Clasquin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clasquin Bundle

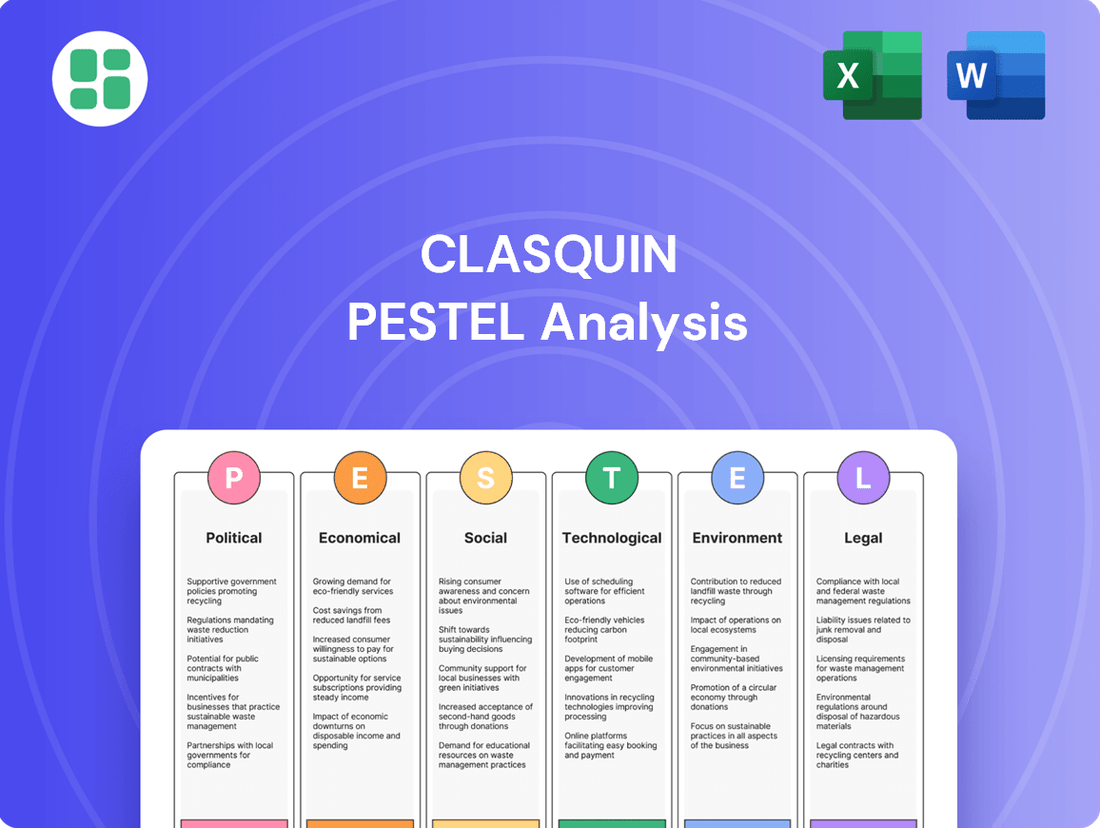

Unlock the strategic landscape surrounding Clasquin with our comprehensive PESTLE Analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are actively shaping the company's trajectory and market position. This expert-crafted analysis provides the critical insights you need to anticipate challenges and capitalize on emerging opportunities. Download the full version now to gain a decisive advantage.

Political factors

Geopolitical tensions, like the ongoing US-China rivalry and conflicts in Eastern Europe and the Middle East, significantly disrupt global trade. For Clasquin, a global freight forwarder, this means direct exposure to supply chain instability and increased operational costs.

Events like the Red Sea crisis in late 2023 and early 2024 forced rerouting, adding substantial costs and delays for many shipping companies, a direct impact Clasquin would manage. These political shifts also encourage trends like nearshoring and friend-shoring, altering traditional trade flows.

These dynamics demand that Clasquin implement robust risk management and develop flexible, diversified logistics strategies to navigate the volatile political landscape and maintain operational efficiency.

Changes in government trade policies, such as new tariffs or protectionist measures, directly impact the cost and practicality of international shipping, a core component of Clasquin's operations. For instance, shifts in US trade policy, which were a significant concern in 2024, could necessitate adjustments in global supply chains, influencing freight volumes and pricing structures for Clasquin.

The global shift towards regional trade blocs is accelerating, with a growing emphasis on shorter supply chains to cut costs and delivery times. This trend is also a strategic response to geopolitical uncertainties, encouraging businesses to diversify manufacturing and shipping routes away from single, high-risk areas.

For Clasquin, this means adapting its logistics strategies to better serve intra-regional trade flows. The company might see increased demand for services that optimize localized warehousing and distribution networks within these emerging regional hubs.

In 2024, for instance, intra-Asia trade saw significant growth, with many companies looking to reduce reliance on longer, transcontinental routes. This regionalization directly impacts how Clasquin plans its freight management and network optimization, favoring more localized solutions.

Political Stability in Operating Countries

Clasquin's operations are significantly influenced by the political stability of the countries where it has a presence or through which its supply chains run. Political instability can manifest as civil unrest, strikes, or changes in government policy, all of which can disrupt logistics and increase operational costs. For instance, regions experiencing heightened political tensions may see sudden border closures or increased security measures, directly impacting transit times and reliability for Clasquin's clients.

The company must continuously monitor and adapt to varying political landscapes to ensure business continuity. For example, in 2023, geopolitical events in Eastern Europe led to significant rerouting and increased transit times for many freight forwarders, a challenge Clasquin would have navigated. Proactive risk assessment in politically sensitive areas is therefore a key strategic imperative.

- Geopolitical Risk Assessment: Clasquin actively assesses political stability in key operating regions, considering factors like election cycles and potential for social unrest.

- Supply Chain Resilience: The company diversifies its transportation routes and partners to mitigate disruptions caused by political instability.

- Regulatory Environment: Changes in trade policies, customs regulations, or sanctions imposed by governments can directly affect Clasquin's service offerings and profitability.

International Sanctions and Regulations

Clasquin’s operations are significantly influenced by international sanctions and evolving regulations. The imposition of sanctions on specific countries or entities directly affects the legality and practicality of conducting logistics and supply chain operations in those areas. For instance, sanctions imposed by the European Union or the United States on countries like Russia or Iran can create substantial hurdles for Clasquin’s clients seeking to move goods to or from these regions.

Adhering to these complex and frequently changing legal frameworks is paramount for Clasquin to avoid severe penalties. This necessitates continuous monitoring of global political relations and regulatory updates. As of early 2024, the ongoing geopolitical tensions continue to lead to new sanctions being implemented, requiring constant vigilance and adaptation in Clasquin's compliance strategies.

- Impact of Sanctions: Clasquin must navigate sanctions that restrict trade with certain nations, impacting its ability to offer services in those markets.

- Compliance Burden: The company faces a significant compliance burden, requiring dedicated resources to track and implement evolving international regulations.

- Geopolitical Sensitivity: Clasquin’s business continuity is sensitive to shifts in international relations, which can rapidly alter the regulatory landscape for global trade.

Geopolitical shifts, including the US-China rivalry and conflicts in Eastern Europe and the Middle East, directly impact global trade flows and create supply chain instability for freight forwarders like Clasquin. The Red Sea crisis in late 2023 and early 2024, for instance, led to significant rerouting and increased costs, a challenge Clasquin would manage. These political dynamics also fuel trends like nearshoring and friend-shoring, altering traditional trade patterns and necessitating adaptive logistics strategies for Clasquin.

Government trade policies, such as tariffs and protectionist measures, directly affect international shipping costs and feasibility for Clasquin. For example, changes in US trade policy in 2024 could necessitate adjustments in global supply chains, influencing freight volumes and pricing. The growing emphasis on regional trade blocs, driven by geopolitical uncertainties and a desire for shorter supply chains, means Clasquin must adapt its strategies to better serve intra-regional trade, as seen with the growth in intra-Asia trade in 2024.

Political instability in operating regions can disrupt logistics and increase costs for Clasquin through civil unrest or policy changes. For example, heightened political tensions in 2023 led to rerouting and transit delays for many freight forwarders. Clasquin must continuously monitor political landscapes and conduct proactive risk assessments in sensitive areas to ensure business continuity and navigate evolving regulations, including international sanctions that can restrict trade and create compliance burdens.

| Political Factor | Impact on Clasquin | Example/Data (2023-2024) |

|---|---|---|

| Geopolitical Tensions | Supply chain disruption, increased operational costs | Red Sea crisis (late 2023-early 2024) led to rerouting and delays. |

| Trade Policy Changes | Altered freight volumes and pricing structures | Potential shifts in US trade policy impacting global supply chains. |

| Regionalization Trends | Shift towards localized warehousing and distribution | Growth in intra-Asia trade (2024) favoring regional solutions. |

| Political Instability | Transit delays, increased security measures | Events in Eastern Europe (2023) caused rerouting and transit time increases. |

| International Sanctions | Restrictions on trade, compliance burden | Sanctions on countries like Russia or Iran create hurdles for logistics. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Clasquin, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The overall health of the global economy is a critical driver for freight forwarding demand. Projections for 2024 and 2025 suggest a period of steady, though moderate, global economic growth. This upward trend is expected to be accompanied by an increase in world trade volumes, which is generally a positive indicator for companies like Clasquin that specialize in air and sea freight.

For instance, the International Monetary Fund (IMF) forecast in April 2024 projected global growth to be 3.2% in 2024 and 3.2% again in 2025, mirroring the 2023 rate. Similarly, the World Trade Organization (WTO) anticipated merchandise trade volume growth to reach 2.6% in 2024, up from 0.9% in 2023. These figures suggest a supportive environment for Clasquin's operations.

However, it's important to acknowledge that economic performance isn't uniform across all regions. Disparities in growth rates and trade patterns between different markets can create varied opportunities and challenges for Clasquin, impacting specific segments of their business more than others.

Global fuel prices, especially for aviation and maritime transport, are a critical economic factor for Clasquin. For instance, the average price of jet fuel in early 2024 hovered around $2.50 per gallon, a significant cost for air freight operations. These fluctuations directly influence Clasquin's operational expenses and, consequently, its profit margins.

While some analysts anticipate that falling commodity prices might partially offset rising energy costs, the overall expense of energy remains a substantial economic consideration for the entire logistics sector. The International Energy Agency (IEA) reported in late 2023 that global energy demand growth was projected to slow in 2024, but volatility in oil markets, influenced by geopolitical events, continues to pose a risk to cost stability.

Persistent inflationary pressures in 2024 and projected into 2025 are directly impacting Clasquin's operational costs. We're seeing an increase in expenses for labor and raw materials, which can squeeze profit margins if not managed effectively. For instance, the Eurozone's inflation rate, while moderating from its 2023 peaks, remained elevated at an estimated 2.4% in early 2024, impacting global supply chain costs.

Central banks, including the European Central Bank and the US Federal Reserve, have maintained higher interest rates throughout 2024 to curb inflation. This policy environment can deter clients from making significant investments in their supply chains, potentially leading to a slowdown in overall trade activity. As of mid-2024, key interest rates in major economies are hovering around 4-5%, a significant increase from previous years.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Clasquin, an international logistics and transport company. Fluctuations in exchange rates directly impact the profitability of its cross-border operations, as revenues earned in one currency may be worth less when converted back to its reporting currency. For instance, a strengthening Euro against currencies where Clasquin operates could reduce the reported value of its foreign earnings.

Managing foreign exchange risk is therefore a crucial financial consideration for Clasquin. The company's exposure stems from its global network of clients and suppliers, meaning that changes in the value of currencies like the US Dollar, Chinese Yuan, or British Pound can materially affect its financial performance. This necessitates robust hedging strategies and careful financial planning to mitigate potential losses.

For example, in 2024, the Euro experienced notable shifts against major trading currencies. The average EUR/USD exchange rate saw fluctuations, impacting companies with significant transatlantic business. Similarly, shifts in the EUR/CNY rate in 2024 would have directly influenced Clasquin's costs and revenues related to its Asian operations.

- Impact on Revenue: A weaker foreign currency against the Euro reduces the Euro-equivalent value of revenue earned abroad.

- Impact on Costs: Conversely, a stronger foreign currency increases the Euro cost of imported services or supplies.

- Hedging Strategies: Clasquin likely employs financial instruments such as forward contracts or options to lock in exchange rates for future transactions.

- 2024/2025 Outlook: Analysts projected continued volatility in major currency pairs throughout 2024 and into 2025, driven by differing monetary policies and geopolitical events, underscoring the ongoing need for vigilant currency risk management.

E-commerce Growth and Demand for Last-Mile Logistics

The relentless expansion of e-commerce, projected to reach over $8 trillion globally by 2025, directly fuels the need for robust last-mile delivery services. This surge in online shopping necessitates quicker, more dependable, and transparent delivery networks, creating a significant market opportunity for logistics providers like Clasquin.

Meeting these heightened customer expectations requires substantial investment in advanced infrastructure and digital technologies. Clasquin must adapt by enhancing its fleet management, optimizing delivery routes, and implementing real-time tracking systems to maintain a competitive edge in this dynamic sector.

- E-commerce Sales Growth: Global e-commerce sales are anticipated to climb approximately 10% year-over-year through 2025, underscoring sustained demand for efficient delivery.

- Last-Mile Delivery Costs: Last-mile delivery can account for up to 53% of total shipping costs, highlighting the financial imperative for optimization.

- Customer Expectations: Over 60% of consumers expect same-day or next-day delivery, a trend that continues to intensify.

Global economic growth is a key indicator for Clasquin's business. Projections for 2024 and 2025 point to continued moderate expansion, with the IMF forecasting 3.2% global growth for both years. This is expected to boost world trade volumes, with the WTO predicting merchandise trade to grow by 2.6% in 2024, a significant increase from 0.9% in 2023. These trends create a generally favorable environment for freight forwarding services.

Fuel prices remain a critical cost factor. Average jet fuel prices around $2.50 per gallon in early 2024 directly affect air freight expenses. While some commodity price decreases might offer minor relief, energy costs are a persistent concern for the logistics sector, with the IEA noting a projected slowdown in global energy demand growth for 2024, though market volatility persists.

Inflationary pressures continue to impact operational costs, with labor and raw material expenses rising. The Eurozone's inflation rate, estimated at 2.4% in early 2024, contributes to higher global supply chain costs. Coupled with higher interest rates maintained by central banks like the ECB and Federal Reserve (around 4-5% mid-2024), this environment could dampen investment in supply chains and slow trade activity.

Currency fluctuations present a significant challenge for Clasquin's international operations. For instance, the Euro's performance against the US Dollar and Chinese Yuan in 2024 directly influences the value of foreign earnings and costs. Managing this foreign exchange risk through hedging strategies is crucial, especially with analysts projecting continued currency volatility through 2025.

Full Version Awaits

Clasquin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Clasquin PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. You'll gain valuable insights into the external forces shaping Clasquin's business landscape.

Sociological factors

The logistics sector, including freight forwarding, is grappling with substantial labor shortages, especially for truck drivers and warehouse staff. This issue is intensified by an aging workforce and a declining interest from younger generations in these roles.

These shortages directly contribute to rising labor expenses and compel companies like Clasquin to adopt forward-thinking recruitment and employee retention initiatives. Furthermore, the need for greater automation in warehouses and for delivery operations is becoming increasingly apparent to mitigate these workforce challenges.

In 2024, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure projected to grow. This directly impacts delivery times and operational costs for logistics firms, necessitating strategic responses beyond just hiring.

Modern customers, driven by the relentless growth of e-commerce, now expect unprecedented transparency and speed in their supply chains. This shift means businesses need to know exactly where their goods are at any given moment, and how quickly they'll arrive. For instance, in 2024, consumer surveys indicated that over 70% of online shoppers consider delivery speed a critical factor in their purchasing decisions.

To meet these heightened expectations, companies like Clasquin must embrace digital transformation. Implementing advanced digital tools for real-time tracking and communication is no longer optional; it's essential for providing end-to-end visibility. This allows for seamless, responsive services that build trust and loyalty, a key differentiator in today's competitive logistics landscape.

Societal expectations are shifting, with consumers increasingly demanding that logistics companies like Clasquin ensure their supply chains are ethically sound. This means goods must be sourced and transported in ways that respect human rights and fair labor practices. For instance, by 2024, reports indicated a significant rise in consumer willingness to pay more for ethically produced goods, underscoring this trend.

Meeting these demands necessitates that Clasquin implement rigorous due diligence and traceability systems throughout its entire network. This involves verifying the origins of goods and ensuring fair treatment of workers at every stage, from raw material sourcing to final delivery. The pressure is on for transparency, with many organizations actively seeking certifications related to ethical sourcing.

Demand for Sustainable and Eco-Friendly Logistics

Societal awareness of environmental issues is significantly shaping consumer choices, with a growing segment willing to pay a premium for sustainable goods and services. This trend directly impacts the logistics sector, compelling companies like Clasquin to integrate eco-friendly operations. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor when purchasing, a figure expected to rise.

This demand translates into pressure for logistics providers to adopt greener practices. Clasquin, like its peers, is increasingly investing in route optimization software to reduce mileage and fuel consumption. Furthermore, the exploration and adoption of alternative fuels, such as biofuels and electric vehicles for last-mile delivery, are becoming critical competitive differentiators. By 2025, it's projected that the market for green logistics solutions will see a compound annual growth rate of 8-10%.

- Consumer Preference: Over 60% of consumers in 2024 expressed a willingness to pay more for eco-friendly products and services, a key driver for sustainable logistics.

- Industry Investment: The green logistics market is anticipated to grow at an annual rate of 8-10% through 2025, reflecting significant industry investment in sustainability.

- Operational Shifts: Logistics firms are prioritizing route optimization, alternative fuels, and sustainable packaging to meet evolving consumer and regulatory demands.

Impact of Urbanization on Logistics Networks

Increasing urbanization significantly reshapes consumption patterns, driving demand for more frequent and localized deliveries. This trend presents a substantial challenge for last-mile logistics, necessitating a greater reliance on smaller, strategically placed urban warehouses and innovative, efficient city-based transport solutions. For companies like Clasquin, this means a critical need to adapt road transport and warehousing strategies to effectively serve these densely populated and often congested urban environments.

By 2025, it's projected that over 60% of the global population will reside in urban areas, a figure that continues to climb. This demographic shift intensifies the pressure on existing logistics infrastructure. For instance, the rise of e-commerce, particularly in major metropolitan hubs, has led to a surge in delivery volumes. In 2024, urban last-mile delivery costs accounted for roughly 50% of total shipping expenses in many developed economies, highlighting the economic impact of urbanization on logistics.

- Urban Population Growth: Global urban population expected to reach 60% by 2025, increasing delivery density.

- E-commerce Impact: Continued growth in online shopping fuels demand for faster, more localized urban deliveries.

- Last-Mile Costs: Last-mile delivery expenses represent a significant portion, often around 50%, of total shipping costs in urban settings as of 2024.

- Infrastructure Adaptation: Logistics providers must invest in micro-fulfillment centers and alternative delivery methods to navigate urban complexities.

Societal shifts are profoundly impacting the logistics industry, pushing for greater ethical considerations and sustainability. Consumers in 2024 showed a clear preference for ethically sourced goods, with many willing to pay a premium, driving logistics firms to enhance due diligence and traceability. Simultaneously, environmental awareness is high, with over 60% of consumers in 2024 considering sustainability a key purchasing factor, fueling an 8-10% projected annual growth in the green logistics market through 2025.

The increasing urbanization, with over 60% of the global population expected in cities by 2025, is reshaping delivery demands. This trend necessitates more frequent, localized deliveries, making last-mile logistics in urban areas, which accounted for about 50% of total shipping costs in developed economies in 2024, a critical focus. Consequently, logistics companies must adapt by investing in micro-fulfillment centers and exploring efficient urban transport solutions.

| Societal Factor | 2024/2025 Data Point | Impact on Logistics |

|---|---|---|

| Ethical Consumerism | Significant rise in consumer willingness to pay more for ethically produced goods (2024). | Increased demand for supply chain transparency and fair labor practices. |

| Environmental Awareness | Over 60% of consumers consider sustainability in purchasing decisions (2024). | Growth in green logistics market (8-10% CAGR projected through 2025); adoption of eco-friendly practices. |

| Urbanization | Over 60% global population in urban areas by 2025. | Intensified demand for localized, frequent deliveries; higher last-mile costs (approx. 50% of total shipping costs in urban areas, 2024). |

Technological factors

Digital transformation, especially the integration of Artificial Intelligence (AI) and machine learning, is fundamentally reshaping the logistics landscape. Clasquin can harness AI for optimizing shipping routes, predicting potential risks, automating paperwork, and improving customer interactions via chatbots, all contributing to greater efficiency and reduced costs.

For instance, the global AI in logistics market was valued at approximately $3.5 billion in 2023 and is projected to reach over $15 billion by 2028, demonstrating substantial growth potential. This adoption allows for predictive maintenance of fleets, real-time shipment tracking, and more accurate demand forecasting, directly impacting Clasquin's operational performance and competitiveness.

The integration of IoT and blockchain is revolutionizing supply chain transparency. For Clasquin, IoT sensors can provide real-time location and condition data for shipments, while blockchain ensures immutable records of every transaction. This enhanced visibility, as seen in the growing adoption of IoT in logistics, which was projected to reach over 20 billion devices by 2024, directly combats losses and delays.

Automation technologies like robotics and AI are revolutionizing warehousing. These advancements are not just streamlining operations but also directly tackling persistent labor shortages in the logistics sector. For instance, by 2024, the global warehouse automation market was projected to reach $30 billion, highlighting significant investment in these areas.

Clasquin can leverage these automated solutions to boost productivity and enhance space utilization within its facilities. Implementing AI-powered inventory management, for example, could lead to a 15-20% reduction in errors and a faster order fulfillment cycle, directly improving customer satisfaction and operational efficiency.

Advanced Data Analytics for Decision Making

Leveraging big data and advanced analytics is transforming logistics. Companies like Clasquin can now make far more informed decisions, predict demand with greater accuracy, and spot potential supply chain disruptions before they become major issues. For instance, in 2024, the adoption of AI and machine learning in supply chain forecasting showed significant improvements, with some studies indicating up to a 15% reduction in forecasting errors for major logistics providers.

These insights are crucial for optimizing operations. By analyzing vast datasets, Clasquin can refine its supply chain management, leading to more efficient routing, better inventory control, and enhanced responsiveness to market changes. This data-driven approach allows for proactive problem-solving, ensuring smoother operations and improved customer satisfaction.

The impact of advanced analytics is evident in several key areas:

- Demand Forecasting: Improved accuracy reduces overstocking and stockouts, directly impacting profitability.

- Route Optimization: Real-time data analysis can cut transit times and fuel costs, with some companies reporting savings of up to 10% on transportation expenses.

- Risk Management: Predictive analytics can identify potential delays due to weather, geopolitical events, or supplier issues, allowing for contingency planning.

- Customer Service: Enhanced visibility into shipments and proactive communication based on data analysis leads to better customer experiences.

Cybersecurity and Data Protection

As logistics operations become increasingly digital, cybersecurity is paramount for Clasquin. The growing reliance on interconnected systems means that cyber threats and data breaches pose a significant risk. Protecting sensitive client information and operational data is crucial for maintaining trust and ensuring the reliability of Clasquin's digital platforms.

Clasquin must continue to invest in robust cybersecurity measures to safeguard its operations. This includes implementing advanced threat detection, data encryption, and regular security audits. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial and reputational damage that can result from a breach.

- Increased Digitalization: Logistics is moving towards paperless and interconnected systems, amplifying the attack surface for cyber threats.

- Data Protection Mandates: Stricter regulations like GDPR and similar frameworks globally necessitate significant investment in data security and privacy compliance.

- Reputational Risk: A data breach can severely damage Clasquin's reputation, leading to loss of clients and market share.

- Operational Continuity: Ensuring the integrity and reliability of digital tools is vital for uninterrupted logistics operations.

Technological advancements are fundamentally reshaping logistics, with AI and automation driving efficiency. Clasquin can leverage these tools for route optimization, predictive maintenance, and streamlined warehousing. The increasing adoption of IoT and blockchain enhances supply chain transparency, while robust cybersecurity is crucial to protect data and maintain trust in an increasingly digital environment.

Legal factors

Clasquin, operating as a global freight forwarder, navigates a dense landscape of international trade laws and customs regulations. These rules vary significantly by country, impacting everything from documentation requirements to tariffs and prohibited goods. For instance, the World Trade Organization (WTO) agreements, which many nations adhere to, aim to streamline trade but still require meticulous adherence to specific national implementations.

The dynamic nature of these legal frameworks necessitates constant vigilance. Changes in trade policy, sanctions, or security measures can swiftly alter compliance obligations. In 2024, ongoing geopolitical shifts and a focus on supply chain resilience are leading many governments to review and potentially tighten import/export controls, directly affecting forwarders like Clasquin who must adapt to these evolving requirements to prevent disruptions and fines.

Clasquin operates within an increasingly stringent environmental regulatory landscape. The EU Emissions Trading System (EU ETS) and upcoming initiatives like FuelEU Maritime are directly influencing shipping and logistics costs, with potential carbon pricing mechanisms set to impact operations. For example, under the EU ETS, maritime transport is gradually being integrated, with companies needing to acquire allowances for their emissions, a cost that will likely be passed down the supply chain.

New supply chain legislation, such as Germany's Supply Chain Due Diligence Act (LkSG) and the upcoming EU Corporate Sustainability Due Diligence Directive (CSDDD), significantly impacts companies like Clasquin. These laws mandate that businesses proactively identify, assess, and mitigate human rights and environmental risks throughout their supply chains.

To comply, Clasquin must invest in and strengthen its traceability and due diligence frameworks. The CSDDD, for instance, is expected to apply to large EU companies and non-EU companies with significant turnover in the EU, potentially covering thousands of businesses and impacting global trade flows.

Labor Laws and Employment Regulations

Clasquin must navigate a complex web of labor laws across its international operations, ensuring adherence to varying regulations on working hours, minimum wages, and workplace safety. For instance, in 2024, many European countries continued to grapple with labor shortages in the logistics sector, potentially increasing wage pressures and impacting recruitment strategies. Changes in immigration policies, as seen with evolving visa requirements in some key markets, could further affect the availability of skilled personnel.

Key labor considerations for Clasquin include:

- Compliance with Diverse Labor Laws: Ensuring adherence to national and regional employment statutes globally, covering aspects like overtime pay and employee benefits.

- Workforce Availability and Shortages: Addressing the impact of ongoing labor shortages in the logistics industry, which can affect operational capacity and costs.

- Immigration and Employment Policy Changes: Adapting to shifts in government policies that influence the hiring and retention of international talent.

- Worker Safety and Health Standards: Maintaining rigorous safety protocols to comply with regulations and protect employees, particularly in demanding operational environments.

Data Privacy and Protection Regulations (e.g., GDPR)

Clasquin's reliance on digital platforms and client data means strict adherence to data privacy laws like GDPR is crucial. Failure to comply can result in substantial penalties, impacting financial performance and brand trust. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Robust data management and security measures are therefore essential to mitigate these risks. This includes secure data storage, transparent data usage policies, and clear consent mechanisms for handling personal information.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Reputational Risk: Data breaches can severely damage customer trust and brand image.

- Operational Impact: Non-compliance necessitates costly investments in data security and compliance training.

- Competitive Advantage: Strong data protection can be a differentiator, attracting privacy-conscious clients.

Clasquin must navigate evolving international trade regulations and customs laws, which vary significantly by jurisdiction and can impact operational costs and efficiency. For example, the ongoing integration of maritime transport into the EU Emissions Trading System (EU ETS) from 2024 onwards introduces carbon pricing, directly affecting shipping expenses and requiring careful cost management. Furthermore, new due diligence laws like Germany's Supply Chain Due Diligence Act (LkSG) and the forthcoming EU Corporate Sustainability Due Diligence Directive (CSDDD) mandate increased transparency and risk mitigation across global supply chains, compelling companies like Clasquin to invest in robust compliance frameworks.

The company also faces stringent data privacy regulations, such as the GDPR. Non-compliance can lead to substantial fines, with penalties potentially reaching up to 4% of global annual turnover or €20 million. This necessitates significant investment in data security and management systems to protect client information and maintain trust.

Labor laws present another critical legal factor, requiring adherence to diverse regulations on working conditions, wages, and safety across different operating regions. In 2024, persistent labor shortages in the logistics sector in many European countries are also creating upward pressure on wages and impacting recruitment efforts, demanding adaptable human resource strategies.

| Legal Factor | Implication for Clasquin | 2024/2025 Relevance |

| International Trade & Customs | Compliance with varying import/export rules, tariffs, and documentation. | EU ETS integration for maritime transport impacts shipping costs; geopolitical shifts may tighten controls. |

| Supply Chain Due Diligence | Proactive identification and mitigation of human rights/environmental risks. | LkSG and CSDDD require enhanced traceability and risk management frameworks. |

| Data Privacy (e.g., GDPR) | Protection of client data and adherence to privacy regulations. | Fines up to 4% of global turnover; strong data protection is a competitive differentiator. |

| Labor Laws | Adherence to employment standards, wages, and safety regulations globally. | Labor shortages in logistics may increase wage pressures; evolving immigration policies affect workforce availability. |

Environmental factors

The logistics sector, including Clasquin's operations, is under intense scrutiny for its substantial contribution to global greenhouse gas emissions, estimated to be around 10% of the total. This reality fuels mounting pressure from governments, clients demanding greener supply chains, and the public for significant decarbonization efforts.

Clasquin is therefore compelled to implement robust strategies to shrink its carbon footprint. This involves critical actions such as sophisticated route optimization to minimize mileage, strategic investments in fleets that utilize more fuel-efficient technologies, and actively exploring and adopting alternative fuels like biofuels or hydrogen for its transport operations.

For instance, the International Energy Agency (IEA) reported in 2024 that the transport sector's emissions continue to rise, underscoring the urgency. Clasquin’s proactive stance on adopting electric or hydrogen-powered vehicles, as seen in pilot programs by other major logistics players in 2024, will be crucial for its long-term sustainability and competitive positioning.

Climate change presents significant physical risks to Clasquin's operations. Extreme weather events like floods and hurricanes, which are becoming more frequent and intense, can severely disrupt vital transportation infrastructure such as ports and rail lines, impacting global supply chains. For example, the European Environment Agency reported that extreme weather events caused over €150 billion in economic losses in the EU between 2019 and 2022, highlighting the potential for significant operational disruptions.

Rising sea levels also pose a long-term threat to coastal logistics hubs and warehousing facilities, potentially necessitating costly relocations or protective measures. Clasquin must proactively build resilience into its network, which could involve diversifying transportation routes, investing in climate-resilient infrastructure, or strategically adapting warehousing locations away from vulnerable coastal areas to mitigate these escalating environmental risks.

Growing concerns over resource scarcity, particularly for essential elements like fuel and packaging materials, are pushing logistics firms, including Clasquin, towards more sustainable operational models. This trend is driven by increasing environmental awareness and regulatory pressures.

To address this, Clasquin must prioritize efficient resource utilization, implement robust waste reduction programs, and actively seek out eco-friendly and recyclable packaging alternatives. For instance, the global packaging market is projected to reach $1.18 trillion by 2024, with a growing segment dedicated to sustainable solutions, indicating a significant market opportunity for companies like Clasquin that invest in these areas.

Adoption of Green Logistics Technologies

The logistics sector is rapidly embracing green technologies to reduce its environmental footprint. This includes the deployment of electric and alternative-fuel fleets, the development of carbon-neutral warehousing solutions, and the use of AI for optimizing delivery routes, all aimed at minimizing emissions and resource consumption.

For Clasquin, a proactive stance on adopting these green logistics technologies is not merely an environmental consideration but a strategic imperative for long-term viability and market positioning. Companies that lead in sustainability often see enhanced brand reputation and operational efficiencies.

The global green logistics market is projected for significant growth. For instance, the market for electric commercial vehicles, a key component of green logistics, is expected to see substantial expansion, with sales in Europe alone showing a strong upward trend. Furthermore, investments in AI for supply chain optimization are increasing, with many firms reporting cost savings and emission reductions. For example, by mid-2024, several major logistics providers reported a 10-15% reduction in fuel consumption through AI-powered route planning.

- Electric Vehicle Adoption: The European Union's targets for reducing CO2 emissions from heavy-duty vehicles are driving significant investment in electric trucks, with several manufacturers planning to expand their offerings by 2025.

- AI in Route Optimization: Companies utilizing AI for route optimization have reported an average reduction of 5-10% in mileage and associated fuel costs, contributing to lower carbon emissions.

- Sustainable Warehousing: Investments in renewable energy sources for warehouses and energy-efficient building designs are becoming standard practice, with many aiming for net-zero energy consumption by 2030.

- Data Analytics for Emissions: Enhanced data analytics are enabling better tracking and reporting of Scope 1, 2, and 3 emissions, allowing companies like Clasquin to identify key areas for improvement.

Corporate Social Responsibility and Sustainability Reporting

Companies are increasingly expected to showcase their dedication to environmental sustainability through clear reporting and corporate social responsibility (CSR) efforts. This trend means Clasquin will likely face greater demands for in-depth sustainability reports, potentially aligning with regulations such as the Corporate Sustainability Reporting Directive (CSRD), to foster stakeholder confidence and appeal to environmentally aware customers.

The CSRD, which became applicable for large companies in January 2024, mandates extensive disclosure on environmental, social, and governance (ESG) matters. For instance, in 2024, many logistics companies are investing in greener fleets and optimizing routes to reduce their carbon footprint, a trend Clasquin will need to mirror and report on transparently.

- Growing Stakeholder Demand: Investors and clients are prioritizing companies with strong ESG performance, influencing supply chain decisions.

- Regulatory Compliance: Directives like the CSRD require detailed environmental and social impact reporting, impacting operational transparency.

- Competitive Advantage: Proactive sustainability reporting can differentiate Clasquin in the market and attract business from eco-conscious partners.

- Risk Mitigation: Addressing environmental factors proactively helps mitigate regulatory, reputational, and operational risks.

The logistics industry, including Clasquin, faces intense pressure to decarbonize due to its significant environmental impact, contributing around 10% of global greenhouse gas emissions. This necessitates strategic investments in fuel-efficient fleets and alternative fuels, as exemplified by the growing adoption of electric and hydrogen vehicles observed in pilot programs by industry peers in 2024.

Extreme weather events, amplified by climate change, pose a direct threat to transportation infrastructure, with the EU reporting over €150 billion in economic losses from such events between 2019 and 2022. Clasquin must therefore build resilience by diversifying routes and investing in climate-resilient infrastructure to mitigate these disruptions.

Resource scarcity, particularly for fuels and packaging, is driving a shift towards efficiency and sustainability. The global packaging market's growth, with a rising segment for eco-friendly solutions, presents an opportunity for Clasquin to embrace recyclable materials and reduce waste.

| Environmental Factor | Impact on Logistics | Clasquin's Response/Opportunity | Supporting Data (2024/2025) |

|---|---|---|---|

| Carbon Emissions | Significant contributor to global emissions; regulatory pressure for reduction. | Invest in electric/alternative fuel fleets, optimize routes. | Transport sector emissions continue to rise (IEA 2024); AI route optimization can reduce mileage by 5-10%. |

| Climate Change & Extreme Weather | Disruption of infrastructure (ports, rail); physical risk to assets. | Build network resilience, diversify routes, invest in climate-resilient infrastructure. | EU economic losses from extreme weather: €150B (2019-2022). |

| Resource Scarcity & Waste | Increased costs for fuel, packaging; demand for sustainable materials. | Prioritize resource efficiency, implement waste reduction, use eco-friendly packaging. | Global packaging market projected at $1.18T by 2024, with growing sustainable segment. |

PESTLE Analysis Data Sources

Our Clasquin PESTLE Analysis is meticulously constructed using a blend of public and proprietary data sources. This includes insights from international organizations, government reports, industry-specific publications, and real-time market intelligence, ensuring a comprehensive and accurate macro-environmental assessment.