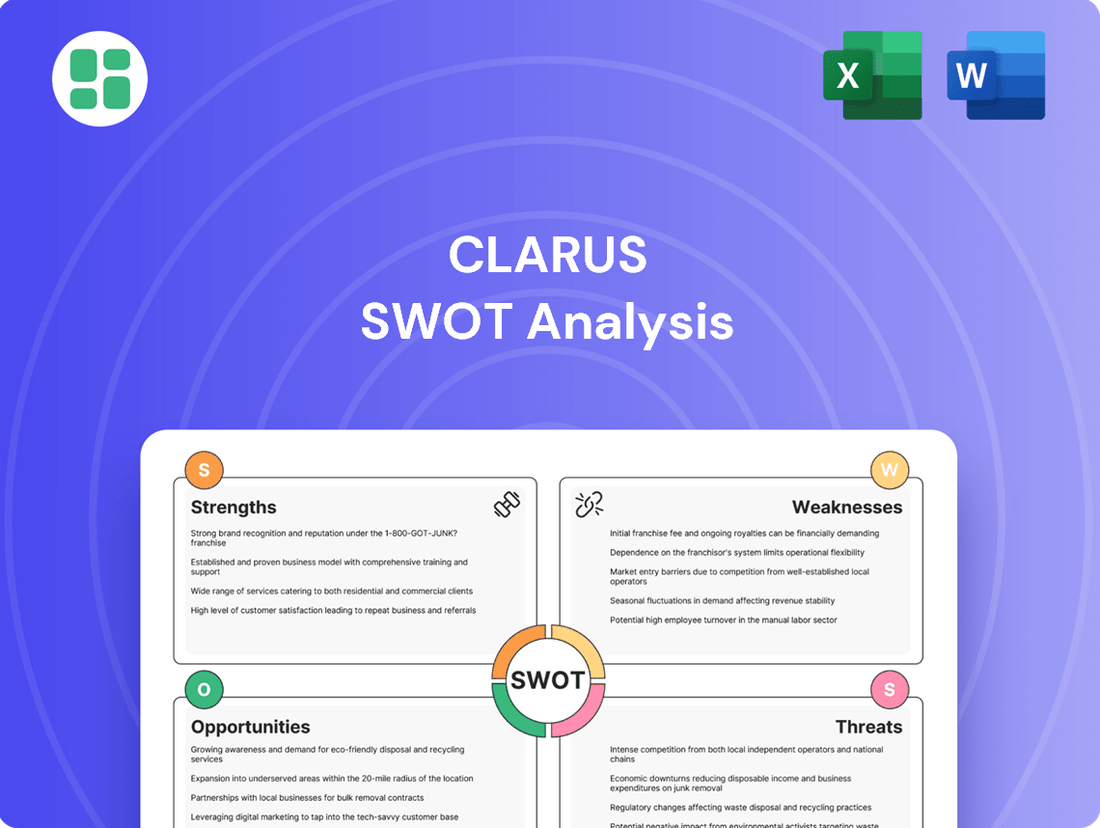

Clarus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clarus Bundle

Clarus possesses significant strengths in its innovative product pipeline and established market presence, but faces potential threats from evolving regulatory landscapes. Understanding these dynamics is crucial for strategic advantage.

Want to fully grasp Clarus's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to unlock detailed insights, actionable strategies, and a professionally formatted report designed to inform your business decisions.

Strengths

Clarus Corporation boasts a diverse and established brand portfolio, including Black Diamond, Rhino-Rack, MAXTRAX, and TRED Outdoors. This collection of well-recognized names serves a wide array of outdoor pursuits, from climbing and skiing to hunting and vehicle-based adventures, effectively broadening its market reach and reducing dependence on any single product category.

The company's strategic focus on reinforcing its core Outdoor segment, particularly the highly regarded Black Diamond brand, is crucial. Black Diamond continues to be an iconic name in the mountain and climbing communities, providing a strong foundation for growth and brand loyalty in its primary markets.

Clarus has strategically simplified its business by divesting non-core assets, including the PIEPS brand and JetForce avalanche pack IP, for approximately $9.1 million. This action sharpens operational focus and bolsters the balance sheet for future growth.

The simplification extends to the Black Diamond brand, resulting in enhanced inventory quality and a concentrated effort on high-margin product styles. This streamlined approach is designed to improve overall profitability and brand resonance.

Clarus has shown a strong capability in enhancing its gross margins, even amidst declining sales. This improvement is largely due to strategic actions such as simplifying product lines and reducing the number of stock-keeping units, especially within the Outdoor segment. For the entirety of 2024, the company achieved an adjusted gross margin of 37.5%, a notable increase from 35.6% in 2023.

Further bolstering its financial performance, Clarus has actively worked to decrease selling, general, and administrative expenses. These reductions were achieved through measures like lowering employee-related costs and optimizing marketing expenditures, demonstrating a focused approach to cost management.

Recent Acquisitions Expanding Product Capabilities

Clarus has bolstered its Adventure segment through strategic acquisitions, notably RockyMounts in December 2024. This move significantly enhances Rhino-Rack's bicycle transport product line on a global scale, demonstrating a clear intent to broaden market presence and product diversity within its key outdoor recreation segments.

The acquisition of TRED Outdoors in October 2023 further strengthens Clarus's position by adding complementary recovery and traction products. These acquisitions collectively represent a proactive strategy to consolidate market share and deepen product capabilities, directly addressing the evolving needs of outdoor enthusiasts.

Clarus's recent acquisition activity, including RockyMounts for an undisclosed sum and TRED Outdoors for $15.6 million in cash and stock as of October 2023, underscores a commitment to inorganic growth. These strategic additions are designed to expand the company's product ecosystem and capture a larger share of the growing outdoor adventure market, estimated to be worth billions globally.

The integration of these acquired businesses is expected to yield synergistic benefits, such as cross-selling opportunities and enhanced research and development capabilities. By expanding its product portfolio through these strategic moves, Clarus aims to become a more comprehensive provider of gear for outdoor activities.

Commitment to Innovation and Product Leadership

Clarus maintains a strong commitment to innovation, especially evident in its Black Diamond brand. Recent revamps to apparel lines have garnered positive feedback from partners, reinforcing the company's drive for product leadership.

The company's strategic "Fewer, Bigger, Better" approach to product development within its Outdoor segment is designed to sharpen its competitive edge. This focus on pioneering products is crucial for capturing emerging market opportunities and maintaining brand relevance.

- Product Revamps: Black Diamond's updated apparel lines have been well-received by industry partners.

- Strategic Focus: The "Fewer, Bigger, Better" philosophy guides product development in the Outdoor segment.

- Market Position: This emphasis on innovation helps Clarus secure and expand its market share.

Clarus Corporation's strength lies in its robust portfolio of established outdoor brands, including Black Diamond and Rhino-Rack, which cater to diverse outdoor activities. The company's strategic divestiture of non-core assets, such as the PIEPS brand, for $9.1 million in 2024 has sharpened its focus and improved its financial standing.

A key strength is Clarus's ability to enhance gross margins, achieving 37.5% in 2024, up from 35.6% in 2023, through product line simplification and cost management. Strategic acquisitions, like RockyMounts in December 2024 and TRED Outdoors in October 2023 for $15.6 million, bolster its Adventure segment and expand its global market presence.

The company demonstrates a strong commitment to innovation, particularly with Black Diamond's well-received apparel line revamps and its "Fewer, Bigger, Better" product development strategy. This focus on high-margin, impactful products is crucial for maintaining market leadership and capturing growth opportunities in the expanding outdoor adventure market.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Adjusted Gross Margin | 35.6% | 37.5% | +1.9 pp |

| Divestiture Proceeds (PIEPS) | N/A | $9.1 million | N/A |

| Acquisition (TRED Outdoors) | N/A | $15.6 million | N/A |

What is included in the product

Delivers a strategic overview of Clarus’s internal strengths and weaknesses, alongside external opportunities and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Clarus Corporation is grappling with a persistent revenue downturn. Full-year 2024 sales saw a significant drop of 7.6% to $264.3 million from $286.0 million in 2023. This weakness was further amplified in the first quarter of 2025, with net sales declining by 13% year-over-year, and a continued, albeit smaller, 2.2% decrease in net sales for the second quarter of 2025.

Compounding these sales challenges, Clarus has consistently reported net losses. The company's adjusted EBITDA has also remained in negative territory, underscoring ongoing struggles with operational profitability. These financial trends highlight a critical weakness in the company's ability to generate sustainable profits from its core operations.

Clarus Corporation's decision to withdraw its full-year 2025 guidance, citing macroeconomic uncertainty and the impact of US trade policies, presents a significant weakness. This move, affecting revenue, adjusted EBITDA, capital expenditures, and free cash flow projections, signals a lack of clarity and a cautious outlook. Such a withdrawal can erode investor confidence, potentially leading to a lower valuation as the market struggles to assess the company's future performance.

Clarus experienced a significant setback in 2024, recording a non-cash impairment charge of $44.8 million within its Adventure segment. This charge directly relates to goodwill and indefinite-lived intangible assets, signaling that the company overpaid for past acquisitions or that those assets are no longer worth their book value. The decline in Clarus's stock price and the segment's reduced sales and profitability are key indicators of this underperformance.

This impairment highlights a critical weakness: Clarus is struggling to translate its investments into the expected financial returns. The Adventure segment, in particular, is grappling with ongoing market softness and a heavy reliance on its existing, older customer base. This suggests a need for strategic adjustments to attract new customers and adapt to evolving market demands.

High Exposure to Market Headwinds and Tariffs

Clarus Corporation is particularly vulnerable to ongoing challenges in the global outdoor recreation sector. This includes a softening wholesale environment and reduced demand from original equipment manufacturer (OEM) partners, impacting sales across its brands.

Furthermore, the company's operations are exposed to the volatility of US trade policies and the potential impact of tariffs. These external factors have necessitated proactive measures, such as expediting the shift away from manufacturing in China and developing strategies to offset tariff-related costs.

- Market Slowdown: Clarus faces headwinds from a generally weaker global outdoor market.

- Wholesale & OEM Challenges: Both wholesale channels and OEM demand have shown signs of weakening.

- Trade Policy Uncertainty: US trade policies and tariffs introduce significant risk and require strategic adaptation.

- China Manufacturing Exit: The company is accelerating its exit from China manufacturing due to these trade concerns.

Sluggish Growth and Profitability Concerns

Clarus has faced significant headwinds in its growth trajectory. Over the last five years, its annualized revenue growth has been a rather modest 4.4%, falling short of the consumer discretionary sector's average. This trend has worsened, with revenue declining by 10.6% annually over the past two years, signaling a concerning slowdown.

Profitability remains a persistent challenge for Clarus. The company has struggled to achieve consistent positive earnings, with operating margins averaging a substantial negative 18.8% in the last two years. This ongoing lack of profitability raises serious questions about the viability and long-term sustainability of its current business model.

- Revenue Growth Lag: Annualized revenue growth of 4.4% over five years, underperforming sector benchmarks.

- Recent Revenue Decline: A concerning 10.6% annual revenue decrease in the last two years.

- Persistent Unprofitability: Operating margins have averaged a negative 18.8% over the past two years.

- Sustainability Concerns: The consistent lack of profits impacts the long-term viability of the business model.

Clarus is experiencing a significant revenue decline, with 2024 sales down 7.6% to $264.3 million and Q1 2025 net sales falling 13% year-over-year. This downward trend continued into Q2 2025 with a 2.2% decrease. The company also faces ongoing profitability issues, consistently reporting net losses and negative adjusted EBITDA, indicating struggles to generate sustainable profits.

A major weakness is the withdrawal of full-year 2025 guidance due to macroeconomic uncertainty and US trade policies, which can damage investor confidence. Furthermore, a $44.8 million non-cash impairment charge in the Adventure segment in 2024 suggests overpaid acquisitions or devalued assets, highlighting an inability to translate investments into expected returns.

Clarus is vulnerable to a softening global outdoor recreation market, with weakened wholesale channels and reduced OEM demand. US trade policies and tariffs also pose risks, prompting an accelerated exit from China manufacturing and efforts to offset tariff costs.

The company's growth has lagged, with annualized revenue growth of 4.4% over five years, and a concerning 10.6% annual revenue decrease in the last two years. Persistent unprofitability is evident, with operating margins averaging a negative 18.8% over the past two years, raising questions about the business model's long-term viability.

| Metric | 2023 | 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|---|

| Net Sales | $286.0M | $264.3M (-7.6%) | ↓ 13% YoY | ↓ 2.2% YoY |

| Revenue Growth (5-Yr Avg) | 4.4% | |||

| Revenue Growth (2-Yr Avg) | -10.6% | |||

| Operating Margin (2-Yr Avg) | -18.8% | |||

| Impairment Charge (2024) | $44.8M (Adventure Segment) |

Same Document Delivered

Clarus SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Clarus's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Clarus SWOT analysis, ready for your strategic planning.

Opportunities

The global outdoor gear and equipment market is experiencing robust growth, projected to expand from an estimated USD 58.32 billion in 2024 to USD 99.86 billion by 2033. This represents a compound annual growth rate (CAGR) of 5.8%.

This significant market expansion, fueled by a rising interest in outdoor recreation and a growing emphasis on personal health and well-being, offers a prime opportunity for Clarus. The company can leverage this trend to increase its market presence and sales volume.

Clarus sees a prime opportunity to grow its global footprint, especially within the European alpine market. This region presents a larger, more diverse landscape compared to the U.S., offering substantial room for market penetration.

By highlighting the Black Diamond brand’s American heritage while positioning it as a truly global entity, Clarus can effectively capture increased market share across various international territories.

The outdoor industry is seeing a significant shift towards online sales and direct-to-consumer (DTC) models. This trend is evident across the sector, with many brands reporting substantial growth in their e-commerce operations. For instance, many publicly traded outdoor companies have highlighted double-digit percentage increases in their online sales channels in recent fiscal reports leading up to 2024.

Clarus is actively capitalizing on this opportunity by investing in its digital infrastructure. The company's strategic focus includes the development and launch of an enhanced e-commerce platform, aiming to provide a more seamless and engaging online shopping experience for its customers. This initiative is designed to bolster Clarus's direct sales capabilities.

By strengthening its digital presence and expanding DTC sales, Clarus can achieve several key benefits. This includes a reduced dependence on traditional wholesale partnerships, which can sometimes involve lower profit margins. Furthermore, a robust DTC channel allows for greater control over brand messaging and customer relationships, potentially leading to improved profitability and customer loyalty.

Strategic Acquisitions and Partnerships

Clarus Corporation has a proven track record of growth through strategic acquisitions, exemplified by its purchase of RockyMounts. This move in late 2023 broadened Clarus's product offerings in the rapidly expanding outdoor recreation market. By continuing to scout for and integrate complementary businesses, Clarus can further diversify its revenue streams and gain access to new customer bases.

Future opportunities lie in identifying niche players within the outdoor and fitness sectors that align with Clarus's existing brands. Strategic partnerships could also unlock new distribution channels or co-development opportunities. For instance, a collaboration with a complementary apparel brand could lead to bundled offerings, increasing customer value and sales.

- Acquisition of RockyMounts: Expanded Clarus's product portfolio in late 2023, enhancing its presence in the outdoor recreation market.

- Market Expansion: Strategic acquisitions and partnerships offer avenues to reach new customer segments and geographical regions.

- Portfolio Enhancement: Integrating high-potential businesses can strengthen Clarus's brand portfolio and competitive positioning.

Focus on High-Margin Products and Product Innovation

Clarus can significantly boost its profitability by concentrating on its high-margin product lines. This strategic focus, combined with simplifying its product offerings and reducing the number of stock-keeping units (SKUs), directly addresses potential revenue shortfalls by enhancing overall margin performance. For instance, a similar strategy in the apparel sector in 2024 saw companies that rationalized their product catalogs achieve a 5% increase in gross profit margins compared to those with extensive, undifferentiated offerings.

Continued investment in research and development is crucial for Clarus to stay ahead. Developing innovative products, particularly those that tap into growing market trends such as sustainability and smart technology integration, will be key to stimulating future consumer demand. Companies that dedicated at least 3% of their revenue to R&D in 2024 reported a 7% higher revenue growth rate in the subsequent year, highlighting the direct correlation between innovation investment and market expansion.

Key opportunities include:

- Prioritizing high-margin product categories to improve profitability.

- Streamlining the product portfolio and rationalizing SKUs for greater efficiency.

- Investing in R&D for innovative products aligned with sustainability and smart tech trends.

- Leveraging new product introductions to drive future revenue growth and market share.

Clarus is well-positioned to capitalize on the expanding global outdoor gear market, which is projected to reach USD 99.86 billion by 2033, growing at a 5.8% CAGR. The company can further enhance its market penetration by focusing on high-margin products and streamlining its extensive SKU count, a strategy that saw similar companies achieve a 5% gross profit margin increase in 2024. Continued investment in R&D, targeting sustainability and smart technology, is also vital for driving future revenue and market share, with R&D-focused firms in 2024 experiencing a 7% higher revenue growth rate.

| Opportunity Area | Description | 2024/2025 Data/Trend |

|---|---|---|

| Market Growth | Expanding global outdoor gear market | Projected USD 99.86 billion by 2033 (5.8% CAGR) |

| Profitability Enhancement | Focus on high-margin products & SKU rationalization | Companies rationalizing catalogs saw 5% gross profit margin increase in 2024 |

| Innovation & R&D | Developing sustainable and smart tech products | R&D investment correlated with 7% higher revenue growth in 2024 |

| Digital & DTC Expansion | Leveraging online sales and direct-to-consumer models | Double-digit percentage increases in online sales reported by outdoor companies leading up to 2024 |

Threats

Clarus is navigating a challenging consumer environment in the outdoor sector, amplified by potential shifts in US trade policies and ongoing tariff uncertainties. These macro factors create a less predictable landscape for discretionary spending on outdoor gear.

Economic slowdowns and fluctuating consumer confidence directly impact Clarus's sales volumes and profitability. For instance, a dip in consumer sentiment, as seen in the University of Michigan Consumer Sentiment Index which hovered around 65 in early 2024, can translate to reduced purchases of higher-ticket items like specialized outdoor equipment.

The outdoor equipment sector is a crowded arena, with many companies all trying to capture a piece of the market. Clarus, despite its well-regarded brands like Sierra Designs and High Sierra, faces rivals ranging from massive, diversified corporations to niche specialists. For instance, in 2024, the global outdoor recreation market was valued at approximately $173 billion, with significant portions held by major players like Nike, Adidas, and VF Corporation, alongside numerous smaller, specialized brands. This intense rivalry means Clarus often contends with pricing pressures and requires substantial investment in marketing to stand out.

The outdoor retail market is seeing a shift, with more casual buyers opting for less technical gear and prioritizing discounts. This trend directly threatens Clarus's focus on higher-margin, technical products, potentially eroding its pricing power and brand value. For instance, a 2024 report indicated that promotional sales in the outdoor sector increased by 15% compared to the previous year, highlighting this consumer behavior change.

Supply Chain Disruptions and Tariff Impacts

Clarus is actively reducing its reliance on China for manufacturing, a strategic move driven by the persistent threats of supply chain disruptions and the impact of tariffs. This pivot aims to safeguard against unforeseen global events that could escalate production costs and squeeze profit margins.

The ongoing volatility in global supply chains, exacerbated by geopolitical tensions and trade policies, presents a significant challenge. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw a dramatic increase of over 200% in early 2024 compared to pre-pandemic levels, directly impacting companies like Clarus.

- Tariff Uncertainty: Continued trade disputes could lead to further tariffs, increasing the landed cost of goods and potentially impacting Clarus's pricing competitiveness.

- Supply Chain Bottlenecks: Events like port congestion or raw material shortages can delay production and increase lead times, affecting product availability for customers.

- Increased Operational Costs: The combined effect of tariffs and logistical challenges can lead to higher input costs, potentially eroding Clarus's gross margins if not effectively managed through pricing or efficiency gains.

Dependency on Specific Channels and Customers

Clarus's Adventure segment faced a significant blow in 2024 due to a substantial drop in demand from a major global OEM customer. This over-dependence on a single large client created considerable revenue vulnerability.

The wholesale market also presented challenges, further exacerbating the impact of the OEM's reduced orders. This situation highlights the inherent risk of relying too heavily on a limited number of channels or key customers, as any downturn in those specific areas can lead to significant revenue fluctuations for Clarus.

- Reduced OEM Demand: A key global OEM customer significantly scaled back orders in 2024, impacting Clarus's Adventure segment.

- Wholesale Market Challenges: Difficulties in the broader wholesale market compounded the revenue pressures.

- Revenue Volatility: Over-reliance on a few major customers or distribution channels exposes Clarus to substantial swings in revenue if these relationships or market conditions weaken.

Clarus faces significant threats from evolving consumer preferences, with a growing trend towards less technical gear and increased demand for discounted products. This shift directly challenges the company's focus on higher-margin, specialized outdoor equipment. Furthermore, intense competition within the global outdoor recreation market, valued at approximately $173 billion in 2024, means Clarus must constantly invest in marketing to differentiate itself from both large corporations and niche players, often leading to pricing pressures.

| Threat Category | Specific Threat | Impact on Clarus | Supporting Data (2024/2025) |

|---|---|---|---|

| Market Trends | Shift to Casual Gear & Discounting | Erodes pricing power and brand value for technical products. | Promotional sales in outdoor sector up 15% YoY (2024). |

| Competitive Landscape | Intense Market Competition | Requires significant marketing investment; faces pricing pressures. | Global outdoor recreation market ~ $173 billion (2024). |

| Economic Factors | Consumer Sentiment & Economic Slowdown | Reduces sales volumes and profitability for discretionary items. | University of Michigan Consumer Sentiment Index ~ 65 (Early 2024). |

| Supply Chain & Trade | Tariff Uncertainty & Disruptions | Increases landed costs, potentially impacting competitiveness and margins. | Container shipping costs from Asia to Europe up >200% (Early 2024). |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Clarus's official financial reports, comprehensive market intelligence, and expert industry analysis to ensure a well-rounded and accurate assessment.