Clasquin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clasquin Bundle

Clasquin's strengths lie in its robust global network and expertise in complex supply chains, while its opportunities stem from growing e-commerce and digitalization trends. However, potential threats include intense competition and evolving regulatory landscapes.

Want the full story behind Clasquin's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Clasquin's significant strength lies in its extensive global network, boasting 85 offices across 25 countries. This vast operational footprint, coupled with deep local expertise in each region, allows Clasquin to provide seamless, end-to-end logistics solutions for complex international supply chains. This integrated approach ensures efficient management of freight and logistics, a critical advantage in today's globalized market.

Clasquin's commitment to digital transformation is a significant strength, particularly evident in its 'Live by Clasquin' platform. This advanced digital ecosystem offers clients real-time shipment tracking, crucial CO2 emission data, and consolidated financial views, directly addressing modern supply chain demands for transparency and control.

The strategic investment in digital solutions like 'Live by Clasquin' is paying off, as it accounted for a substantial 63% of the Group's gross profit in the first half of 2024. This highlights the platform's effectiveness in driving revenue and solidifying Clasquin's position as a digitally-enabled logistics provider.

Clasquin's strength lies in its extensive and adaptable service portfolio, encompassing air, ocean, road, and rail freight, alongside customs brokerage, warehousing, and full supply chain management. This breadth ensures they can handle diverse logistical challenges.

Their client-centric philosophy is key, enabling the creation of bespoke solutions tailored precisely to individual customer requirements. This customization fosters strong client relationships and addresses unique operational demands effectively.

For instance, in 2023, Clasquin reported a revenue of €796.6 million, showcasing the scale of their operations and the demand for their comprehensive services across various sectors.

Strategic 'Pure Player' Positioning

Clasquin's strategic advantage lies in its 'pure player' positioning within international freight management. This means they focus solely on logistics, distinguishing them from diversified conglomerates. This specialization enables a deep understanding of the freight market and a streamlined service offering that resonates with clients seeking expert handling of their shipments.

This unique blend of scale and agility allows Clasquin to offer the extensive service capabilities typically associated with larger, multinational competitors, while retaining the customer-centric approach and flexibility often found in smaller, niche providers. This dual advantage fosters strong, personalized client relationships and enables highly tailored solutions.

For instance, in 2023, Clasquin reported revenue of €798 million, demonstrating significant operational scale. Yet, their ability to adapt to evolving market demands and provide responsive service, a hallmark of a pure player, is crucial for maintaining client loyalty in a competitive landscape.

- Specialized Expertise: Focus on freight management allows for deeper market knowledge and service refinement.

- Balanced Capabilities: Combines the reach of large firms with the responsiveness of smaller ones.

- Client-Centric Approach: Tailored services and strong relationships are key differentiators.

Strong Financial Performance and Growth Strategy

Clasquin has showcased impressive financial results, with a notable 14% increase in gross profit in the third quarter of 2024, driven by strong performances in its ocean and air freight segments. This financial health is a key strength, enabling further strategic investments.

The company is actively pursuing a growth strategy centered on developing high value-added services and expanding its global footprint. This forward-looking approach is supported by a solid financial foundation, positioning Clasquin for sustained expansion and market penetration.

- Robust Q3 2024 Gross Profit: 14% increase, particularly strong in ocean and air freight.

- Strategic Focus: Expansion of high value-added services and international network.

- Financial Strength: Underpins the company's growth initiatives and operational capabilities.

Clasquin's extensive global presence, with 85 offices in 25 countries, combined with deep local expertise, allows for seamless international logistics solutions. Their 'Live by Clasquin' platform is a significant strength, providing clients with real-time tracking and crucial CO2 data, contributing to 63% of the Group's gross profit in H1 2024.

The company's comprehensive service portfolio, covering air, ocean, road, and rail freight, alongside customs and warehousing, demonstrates its adaptability. This breadth of services, coupled with a client-centric approach to create bespoke solutions, fosters strong customer relationships. For instance, Clasquin reported €796.6 million in revenue for 2023, highlighting the demand for their integrated logistics offerings.

As a specialized 'pure player' in international freight management, Clasquin offers deep market knowledge and a focused service offering. This specialization allows them to combine the extensive capabilities of larger firms with the agility and personalized service of smaller ones, a balance crucial for client retention. Their robust financial performance, including a 14% increase in gross profit in Q3 2024, supports their strategy of expanding high value-added services and their global network.

What is included in the product

Delivers a strategic overview of Clasquin’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage Clasquin's competitive advantages.

Helps pinpoint and address internal weaknesses and external threats proactively.

Weaknesses

Clasquin's reliance on its extensive subcontractor network, while enabling operational flexibility and broad global reach, inherently creates a dependency that can impact service consistency. This external reliance means that maintaining uniform quality standards across all logistics operations, from warehousing to transportation, is a persistent challenge.

In 2023, Clasquin reported that approximately 70% of its transport volumes were handled by third-party carriers, highlighting the significant degree to which the company outsources its physical logistics. This high percentage underscores the potential vulnerability if key subcontractors experience disruptions or fail to meet performance benchmarks, directly affecting Clasquin's ability to deliver on client promises and potentially impacting customer satisfaction.

The acquisition of a significant stake in Clasquin by SAS Shipping Agencies Services Sàrl, an MSC subsidiary, presents potential integration challenges. Merging disparate operational processes, IT systems, and corporate cultures could create short-to-medium term friction, potentially impacting efficiency and synergy realization.

Clasquin, like many in the freight forwarding sector, faces significant vulnerability to market volatility. For instance, the Red Sea crisis in late 2023 and early 2024 caused major shipping disruptions, leading to increased transit times and surcharges. This directly impacts freight volumes and rate predictability, posing a challenge to maintaining stable profitability.

Continuous Investment Requirements for Digital Edge

Digital Edge, while a strength, demands ongoing, significant financial commitment. Clasquin must consistently invest in cutting-edge technology, research, and development to maintain its competitive advantage. For instance, the logistics technology sector saw global investment reach an estimated $20 billion in 2024, highlighting the intense R&D landscape.

Falling behind in this rapid technological evolution or failing to match competitor innovation poses a direct threat to Clasquin's digital leadership. This continuous investment requirement can strain financial resources, especially if returns on new digital initiatives are not immediate or guaranteed.

- High Capital Expenditure: Sustaining a digital edge requires substantial and recurring capital outlays for software, hardware, and specialized talent.

- Risk of Obsolescence: Rapid technological advancements mean investments can quickly become outdated, necessitating further expenditure to stay current.

- Competitive Pressure: Competitors are also investing heavily in digital transformation, creating a constant need for Clasquin to innovate or risk losing market share.

- Integration Challenges: Implementing and integrating new digital solutions can be complex and costly, with potential for unforeseen expenses.

Competitive Pressure from Larger Giants

Clasquin faces significant competitive pressure from much larger global logistics players who possess greater financial muscle and benefit from substantial economies of scale. These giants can leverage their extensive networks and resources to offer aggressive pricing, particularly on high-volume shipments and for contracts requiring significant capital investment in infrastructure.

This disparity in resources means that while Clasquin excels as a pure player, it must constantly innovate and differentiate to compete effectively. For instance, in 2024, the global freight forwarding market, a key area for Clasquin, saw continued consolidation with major players like Kuehne+Nagel and DHL Global Forwarding reporting robust revenues, highlighting the scale of competition.

- Market Dominance: Larger competitors often control a disproportionately large share of the global logistics market, giving them considerable pricing power and market influence.

- Resource Disparity: Giants can invest more heavily in technology, marketing, and talent acquisition, creating a higher barrier to entry for smaller, specialized firms.

- Economies of Scale: Their vast operational volumes allow them to negotiate better rates with carriers and suppliers, translating into lower costs and potentially more competitive bids.

Clasquin's substantial reliance on subcontractors, with roughly 70% of its 2023 transport volumes outsourced, presents a significant weakness. This dependency creates challenges in maintaining consistent service quality and exposes the company to disruptions if these third parties falter. The recent acquisition by an MSC subsidiary also introduces potential integration hurdles, which could temporarily impact operational efficiency.

Preview Before You Purchase

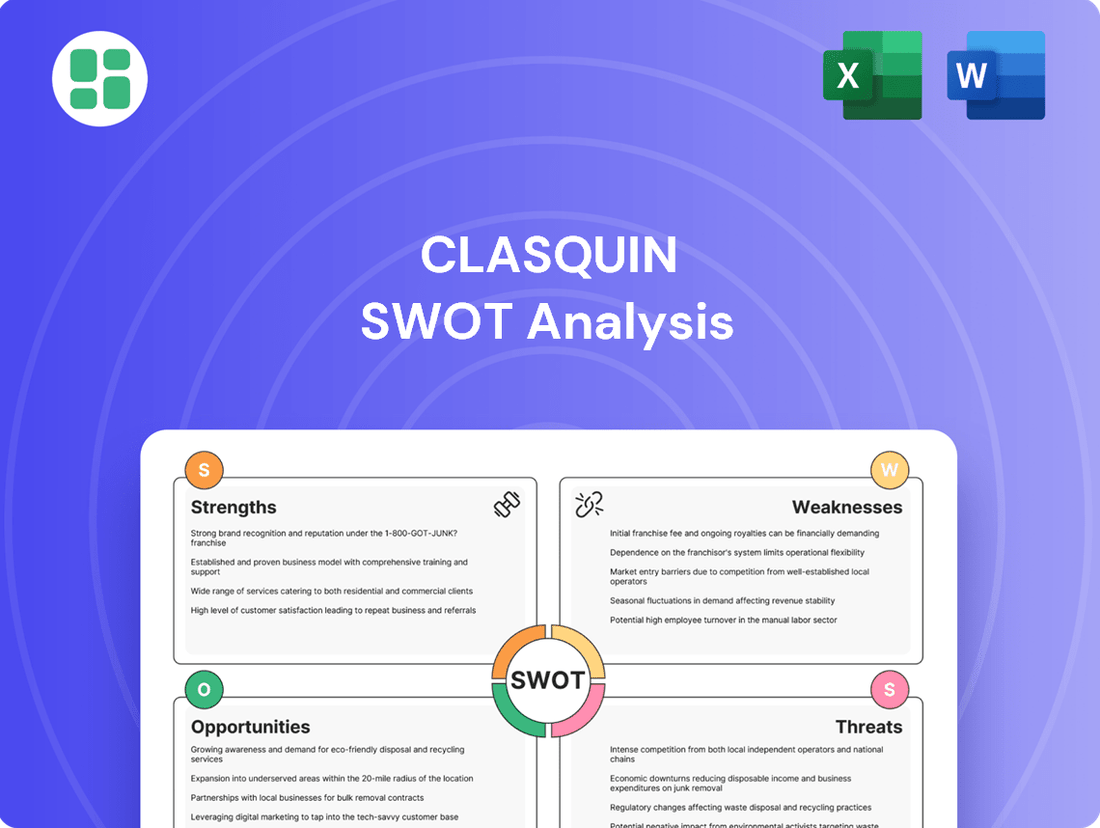

Clasquin SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive report, ensuring you know exactly what you're getting. Unlock the full, detailed insights into Clasquin's strategic positioning by completing your purchase.

Opportunities

The acquisition by SAS Shipping Agencies Services Sàrl, a subsidiary of MSC Mediterranean Shipping Company SA, offers Clasquin a powerful avenue to tap into MSC's extensive global network and substantial freight volumes. This integration is poised to unlock significant synergies, potentially boosting Clasquin's service capabilities and operational efficiency.

Leveraging MSC's vast resources allows Clasquin to expand its market reach considerably. For instance, MSC's 2023 revenue of approximately $30 billion provides a strong financial backing and a massive customer base that Clasquin can now more effectively serve, leading to increased market share.

The logistics industry is experiencing a significant shift, with clients increasingly demanding real-time visibility and predictive analytics within their supply chains. This growing need for transparency and data-driven insights directly plays into Clasquin's strengths. Our 'Live by Clasquin' platform is designed to meet these evolving expectations, offering advanced digital solutions that provide granular control and foresight. This presents a clear opportunity for Clasquin to capture greater market share and expand its service offerings by leveraging its technological capabilities to address this burgeoning demand.

Clasquin is strategically prioritizing expansion into high-growth trade lanes, especially along North-South routes connecting Europe, Africa, and Asia, as well as the USA to Africa. This focus is designed to capitalize on the burgeoning international trade activity in these regions, offering significant opportunities for increased freight volumes and revenue. For instance, trade between Europe and Africa has seen substantial growth, with bilateral trade expected to continue its upward trajectory in the coming years.

Increasing Focus on Sustainable Supply Chains

Clasquin's 'Green Offer' and CO2 emissions tracker directly address the increasing corporate demand for sustainable logistics. This focus positions them to attract environmentally conscious clients, a growing segment in the market. For instance, by 2024, over 70% of global consumers indicated they were willing to pay more for sustainable products, a trend extending to service providers like Clasquin.

The company's proactive approach in developing these tools allows them to differentiate themselves from competitors. This is crucial as regulatory pressures and investor scrutiny on environmental, social, and governance (ESG) factors intensify. By 2025, it's projected that ESG investing will account for a significant portion of all professionally managed assets globally, highlighting the strategic advantage of Clasquin's green initiatives.

- Capitalizing on Demand: Clasquin's green solutions align with the rising consumer and business preference for eco-friendly services.

- Market Differentiation: The CO2 emissions tracker provides a tangible advantage over less environmentally focused competitors.

- ESG Alignment: The company's offerings are well-suited to meet the growing ESG investment criteria and regulatory expectations.

Strategic Acquisitions to Enhance Network and Services

Clasquin's history of successful strategic acquisitions, like the integration of TIMAR, demonstrates its capability to rapidly broaden its geographical reach and bolster its service offerings. This approach has consistently fueled growth and market share expansion in critical areas. For instance, TIMAR's acquisition in 2022 significantly strengthened Clasquin's presence in the Mediterranean and North Africa, adding to its already robust European network.

This proven strategy offers a clear pathway for continued diversification and market penetration. By identifying and integrating complementary businesses, Clasquin can unlock new revenue streams and enhance its competitive positioning. The company's agile M&A strategy is a key driver for staying ahead in the dynamic logistics sector, allowing for swift adaptation to evolving market demands and customer needs.

Opportunities for further strategic acquisitions remain significant. Potential targets could include companies specializing in niche logistics services, advanced technology solutions for supply chain management, or businesses with strong footholds in emerging markets. Such moves would not only expand Clasquin's operational capabilities but also reinforce its value proposition to a global clientele.

- Acquisition of TIMAR (2022): Expanded geographical footprint and service capabilities, particularly in the Mediterranean and North Africa.

- Proven M&A Track Record: Demonstrates ability to integrate acquired entities effectively, driving growth and market share.

- Diversification Potential: Opportunities exist to acquire businesses in specialized logistics, technology, or emerging markets.

- Enhanced Competitive Edge: Strategic acquisitions allow Clasquin to adapt swiftly and strengthen its overall market position.

Clasquin's integration with MSC, a global shipping giant with approximately $30 billion in revenue in 2023, presents a substantial opportunity to leverage a vast network and customer base. This synergy allows Clasquin to significantly expand its market reach and operational capabilities.

The growing demand for real-time supply chain visibility and predictive analytics is a key opportunity. Clasquin's 'Live by Clasquin' platform is well-positioned to meet these needs, offering advanced digital solutions that enhance client control and foresight, thereby capturing greater market share.

Clasquin's strategic focus on high-growth trade lanes, particularly North-South routes connecting Europe, Africa, and Asia, and USA to Africa, capitalizes on burgeoning international trade activity. This expansion into regions with strong trade growth potential is set to drive increased freight volumes and revenue.

The company's 'Green Offer' and CO2 emissions tracker directly appeal to the increasing corporate demand for sustainable logistics. With over 70% of global consumers willing to pay more for sustainable products in 2024, this focus provides a significant competitive advantage and aligns with intensifying ESG scrutiny, as ESG investing is projected to capture a substantial portion of managed assets by 2025.

Clasquin's proven track record of successful acquisitions, exemplified by the 2022 integration of TIMAR, demonstrates its ability to rapidly expand geographical reach and service offerings. This strategy offers a clear path for continued diversification and market penetration by acquiring businesses in specialized logistics, technology, or emerging markets.

| Opportunity Area | Key Driver | 2023/2024 Data Point |

|---|---|---|

| MSC Integration | Leveraging global network and customer base | MSC 2023 Revenue: ~$30 billion |

| Digitalization Demand | Client need for real-time visibility and analytics | Growing market demand for supply chain transparency |

| Trade Lane Expansion | Capitalizing on growth in specific trade routes | Focus on North-South and USA-Africa routes |

| Sustainability Focus | Corporate demand for eco-friendly logistics | 70%+ consumers willing to pay more for sustainable products (2024) |

| Strategic Acquisitions | Expanding reach and capabilities through M&A | TIMAR acquisition (2022) strengthened Mediterranean presence |

Threats

The global freight forwarding market is incredibly crowded, with a mix of giants and specialized digital players vying for business. This fierce rivalry often translates into aggressive pricing strategies, putting significant strain on profitability for companies like Clasquin.

Geopolitical instability, including ongoing regional conflicts and escalating trade disputes, presents a substantial threat to Clasquin's operations. These global events directly impact international supply chains, potentially leading to extended transit times and increased operational expenses. For instance, the ongoing disruptions in the Red Sea, which began in late 2023 and continued into early 2024, forced many shipping lines to reroute vessels around the Cape of Good Hope, adding significant time and cost to voyages.

Protectionist policies enacted by various nations can further exacerbate these challenges by restricting trade flows and increasing the complexity of cross-border logistics. This can result in reduced overall trade volumes, directly affecting demand for Clasquin's services. The International Monetary Fund (IMF) has repeatedly warned that rising trade tensions could hinder global economic growth, a direct concern for logistics providers reliant on international commerce.

Clasquin's profitability is directly impacted by the volatility of freight rates and fuel prices. For instance, in 2024, the shipping industry experienced significant rate swings due to geopolitical events and shifting demand, making it challenging for Clasquin to maintain stable margins. These cost increases are often difficult to fully pass on to customers, directly squeezing gross profit.

Evolving Regulatory Landscape and Compliance Costs

The global logistics sector, including companies like Clasquin, navigates a complex web of international trade regulations that are continually updated. These changes, covering customs procedures, environmental standards, and security measures, demand constant vigilance and adaptation. For instance, the EU’s Carbon Border Adjustment Mechanism (CBAM), phased in from October 2023, introduces new reporting and compliance obligations for carbon emissions in imported goods, directly impacting logistics providers managing supply chains within and into the EU.

Ensuring adherence to these diverse and evolving mandates across multiple jurisdictions presents a significant challenge. The cost associated with staying compliant can be substantial, encompassing investments in new technology, staff training, and updated administrative processes. In 2024, many logistics firms are allocating increased budgets towards compliance technology and expertise to manage these growing requirements effectively, with some estimates suggesting compliance costs could rise by 5-10% year-over-year due to new regulations.

- Regulatory Complexity: International trade laws, customs, environmental mandates, and security protocols are constantly changing globally.

- Compliance Costs: Adapting to these evolving regulations incurs significant operational and administrative expenses for logistics firms.

- Impact of New Regulations: Initiatives like the EU's CBAM from late 2023 add new layers of reporting and financial obligations for imported goods.

- Increased Investment: Companies are boosting spending on compliance technology and personnel to manage these growing demands in 2024.

Cybersecurity Risks and Data Security Breaches

Clasquin, like many logistics and supply chain firms, is highly susceptible to cybersecurity risks. A significant data breach could compromise sensitive client information and operational data, leading to severe financial penalties and a substantial blow to its reputation. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's latest report.

The company's reliance on digital platforms for managing shipments and client interactions makes it a prime target for cyberattacks. System failures, whether due to malicious intent or technical glitches, could disrupt operations, causing delays and impacting service delivery. This vulnerability extends to potential ransomware attacks that could cripple Clasquin's IT infrastructure.

The consequences of such threats are multifaceted:

- Financial Losses: Direct costs from incident response, recovery, and potential regulatory fines.

- Reputational Damage: Erosion of client trust and a negative impact on brand image, making it harder to attract new business.

- Operational Disruptions: Delays in logistics, inability to access critical data, and loss of productivity.

- Loss of Competitive Advantage: Exposure of proprietary information or client lists to competitors.

Clasquin faces intense competition from established players and new digital entrants, leading to price wars that squeeze profit margins. Geopolitical instability, such as ongoing conflicts and trade disputes, disrupts global supply chains, increasing transit times and costs, as evidenced by the Red Sea shipping disruptions in late 2023 and early 2024. Furthermore, the rise of protectionist policies can reduce trade volumes, directly impacting demand for logistics services, a concern highlighted by the IMF's warnings about trade tensions hindering global growth.

SWOT Analysis Data Sources

This Clasquin SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis to provide a thoroughly informed strategic overview.