Clarus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clarus Bundle

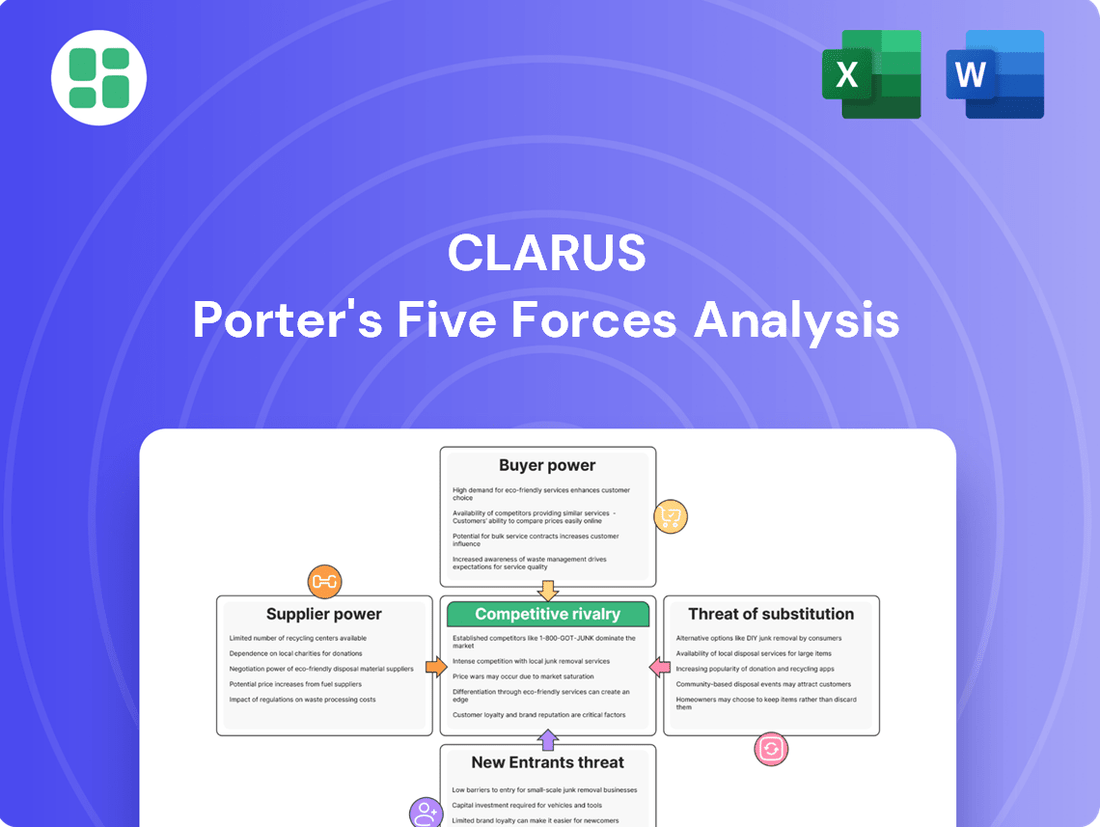

Porter's Five Forces Analysis provides a crucial framework for understanding the competitive landscape of any industry, including Clarus's market. By dissecting buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, we gain a clear picture of the forces shaping profitability and strategic positioning.

The complete report reveals the real forces shaping Clarus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Clarus Corporation is significantly shaped by the concentration of those providing specialized inputs. For instance, if Clarus relies on a limited number of suppliers for advanced fabrics crucial to its Black Diamond climbing gear or unique metal alloys for Rhino-Rack vehicle accessories, these suppliers gain considerable leverage. This is particularly true when these specialized materials are not easily substitutable.

In 2023, the global specialty fabrics market, a key input for outdoor apparel and gear, was valued at approximately $25 billion, with a compound annual growth rate projected to be around 5.5% through 2028. A concentrated supplier base within this niche could exert substantial pricing power over Clarus if alternative material sourcing is difficult or costly to develop.

Clarus can mitigate this supplier power by actively seeking out multiple vendors for critical components or investing in research and development to create or source alternative materials. Diversifying its supplier base, even for specialized items, reduces dependence on any single provider and strengthens Clarus's negotiating position.

For Clarus, high switching costs for critical components, such as specialized materials or proprietary electronic modules, would significantly bolster supplier bargaining power. Imagine if Clarus relied on a unique alloy for its premium ski poles; forcing a change would necessitate extensive retooling and product redesign, making it costly and time-consuming to switch providers. This integration means suppliers of such specialized items can command higher prices, as Clarus would face substantial disruption and expense if they sought an alternative.

If suppliers, particularly those providing specialized components or finished accessories, could credibly threaten to enter Clarus's outdoor equipment or vehicle accessory markets directly, their bargaining power would significantly increase. This would allow them to bypass Clarus and capture more of the value chain, potentially offering their own branded products to consumers or retailers.

For instance, a supplier of high-performance tent fabrics or advanced GPS modules might leverage their technical expertise and existing manufacturing capabilities to produce their own line of outdoor gear. While this threat is less pronounced for suppliers of basic raw materials like cotton or plastic pellets, it becomes more relevant for those who have developed strong brand recognition or possess established distribution networks, enabling them to reach end-customers more effectively.

Importance of Supplier's Input to Clarus's Product Differentiation

Suppliers of critical, innovative, or patented components significantly bolster Clarus's product differentiation, particularly for brands like Black Diamond. These suppliers enable Clarus to offer superior performance, enhanced safety features, and distinctive designs, directly impacting market appeal and competitive advantage.

Clarus's commitment to a 'best-in-class' reputation hinges on the consistent delivery of high-quality materials. Consequently, suppliers who can reliably provide advanced and superior inputs are invaluable, wielding considerable bargaining power due to their essential role in maintaining product integrity and brand perception.

- Supplier Dependence: Clarus's reliance on specialized materials for its premium outdoor gear means suppliers of these unique inputs have substantial leverage.

- Innovation Contribution: Suppliers who contribute innovative materials or manufacturing processes that enhance product performance or safety gain significant power.

- Quality Assurance: The need for consistent, high-quality inputs to uphold Clarus's brand image empowers suppliers who meet these stringent standards.

- Limited Alternatives: If few suppliers can provide the specific, high-performance components Clarus requires, their bargaining power increases substantially.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier bargaining power. If Clarus can readily source alternative raw materials or components from different sectors, or even develop the capability for in-house production, its reliance on any single supplier diminishes. For instance, if Clarus currently uses a proprietary alloy for its advanced electronics, but a more common, readily available metal can be substituted with only a minor impact on performance, the supplier of the proprietary alloy loses leverage. In 2023, the automotive industry saw a notable shift as manufacturers explored alternative materials for components like battery casings, moving away from specialized plastics towards more abundant composites, thereby reducing their dependence on specific petrochemical suppliers.

This ability to substitute or self-produce is a powerful countermeasure against supplier price hikes or unfavorable terms. Consider Clarus’s potential to develop internal manufacturing for certain key components. If a supplier attempts to increase prices for a specialized semiconductor, Clarus’s investment in developing its own chip fabrication capabilities, even on a smaller scale, would provide a strong bargaining chip or an alternative path. For example, in the semiconductor industry, companies like Intel have historically pursued vertical integration, producing their own chips, which grants them greater control over supply chains and reduces their vulnerability to external foundries. This strategy was particularly evident as global chip shortages persisted through 2022 and into 2023, highlighting the strategic advantage of in-house capabilities.

- Reduced Supplier Dependence: The presence of viable alternatives or in-house production options directly weakens a supplier's ability to dictate terms.

- Cost Control: Clarus can leverage substitute inputs to manage raw material costs, especially when facing price increases from existing suppliers.

- Supply Chain Resilience: Diversifying input sources or having in-house capacity enhances Clarus's ability to weather supply disruptions.

The bargaining power of suppliers for Clarus Corporation is influenced by how concentrated their supplier base is for critical inputs. If Clarus relies on a few providers for specialized materials, like advanced fabrics for Black Diamond gear or unique alloys for Rhino-Rack, these suppliers gain leverage, especially when substitutes are scarce. For example, the global market for high-performance outdoor textiles, a key input for Clarus, was valued at over $25 billion in 2023, and a concentrated supplier base within this niche allows for significant pricing power.

High switching costs for essential components also empower suppliers. If Clarus faces substantial disruption and expense in finding new providers for specialized items, such as a unique metal for premium ski poles, suppliers can command higher prices. This integration means suppliers of specialized items can leverage Clarus's dependence to their advantage.

Suppliers who can credibly threaten to enter Clarus's markets directly, offering their own branded products, also increase their bargaining power. This is more relevant for suppliers with established brand recognition or distribution networks, enabling them to bypass Clarus and capture more value.

The availability of substitute inputs significantly weakens supplier power. If Clarus can easily source alternative materials or develop in-house production capabilities, its reliance on specific suppliers diminishes. For instance, if a more common metal can replace a proprietary alloy in electronics with minimal performance impact, the proprietary alloy supplier loses leverage. The automotive industry's 2023 exploration of alternative materials for components, moving from specialized plastics to composites, reduced dependence on specific petrochemical suppliers.

| Factor | Impact on Clarus | Example |

|---|---|---|

| Supplier Concentration | High power for few suppliers | Reliance on specialized fabrics for Black Diamond gear |

| Switching Costs | High power for suppliers | Costly retooling for unique metal alloys in Rhino-Rack |

| Threat of Forward Integration | Increased power for suppliers | Tent fabric suppliers entering the outdoor gear market |

| Availability of Substitutes | Reduced power for suppliers | Using common metals instead of proprietary alloys in electronics |

What is included in the product

Clarus Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of Clarus's industry, detailing the power of buyers, suppliers, new entrants, substitutes, and existing rivals.

Instantly identify and mitigate threats by visualizing competitive intensity with a dynamic industry landscape map.

Customers Bargaining Power

Clarus's customers, from wholesale retailers to end-consumers, exhibit a notable price sensitivity. This means they are quite attuned to the cost of goods, and if prices rise too high, they'll actively look for cheaper alternatives. For instance, in 2024, with persistent inflation impacting consumer budgets, many markets saw an increase in demand for value-oriented products, a trend that directly pressures brands like Clarus to maintain competitive pricing.

If Clarus relies heavily on a few major retailers, like large outdoor chains or significant automotive distributors, these key customers gain considerable leverage. Their substantial order volumes mean they can negotiate for lower prices, more favorable payment schedules, or increased marketing assistance, directly impacting Clarus's profitability.

Customers wield significant power when a plethora of substitute outdoor equipment and lifestyle products exist from rival companies. These alternatives often mirror Clarus's offerings in terms of functionality, quality, or even brand desirability, providing consumers with ample choices.

For instance, in the climbing gear market, a customer dissatisfied with Clarus's pricing or innovation can readily shift to brands like Black Diamond or Petzl, which offer comparable products. This ease of switching amplifies customer bargaining power, forcing Clarus to remain competitive.

The outdoor recreation market in 2024 saw continued growth, with the global market for sporting goods projected to reach over $200 billion. This expansion fuels the availability of substitutes, as new entrants and established players alike vie for market share, further empowering consumers.

Buyer's Switching Costs

Buyer's switching costs are a crucial element in understanding the bargaining power of customers. When it's easy and inexpensive for customers to switch from Clarus's products to those of a competitor, their power to negotiate better terms significantly increases. This is because Clarus would have to work harder to retain them.

For example, if a consumer can readily purchase a comparable climbing harness or roof rack from another brand without facing significant inconvenience or incurring substantial costs, their leverage to demand better prices or terms from Clarus rises. This low barrier to switching essentially means Clarus faces constant pressure to offer competitive value.

- Low Switching Costs: Customers can easily shift to competitors if Clarus's offerings become less attractive.

- Increased Customer Power: This ease of switching empowers customers to demand better pricing and terms.

- Competitive Pressure: Clarus must remain competitive in pricing and product quality to retain customers.

- Example Scenario: A consumer easily finding an alternative climbing harness without hassle or extra expense highlights this dynamic.

Threat of Backward Integration by Customers

Customers, particularly large retailers, possess the potential to integrate backward by developing their own private-label outdoor equipment or vehicle accessories. This strategy would allow them to bypass Clarus, directly impacting sales. For instance, a major sporting goods retailer could leverage its existing distribution channels and brand recognition to launch its own line of climbing ropes or bike racks, thereby reducing reliance on Clarus.

While the threat of backward integration is less pronounced for highly specialized or technical products where Clarus holds a competitive edge through proprietary technology or design, it becomes a more credible concern for commoditized items. For example, basic camping tents or car floor mats are more susceptible to private-labeling by large retailers, as the barriers to entry for manufacturing are lower. This leverage can translate into increased pressure on Clarus for pricing concessions or more favorable contract terms.

- Backward Integration Threat: Large retailers could launch private-label outdoor gear or vehicle accessories, bypassing Clarus.

- Impact on Specialized Products: High barriers exist for technical items like climbing gear, limiting this threat.

- Commoditized Product Risk: Basic items such as camping tents are more vulnerable to private-labeling, increasing customer leverage.

- Customer Leverage: The potential for backward integration empowers customers to negotiate better terms with Clarus.

The bargaining power of customers is a significant factor for Clarus, as buyers can easily switch to competitors if prices are too high or product offerings are not compelling. This is particularly true for less specialized items where numerous substitutes exist. For instance, in 2024, the continued expansion of the global sporting goods market, projected to exceed $200 billion, means more brands are available, increasing consumer choice and leverage.

Customers, especially large retailers, can exert considerable pressure by demanding lower prices or threatening to develop their own private-label products. This threat is more pronounced for commoditized goods like basic camping tents than for highly technical climbing gear. In 2024, with economic pressures on consumers, retailers are more inclined to seek cost savings, amplifying their negotiating power with suppliers like Clarus.

| Factor | Description | Impact on Clarus | 2024 Relevance |

|---|---|---|---|

| Price Sensitivity | Customers are highly aware of prices and will seek alternatives if costs rise. | Forces competitive pricing strategies. | Inflationary pressures in 2024 increased consumer focus on value. |

| Availability of Substitutes | Numerous competing products offer similar functionality and quality. | Reduces Clarus's pricing power and customer loyalty. | Market growth in 2024 led to more substitute options. |

| Switching Costs | Low costs and minimal inconvenience for customers to switch brands. | Empowers customers to negotiate better terms. | Easy online purchasing further reduces switching barriers. |

| Backward Integration Threat | Major retailers could create their own brands, bypassing Clarus. | Threatens sales volume, especially for commoditized products. | Retailers actively seek private-label opportunities to boost margins. |

What You See Is What You Get

Clarus Porter's Five Forces Analysis

This preview showcases the complete Clarus Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this comprehensive analysis, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The outdoor equipment and lifestyle market is quite crowded, with many companies vying for customers. This includes both big, well-known brands and smaller, specialized ones focusing on specific activities like climbing or skiing, as well as things like vehicle accessories.

For instance, brands such as Petzl, Mammut, and Arc'teryx are direct competitors in the climbing and outdoor apparel spaces. Similarly, numerous automotive accessory companies compete with Clarus's offerings in that segment. This broad range of players creates a highly competitive environment.

In 2024, the global outdoor recreation market was valued at approximately $114.4 billion, showcasing the significant size and attractiveness of this industry. This large market size naturally draws a diverse set of competitors, all aiming to capture a share of consumer spending.

While the broader outdoor recreation market has demonstrated growth, certain niches might see a more subdued expansion. This disparity can sharpen competition as businesses vie more aggressively for their slice of the market. For instance, in 2024, the outdoor market experienced a modest rebound, yet sales of equipment actually decreased. This indicates a heightened competitive landscape where companies are intensely focused on capturing existing consumer demand.

Clarus Corporation's ability to differentiate its offerings, particularly through its well-established Black Diamond brand, serves as a key bulwark against intense competitive rivalry. Innovation and a reputation for quality help foster strong brand loyalty, reducing the likelihood of customers switching based solely on price.

However, if Clarus's products were to become perceived as commodities or if its brand loyalty erodes, the competitive landscape would likely shift towards price-based competition, impacting margins. For instance, in the competitive outdoor gear market, brands that consistently invest in R&D and marketing, like Black Diamond, often command premium pricing.

High Exit Barriers

High exit barriers significantly intensify competitive rivalry. When companies face substantial costs or difficulties in leaving an industry, such as specialized, non-transferable assets or significant contractual obligations, they are often compelled to stay and compete, even in unfavorable market conditions. This can result in prolonged periods of intense competition, including price wars and elevated marketing expenditures, as firms fight to maintain their market share.

For instance, in the semiconductor manufacturing industry, the immense cost of specialized fabrication equipment, often running into billions of dollars, creates a formidable exit barrier. Companies that have invested heavily in these facilities are unlikely to cease operations easily, even if profitability declines. This dynamic can lead to aggressive pricing strategies to utilize capacity, as seen in periods of oversupply where chip prices can plummet, impacting overall industry profitability.

- Specialized Assets: High capital investment in unique machinery or facilities that have limited resale value.

- Long-Term Contracts: Commitments to suppliers or customers that are costly to break.

- Emotional Attachments: Founder or management reluctance to abandon a long-established business.

- Government or Social Restrictions: Regulations or public perception that make closure difficult or undesirable.

Strategic Stakes and Aggressiveness of Competitors

The outdoor recreation market is highly strategic for many companies, fueling intense competition. This often translates into aggressive tactics like price wars, extensive marketing blitzes, and a rapid pace of new product development. For instance, in 2024, major players like Nike and Adidas continued to heavily invest in their outdoor segments, with Nike reporting a 12% year-over-year increase in its 'Adventure' category sales for the first half of 2024. This aggressive posture means Clarus must be prepared for significant pressure on its margins and market share.

Competitors in the outdoor space are frequently willing to accept lower short-term profits to secure or defend their market standing. This can manifest as deep discounts during peak seasons or substantial R&D spending on next-generation products. In 2023, several key competitors in the performance apparel sector saw their operating margins dip by an average of 1.5% as they engaged in promotional activities to clear inventory and attract new customers, a trend expected to continue into 2024. This strategic sacrifice directly impacts Clarus’s financial results, necessitating careful cost management and differentiated product offerings.

- Aggressive Pricing: Competitors may engage in price matching or undercutting to capture market share, impacting Clarus's revenue.

- Intense Marketing: High spending on advertising and sponsorships by rivals can make it harder for Clarus to gain visibility.

- Rapid Innovation Cycles: The pressure to release new, improved products quickly can strain Clarus's R&D resources.

- Profit Sacrifice: Competitors' willingness to accept lower profits for market position creates a challenging financial environment for Clarus.

Competitive rivalry within the outdoor equipment and lifestyle market is intense, driven by a multitude of established brands and specialized niche players across various segments like climbing, skiing, and automotive accessories. This crowded landscape, valued at approximately $114.4 billion globally in 2024, forces companies to constantly innovate and differentiate. For instance, Nike's 12% year-over-year sales increase in its 'Adventure' category for the first half of 2024 highlights the aggressive marketing and product development strategies employed by major players.

Clarus's strong brand reputation, particularly with Black Diamond, is a key defense against this rivalry, enabling premium pricing. However, if this brand loyalty weakens, price-based competition could erode margins. The industry sees competitors willing to sacrifice short-term profits for market share, as evidenced by a 1.5% average dip in operating margins for performance apparel companies in 2023 due to promotional activities. This strategic profit sacrifice puts pressure on Clarus to manage costs and maintain product differentiation.

High exit barriers, such as specialized assets and long-term contracts, compel companies to remain in the market even during downturns, intensifying competition. This can lead to aggressive pricing and increased marketing spend as firms fight to retain their positions. The outdoor market experienced a modest rebound in 2024, but equipment sales decreased, indicating a heightened focus on capturing existing demand amidst fierce competition.

The competitive landscape requires Clarus to navigate aggressive pricing, extensive marketing, rapid innovation cycles, and competitors' willingness to accept lower profits for market standing. For example, in 2024, outdoor market sales showed a modest rebound, yet equipment sales declined, underscoring the intense battle for consumer spending and the need for strategic differentiation.

| Competitor Tactic | Impact on Clarus | Example (2024 Data) |

|---|---|---|

| Aggressive Pricing/Promotions | Margin erosion, reduced revenue | Performance apparel competitors saw 1.5% margin dip in 2023 due to promotions. |

| Intense Marketing & R&D | Increased costs, pressure to innovate | Nike's 'Adventure' category sales up 12% YoY (H1 2024) due to investment. |

| Profit Sacrifice for Market Share | Challenging financial environment | Competitors may accept lower profits to gain or defend market position. |

| Product Differentiation | Brand loyalty, premium pricing potential | Black Diamond's reputation helps Clarus command higher prices. |

SSubstitutes Threaten

The threat of substitutes for Clarus's outdoor adventure products is significant, particularly when these alternatives offer a similar benefit at a reduced cost or with increased convenience. For instance, indoor climbing gyms, which often require less specialized and costly gear compared to outdoor climbing, present a viable substitute for traditional rock climbing enthusiasts. Similarly, general fitness activities like running or gym workouts can serve as alternatives for individuals seeking physical exertion, potentially drawing customers away from Clarus's offerings.

Customer willingness to switch to alternative ways of meeting their outdoor or adventure needs directly impacts the threat of substitutes. For example, if consumers increasingly opt for versatile, multi-purpose gear instead of specialized equipment, this dilutes the demand for single-purpose items. In 2024, the outdoor recreation market saw a notable trend towards adaptable products, with sales of convertible clothing and modular camping systems showing strong growth.

Choosing simpler, less gear-intensive outdoor activities also represents a significant substitute. Instead of investing in expensive technical climbing gear, a consumer might opt for hiking or trail running, which require less specialized and costly equipment. This shift was evident in 2024 as participation in activities like walking and cycling saw a resurgence, often favored for their accessibility and lower barrier to entry compared to more equipment-heavy pursuits.

The threat of substitutes for Clarus Porter's premium outdoor gear is significant due to their widespread availability and accessibility. Consumers can easily find generic or budget-friendly outdoor brands, or even opt for rental services for specific equipment, which directly compete with Clarus's higher-priced, quality-focused products.

Changes in Consumer Lifestyle and Preferences

Shifts in consumer lifestyles and preferences can significantly impact the demand for specialized outdoor gear, posing a threat of substitutes. For instance, a growing preference for more accessible and less technically demanding outdoor activities could lead consumers to opt for general lifestyle apparel rather than highly specialized equipment.

This trend might see a decline in the market for niche products, as broader lifestyle brands gain traction. In 2024, the global athleisure market, a prime example of this shift, was valued at approximately $320 billion, demonstrating a substantial consumer move towards comfortable, versatile apparel that can be used for both athletic and casual purposes. This growth suggests that consumers are increasingly prioritizing comfort and everyday wearability over highly specialized performance gear.

- Shifting Recreation Trends: A move towards more casual outdoor experiences like park visits or light hiking over demanding activities like mountaineering or extreme sports.

- Rise of Athleisure: Increased consumer spending on versatile apparel that serves multiple functions, potentially cannibalizing sales of specialized outdoor clothing. In 2024, athleisure sales grew by an estimated 8% globally.

- Digital Entertainment Alternatives: Growing popularity of virtual reality, advanced gaming, and other digital forms of entertainment could divert consumer time and spending away from outdoor pursuits.

- Focus on Sustainability and Simplicity: Some consumers may opt for simpler, more sustainable outdoor experiences that require less specialized gear, favoring brands that align with these values.

Technological Advancements in Substitutes

Technological advancements are constantly reshaping the landscape of substitutes, making them more appealing and effective. For example, innovations in battery technology and electric motor efficiency have significantly improved the performance and range of electric bicycles, presenting a stronger substitute for traditional gasoline-powered motorcycles and even short-distance car trips. As of early 2024, the global electric bicycle market is projected to reach over $80 billion, indicating a substantial and growing threat to established transportation sectors.

These innovations can directly impact product attractiveness. Consider the outdoor recreation industry: advancements in lightweight, durable, and weather-resistant materials for general sporting goods can create viable substitutes for specialized, high-cost outdoor gear. Furthermore, the increasing sophistication and accessibility of virtual reality (VR) and augmented reality (AR) technologies offer immersive simulation experiences that can partially substitute for actual outdoor adventures, potentially impacting attendance at physical locations.

- Technological progress enhances the performance and appeal of substitute products.

- Material science innovations can lead to more affordable and effective alternatives in various industries, like outdoor gear.

- Digital experiences, such as VR and AR, are increasingly substituting for real-world activities, impacting sectors like tourism and recreation.

- The global electric bicycle market's projected growth to over $80 billion by 2024 highlights the tangible impact of technological substitution in transportation.

The threat of substitutes for Clarus's products is substantial, driven by accessible and often more affordable alternatives that fulfill similar needs. For example, the growing popularity of athleisure wear, valued at around $320 billion globally in 2024, directly competes with specialized outdoor apparel by offering versatility and comfort for a wider range of activities.

Furthermore, shifts towards simpler outdoor pursuits like hiking and cycling, which require less specialized gear, present a significant substitute. This trend is supported by the resurgence of these activities, indicating a consumer preference for lower-barrier-to-entry options. Technological advancements also play a role, with innovations in electric bicycles, a market projected to exceed $80 billion by 2024, offering an alternative to traditional transportation and potentially impacting the demand for some outdoor equipment.

| Substitute Category | Example | 2024 Market Impact/Trend | Clarus Product Impact |

|---|---|---|---|

| Lifestyle Apparel | Athleisure Wear | Global market valued at ~$320 billion | Potential cannibalization of specialized clothing sales |

| Simpler Outdoor Activities | Hiking, Cycling | Resurgence in participation | Reduced demand for technical gear |

| Technological Alternatives | Electric Bicycles | Market projected to exceed $80 billion | Indirect impact on transportation-related outdoor gear |

Entrants Threaten

The outdoor equipment market demands substantial upfront capital for research, development, and robust manufacturing facilities. For instance, establishing a new production line for high-performance tents or specialized climbing gear can easily run into millions of dollars, a significant hurdle for aspiring companies. This high capital requirement acts as a formidable barrier, deterring many potential new entrants from even attempting to enter the market.

Established companies, including Clarus, leverage significant economies of scale. In 2024, major outdoor gear manufacturers reported production volumes that allowed them to negotiate lower raw material costs by as much as 15-20% compared to smaller operations. This cost advantage makes it incredibly difficult for new, smaller players to match the pricing of established brands, further solidifying the threat of new entrants as moderate.

Clarus's established brands, such as Black Diamond and Rhino-Rack, enjoy substantial brand recognition and deep customer loyalty. This loyalty is a direct result of years of consistent product innovation and proven performance in demanding environments. For instance, Black Diamond's reputation for durable and reliable climbing gear is well-earned, making it a go-to choice for serious climbers.

Newcomers entering the market face a considerable hurdle in cultivating similar trust and brand equity. They must invest heavily in marketing and product development to even begin to rival the established presence of Clarus's brands. This significant barrier means that while new entrants are a potential threat, their ability to quickly gain market share is often limited by the strong emotional and practical connections consumers have with existing, trusted brands.

For new companies looking to enter the outdoor gear market, securing shelf space in established retail locations, like specialty outdoor stores or major sporting goods chains, presents a significant barrier. These channels are crucial for reaching the target audience.

Clarus Porter, with its existing network and established logistics, already possesses a strong advantage in accessing these vital distribution channels. This existing infrastructure allows them to efficiently reach consumers worldwide, a feat that would be costly and time-consuming for a newcomer to replicate.

Proprietary Product Technology and Patents

Clarus's substantial investment in the design, development, and protection of intellectual property for its specialized gear, such as climbing and avalanche safety equipment, erects a significant barrier to entry. For instance, the company holds numerous patents on its innovative airbag technology for avalanche backpacks, a key differentiator.

New companies entering this market would face considerable hurdles. They would need to allocate significant capital towards research and development to create products that are either comparable or demonstrably superior to Clarus's offerings. Crucially, they must navigate existing patents to avoid infringement, which could lead to costly legal battles or substantial licensing fees.

Consider the financial commitment: R&D spending in the outdoor equipment sector can easily reach millions of dollars annually for established players.

- High R&D Investment: New entrants must match or exceed Clarus's historical R&D expenditure to develop competitive technologies.

- Patent Portfolio: Clarus's extensive patent portfolio for critical product features necessitates either costly licensing or the development of entirely novel, non-infringing technologies.

- Product Differentiation: Without proprietary technology, new entrants struggle to differentiate their products, making it difficult to attract customers away from established, trusted brands like Clarus.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in the outdoor equipment sector. Compliance with product safety standards, environmental regulations, and international trade agreements can create substantial barriers. For instance, in 2024, companies launching new outdoor gear often face stringent testing requirements and certifications, adding considerable upfront costs and time to market entry.

These compliance costs and the need for specialized expertise can be particularly challenging for smaller, less capitalized new entrants. Navigating diverse global markets, each with its own regulatory framework, further amplifies these challenges. For example, a new entrant aiming for European markets in 2024 must understand and adhere to REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, impacting material sourcing and product design.

- Regulatory Hurdles: New outdoor equipment companies must invest in understanding and meeting safety, environmental, and import/export laws.

- Compliance Costs: Adherence to regulations like REACH or specific national safety standards can add millions to initial operating expenses.

- Market Access Barriers: Differing regulations across regions can fragment markets and increase the complexity and cost of global expansion for new players.

- Expertise Requirement: New entrants may lack the in-house knowledge or the budget to hire consultants for navigating complex legal and technical compliance.

The threat of new entrants into the outdoor equipment market is generally moderate, primarily due to significant capital requirements for R&D and manufacturing, as well as established brand loyalty. For example, in 2024, the cost of developing and launching a new line of high-performance outdoor gear often necessitates millions in upfront investment. This financial barrier, coupled with the need to build brand recognition against established players like Clarus, limits the ease with which new companies can gain traction.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial statements to provide a comprehensive understanding of competitive dynamics.