Cleanaway Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

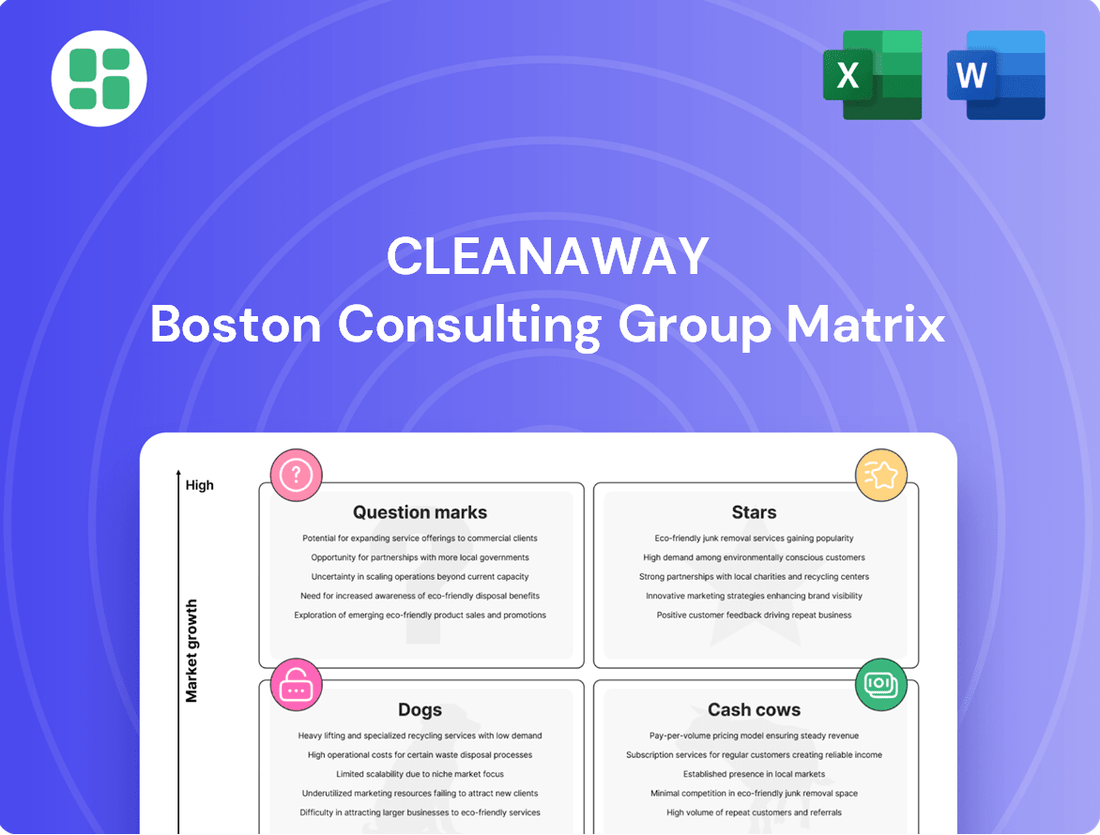

Unlock the strategic potential of Cleanaway's product portfolio with a glimpse into their BCG Matrix. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the foundational insights for informed decision-making.

Don't just see the categories; understand the implications. Purchase the full Cleanaway BCG Matrix report to gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

This is your chance to move beyond a superficial understanding. Secure the complete BCG Matrix for Cleanaway and equip yourself with the strategic clarity needed to navigate the competitive landscape and drive future growth.

Stars

Cleanaway is making significant strides in advanced resource recovery, a key component of its BCG matrix positioning. The company's substantial investments in cutting-edge facilities, like the Circular Plastics Australia joint ventures for PET and HDPE/PP recycling, which commenced operations in early 2024, highlight this commitment. These ventures are designed to process a considerable volume of plastic waste, contributing to a more circular economy.

This segment thrives in a high-growth market, fueled by escalating demand for recycled materials and robust circular economy initiatives. Cleanaway's proactive approach positions it as a frontrunner in delivering sustainable waste management solutions, directly addressing the growing need for environmentally responsible practices.

By prioritizing the diversion of waste from landfills, Cleanaway aligns perfectly with governmental sustainability targets and evolving consumer preferences. This strategic focus not only reinforces its market leadership but also signals a strong potential for future expansion and increased market share in the coming years.

Cleanaway's Container Deposit Scheme (CDS) operations across Australia, particularly in NSW and QLD, represent a significant player in a burgeoning market. The recent expansion into Victoria, with operations commencing in November 2023, has further solidified its position and is already contributing to substantial volume increases.

This segment benefits from strong government backing and growing consumer engagement, creating a favorable environment for continued expansion. In 2023, Cleanaway reported handling over 2.5 billion containers through its CDS network, highlighting the scale of its operations.

Liquid Technical Services (LTS) demonstrated robust performance in FY24, with significant increases in both revenue and Earnings Before Interest and Taxes (EBIT). This growth highlights its specialized expertise in handling challenging liquid waste, a critical area within the industrial and hazardous waste management sector.

LTS operates within a specialized, yet expanding, market segment. Cleanaway's established infrastructure and technical proficiency provide a distinct competitive advantage, reinforcing its market leadership in managing complex waste streams.

The successful renewal of major contracts for LTS in FY24 is a strong indicator of its sustained market position and future growth prospects. This segment continues to be a key contributor to Cleanaway's overall strategy.

Health Services Transformation

Cleanaway's Health Services division has achieved a significant turnaround, shifting from a loss-making state in FY23 to reaching its targeted annualised EBIT run-rate in FY24. This segment is projected to deliver around $15 million in EBIT for FY25.

This success reflects a substantial gain in market share within a sector characterized by consistent demand. Key drivers include enhanced operational efficiencies and elevated service standards.

- FY23: Loss-making position

- FY24: Achieved targeted annualised EBIT run-rate

- FY25 Projection: Approximately $15 million EBIT

- Key Strengths: Strong market share gain, improved operational efficiencies, consistent demand in healthcare waste sector

Specialized Industrial & Decommissioning, Decontamination & Remediation (DD&R) Services

Cleanaway's acquisition of Contract Resources in March 2025 marks a significant strategic enhancement of its Specialized Industrial & DD&R services. This move bolsters Cleanaway's presence in higher-margin technical services, including catalyst handling and chemical cleaning, directly supporting its decommissioning, decontamination, and remediation growth ambitions.

This expansion positions Cleanaway as a key player in the burgeoning technical services sector, especially for the oil and gas industry and other industrial applications. The integration is anticipated to yield substantial financial benefits, projecting high-single digit earnings per share accretion for Cleanaway.

- Strategic Expansion: Acquisition of Contract Resources in March 2025.

- Service Enhancement: Entry into higher-margin catalyst handling and chemical cleaning.

- Market Positioning: Aiming for leadership in technical services for oil and gas and industrial sectors.

- Financial Impact: Expected high-single digit earnings per share accretion.

Stars in the Cleanaway BCG matrix represent segments with high market share in high-growth industries. These are the growth engines of the company, requiring significant investment to maintain their leading positions and capitalize on market expansion opportunities. Their performance is crucial for overall company growth and profitability.

The advanced resource recovery segment, particularly with its PET and HDPE/PP recycling ventures, fits this description. These operations, which began in early 2024, are positioned in a rapidly expanding market driven by sustainability demands. Similarly, the Container Deposit Scheme, with over 2.5 billion containers processed in 2023 and expansion into Victoria, also operates in a high-growth area supported by government policy.

These 'Stars' are characterized by their potential for substantial future growth and profitability. Cleanaway's strategic investments and operational successes in these areas underscore their importance as key drivers of the company's future trajectory.

| Segment | Market Growth | Market Share | Key Developments |

|---|---|---|---|

| Advanced Resource Recovery (e.g., Plastics Recycling) | High | High | Circular Plastics Australia JV commenced operations early 2024. |

| Container Deposit Scheme (CDS) | High | High | Processed over 2.5 billion containers in 2023; expanded to Victoria Nov 2023. |

What is included in the product

The Cleanaway BCG Matrix analyzes its business units based on market share and growth, guiding investment and divestment decisions.

A clear BCG Matrix visualizes Cleanaway's portfolio, easing the pain of resource allocation decisions.

Cash Cows

Cleanaway's general solid waste collection business is a cornerstone, boasting Australia's largest market share across municipal, commercial, and industrial sectors. Despite being a mature market, this segment consistently generates substantial revenue thanks to its vast operational network and secure, long-term contracts. In FY23, Cleanaway reported a significant portion of its revenue derived from its Solid Waste services, highlighting its role as a reliable cash generator.

Cleanaway's established landfill operations are its bedrock, a national network of engineered sites that are crucial for waste management. Even as the industry pivots towards resource recovery, these landfills remain vital for disposing of waste that can't be recycled or reused, consistently bringing in substantial cash. For instance, in the fiscal year 2023, Cleanaway's Waste Management segment, which heavily relies on landfill operations, reported a revenue of $1.8 billion, showcasing the ongoing financial contribution of these assets.

Cleanaway's traditional recycling services, encompassing paper, cardboard, and metals, are firmly positioned as Cash Cows. These operations benefit from well-established infrastructure and consistent demand, generating a steady and predictable cash flow for the company. For instance, in fiscal year 2023, Cleanaway reported a significant portion of its revenue derived from its solid waste services, which heavily includes traditional recycling streams, underscoring their stable contribution.

Core Liquid Waste Collection

Cleanaway's core liquid waste collection, distinct from its specialized technical services, acts as a significant cash cow. This segment reliably generates substantial revenue by serving a wide array of industrial and commercial clients with routine non-hazardous liquid waste disposal.

The market for this service is mature, characterized by high barriers to entry. These barriers stem from the substantial investment needed for specialized collection fleets and the necessary infrastructure, ensuring Cleanaway's established position and predictable earnings.

- Cash Flow Generation: This segment provides a consistent and substantial cash flow, underpinning the company's financial stability.

- Client Base: Serves a broad spectrum of industrial and commercial clients, indicating a diverse and stable demand.

- Market Maturity: Operates in a mature market, suggesting established demand and limited disruptive threats.

- Barriers to Entry: High capital requirements for specialized fleets and infrastructure protect Cleanaway's market share.

Large-scale Transfer Station Network

Cleanaway's large-scale transfer station network functions as a significant cash cow within its business portfolio. These facilities are strategically positioned across Australia, acting as essential consolidation points for waste materials. Their operational efficiency and high throughput in key urban centers ensure a consistent revenue stream from processing fees.

The network's established infrastructure and ongoing high utilization rates, particularly in major metropolitan areas, underscore its role as a reliable generator of stable cash flow. This network is fundamental to Cleanaway's operational backbone, enabling economies of scale in waste management services.

- Revenue Generation: Transfer stations generate consistent revenue through tipping fees and processing charges, contributing significantly to Cleanaway's financial stability.

- Operational Efficiency: The network's extensive reach and consolidation capabilities enhance operational efficiency, reducing transportation costs and improving waste processing.

- Market Position: Cleanaway's dominant presence in key Australian markets through its transfer station network solidifies its cash cow status by capturing substantial market share.

Cleanaway's established landfill operations are its bedrock, a national network of engineered sites crucial for waste management. Even as the industry pivots towards resource recovery, these landfills remain vital for disposing of waste that can't be recycled or reused, consistently bringing in substantial cash. For instance, in the fiscal year 2023, Cleanaway's Waste Management segment, which heavily relies on landfill operations, reported a revenue of $1.8 billion, showcasing the ongoing financial contribution of these assets.

Cleanaway's traditional recycling services, encompassing paper, cardboard, and metals, are firmly positioned as Cash Cows. These operations benefit from well-established infrastructure and consistent demand, generating a steady and predictable cash flow for the company. For instance, in fiscal year 2023, Cleanaway reported a significant portion of its revenue derived from its solid waste services, which heavily includes traditional recycling streams, underscoring their stable contribution.

Cleanaway's core liquid waste collection, distinct from its specialized technical services, acts as a significant cash cow. This segment reliably generates substantial revenue by serving a wide array of industrial and commercial clients with routine non-hazardous liquid waste disposal, benefiting from high barriers to entry due to substantial investment in specialized fleets and infrastructure.

| Business Segment | BCG Category | FY23 Revenue (Approx.) | Key Characteristics |

|---|---|---|---|

| Solid Waste Collection | Cash Cow | Significant portion of total revenue | Largest market share, mature market, long-term contracts |

| Landfill Operations | Cash Cow | $1.8 billion (Waste Management Segment) | National network, essential disposal, consistent cash generation |

| Traditional Recycling | Cash Cow | Included in Solid Waste revenue | Established infrastructure, consistent demand, predictable cash flow |

| Core Liquid Waste Collection | Cash Cow | Substantial revenue | Mature market, high barriers to entry, broad client base |

| Transfer Station Network | Cash Cow | Consistent revenue stream | High throughput, strategic locations, operational efficiency |

What You’re Viewing Is Included

Cleanaway BCG Matrix

The Cleanaway BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections; you get the complete, professionally formatted strategic analysis ready for immediate application.

Dogs

While Cleanaway's Industrial & Waste Services (I&WS) segment is generally a growth area bolstered by acquisitions, some specific sub-segments showed flat Earnings Before Interest and Taxes (EBIT) in fiscal year 2024. This stagnation was attributed to prevailing softer economic conditions impacting demand.

These underperforming areas, if they persist with low demand or face stiff competition without a strong market position, could be categorized as Dogs within the BCG Matrix. They represent segments that tie up capital and resources without generating substantial returns or contributing meaningfully to the company's growth trajectory.

For instance, if a particular industrial cleaning service within I&WS saw its EBIT remain flat at $5 million in FY24, while other segments grew by 10-15%, it would highlight a potential Dog. Such segments warrant a strategic review, potentially leading to divestment or a significant operational overhaul to improve performance or free up resources for more promising ventures.

Cleanaway's 'Blueprint 2030' strategy targets upgrading its infrastructure. Outdated or inefficient treatment facilities, characterized by low market share due to technological obsolescence, fall into the 'Dog' category within the BCG Matrix. These sites often struggle with higher operating costs and reduced returns, impacting overall profitability.

Cleanaway's core strength is its extensive national, integrated network. However, some smaller, isolated regional operations might not benefit from this scale. These units often hold a low market share in their local areas, placing them in the 'Dog' quadrant of the BCG Matrix.

These regional operations can face profitability challenges. Their per-unit costs are typically higher, and they have fewer avenues for growth or cross-selling services within the larger Cleanaway ecosystem. For instance, a small waste collection depot in a sparsely populated area might incur significant operational costs without the volume to offset them.

Non-Strategic Hydrocarbons Business

Cleanaway's hydrocarbons business, despite demonstrating some EBIT growth in FY24, is under strategic review. This assessment considers its value proposition in a market increasingly prioritizing low-carbon alternatives.

If this segment struggles to adapt and maintains a low market share in the evolving energy landscape, it could be classified as a 'Dog' in the BCG matrix. Such a segment might demand significant investment for minimal future returns, especially when compared to other business areas.

- FY24 EBIT Growth: The hydrocarbons segment experienced some earnings before interest and taxes (EBIT) growth in the fiscal year 2024.

- Strategic Review: A comprehensive review is underway to evaluate the business's long-term viability and market positioning.

- Market Shift: The market's increasing demand for low-carbon products poses a challenge to traditional hydrocarbon businesses.

- Potential 'Dog' Classification: Without adaptation, a low market share and limited future growth prospects could lead to its classification as a 'Dog'.

Divested or Phased-Out Non-Core Assets

Cleanaway has strategically divested or phased out non-core assets as part of its ongoing portfolio optimization. This includes the sale of its stake in Cleanaway ResourceCo RRF Pty Ltd during the first half of fiscal year 2025, which resulted in a reported loss. These actions reflect a deliberate move to exit ventures that did not meet strategic growth or market share objectives.

These divested assets, though not products in the traditional sense, represent past investments and associated operations that were deemed underperforming. The decision to divest signifies a commitment to focusing resources on core business areas that offer greater potential for future returns and align with Cleanaway's long-term strategic vision.

- Divestiture of Cleanaway ResourceCo RRF Pty Ltd: Occurred in 1H FY25.

- Financial Impact: Resulted in a loss for Cleanaway.

- Strategic Rationale: Assets deemed not meeting desired market share or growth expectations.

- Portfolio Optimization: Part of a broader strategy to streamline operations and focus on core strengths.

Segments within Cleanaway that exhibit low market share and low growth potential are classified as Dogs in the BCG Matrix. These are typically businesses or operations that consume resources without generating significant returns, often due to market saturation, technological obsolescence, or intense competition. For example, a small, isolated regional waste collection depot with high operating costs and limited volume would fit this description.

These 'Dog' segments can drain capital and management attention. Their continued operation might be unsustainable without substantial strategic intervention, such as operational efficiency improvements or a complete business model overhaul. The divestment of non-core assets, like the stake in Cleanaway ResourceCo RRF Pty Ltd sold in 1H FY25, often represents management's recognition of such underperforming units.

The hydrocarbons business, while showing some EBIT growth in FY24, faces challenges from the market's shift towards low-carbon alternatives. If it fails to adapt and maintain market share, it could become a 'Dog', requiring significant investment for minimal future returns.

Outdated treatment facilities, characterized by low market share due to technological limitations, also fall into the 'Dog' category. These operations often incur higher costs and yield lower returns, impacting overall company profitability.

| Business Segment Example | Market Share | Growth Rate | BCG Classification | FY24 EBIT Impact |

| Isolated Regional Waste Depot | Low | Low | Dog | Negative (due to high costs) |

| Outdated Treatment Facility | Low | Low | Dog | Negative (due to high operating costs) |

| Hydrocarbons Business (if adaptation fails) | Low | Low | Potential Dog | Stagnant or declining |

Question Marks

The Australian waste management market is experiencing a surge in interest and projected growth for waste-to-energy (WtE) solutions, signaling substantial market growth potential. Cleanaway is actively exploring and investing in these technologies, though its specific WtE projects are likely in early development or pilot stages, currently commanding a low market share in this emerging sector.

These ventures necessitate considerable capital outlay and successful implementation to advance into the 'Stars' category of the BCG matrix. For instance, the Australian government's commitment to reducing landfill waste and promoting circular economy principles, as outlined in various state-level waste strategies, provides a favorable regulatory environment for WtE development.

Cleanaway's collaboration with Viva Energy on soft plastics recycling, aiming to produce feedstock for food-grade plastic resin, is a prime example of a 'Question Mark' in the BCG matrix. This initiative is in its early stages, with a pre-feasibility assessment underway, indicating a nascent market position but significant future growth potential.

The market for advanced chemical recycling is experiencing rapid expansion, driven by increasing demand for sustainable materials and stricter environmental regulations. While specific market share data for Cleanaway in this niche is not yet publicly available due to the project's developmental phase, the overall sector is projected to grow substantially. For instance, the global chemical recycling market was valued at approximately USD 1.5 billion in 2023 and is anticipated to reach over USD 8 billion by 2030, growing at a CAGR of around 25%.

Cleanaway is actively investing in innovative technologies to tackle difficult-to-recycle materials, signaling a strategic move into potentially high-growth sectors. This commitment is demonstrated through collaborations aimed at developing novel recycling and reuse solutions for challenging waste streams, aligning with the global push for a circular economy.

While these advanced initiatives address significant waste challenges, Cleanaway's current market share in these emerging technological areas remains low. For instance, in 2023, the company reported increased R&D expenditure focused on advanced sorting and chemical recycling technologies, though specific revenue contributions from these nascent areas are yet to be substantial.

The successful development and implementation of these technologies hold the potential to unlock considerable future value for Cleanaway. However, these ventures are inherently risky and demand significant capital investment, with the long-term return on investment still subject to market adoption and technological maturity.

Expansion into New Niche Industrial Waste Streams

Cleanaway's expansion into new niche industrial waste streams, such as specialized electronic waste recycling or advanced chemical waste treatment, represents a classic 'Question Mark' in the BCG matrix. These are areas where the market is growing quickly, driven by factors like increased e-waste generation and stricter environmental regulations for hazardous materials, but Cleanaway's current market share is likely small. For instance, the global e-waste market was projected to reach over $100 billion by 2024, with specialized recycling technologies becoming increasingly crucial.

These emerging niches demand significant, targeted investment to build the necessary infrastructure, acquire specialized technology, and develop the expertise required to handle these complex waste materials safely and efficiently. Cleanaway's strategy here involves carefully evaluating the long-term potential of these streams and committing resources to gain a competitive edge before competitors solidify their positions. The company's existing technical capabilities in broader industrial waste management provide a foundation for leveraging into these specialized areas.

- Niche Market Growth: Emerging industrial waste streams are experiencing rapid growth, driven by technological advancements and evolving regulatory landscapes.

- Low Current Market Share: Cleanaway's penetration in these highly specialized waste segments is currently limited, characteristic of a 'Question Mark' opportunity.

- Strategic Investment Required: Capturing market share in these niches necessitates dedicated capital expenditure for specialized equipment and operational expertise.

- Leveraging Technical Expertise: Cleanaway can utilize its existing knowledge in waste management to adapt and excel in handling complex, niche waste materials.

Monetization of Data & Analytics Capabilities

Cleanaway's internal data and analytics capabilities have already proven their worth, driving margin expansion through improved operational efficiency. This suggests a strong foundation for potential external offerings.

By transforming these internal strengths into consulting services for the waste sector, Cleanaway could tap into the burgeoning market for digital transformation and efficiency solutions. This market is experiencing significant growth, with digital transformation in the industrial sector projected to reach hundreds of billions of dollars globally by 2025, and the waste management sector is increasingly looking for such innovations.

As a new venture with minimal existing market share in this external service area, Cleanaway's data monetization efforts would currently be classified as a 'Question Mark' within the BCG Matrix. This position acknowledges the substantial growth potential and the opportunity for diversification, but also the inherent risks and investment required to establish a strong market presence.

- Market Entry: Cleanaway's data monetization would represent a new venture into a high-growth digital transformation market.

- Potential: Significant potential exists for diversification and capturing market share in efficiency solutions for the waste sector.

- Current Status: Positioned as a 'Question Mark' due to minimal external market share and the need for further investment and strategy development.

- Internal Success: Prior internal success in margin expansion through data analytics provides a strong proof of concept.

Cleanaway's ventures into waste-to-energy (WtE) and advanced chemical recycling represent 'Question Marks'. These emerging sectors offer substantial growth potential, driven by government initiatives and demand for sustainability. However, Cleanaway's current market share in these areas is minimal, requiring significant capital investment and technological development to mature.

The company's exploration of niche industrial waste streams, such as specialized e-waste recycling, also falls into the 'Question Mark' category. While the global e-waste market is expanding rapidly, Cleanaway's presence in these specialized segments is nascent, necessitating targeted investment in infrastructure and expertise.

Furthermore, Cleanaway's potential to monetize its internal data analytics capabilities by offering consulting services to the waste sector is a 'Question Mark'. This new venture targets the growing digital transformation market, but requires strategic development and investment to build an external client base and establish market share.

| Initiative | Market Potential | Current Market Share | Investment Need |

| Waste-to-Energy (WtE) | High, driven by circular economy goals | Low | Significant capital for infrastructure and technology |

| Advanced Chemical Recycling | Very High, projected CAGR ~25% globally | Low | Substantial investment in R&D and processing facilities |

| Niche Industrial Waste Streams (e.g., e-waste) | High, global e-waste market >$100bn by 2024 | Low | Specialized equipment and operational expertise |

| Data Monetization (Consulting) | High, digital transformation in industry | Minimal (external) | Strategy development, sales, and marketing |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Cleanaway's annual reports, market share analysis, and industry growth forecasts to accurately position each business unit.