Clasquin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clasquin Bundle

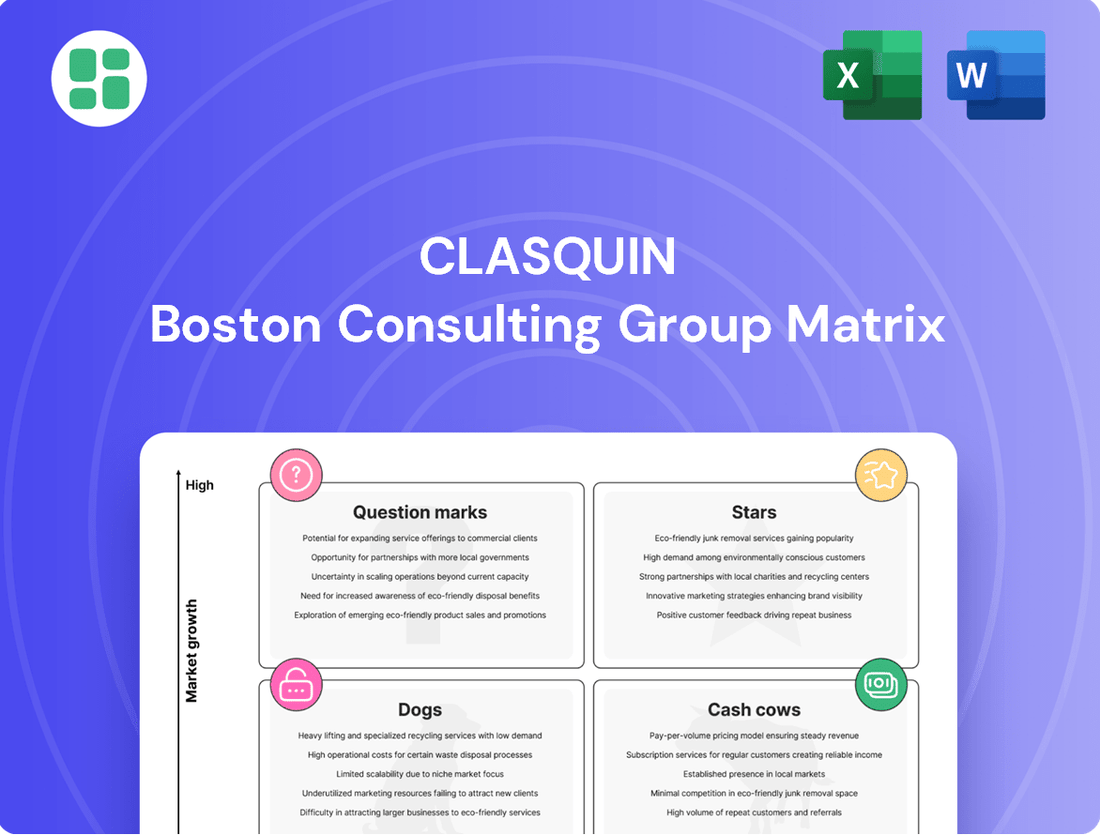

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See how each product fits into the Stars, Cash Cows, Dogs, or Question Marks quadrants, giving you a glimpse into their market share and growth potential.

Ready to transform this glimpse into actionable strategy? Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's placement, complete with data-driven recommendations and a clear roadmap for optimizing your investments and product development.

Stars

Clasquin's integration into MSC Group, following its acquisition by SAS Shipping Agencies Services Sàrl in October 2024, places its freight forwarding operations within a powerful global network. This strategic move is poised to dramatically expand Clasquin's market presence, particularly in sea freight, by tapping into MSC's substantial industry influence and infrastructure. The combined entity is set to unlock significant growth avenues.

Clasquin's Global Accounts segment is a clear star in its business portfolio. In the first half of 2024, this area saw a significant 13% jump in growth. This impressive performance highlights the strong demand from large international clients for sophisticated, end-to-end logistics services.

This robust expansion in Global Accounts suggests Clasquin holds a substantial market share among major global players. It also points to considerable ongoing potential for further development within this high-value segment.

Clasquin's air freight sector is a clear star in its BCG matrix. In Q3 2024, tonnage surged by 8.5%, and gross profit climbed 9%, demonstrating remarkable resilience and growth despite market volatility. This robust performance is partly fueled by a shift in some sea freight volumes to air due to ongoing disruptions, highlighting Clasquin's ability to capitalize on evolving logistics landscapes.

Expanding Market Share through New Clients

Clasquin demonstrates a strong ability to capture new clients, a hallmark of a Star in the BCG Matrix. This expansion is directly linked to its market share growth. The company's capacity to attract new business and broaden its client roster in a challenging environment points to a compelling offering and successful sales efforts.

In the first half of 2024, new clients represented a significant 5% of Clasquin's gross profit. This financial contribution underscores the success of their client acquisition strategies and validates their position as a growing entity. Such organic expansion is a critical indicator of a product or service performing exceptionally well in the market.

- New client acquisition is a key driver of Clasquin's market share expansion.

- In H1 2024, new clients contributed 5% to Clasquin's gross profit.

- This organic growth reflects a strong value proposition and effective sales strategies.

- Clasquin's ability to attract new business positions it as a Star in the BCG Matrix.

Strategic Position in Asia-Pacific and North America Corridors

Clasquin's strategic positioning in the Asia-Pacific and North America corridors is a significant strength, aligning with robust global trade activity. These lanes are vital for international commerce, and Clasquin's established presence there allows it to capitalize on ongoing growth trends.

By concentrating on these high-volume trade routes, Clasquin effectively leverages its network and expertise. This focus not only solidifies its market share but also positions the company for continued expansion within critical logistics segments.

- Asia-Pacific Trade Growth: In 2024, the Asia-Pacific region continued to be a powerhouse for global trade, with containerized trade volumes expected to see a notable increase year-over-year.

- North America Trade Dynamics: North America remains a key destination and origin for goods, with significant import and export volumes contributing to Clasquin's operational focus.

- Corridor Efficiency: Clasquin's investment in optimizing operations along these key corridors enhances its competitive advantage by ensuring efficient cargo movement and timely delivery.

Clasquin's Global Accounts and air freight operations are performing exceptionally well, indicating they are Stars in the BCG matrix. These segments are characterized by high growth and significant market share. The company's ability to attract new clients, contributing 5% to gross profit in H1 2024, further solidifies this Star status. Focusing on high-volume corridors like Asia-Pacific and North America also supports this strong market position.

| Business Segment | H1 2024 Growth | Q3 2024 Tonnage Growth | New Client Contribution to Gross Profit (H1 2024) |

|---|---|---|---|

| Global Accounts | 13% | N/A | N/A |

| Air Freight | N/A | 8.5% | N/A |

| New Client Acquisition | N/A | N/A | 5% |

What is included in the product

The Clasquin BCG Matrix analyzes business units by market share and growth rate, guiding investment decisions.

Clasquin BCG Matrix offers a clear visual of your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Clasquin's mature sea freight operations are a cornerstone of its business, contributing significantly to its gross commercial margin. At the close of 2023, this segment accounted for 48.1% of the company's gross commercial margin, underscoring its substantial market presence in a stable, albeit competitive, logistics sector.

These established services consistently deliver robust cash flow, a direct result of their critical function in facilitating global trade. Despite potential volatility in freight rates, the sheer volume and foundational nature of sea freight forwarding ensure it remains a dependable source of cash for Clasquin.

Clasquin's core European and French market presence positions it firmly within the Cash Cows quadrant of the BCG Matrix. France alone accounts for a substantial 44.4% of its gross margin, highlighting its deep penetration in a mature yet stable market. This strong foundation in established European logistics, contributing another 14.6% of gross margin, ensures consistent demand for its freight forwarding and logistics services.

Clasquin's comprehensive customs brokerage services are a cornerstone of its integrated supply chain offerings, ensuring smooth international trade operations. These services are crucial for navigating complex regulations, providing clients with compliance and efficiency.

Unlike more volatile freight markets, customs brokerage typically generates stable, recurring revenue streams. This stability is a key characteristic of a Cash Cow, as demand for these essential services remains consistent, especially within established and mature regulatory frameworks.

In 2024, Clasquin's continued investment in technology and expertise for its customs brokerage division is expected to solidify its position. This focus on maintaining high service levels and adapting to evolving trade policies ensures these operations remain a reliable contributor to the company's overall financial health.

Integrated Warehousing and Logistics Solutions

Clasquin's integrated warehousing and logistics solutions represent a classic Cash Cow within the BCG Matrix. These services are designed for optimized inventory and distribution, often secured through long-term client contracts. This stability translates into predictable and consistent cash flow for the company.

The reliability of these operations, while not exhibiting high growth, forms a crucial stable foundation. They provide the financial muscle to support other, more growth-oriented segments of Clasquin's business. For instance, in 2024, Clasquin reported that its logistics and warehousing segments continued to be a bedrock of its financial performance, contributing significantly to overall profitability.

- Stable Revenue Generation: Long-term contracts ensure predictable income streams.

- Low Growth, High Reliability: These services offer consistent cash flow with minimal market volatility.

- Support for Growth Areas: Profits generated here fund investments in more dynamic business units.

Established Client Relationships and Network

Clasquin's established client relationships and extensive network are key strengths, positioning it as a Cash Cow within the BCG framework. With 85 offices globally, the company leverages deep-seated connections with a diverse clientele to deliver seamless, end-to-end logistics solutions. This robust, integrated infrastructure, cultivated over many years, ensures a consistent revenue stream and operational efficiency, particularly in its more mature markets.

The loyalty of these long-standing clients translates into predictable cash flow, a hallmark of a Cash Cow. For instance, Clasquin's ability to retain clients speaks to the value and reliability of its services. This stability allows the company to generate substantial profits with relatively low investment requirements, freeing up capital for other strategic initiatives.

- Global Presence: 85 offices worldwide facilitate comprehensive service offerings.

- Client Loyalty: Established relationships ensure recurring revenue and predictable cash generation.

- End-to-End Solutions: The network enables integrated logistics services, enhancing client retention.

- Mature Market Strength: Efficient operations in established markets contribute to consistent profitability.

Clasquin's mature sea freight operations, which represented 48.1% of its gross commercial margin in 2023, are a prime example of a Cash Cow. These services benefit from stable demand and long-term client relationships, ensuring consistent cash flow generation.

Similarly, customs brokerage and integrated warehousing services act as Cash Cows due to their recurring revenue streams and essential nature, providing a reliable financial base for the company. Clasquin’s extensive global network of 85 offices further solidifies these segments as dependable profit centers.

The company's strong presence in mature markets like France, accounting for 44.4% of its gross margin, underscores the Cash Cow status of its core logistics offerings. These established operations deliver predictable profits with relatively low investment needs.

Clasquin's strategic focus on leveraging client loyalty and operational efficiency in these mature segments allows for sustained profitability, fueling growth in other business areas.

| Segment | Contribution to Gross Margin (2023) | BCG Category | Key Characteristics |

|---|---|---|---|

| Sea Freight | 48.1% | Cash Cow | Stable demand, long-term contracts, consistent cash flow |

| Customs Brokerage | N/A (Essential Service) | Cash Cow | Recurring revenue, regulatory necessity, stable demand |

| Warehousing & Logistics | N/A (Integrated) | Cash Cow | Predictable cash flow, long-term client agreements, operational efficiency |

| French Market Operations | 44.4% | Cash Cow | Mature market strength, deep client penetration, reliable profitability |

Preview = Final Product

Clasquin BCG Matrix

The Clasquin BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a direct and unadulterated view of its content. This means no watermarks, no demo elements, and absolutely no surprises—just the complete, professionally formatted strategic tool ready for immediate application in your business analysis. You can confidently assess its value, knowing the downloaded version will be identical, allowing for seamless integration into your planning processes or client presentations. This preview serves as a transparent guarantee of the quality and completeness of the BCG Matrix report you are investing in.

Dogs

The acquisition of Timar, a Moroccan logistics group, in 2023 was intended to bolster Clasquin's presence in North Africa. However, the entity has faced considerable headwinds, with reports highlighting challenging market conditions in the region compared to the first half of 2023.

Timar has experienced a significant downturn, indicating it is operating in a low-growth market and currently holds a low market share. This situation suggests the acquired business is consuming resources without generating substantial returns, placing it in the Dogs category of the BCG matrix.

Clasquin observed a decline in unit margins during the first half of 2024. Air freight saw a 3.4% decrease, while sea freight experienced a more significant 10.5% drop, though conditions stabilized in the second quarter.

Even with overall gross profit growth, certain freight lanes or client segments facing persistent margin erosion without corresponding volume increases could be classified as Dogs. These segments may struggle due to fierce market competition or an overabundance of capacity.

Clasquin's road transportation segment may include low-volume, niche routes where market share is minimal. These routes often exist in low-growth segments, potentially struggling with efficiency and profitability due to intense local competition or a lack of integration into broader global logistics networks. Such operations might represent a drain on capital with limited strategic upside.

Legacy IT Services without Modernization

Clasquin's IT services, encompassing technical support, consulting, and training, might include legacy offerings. These outdated services often face declining market demand and minimal growth potential. Without continuous updates or integration with modern digital solutions, they risk becoming irrelevant and yielding very low returns.

For instance, a significant portion of IT spending in 2024 continues to be directed towards modernizing infrastructure and adopting cloud-native solutions, leaving legacy systems with diminishing investment. Companies are actively divesting from or phasing out support for technologies that are no longer cost-effective or secure.

- Low Market Share: Legacy IT services often represent a small fraction of a company's overall IT budget.

- Declining Growth: The market for these outdated services is shrinking as newer technologies emerge.

- High Maintenance Costs: Maintaining legacy systems can be expensive, with limited return on investment.

- Obsolescence Risk: Failure to modernize these services leads to them becoming completely irrelevant.

Underperforming Regional Offices in Stagnant Markets

Within Clasquin's global operations, some regional offices find themselves in markets experiencing minimal economic growth or facing intense competition. These locations, often characterized by limited expansion opportunities, struggle to generate substantial revenue or market penetration. For instance, in 2024, several European logistics hubs, while part of a robust international network, reported growth rates below the company average, impacting overall profitability.

- Stagnant Market Presence: Offices in regions with low GDP growth or declining industrial activity are particularly vulnerable.

- Low Market Share: These offices may hold a small percentage of their local market, limiting their revenue potential.

- Resource Drain: Continued investment in underperforming areas can divert capital from more promising ventures.

- Profitability Challenges: High operating costs relative to revenue can make these units net negative contributors.

Clasquin's acquired Timar entity in Morocco, facing challenging market conditions and low growth, exemplifies a Dog. Similarly, certain legacy IT services and specific low-volume, niche road transportation routes within Clasquin may also fit this category. These segments often struggle with minimal market share and declining growth, potentially draining resources without significant returns.

| Business Unit/Segment | Market Share | Market Growth | Profitability | BCG Category |

|---|---|---|---|---|

| Timar (Morocco Logistics) | Low | Low | Challenging | Dog |

| Legacy IT Services | Low | Declining | Low Returns | Dog |

| Niche Road Freight Routes | Minimal | Low | Struggling | Dog |

Question Marks

Clasquin is strategically investing in its 'Digital Offer,' featuring visibility and performance management tools under the LIVE by CLASQUIN brand. This positions them in a rapidly expanding segment of the logistics industry, aiming to enhance client experience and operational efficiency.

While the digital solutions market presents significant growth potential, Clasquin's current market share within this specialized tech-focused niche is likely still developing. This suggests the 'LIVE by CLASQUIN' offering might be considered a question mark in the BCG matrix, requiring further investment to establish a stronger foothold.

Clasquin's rail business experienced a remarkable upturn in the first half of 2024, with growth reported at a factor of seven. This signifies an exceptionally rapid expansion, though it's important to note this surge likely originates from a comparatively small base.

While the current market share within the broader rail freight sector may be modest, this high growth trajectory presents a substantial opportunity. Continued strategic investment could translate this impressive expansion into a more significant and sustainable market position.

Clasquin's strategic expansion into new or emerging geographical markets, while not a direct component of the traditional BCG matrix, represents a critical element for future growth. These ventures, such as potential entries into Southeast Asian logistics hubs or further penetration into underserved African trade routes, are characterized by high potential returns but also significant upfront capital requirements and market uncertainty. For instance, a hypothetical investment of €50 million in establishing new warehousing and distribution networks in a burgeoning market could unlock substantial long-term revenue streams, but it also carries the risk of lower initial adoption rates compared to established regions.

Specialized Project Logistics and Art Shipping

Clasquin's Project Logistics and Art Shipping International services target specialized, high-value segments. These offerings, while showcasing distinct capabilities, likely represent a smaller portion of Clasquin's overall market share due to their niche focus. Continued investment in these areas could unlock significant growth potential within these specialized domains.

The global project logistics market, particularly for large-scale infrastructure and energy projects, saw robust activity in 2024. Similarly, the art shipping sector experienced a rebound, driven by increased auction volumes and gallery exhibitions. For instance, the art market's global sales were estimated to reach $65 billion in 2024, with specialized shipping being a critical component of this value chain.

- Niche Market Focus: Project Logistics and Art Shipping cater to specialized, high-demand sectors.

- Growth Potential: These services can capture high-value segments with targeted investment.

- Market Dynamics (2024): Project logistics benefited from infrastructure spending, while art shipping saw increased activity due to a recovering art market.

- Strategic Consideration: Scaling these specialized services requires focused capital allocation to maximize their contribution to Clasquin's portfolio.

Integration of New Technologies (e.g., AI/Automation in Supply Chain)

Clasquin's potential integration of advanced technologies like AI for supply chain optimization and automation in warehousing positions them for high growth, but their current market share in these emerging areas is likely minimal. Significant investment in research and development will be crucial for Clasquin to establish a foothold. For instance, the global AI in supply chain market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 15 billion by 2028, indicating a substantial growth trajectory that Clasquin could tap into.

These cutting-edge applications, while promising, represent a significant commitment for Clasquin, potentially classifying them as 'Question Marks' within a BCG matrix framework. This means they require substantial investment to capture market share in these rapidly evolving segments.

- AI-driven optimization: Enhancing route planning, demand forecasting, and inventory management.

- Advanced automation: Implementing robotics in warehouses for picking, packing, and sorting.

- Blockchain for transparency: Securing and tracking goods throughout the supply chain.

Clasquin's 'Digital Offer,' branded as LIVE by CLASQUIN, represents a strategic push into the growing logistics technology sector. While this area offers significant expansion potential, Clasquin's current market penetration in this tech-focused niche is likely still in its early stages. This positions the digital offering as a potential 'Question Mark,' demanding focused investment to build a stronger market presence and capitalize on its inherent growth opportunities.

Clasquin's investment in emerging technologies like AI for supply chain optimization and warehouse automation places them in high-growth segments. However, their current market share in these advanced applications is likely minimal, necessitating substantial R&D investment. The global AI in supply chain market, valued at approximately USD 3.5 billion in 2023, is projected to exceed USD 15 billion by 2028, highlighting the substantial growth Clasquin aims to capture with these 'Question Mark' initiatives.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and growth projections, to accurately position business units.