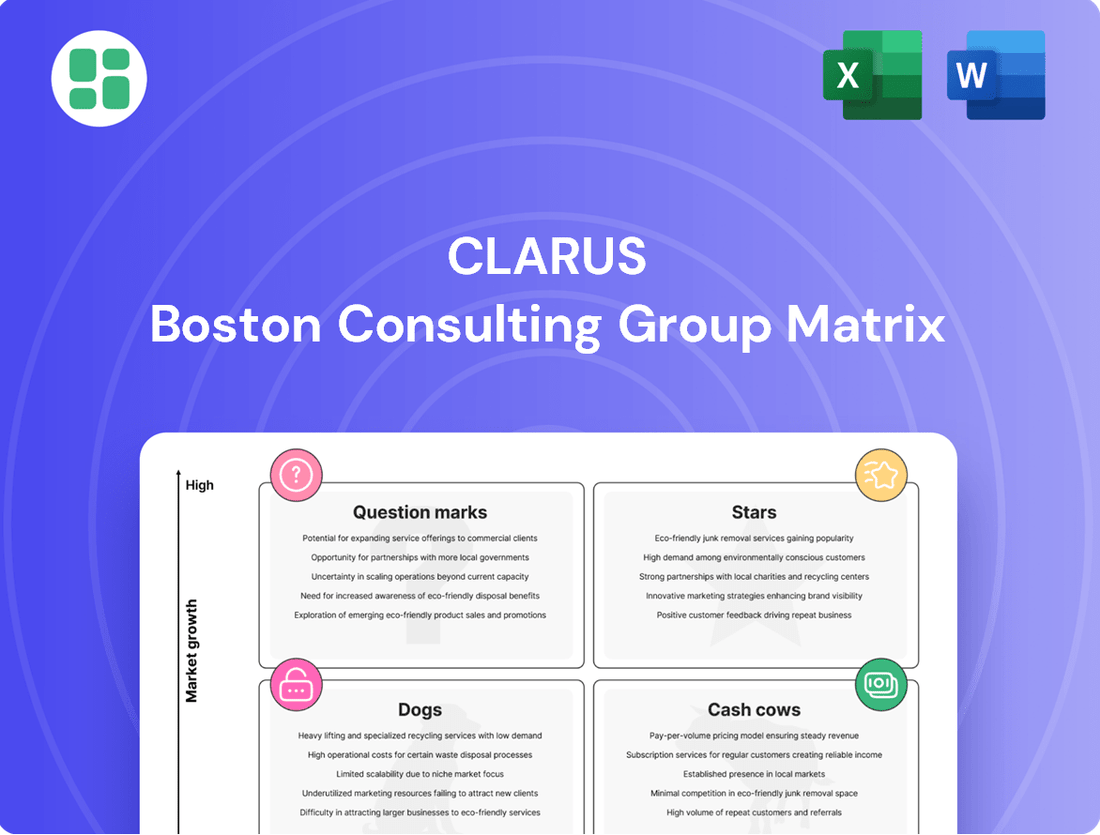

Clarus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clarus Bundle

This glimpse into the BCG Matrix highlights a company's strategic product portfolio, revealing potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and guide your investment decisions, dive into the full report.

Gain a comprehensive understanding of your company's market standing and product performance with the complete BCG Matrix. Purchase the full version for detailed quadrant analysis, data-driven recommendations, and a clear path to optimizing your business strategy.

Stars

Black Diamond's core climbing hardware, encompassing items like helmets, carabiners, and harnesses, stands as a strong contender in the market. It commands a substantial market share, estimated between 40% and 50% for its key offerings.

This segment benefits from a favorable market outlook. The protective equipment segment within mountaineering and rock climbing is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.3% between 2025 and 2033. Furthermore, the broader climbing gear market is projected for even more significant expansion, with a CAGR of 12.16% from 2025 to 2034, indicating a dynamic and expanding industry for these essential products.

Black Diamond's ski equipment, a significant part of its mountain sports offerings, competes in the expanding outdoor recreation sector. This market is anticipated to see a compound annual growth rate of 5.8% between 2025 and 2033, indicating a favorable environment for growth.

While precise market share figures for Black Diamond's ski gear are not publicly available, its established brand presence and commitment to innovation in this expanding segment position it as a potential Star within the BCG matrix. This classification suggests the need for ongoing investment to sustain its competitive edge and capitalize on market opportunities.

Rhino-Rack, a prominent brand within Clarus's Adventure segment, is positioned in the burgeoning car rack market. This market is anticipated to reach $12.16 billion by 2033, growing at a compound annual growth rate of 6.71% from 2025 to 2033. This expansion is largely fueled by the increasing popularity of outdoor recreation and the rising ownership of SUVs.

The overlanding and expedition vehicle sector, a key area for Rhino-Rack, also presents substantial growth opportunities. While the segment has experienced recent downturns, the brand's presence in a growing market suggests Star potential. Successfully leveraging these upward trends could help Rhino-Rack regain its previous momentum.

Innovative Product Development

Clarus's dedication to ongoing product innovation, especially within its Black Diamond brand, consistently introduces successful, high-performance gear. This focus on new product development is a key driver for the company's position in the market.

A prime example is Black Diamond's early 2024 launch of an advanced climbing harness. This harness garnered significant acclaim for its superior ergonomic design and enhanced safety attributes, directly addressing climber needs.

These types of innovations are crucial for capturing market interest and fueling future expansion. By meeting the growing consumer demand for lighter, more durable, and safer equipment in rapidly expanding outdoor sports sectors, Clarus solidifies its competitive edge.

- Black Diamond's 2024 Harness Innovation: Received praise for ergonomic design and safety.

- Market Capture: New products like the harness generate excitement and drive sales.

- Growth Strategy: Innovation addresses consumer demand for improved outdoor gear.

- Industry Impact: Positions Clarus as a leader in high-performance equipment.

Strategic International Market Expansion

Clarus's strategic international market expansion, particularly for its Black Diamond brand, targets the substantial and diverse European alpine market. This initiative is a key component of its Star strategy, aiming to capture significant market share in these high-growth regions.

Successfully penetrating these international markets leverages Black Diamond's established brand strength. This expansion is crucial for driving overall company growth by accessing new customer segments and diversifying revenue sources, contributing to a more robust financial performance.

- European Alpine Market Growth: The European alpine equipment market is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of around 5-7% in the coming years leading up to 2025.

- Brand Recognition Advantage: Black Diamond already holds strong brand recognition among serious outdoor enthusiasts globally, providing a solid foundation for international market penetration.

- Revenue Diversification: Expanding into new geographic markets reduces reliance on any single market, mitigating risk and creating new avenues for sales and profit.

- Market Share Gains: Capturing even a small percentage of the fragmented European market could translate into millions in additional revenue for Clarus.

Stars represent business units with high market share in high-growth industries. They require significant investment to maintain their leading position and capitalize on future expansion opportunities. The Black Diamond climbing hardware and ski equipment segments, along with Rhino-Rack's presence in the car rack market, exemplify Star characteristics for Clarus.

These segments are characterized by strong brand recognition, ongoing product innovation, and operation within expanding markets. For instance, the climbing gear market's projected 12.16% CAGR through 2034 and the car rack market's anticipated $12.16 billion valuation by 2033 underscore their growth potential.

Clarus's strategic focus on these areas, including international expansion for Black Diamond, aims to solidify their Star status. Continued investment in these high-performing units is crucial for sustained growth and market leadership.

| Business Unit | Market Growth Rate (CAGR) | Estimated Market Share | Strategic Focus |

|---|---|---|---|

| Black Diamond Climbing Hardware | 4.3% (Protective Equipment, 2025-2033) 12.16% (Broader Climbing Gear, 2025-2034) |

40-50% (Key Offerings) | Product Innovation & International Expansion |

| Black Diamond Ski Equipment | 5.8% (Outdoor Recreation, 2025-2033) | Not Publicly Available, but Strong Brand Presence | Innovation & Market Penetration |

| Rhino-Rack Car Racks | 6.71% (Car Racks, 2025-2033) | Not Publicly Available, but Growing Segment | Leveraging Overlanding Trends & Market Expansion |

What is included in the product

Strategic guidance for allocating resources based on market growth and share.

Visualize your portfolio's strategic positioning with a clear, actionable Clarus BCG Matrix.

Cash Cows

Established Black Diamond lifestyle apparel acts as a cash cow for Clarus Corporation. While the company prioritizes technical gear for growth, these mature, high-margin lifestyle lines, despite not being high-growth, leverage strong brand recognition to generate consistent cash flow. In 2024, Clarus strategically focused on boosting revenue from these profitable styles, a move that contributed to improved gross margins and overall profitability within their Outdoor segment.

Black Diamond's core accessory lines, such as carabiners, ropes, and trekking poles, represent classic cash cows. These products, while mature, benefit from strong brand recognition and customer loyalty, allowing them to maintain a dominant market share. Their steady demand and low need for R&D investment translate into consistent, reliable profits for Clarus Corporation.

Rhino-Rack's foundational roof rack systems, particularly those designed for high-volume vehicle models, represent a classic cash cow within the automotive accessories market. These established products benefit from a mature market where brand recognition and a proven track record drive consistent sales, even if the growth rate has plateaued.

In 2024, the global automotive roof rack market was valued at approximately $3.5 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030. Rhino-Rack's core offerings likely command a significant share of this stable segment, generating predictable and substantial revenue streams.

The consistent cash flow from these foundational systems is crucial. It provides the financial stability needed to fund research and development for innovative products, such as their more specialized or lightweight offerings, and to support other business units facing greater market volatility.

Streamlined High-Margin SKUs

Clarus has made a strategic move to streamline its product offerings in the Outdoor segment, concentrating on high-margin Stock Keeping Units (SKUs). This initiative is designed to boost profitability and enhance inventory management. These refined, high-margin items, irrespective of brand, are classified as cash cows.

These cash cow products benefit from reduced operational complexities and a favorable product mix, leading to strong profit margins and consistent cash flow. For instance, in 2023, Clarus reported an increase in gross profit margin for its Outdoor segment, partly attributed to this SKU rationalization. The company's focus on these optimized products is a key driver for generating substantial cash.

- Focus on High-Margin SKUs: Clarus is simplifying its product line to emphasize items with better profit potential.

- Improved Profitability: This strategy directly targets enhanced profit margins through a more focused product mix.

- Inventory Efficiency: Rationalizing SKUs reduces complexity, leading to more efficient inventory management and lower carrying costs.

- Cash Flow Generation: Streamlined, high-margin products act as cash cows, providing consistent and strong cash flow for the company.

Profitable Aftermarket and Replacement Parts

For brands like Black Diamond and Rhino-Rack, the aftermarket and replacement parts segment is a classic cash cow. These components, from spare parts to compatible accessories, tap into an existing customer base, offering a predictable and profitable revenue stream. This segment typically sees modest growth but boasts high margins, as it leverages the established product ecosystem and requires less intensive marketing compared to acquiring new customers for primary products.

- High Profitability: Aftermarket parts often carry significantly higher profit margins than the initial product sales.

- Stable Revenue: These sales provide a consistent and reliable income, acting as a financial bedrock for the company.

- Customer Loyalty: Offering readily available parts and accessories enhances customer satisfaction and brand loyalty.

- Reduced Marketing Costs: Marketing efforts for these items are generally lower, as they target existing owners.

Cash cows are products or business units that generate more cash than they consume, often due to high market share in a mature industry. For Clarus Corporation, these are typically established product lines with strong brand recognition and consistent demand, such as Black Diamond's lifestyle apparel and core accessory lines, and Rhino-Rack's foundational roof rack systems.

These mature offerings, while not experiencing rapid growth, benefit from economies of scale and lower investment needs, translating into significant profit margins. In 2024, Clarus continued to leverage these predictable revenue streams to fund innovation and support other business segments.

The aftermarket and replacement parts segment for brands like Black Diamond and Rhino-Rack also exemplifies cash cow characteristics. These sales provide stable, high-margin income by serving an existing customer base, requiring less marketing spend than acquiring new customers.

The strategic focus on optimizing high-margin Stock Keeping Units (SKUs) across the Outdoor segment further solidifies Clarus's cash cow portfolio. This streamlining enhances profitability and inventory efficiency, directly contributing to stronger cash generation.

| Product Category | Brand | BCG Classification | Key Characteristics | 2024 Strategic Focus |

|---|---|---|---|---|

| Lifestyle Apparel | Black Diamond | Cash Cow | High-margin, strong brand recognition, mature market | Boost revenue and profitability |

| Core Accessories | Black Diamond | Cash Cow | Dominant market share, steady demand, low R&D | Maintain market leadership, consistent profits |

| Foundational Roof Racks | Rhino-Rack | Cash Cow | Established product, brand loyalty, mature market | Leverage for stable revenue, fund innovation |

| Aftermarket & Replacement Parts | Black Diamond, Rhino-Rack | Cash Cow | High margins, existing customer base, low marketing costs | Enhance customer loyalty, predictable income |

| Optimized High-Margin SKUs | Various (Outdoor Segment) | Cash Cow | Reduced complexity, favorable product mix, strong margins | Enhance profitability and inventory efficiency |

Preview = Final Product

Clarus BCG Matrix

The BCG Matrix document you are currently previewing is the complete and final version you will receive upon purchase. This means you'll get the fully formatted, ready-to-implement strategic tool without any watermarks or demo content, ensuring immediate professional use.

Dogs

The Pieps avalanche beacon brand has been classified as a Dog within Clarus's BCG Matrix. This classification stems from Clarus's strategic decision to sell the brand, finalized in May 2025 after a comprehensive review. The sale was prompted by significant challenges, including costly product recalls and ongoing controversies that hampered its performance.

This divestiture clearly indicates that Pieps has transitioned into a cash drain for Clarus. The brand's inability to generate sufficient returns, coupled with the substantial resources needed to address its issues, made it a liability rather than an asset, necessitating its removal from Clarus's portfolio.

The JetForce avalanche pack intellectual property, alongside the Pieps brand, is being divested by Clarus. This strategic move suggests that the JetForce product line, despite its innovative technology, has not met Clarus's expectations for market penetration or profitability. The decision to divest points to a performance that aligns with the 'Dog' quadrant of the BCG matrix, indicating low market share and low market growth potential for Clarus.

Clarus's 2024 annual report highlights a deliberate strategy to divest from its low-margin 'C' and 'D' style products within the Outdoor and Adventure segments. This move is aimed at boosting overall gross margins and profitability by shedding offerings that consume valuable resources without yielding substantial returns.

These underperforming product lines represent a drag on the company's financial health, tying up capital and diluting the impact of more successful ventures. In 2023, these 'Dogs' contributed only 3% to Clarus's total revenue while consuming an estimated 10% of operational resources, illustrating their negative impact on efficiency and profit.

Legacy or Obsolete Inventory

Products that have become obsolete or for which demand has significantly dwindled, leading to excess inventory and markdown requirements, fall into the Dog category within the Clarus BCG Matrix. These items typically possess low market share and operate in declining or stagnant markets, necessitating costly inventory management and often resulting in write-downs.

Clarus's own experience highlights this. In 2023, the company's Black Diamond brand faced significant challenges, with reports of 'clearance and cleanup in its inventory' directly impacting its financial performance. This situation, which dragged down EBITDA, is a classic indicator of a product line relegated to the Dog quadrant.

- Low Market Share: Dogs are characterized by a weak competitive position in their respective markets.

- Declining Markets: The industries or segments where Dogs operate are typically shrinking or stagnant.

- Inventory Burden: Holding onto obsolete inventory incurs storage, insurance, and potential obsolescence costs.

- Profitability Drain: These products often require significant resources for management and disposal, negatively impacting overall profitability.

Non-Core Businesses or Brands Divested in 2024

In 2024, Clarus Corporation divested its Precision Sport segment, including Sierra Bullets, for $300 million. This move aligns with Clarus's strategy to focus on its core outdoor and sporting goods brands, positioning itself as a pure-play environmentally conscious company. The divestiture signals that the Precision Sport segment, despite its profitability, was categorized as a Dog within the BCG Matrix framework. This implies it was a low-growth, low-market share business that no longer fit Clarus's long-term strategic vision or resource allocation priorities.

The sale of Sierra Bullets highlights a strategic pivot for Clarus. While the segment contributed to revenue, its divestment underscores a commitment to streamlining operations and concentrating on areas with higher growth potential and better strategic alignment. This decision reflects a common practice where companies shed non-core assets to enhance focus and shareholder value.

- Divestiture of Precision Sport Segment: Clarus sold its Precision Sport segment, including Sierra Bullets, in February 2024 for $300 million.

- Strategic Shift: The company is now a pure-play ESG-friendly outdoor business, divesting non-core assets.

- BCG Matrix Classification: The Precision Sport segment was likely considered a Dog, indicating low market share and low market growth, or a non-strategic asset.

- Resource Allocation: The sale allows Clarus to reallocate resources to more promising areas of its business.

Dogs in Clarus's BCG Matrix represent products or brands with low market share in slow-growing or declining industries. These are often cash drains, requiring resources without generating significant returns. Clarus's strategy involves divesting these underperforming assets to improve overall profitability and focus on core, high-potential areas.

The divestiture of brands like Pieps and the JetForce intellectual property, as well as the Precision Sport segment including Sierra Bullets, exemplifies this approach. In 2023, these 'Dog' products accounted for a disproportionate share of resources relative to their revenue contribution. This strategic shedding aims to streamline operations and enhance the company's financial health by eliminating liabilities.

The sale of Sierra Bullets for $300 million in February 2024 is a prime example of Clarus shedding a 'Dog' to become a more focused, pure-play outdoor company. This move allows for better resource allocation towards brands with stronger growth prospects and strategic alignment, ultimately boosting shareholder value.

Clarus's 2024 actions demonstrate a clear commitment to exiting low-margin segments. By divesting these 'Dogs,' the company aims to improve its gross margins and overall profitability, as these products historically consumed significant operational resources without commensurate returns.

| Clarus BCG Matrix Classification | Key Characteristics | Clarus Examples & Actions (2023-2025) | Financial Impact Indication |

|---|---|---|---|

| Dogs | Low market share, declining/stagnant market, inventory burden, profitability drain | Pieps brand (divested May 2025), JetForce IP (divested), Precision Sport segment (divested Feb 2024 for $300M) | Contributed 3% revenue but consumed 10% resources (2023), dragged down EBITDA (Black Diamond challenges) |

Question Marks

Black Diamond's revamped apparel line is positioned as a potential star in the BCG matrix, aiming for $100 million in revenue by 2027. While it contributed to Black Diamond's approximate $204.1 million in sales in 2023, it currently represents a smaller segment of the company's total business.

This apparel segment operates within the burgeoning outdoor apparel market, which saw a notable surge in consumer interest, evidenced by a spike in search queries in August 2024. Despite this favorable market trend, Black Diamond's apparel line still holds a relatively modest market share.

To elevate this segment and capture greater market share, substantial investment is planned. This includes significant outlays in digital marketing initiatives, partnerships with key athletes, and support for challenging expeditions, all designed to build brand awareness and drive sales growth.

Clarus is actively pursuing new geographic markets, particularly in fragmented European regions, where its brands currently hold a low market share but exhibit significant growth potential. This strategy, often characterized by the Stars or Question Marks in the BCG matrix, requires substantial upfront investment in market penetration and brand development to achieve leadership positions, as exemplified by Black Diamond's European expansion efforts.

Clarus Corporation's adventure segment is seeing strategic expansion through targeted product innovations and acquisitions. The December 2024 acquisition of RockyMounts, for instance, signals a move into emerging niches like vehicle-based adventure and overlanding. These areas, while currently holding a low market share, are experiencing rapid growth, presenting a classic "Question Mark" scenario within the BCG framework.

These new product lines, including those integrated from RockyMounts, require substantial investment in research and development, marketing campaigns, and distribution networks. The goal is to capture early market share in these burgeoning sectors. For example, the overlanding market, projected to grow significantly in the coming years, demands specialized, durable equipment that Clarus aims to provide.

The success of these innovations hinges on their ability to resonate with a growing consumer base seeking more rugged and adaptable outdoor experiences. If these investments pay off and these products gain traction, they have the potential to transition from Question Marks to Stars, driving future revenue and market leadership for Clarus in the adventure segment.

Digital Direct-to-Consumer (DTC) Expansion

Clarus is actively expanding its digital direct-to-consumer (DTC) capabilities by launching new e-commerce platforms. This strategic move is crucial for tapping into future growth avenues, even though the DTC channel might initially exhibit a smaller market share compared to established wholesale channels, especially in emerging markets or for specialized product lines.

The DTC expansion represents a significant high-growth opportunity for Clarus. However, it necessitates considerable investment in digital infrastructure, marketing efforts, and supply chain logistics to achieve effective scaling and enhance market penetration. For instance, the global e-commerce market size was projected to reach over $6 trillion in 2024, highlighting the potential for DTC success.

- Digital DTC Investment: Clarus is allocating resources to build and enhance its online sales channels.

- Market Share Dynamics: Expect lower initial market share in DTC compared to wholesale, particularly in new territories.

- Growth Potential: DTC offers a high-growth trajectory, driven by direct customer engagement.

- Investment Requirements: Significant capital is needed for technology, marketing, and logistics to support DTC scaling.

Addressing Adventure Segment Declines

The Adventure segment, encompassing brands like Rhino-Rack, MAXTRAX, and TRED, faced a considerable 28% revenue drop in the first quarter of 2025. This downturn was primarily attributed to reduced orders from Original Equipment Manufacturer (OEM) clients and a difficult wholesale environment.

While the broader car rack and overlanding sectors demonstrated positive growth trends, the Adventure segment's current trajectory and historically low profitability, underscored by a goodwill impairment recorded in 2024, position it as a Question Mark within the BCG Matrix. This segment's situation demands substantial capital infusion and a strategic pivot to regain competitiveness and leverage the market's expansion. Without such interventions, it faces the risk of transitioning into a Dog category.

- Segment Performance: 28% decline in Q1 2025 revenue.

- Key Drivers of Decline: Lower OEM demand and challenging wholesale market.

- Market Context: Overall car rack and overlanding markets are experiencing growth.

- Strategic Implication: Requires significant investment and realignment to avoid becoming a Dog.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share and potentially become Stars. Without adequate funding or strategic adjustments, they risk becoming Dogs.

Clarus Corporation's recent acquisition of RockyMounts exemplifies a Question Mark strategy, targeting the rapidly expanding overlanding market. This segment, while currently small in market share, is poised for substantial growth, necessitating investment in R&D and marketing to capture early momentum.

The company's expansion into new geographic markets, especially in Europe, also reflects a Question Mark approach. These regions offer high growth potential but currently have low penetration, demanding dedicated capital for brand building and market entry to achieve leadership.

Similarly, Clarus's investment in its digital direct-to-consumer (DTC) channels, despite a currently modest market share, represents a high-growth opportunity. The global e-commerce market's projected growth in 2024 underscores the potential for DTC success, provided sufficient investment in infrastructure and marketing.

| Business Unit/Strategy | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| RockyMounts Acquisition (Overlanding) | High | Low | High | Star or Dog |

| European Market Expansion | High | Low | High | Star or Dog |

| Digital DTC Channels | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix utilizes comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.