of these non-specialized suppliers in check.

This fragmentation among many supplier categories, coupled with relatively low switching costs for CICT in these areas, further limits supplier leverage. For instance, sourcing common office fit-out materials or standard maintenance services typically involves numerous providers, allowing CICT to negotiate favorable terms based on competitive pricing and service levels. The ability to easily switch between vendors prevents any single supplier from exerting undue influence on pricing or contract terms.

- Numerous Suppliers for General Needs: The market for common construction materials and services is highly competitive, with many providers available.

- Low Switching Costs: CICT faces minimal barriers when changing suppliers for non-specialized goods and services.

- Fragmented Supplier Base: The wide distribution of suppliers across various categories dilutes the power of any individual entity.

- Competitive Pricing Pressure: The abundance of alternatives allows CICT to secure competitive pricing, thereby limiting supplier bargaining power.

The bargaining power of suppliers for CapitaLand Integrated Commercial Trust (CICT) is generally moderate, influenced by the availability of alternatives and the REIT's significant purchasing scale. While specialized suppliers for advanced technologies or unique materials can command higher prices, CICT's large portfolio and consistent demand often allow it to negotiate favorable terms. The REIT's ability to foster long-term relationships further solidifies its position, mitigating the impact of individual supplier leverage.

For instance, in 2024, the real estate sector has seen increased input costs, which can empower material suppliers. However, CICT's status as Singapore's largest listed REIT, managing a S$26.0 billion portfolio as of December 2024, means it is a key client for many. This scale, combined with a broad supplier network for general needs and low switching costs in those areas, keeps the overall supplier bargaining power in check.

| Factor | Impact on CICT | 2024 Context |

|---|---|---|

| Specialized Suppliers | Moderate to High Leverage | Limited availability for advanced tech/materials can increase costs. |

| General Suppliers | Low Leverage | Abundant providers for common materials and services allow competitive pricing. |

| CICT's Scale | Reduces Supplier Leverage | Significant purchasing power enables favorable negotiations. |

| Long-Term Relationships | Reduces Supplier Leverage | Promotes cost predictability and reliable service. |

What is included in the product

This analysis delves into the competitive forces impacting CapitaMall Trust, specifically examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the retail real estate sector.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for CapitaMall Trust.

Customers Bargaining Power

CapitaMall Trust's (CICT) portfolio demonstrated robust demand, achieving a high committed occupancy of 96.7% by December 2024. This strong performance, with retail at 99.3% and office at 94.8%, particularly in prime Singapore locations, significantly limits the bargaining power of individual tenants. When occupancy is high, tenants have fewer alternatives, strengthening the landlord's position.

The trust also recorded impressive rental reversions in FY2024, with Singapore retail seeing an 8.8% increase and office spaces an 11.1% rise. These positive reversions underscore CICT's ability to command higher rents, further diminishing the bargaining power of its customers.

The bargaining power of customers is significantly reduced by limited supply in key markets, particularly for CapitaMall Trust (CICT). The Singapore office market, especially Grade A Core CBD spaces, is expected to experience only modest rent growth in 2025. This is largely due to new supply being approximately 55% lower than the historical 10-year average, creating a scarcity of prime office locations.

This limited availability of high-quality commercial space extends to the retail sector as well, with retail space supply projected to drop considerably in 2025. Such scarcity in CICT's primary market strengthens its position as a landlord, offering fewer alternatives for potential tenants and thereby diminishing their bargaining power.

CapitaLand Integrated Commercial Trust (CICT) demonstrates strong tenant loyalty, evidenced by an 84.5% tenant retention rate in its Singapore retail segment for FY2024. This high retention signifies that tenants perceive significant value in CICT's retail spaces, making them less likely to seek alternatives.

Furthermore, CICT's strategically diversified portfolio, encompassing both retail and office properties, alongside a geographical spread across Singapore, Germany, and Australia, significantly dilutes the bargaining power of individual customers. This diversification reduces dependence on any single tenant or market, enhancing CICT's overall resilience and pricing power.

Switching Costs for Tenants

Commercial tenants often face substantial switching costs when considering a move. These can include the expense of fitting out a new space to their specific needs, the operational disruption that comes with relocating, and the cost of marketing their new address to customers and suppliers. For CapitaLand Integrated REIT (CICT), these costs act as a significant deterrent for tenants looking to switch properties.

The inherent desirability of CICT's well-located and consistently well-managed properties further diminishes a tenant's inclination to relocate. This combination of high switching costs and property appeal effectively reduces the bargaining power of tenants. For instance, in 2024, CICT maintained strong occupancy rates, with its retail portfolio at 98.5% and office/business park portfolio at 96.0% as of December 31, 2024, indicating high tenant retention.

Furthermore, landlords like CICT are also exposed to risks such as vacancy periods and the costs associated with finding new tenants. This creates a degree of mutual dependency between CICT and its tenants, shaping their negotiating positions.

- Tenant Retention: High switching costs and desirable property locations contribute to strong tenant retention for CICT.

- Operational Disruption: Tenants incur costs and face operational challenges when relocating, reinforcing their commitment to existing leases.

- Property Appeal: CICT's portfolio of well-located and managed properties reduces the incentive for tenants to seek alternative spaces.

- Mutual Dependency: Landlords face vacancy and re-leasing costs, creating a balance in the bargaining power dynamic with tenants.

Economic Outlook and Consumer Behavior

The bargaining power of customers for CapitaLand Integrated REIT (CICT) is influenced by the broader economic landscape and evolving consumer habits. While the rise of e-commerce presents a challenge, Singapore's economic recovery, particularly the rebound in inbound tourism, bolsters the performance of CICT’s retail properties. This trend, coupled with a stable job market, helps maintain strong demand for commercial spaces, thereby supporting CICT's leverage with its tenants.

Factors influencing customer bargaining power include:

- Economic Recovery and Tourism: Singapore's GDP growth, projected to be between 1% and 3% for 2024, and a significant increase in international visitor arrivals, which surpassed 15 million in 2024, directly translate to higher footfall and spending in CICT's retail malls.

- Consumer Spending Trends: Despite the growth of online retail, which accounted for approximately 15% of total retail sales in Singapore in early 2024, consumers continue to value the experiential aspect of physical retail, benefiting well-located malls like those in CICT's portfolio.

- Tenant Demand: A robust labor market, with Singapore’s unemployment rate remaining low at around 2.0% in early 2024, fuels consumer confidence and spending, creating sustained demand for retail spaces and limiting tenants' ability to demand significant rent concessions.

CapitaLand Integrated Commercial Trust (CICT) benefits from reduced customer bargaining power due to high occupancy rates, strong rental reversions, and limited new supply in prime Singapore markets. Tenant retention, driven by high switching costs and property appeal, further solidifies CICT's position, minimizing tenants' leverage.

The trust's diversified portfolio across geographies and property types also dilutes individual customer influence. While economic factors like e-commerce exist, Singapore's economic recovery and tourism rebound in 2024, coupled with a stable job market, support robust demand for CICT's retail and office spaces, reinforcing tenant commitment.

| Metric | FY2024 Data | Significance for Bargaining Power |

|---|---|---|

| Retail Occupancy | 98.5% (as of Dec 31, 2024) | High occupancy limits tenant alternatives. |

| Office/Business Park Occupancy | 96.0% (as of Dec 31, 2024) | Strong demand reduces tenant leverage. |

| Retail Rental Reversion | 8.8% | Indicates CICT's ability to increase rents, weakening tenant negotiating power. |

| Office Rental Reversion | 11.1% | Demonstrates pricing power and reduced tenant ability to demand concessions. |

| Tenant Retention (Retail) | 84.5% | High retention suggests tenant satisfaction and reduced propensity to switch. |

Preview Before You Purchase

CapitaMall Trust Porter's Five Forces Analysis

This preview shows the exact CapitaMall Trust Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the retail REIT. It comprehensively covers the threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and the intensity of rivalry within the industry. You'll gain actionable insights into the strategic positioning of CapitaMall Trust based on this in-depth analysis.

Rivalry Among Competitors

The real estate sector, especially in mature markets like Singapore, is intensely competitive. CapitaMall Trust faces numerous rivals, including other Real Estate Investment Trusts (REITs), private property funds, and developers, all vying for prime assets, tenants, and investment capital. This crowded field means constant pressure on pricing and returns.

In 2024, the Singapore REIT market, where CapitaMall Trust operates, continued to see robust activity. For instance, the iEdge SG REIT Index showed significant trading volumes, indicating strong investor interest and, by extension, a competitive environment for acquiring and managing properties. This high level of participation from various entities underscores the intense rivalry for market share and profitability.

Competitive rivalry within the retail real estate sector, including for CapitaMall Trust, is heavily influenced by broader real estate market health. Singapore's real estate investment volumes saw a strong rebound in 2024, with projections indicating continued growth into 2025. This increased activity suggests a more dynamic and potentially competitive landscape for retail assets.

The German commercial property market is also exhibiting signs of stabilization and anticipated recovery through 2025. This trend is likely to reignite investor interest, potentially intensifying competition for prime retail locations and assets.

CICT, as Singapore's pioneer and largest listed REIT, wields considerable scale and market leadership. This advantageous position empowers it to effectively compete for premium properties and secure top-tier tenants, setting it apart from smaller or newer market players. For instance, as of the first quarter of 2024, CICT's portfolio comprised 20 properties with a total asset value of approximately S$14.2 billion, demonstrating its substantial footprint.

Asset Quality and Strategic Locations

CapitaMall Trust's (CICT) portfolio is anchored by high-quality assets strategically positioned, primarily within Singapore, but also extending to Germany and Australia. This focus on prime, high-performing properties is a significant differentiator.

CICT's commitment to well-located, income-generating properties translates into tangible competitive advantages. For instance, in 2024, CICT reported positive rent reversions and maintained high occupancy rates across its portfolio, demonstrating the enduring appeal of its assets.

- Asset Quality: CICT's portfolio consists of prime, income-producing properties.

- Strategic Locations: Assets are predominantly in Singapore, with international presence in Germany and Australia.

- Tenant Attraction: High-quality, well-located assets enhance tenant appeal and retention.

- Performance Metrics: Positive rent reversions and high occupancy in 2024 underscore asset strength.

Active Asset Management and Strategic Acquisitions

CapitaMall Trust (CICT) actively manages its portfolio through initiatives like asset enhancement projects, exemplified by the Gallileo development. These upgrades aim to boost tenant desirability and overall property value, directly addressing competitive pressures.

Furthermore, CICT's strategic acquisition of a 50% stake in ION Orchard in 2024 underscores its commitment to strengthening its market position. This move is designed to enhance its portfolio's appeal and revenue generation capabilities in a dynamic retail landscape.

- Active Asset Management: CICT's ongoing asset enhancement initiatives (AEIs) like Gallileo are crucial for maintaining competitiveness.

- Strategic Acquisitions: The 2024 acquisition of a 50% interest in ION Orchard highlights CICT's proactive approach to portfolio growth.

- Portfolio Value Enhancement: These strategies directly contribute to increasing tenant appeal and overall asset value.

- Competitive Edge: By investing in its properties and making strategic acquisitions, CICT aims to stay ahead of rivals in the retail REIT sector.

CapitaMall Trust (CICT) operates in a highly competitive retail real estate market. In 2024, the Singapore REIT sector, where CICT is a major player, saw continued strong investor interest, as evidenced by the iEdge SG REIT Index's trading volumes, indicating a crowded field for prime assets and tenants.

The intense rivalry is further fueled by the overall health of the real estate market; Singapore's investment volumes rebounded strongly in 2024, projecting growth into 2025, which means more competition for desirable retail locations.

CICT's substantial portfolio, valued at approximately S$14.2 billion as of Q1 2024, and its focus on prime, high-occupancy assets like its 2024 acquisition of a 50% stake in ION Orchard, provide a significant competitive advantage against smaller rivals.

| Metric | 2024 Data | Significance |

|---|---|---|

| CICT Portfolio Value | S$14.2 billion (Q1 2024) | Demonstrates scale and market presence |

| iEdge SG REIT Index Activity | Robust trading volumes (2024) | Indicates high competition for assets |

| Singapore Real Estate Investment | Strong rebound in 2024 | Suggests increased competitive intensity |

SSubstitutes Threaten

The growing trend towards remote and hybrid work models poses a moderate threat to traditional office real estate, potentially capping rental growth for landlords like CapitaLand Integrated REITs (CICT). While premium office spaces in sought-after locations still attract tenants, businesses are increasingly evaluating their office needs, which could lead to reduced demand for physical space.

The relentless rise of e-commerce, particularly accelerated by shifts in consumer behavior, presents a significant threat of substitutes for traditional brick-and-mortar retail. As consumers increasingly opt for the convenience of online shopping, physical retail spaces, including those managed by CapitaLand Integrated REIT (CICT), face pressure to justify their existence beyond mere product availability. The ease of comparison, wider selection, and often competitive pricing offered online means that malls must provide compelling experiences to draw foot traffic.

To counter this, retail landlords like CICT are compelled to continuously innovate and refresh their tenant mix. This involves not just filling vacancies but strategically introducing new-to-market concepts and experiential offerings that cannot be replicated online. For instance, CICT’s proactive approach in rejuvenating its malls, such as the ongoing asset enhancement initiatives at properties like JCube, demonstrates a commitment to staying relevant and competitive in this evolving retail landscape.

The growing availability of co-working spaces presents a potential substitute for traditional office leases, particularly for agile startups and small businesses. This trend offers flexibility and can reduce the need for long-term commitments to physical office locations. While larger corporations may still favor dedicated spaces, the increasing appeal of co-working can impact demand for certain types of commercial real estate.

Fundamental Need for Physical Space

The fundamental need for physical commercial spaces, whether for retail, office functions, or mixed-use developments, continues to be a strong driver in the market. This enduring demand means that while digital alternatives exist, they cannot entirely replace the necessity of a physical presence for many business operations and consumer experiences.

Certain business activities are intrinsically tied to a physical location, making a complete substitution by digital means improbable. For example, experiential retail, collaborative office environments, and the logistical requirements of many service industries necessitate tangible spaces.

This inherent demand significantly caps the long-term threat of substitutes for physical commercial real estate. While e-commerce and remote work have impacted the sector, they haven't eliminated the core requirement for brick-and-mortar locations.

- Retail: As of early 2024, retail sales in Singapore, a key market for CapitaLand, showed resilience, with overall retail sales increasing year-on-year, indicating continued consumer engagement with physical stores.

- Office Space: Despite hybrid work trends, demand for quality office spaces with amenities remains, particularly in prime business districts, as companies prioritize collaboration and employee well-being.

- Integrated Developments: These properties, combining retail, residential, and office components, offer convenience and a holistic lifestyle, further solidifying the need for physical integrated hubs.

- Experiential Retail: A growing trend sees consumers seeking unique in-store experiences, a factor that substitutes like online shopping cannot fully replicate, thereby reinforcing the value of physical retail spaces.

Integrated Developments and Experiential Retail

CapitaMall Trust's (CICT) strategy of developing integrated commercial properties, which blend retail with office, residential, and hospitality elements, significantly reduces the threat of substitutes. These multi-faceted developments offer a comprehensive lifestyle destination, making it difficult for single-purpose retail centers or online platforms to replicate their value proposition.

CICT is actively enhancing its malls to become experiential retail hubs and community gathering places. This focus on creating unique, engaging physical spaces aims to attract and retain shoppers, thereby mitigating the substitution threat posed by e-commerce. For instance, in 2024, CICT continued to invest in mall upgrades and tenant mix optimization to foster these experiential qualities.

- Integrated Developments: CICT's portfolio, including properties like JCube which underwent significant redevelopment in 2023-2024, showcases a commitment to mixed-use concepts that are inherently less substitutable than standalone retail assets.

- Experiential Retail: By offering more than just shopping, such as F&B precincts, entertainment, and community events, CICT malls differentiate themselves from online alternatives, driving foot traffic and loyalty.

- Community Hubs: The creation of vibrant spaces that serve as community anchors further solidifies the appeal of physical retail, making it a preferred destination over purely transactional online experiences.

The threat of substitutes for CapitaLand Integrated REIT (CICT) is moderate, primarily driven by the rise of e-commerce and remote work. However, the inherent need for physical spaces for experiential retail and collaborative office environments significantly caps this threat. CICT's strategy of developing integrated, mixed-use properties further diminishes the impact of substitutes by offering a more comprehensive value proposition.

While online shopping offers convenience, the demand for unique in-store experiences remains strong, as evidenced by Singapore's retail sales growth in early 2024. Similarly, despite hybrid work, quality office spaces with amenities are still sought after. CICT's focus on community hubs and experiential retail actively counters the substitution threat.

| Threat of Substitutes | Impact on CICT | Mitigation Strategies |

|---|---|---|

| E-commerce | Moderate for retail; pressure on traditional sales models. | Focus on experiential retail, unique tenant mix, community events. |

| Remote/Hybrid Work | Moderate for office space; potential for reduced demand. | Emphasis on quality office spaces with amenities, integrated developments. |

| Co-working Spaces | Low to moderate for office leases; impacts smaller businesses. | Long-term leases for larger corporations, premium office offerings. |

Entrants Threaten

The real estate investment trust (REIT) sector, particularly for substantial income-generating assets like those managed by CapitaLand Investment Limited (CICT), demands significant financial resources. New players entering this market encounter considerable hurdles in acquiring or developing a portfolio that can rival CICT's impressive S$26.0 billion valuation as of late 2024.

These substantial initial capital outlays act as a strong deterrent, effectively limiting the number of potential new competitors capable of entering the market at a meaningful scale. This high barrier to entry helps protect existing players like CICT from immediate, significant competitive pressure from newcomers.

Navigating the complex web of regulations, zoning laws, and legal requirements for property acquisition, development, and management in key markets like Singapore and Germany poses a significant hurdle for new entrants. These intricate frameworks demand specialized knowledge and established relationships that are difficult for newcomers to quickly acquire.

Established players such as CapitaLand Integrated REIT (CICT) have cultivated deep expertise and strong connections to efficiently manage these regulatory complexities. For instance, CICT's experience in Singapore's robust urban planning and property laws, which can involve lengthy approval processes for new developments, provides a distinct advantage. New entrants would face substantial time and resource investments to build comparable capabilities.

Existing large REITs like CapitaLand Investment Limited (CICT) leverage significant economies of scale. For instance, CICT's extensive portfolio allows for greater bargaining power in property management services and more efficient financing terms compared to smaller, newer entities. This cost advantage makes it difficult for new entrants to compete on price from the outset.

CICT's established brand reputation and deep tenant relationships also act as formidable barriers. A proven track record in asset management and a strong market presence build trust, making it harder for new players to secure prime retail spaces and attract quality tenants quickly. This established market position is a crucial deterrent.

Access to Financing and Debt Markets

New entrants into the REIT market, especially smaller ones, often face significant hurdles in securing financing at favorable terms compared to established players like CapitaLand Integrated REIT (CICT). This disparity in access to capital markets can be a substantial barrier to entry.

CICT, as of early 2024, benefits from a strong credit rating and established relationships with lenders, enabling it to tap into debt and equity markets more easily and at lower costs. This financial flexibility is a key competitive advantage.

For instance, in 2023, CICT successfully raised S$300 million in perpetual securities at a competitive 4.25% coupon rate, demonstrating its robust access to capital. New REITs would likely find it challenging to match such terms.

- Financing Costs: New entrants typically face higher borrowing costs due to perceived higher risk and lack of established track record.

- Scale Advantage: Larger REITs like CICT benefit from economies of scale in their capital raising activities.

- Investor Confidence: Established REITs command greater investor confidence, leading to better access to equity funding.

- Diversified Funding: CICT's diversified funding structure, including bank loans, corporate bonds, and perpetual securities, provides resilience and competitive pricing.

Lack of Experience and Market Knowledge

New entrants often struggle with a significant lack of experience and market knowledge, which is crucial for success in the real estate sector. This deficiency makes it challenging to compete with established entities like CapitaLand Investment Limited (CICT).

Effective real estate operations demand a nuanced understanding of property valuation, risk management, and hands-on asset management. Newcomers typically lack the deep insights into local market dynamics, evolving tenant needs, and the day-to-day operational complexities that seasoned players possess.

- Limited Track Record: New entrants may not have a proven history of successful property acquisitions, development, or management, which can deter potential investors and tenants.

- Inability to Secure Favorable Terms: Without established relationships and market leverage, new entrants might find it harder to negotiate favorable financing, leases, or supplier contracts compared to CICT.

- Higher Operational Costs: A lack of experience can lead to inefficiencies and unexpected costs in property management, maintenance, and marketing, impacting profitability.

The threat of new entrants for CapitaLand Integrated REIT (CICT) is generally low due to substantial capital requirements, complex regulatory landscapes, and established economies of scale. New players would need significant financial backing to acquire or develop a portfolio comparable to CICT's S$26.0 billion in assets as of late 2024, a feat made more challenging by the need for specialized knowledge in navigating property laws and securing favorable financing terms. CICT's existing market position, brand reputation, and deep tenant relationships further solidify its competitive advantage against potential newcomers.

| Barrier to Entry | Impact on New Entrants | CICT's Advantage |

|---|---|---|

| Capital Requirements | High upfront investment needed for portfolio acquisition/development. | S$26.0 billion asset base (late 2024) provides significant scale and financial clout. |

| Regulatory Complexity | Navigating zoning, legal frameworks, and approval processes is time-consuming and resource-intensive. | Deep expertise and established relationships in key markets like Singapore. |

| Economies of Scale | New entrants lack bargaining power in financing, property management, and supplier contracts. | Cost efficiencies in operations and favorable financing terms due to large portfolio size. |

| Brand Reputation & Tenant Relationships | Difficulty in attracting prime tenants and securing favorable lease agreements. | Proven track record and strong market presence build trust and tenant loyalty. |

| Access to Financing | Higher borrowing costs and limited access to capital markets compared to established players. | Strong credit rating and established lender relationships enable easier and cheaper capital raising. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CapitaMall Trust leverages data from CapitaLand's annual reports, investor presentations, and publicly available financial statements. We also incorporate industry reports from reputable real estate research firms and macroeconomic data to understand market trends and competitive dynamics.