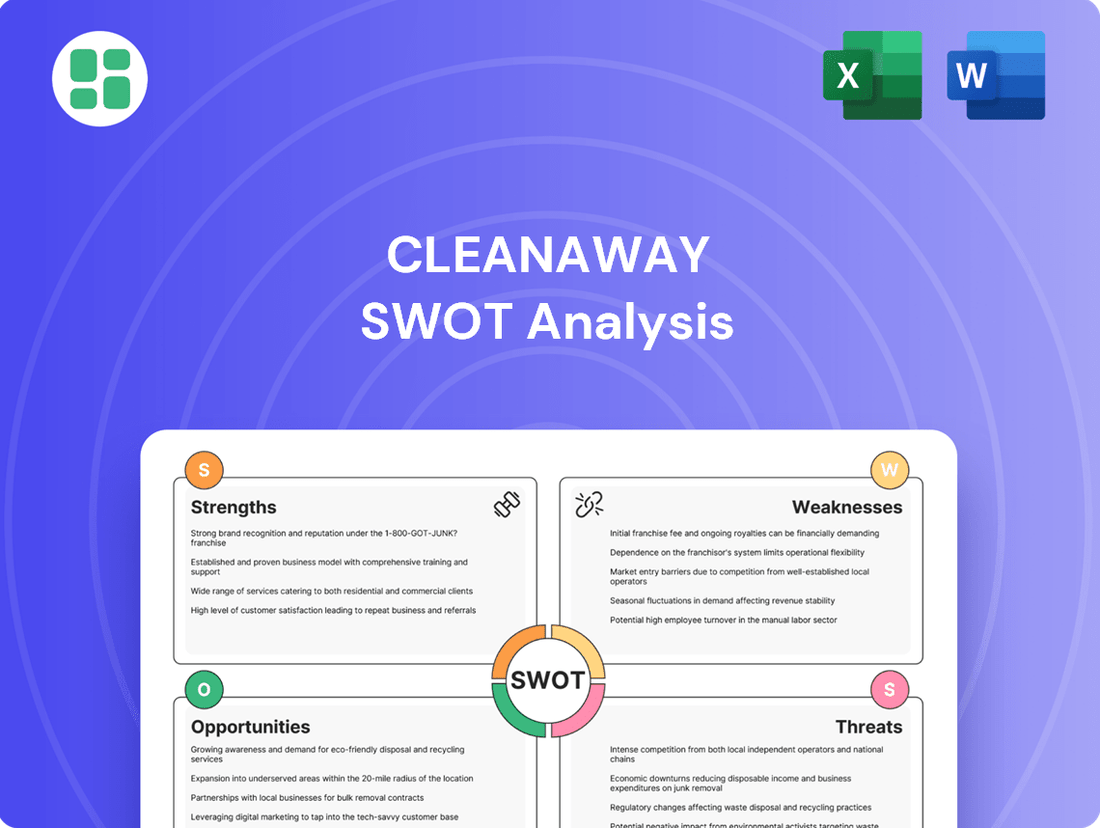

Cleanaway SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

Cleanaway's strong market presence and commitment to sustainability are significant strengths, but potential regulatory changes and competitive pressures present notable challenges. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Cleanaway's opportunities for expansion and the threats to its market share? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Cleanaway Waste Management Limited solidified its position as Australia's foremost waste management provider, operating an expansive network of over 330 sites nationwide. This infrastructure, encompassing collection fleets, recycling facilities, transfer stations, engineered landfills, and treatment plants, grants a substantial competitive edge.

This extensive operational footprint translates into efficient service delivery and unparalleled market reach, reinforcing Cleanaway's dominant standing within the Australian waste management sector.

Cleanaway's comprehensive service offering is a significant strength, covering the entire waste management lifecycle from collection and recycling to treatment and disposal. This integrated model, which includes solid, liquid, and hazardous waste, positions them as a one-stop shop for a wide range of clients, including municipalities, businesses, and industrial facilities.

This broad capability allows Cleanaway to address complex waste challenges effectively, fostering deeper client relationships. For instance, their ability to handle specialized waste streams, such as those from healthcare facilities, opens up cross-selling opportunities and enhances customer retention. In the 2023 financial year, Cleanaway reported revenue of AUD 3.1 billion, reflecting the demand for their extensive service portfolio.

Cleanaway has showcased impressive financial strength, with double-digit EBIT growth and consistent margin expansion. In the first half of FY25, the company saw its net revenue climb by 4.6%, demonstrating a healthy top-line increase. This performance indicates effective financial management and a clear path towards its FY25 underlying EBIT guidance and mid-term FY26 ambitions.

Commitment to Sustainability and Circular Economy

Cleanaway's core mission, 'making a sustainable future possible together,' directly translates into a robust commitment to the circular economy. This isn't just a slogan; it's embedded in their operational strategy, focusing on resource recovery and environmental protection. For instance, their 2024 Sustainability Framework highlights key areas like diverting waste from landfill and investing in advanced recycling technologies, crucial steps in Australia's shift towards a more sustainable model.

The company's dedication to environmental stewardship is evident in its tangible efforts to reduce its ecological footprint. By actively diverting waste from landfills, Cleanaway contributes significantly to resource conservation and minimizes the environmental impact associated with traditional waste disposal. This proactive approach positions them as a key player in fostering a circular economy, where materials are reused and recycled rather than discarded.

- Resource Recovery Focus: Cleanaway's strategy prioritizes recovering valuable resources from waste streams, aligning with circular economy principles.

- 2024 Sustainability Framework: This framework guides their efforts in resource recovery, environmental protection, and emissions reduction.

- Circular Economy Transition: The company plays a vital role in Australia's move towards a circular economy through waste diversion and recycling infrastructure investment.

- Environmental Stewardship: Their investments in recycling infrastructure and waste diversion demonstrate a strong commitment to protecting the environment.

Strategic Acquisitions and Diversification

Cleanaway has a strong history of growth through strategic acquisitions, which has significantly broadened its service portfolio. For instance, the acquisition of Citywide Service Solutions in early 2025, followed by Contract Resources later that year, exemplifies this approach. These moves have not only expanded Cleanaway's footprint but also integrated higher-margin technical services like decommissioning and decontamination into its operations.

This disciplined expansion directly supports Cleanaway's long-term Blueprint 2030 strategy. By integrating new capabilities, the company is enhancing its earnings potential and diversifying its revenue streams away from traditional waste management. This diversification is crucial for building resilience and capturing new market opportunities in the evolving environmental services sector.

- Acquisition of Citywide Service Solutions (2025): Expanded capabilities and market share in integrated waste management.

- Acquisition of Contract Resources (2025): Bolstered technical services, including decommissioning and remediation.

- Revenue Diversification: Reduced reliance on traditional waste streams by incorporating higher-margin technical services.

- Blueprint 2030 Alignment: Acquisitions are strategically aligned to drive earnings accretion and long-term growth.

Cleanaway's extensive national infrastructure, comprising over 330 sites, provides a significant competitive advantage through efficient service delivery and broad market reach. Their comprehensive service offering covers the entire waste management lifecycle, from collection to disposal, including specialized waste streams, fostering strong client relationships and cross-selling opportunities. Financially, Cleanaway has demonstrated robust performance with double-digit EBIT growth and margin expansion, as evidenced by a 4.6% increase in net revenue in the first half of FY25, reinforcing their FY25 and FY26 financial targets.

| Metric | FY23 | H1 FY25 |

|---|---|---|

| Revenue | AUD 3.1 billion | |

| Net Revenue Growth | 4.6% | |

| EBIT Growth | Double-digit | |

| Margin Expansion | Consistent |

What is included in the product

Delivers a strategic overview of Cleanaway’s internal and external business factors, highlighting its strengths in market leadership and operational efficiency, while also identifying weaknesses in its cost structure and opportunities in waste-to-energy, alongside threats from regulatory changes and competition.

Offers a clear, actionable framework to identify and address Cleanaway's operational challenges and market vulnerabilities.

Weaknesses

The waste management sector, by its very nature, involves inherent safety risks. Cleanaway has experienced operational incidents, such as the significant fire at its St Marys facility in February 2025, which underscore these challenges.

These events can lead to considerable financial burdens, damage to the company's reputation, and disruptions to its services. While Cleanaway is actively working on enhancing its safety protocols, the occurrence of such incidents points to persistent difficulties in achieving a completely incident-free operational environment across its wide-ranging activities.

Cleanaway's operations are inherently capital intensive, requiring substantial ongoing investment to maintain and expand its extensive waste management network across Australia. This includes a large fleet of vehicles and numerous processing facilities, all of which necessitate significant capital expenditure for upkeep, modernization, and growth initiatives.

This high level of capital intensity can place pressure on cash flow and impact the return on invested capital, even when the company demonstrates strong earnings growth. For instance, capital expenditure was approximately $260 million in FY23, reflecting the continuous need for investment in infrastructure and fleet upgrades.

Furthermore, to remain competitive and adapt to evolving waste management demands, Cleanaway must consistently invest in new technologies and infrastructure. This ongoing requirement for capital investment presents a continuous financial demand on the business, influencing its financial flexibility and strategic investment decisions.

Cleanaway's Industrial & Waste Services (I&WS) segment shows a clear vulnerability to economic downturns, as evidenced by its challenging market conditions. In the first half of fiscal year 2024, this segment experienced a decline in revenue and earnings before interest and taxes (EBIT). This sensitivity means that broader economic slowdowns or specific industry-specific issues, such as customer site closures, can directly impact Cleanaway's overall financial performance.

The I&WS segment's revenue and EBIT are particularly susceptible to fluctuations in economic activity. For instance, during periods of economic contraction, companies often reduce non-essential spending, including maintenance and waste management services. This can lead to deferred projects or reduced volumes for Cleanaway, directly affecting the segment's profitability and, consequently, the group's overall growth trajectory if these impacts are not effectively mitigated by other business areas.

Complexity of Regulatory Compliance

Cleanaway's operations across Australia's diverse states mean navigating a patchwork of waste levies, environmental regulations, and approval procedures. This fragmentation makes consistent compliance a significant challenge, demanding substantial resources and meticulous oversight to avoid potential penalties. For instance, differing state-based landfill levies can impact operational costs unevenly.

The absence of a unified national approach to waste policy creates an uneven competitive landscape and complicates efforts to streamline operations. This regulatory complexity can lead to inefficiencies and increased administrative burdens, as the company must adapt its strategies to meet varying jurisdictional requirements. In 2023, the Australian government continued to explore national waste management strategies, highlighting the ongoing need for harmonization.

- Fragmented Regulatory Landscape: Operating across multiple Australian states with distinct waste levies and environmental policies.

- Compliance Burden: Ensuring consistent adherence to varying regulations is complex and resource-intensive.

- Operational Inefficiencies: Lack of national policy harmonization can hinder streamlined operations and create an uneven playing field.

- Potential Penalties: Non-compliance due to complexity can result in fines and reputational damage.

Challenges in Specific Waste Streams

Despite significant investments in resource recovery, Australia still struggles with specific waste streams, notably the persistent high volume of plastics ending up in landfills. For instance, in 2023, it was estimated that over 80% of plastic waste in Australia was still being sent to landfill or incineration, highlighting a critical bottleneck.

While Cleanaway is a major player in recycling and recovery efforts, systemic challenges can impede progress. Issues like contamination in household source separation, a persistent problem affecting material quality, and the lack of scaled solutions for materials like soft plastics, directly impact the efficiency and economic viability of recycling operations. This can create headwinds for achieving ambitious resource recovery targets.

- Plastic Waste: Over 80% of Australian plastic waste went to landfill or incineration in 2023, a key challenge.

- Contamination: High levels of contamination in source-separated waste streams reduce the quality and value of recyclables.

- Soft Plastics: Limited at-scale processing solutions for soft plastics continue to be a significant hurdle for effective recycling.

Cleanaway's reliance on its Industrial & Waste Services (I&WS) segment makes it susceptible to economic downturns, as seen in the first half of fiscal year 2024 with declining revenue and EBIT. This sensitivity means that broader economic slowdowns or industry-specific issues can directly impact the company's overall financial performance.

The company faces a complex and fragmented regulatory landscape across Australia, with differing state-based waste levies and environmental policies. This necessitates significant resources and meticulous oversight for consistent compliance, creating potential for inefficiencies and increased administrative burdens.

Despite investments in resource recovery, systemic challenges persist, particularly with plastic waste, where over 80% of Australian plastic waste still went to landfill or incineration in 2023. Contamination in source-separated waste streams and a lack of scaled solutions for materials like soft plastics also hinder effective recycling operations.

Operational incidents, such as the February 2025 fire at the St Marys facility, highlight ongoing challenges in maintaining a completely incident-free operational environment, leading to financial burdens and reputational damage.

Full Version Awaits

Cleanaway SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Cleanaway's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing strategic insights for Cleanaway.

Opportunities

Australia's commitment to reducing landfill waste, aiming for an 80% resource recovery rate by 2030, is a major tailwind. This national objective is spurring substantial investment in recycling and waste-to-energy projects, creating a fertile ground for companies like Cleanaway to grow their service offerings.

The burgeoning circular economy presents a significant opportunity for Cleanaway to expand its resource recovery capabilities. This includes developing advanced recycling solutions and enhancing organic waste processing, aligning perfectly with the company's strategic direction and existing infrastructure.

The waste management sector is seeing a surge in technological innovation, from AI-powered sorting to chemical recycling methods. These advancements offer significant opportunities for companies like Cleanaway to boost efficiency and recover more valuable resources from waste streams.

Cleanaway can capitalize on these trends by integrating technologies like advanced sorting systems, which can process materials more effectively, and smart bins that optimize collection routes. For instance, the global waste management market is projected to reach $700 billion by 2027, indicating substantial growth potential driven by technological adoption.

By investing in these cutting-edge solutions, Cleanaway can not only improve its operational performance but also develop innovative, higher-value waste processing services. This strategic adoption of technology will solidify its competitive position and drive more sustainable outcomes in the industry.

The Australian government's heightened focus on waste management is a significant tailwind. New legislation, such as the landfill levy increases in New South Wales and Victoria, incentivizes waste diversion and reprocessing. For instance, NSW's levy is projected to reach $149 per tonne by 2030, driving demand for alternative solutions.

This policy shift is coupled with substantial government investment in waste infrastructure. Programs like the Recycling Modernisation Fund are injecting capital into facilities that can process mixed waste streams and recover valuable resources. Cleanaway is well-positioned to leverage these funding opportunities to expand its capabilities and secure long-term contracts.

The commitment to sustainable waste practices, including bans on exporting certain recyclables, directly benefits companies like Cleanaway that operate domestic processing facilities. This creates a more predictable and supportive market for recycled materials, encouraging investment in advanced sorting and treatment technologies.

Expansion into Higher-Margin Technical Services and Decommissioning

Cleanaway's acquisition of Contract Resources signals a strategic push into higher-margin technical services, notably within the oil and gas sector. This includes specialized areas like decommissioning, decontamination, and remediation (DD&R), tapping into a market with significant growth potential.

The global offshore oil and gas decommissioning market is substantial, with projections indicating billions of dollars in value over the next few decades. For instance, estimates suggest the market could reach over $70 billion by 2027. This move allows Cleanaway to diversify its revenue and capitalize on its existing capabilities in a specialized and expanding field.

- Diversification: Entry into technical services reduces reliance on traditional waste management streams.

- Market Growth: The oil and gas decommissioning sector presents a multi-billion dollar opportunity.

- Synergies: Leveraging existing expertise in waste handling and logistics for specialized services.

- Profitability: Technical services typically command higher profit margins compared to standard waste collection.

Population Growth and Urbanization

Australia's population is projected to reach 30 million by 2030, with a significant portion of this growth concentrated in urban areas. This demographic shift directly translates into a greater volume of waste, presenting a substantial opportunity for waste management companies like Cleanaway. The increasing complexity of waste streams, driven by evolving consumption patterns and packaging, also necessitates advanced processing and disposal solutions.

Cleanaway's extensive network of facilities, particularly in major metropolitan hubs, positions it advantageously to service the expanding waste needs of these growing urban populations. The company’s established infrastructure is crucial for efficiently managing the collection, sorting, and treatment of this increasing waste. This allows Cleanaway to capture a larger share of the market as waste generation escalates.

- Population Growth: Australia's population is expected to grow by approximately 1.5% annually, reaching over 30 million by 2030.

- Urbanization Trend: Over 85% of Australians currently live in urban areas, a figure expected to rise, concentrating waste generation.

- Waste Volume Increase: The growing population and economic activity are projected to increase total waste generation by an estimated 10-15% by 2028.

- Service Demand: This demographic expansion fuels sustained demand for integrated waste management services, from kerbside collection to specialized industrial waste treatment.

Australia's commitment to reducing landfill waste, aiming for an 80% resource recovery rate by 2030, is a major tailwind. This national objective is spurring substantial investment in recycling and waste-to-energy projects, creating a fertile ground for companies like Cleanaway to grow their service offerings.

The burgeoning circular economy presents a significant opportunity for Cleanaway to expand its resource recovery capabilities. This includes developing advanced recycling solutions and enhancing organic waste processing, aligning perfectly with the company's strategic direction and existing infrastructure.

The waste management sector is seeing a surge in technological innovation, from AI-powered sorting to chemical recycling methods. These advancements offer significant opportunities for companies like Cleanaway to boost efficiency and recover more valuable resources from waste streams.

Cleanaway can capitalize on these trends by integrating technologies like advanced sorting systems, which can process materials more effectively, and smart bins that optimize collection routes. For instance, the global waste management market is projected to reach $700 billion by 2027, indicating substantial growth potential driven by technological adoption.

By investing in these cutting-edge solutions, Cleanaway can not only improve its operational performance but also develop innovative, higher-value waste processing services. This strategic adoption of technology will solidify its competitive position and drive more sustainable outcomes in the industry.

The Australian government's heightened focus on waste management is a significant tailwind. New legislation, such as the landfill levy increases in New South Wales and Victoria, incentivizes waste diversion and reprocessing. For instance, NSW's levy is projected to reach $149 per tonne by 2030, driving demand for alternative solutions.

This policy shift is coupled with substantial government investment in waste infrastructure. Programs like the Recycling Modernisation Fund are injecting capital into facilities that can process mixed waste streams and recover valuable resources. Cleanaway is well-positioned to leverage these funding opportunities to expand its capabilities and secure long-term contracts.

The commitment to sustainable waste practices, including bans on exporting certain recyclables, directly benefits companies like Cleanaway that operate domestic processing facilities. This creates a more predictable and supportive market for recycled materials, encouraging investment in advanced sorting and treatment technologies.

Cleanaway's acquisition of Contract Resources signals a strategic push into higher-margin technical services, notably within the oil and gas sector. This includes specialized areas like decommissioning, decontamination, and remediation (DD&R), tapping into a market with significant growth potential.

The global offshore oil and gas decommissioning market is substantial, with projections indicating billions of dollars in value over the next few decades. For instance, estimates suggest the market could reach over $70 billion by 2027. This move allows Cleanaway to diversify its revenue and capitalize on its existing capabilities in a specialized and expanding field.

- Diversification: Entry into technical services reduces reliance on traditional waste management streams.

- Market Growth: The oil and gas decommissioning sector presents a multi-billion dollar opportunity.

- Synergies: Leveraging existing expertise in waste handling and logistics for specialized services.

- Profitability: Technical services typically command higher profit margins compared to standard waste collection.

Australia's population is projected to reach 30 million by 2030, with a significant portion of this growth concentrated in urban areas. This demographic shift directly translates into a greater volume of waste, presenting a substantial opportunity for waste management companies like Cleanaway. The increasing complexity of waste streams, driven by evolving consumption patterns and packaging, also necessitates advanced processing and disposal solutions.

Cleanaway's extensive network of facilities, particularly in major metropolitan hubs, positions it advantageously to service the expanding waste needs of these growing urban populations. The company’s established infrastructure is crucial for efficiently managing the collection, sorting, and treatment of this increasing waste. This allows Cleanaway to capture a larger share of the market as waste generation escalates.

- Population Growth: Australia's population is expected to grow by approximately 1.5% annually, reaching over 30 million by 2030.

- Urbanization Trend: Over 85% of Australians currently live in urban areas, a figure expected to rise, concentrating waste generation.

- Waste Volume Increase: The growing population and economic activity are projected to increase total waste generation by an estimated 10-15% by 2028.

- Service Demand: This demographic expansion fuels sustained demand for integrated waste management services, from kerbside collection to specialized industrial waste treatment.

Cleanaway is well-positioned to benefit from the increasing focus on resource recovery and the circular economy, driven by government targets and consumer demand for sustainable practices. The company can leverage its infrastructure and expertise to expand into higher-value processing services, such as advanced recycling and waste-to-energy solutions.

The expansion into specialized technical services, particularly in the oil and gas decommissioning sector, offers significant diversification and access to a growing, high-margin market. This strategic move, exemplified by the Contract Resources acquisition, taps into a substantial global market projected to reach over $70 billion by 2027.

Technological advancements in waste management present a clear opportunity for Cleanaway to enhance operational efficiency and develop innovative solutions. Investing in AI-powered sorting and chemical recycling can improve resource recovery rates and create new revenue streams, aligning with the projected global waste management market growth to $700 billion by 2027.

The increasing population and ongoing urbanization in Australia will lead to a greater volume and complexity of waste, directly increasing demand for Cleanaway's core services. Its established network in metropolitan areas positions it to capitalize on this growth, with waste generation expected to increase by 10-15% by 2028.

Threats

The Australian waste management sector is highly competitive, with Cleanaway, despite being the largest player, facing significant rivalry. Numerous regional and specialized operators vie for market share, creating pricing pressures that can impact profitability. For instance, in the fiscal year 2023, Cleanaway reported revenue of $3.7 billion, a testament to its scale but also highlighting the market size that attracts substantial competition.

Cleanaway's recycling and resource recovery segment is sensitive to global commodity prices for materials like metals, plastics, and paper. A sharp decline in these prices, as seen in some periods of 2024, directly impacts the revenue generated from selling these recovered resources, potentially squeezing profit margins.

This reliance on volatile external markets represents a significant financial risk, as Cleanaway has limited control over these price fluctuations. For instance, while specific figures for Cleanaway's 2024 commodity sales aren't publicly detailed, broader market trends in 2024 showed significant price swings for recycled plastics, impacting profitability across the sector.

While Cleanaway can benefit from evolving environmental policies, the risk of escalating compliance costs and unpredictable regulatory shifts across different Australian states presents a significant threat. For instance, if new mandates require substantial capital outlays for advanced waste processing technologies without clear revenue streams, it could strain profitability.

Increased landfill levies, a common policy tool to discourage waste disposal, directly impact operational expenses for companies like Cleanaway. Furthermore, potential bans on waste exports, which have been a topic of discussion globally and in Australia, could force a redirection of waste streams, potentially increasing logistical challenges and costs if domestic processing capacity is insufficient.

The uneven application of environmental standards across various jurisdictions can create competitive disadvantages. Businesses operating in regions with less stringent enforcement or lower compliance burdens might enjoy cost savings, making it harder for Cleanaway to compete on price if it faces stricter requirements elsewhere.

Economic Downturns Affecting Industrial Waste Volumes

Economic slowdowns can significantly reduce waste generation, particularly from Cleanaway's commercial and industrial clients. This directly impacts revenue streams as these sectors are major contributors. For example, during periods of economic contraction, businesses often scale back operations, leading to lower waste volumes.

The Industrial & Waste Services segment has historically shown sensitivity to market conditions. A broader economic downturn in 2024 or 2025 could exacerbate this, leading to decreased waste volumes and delayed non-essential maintenance projects. This would negatively affect the company's overall financial performance, impacting both revenue and profitability.

- Reduced Industrial Output: Economic downturns often correlate with a decrease in manufacturing and construction activity, directly lowering industrial waste generation.

- Commercial Sector Slowdown: Retail and service industries, also significant waste generators, tend to contract during recessions, cutting back on operational waste.

- Deferred Capital Expenditure: Businesses may postpone investments in waste management infrastructure or services during uncertain economic times, impacting service demand.

Public Scrutiny and Reputation Risk

The waste management sector faces intense public scrutiny, particularly concerning environmental practices. Cleanaway, like its peers, is under constant observation regarding its landfill operations and the efficacy of its recycling programs. For instance, in 2023, the company reported a slight increase in its environmental incident rate, though it remained within acceptable industry benchmarks, highlighting the ongoing challenge of maintaining pristine operations.

Incidents such as facility fires, like the one at its Melbourne facility in late 2023 which caused temporary operational disruptions but no environmental breaches, can significantly damage public perception. Such events can lead to community opposition and question the company's social license to operate, directly impacting its ability to secure new contracts or expand existing services.

Maintaining public trust is paramount. Cleanaway's commitment to transparent environmental performance, including detailed reporting on emissions and waste diversion rates, is crucial. In its 2024 sustainability report, the company highlighted a 5% improvement in its waste diversion rate, aiming to further mitigate reputation risks and reinforce its environmental stewardship.

Cleanaway faces significant threats from volatile commodity prices impacting its resource recovery segment, as demonstrated by sector-wide price swings for recycled plastics in 2024. Escalating landfill levies and potential waste export bans could also increase operational costs and logistical complexities.

Economic downturns pose a substantial risk, reducing waste generation from commercial and industrial clients, which directly affects revenue. For example, a slowdown in 2024 could lead to decreased waste volumes and delayed service needs.

Intense public scrutiny regarding environmental practices, coupled with the risk of operational incidents like facility fires, can damage Cleanaway's reputation and social license to operate. Maintaining public trust through transparent reporting, such as the reported 5% improvement in waste diversion rate in 2024, is crucial for mitigating these threats.

SWOT Analysis Data Sources

This SWOT analysis draws from a robust foundation of data, including Cleanaway's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic overview.