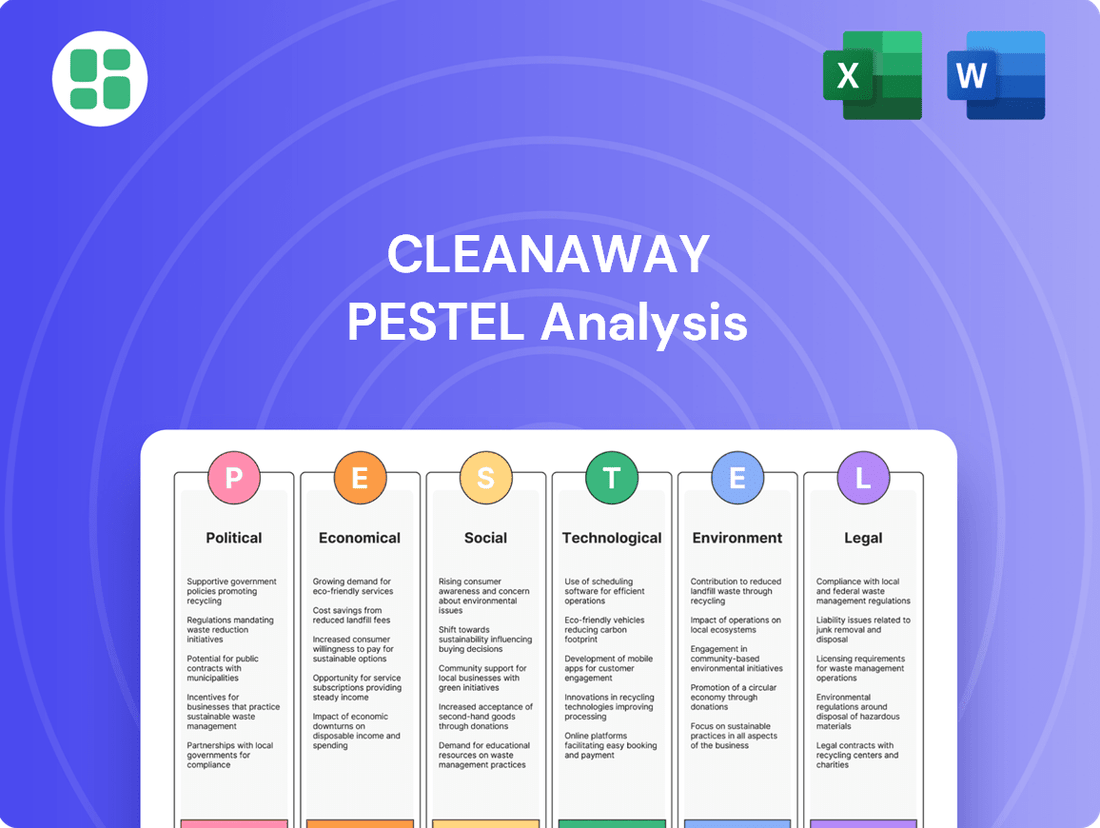

Cleanaway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Cleanaway's trajectory. Our meticulously researched PESTLE analysis provides the essential intelligence you need to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full, actionable report today and gain a decisive competitive advantage.

Political factors

Government policy, especially the National Waste Policy Action Plan 2024, is a major driver for Cleanaway. This plan aims for significant waste reduction and increased resource recovery by 2030, directly boosting demand for Cleanaway's recycling services.

The plan's focus on a circular economy provides a clear, long-term strategy for Australia's waste management sector. For instance, the 2024 plan targets a 30% reduction in total waste generated per capita by 2030, which will necessitate greater investment in and utilization of advanced recycling technologies that Cleanaway provides.

Australia's comprehensive ban on exporting unprocessed waste materials, including plastic, paper, glass, and tyres, fully commenced in July 2024. This significant policy shift is designed to cultivate a robust domestic market for waste processing and recycling. It directly encourages a move towards onshore solutions, presenting a clear opportunity for companies like Cleanaway to bolster their local infrastructure and recycling capabilities in anticipation of heightened demand for domestic waste treatment.

State and territory governments are actively shaping waste management through distinct strategies. For instance, the ACT's Circular Economy Strategy and Action Plan, alongside NSW's Waste and Sustainable Materials Strategy 2041, exemplify this trend. These localized policies, including measures like e-waste bans and single-use plastic phase-outs, establish a varied regulatory environment and create specific service demands for companies like Cleanaway across different Australian regions.

Landfill Levies and Carbon Pricing

The potential for increased and harmonised landfill levies across Australian states presents a significant political factor for Cleanaway. For example, New South Wales has progressively increased its landfill levy, reaching $149.70 per tonne in July 2024, incentivising waste diversion. This trend suggests a national move towards higher levies, making resource recovery a more economically attractive alternative to landfilling, which aligns with Cleanaway's strategic direction.

Furthermore, the ongoing review and potential adjustments to carbon reduction incentives, such as the Australian Carbon Credit Unit (ACCU) Scheme, also play a crucial role. Changes to ACCU pricing or eligibility criteria could impact the financial feasibility of carbon abatement projects within the waste sector. For instance, while ACCU prices have seen volatility, averaging around $30-$40 per tonne in early 2024, any sustained increase or policy support for carbon sequestration in landfills or methane capture technologies could influence operational decisions.

- Landfill Levy Harmonisation: A push for consistent, higher landfill levies across states like NSW ($149.70/tonne from July 2024) directly benefits resource recovery operations by making landfilling less cost-effective.

- Carbon Pricing Mechanisms: The effectiveness and pricing of schemes like the ACCU Scheme (with prices fluctuating around $30-$40/tonne in early 2024) influence the financial viability of carbon reduction initiatives in waste management.

- Policy Incentives for Circular Economy: Government policies favouring waste diversion and the circular economy create a supportive political environment for companies like Cleanaway focused on resource recovery.

- Regulatory Certainty: Clear and stable government policy regarding waste management, levies, and carbon pricing provides crucial certainty for long-term investment in infrastructure and technology.

Infrastructure Investment and Funding

Government investment in waste management and recycling infrastructure is a significant political factor influencing companies like Cleanaway. Initiatives such as the Recycling Modernisation Fund, which aims to boost Australia's recycling capacity, directly support the industry. For instance, in 2022-23, the Australian government allocated $60.1 million through this fund to support 10 projects, enabling the processing of an additional 170,000 tonnes of waste annually. This funding de-risks strategic investments in new facilities and technologies, fostering growth in resource recovery and onshore processing capabilities.

These government funding opportunities, often provided as grants and co-funding, are crucial for Cleanaway. They provide a financial cushion, making it more feasible for the company to undertake large-scale capital expenditures required for upgrading or building new waste processing and recycling plants. This support is vital for developing the infrastructure needed to meet increasing waste volumes and evolving regulatory requirements.

- Government funding directly enhances the capacity of the waste management sector to process waste onshore.

- The Recycling Modernisation Fund is a key example of government support, with $60.1 million allocated in 2022-23 to 10 projects.

- These initiatives reduce the financial risk associated with Cleanaway's strategic investments in new infrastructure and advanced technologies.

- Such support is essential for Cleanaway's growth strategy in resource recovery and its ability to meet market demands.

Government policy continues to shape Australia's waste management landscape, with the National Waste Policy Action Plan 2024 setting ambitious targets for waste reduction and resource recovery by 2030. This plan, coupled with a nationwide ban on unprocessed waste exports effective July 2024, significantly boosts domestic recycling demand. State-level strategies, such as those in the ACT and NSW, further fragment the regulatory environment, creating varied service needs. For instance, NSW's landfill levy reached $149.70 per tonne in July 2024, incentivizing waste diversion and benefiting resource recovery operations.

| Policy/Initiative | Key Feature | Impact on Cleanaway | Data Point |

|---|---|---|---|

| National Waste Policy Action Plan 2024 | Waste reduction & resource recovery targets by 2030 | Increases demand for recycling services | Targets 30% reduction in waste per capita |

| Waste Export Ban (July 2024) | Ban on unprocessed waste exports | Drives onshore processing demand | Covers plastic, paper, glass, tyres |

| NSW Landfill Levy | Increasing landfill costs | Incentivizes waste diversion to resource recovery | $149.70/tonne (July 2024) |

| Recycling Modernisation Fund | Government funding for recycling infrastructure | De-risks investment in new facilities | $60.1 million allocated (2022-23) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Cleanaway, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Cleanaway and mitigating the pain of information overload.

Economic factors

Australia's economic trajectory in 2024 and 2025 points towards continued expansion, with forecasts suggesting GDP growth around 2.5% to 3%. This sustained economic activity, coupled with an anticipated population increase of approximately 1.5% annually, directly fuels a rise in waste generation across all sectors. More people and more economic activity inevitably mean more discarded materials.

This escalating waste volume translates into a robust and expanding market for waste management solutions. Cleanaway, as a leading provider, benefits from this trend as demand for its services, encompassing everything from kerbside collection to advanced recycling and disposal, remains consistently high and is projected to grow. The sheer volume of waste generated by a growing economy and population creates a predictable revenue stream.

The Australian waste management sector is a dynamic and expanding market, presenting considerable avenues for growth. Projections indicate the market will reach an impressive AUD 10.35 billion by 2034. This represents a compound annual growth rate (CAGR) of 6.20% between 2025 and 2034.

This significant market expansion underscores the robust demand for waste management services across Australia. For companies like Cleanaway, this translates into ample opportunities to increase revenue and capture a larger share of the market by leveraging their comprehensive suite of services.

Cleanaway's recycling and resource recovery segments are directly tied to the market prices of recycled materials like plastics, paper, glass, and metals. For instance, the price of recycled PET plastic, a key material for Cleanaway, saw significant volatility in 2024, with prices fluctuating based on global demand and feedstock costs. This directly impacts the revenue Cleanaway earns from selling these recovered resources, influencing the profitability of its recycling operations.

Investment in Circular Economy Infrastructure

The global push for a circular economy is accelerating, with significant capital flowing into advanced recycling and resource recovery infrastructure. This trend is bolstered by supportive government policies and increasing private sector investment, creating substantial opportunities for companies like Cleanaway. These investments are vital for upgrading capabilities and meeting growing demand for sustainable waste management solutions.

Cleanaway is strategically positioned to benefit from this economic transition. Their investments in key projects, such as the Western Sydney Materials Recovery Facility (MRF), and acquisitions, like Citywide's waste management assets, are designed to capture value from these evolving market dynamics. These moves are crucial for enhancing operational efficiency and securing long-term profitability in a sector increasingly focused on resource circularity.

- Increased Investment: Global investment in circular economy infrastructure is projected to reach hundreds of billions of dollars by 2030, driven by policy and consumer demand.

- Cleanaway's Strategy: Cleanaway's capital expenditure in 2023 financial year included significant outlays for infrastructure upgrades and acquisitions to bolster its circular economy capabilities.

- Market Growth: The Australian waste management market, particularly the recycling and resource recovery segment, is expected to grow at a compound annual growth rate of over 5% through to 2028.

- Policy Support: Government initiatives, such as landfill levies and targets for recycled content, are creating a favorable economic environment for circular economy investments.

Operating Costs and Inflationary Pressures

Cleanaway, like many businesses, is navigating a challenging economic landscape marked by escalating operating costs. These pressures are particularly acute in sectors like waste management, which are inherently capital-intensive and reliant on resources susceptible to price volatility. Fuel, a significant expense for transportation and operations, saw considerable increases throughout 2023 and into early 2024, directly impacting Cleanaway's bottom line.

Inflationary trends further exacerbate these cost pressures. Rising labor costs, driven by a competitive job market and increased demand for skilled workers, alongside higher expenses for vehicle maintenance and parts, squeeze profit margins. For instance, the Australian Consumer Price Index (CPI) recorded a 3.6% increase in the year to March 2024, indicating sustained inflationary effects across the economy that directly translate to Cleanaway's operational expenditures.

- Fuel Costs: Significant increases in diesel prices throughout 2023 and early 2024 directly impacted Cleanaway's transportation and operational expenses.

- Labor Expenses: A tight labor market and wage inflation contributed to higher staffing costs, a key operating expense for the company.

- Maintenance and Parts: Increased costs for vehicle maintenance and replacement parts, influenced by global supply chain issues and general inflation, added to operating expenditures.

- Capital Intensity: The capital-intensive nature of waste management means that rising costs for equipment, machinery, and infrastructure have a pronounced effect on overall profitability.

Australia's economic growth, projected at 2.5% to 3% for 2024-2025, coupled with a 1.5% annual population increase, directly drives higher waste generation, creating a larger market for waste management services. This expanding market, predicted to reach AUD 10.35 billion by 2034 with a 6.20% CAGR, presents significant revenue opportunities for Cleanaway. However, rising operating costs due to inflation, with CPI at 3.6% to March 2024, and increased fuel and labor expenses, are key challenges impacting profitability.

| Economic Factor | 2024/2025 Projection/Data | Impact on Cleanaway |

| GDP Growth | 2.5% - 3% | Increased waste generation, higher demand for services |

| Population Growth | ~1.5% annually | Further contributes to waste volume |

| Waste Management Market Growth | AUD 10.35 billion by 2034 (6.20% CAGR 2025-2034) | Significant revenue and market share opportunities |

| Inflation (CPI) | 3.6% (Year to March 2024) | Increased operating costs (fuel, labor, maintenance) |

| Fuel Costs | Significant increases in 2023-early 2024 | Directly impacts transportation and operational expenses |

Full Version Awaits

Cleanaway PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Cleanaway provides a comprehensive overview of the external factors impacting the company. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape, enabling informed strategic decisions.

Sociological factors

Public awareness regarding environmental sustainability and the circular economy is on the rise, directly fueling demand for better recycling and waste reduction services. This growing consciousness means companies like Cleanaway are seeing increased interest in their offerings.

However, Cleanaway's own research, as of early 2024, highlights that despite increased awareness, significant knowledge gaps persist. Many consumers remain unsure about proper waste sorting and disposal methods, indicating a critical need for continuous public education campaigns and active community involvement to improve recycling rates.

Shifting consumer preferences are significantly impacting waste management. The rapid expansion of the fast-food industry and the boom in e-commerce, for instance, have directly contributed to a surge in packaging waste and food scraps. This creates more diverse and complex waste streams that companies like Cleanaway must adeptly handle.

The rise of online shopping, particularly evident in Australia where e-commerce sales grew by an estimated 10.4% in 2023 according to NAB, means more cardboard, plastic films, and shipping materials entering the waste cycle. Similarly, the convenience of fast food generates substantial quantities of single-use plastics and food waste, demanding innovative collection and processing solutions.

Effectively managing these evolving consumption patterns requires Cleanaway to develop specialized services for challenging waste types. This includes finding viable solutions for soft plastics, which are notoriously difficult to recycle, and the growing problem of e-waste, driven by rapid technological obsolescence. Adapting to these trends is crucial for maintaining and expanding service relevance.

Community trust in recycling systems is a critical sociological factor for Cleanaway. A 2023 survey indicated that 40% of Australians are unsure if their recycling efforts are effective, highlighting a persistent gap in public confidence regarding the actual processing of recyclables. This skepticism can directly impact participation rates and the quality of collected materials.

Cleanaway's commitment to transparency is therefore paramount. By providing clear, accessible information about their sorting and processing facilities, and by showcasing successful resource recovery outcomes, the company can actively work to rebuild and strengthen community trust. Initiatives like facility tours and detailed impact reports are essential tools in demonstrating the tangible benefits of their operations.

Demand for Sustainable Waste Solutions

Societal expectations are increasingly prioritizing environmental responsibility, driving a significant demand for sustainable waste management. Consumers and businesses alike are actively seeking eco-friendly options, recycling programs, and circular economy solutions. This trend directly impacts waste management providers, necessitating a shift towards resource recovery and innovative approaches.

Cleanaway is well-positioned to capitalize on this societal evolution. Their strategic focus on resource recovery and sustainable waste solutions directly addresses the growing market need. This alignment provides a distinct competitive advantage in a sector where environmental consciousness is becoming a primary purchasing driver.

- Growing Demand: In 2023, the global waste management market was valued at approximately USD 1.2 trillion, with a significant portion attributed to the increasing demand for recycling and sustainable practices. Projections indicate continued strong growth driven by environmental regulations and consumer preferences.

- Circular Economy Focus: Companies adopting circular economy principles, which emphasize waste reduction and resource reuse, are seeing increased investment and consumer loyalty. This shift is reshaping traditional waste disposal models.

- Regulatory Push: Governments worldwide are implementing stricter regulations on waste disposal and encouraging recycling, further fueling the demand for advanced waste management solutions. For example, many regions are setting ambitious targets for landfill diversion rates by 2030.

- Cleanaway's Advantage: Cleanaway's investment in advanced sorting technologies and resource recovery facilities directly supports this societal demand, positioning them as a leader in sustainable waste management.

Workforce Safety and Community Relations

Cleanaway, as a significant employer, understands that its standing within communities hinges on its dedication to workforce safety and fostering positive relationships. Incidents, whether safety-related or environmental, can severely damage public trust and stakeholder confidence, underscoring the critical need for strong health, safety, and community engagement initiatives.

In 2023, Cleanaway reported a Total Recordable Injury Frequency Rate (TRIFR) of 4.0, a figure that highlights the ongoing focus on improving safety performance. The company actively invests in safety training and risk management programs to mitigate potential hazards, recognizing that a safe operation is fundamental to its social license to operate.

- Workforce Safety: Maintaining a low TRIFR is a key performance indicator, with ongoing efforts to reduce workplace incidents.

- Community Engagement: Cleanaway participates in local initiatives and maintains open communication channels to address community concerns.

- Reputation Management: Proactive management of safety and environmental performance directly impacts public perception and stakeholder trust.

- Social License to Operate: Demonstrating commitment to safety and community well-being is essential for continued operational acceptance.

Societal expectations are increasingly prioritizing environmental responsibility, driving a significant demand for sustainable waste management solutions. Consumers and businesses alike are actively seeking eco-friendly options, recycling programs, and circular economy solutions, directly impacting waste management providers and necessitating a shift towards resource recovery.

Cleanaway is well-positioned to capitalize on this societal evolution, with their strategic focus on resource recovery and sustainable waste solutions directly addressing the growing market need. This alignment provides a distinct competitive advantage in a sector where environmental consciousness is becoming a primary purchasing driver, as evidenced by the global waste management market's approximate USD 1.2 trillion valuation in 2023.

Community trust in recycling systems is critical, with a 2023 survey indicating 40% of Australians are unsure if their recycling efforts are effective, highlighting a persistent gap in public confidence. Cleanaway's commitment to transparency through facility tours and detailed impact reports is essential for rebuilding and strengthening this trust.

Workforce safety is paramount, with Cleanaway reporting a Total Recordable Injury Frequency Rate (TRIFR) of 4.0 in 2023, underscoring ongoing efforts to improve safety performance through training and risk management programs. This commitment to safety is fundamental to their social license to operate.

| Sociological Factor | Description | Impact on Cleanaway | Supporting Data/Trend |

|---|---|---|---|

| Environmental Awareness | Growing public consciousness about sustainability and the circular economy. | Increased demand for recycling and waste reduction services. | Global waste management market valued at ~USD 1.2 trillion in 2023, with strong growth driven by environmental preferences. |

| Consumer Preferences | Shifting consumption patterns due to e-commerce and fast food. | Surge in packaging and food waste requiring specialized handling. | Australian e-commerce sales grew ~10.4% in 2023; fast food generates significant single-use plastic and food waste. |

| Community Trust | Public confidence in the effectiveness of recycling systems. | Impacts participation rates and material quality; necessitates transparency. | 40% of Australians unsure of recycling effectiveness (2023 survey). |

| Workforce Safety | Importance of employee health and safety for public perception. | Affects reputation and social license to operate; requires strong safety initiatives. | Cleanaway's TRIFR was 4.0 in 2023. |

Technological factors

Technological advancements are significantly reshaping waste management. Innovations like AI-powered sorting systems and smart bins are making waste processing more efficient and effective. These technologies improve resource recovery and reduce reliance on landfills.

Cleanaway is actively investing in these cutting-edge technologies. For instance, their new Material Recovery Facility (MRF) in Western Sydney, operational since late 2023, utilizes advanced sorting capabilities. This facility is designed to process a higher volume of recyclables, aiming to boost resource recovery rates by an estimated 30% compared to older facilities.

Waste-to-energy (WtE) technologies, such as thermal treatment, anaerobic digestion, and gasification, are emerging as viable options for managing non-recyclable waste by transforming it into energy. These methods are increasingly being adopted in Australia, offering Cleanaway a chance to expand its waste treatment services and support the nation's renewable energy targets.

Cleanaway is increasingly leveraging data analytics and digital platforms to streamline its operations. For instance, by optimizing collection routes through advanced algorithms, the company can significantly reduce fuel consumption and vehicle wear and tear. This technological integration aims to boost asset utilization, ensuring that trucks and equipment are used more effectively across its vast service network.

The implementation of data-driven insights directly translates into tangible cost savings for Cleanaway. By analyzing operational data, the company can identify inefficiencies and implement targeted improvements, leading to better service delivery for its customers. This focus on data enhances decision-making at all levels, from on-the-ground logistics to strategic planning, ultimately improving the company's bottom line.

Innovation in Hazardous Waste Treatment

Technological advancements are critical for Cleanaway's hazardous waste operations. The company must continually invest in and adopt new treatment and disposal technologies to meet stringent environmental regulations and manage increasingly complex waste streams. This includes staying ahead of innovations in areas like PFAS (per- and polyfluoroalkyl substances) treatment, which is becoming a significant focus for environmental management globally.

The demand for sophisticated hazardous waste solutions is growing, driven by stricter environmental standards and the increasing complexity of industrial byproducts. For instance, the global hazardous waste management market was valued at approximately USD 35.5 billion in 2023 and is projected to grow, underscoring the need for technological leadership. Cleanaway's ability to offer advanced treatment options, such as those for persistent organic pollutants or specific industrial chemicals, will be a key differentiator.

Key technological areas influencing Cleanaway's hazardous waste segment include:

- Advanced Oxidation Processes: For breaking down recalcitrant organic contaminants in liquid hazardous waste.

- Supercritical Water Oxidation (SCWO): A technology showing promise for treating highly toxic and hazardous waste streams efficiently and with minimal secondary pollution.

- Specialized Filtration and Membrane Technologies: Essential for separating and concentrating hazardous components from wastewater and other liquid effluents.

- Digitalization and AI: For optimizing waste tracking, treatment process control, and predictive maintenance of specialized equipment, enhancing both efficiency and safety.

Automation and Robotics in Waste Processing

The integration of automation and robotics within waste processing is significantly reshaping the sector. These advancements directly contribute to enhanced worker safety by removing humans from hazardous tasks, while simultaneously boosting sorting precision and overall processing speed. For Cleanaway, this means a greater capacity to handle increasing waste volumes efficiently and to improve the purity of recycled materials, making them more valuable in the market.

The financial implications are substantial. For instance, the global waste management market, heavily influenced by technological adoption, was projected to reach approximately USD 1.7 trillion by 2024, with automation playing a key role in efficiency gains. In 2023, investments in AI and robotics for waste sorting saw a notable uptick, with companies reporting up to a 20% increase in recovery rates for certain materials.

- Improved Safety: Robotics handle hazardous materials and repetitive tasks, reducing workplace injuries.

- Enhanced Sorting Accuracy: AI-powered optical sorters can identify and separate recyclables with greater precision than manual methods.

- Increased Throughput: Automated systems process waste at a faster rate, allowing facilities to manage larger volumes.

- Higher Quality Recovered Materials: Better sorting leads to cleaner material streams, increasing their market value.

Technological advancements are a major driver in modernizing waste management, with AI and automation enhancing efficiency and resource recovery. Cleanaway's investment in facilities like its Western Sydney MRF, operational since late 2023, highlights this trend, aiming for a 30% increase in resource recovery. Waste-to-energy technologies are also gaining traction in Australia, offering new avenues for non-recyclable waste treatment.

Data analytics and digital platforms are crucial for optimizing operations, such as route planning, leading to reduced fuel consumption and improved asset utilization. Cleanaway's focus on data-driven insights translates into cost savings and better service delivery. The company must also stay abreast of evolving hazardous waste treatment technologies, like those for PFAS, to meet stringent environmental regulations.

The global hazardous waste management market, valued at approximately USD 35.5 billion in 2023, is growing, emphasizing the need for technological leadership in advanced treatment solutions. Automation and robotics are transforming waste processing by improving worker safety and sorting accuracy, with the global waste management market projected to reach USD 1.7 trillion by 2024.

Legal factors

Cleanaway faces rigorous environmental protection laws across Australia, impacting its waste management operations. The company must comply with federal and state regulations governing waste collection, treatment, and disposal, requiring permits and adherence to strict environmental standards. For instance, in 2023, the Australian government continued to emphasize circular economy principles, potentially increasing compliance burdens for waste processors.

Failure to meet these environmental obligations can lead to substantial financial penalties and reputational damage. Cleanaway’s commitment to robust environmental management systems is therefore crucial for its ongoing operational viability and license to operate, especially as environmental scrutiny intensifies.

The Recycling and Waste Reduction Act 2020 significantly impacts Cleanaway by prohibiting the export of unprocessed waste, compelling the company to focus on domestic processing solutions. This legislative change directly influences waste management strategies and necessitates greater investment in local recycling and treatment facilities to comply with the new mandates.

This regulatory shift creates a clear legal obligation for Cleanaway to enhance its Australian-based processing capabilities, as exporting raw waste is no longer a viable option. Consequently, the company must prioritize developing and expanding its domestic infrastructure to handle a wider range of waste streams efficiently and in accordance with the law.

Cleanaway's operations, particularly those involving hazardous waste, are heavily governed by stringent occupational health and safety (OHS) regulations. These laws are designed to safeguard workers and the general public from potential harm. For instance, in Australia, the Safe Work Australia framework sets national policy for Work Health and Safety (WHS), which Cleanaway must adhere to across its diverse sites and services.

Failure to comply with these OHS mandates can result in severe penalties, including substantial fines and legal action. In 2023, for example, a waste management company in Queensland was fined AUD $150,000 for safety breaches related to hazardous material handling, highlighting the significant financial risks associated with non-compliance. Cleanaway's commitment to a robust safety culture is therefore not just an ethical obligation but a critical legal and financial necessity.

Circular Economy Regulatory Frameworks

Australia is seeing a rise in circular economy regulations at both federal and state levels. These new frameworks are pushing for products to be designed with recycling in mind, implementing extended producer responsibility (EPR) for waste management, and mandating higher percentages of recycled materials in manufacturing. For instance, New South Wales has introduced ambitious recycling targets and waste reduction plans, aiming to divert 80% of waste from landfill by 2030.

Cleanaway needs to actively adjust its service offerings and partner with manufacturers to comply with these growing legal demands. This includes developing capabilities to handle a wider range of recyclable materials and supporting businesses in meeting their EPR obligations. The company's ability to adapt to these legislative changes will be crucial for its continued success and compliance in the evolving waste management landscape.

- Evolving National and State Legislation: New circular economy frameworks are being implemented across Australia, requiring businesses to adapt.

- Focus on Product Design and Recyclability: Regulations are increasingly emphasizing product design that facilitates easier recycling and reuse.

- Extended Producer Responsibility (EPR): EPR schemes are becoming more prevalent, placing greater responsibility on producers for the end-of-life management of their products.

- Increased Use of Recycled Content: Mandates for incorporating recycled materials into new products are on the rise, creating demand for recycled feedstock.

Landfill and Emissions Regulations

Regulations governing landfill operations, such as those mandating methane capture and stringent emissions controls, directly influence the operational costs and strategic planning for Cleanaway's landfill assets. These environmental mandates are increasingly pushing the company to invest in more sophisticated, compliant disposal and recovery technologies.

Stricter limits on landfill emissions, for instance, necessitate advanced technologies for managing volatile organic compounds (VOCs) and greenhouse gases. Furthermore, regulatory pressure to adopt alternative waste treatment methods, like advanced recycling and waste-to-energy, encourages Cleanaway to diversify its service offerings beyond traditional landfilling, potentially leading to new revenue streams and reduced environmental liabilities.

- Methane Capture Mandates: Many jurisdictions now require landfills to capture a significant percentage of methane produced, often exceeding 75%, to mitigate greenhouse gas emissions.

- Emissions Standards: Regulations like the US EPA's New Source Performance Standards (NSPS) for landfills set specific limits on landfill gas emissions, requiring continuous monitoring and control systems.

- Landfill Diversion Targets: Government policies increasingly aim to divert waste from landfills through recycling, composting, and other recovery programs, impacting the volume of waste managed by traditional landfill operations.

- Leachate Management: Strict rules govern the collection and treatment of leachate, a toxic liquid that can form in landfills, requiring robust containment and processing infrastructure.

Legal frameworks in Australia are increasingly shaping waste management practices, with a strong emphasis on environmental protection and circular economy principles. For instance, the Recycling and Waste Reduction Act 2020 directly impacts Cleanaway by restricting waste exports, thereby mandating greater investment in domestic processing capabilities.

Furthermore, stringent occupational health and safety (OHS) regulations, such as the Safe Work Australia framework, are critical for Cleanaway's operations, particularly concerning hazardous waste handling. Non-compliance risks significant financial penalties, as evidenced by a AUD $150,000 fine in Queensland in 2023 for safety breaches.

The evolving landscape of circular economy legislation, including Extended Producer Responsibility (EPR) schemes and mandates for recycled content, requires Cleanaway to adapt its service offerings and infrastructure to meet new compliance demands and market opportunities.

Environmental factors

Australia's ambitious goal to double its circularity by 2035 is a major driver for companies like Cleanaway. This national push towards a circular economy, which emphasizes designing out waste and keeping materials in use, directly influences Cleanaway's strategy, pushing it further into resource recovery and innovative sustainable solutions.

The transition means Cleanaway will likely see increased demand for its services in recycling, composting, and waste-to-energy. For instance, the Australian government's National Waste Policy Action Plan aims to halve the amount of organic waste sent to landfill by 2030, a target that directly benefits waste management and resource recovery providers.

The global push to slash greenhouse gas emissions, especially methane from landfills, is a major driver for Cleanaway. This pressure directly shapes how they operate and spurs investment in technologies like landfill gas capture systems and waste-to-energy facilities. For instance, Cleanaway's commitment to Paris-aligned 2030 targets highlights their proactive approach to managing climate-related risks and opportunities.

Growing concerns over resource scarcity are significantly boosting the demand for effective resource recovery from waste. This trend directly benefits companies like Cleanaway, whose operations in collecting, sorting, and processing materials for reuse and recycling are vital for conserving Australia's natural resources. The push towards a circular economy means that waste is increasingly viewed as a valuable resource, not just an end-product.

In 2023, Australia's national waste policy aimed to divert 80% of waste from landfills by 2030, highlighting the critical role of resource recovery. Cleanaway's infrastructure and expertise in managing diverse waste streams are therefore essential for meeting these ambitious sustainability targets and reducing reliance on virgin materials.

Pollution and Contamination Management

Managing diverse waste streams, from general refuse to highly problematic substances like PFAS, necessitates stringent environmental controls to safeguard land, water, and air from contamination. Cleanaway's specialized capabilities in safely processing and treating such materials are paramount for preserving ecological integrity and safeguarding community well-being.

The company's commitment to advanced treatment technologies is crucial in mitigating environmental risks associated with waste disposal. For instance, in 2024, Cleanaway continued to invest in infrastructure designed to handle complex waste, including those containing persistent organic pollutants.

- PFAS Remediation: Cleanaway is actively involved in developing and implementing solutions for Per- and Polyfluoroalkyl Substances (PFAS), a group of chemicals known for their persistence in the environment.

- Hazardous Waste Handling: The company possesses licenses and expertise to manage a wide array of hazardous wastes, ensuring compliance with strict regulatory frameworks in 2024.

- Contaminated Site Management: Cleanaway provides services for the remediation of contaminated land and water bodies, contributing to the restoration of affected ecosystems.

- Air Quality Controls: Operations are designed to minimize air emissions, with advanced filtration and monitoring systems in place to prevent atmospheric pollution.

Biodiversity and Ecosystem Protection

Cleanaway's waste management activities, especially when it comes to developing new landfill sites or expanding existing ones, can unfortunately affect local wildlife and natural habitats. This is a significant environmental consideration for the company.

Responsible land management is therefore crucial for Cleanaway. This includes implementing effective rehabilitation programs for closed sites and strictly following environmental impact assessments before any new developments. These practices are key to reducing the company's impact on the environment and ensuring its operations can continue sustainably.

- Biodiversity Impact: Landfill operations can lead to habitat loss and fragmentation, impacting species diversity.

- Rehabilitation Efforts: Cleanaway's commitment to rehabilitating closed landfill sites aims to restore ecological function and biodiversity.

- Regulatory Compliance: Adherence to environmental impact assessments (EIAs) is mandated to mitigate potential harm to ecosystems.

- Sustainable Practices: Minimizing ecological footprint through responsible land management is central to Cleanaway's long-term sustainability strategy.

Australia's strong commitment to environmental sustainability, including ambitious targets for waste reduction and increased circularity, directly benefits Cleanaway. The nation's focus on diverting waste from landfills and promoting resource recovery aligns perfectly with Cleanaway's core business, driving demand for its services in recycling and waste-to-energy solutions.

The increasing global emphasis on reducing greenhouse gas emissions, particularly methane from landfills, is a significant environmental factor influencing Cleanaway's operations and investment in cleaner technologies. For example, Cleanaway's 2030 targets are aligned with Paris Agreement goals, demonstrating a proactive stance on climate change mitigation.

Growing concerns over resource scarcity are escalating the demand for effective resource recovery, positioning waste management companies like Cleanaway as crucial players in conserving natural resources. The company's expertise in managing diverse waste streams and its role in the circular economy are vital for reducing reliance on virgin materials.

Cleanaway's operations, particularly in managing complex waste streams like PFAS and hazardous materials, require stringent environmental controls to prevent land, water, and air contamination. The company's investment in advanced treatment technologies in 2024 underscores its commitment to mitigating these environmental risks and ensuring regulatory compliance.

| Environmental Factor | Impact on Cleanaway | Key Data/Initiative (2024/2025) |

|---|---|---|

| Circular Economy Push | Increased demand for resource recovery and recycling services. | Australia aims to double circularity by 2035; National Waste Policy Action Plan targets halving organic waste to landfill by 2030. |

| Greenhouse Gas Reduction | Drives investment in landfill gas capture and waste-to-energy. | Cleanaway's 2030 targets aligned with Paris Agreement; focus on reducing landfill methane emissions. |

| Resource Scarcity | Boosts demand for waste as a resource. | Growing emphasis on conserving virgin materials through recycling and reuse. |

| Environmental Contamination Management | Requires specialized handling of hazardous waste and remediation. | Continued investment in infrastructure for complex waste, including PFAS remediation. |

| Land Use and Biodiversity | Necessitates responsible land management and rehabilitation. | Adherence to Environmental Impact Assessments (EIAs) for new developments and rehabilitation of closed sites. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cleanaway is built upon a robust foundation of data from government environmental agencies, industry-specific market research, and reputable economic forecasting bodies. We meticulously gather insights on regulatory changes, economic indicators, and technological advancements to provide a comprehensive view.