Cleanaway Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

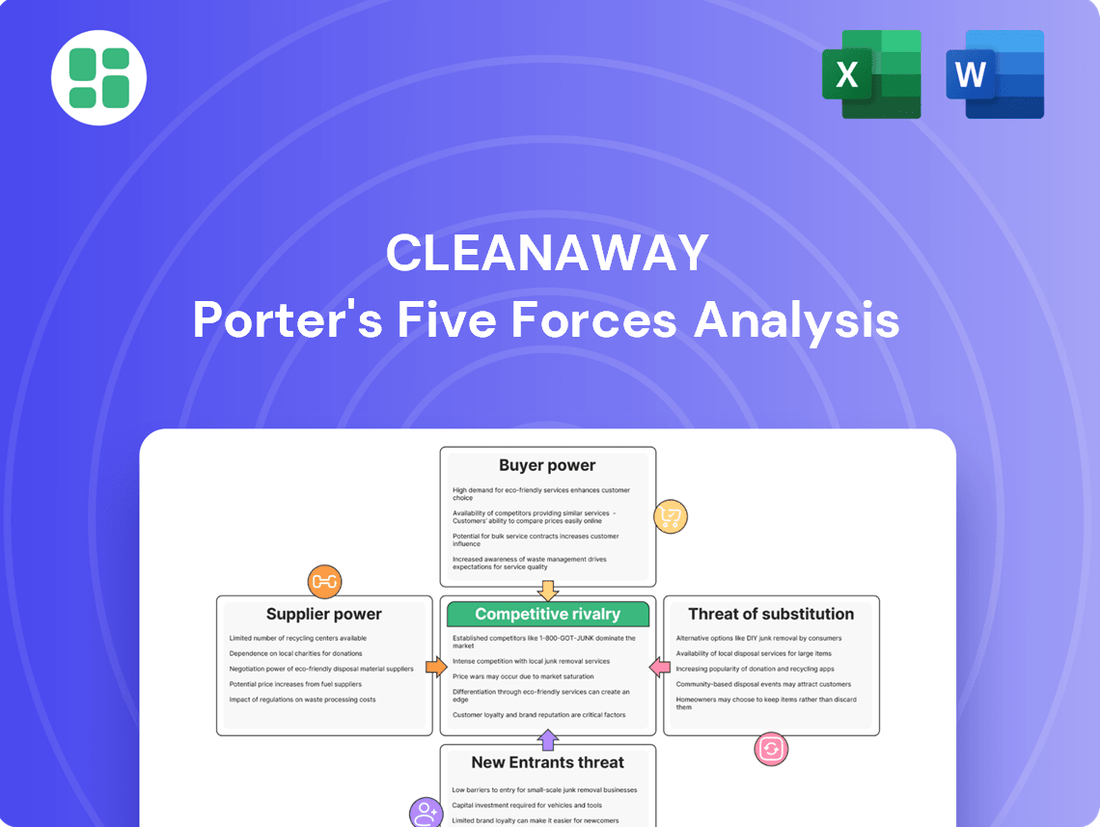

Cleanaway operates in a dynamic waste management sector, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cleanaway’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Cleanaway is a crucial factor, especially considering the concentration of key providers for specialized inputs. For instance, if there are only a few manufacturers of advanced sorting equipment or specific hazardous waste containment systems, these suppliers can leverage their position to influence pricing and terms. In 2023, the global market for waste management equipment saw significant price increases for advanced technologies, impacting companies like Cleanaway.

The uniqueness and differentiation of Cleanaway's inputs significantly influence supplier power. For example, if suppliers offer proprietary recycling technologies or highly specialized equipment, they gain considerable leverage. This is because Cleanaway would have fewer alternatives for these critical components, making them more dependent on those specific suppliers.

Conversely, for more commoditized inputs such as fuel or standard vehicle parts, Cleanaway's bargaining power is considerably stronger. The availability of multiple suppliers for these essential items means Cleanaway can more easily switch providers if prices become unfavorable or if supply is threatened, thus mitigating supplier leverage.

Cleanaway's bargaining power with its suppliers is influenced by switching costs. If it's difficult or expensive for Cleanaway to change suppliers, perhaps due to specialized equipment or long-term contracts, suppliers gain more leverage. For instance, if a new waste processing technology requires significant retooling, Cleanaway might be hesitant to switch providers, giving existing suppliers more power to dictate terms.

Supplier Power 4

The bargaining power of suppliers for Cleanaway is influenced by the threat of forward integration. If suppliers, particularly those providing specialized waste treatment technologies or logistics solutions, were to enter the waste management market directly, they could exert more pressure on Cleanaway. While direct competition with an entity as large as Cleanaway is challenging for most, niche technology providers might find opportunities to serve specific customer segments directly, thereby increasing their leverage.

This dynamic is a key consideration in managing supplier relationships. For instance, a supplier of advanced recycling equipment might consider offering integrated processing services, bypassing the need for a waste management company like Cleanaway as an intermediary. This could shift the balance of power, particularly if the technology is proprietary and difficult for Cleanaway to replicate internally. The potential for such moves is a constant factor in contract negotiations and partnership development.

- Forward Integration Threat: Suppliers entering Cleanaway's service market increases their bargaining power.

- Niche Market Opportunities: Specialized technology providers may target specific customer segments directly.

- Impact on Negotiations: This threat influences contract terms and partnership strategies for Cleanaway.

Supplier Power 5

The bargaining power of suppliers is a crucial factor for Cleanaway, particularly concerning labor. Skilled labor, essential for operating specialized waste management machinery, handling hazardous materials, and driving unique vehicles, forms a significant supplier group. A constrained labor market or robust union presence can amplify the negotiating leverage of this workforce, potentially driving up wage demands and impacting Cleanaway's overall operational expenses and the reliability of its services.

In 2024, the Australian waste management sector, like many others, experienced ongoing labor shortages, especially for roles requiring specific certifications and experience. For instance, the demand for qualified truck drivers, a critical component of Cleanaway's operations, remained high. This scarcity directly translates to increased bargaining power for these skilled workers, as companies compete to attract and retain talent, leading to upward pressure on wages and benefits.

- Skilled Labor Demand: High demand for certified machinery operators and specialized drivers in 2024.

- Union Influence: Potential for strong union negotiation on wages and working conditions.

- Labor Shortages: Persistent scarcity of qualified personnel impacting recruitment and retention costs.

- Wage Pressures: Increased labor costs directly affecting operational expenditure.

The bargaining power of suppliers for Cleanaway is a significant element, particularly concerning specialized equipment and skilled labor. When suppliers provide unique technologies or critical components with few alternatives, they can command higher prices and dictate terms, impacting Cleanaway's cost structure. In 2023, global supply chain disruptions led to increased costs for essential waste management equipment, a trend that continued into early 2024, affecting companies like Cleanaway.

Labor, especially skilled labor such as certified equipment operators and specialized vehicle drivers, represents a key supplier group for Cleanaway. In 2024, Australia continued to face shortages in these critical roles, enhancing the bargaining power of these workers and potentially increasing wage demands. This scarcity directly influences Cleanaway's operational costs and service reliability.

| Supplier Type | Impact on Cleanaway | 2024 Data/Trend |

|---|---|---|

| Specialized Equipment Manufacturers | Potential for higher pricing and stricter terms due to limited alternatives. | Continued price increases for advanced sorting and processing technologies observed. |

| Skilled Labor (Drivers, Operators) | Increased wage demands and potential for labor disputes due to scarcity. | Persistent shortages in skilled trades impacting recruitment and retention efforts. |

| Fuel and Standard Parts Suppliers | Lower bargaining power for suppliers due to availability of multiple vendors. | Competitive pricing generally available, though subject to broader commodity market fluctuations. |

What is included in the product

Tailored exclusively for Cleanaway, analyzing its position within its competitive landscape by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes.

Instantly identify and address competitive threats with a clear, actionable breakdown of each Porter's Five Force, empowering strategic responses.

Customers Bargaining Power

The bargaining power of customers for Cleanaway is influenced by their concentration and the volume of services they procure. Large clients, such as major municipalities or industrial corporations, can wield significant influence due to the substantial revenue they represent, enabling them to negotiate favorable pricing and service conditions. For instance, in 2023, Cleanaway's municipal segment, which includes contracts with local governments, formed a core part of its revenue, highlighting the importance of these large customer groups.

Cleanaway's buyer power is significantly influenced by customer switching costs. If it's simple and cheap for a client to move to a competitor, their ability to negotiate better terms with Cleanaway increases. For instance, a small business with a standard waste bin collection contract might find switching providers relatively easy.

However, for larger clients or those with specialized waste streams requiring specific infrastructure or long-term service agreements, switching costs can be substantial. This reduces their leverage. For example, a large industrial facility relying on Cleanaway for hazardous waste disposal, which involves specialized treatment and regulatory compliance, would face high costs and complexities in changing providers.

In 2023, Cleanaway reported that its revenue from industrial and commercial customers, who often have more complex needs and thus higher switching costs, formed a significant portion of its earnings, indicating a degree of customer stickiness.

The bargaining power of customers in the waste management sector can be significant, especially when services are standardized, allowing clients to easily switch providers based on price. For instance, in 2024, a large municipal contract might see numerous waste management companies vying for business, driving down margins for the winning bidder.

Cleanaway counters this by offering a broad spectrum of integrated waste solutions, from collection to advanced treatment and disposal. This comprehensive approach, which includes specialized services for hazardous or industrial waste, makes direct price comparisons more difficult for many of its larger commercial and industrial clients, thereby mitigating some of the buyer power.

Buyer Power 4

The bargaining power of customers, particularly large industrial clients, can significantly influence Cleanaway. These clients possess the potential for backward integration, meaning they could manage their waste streams internally. For instance, a major manufacturing company might invest in on-site waste treatment or recycling facilities, thereby reducing their dependence on external waste management services like Cleanaway.

While complete backward integration is a substantial undertaking, requiring considerable capital investment, even partial internal management of waste can shift negotiation leverage. This threat forces waste management providers to remain competitive on pricing and service quality to retain these key accounts. For example, in 2023, the Australian industrial sector saw continued investment in sustainability initiatives, with some large corporations exploring circular economy models that could involve greater in-house waste processing.

- Potential for backward integration by large industrial clients.

- Reduced reliance on external waste management services through internal processing.

- Impact on pricing and service demands from powerful customers.

- The trend towards sustainability in Australian industry may encourage more in-house waste management solutions.

Buyer Power 5

Customers hold significant bargaining power, especially when dealing with basic waste management services. This is because many waste streams are seen as commodities, meaning customers can easily switch providers if they find a cheaper option. For instance, in 2024, the Australian waste management sector continued to see competitive pricing pressure, particularly for general commercial waste collection.

Cleanaway can counter this by offering specialized services that go beyond simple disposal. These might include sophisticated recycling programs, resource recovery initiatives, or detailed sustainability reporting for businesses. By demonstrating tangible value and environmental benefits, Cleanaway can lessen the customer's focus solely on price. For example, companies increasingly value transparent reporting on waste diversion and recycling rates, which can justify a premium service.

- High Price Sensitivity: Customers often prioritize cost-effectiveness for standard waste disposal, making them price-sensitive.

- Commoditized Waste Streams: Many waste types are viewed as commodities, increasing the ease of switching providers.

- Value-Added Services: Cleanaway can reduce buyer power by offering advanced recycling, resource recovery, and sustainability reporting.

- Differentiation Beyond Price: These added services highlight benefits beyond cost, fostering customer loyalty and reducing price sensitivity.

Customers in the waste management sector, particularly those procuring standardized services, possess considerable bargaining power. This stems from the relatively low switching costs associated with basic waste collection and disposal, allowing clients to readily shift to competitors offering more attractive pricing. For instance, in 2024, the competitive landscape for general commercial waste services in Australia continued to exert downward pressure on pricing.

Cleanaway mitigates this by emphasizing its integrated waste solutions, which encompass specialized services like hazardous waste management and resource recovery. These more complex offerings, often tailored to specific client needs, create higher switching costs and reduce the customer's ability to solely focus on price. For example, a large industrial client requiring compliant disposal of chemical by-products would find it significantly more challenging and expensive to change providers compared to a small business with standard bin collections.

The potential for backward integration by large industrial clients also represents a significant lever. These entities may explore managing waste streams internally, thereby diminishing their reliance on external providers like Cleanaway. This threat encourages Cleanaway to maintain competitive service levels and pricing to retain these key accounts. In 2023, a growing emphasis on circular economy principles within Australian industries suggested a potential increase in in-house waste processing capabilities among large corporations.

| Customer Segment | Switching Costs | Bargaining Power Influence | Cleanaway Mitigation Strategy |

|---|---|---|---|

| Small Businesses (Standard Collection) | Low | High (Price-driven) | Standardized, efficient service delivery |

| Large Municipalities | Moderate to High (Contractual) | Moderate (Volume-driven) | Integrated service offerings, long-term partnerships |

| Industrial Clients (Specialized Waste) | High (Technical, Regulatory) | Low to Moderate (Service-quality driven) | Specialized treatment, resource recovery, compliance reporting |

| Large Corporations (Potential Backward Integration) | High (Capital Investment) | Moderate to High (Threat of self-sufficiency) | Value-added services, sustainability solutions, competitive pricing |

Preview Before You Purchase

Cleanaway Porter's Five Forces Analysis

This preview showcases the complete Cleanaway Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the waste management industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive a ready-to-use strategic tool without any discrepancies.

Rivalry Among Competitors

Competitive rivalry in Australia's waste management sector is robust, featuring dominant players like Cleanaway alongside numerous regional and specialized firms. This dynamic is intensified by ongoing market consolidation, evident in significant transactions like the Veolia-Suez merger and Cleanaway's strategic acquisition of Citywide's waste management operations in 2022, which bolstered its market share.

The waste management industry, while experiencing a positive projected CAGR of 5.18% from 2025-2033, still presents a dynamic competitive landscape. This growth suggests opportunities for expansion, potentially easing direct clashes for market share. However, the maturity of certain waste management segments means competition for established contracts remains a significant factor, driving rivalry among players.

Competitive rivalry in the waste management sector is notably fierce, largely driven by the substantial fixed costs tied to essential infrastructure. Think about the massive investments required for landfills, transfer stations, and specialized vehicle fleets. These aren't small expenses; they represent significant capital outlays that necessitate high operational utilization to be cost-effective.

To cover these high fixed costs and achieve economies of scale, companies are compelled to secure large volumes of waste. This often translates into aggressive pricing strategies as businesses compete fiercely for contracts and market share. For instance, in Australia, Cleanaway, a major player, operates extensive infrastructure, and maintaining high utilization across these assets is critical for profitability, directly fueling intense price competition.

Competitive Rivalry 4

Competitive rivalry in the waste management sector, including for Cleanaway, is intense. Companies are increasingly differentiating their services beyond just basic waste collection and disposal.

This differentiation often centers on advanced recycling capabilities, stringent environmental compliance, the integration of new technologies for tracking and efficiency, and superior customer service. For instance, Cleanaway actively promotes its focus on resource recovery and sustainable solutions as key differentiators in a crowded market.

- Service Differentiation: Companies compete on factors like advanced recycling, environmental compliance, technology, and customer service.

- Cleanaway's Strategy: Focus on resource recovery and sustainable solutions to stand out.

- Market Dynamics: The industry sees companies vying for market share through innovation and specialized offerings.

Competitive Rivalry 5

Competitive rivalry within the waste management sector, particularly for companies like Cleanaway, is significantly influenced by high exit barriers. These barriers stem from the substantial investment in specialized equipment, such as trucks, processing facilities, and landfills, which have limited alternative uses. Furthermore, stringent environmental regulations and licensing requirements make it difficult and costly for companies to simply cease operations or divest assets, locking them into the market. This often results in a sustained period of intense price competition and potential overcapacity, as existing players are compelled to remain operational even when market conditions are unfavorable.

The persistence of players despite challenging market conditions fuels aggressive competition. For instance, in 2024, the Australian waste management market continued to see intense bidding for municipal contracts, with companies leveraging their existing infrastructure to maintain market share. This dynamic can lead to lower profit margins for all participants as they vie for contracts and customers. The capital-intensive nature of the industry means that new entrants face considerable hurdles, but the difficulty of exiting for established firms paradoxically intensifies the rivalry among them.

- High Capital Investment: Specialized assets in waste management are costly and illiquid, deterring exits.

- Regulatory Lock-in: Compliance with environmental laws and permits creates significant costs for exiting firms.

- Sustained Price Pressure: Companies remaining in the market despite low profitability often engage in price wars.

- Overcapacity Risk: Exit barriers can lead to more capacity than market demand, intensifying competition.

Competitive rivalry in the waste management sector is intense due to high fixed costs associated with infrastructure like landfills and fleets, pushing companies towards aggressive pricing to maximize asset utilization. Companies like Cleanaway differentiate through advanced recycling and sustainability, but the core competition often remains price-driven for securing large waste volumes.

High exit barriers, including specialized equipment and regulatory compliance, keep players locked into the market, even during periods of low profitability. This persistence fuels ongoing price wars and potential overcapacity, as seen in 2024 with intense bidding for Australian municipal contracts.

| Key Factor | Impact on Rivalry | Example (Cleanaway) |

| High Fixed Costs | Drives aggressive pricing for asset utilization | Investment in landfills, transfer stations, and fleet |

| Service Differentiation | Attempt to move beyond price competition | Focus on resource recovery and sustainable solutions |

| High Exit Barriers | Leads to sustained price pressure and overcapacity | Specialized equipment, regulatory compliance |

SSubstitutes Threaten

The threat of substitutes for traditional waste management services is significant, driven by a growing emphasis on waste reduction at the source. Businesses and consumers are increasingly adopting more efficient processes, reducing packaging, and practicing conscious consumption, all of which directly diminish the volume of waste requiring disposal. For instance, the global push towards a circular economy aims to keep resources in use for as long as possible, thereby cutting down on waste generation.

Government policies and widespread consumer awareness campaigns further bolster this threat by prioritizing waste avoidance as the highest tier in the waste hierarchy. Initiatives promoting reuse, repair, and recycling, alongside stricter regulations on landfilling, encourage alternatives to conventional waste management. In 2024, many developed nations are seeing renewed focus on Extended Producer Responsibility (EPR) schemes, which place the onus on manufacturers to manage their products' end-of-life, potentially diverting waste from traditional channels.

The threat of substitutes for Cleanaway is intensifying due to the rise of enhanced resource recovery and circular economy initiatives. These programs focus on keeping materials in use longer, thereby reducing the need for traditional waste disposal and recycling services. For instance, advanced sorting technologies and waste-to-energy plants are transforming waste into valuable resources, offering alternatives to conventional waste management.

Extended Producer Responsibility (EPR) schemes are increasingly influencing the waste management landscape. These programs place the onus of waste management and recycling on the producers of goods, incentivizing them to create more sustainable products. For instance, in 2024, many European nations continued to expand their EPR frameworks, impacting sectors like packaging and electronics, which directly affects the volume and composition of waste streams that companies like Cleanaway manage.

4

The threat of substitutes for Cleanaway is moderate, but growing due to technological innovation. For instance, advancements in modular, on-site waste treatment solutions, such as insect-based organic waste breakdown, present viable alternatives to traditional large-scale, centralized waste processing facilities. This allows customers, particularly those with significant organic waste streams, to potentially manage their waste internally, bypassing the need for services from companies like Cleanaway.

These emerging technologies can reduce reliance on established waste management providers by offering localized and potentially more cost-effective solutions. As these technologies mature and become more accessible, they could capture market share from conventional waste management services.

- Emerging Technologies: Insect-based waste processing offers an on-site alternative to centralized facilities.

- Customer Empowerment: Customers can gain more control over their waste management processes.

- Potential Market Disruption: New solutions may reduce the need for traditional waste management services.

- Cost-Effectiveness: On-site solutions could offer competitive pricing for specific waste streams.

5

The threat of substitutes for Cleanaway's services is growing, particularly in the residential sector. As more households embrace home composting for organic waste, this directly reduces the volume of organic waste requiring commercial collection. Similarly, the rise of community-level recycling initiatives can divert materials like paper, plastics, and metals away from traditional waste management providers.

These alternative methods offer a more localized and often cost-effective solution for consumers, presenting a direct substitution for Cleanaway's core waste collection services. For instance, in 2024, reports indicated a significant uptick in interest and adoption of home composting across various urban and suburban areas, driven by environmental consciousness and a desire for reduced waste bills.

- Home Composting: Reduces organic waste streams for collection.

- Community Recycling: Diverts recyclable materials from commercial services.

- Cost-Effectiveness: Substitutes can offer lower direct costs to consumers.

- Environmental Awareness: Growing consumer focus on sustainability drives adoption of alternatives.

The threat of substitutes for traditional waste management is escalating due to advancements in resource recovery and circular economy models. These approaches aim to transform waste into valuable resources, offering alternatives to conventional disposal methods. For example, waste-to-energy technologies and sophisticated material sorting systems are becoming more prevalent, diverting waste from landfills and reducing the demand for basic collection services.

Extended Producer Responsibility (EPR) schemes are also a significant substitute driver. By holding producers accountable for their products' end-of-life, EPR incentivizes waste reduction and the use of recyclable materials, thereby diminishing the volume of waste managed by traditional providers. In 2024, many regions expanded EPR regulations, particularly for packaging and electronics, impacting waste streams handled by companies like Cleanaway.

Emerging technologies, such as on-site organic waste processing using insects, present localized alternatives to centralized waste management. These solutions empower customers to manage their waste internally, potentially reducing their reliance on external service providers. As these innovations mature, they offer a more direct and potentially cost-effective substitute for specific waste streams.

The increasing adoption of home composting and community recycling initiatives further weakens the threat of substitutes for conventional waste management. These grassroots efforts directly reduce the volume of organic and recyclable materials sent for commercial collection. In 2024, consumer interest in home composting saw a notable rise, driven by environmental concerns and a desire for cost savings.

| Substitute Type | Impact on Traditional Waste Management | Key Drivers | 2024 Trend Example |

|---|---|---|---|

| Circular Economy Initiatives | Reduces overall waste volume and reliance on disposal | Resource efficiency, waste valorization | Growth in waste-to-energy capacity |

| Extended Producer Responsibility (EPR) | Shifts responsibility to producers, incentivizes reduction | Regulatory pressure, product lifecycle management | Expansion of EPR for electronics in EU |

| On-site Waste Processing | Offers localized, customer-controlled alternatives | Technological innovation, cost-effectiveness | Increased interest in insect-based bioconversion |

| Home Composting & Community Recycling | Diverts organic and recyclable waste streams | Consumer awareness, cost savings | Rise in household composting adoption |

Entrants Threaten

The threat of new entrants in the integrated waste management sector, particularly for companies like Cleanaway, is generally considered low. A major hurdle is the substantial capital investment required. Building or acquiring essential infrastructure, such as waste collection fleets, transfer stations, recycling facilities, and especially regulated landfills, demands significant upfront funding. For instance, establishing a new, compliant landfill can cost hundreds of millions of dollars, making it an almost insurmountable barrier for most potential new competitors.

The threat of new entrants in the waste management sector, particularly for companies like Cleanaway, is significantly mitigated by high barriers to entry. Stringent environmental regulations and complex licensing requirements create substantial hurdles for any new player looking to establish operations. For instance, securing permits for waste treatment facilities or landfills is a notoriously time-consuming and expensive undertaking, demanding extensive compliance with environmental impact assessments and ongoing monitoring.

The threat of new entrants into the waste management sector, particularly for a company like Cleanaway, is relatively low due to significant barriers. Established players benefit from substantial economies of scale. Cleanaway's extensive national network and large operational footprint allow for more efficient asset utilization and greater purchasing power, making it challenging for newcomers to match their cost structures. For instance, in 2024, Cleanaway reported significant capital expenditure on its fleet and facilities, reinforcing its scale advantage.

4

The threat of new entrants in the waste management sector, particularly for a company like Cleanaway, is generally considered moderate. Established players benefit significantly from substantial upfront capital requirements for specialized equipment, such as trucks, processing facilities, and landfill sites. This creates a considerable barrier for newcomers. For instance, the cost of a modern waste collection truck can range from $300,000 to $500,000, and building a new transfer station or recycling facility can run into tens of millions of dollars.

Access to established collection routes, long-term customer contracts, especially with municipalities, and a hard-won reputation for reliable service are critical for success in this industry. New entrants find it challenging to replicate this extensive network and build the necessary trust quickly, given the service-intensive nature of waste management. In 2023, Cleanaway reported securing several new municipal contracts, underscoring the importance of these established relationships.

- High Capital Investment: Significant costs for specialized vehicles and infrastructure deter new market entrants.

- Established Networks: Existing companies possess extensive collection routes and operational efficiencies.

- Customer Lock-in: Long-term contracts, particularly with local governments, create loyalty and barriers to switching.

- Reputational Barriers: Trust and a proven track record are vital, making it difficult for new, unproven entities to gain traction.

5

The threat of new entrants for Cleanaway is moderate, primarily due to the high capital investment and specialized knowledge required. Companies need significant expertise in areas like waste treatment, resource recovery, and hazardous waste management to compete effectively. For instance, developing or acquiring the necessary know-how and intellectual property for advanced, sustainable waste solutions demands substantial financial outlay and considerable time.

New players face hurdles in obtaining permits and licenses, which are often stringent and geographically specific. Building the infrastructure for waste collection, processing, and disposal also represents a major barrier.

- High Capital Investment: Establishing waste management facilities, including transfer stations, recycling plants, and landfill sites, requires millions in upfront capital.

- Technological Expertise: Advanced waste treatment and resource recovery technologies demand specialized engineering and scientific knowledge, creating a barrier for less experienced entrants.

- Regulatory Hurdles: Navigating complex environmental regulations and obtaining necessary permits can be a lengthy and costly process, deterring many potential new competitors.

- Economies of Scale: Established players like Cleanaway benefit from economies of scale, allowing them to offer more competitive pricing, making it difficult for smaller new entrants to match.

The threat of new entrants for Cleanaway is generally low, primarily due to the significant capital investment required to establish operations. Building and maintaining specialized infrastructure like waste collection fleets, processing facilities, and compliant landfills demands hundreds of millions of dollars, a substantial barrier for newcomers.

Stringent regulatory environments and complex licensing further deter new competition, as obtaining necessary permits for waste treatment and disposal is a time-consuming and costly process. For instance, securing landfill permits can take years and involve extensive environmental impact studies.

Established players like Cleanaway also benefit from economies of scale, enabling more competitive pricing. In 2024, Cleanaway's continued investment in its national network and fleet reinforced its scale advantage, making it difficult for new entrants to match operational efficiencies and cost structures.

Furthermore, existing customer relationships, particularly long-term municipal contracts, and a strong reputation for reliability create significant customer lock-in. New entrants struggle to replicate these established networks and build the necessary trust quickly.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Investment | Acquisition of specialized vehicles, transfer stations, recycling facilities, and landfills. | Hundreds of millions for a new landfill; tens of millions for processing facilities. A single waste collection truck can cost $300,000 - $500,000. |

| Regulatory Hurdles | Obtaining environmental permits, licenses, and complying with stringent regulations. | Lengthy and expensive process, often taking years. |

| Economies of Scale | Efficient asset utilization, purchasing power, and optimized logistics. | New entrants struggle to match the cost per tonne of established players. |

| Customer Relationships | Securing long-term municipal contracts and building trust for reliable service. | Cleanaway secured several new municipal contracts in 2023, highlighting the value of these relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cleanaway is built upon a foundation of publicly available financial statements, investor presentations, and annual reports from Cleanaway and its key competitors. We supplement this with industry-specific market research reports and data from reputable business intelligence platforms to capture current market dynamics and competitive pressures.