Clasquin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clasquin Bundle

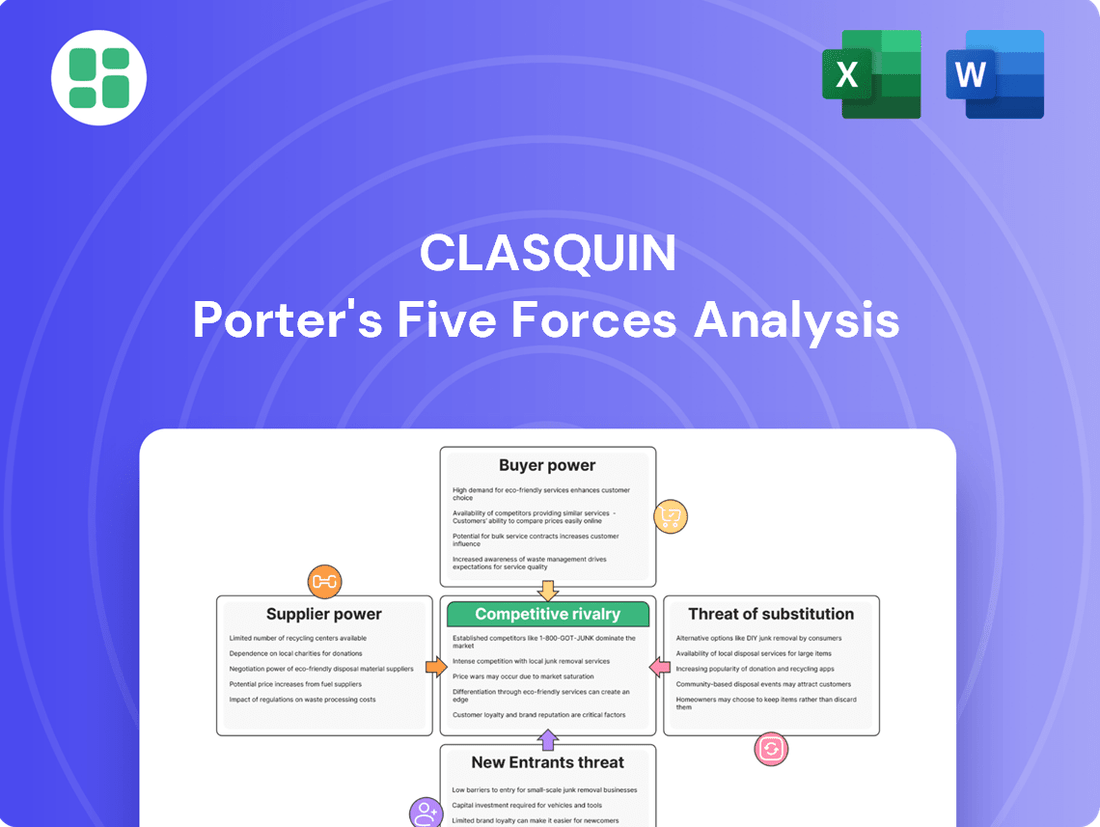

Understanding the competitive landscape for Clasquin requires a deep dive into Porter's Five Forces. This framework reveals the hidden pressures that shape industry profitability, from the power of buyers and suppliers to the threat of new entrants and substitutes.

The complete report reveals the real forces shaping Clasquin’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The freight forwarding industry, especially for ocean freight, sees a moderate level of consolidation. A handful of major ocean carriers wield considerable influence. This means they can significantly impact pricing and available capacity, particularly when vessel space is tight.

Clasquin, like its competitors, depends heavily on these dominant shipping lines and airlines for its primary transportation needs. In 2024, the top 10 ocean carriers controlled approximately 70% of global container vessel capacity, underscoring their market power.

Specialized technology providers hold significant bargaining power in the logistics sector, as companies like Clasquin increasingly rely on advanced digital solutions. The market for these critical technologies, including AI-driven analytics and real-time tracking, is concentrated among a few dominant players.

This limited competition means these tech suppliers can command higher prices for the software and platforms essential for operational efficiency and improved customer service. For instance, the global logistics technology market was valued at approximately $20 billion in 2023 and is projected to grow significantly, indicating strong demand and pricing power for leading providers.

Clasquin, like many third-party logistics (3PL) providers, leans heavily on a select group of dependable transportation firms to manage its worldwide operations. This reliance means that if a significant shipping partner decides to hike prices or alter contract conditions, it directly impacts Clasquin's operational expenses and, consequently, the prices it charges its customers. For instance, in 2024, global shipping costs saw considerable volatility, with the Freightos Baltic Index for container shipping experiencing fluctuations that could significantly affect a 3PL's margins if they lack diversified carrier relationships.

This dependence grants these essential transport providers substantial leverage. When a 3PL cannot easily switch to an alternative carrier without incurring significant disruption or cost, the existing supplier holds a strong bargaining position. This was particularly evident in early 2025, as capacity constraints in certain key shipping lanes continued to put pressure on freight rates, giving major carriers more room to negotiate terms with their 3PL clients.

Impact of Fluctuating Freight Rates and Fuel Surcharges

Clasquin's financial performance is directly tied to the unpredictable nature of freight rates and fuel surcharges. These essential costs, which significantly influence Clasquin's sales and gross profit, are heavily influenced by factors beyond the company's control. Global supply and demand imbalances, geopolitical tensions, and fluctuations in oil prices are the primary drivers, demonstrating the substantial bargaining power held by carriers – Clasquin's suppliers.

The volatility is starkly illustrated by the dramatic surge in freight rates observed between December 2023 and June 2024. This period saw significant market disruptions that directly translated into higher operating costs for Clasquin, highlighting the suppliers' ability to dictate terms and impact profitability.

- Global freight rates experienced significant upward pressure from late 2023 through mid-2024.

- Fuel surcharges, a major component of shipping costs, are directly linked to volatile oil prices.

- Geopolitical events and supply chain disruptions are key determinants of these supplier-controlled costs.

- Clasquin's gross profit margins are therefore vulnerable to external forces impacting transportation expenses.

Limited Alternatives for Core Transport Modes

While Clasquin provides multimodal transport options, the foundational infrastructure for air, ocean, and road freight is largely managed by a limited number of major global carriers. This concentration means Clasquin cannot easily pivot between these core transport modes without facing substantial costs or operational disruptions.

The high switching costs associated with changing primary carriers, coupled with the specialized nature of each transport service, significantly bolster the bargaining power of these suppliers. For instance, in 2024, the top five global ocean carriers controlled over 60% of the global container shipping capacity, illustrating this concentration.

- Concentrated Infrastructure: Key transport modes are dominated by a few large providers.

- High Switching Costs: Moving between core transport providers is expensive and disruptive.

- Specialized Services: The unique requirements of air, ocean, and road freight limit flexibility.

- Supplier Leverage: These factors grant significant bargaining power to transport infrastructure suppliers.

Suppliers in the freight forwarding industry, particularly major ocean and air carriers, possess significant bargaining power due to market concentration and high switching costs. This leverage allows them to influence pricing and contract terms, directly impacting Clasquin's operating expenses and profitability.

The concentration of key transport infrastructure among a few dominant players, such as the top 10 ocean carriers controlling around 70% of global capacity in 2024, amplifies supplier leverage. Specialized technology providers also hold considerable power, as reliance on advanced digital solutions creates dependence on a limited number of market leaders.

Clasquin's vulnerability to supplier power is evident in the volatile freight rates and fuel surcharges, which are subject to global demand, geopolitical events, and oil prices. For example, freight rates saw substantial increases between late 2023 and mid-2024, directly affecting Clasquin's margins.

| Supplier Type | Market Concentration (2024) | Impact on Clasquin | Key Cost Drivers |

|---|---|---|---|

| Ocean Carriers | Top 10 control ~70% global capacity | Pricing power, capacity availability | Freight rates, fuel surcharges |

| Air Carriers | Concentrated among major airlines | Pricing power, service availability | Air cargo rates, fuel costs |

| Technology Providers | Dominated by a few key players | Higher software costs, dependence on platforms | Demand for advanced logistics tech |

What is included in the product

Clasquin's Porter's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Quickly identify and address competitive threats with a visual representation of industry power dynamics.

Customers Bargaining Power

Large business-to-business (B2B) customers are a major force in the freight forwarding market, representing over 59% of the sector in 2024. Their sheer volume means they have considerable sway when it comes to pricing and service agreements.

These significant shippers consistently push for competitive pricing structures and enhanced service terms. Furthermore, they require robust, real-time visibility across their intricate and often global supply chains, a demand that drives service innovation.

Clasquin's strategic focus on expanding its Global Accounts segment underscores its direct engagement with these powerful clients. This approach acknowledges and addresses the substantial bargaining power held by major shippers in the industry.

Small to medium-sized businesses (SMBs) are often very focused on cost, making them highly sensitive to the prices of logistics services. This means they are always on the lookout for the most affordable options to manage their shipping needs. For companies like Clasquin, this translates into a constant pressure to keep their pricing competitive to win and keep these clients.

The ability for SMBs to easily compare prices across different freight forwarders significantly boosts their bargaining power. For instance, a 2024 survey indicated that over 60% of SMBs consider price the primary factor when selecting a logistics partner, highlighting their leverage in negotiations.

The sheer number of logistics providers available globally significantly strengthens customer bargaining power. In 2024, the freight forwarding market continues to host a wide array of companies, from multinational corporations to specialized regional players, offering customers ample choice. This competitive landscape allows businesses to readily compare services, pricing, and contract terms, driving down costs and improving service levels as providers vie for their business.

Customer Expectations for Rapid and Reliable Services

The relentless growth of e-commerce has dramatically reshaped customer demands, pushing for quicker and more dependable delivery services. This heightened expectation for speed and efficiency directly translates into increased bargaining power for customers, pressuring logistics providers to innovate in areas like last-mile delivery and sophisticated inventory management.

In 2024, the average consumer expects online orders to arrive within 2-3 days, a stark contrast to the week-long waits common just a decade ago. This shift is fueled by major online retailers setting new benchmarks for delivery speed and reliability, making it difficult for smaller players to compete without significant investment in their supply chains.

- E-commerce Dominance: Online retail sales in 2024 are projected to exceed $6.3 trillion globally, underscoring the massive customer base with high delivery expectations.

- Delivery Speed Metrics: Studies in early 2024 show that over 70% of online shoppers consider delivery speed a crucial factor in their purchasing decisions.

- Customer Retention: Companies failing to meet these rapid delivery expectations risk losing customers, with reports indicating that a single negative delivery experience can deter up to 40% of consumers from future purchases with that brand.

- Logistics Investment: The pressure to meet these demands is driving significant investment in logistics technology and infrastructure, with global spending on supply chain and logistics solutions expected to reach new highs in 2024.

Preference for Integrated, End-to-End Solutions

Customers increasingly favor suppliers who can manage their entire logistics chain, from initial freight forwarding to final delivery. This preference for end-to-end solutions means businesses are looking to consolidate their needs with fewer providers, giving them more leverage. For instance, in 2024, the global logistics market saw a significant shift towards integrated platforms, with companies actively seeking partners capable of offering a full suite of services. This consolidation trend empowers buyers, as they can choose providers offering a more comprehensive and cost-effective package.

This demand for bundled services means companies like Clasquin must expand their offerings to remain competitive. By providing a wider range of value-added services, they can meet customer needs for streamlined operations. A survey of global shippers in late 2023 revealed that over 60% of respondents preferred working with logistics providers offering integrated technology solutions, highlighting the growing customer expectation for seamless, end-to-end management.

- Consolidation of Logistics Needs: Businesses are reducing the number of logistics partners to simplify operations and gain better control over their supply chains.

- Demand for Value-Added Services: Customers expect more than just basic transportation; they seek customs brokerage, warehousing, and distribution as part of a single package.

- Increased Bargaining Power: By having fewer, more capable providers to choose from, customers can negotiate better terms and pricing for comprehensive service offerings.

- Impact on Providers: Logistics companies must invest in technology and service expansion to meet this evolving customer demand for integrated solutions.

Customers in the freight forwarding sector wield significant power, particularly large B2B clients who represent over 59% of the market in 2024. Their substantial shipping volumes allow them to negotiate favorable pricing and service terms, pushing for greater transparency and efficiency across global supply chains.

The increasing demand for end-to-end logistics solutions further empowers customers. Businesses are consolidating their needs with fewer providers, seeking integrated services from freight forwarding to final delivery. This trend, evident in the growing preference for bundled offerings and seamless technology platforms, allows buyers to leverage their consolidated business for better pricing and terms.

| Customer Segment | Market Share (2024 Est.) | Key Bargaining Factors | Impact on Providers |

|---|---|---|---|

| Large B2B Customers | > 59% | Volume, demand for integrated solutions, pricing pressure | Need for tailored global account management, service innovation |

| SMBs | Significant, growing | Price sensitivity, ease of comparison, demand for cost-effectiveness | Pressure for competitive pricing, efficient service delivery |

| E-commerce Consumers | Driving demand | Expectation of speed, reliability, and convenience | Investment in last-mile delivery, supply chain visibility |

Full Version Awaits

Clasquin Porter's Five Forces Analysis

This preview showcases the complete Clasquin Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You're previewing the final, professionally formatted analysis, guaranteeing instant access to valuable insights upon completion of your transaction.

Rivalry Among Competitors

The global transport and logistics sector presents a complex competitive landscape, a blend of widespread fragmentation and significant top-tier concentration. This means while there are many smaller companies, a few massive global players dominate a substantial portion of the market.

Clasquin, operating as a multinational mid-cap 'Pure Player' in this environment, finds itself in direct competition with industry titans such as DHL, Kuehne + Nagel, and DSV. These larger entities possess considerable resources and market reach, amplifying the competitive pressures on mid-sized firms.

This dual market structure intensifies rivalry. Smaller and mid-sized companies like Clasquin must constantly innovate and differentiate themselves to capture market share from these dominant forces, leading to a dynamic and challenging competitive arena.

The freight forwarding sector is marked by fierce rivalry, where companies battle on both price and service quality, especially when market conditions are unpredictable. This constant pressure often squeezes profit margins, a challenge Clasquin itself faced in the first half of 2024, reporting a decline in its unit margins.

To stand out and keep customers, businesses in this space need to constantly find new ways to improve their operations and offer attractive pricing without sacrificing the quality of their services. For instance, in 2023, the global freight forwarding market was valued at approximately $270 billion, highlighting the significant scale and competitive nature of the industry.

The logistics industry is witnessing fierce competition driven by rapid digital transformation. Companies are leveraging technologies like AI, IoT, and blockchain to optimize supply chains, offering greater visibility and efficiency. For instance, in 2024, the global logistics market was valued at over $10 trillion, with digital solutions playing a crucial role in capturing market share.

Freight forwarders that are slow to adopt these digital tools are at a significant disadvantage. Those embracing innovation, like digital platforms for booking and tracking, can offer superior customer experiences and operational agility. This technological leap is redefining competitive benchmarks, pushing all players to invest in digitalization to remain relevant and competitive in the evolving market landscape.

Strategic Partnerships and Consolidation Trends

The logistics sector is experiencing a significant wave of consolidation, driven by the pursuit of economies of scale and enhanced data capabilities. Strategic partnerships and mergers and acquisitions (M&A) are becoming commonplace as companies aim to bolster their market presence and operational efficiency. A prime example is DSV's acquisition of DB Schenker, a move that significantly reshapes the competitive landscape.

This trend is also evident in the recent acquisition of Clasquin by MSC. Such consolidations are strategic maneuvers designed to increase operational scale, improve data integration for better decision-making, and ultimately strengthen competitive positioning in an increasingly complex global market.

- Industry Consolidation: Increased M&A activity and strategic alliances are reshaping the competitive landscape.

- Key Drivers: Companies are seeking greater scale, improved data density, and enhanced competitive positioning through these strategic moves.

- Notable Transactions: DSV's acquisition of DB Schenker exemplifies the significant consolidation occurring.

- Impact on Clasquin: Clasquin's recent acquisition by MSC underscores its participation in this overarching industry trend.

Global Economic Conditions and Geopolitical Instability

Competitive rivalry within the freight forwarding industry is significantly intensified by fluctuating global economic conditions and persistent geopolitical instability. Events like trade wars and the imposition of tariffs directly impact international trade flows, creating an environment of uncertainty. For instance, the ongoing trade tensions between major economies in 2024 continue to create volatility in shipping volumes and routes.

These external pressures disrupt established supply chains, leading to increased operational costs for freight forwarders due to unpredictable demand, extended transit times, and the need for contingency planning. According to industry reports from early 2024, surcharges related to geopolitical risks and rerouting have become a more common component of freight costs.

- Trade Volatility: Global trade growth forecasts for 2024 have been revised downwards by organizations like the World Trade Organization (WTO) due to these uncertainties, directly affecting the volume of business for freight forwarders.

- Supply Chain Disruptions: Geopolitical events, such as regional conflicts or port congestion exacerbated by trade disputes, can lead to significant delays and increased expenses, impacting the efficiency and profitability of freight operations.

- Cost Pressures: Tariffs and sanctions increase the cost of moving goods, forcing freight forwarders to absorb some of these costs or pass them on to clients, thereby affecting pricing strategies and competitive positioning.

- Adaptability is Key: Freight forwarders demonstrating agility in adapting to changing trade regulations and rerouting strategies are better positioned to maintain their competitive edge in this challenging landscape.

Competitive rivalry in the logistics sector is intense, driven by a mix of large global players and numerous smaller firms. This dynamic means companies like Clasquin must constantly innovate and differentiate to capture market share. The industry is also undergoing significant consolidation, with major acquisitions reshaping the competitive landscape.

Digital transformation is a key battleground, with companies leveraging AI, IoT, and blockchain to optimize supply chains and offer greater visibility. Those slow to adopt these technologies face a significant disadvantage. Fluctuating global economic conditions and geopolitical instability further intensify rivalry, creating cost pressures and supply chain disruptions.

The freight forwarding market, valued at around $270 billion in 2023, sees fierce competition on both price and service quality. For instance, Clasquin reported declining unit margins in the first half of 2024, highlighting the pressure on profitability. Adaptability to changing trade regulations and rerouting strategies is crucial for maintaining a competitive edge.

| Factor | Impact on Rivalry | Example/Data Point |

|---|---|---|

| Market Structure | High rivalry due to fragmentation and dominant players | Clasquin competes with giants like DHL, Kuehne + Nagel, DSV. |

| Digitalization | Intensified competition through technology adoption | Global logistics market valued over $10 trillion in 2024, with digital solutions crucial. |

| Consolidation | Reshaping landscape via M&A | DSV acquired DB Schenker; MSC acquired Clasquin. |

| Economic/Geopolitical Factors | Increased cost pressures and operational challenges | WTO revised global trade growth forecasts downwards for 2024; surcharges for geopolitical risks common in early 2024. |

SSubstitutes Threaten

Large corporations, especially those with substantial shipping volumes, are increasingly building out their own in-house logistics capabilities. This trend, often termed backward integration, allows them to bring core transportation and supply chain management functions under their direct control, lessening their dependence on external freight forwarders.

For example, in 2024, many major retailers and manufacturers continued to invest in expanding their private fleets and logistics technology. This strategy is driven by a desire for greater operational control and the potential for significant cost savings, as companies aim to optimize their supply chain expenditures.

The burgeoning growth of e-commerce has empowered manufacturers and retailers to increasingly adopt direct-to-consumer (D2C) shipping models. This trend allows them to bypass traditional freight forwarders for specific parts of their logistics, potentially impacting the volume handled by forwarding specialists if they don't adapt their service portfolios. For instance, in 2024, the global D2C e-commerce market was projected to reach over $3.3 trillion, indicating a significant shift in how goods reach consumers.

While ocean freight remains king for bulk, air cargo is a potent substitute for urgent or high-value shipments. For instance, in 2024, air cargo rates for certain routes saw increases, making the cost-benefit analysis even more critical for shippers.

Rail transport also presents a compelling alternative, particularly for moving goods across continents. Clasquin needs to highlight its unique service advantages to retain customers who might otherwise shift to rail for specific, cost-sensitive, or geographically advantageous movements.

Rise of Digital Freight Marketplaces and Platforms

The growing prevalence of digital freight marketplaces and online platforms presents a significant threat of substitution for traditional freight forwarding services. These digital-first solutions, such as freight.io or Freightos, streamline the process by connecting shippers directly with carriers, often for simpler, standardized shipments. They provide instant quotes and simplified booking, bypassing intermediaries.

For instance, in 2024, the global digital freight forwarding market was valued at approximately $25 billion, with projections indicating substantial growth. This trend directly challenges the business model of established players like Clasquin, particularly for less complex, high-volume freight movements where speed and cost efficiency are paramount. These platforms can offer a more agile and cost-effective alternative for certain customer segments.

To counter this threat, Clasquin is actively investing in its own digital capabilities. Its 'Live' solution, for example, aims to provide similar levels of transparency, efficiency, and ease of use that digital marketplaces offer. This strategic move is crucial for retaining market share and adapting to evolving customer expectations in the logistics industry.

- Digital Freight Marketplaces: Platforms like Freightos and digital.ai are enabling direct shipper-carrier connections.

- Streamlined Transactions: These platforms offer instant quotes and simplified booking processes.

- Disintermediation Risk: Traditional freight forwarders face potential disintermediation for standardized shipments.

- Clasquin's Response: Development of digital tools like 'Live' to compete with these new market entrants.

Specialized Niche Logistics Providers

For clients with highly specialized logistical needs, such as the transport of temperature-sensitive pharmaceuticals or hazardous goods, niche providers can offer superior, tailored solutions. These specialized companies often boast unique certifications, advanced equipment, and deep industry expertise that generalist freight forwarders may lack, presenting a direct substitute for Clasquin's broader services.

The threat from these specialized providers is amplified in sectors demanding stringent compliance and specialized handling. For instance, the global cold chain logistics market, which includes pharmaceuticals and high-value food products, was valued at approximately $16.7 billion in 2023 and is projected to grow significantly. This growth indicates a robust demand for specialized services that general providers might struggle to meet comprehensively, potentially diverting business from companies like Clasquin if their offerings aren't sufficiently specialized.

- Specialized Expertise: Niche providers focus on specific cargo types (e.g., perishables, dangerous goods), offering specialized knowledge and compliance.

- Unique Assets: They often possess dedicated fleets, advanced tracking systems, and specialized warehousing tailored to particular requirements.

- Regulatory Compliance: For sensitive shipments, adherence to strict regulations is paramount, a strength of specialized logistics firms.

- Market Segmentation: These providers target specific customer segments that value specialized capabilities over generalist solutions.

The threat of substitutes for freight forwarding services is multifaceted, encompassing digital platforms, alternative transport modes, and specialized logistics providers. Digital marketplaces are disintermediating traditional forwarders by directly connecting shippers with carriers, offering streamlined transactions and instant quotes. In 2024, the digital freight forwarding market, valued at approximately $25 billion, demonstrated this trend, challenging established players for simpler, high-volume movements.

Alternative transport modes like air cargo and rail also serve as substitutes, particularly for urgent or cost-sensitive shipments, forcing companies like Clasquin to emphasize their unique service advantages. Furthermore, specialized logistics providers cater to niche markets requiring specific expertise, such as cold chain or hazardous goods transport, a segment that saw robust growth in 2023, valued at around $16.7 billion.

| Substitute Type | Key Characteristics | Impact on Freight Forwarders | 2024 Market Context/Data |

| Digital Freight Marketplaces | Direct shipper-carrier connection, instant quotes, simplified booking | Disintermediation risk for standardized shipments | Global digital freight forwarding market projected for substantial growth from its ~ $25 billion 2024 valuation |

| Alternative Transport Modes (Air, Rail) | Speed (air), cost-effectiveness/reach (rail) | Competition for specific shipment types and routes | Air cargo rates saw fluctuations in 2024, impacting cost-benefit analyses |

| Specialized Logistics Providers | Niche expertise, tailored solutions, regulatory compliance | Diversion of business for specialized cargo | Global cold chain logistics market valued at ~$16.7 billion in 2023, indicating strong demand for specialized services |

Entrants Threaten

Entering the global freight forwarding arena demands significant capital for technology, infrastructure, and building an extensive international network. This includes establishing offices, warehouses, and crucial partner relationships worldwide.

Clasquin's existing global presence, boasting over 85 offices in 25 countries as of early 2024, presents a formidable barrier. New entrants would struggle to replicate this established international footprint and the associated operational efficiencies.

New entrants into the logistics and supply chain sector, like those serving companies such as Clasquin, confront substantial obstacles due to complex regulatory frameworks. Navigating international trade laws, customs procedures, and varying compliance standards across different countries requires significant investment in expertise and licensing, acting as a strong deterrent for potential new competitors.

For instance, the World Trade Organization's Trade Facilitation Agreement, implemented in 2017 and continually updated, aims to streamline customs processes but still involves intricate documentation and procedural adherence. Companies failing to meet these evolving standards risk significant delays and penalties, making it difficult for less established players to compete effectively.

Established players in the logistics sector, like Clasquin, often possess substantial economies of scale. This allows them to secure better pricing from shipping lines and other transportation providers, a significant advantage that new entrants find hard to replicate. For instance, in 2024, major global freight forwarders leveraging scale could negotiate spot rates that were 5-10% lower than those available to smaller, less volume-heavy companies.

Newcomers entering the market would face considerable hurdles in matching these cost efficiencies. Without the established volume and bargaining power, their operational costs per unit would likely be higher, making it challenging to offer competitive pricing to customers. This cost disadvantage can act as a powerful deterrent, effectively raising the barrier to entry for aspiring competitors.

Difficulty in Building Brand Reputation and Customer Relationships

New entrants face a significant hurdle in establishing brand recognition and fostering trust within the freight forwarding industry. This sector thrives on long-standing relationships and a demonstrated history of reliability, crucial for navigating intricate global logistics. Building this credibility, especially for securing large, international clients, is a protracted and resource-intensive process.

The freight forwarding landscape is deeply rooted in personal connections and proven performance. Customers, particularly those managing substantial global supply chains, prioritize partners they can depend on. This reliance on trust and a solid track record makes it challenging for newcomers to displace established players who have cultivated these relationships over years, if not decades.

Consider the impact on attracting major clients:

- Brand Loyalty: Established freight forwarders benefit from high customer loyalty, often stemming from decades of consistent service.

- Risk Aversion: Large corporations tend to be risk-averse when selecting logistics partners, preferring the perceived security of well-known, reputable companies.

- Time to Trust: For instance, a company might require several years of successful, uninterrupted shipments before fully entrusting a new freight forwarder with their most critical cargo.

Intensive Investment in Advanced Technology and Expertise

The logistics and supply chain sector, particularly for companies like Clasquin, is increasingly demanding significant capital outlay for advanced digital tools, artificial intelligence, and sophisticated data analytics. This technological arms race means that new entrants must be prepared to invest heavily in infrastructure and acquire highly specialized talent to compete effectively.

While technological advancements can theoretically lower barriers to entry, the reality is that the sheer cost and complexity of implementing and managing cutting-edge systems create a formidable obstacle for startups. For instance, the global supply chain management software market was valued at approximately $22.5 billion in 2023 and is projected to grow significantly, indicating the scale of investment required.

- High Capital Expenditure: New entrants face substantial upfront costs for acquiring and integrating advanced software, hardware, and cloud-based solutions.

- Talent Acquisition Costs: The need for data scientists, AI specialists, and logistics technology experts drives up recruitment and retention expenses.

- R&D Investment: Continuous innovation in areas like predictive analytics and automation necessitates ongoing research and development funding.

- Scalability Challenges: Startups must invest in scalable technology from the outset to handle growing volumes and complex global networks, adding to initial investment burdens.

The threat of new entrants for Clasquin is moderate due to high initial capital requirements for technology and infrastructure, coupled with the necessity of building an extensive global network. Existing players benefit from significant economies of scale, allowing for better negotiation of shipping rates, a cost advantage difficult for newcomers to match. Furthermore, the industry's reliance on trust and established relationships creates a substantial barrier for new companies seeking to gain credibility and attract major clients.

| Barrier to Entry | Impact on New Entrants | Example/Data (2023-2024) |

|---|---|---|

| Capital Investment (Technology & Infrastructure) | High | Global supply chain management software market valued at ~$22.5 billion in 2023. |

| Global Network & Infrastructure | High | Clasquin operates over 85 offices in 25 countries (early 2024). |

| Economies of Scale | High | New entrants could face 5-10% higher spot rates compared to large players in 2024. |

| Brand Recognition & Trust | High | Large corporations often require years of consistent service before entrusting critical cargo. |

| Regulatory Compliance | Moderate to High | Navigating international trade laws and customs requires significant expertise and licensing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial reports, industry-specific market research, and expert commentary from leading trade publications to provide a comprehensive view of competitive dynamics.