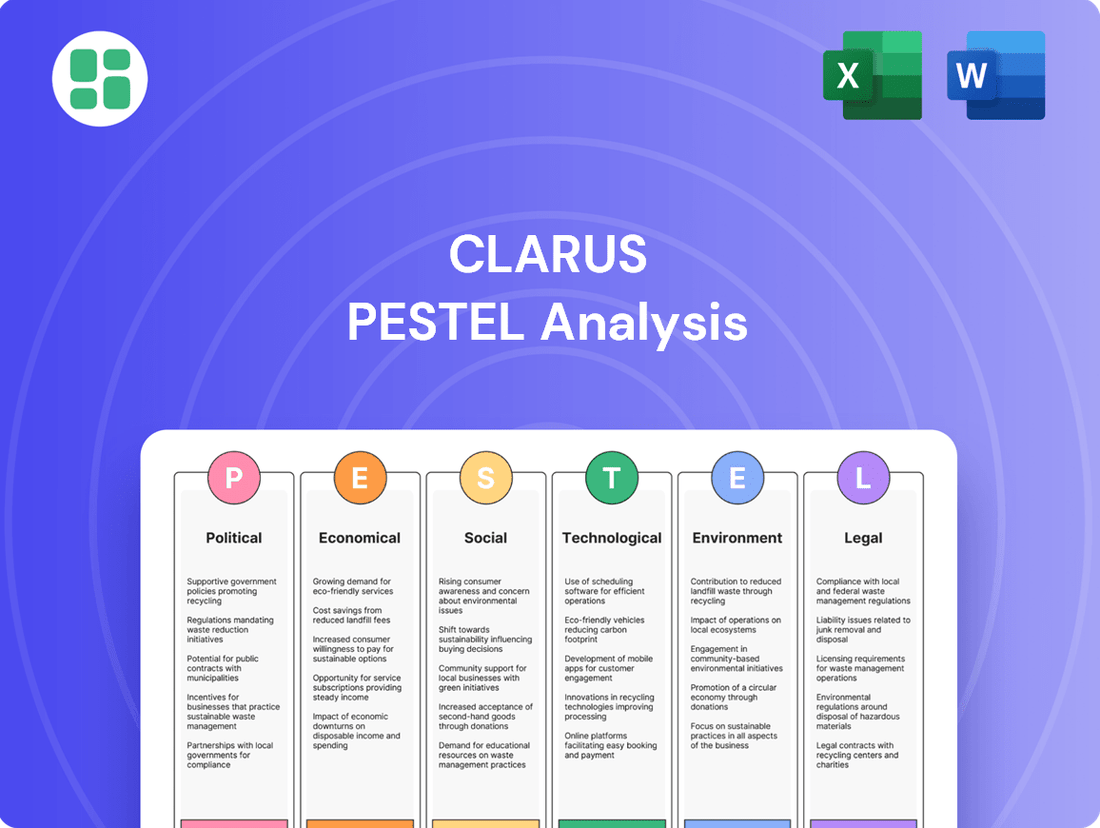

Clarus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clarus Bundle

Uncover the critical external forces shaping Clarus's trajectory with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with the strategic foresight needed to navigate this complex landscape. Purchase the full analysis now for actionable intelligence that drives informed decisions.

Political factors

Trade tariffs represent a significant political factor for Clarus Corporation. New tariffs imposed by the United States on imports from countries such as China, Vietnam, and Mexico could directly impact the cost of producing technical outdoor gear, a sector where Clarus operates. For instance, if tariffs increase by 10% on key components sourced from these regions, Clarus’s cost of goods sold could rise substantially.

These increased manufacturing costs stemming from tariffs may force Clarus to either absorb the expenses, impacting profit margins, or pass them onto consumers through higher retail prices. This dynamic could affect Clarus's competitive pricing strategy and overall sales volume in the 2024-2025 period. As of early 2024, many companies in the apparel and outdoor goods sector were already reporting increased input costs due to existing trade disputes, a trend likely to continue or intensify.

Consequently, Clarus, like many in the outdoor equipment industry, might accelerate efforts to diversify its supply chain. This could involve shifting production to countries not subject to these tariffs or exploring nearshoring options to mitigate the financial and logistical risks associated with global trade policy changes. Such diversification, however, often involves significant upfront investment and can take time to implement effectively.

Government policies significantly influence the outdoor recreation sector. For instance, in 2024, the U.S. Department of the Interior announced a $2.8 billion investment in public lands infrastructure, aiming to improve visitor experiences and conservation efforts. This directly benefits companies like Clarus, which provide gear and services for outdoor activities.

Increased government support for maintaining and expanding access to national parks, forests, and trails in 2024 and projected for 2025 encourages greater public engagement. This trend, supported by initiatives like the Great American Outdoors Act, which aims to address a significant backlog of maintenance on public lands, translates into higher demand for outdoor equipment and apparel.

Global geopolitical unrest, including ongoing conflicts and shifts towards nationalism, creates significant uncertainty for international businesses. For instance, the prolonged Russia-Ukraine conflict, which began in early 2022, continues to impact energy markets and global food security, with the World Bank projecting a slowdown in global growth to 2.4% in 2024, partly due to these persistent geopolitical tensions.

These disruptions can severely affect supply chains, leading to increased costs and delivery delays. Protectionist policies, like tariffs and trade barriers, further complicate international trade, making it harder for companies to operate efficiently across borders. Consumer confidence can also erode in such an environment, as economic instability often translates into cautious spending habits.

State-Level Climate and Sustainability Legislation

Beyond federal regulations, individual states are increasingly enacting their own ambitious climate and sustainability legislation. For instance, the New York Fashion Act and the Washington State Fashion Sustainability Accountability Act are prime examples of this trend, targeting the fashion industry specifically. These state-level initiatives can introduce significant new compliance burdens for manufacturers, dictating specific requirements for materials used and production methods employed.

These legislative efforts are not just symbolic; they carry tangible financial implications. Companies operating in or selling into these states will need to adapt their supply chains and manufacturing processes to meet these evolving standards. Failure to comply could result in penalties, impacting profitability and market access.

The impact of these state-level acts can be far-reaching:

- Increased operational costs: Sourcing sustainable materials or altering production processes often incurs higher upfront expenses.

- Supply chain adjustments: Manufacturers may need to re-evaluate and potentially overhaul their entire supply chain to ensure compliance.

- Market access considerations: Non-compliance could restrict a company's ability to sell products in key consumer markets.

- Innovation driver: Conversely, these regulations can also spur innovation in sustainable materials and manufacturing technologies.

Regulatory Pressure on Manufacturing Practices

Governments worldwide are intensifying scrutiny on manufacturing processes, particularly concerning product composition. This is evident in the growing regulations around substances like hydrofluorocarbons (HFCs) and per- and polyfluoroalkyl substances (PFAS), often referred to as 'forever chemicals'. Clarus, as a manufacturer, needs to proactively adapt to these evolving environmental compliance mandates.

For instance, the European Union's proposed PFAS restrictions, potentially impacting thousands of chemicals, could significantly alter manufacturing inputs and product designs for companies like Clarus. Similarly, ongoing phase-downs of HFCs under the Kigali Amendment to the Montreal Protocol necessitate the adoption of lower global warming potential (GWP) alternatives in cooling and refrigeration systems, a key sector for many manufacturers.

- Increased compliance costs: Adapting manufacturing lines and sourcing new materials to meet stricter regulations can lead to higher operational expenses.

- Supply chain disruptions: Restrictions on certain chemicals may limit the availability of raw materials, requiring Clarus to find alternative suppliers or formulations.

- Innovation imperative: These regulatory pressures often spur innovation, driving the development of more sustainable and environmentally friendly products and processes.

- Market access: Failure to comply with evolving regulations could restrict Clarus's access to certain markets or lead to penalties, impacting overall revenue.

Government policies directly shape the competitive landscape for Clarus. Trade tariffs, such as potential U.S. tariffs on goods from China and Vietnam, could increase component costs by 10% or more, impacting Clarus's profit margins or forcing price hikes. This aligns with broader industry trends observed in early 2024, where many apparel companies reported rising input costs due to trade disputes.

Government investments in public lands, like the U.S. Department of the Interior's $2.8 billion allocation for infrastructure in 2024, directly benefit outdoor recreation companies. This funding, coupled with initiatives like the Great American Outdoors Act, boosts demand for gear and apparel as public access and enjoyment of natural spaces increase. Geopolitical instability, such as the ongoing Russia-Ukraine conflict, contributes to global economic slowdowns, with the World Bank projecting 2.4% global growth for 2024, potentially dampening consumer spending on discretionary items.

State-level environmental regulations, like the New York and Washington Fashion Acts, are imposing new compliance burdens on manufacturers, requiring shifts in materials and production methods. These changes can increase operational costs and necessitate supply chain adjustments. Furthermore, global regulations targeting substances like PFAS and HFCs are forcing manufacturers to adapt their product formulations and sourcing strategies to meet evolving environmental standards and ensure market access.

| Policy Area | Potential Impact on Clarus | Example/Data Point (2024-2025) |

|---|---|---|

| Trade Tariffs | Increased Cost of Goods Sold, Reduced Profit Margins, Higher Retail Prices | Potential 10% tariff on components from China/Vietnam |

| Public Land Investment | Increased Demand for Outdoor Gear, Enhanced Consumer Engagement | $2.8 billion U.S. Dept. of Interior investment in public lands infrastructure (2024) |

| Geopolitical Instability | Supply Chain Disruptions, Economic Slowdown, Reduced Consumer Confidence | World Bank projection of 2.4% global growth (2024) due to ongoing conflicts |

| State Environmental Regulations | Higher Compliance Costs, Supply Chain Adjustments, Potential Market Access Restrictions | New York Fashion Act and Washington State Fashion Sustainability Accountability Act |

| Chemical Regulations (PFAS/HFCs) | Need for Alternative Materials/Formulations, Increased R&D Investment, Potential Supply Chain Shifts | EU's proposed PFAS restrictions, Kigali Amendment HFC phase-downs |

What is included in the product

The Clarus PESTLE Analysis provides a comprehensive examination of external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise yet comprehensive overview of external factors, eliminating the overwhelm of lengthy reports and enabling faster, more informed decision-making.

Economic factors

The global market for recreational and outdoor products is on a strong upward trajectory, with projections indicating it will reach USD 137.7 billion in 2024. This robust growth is expected to continue, with a compound annual growth rate (CAGR) exceeding 5.7% between 2025 and 2034.

This expansion is largely fueled by a surge in people participating in outdoor activities and a heightened focus on personal health and overall wellness. Consumers are increasingly prioritizing experiences and activities that promote physical and mental well-being.

Consumers are increasingly directing their budgets towards wellness and long-lasting goods, a trend that significantly boosts sectors like outdoor recreation and sporting equipment. For instance, in 2024, the global sporting goods market was projected to reach over $200 billion, reflecting this shift.

However, a contraction in disposable income, as seen with persistent inflation impacting household budgets through 2024 and into 2025, can dampen consumer enthusiasm for non-essential purchases. This economic pressure directly challenges industries reliant on discretionary spending, such as leisure and travel.

Economic uncertainty and rising inflation can significantly dampen consumer spending, directly impacting sales for sectors like outdoor gear. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2024, reaching 3.4% in April, which can reduce discretionary income available for non-essential purchases.

Brands that have integrated circularity initiatives, such as robust resale platforms or repair services, may find themselves more resilient. These programs can offer consumers more affordable entry points into their product lines, mitigating the impact of higher prices and economic caution.

E-commerce Expansion and Digital Retail

The e-commerce boom continues to reshape how recreational products reach consumers, with platforms like Amazon and specialized outdoor retailers seeing significant growth. This expansion offers outdoor brands unprecedented access to a global customer base, breaking down geographical barriers and enabling wider distribution. For instance, global e-commerce sales were projected to reach $6.3 trillion in 2024, a substantial increase from previous years, highlighting the growing importance of online channels for all retail sectors, including outdoor gear.

Leveraging direct-to-consumer (D2C) strategies has become a key differentiator for many outdoor brands in 2024 and 2025. This model allows companies to build direct relationships with their customers, gather valuable data, and often offer more competitive pricing by cutting out intermediaries. Brands are investing heavily in their own online storefronts and digital marketing to foster loyalty and control the customer experience. This shift is evident in the increasing number of brands launching or expanding their D2C operations, aiming for higher margins and direct customer engagement.

- Global e-commerce sales are expected to reach $6.3 trillion in 2024, indicating a strong preference for online purchasing.

- Direct-to-consumer (D2C) sales are a growing segment, allowing brands to bypass traditional retail and connect directly with customers.

- Digital marketing spend for e-commerce is increasing, with brands allocating more resources to online advertising and customer acquisition.

- Mobile commerce (m-commerce) continues its upward trend, with a significant portion of online purchases being made via smartphones and tablets.

Supply Chain Disruptions and Costs

Ongoing supply chain disruptions, fueled by geopolitical tensions and increasingly severe weather events, continue to challenge businesses. These disruptions directly affect material availability and drive up freight costs. For instance, the International Monetary Fund (IMF) noted in early 2024 that while some supply chain pressures had eased, new bottlenecks were emerging, particularly in key shipping routes due to regional conflicts.

In response, companies are prioritizing supply chain resilience. Strategies like diversification of suppliers and nearshoring are gaining traction. This shift aims to reduce reliance on single sources and shorten lead times, mitigating the impact of future shocks. A 2024 survey by McKinsey indicated that over 90% of supply chain leaders planned to increase their supply chain resilience in the coming years.

- Geopolitical Impact: Conflicts and trade disputes in various regions continue to create unpredictable disruptions in global shipping and component sourcing.

- Weather Volatility: Extreme weather events, from hurricanes to droughts, are increasingly impacting agricultural output and transportation networks, adding to supply chain strain.

- Rising Freight Costs: The cost of shipping, while fluctuating, remains a significant concern for many industries, with surcharges and increased insurance premiums becoming common.

- Resilience Strategies: Companies are investing in technologies and partnerships to build more robust supply chains, including dual sourcing and regional manufacturing hubs.

Economic factors present a mixed outlook for the recreational and outdoor products market. While consumer spending on wellness and experiences remains strong, persistent inflation and potential contractions in disposable income through 2024 and into 2025 pose challenges for discretionary purchases. Brands focusing on value, durability, and circularity initiatives may prove more resilient in this environment.

The global e-commerce market's continued expansion, projected to reach $6.3 trillion in 2024, offers significant opportunities for brands to reach consumers directly. However, rising freight costs and ongoing supply chain disruptions, exacerbated by geopolitical tensions and weather volatility, continue to impact availability and increase operational expenses. Companies are actively investing in supply chain resilience strategies to mitigate these risks.

| Economic Factor | 2024 Projection/Data | Impact on Recreational Products |

|---|---|---|

| Global E-commerce Sales | $6.3 trillion | Increased reach and direct consumer access |

| US Consumer Price Index (CPI) | 3.4% (April 2024) | Reduced disposable income for non-essential goods |

| Supply Chain Resilience Investment | Over 90% of leaders planning increases (McKinsey Survey 2024) | Mitigation of disruptions and cost volatility |

| Global Sporting Goods Market | Over $200 billion | Reflects strong consumer focus on health and wellness |

Same Document Delivered

Clarus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Clarus PESTLE Analysis provides a comprehensive overview of the external factors impacting a business, ensuring you get the complete, actionable insights you need.

Sociological factors

There's a noticeable shift in society, with people prioritizing their health and mental well-being more than ever. This is leading a growing number of individuals to embrace outdoor pursuits such as hiking, camping, and cycling.

This heightened focus on active living directly translates into increased consumer demand for outdoor gear and lifestyle products. For instance, sales of cycling equipment saw a significant boost, with the global bicycle market projected to reach approximately $80 billion by 2025, reflecting this desire for healthier lifestyles.

Consumers, especially younger generations such as Millennials and Gen Z, are increasingly prioritizing outdoor gear that is both eco-conscious and ethically produced. This means a growing demand for products made from sustainable materials and manufactured under fair labor practices.

Brands that actively incorporate circular economy principles, like repair programs or take-back initiatives, and demonstrate strong social responsibility are resonating deeply with these environmentally and socially aware adventurers. For instance, a 2024 survey indicated that 68% of consumers are willing to pay more for sustainable products, a figure that climbs to 73% for those aged 18-34.

The athleisure trend continues to redefine consumer wardrobes, blurring the lines between performance gear and everyday fashion. This shift means people increasingly want apparel that looks good and performs well, whether they're hiking or heading to brunch. For example, sales of activewear as a percentage of total apparel sales in the US have been steadily climbing, reaching approximately 20% in 2023, a significant increase from around 10% a decade prior.

This demand for versatility directly impacts how brands approach product development and marketing. Companies are focusing on creating stylish, comfortable, and functional pieces that cater to a lifestyle where the gym, the office, and social outings can blend seamlessly. This trend is further supported by market research indicating that consumers are willing to pay a premium for versatile clothing, with the global athleisure market projected to grow at a CAGR of over 6% through 2028.

Influence of Social Media and Digital Engagement

Social media platforms, particularly TikTok and Instagram, are now critical for outdoor enthusiasts to discover new products, read reviews, and connect with communities. Brands are increasingly using social commerce features and collaborating with influencers to capture the attention of younger demographics and influence their buying habits. For instance, in 2024, influencer marketing spending in the U.S. was projected to reach $21.1 billion, with a significant portion targeting Gen Z and Millennials who are highly active on these platforms.

Brands in the outdoor sector are adapting by integrating shoppable content directly into their social media feeds and partnering with micro-influencers who have highly engaged niche followings. This approach is proving effective, as studies from 2024 indicate that 60% of consumers discover new products through social media, and a substantial percentage of these discoveries lead to purchases.

- TikTok and Instagram Dominance: These platforms are primary channels for product discovery and community engagement among younger outdoor enthusiasts.

- Social Commerce Growth: Brands are leveraging integrated shopping features on social media to facilitate direct purchases.

- Influencer Marketing Impact: Partnerships with influencers, especially micro-influencers, are key to reaching and persuading target audiences.

- Consumer Behavior Shift: A significant portion of consumers, particularly younger ones, rely on social media for product research and purchasing decisions.

Inclusivity and Customization Demands

The outdoor gear market is seeing a significant shift towards inclusivity, with consumers increasingly seeking products that accommodate a wider range of body types and offer greater customization. This trend reflects a broader societal move towards valuing individual expression and personal fit.

Brands are responding by expanding their sizing ranges and introducing more adaptable designs. For instance, some companies are now offering extended sizing, with reports indicating a growth in this segment. This push for personalization isn't just about fit; it's also about aligning with consumers' values, as many actively seek out brands that demonstrate a commitment to diversity and inclusion in their product development and marketing efforts.

- Expanded Sizing: Many outdoor apparel brands are now offering sizes beyond traditional S-XL, with some extending to 4XL or even larger, reflecting a growing demand for inclusive sizing.

- Customization Features: Products incorporating adjustable elements like drawcords, interchangeable components, or made-to-measure options are gaining traction.

- Brand Perception: Companies that prioritize inclusivity in their product lines often experience enhanced brand loyalty and positive market perception among a wider consumer base.

- Market Growth: The inclusive apparel market, including outdoor gear, is projected for continued growth as consumer expectations evolve.

Societal values are increasingly emphasizing health and wellness, driving a surge in outdoor activities like hiking and cycling. This trend directly fuels demand for related gear, with the global bicycle market expected to reach around $80 billion by 2025.

Younger consumers, particularly Millennials and Gen Z, are prioritizing sustainable and ethically produced outdoor products. A 2024 survey found 68% of consumers willing to pay more for sustainable goods, a figure rising to 73% for those aged 18-34.

The athleisure trend continues to blur fashion and function, with activewear sales in the US reaching approximately 20% of total apparel sales in 2023. This indicates a strong consumer preference for versatile clothing suitable for both performance and casual wear, with the athleisure market projected to grow at over 6% annually through 2028.

Social media platforms like TikTok and Instagram are critical for product discovery and community engagement in the outdoor sector. Influencer marketing spending in the U.S. was projected to hit $21.1 billion in 2024, with a significant portion targeting younger, platform-active demographics.

| Sociological Factor | Trend Description | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased participation in outdoor activities. | Global bicycle market projected at $80 billion by 2025. |

| Sustainability & Ethics | Demand for eco-conscious and ethically made products. | 68% of consumers willing to pay more for sustainable products (2024). |

| Athleisure Popularity | Integration of performance wear into everyday fashion. | Activewear comprised ~20% of US apparel sales in 2023. |

| Social Media Influence | Platforms driving product discovery and purchasing decisions. | US influencer marketing spend projected at $21.1 billion (2024). |

Technological factors

The outdoor gear sector is increasingly embedding smart sensors and artificial intelligence into apparel. This technological leap allows for features such as real-time biometric tracking and monitoring of UV exposure, significantly improving functionality for outdoor enthusiasts.

By 2024, the wearable technology market, which includes smart apparel, was projected to reach over $150 billion globally, indicating strong consumer adoption and investment in this area. This trend directly benefits the outdoor industry by offering enhanced user experiences and data-driven insights for performance and safety.

Innovations in materials science are transforming the gear industry, with new developments focusing on enhanced durability, breathability, and weather resistance. These advancements are also prioritizing lightweight properties, making gear more comfortable and efficient for users. For instance, the global advanced materials market was valued at approximately $230 billion in 2023 and is projected to grow significantly.

Cutting-edge features like moisture-wicking fabrics and integrated temperature regulation are rapidly becoming standard. These technologies are crucial for improving user performance, especially in challenging environmental conditions, by managing comfort and preventing overheating or chilling. The market for technical textiles, which includes these advanced fabrics, is expected to reach over $250 billion by 2028.

The retail sector is undergoing a massive digital overhaul, with companies pouring billions into AI and AR/VR technologies. For instance, in 2024, global retail AI spending was projected to reach over $10 billion, aiming to create highly personalized shopping journeys and smoother online transactions. This digital shift means online platforms are now central to how consumers find, compare, and buy products, forcing brands to carefully integrate their physical and digital presences.

AI and Data Analytics for Business Operations

Artificial intelligence and data analytics are revolutionizing strategic planning and business operations across industries, including the outdoor sector. Companies are leveraging AI to gain deeper insights into consumer behavior, market trends, and operational efficiencies. For instance, AI can predict demand with greater accuracy, allowing for optimized inventory levels and reduced waste. This technology is also enhancing customer service through personalized recommendations and faster issue resolution.

The impact of AI is quantifiable. By 2024, it's estimated that AI will drive significant cost savings and revenue growth for businesses. For example, in supply chain management, AI-powered predictive analytics can reduce stockouts by up to 15% and improve forecast accuracy by 10-20%. In customer service, AI chatbots can handle a substantial portion of inquiries, freeing up human agents for more complex issues and improving overall customer satisfaction scores.

- Enhanced Supply Chain Visibility: AI algorithms analyze real-time data from various points in the supply chain, identifying potential disruptions and optimizing logistics.

- Optimized Inventory Management: Predictive analytics powered by AI forecast demand more accurately, leading to reduced carrying costs and fewer instances of overstocking or stockouts.

- Improved Customer Service: AI-driven tools like chatbots and personalized recommendation engines enhance customer engagement and satisfaction.

- Data-Driven Decision Making: AI and data analytics provide actionable insights that empower businesses to make more informed strategic and operational decisions.

Enhanced Safety Features and Wearable Technology

Technological advancements are significantly boosting safety in outdoor pursuits. Wearable devices now commonly integrate GPS tracking, allowing for real-time location monitoring. Smart helmets are also emerging, equipped with impact sensors to detect falls or collisions.

These innovations are crucial for user safety, especially in remote environments. Advanced navigation applications further enhance this by providing detailed mapping and route planning, reducing the risk of getting lost. The global market for wearable technology, for instance, was projected to reach over $100 billion in 2024, highlighting the widespread adoption of these safety-enhancing devices.

- GPS Tracking: Real-time location data for users in outdoor settings.

- Impact Sensors: Integrated into gear like helmets to detect potential injuries.

- Advanced Navigation: Sophisticated apps improve route planning and reduce disorientation.

- Emergency Response: Many devices offer quick ways to alert emergency services.

Technological advancements are fundamentally reshaping the outdoor gear sector. Smart sensors and AI are being integrated into apparel for real-time biometric tracking and UV monitoring. The wearable tech market, including smart apparel, was projected to exceed $150 billion globally in 2024, demonstrating strong consumer interest and investment in these innovations.

Innovations in materials science are also key, focusing on enhanced durability, breathability, and weather resistance, alongside lightweight properties. The global advanced materials market was valued around $230 billion in 2023, with significant growth anticipated, directly benefiting the creation of more comfortable and efficient outdoor gear.

| Technology Area | 2024 Projection/Value | Impact on Outdoor Gear |

|---|---|---|

| Wearable Technology | >$150 billion (Global Market) | Biometric tracking, UV monitoring, enhanced safety features |

| Advanced Materials | ~$230 billion (Global Market, 2023) | Improved durability, breathability, weather resistance, lightweight design |

| AI in Retail | >$10 billion (Global Spending) | Personalized shopping experiences, optimized inventory |

Legal factors

Stringent safety regulations and quality standards significantly shape the design, materials, and manufacturing processes for outdoor products. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to enforce rigorous standards for camping equipment, impacting everything from tent flammability to the integrity of climbing harnesses. Companies must invest in robust testing and quality control to meet these requirements, often leading to higher production costs but also fostering consumer trust and product reliability.

The outdoor industry is navigating a landscape of escalating environmental regulations, demanding rigorous compliance with CO2 baseline designs, ambitious decarbonization targets, and stringent waste reduction mandates. Clarus, as a key player, is actively engaged in developing a net-zero transition plan, underscoring the industry's commitment to sustainability.

These legal factors directly impact operational costs and strategic planning. For instance, reporting standards for greenhouse gas emissions, such as those mandated by the SEC's proposed climate disclosure rules (though subject to ongoing review and potential changes), require significant investment in data collection and verification processes for companies like Clarus.

Labor practices and ethical sourcing laws are increasingly stringent, with many jurisdictions mandating fair wages, safe working conditions, and prohibiting child labor. For instance, the UK's Modern Slavery Act 2015 requires businesses with a turnover of over £36 million to report on steps taken to prevent modern slavery in their operations and supply chains. Failure to comply can result in significant penalties and reputational damage.

The global push for fair trade and responsible sourcing means companies must actively audit their supply chains. Reports indicate that in 2024, consumer demand for ethically sourced products continued to rise, with surveys showing over 70% of consumers are willing to pay more for goods produced under fair labor conditions. This legal and consumer pressure necessitates robust due diligence to avoid legal challenges and maintain brand integrity.

Data Privacy and Consumer Protection Laws

Data privacy and consumer protection laws are increasingly vital, especially with the surge in e-commerce and digital interactions. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) mandate stringent data handling protocols.

Companies must prioritize secure storage and processing of customer information, alongside transparent marketing strategies to build trust and avoid penalties. Non-compliance can lead to significant fines, impacting profitability and brand reputation. For instance, in 2023, the FTC reported over 1.1 million fraud reports, highlighting the importance of consumer protection measures.

- GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA allows consumers to request deletion of their personal information and opt-out of its sale.

- The global data privacy management market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly.

- Transparent marketing practices are crucial; misleading advertising can result in regulatory action and loss of consumer confidence.

Trade Regulations and Import/Export Laws

Changes in trade policies, tariffs, and import/export laws significantly impact the cost and accessibility of global sourcing and distribution for companies like Clarus. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to just 0.8% in 2023, down from 2.7% in 2022, reflecting increased protectionist measures and geopolitical tensions that can alter supply chain economics. Clarus must actively monitor and adapt to these evolving legal landscapes to maintain competitive pricing and operational efficiency.

Navigating these complex and often fluctuating legal frameworks is crucial for Clarus's international operations. The imposition of new tariffs, such as those seen in various trade disputes in recent years, can directly increase the cost of imported components or finished goods. Conversely, trade agreements can reduce barriers, opening new markets or making existing ones more profitable. Understanding these dynamics is key to strategic planning and risk management.

Key considerations for Clarus include:

- Monitoring evolving trade agreements: Keeping abreast of new or revised bilateral and multilateral trade pacts that could affect market access or import duties.

- Assessing tariff impacts: Quantifying the financial implications of current and potential tariffs on raw materials and finished products.

- Ensuring compliance with import/export regulations: Adhering to all documentation, licensing, and customs requirements in each operating jurisdiction to avoid penalties and delays.

- Adapting supply chain strategies: Reconfiguring sourcing and distribution networks in response to changes in trade policies to mitigate risks and optimize costs.

Legal frameworks governing product safety, environmental impact, and labor practices are paramount. In 2024, regulatory bodies like the CPSC continued to enforce strict safety standards for outdoor gear, impacting design and manufacturing. Furthermore, increasing environmental regulations necessitate compliance with decarbonization targets and waste reduction mandates, with companies like Clarus developing net-zero transition plans.

Data privacy laws, such as GDPR and CCPA, demand robust data handling and transparent marketing, with GDPR fines potentially reaching 4% of global turnover. Trade policies and tariffs also significantly influence global sourcing; for instance, global trade growth slowed to 0.8% in 2023, highlighting the impact of protectionist measures.

| Legal Area | 2024/2025 Relevance | Impact on Clarus |

|---|---|---|

| Product Safety | Continued stringent enforcement by CPSC | Higher production costs, enhanced consumer trust |

| Environmental Regulations | Net-zero transition plans, CO2 targets | Investment in sustainable practices, potential operational adjustments |

| Data Privacy | GDPR, CCPA compliance | Need for secure data handling, risk of significant fines |

| Trade Policy | Slowing global trade growth (0.8% in 2023) | Supply chain adaptation, monitoring tariffs and trade agreements |

Environmental factors

Consumers are increasingly seeking outdoor gear crafted from recycled, organic, or biodegradable materials, driving a significant environmental trend. This shift is compelling brands like Clarus to prioritize sustainable sourcing and manufacturing to align with evolving market expectations.

In 2024, the global sustainable apparel market was valued at over $10 billion, with a projected compound annual growth rate of 9% through 2030, indicating strong consumer preference for eco-conscious products.

The outdoor industry is increasingly embracing the circular economy, prioritizing product longevity, repair services, and robust recycling programs. This shift is driven by a growing consumer demand for sustainable practices and a desire to minimize environmental impact. For instance, Patagonia reported that its Worn Wear program facilitated the resale of over 100,000 items in 2023, diverting significant waste from landfills.

Rental and secondhand markets for outdoor gear are also experiencing substantial growth, offering consumers more affordable access to equipment while extending the lifecycle of products. This trend not only reduces the demand for new manufacturing but also fosters a culture of responsible consumption. The global secondhand apparel market is projected to reach $350 billion by 2027, with outdoor gear playing a significant role in this expansion.

Climate change is increasingly impacting business operations and supply chains. Extreme weather events, such as hurricanes and floods, are becoming more frequent and intense, causing significant disruptions. For instance, in 2024, the agricultural sector faced substantial losses due to unseasonal droughts and heavy rainfall in key producing regions, directly affecting raw material availability for food processing companies.

Rising global temperatures also present operational challenges, from increased cooling costs for data centers to reduced productivity in outdoor labor. Businesses are recognizing the need for greater resilience. Many are investing in adaptive infrastructure, like flood defenses and diversified sourcing strategies, to buffer against these environmental shifts.

The financial implications are considerable. A 2025 report indicated that companies with less resilient supply chains experienced an average of 15% higher operational costs during periods of climate-related disruption compared to their more prepared counterparts. This highlights the growing imperative for businesses to integrate climate risk management into their core strategies and operational planning.

Emissions Reduction Commitments and Decarbonization

Companies are increasingly vocal about their commitment to reducing greenhouse gas (GHG) emissions and achieving decarbonization. This trend is driven by regulatory pressures, investor expectations, and a growing awareness of climate change impacts.

Clarus Corporation exemplifies this by setting a target to slash its ISO 14064 Category 1-4 GHG emissions by 30% by the year 2030, using 2019 as its baseline. Furthermore, Clarus is actively working on a comprehensive net-zero transition plan, aiming to achieve this ambitious goal by 2050.

- Emissions Reduction Targets: Clarus aims for a 30% reduction in GHG emissions by 2030 (from 2019 baseline).

- Net-Zero Ambition: Clarus is developing a net-zero transition plan by 2050.

- Scope of Emissions: Targets cover ISO 14064 Category 1-4 GHG emissions.

Growth of Ecotourism and Outdoor Conservation

The surging interest in ecotourism and a heightened public awareness of nature's value are fueling demand for outdoor pursuits and related goods. This trend simultaneously underscores the critical need for robust environmental conservation efforts. For instance, the global ecotourism market was valued at approximately $181.3 billion in 2023 and is projected to reach $331.6 billion by 2030, demonstrating significant growth.

This evolving consumer sentiment creates a favorable environment for companies that actively minimize their ecological footprint and champion responsible recreational practices. Brands aligning with these values are poised to capture a larger market share. A 2024 survey indicated that over 70% of travelers consider sustainability when booking trips, a clear indicator of this shift.

- Ecotourism Market Growth: Projected to expand significantly, reflecting increased demand for nature-based travel.

- Consumer Sustainability Focus: A majority of travelers now prioritize eco-friendly options.

- Brand Alignment: Companies emphasizing environmental responsibility are likely to see increased consumer preference.

- Conservation Investment: The growth in ecotourism can translate into greater investment in conservation initiatives.

Environmental factors are increasingly shaping consumer choices and business strategies in the outdoor industry. Consumers are actively seeking sustainable products, driving growth in markets for recycled materials and secondhand gear.

Climate change presents tangible risks, impacting supply chains and operational costs through extreme weather events. Businesses are responding by investing in resilience and setting ambitious emissions reduction targets.

The rise of ecotourism highlights a growing consumer appreciation for nature, creating opportunities for companies that prioritize conservation and responsible practices.

| Trend | 2024/2025 Data Point | Implication for Clarus |

|---|---|---|

| Sustainable Materials Demand | Global sustainable apparel market > $10 billion in 2024 | Opportunity to leverage eco-friendly product lines |

| Circular Economy Adoption | Patagonia's Worn Wear resold > 100,000 items in 2023 | Potential for expanded repair and resale programs |

| Climate Change Impact | 15% higher operational costs for less resilient supply chains (2025 report) | Need for robust climate risk management and diversified sourcing |

| Emissions Reduction | Clarus targets 30% GHG reduction by 2030 (from 2019) | Focus on operational efficiency and decarbonization strategies |

| Ecotourism Growth | Global ecotourism market ~$181.3 billion in 2023 | Increased demand for outdoor gear and experiences |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including international organizations like the IMF and World Bank, government statistical agencies, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.