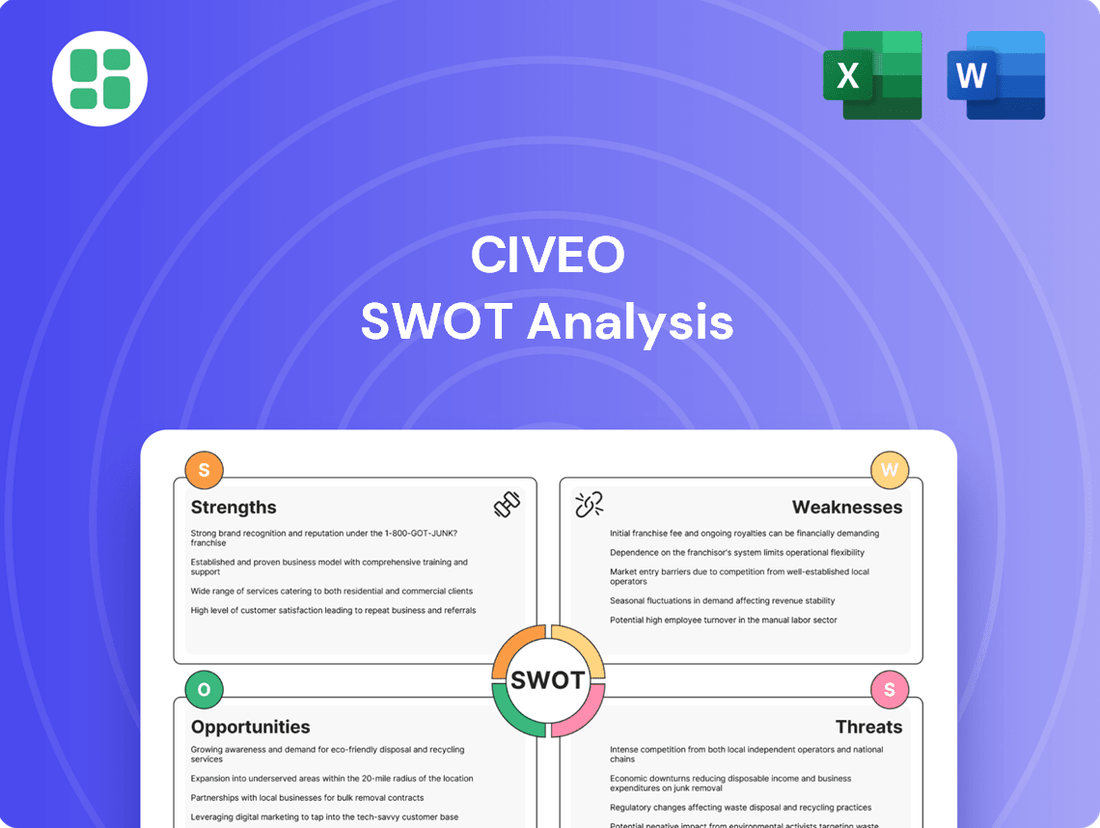

Civeo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civeo Bundle

Civeo's market position is defined by its established operational strengths in remote workforce accommodation, yet it faces challenges from evolving industry demands and competitive pressures. Understanding these dynamics is crucial for any stakeholder looking to navigate this sector.

Want to uncover the full strategic picture, including Civeo's competitive advantages and potential vulnerabilities? Purchase our complete SWOT analysis to gain actionable insights and a professionally crafted report designed to inform your investment or business strategy.

Strengths

Civeo Corporation stands as a global frontrunner in providing essential accommodation and related services to workforces, particularly within the vital natural resource sectors of Australia and North America. This strong international presence is a significant advantage, allowing them to navigate diverse economic landscapes and capitalize on opportunities across different regions.

Their operational footprint in both Australia and North America offers a crucial diversification benefit. This geographic spread helps to smooth out the impact of any single regional downturn, as demonstrated by Civeo's resilience through various commodity cycles. For instance, in the first quarter of 2024, Civeo reported revenues of $239.9 million, with a notable contribution from both its Australia and North America segments, underscoring the importance of this balanced approach.

Civeo's strength lies in its extensive offering of integrated services, extending far beyond basic accommodation. This includes essential functions like facilities management, catering, and housekeeping, as well as crucial utilities such as water and wastewater treatment and power generation.

This all-encompassing approach delivers significant value to clients operating in remote locations by providing comprehensive, end-to-end solutions. For instance, in 2023, Civeo reported that its diversified service model contributed to a robust revenue stream, with integrated service contracts often proving more resilient.

Civeo boasts a strong balance sheet, evidenced by its consistently low net leverage ratio, which stood at approximately 1.0x as of the first quarter of 2024. This indicates effective debt management and a solid financial foundation.

The company's capital allocation strategy prioritizes shareholder returns. In 2023, Civeo repurchased $50 million of its common stock, a move designed to enhance shareholder value and demonstrate financial discipline.

This prudent approach to capital management provides Civeo with significant financial flexibility. It allows for strategic investments in growth opportunities while ensuring the maintenance of a healthy balance sheet, a key strength in navigating market fluctuations.

Long-Term Contracts and Strategic Acquisitions

Civeo’s business model is significantly bolstered by its long-term contracts, especially within its Australian operations. These agreements provide a reliable foundation for revenue, offering a degree of predictability that is highly valued in the often-volatile resources sector.

Further solidifying this strength, Civeo has strategically acquired key assets. For instance, the acquisition of four villages in Australia's Bowen Basin in late 2023 significantly expanded their footprint. This move not only deepens relationships with major clients in the metallurgical coal industry but also secures substantial future revenue streams.

- Long-term contracts in Australia provide stable revenue.

- Strategic acquisitions, like the Bowen Basin villages, enhance market position.

- These acquisitions strengthen client relationships in the metallurgical coal sector.

- The company’s strategic moves are designed to secure future earnings and increase market share.

Commitment to Guest Well-being and Operational Excellence

Civeo's dedication to guest well-being and operational excellence is a significant strength. They focus on creating comfortable and productive living and working spaces for workers in remote areas. This commitment, along with a strong safety record, helps build lasting relationships with clients.

This emphasis on service quality and safety acts as a key differentiator in the competitive workforce accommodation sector. For instance, Civeo reported a total recordable incident frequency rate of 0.79 in Q1 2024, showcasing their strong safety culture. Such a consistent performance fosters client trust and supports retention.

- Guest Well-being: Providing comfortable and productive environments for remote workers.

- Operational Excellence: Ensuring efficient service delivery and high standards.

- Safety Record: Maintaining a strong safety culture, exemplified by low incident rates.

- Client Relationships: Fostering long-term partnerships through reliable service and safety.

Civeo's diversified geographic footprint across Australia and North America provides significant resilience against regional economic fluctuations. This spread was evident in Q1 2024, where revenues of $239.9 million were well-supported by contributions from both key segments, highlighting the benefit of this balanced operational approach.

The company's integrated service model, encompassing accommodation, catering, facilities management, and utilities, offers comprehensive solutions to clients in remote locations. This all-encompassing approach proved valuable in 2023, contributing to a robust revenue stream and demonstrating the resilience of diversified service contracts.

Civeo maintains a strong financial position, characterized by a low net leverage ratio of approximately 1.0x as of Q1 2024, reflecting effective debt management. This financial prudence allows for strategic investments and ensures flexibility during market shifts.

Long-term contracts, particularly in Australia, form a stable revenue base, providing predictability within the volatile resources sector. Strategic asset acquisitions, such as the four Bowen Basin villages in late 2023, further strengthen Civeo's market position and secure future earnings, especially within the metallurgical coal industry.

Civeo's commitment to guest well-being and operational excellence, underscored by a strong safety record with a total recordable incident frequency rate of 0.79 in Q1 2024, differentiates it in the competitive market and fosters client loyalty.

| Metric | Q1 2024 Value | 2023 Value |

|---|---|---|

| Total Revenue | $239.9 million | $998.5 million |

| Net Leverage Ratio | ~1.0x | ~1.1x |

| Total Recordable Incident Frequency Rate | 0.79 | 0.85 |

What is included in the product

This SWOT analysis provides a comprehensive overview of Civeo's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address Civeo's strategic challenges and opportunities, thereby alleviating pain points in planning and execution.

Weaknesses

Civeo's Canadian segment has seen a noticeable downturn, with revenue shrinking and operating losses appearing in recent quarters. This dip is largely attributed to customers in the oil sands region cutting back on spending and fewer rooms being booked.

The underperformance in Canada, a market that has traditionally been a strong performer for Civeo, highlights how sensitive the company is to economic shifts in specific regions and reductions in customer capital expenditures. For instance, in the first quarter of 2024, Civeo reported that its Canadian segment's revenue decreased by 18% year-over-year, contributing to an operating loss in that segment.

While the company is focused on improving its cost structure in Canada, the ongoing challenges in this key market present a significant weakness. This vulnerability could impact overall profitability if the trend continues without a substantial recovery in customer activity or a successful diversification of revenue streams within the region.

Civeo's operations are highly susceptible to shifts in the broader economy and fluctuations in commodity prices, especially within the oil and gas industry. This direct link means that economic slowdowns or drops in oil prices can significantly reduce demand for their workforce accommodation and related services.

The Canadian oil sands, a key market for Civeo, have faced increasing challenges. Factors like declining oil prices and investor scrutiny on environmental, social, and governance (ESG) issues have put pressure on the sector. This environment directly impacts Civeo by dampening demand for their essential services.

This inherent dependence on cyclical industries, such as oil and gas, leaves Civeo vulnerable to periods of market contraction. Downturns in these sectors can lead to reduced project activity and, consequently, a decrease in the need for the company's offerings, impacting revenue and profitability.

Civeo experienced negative operating cash flow in both Q1 and Q2 of 2025, a notable shift despite its generally positive long-term free cash flow outlook. This recent cash drain, attributed to seasonal factors and working capital adjustments, highlights short-term liquidity challenges. If this trend persists, it could indeed constrain Civeo's financial maneuverability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Civeo. The weakening of the Australian and Canadian dollars against the U.S. dollar, for instance, has directly reduced the company's reported revenues and Adjusted EBITDA. As Civeo operates globally and reports its financials in U.S. dollars, this volatility inherently diminishes the translated value of earnings generated in foreign currencies, introducing a layer of unpredictability into its financial performance.

- Impact on Reported Earnings: For example, in the first quarter of 2024, Civeo noted that unfavorable foreign exchange movements negatively impacted its results.

- Reduced Translation Value: Earnings from operations in Australia and Canada are worth less when converted back to U.S. dollars during periods of dollar strength.

- Financial Unpredictability: This currency risk makes it harder to forecast financial results accurately, as the value of international earnings can shift significantly due to market forces beyond the company's direct control.

Seasonality of Operations

Civeo's operations are significantly impacted by seasonality, particularly in Canada, leading to periods of cash outflow. For instance, in Q1 2024, the company reported a net loss, partly attributable to the slower activity during winter months in its Canadian workforce accommodation segment. This cyclical demand pattern inherently causes financial results to vary from quarter to quarter.

Managing these seasonal fluctuations is crucial for Civeo's financial stability. The company must strategically plan its capital expenditures and operational costs to mitigate the impact of lower revenue periods.

- Seasonal Demand: Workforce accommodation demand often peaks during specific construction and resource extraction seasons, leading to revenue volatility.

- Cash Consumption: Off-peak quarters, especially in colder climates like Canada, can see increased operating expenses without corresponding revenue, leading to cash consumption.

- Operational Planning: Civeo needs robust forecasting and resource allocation to navigate these predictable dips in business activity.

- Financial Performance Fluctuation: The company's quarterly earnings reports often reflect these seasonal swings, with stronger performance typically seen in warmer months.

Civeo's reliance on the oil and gas sector, particularly in Canada, exposes it to significant demand volatility. Economic downturns or reduced capital spending by clients in this industry directly translate to lower occupancy rates and revenue, as seen with the 18% year-over-year revenue decrease in its Canadian segment during Q1 2024. This sensitivity to commodity prices and industry-specific economic cycles remains a core weakness.

The company's operations are also subject to the inherent seasonality of its key markets. For instance, colder months in Canada typically lead to reduced activity and higher operating costs without commensurate revenue, contributing to negative operating cash flow in Q1 2025. This cyclical demand pattern creates financial unpredictability and requires careful management of cash flow and operational expenses during off-peak periods.

Currency fluctuations, particularly the weakening of the Australian and Canadian dollars against the U.S. dollar, negatively impact Civeo's reported revenues and Adjusted EBITDA. This foreign exchange risk reduces the translated value of earnings generated in foreign currencies, making financial forecasting more challenging.

Full Version Awaits

Civeo SWOT Analysis

This is the actual Civeo SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full Civeo SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete Civeo SWOT analysis. Once purchased, you’ll receive the full, editable version to tailor to your specific needs.

Opportunities

Civeo is well-positioned to capitalize on the robust activity within Australia's natural resources sector, especially in metallurgical coal. This segment is showing strong customer engagement, indicating a healthy demand for Civeo's services.

The company's strategic moves, including recent acquisitions and securing long-term contracts in the Bowen Basin, underscore a deliberate effort to broaden its presence. These actions directly align with exploiting favorable market conditions in this key Australian region.

For instance, Civeo's 2024 financial results highlighted increased revenue from its Australian operations, driven by higher occupancy rates and new project wins in the resources sector, demonstrating tangible progress in this expansion strategy.

Civeo has a significant opportunity to diversify its Canadian operations beyond the oil sands, a move that would bolster its resilience. This strategic shift could involve targeting growth sectors such as critical minerals mining, renewable energy infrastructure development, or even expanding its reach into different geographic regions within North America where demand for workforce accommodation and services is growing.

By actively pursuing these avenues, Civeo can reduce its dependence on the cyclical nature of the oil and gas industry. For instance, the Canadian critical minerals sector is projected to see substantial investment in the coming years, with estimates suggesting it could contribute billions to the Canadian economy by 2030, presenting a fertile ground for Civeo’s services.

Civeo's integrated services model presents a significant opportunity for margin expansion. By bundling services like accommodation, catering, and facility management, the company can offer a more attractive and efficient solution to clients, thereby commanding higher per-contract profitability. This approach was evident in their 2024 performance, where a focus on integrated solutions contributed to improved operational leverage.

Accretive Acquisitions and Partnership Growth

Civeo's disciplined growth strategy centers on pursuing accretive acquisitions that immediately boost cash flow and solidify its market standing. For instance, in early 2024, Civeo completed the acquisition of a portfolio of workforce accommodation sites, which was expected to be immediately accretive to its earnings per share. This inorganic growth approach can significantly speed up expansion in crucial geographic areas, leveraging existing infrastructure and client relationships.

The successful integration of newly acquired villages and the cultivation of strategic partnerships are key to expanding market share and realizing operational synergies. These collaborations can unlock new revenue streams and improve cost efficiencies. By strategically expanding its network, Civeo can better serve a wider client base, particularly in resource-rich regions experiencing increased activity.

- Accretive Acquisitions: Civeo's strategy prioritizes deals that enhance immediate cash flow and market position.

- Integration Success: The effective assimilation of acquired assets and partnerships drives market share growth.

- Synergy Realization: Operational efficiencies and new revenue streams are unlocked through strategic collaborations.

- Accelerated Expansion: Inorganic growth allows for faster penetration into key geographic markets.

Continued Shareholder Value Creation through Capital Returns

Civeo is well-positioned to continue creating shareholder value through its capital return strategy. A robust balance sheet underpins its ability to return capital, particularly through share repurchase programs. The company's increased authorization for buybacks, as seen in recent periods, reflects management's confidence in Civeo’s financial stability and future earnings potential. This approach can directly boost earnings per share and positively impact the stock's overall valuation.

For instance, Civeo's commitment to capital returns is demonstrated by its dividend payments and share buybacks. As of its most recent reports in late 2024, the company has continued to execute on its capital allocation plans, aiming to directly reward shareholders.

- Enhanced Shareholder Returns: Civeo's ongoing share repurchase programs offer a direct avenue for increasing shareholder value.

- Financial Strength: A solid balance sheet provides the foundation for consistent capital returns, including buybacks.

- Confidence Signal: Increased buyback authorizations signal management's belief in the company's intrinsic value and future performance.

- EPS Improvement: Share repurchases can lead to higher earnings per share, potentially boosting the stock's market valuation.

Civeo can leverage its strong position in Australia’s natural resources sector, particularly in metallurgical coal, to drive growth. The company's recent acquisitions and secured long-term contracts in the Bowen Basin, as reflected in its 2024 financial results showing increased revenue from Australian operations, highlight this opportunity.

Diversifying its Canadian operations beyond oil sands into areas like critical minerals and renewable energy infrastructure presents a significant growth avenue. The Canadian critical minerals sector is projected for substantial investment, potentially reaching billions by 2030, offering a strong market for Civeo's services.

Civeo's integrated service model, combining accommodation, catering, and facility management, allows for margin expansion and more attractive client solutions. This strategy contributed to improved operational leverage in 2024.

The company's disciplined growth through accretive acquisitions, such as the portfolio acquisition in early 2024, immediately boosts cash flow and market standing, accelerating expansion in key regions.

Threats

A significant threat for Civeo is the persistent decrease in spending by its customers within the Canadian oil sands. This reduction in capital and operational expenditures directly curtails the demand for Civeo's services, impacting the number of billed rooms and overall revenue generated in Canada.

The ongoing budget constraints faced by oil sands companies necessitate Civeo implementing continuous cost-cutting strategies. This pressure could unfortunately lead to further consolidation or closure of some of Civeo's lodges, particularly if demand doesn't rebound.

For instance, in 2023, the Canadian Association of Petroleum Producers (CAPP) projected capital spending in the oil and gas sector to be around $76 billion, a figure that has seen downward revisions in previous years, reflecting the cautious spending environment that directly impacts Civeo's operational capacity and revenue streams.

The long-term prognosis for the Canadian oil sands sector remains a point of considerable uncertainty, making it challenging for Civeo to forecast demand and plan for future investments with a high degree of confidence.

Global macroeconomic and geopolitical uncertainties, including persistent inflation and fluctuating interest rates, pose a significant threat to the natural resource sector. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, signaling a challenging environment for commodity-dependent industries.

International conflicts and trade tensions can further disrupt supply chains and dampen investor confidence, leading to reduced investment in new projects. This directly impacts Civeo's ability to secure new contracts and maintain existing ones, as exploration and development activities often scale back during periods of instability.

These broader uncertainties can translate into decreased demand for workforce accommodation services, project delays, and increased operational costs for Civeo. For example, a slowdown in mining or oil and gas production due to economic contraction or geopolitical risk directly reduces the need for the remote site services Civeo provides.

While Civeo's Australian operations are performing well, the inherent volatility of metallurgical coal prices poses a significant threat. A sharp decline in these commodity prices could directly affect how much work mining companies have, thereby reducing their need for Civeo's essential accommodation and services, particularly impacting the profitability of existing long-term agreements in the Bowen Basin.

Intensified Competition in Workforce Accommodation Market

The workforce accommodation sector is inherently competitive, and Civeo faces the threat of intensified rivalry. This heightened competition can translate into significant pricing pressures, potentially squeezing profit margins. Furthermore, it could lead to reduced occupancy rates as more players vie for clients, and an increased risk of losing existing contracts to rivals offering more aggressive terms.

To counter this, Civeo needs to remain agile and committed to innovation and service excellence. Maintaining high service standards is crucial for retaining its market position against both established competitors and new entrants. A failure to do so could result in an erosion of market share, directly impacting the company's overall profitability.

- Pricing pressure: Increased competition can force accommodation providers to lower prices, impacting revenue.

- Occupancy rates: A crowded market may lead to lower utilization of Civeo's facilities.

- Contract loss: Competitors may undercut Civeo on price or offer superior services, leading to contract terminations.

- Market share erosion: Persistent competitive pressure can shrink Civeo's presence in key markets.

Regulatory and Environmental Policy Shifts

Evolving regulatory landscapes and increasingly stringent environmental policies, particularly concerning carbon emissions and resource extraction, pose a significant threat to the natural resource industries Civeo serves. These shifts can directly impact project viability and operational costs for Civeo's clients. For instance, in 2024, several jurisdictions saw increased scrutiny on new mining and oil sands projects, potentially leading to project delays or cancellations that would reduce demand for Civeo's workforce accommodation and related services.

Changes in these policies could lead to reduced project approvals, delays, or even cancellations, thereby diminishing the demand for Civeo's services in affected regions. The International Energy Agency (IEA) has projected that policies aimed at accelerating the energy transition could impact traditional resource development. This presents a risk for Civeo if its key markets face significant regulatory headwinds.

- Increased compliance costs: Stricter environmental regulations may force Civeo's clients to incur higher operational expenses, potentially impacting their capital expenditure budgets for new projects.

- Project delays and cancellations: New environmental impact assessments or changes to permitting processes can lead to extended timelines or outright halts for resource development projects.

- Shifting client priorities: Clients may pivot towards less carbon-intensive projects or locations, potentially reducing the need for services in traditional resource hubs.

- Reputational risk: Association with projects facing environmental opposition could pose a reputational challenge for Civeo.

The persistent decrease in spending by customers in the Canadian oil sands directly curtails demand for Civeo's services, impacting billed rooms and revenue. For example, CAPP projected Canadian oil and gas capital spending around $76 billion for 2023, reflecting a cautious spending environment. Global macroeconomic and geopolitical uncertainties, including inflation and fluctuating interest rates, also pose a threat, with the IMF projecting slower global growth in 2024. This can lead to reduced investment in new projects, directly impacting Civeo's ability to secure contracts.

The volatility of metallurgical coal prices in Australia presents a significant threat, as a sharp decline could reduce mining companies' need for accommodation and services. Furthermore, intensified competition in the workforce accommodation sector can lead to pricing pressures, lower occupancy rates, and contract losses, potentially eroding Civeo's market share.

Evolving regulatory landscapes and stringent environmental policies, particularly concerning carbon emissions, threaten the natural resource industries Civeo serves. Increased scrutiny on projects in 2024 could lead to delays or cancellations, diminishing demand for Civeo's services. The IEA's projections on energy transition policies also present a risk if key markets face significant regulatory headwinds.

| Threat Category | Specific Impact on Civeo | Supporting Data/Trend |

| Customer Spending Reduction | Lower demand for accommodation and services in Canadian oil sands. | CAPP projected Canadian oil & gas capital spending around $76 billion for 2023. |

| Macroeconomic & Geopolitical Instability | Reduced investment in resource projects, impacting contract acquisition. | IMF projected global growth to slow to 2.7% in 2024. |

| Commodity Price Volatility | Decreased client activity in Australian coal sector. | Metallurgical coal prices are subject to significant fluctuations. |

| Intensified Competition | Pricing pressure, lower occupancy, and potential contract loss. | Increased rivalry can lead to reduced profit margins and market share erosion. |

| Regulatory & Environmental Policies | Project delays/cancellations, increased compliance costs for clients. | Increased scrutiny on resource projects in 2024, potential impact from energy transition policies. |

SWOT Analysis Data Sources

This Civeo SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of Civeo's operational landscape and strategic positioning.