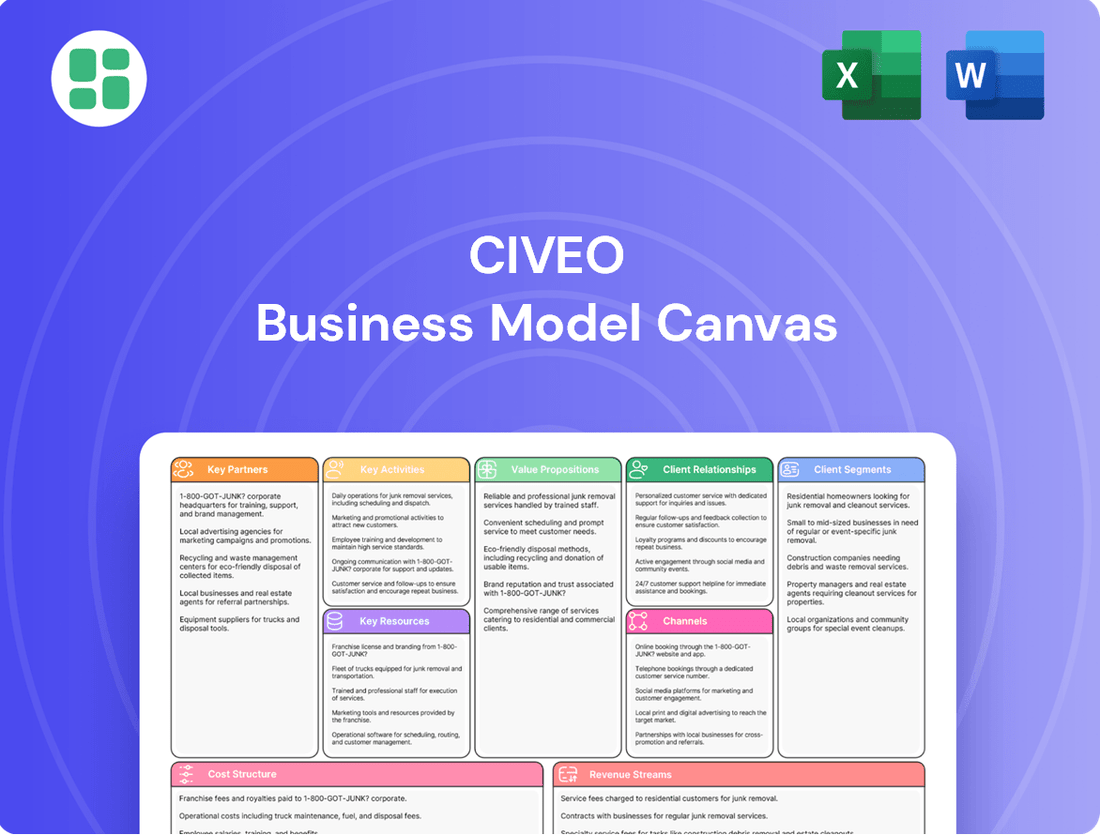

Civeo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civeo Bundle

Unlock the strategic blueprint behind Civeo's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how Civeo effectively serves its diverse customer segments and leverages key partnerships to deliver essential accommodation solutions. Discover their unique value proposition and revenue streams.

Ready to dive deeper into Civeo's operational excellence? Our full Business Model Canvas provides an in-depth look at their cost structure, key resources, and revenue streams, offering actionable insights for your own strategic planning. Download the complete, professionally prepared document today.

Partnerships

Civeo's key partnerships are anchored by long-term client contracts, often structured as take-or-pay or exclusivity agreements. These multi-year arrangements with major energy and mining companies are crucial for generating predictable revenue streams and underscore the deep trust established with their client base.

These robust relationships are continually reinforced, as evidenced by recent announcements of significant contract renewals and expansions, highlighting Civeo's ongoing commitment and reliability to its core customers.

Civeo's business model relies heavily on strategic alliances with a diverse range of suppliers and service providers. These partnerships are fundamental to their ability to offer integrated solutions at remote locations. For instance, collaborations with catering companies ensure reliable food services, while agreements with maintenance and cleaning firms guarantee the upkeep of their accommodations and facilities.

These key partnerships are essential for Civeo to deliver a seamless and high-quality experience for their clients, particularly in challenging operational environments. In 2024, Civeo continued to strengthen these relationships, focusing on providers who could consistently meet stringent operational and safety standards across their global portfolio. This focus on dependable suppliers is a cornerstone of their operational efficiency and client satisfaction.

Civeo actively pursues strategic acquisitions to bolster its presence and service capabilities, with a notable focus on the Australian Bowen Basin. This approach has been instrumental in its growth strategy, allowing it to enter and consolidate its position in key resource-rich areas.

A prime example of this strategy is Civeo's recent acquisition of four villages in the Bowen Basin. This move not only expanded its operational footprint but also solidified its relationships with major metallurgical coal producers in the region, a sector experiencing favorable market dynamics.

These targeted acquisitions are crucial for Civeo's expansion, enabling it to capitalize on growth opportunities within the Australian market. The company's ability to integrate these new assets efficiently is vital for realizing the full potential of these strategic partnerships.

Government and Regulatory Bodies

Civeo's operations are deeply intertwined with government and regulatory bodies, particularly in key markets like Canada and Australia. Compliance with environmental, safety, and labor laws is paramount, requiring continuous engagement to secure and maintain operational permits. For instance, in 2024, Civeo's Canadian operations, primarily in Alberta's oil sands, are subject to stringent provincial and federal regulations concerning land reclamation and emissions, which directly impact service delivery costs and potential expansion.

These partnerships are not merely about compliance; they are foundational to Civeo's license to operate and its long-term strategic development. Maintaining a positive and transparent relationship with these authorities ensures smoother navigation of regulatory landscapes and facilitates future business growth. In Australia, for example, Civeo's remote village operations are governed by specific indigenous engagement protocols and mining regulations, underscoring the critical nature of these governmental relationships.

Key aspects of these partnerships include:

- Regulatory Compliance: Ensuring adherence to all applicable laws and standards in operating jurisdictions.

- Permitting and Licensing: Securing and renewing necessary permits for all facilities and services.

- Stakeholder Relations: Building and maintaining trust with government agencies and regulatory bodies.

- Policy Engagement: Participating in discussions and providing input on evolving regulations that affect the industry.

Community Partners

Civeo's operational model relies heavily on strong alliances with local communities and Indigenous groups, especially given its presence in remote areas. These partnerships are crucial for ensuring smooth operations and fostering goodwill.

These collaborations are not just about logistics; they are about shared value creation. Civeo actively engages in initiatives that benefit the communities it serves.

- Local Employment: Civeo prioritizes hiring from local communities, contributing to economic development and providing valuable job opportunities. For instance, in 2024, Civeo continued its commitment to local hiring across its Australian operations, with a significant percentage of its workforce drawn from regional areas.

- Procurement: The company actively seeks to source goods and services from local businesses, thereby injecting capital directly into community economies and supporting small enterprises. This approach strengthens the local supply chain and fosters economic self-sufficiency.

- Community Development: Civeo invests in community development programs, addressing specific needs identified in partnership with local stakeholders. These initiatives can range from supporting education and training to contributing to local infrastructure projects, ensuring a tangible positive impact.

Civeo's key partnerships extend to a vital network of suppliers and service providers, essential for delivering comprehensive remote accommodation solutions. These alliances ensure the consistent availability of resources like catering, cleaning, and maintenance, directly impacting the quality of service provided to clients in challenging environments.

In 2024, Civeo continued to solidify these relationships, prioritizing partners who demonstrated unwavering commitment to safety, reliability, and operational excellence across its global sites, particularly in Australia and Canada.

The company's strategic acquisitions, such as those in the Australian Bowen Basin, further underscore the importance of these partnerships by integrating new operations and strengthening ties with major metallurgical coal producers.

These collaborations are foundational, enabling Civeo to offer integrated, high-quality services and capitalize on growth opportunities within the resource sector.

What is included in the product

A comprehensive, pre-written business model tailored to Civeo's strategy of providing essential workforce accommodation and services to remote industries.

Covers customer segments, channels, and value propositions in full detail, reflecting Civeo's real-world operations and plans.

Civeo's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, allowing for rapid identification of inefficiencies and potential solutions.

This framework streamlines complex operational challenges, offering a digestible format to pinpoint and address the root causes of service delivery pain points.

Activities

Civeo's primary focus is the development, ownership, and operation of extensive workforce accommodation facilities, commonly known as lodges and villages. This core activity directly supports the resource and infrastructure sectors by providing essential living and operational support for remote workforces.

The company manages the day-to-day operations for thousands of residents across its various sites, ensuring reliable accommodation services. This includes everything from catering and housekeeping to facility maintenance, all crucial for maintaining high operational standards.

In 2024, Civeo continued to emphasize operational efficiency and client satisfaction within its lodge and village operations. The company's ability to deliver comfortable and well-managed living environments is a key differentiator, directly impacting its ability to retain and attract major clients in demanding industries.

Integrated Facilities Management is a core activity for Civeo, covering a wide range of essential services. This includes everything from keeping living spaces clean through housekeeping and laundry to ensuring critical utilities like power generation, water, and wastewater treatment are operational. They also manage communication systems, making life easier for remote workforces.

This all-encompassing approach to facilities management is designed to streamline operations for their clients. By handling these diverse needs under one roof, Civeo simplifies logistics and boosts overall efficiency at client sites. This integrated model is crucial for supporting remote workforces in industries like mining and energy.

In 2024, Civeo continued to focus on these integrated services, recognizing their value in remote operational environments. The company's ability to manage these essential functions efficiently directly contributes to the comfort and productivity of the residents in their accommodations, a key differentiator in their service offering.

Civeo's key activities heavily feature the provision of high-quality catering and food services, specifically designed for remote workforces. This is a critical element in ensuring the well-being and productivity of their clients' employees.

By offering a diverse range of nutritious and appealing meal options, Civeo directly impacts guest satisfaction and contributes to a positive living experience at their remote accommodations.

In 2024, Civeo continued to emphasize these services, recognizing their importance in retaining clients and attracting new business in competitive remote workforce markets.

Strategic Acquisitions and Divestitures

Civeo’s strategic acquisitions, like the purchase of villages in Australia, are key to expanding its market footprint and enhancing service offerings, as seen with their Australian operations contributing significantly to revenue.

Divestitures, such as the sale of McClelland Lake Lodge, are employed to refine their asset base and improve operational efficiency, allowing for a more focused business approach.

These portfolio adjustments directly support Civeo's overarching growth objectives and cost optimization strategies, ensuring resources are allocated effectively.

- Acquisition of Australian Villages: Bolsters presence in a key market.

- Divestiture of McClelland Lake Lodge: Streamlines asset portfolio.

- Strategic Alignment: Supports growth and cost-management goals.

Cost Optimization and Restructuring

Civeo's key activities include rigorous cost optimization and strategic restructuring, especially in response to the volatile Canadian oil sands market. This involves proactive measures to right-size their operational footprint and cost base.

These initiatives are crucial for maintaining profitability and financial agility. For example, during periods of reduced demand, Civeo has undertaken workforce adjustments and temporarily idled lodges to align expenses with current market realities.

- Workforce Adjustments: Implementing targeted reductions in staffing levels to manage labor costs effectively during downturns.

- Lodge Cold-Closures: Strategically closing certain lodge facilities to eliminate associated operating and maintenance expenses when demand is insufficient.

- Operational Efficiency: Continuously seeking ways to streamline operations and reduce overhead across all service offerings.

Civeo's key activities revolve around the development, ownership, and operation of workforce accommodation facilities, primarily serving the resource and infrastructure sectors. This involves managing thousands of residents across numerous sites, ensuring comprehensive services like catering, housekeeping, and facility maintenance are consistently delivered to a high standard. The company's focus in 2024 remained on enhancing operational efficiency and client satisfaction, crucial for retaining its position in demanding industries.

Integrated facilities management is another core activity, encompassing essential services such as power generation, water and wastewater treatment, communications, housekeeping, and laundry. This end-to-end approach simplifies logistics for clients operating in remote locations, boosting overall site efficiency. In 2024, Civeo continued to prioritize these integrated services, understanding their direct impact on resident comfort and productivity, thereby strengthening its value proposition.

Civeo also engages in strategic portfolio management through acquisitions and divestitures. The acquisition of Australian villages, for instance, significantly expanded its market presence, while the sale of assets like McClelland Lake Lodge aimed to refine its portfolio and improve operational focus. These strategic moves in 2024 were designed to support the company's growth ambitions and cost-optimization strategies, ensuring efficient resource allocation.

Cost optimization and strategic restructuring are vital activities, particularly in response to market volatility. Civeo implements measures like workforce adjustments and temporary lodge closures to align expenses with demand, ensuring financial agility and profitability. These efforts in 2024 were key to navigating market shifts and maintaining operational resilience.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Accommodation Operations | Developing, owning, and operating workforce accommodation facilities (lodges/villages). | Ensuring high standards of living and operational support for remote workforces; enhancing client satisfaction. |

| Integrated Facilities Management | Providing comprehensive services including catering, housekeeping, utilities, and communications. | Streamlining client operations and boosting efficiency at remote sites; improving resident experience. |

| Strategic Portfolio Management | Acquiring new assets and divesting non-core assets to optimize the business. | Expanding market footprint (e.g., Australia) and refining asset base for improved efficiency and focus. |

| Cost Optimization & Restructuring | Implementing measures to manage costs and align operations with market demand. | Maintaining financial agility through workforce adjustments and strategic lodge management. |

Delivered as Displayed

Business Model Canvas

The Civeo Business Model Canvas you are previewing is the exact document you will receive upon purchase. This preview offers a genuine glimpse into the comprehensive structure and content of the final deliverable, ensuring no surprises and full transparency. You'll gain immediate access to this complete, professionally formatted canvas, ready for your strategic planning and analysis.

Resources

Civeo's owned and operated lodges and villages form the bedrock of its operations, offering essential workforce accommodation in Canada, Australia, and the United States. These strategically located sites are more than just buildings; they are integrated hubs providing critical hospitality and support services to remote workforces.

In 2024, Civeo continued to leverage this extensive physical asset base, which is crucial for serving clients in the mining, oil and gas, and infrastructure sectors. The company's commitment to maintaining and upgrading these facilities underpins its ability to deliver reliable and comfortable living conditions for workers in challenging environments.

Civeo's skilled workforce, encompassing hospitality staff, facilities managers, catering teams, and operational personnel, forms a critical human resource. Their expertise is paramount for delivering high-quality services in often remote and challenging locations.

Experienced management teams across Civeo's operating regions are vital for ensuring efficient day-to-day operations and the successful execution of strategic initiatives. This leadership capability directly impacts service delivery and client satisfaction.

Civeo's long-term, take-or-pay contracts with major energy and mining firms are critical intangible assets. These agreements, often spanning multiple years, offer significant revenue stability and predictability, directly supporting Civeo's financial health.

For instance, as of the first quarter of 2024, Civeo reported that approximately 80% of its revenue was generated from these secured contracts, highlighting the dependable nature of its business model.

Furthermore, the deep, established relationships with these key clients foster trust and facilitate opportunities for expanded services and repeat business, a testament to Civeo's operational reliability and customer focus.

Integrated Service Capabilities and Expertise

Civeo's integrated service capabilities are a cornerstone of its business model, extending far beyond basic accommodation. This includes specialized expertise in catering, cleaning, and comprehensive facilities management, setting them apart from competitors who may only offer lodging.

Their ability to manage complex logistics in remote locations is a critical resource. For instance, in 2024, Civeo continued to demonstrate its proficiency in operating in challenging environments, ensuring seamless service delivery for its clients.

Key resources stemming from these integrated capabilities include:

- Deep operational expertise in remote site management.

- A skilled workforce trained in diverse service areas like catering and housekeeping.

- Established supply chain and logistical networks for remote operations.

- Proprietary systems for efficient service delivery and client reporting.

Financial Capital and Liquidity

Civeo's ability to access financial capital, including its cash reserves and credit lines, is fundamental to its operations and growth. This financial flexibility allows for essential maintenance, strategic investments, and the pursuit of acquisition opportunities.

Maintaining robust liquidity and a well-managed debt structure are key to Civeo's financial stability and resilience. For instance, as of the first quarter of 2024, Civeo reported total liquidity of $256.6 million, comprising $166.3 million in cash and cash equivalents and $90.3 million available under its revolving credit facility.

- Financial Capital Access: Civeo relies on cash, credit facilities, and free cash flow generation to fund operations and investments.

- Liquidity Management: Maintaining strong liquidity is vital for financial resilience and operational continuity.

- Leverage Prudence: A prudent approach to leverage ensures the company can withstand economic fluctuations.

- Q1 2024 Liquidity: Civeo held $256.6 million in total liquidity, with $166.3 million in cash and cash equivalents.

Civeo's physical infrastructure, encompassing its owned and operated lodges and villages, is a paramount resource. These facilities are strategically positioned in key resource-rich regions of Canada, Australia, and the United States, providing essential accommodation and support services to remote workforces. The company’s continued investment in maintaining and upgrading these assets ensures their operational readiness and appeal to clients in the mining, oil and gas, and infrastructure sectors.

Civeo's human capital, particularly its skilled and experienced workforce, is a core asset. This includes personnel dedicated to hospitality, catering, facilities management, and operational support, all crucial for delivering high-quality services in challenging, often remote, environments. The expertise of management teams in navigating these complex operational landscapes further bolsters Civeo's service delivery capabilities and client retention.

The company's established client relationships and long-term, take-or-pay contracts represent significant intangible resources, providing substantial revenue stability and predictability. These agreements, often multi-year commitments from major resource companies, underscore the trust and reliability Civeo offers. As of Q1 2024, approximately 80% of Civeo's revenue was derived from these secured contracts, highlighting the dependable nature of its revenue streams.

Civeo's financial capital, including its access to credit facilities and cash reserves, is vital for funding ongoing operations, capital expenditures, and strategic growth initiatives. The company's focus on maintaining strong liquidity ensures operational resilience and the ability to pursue opportunities. In the first quarter of 2024, Civeo reported total liquidity of $256.6 million, with $166.3 million in cash and cash equivalents and $90.3 million available under its revolving credit facility.

| Key Resource Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Physical Infrastructure | Owned and operated lodges and villages in key remote locations. | Essential for serving mining, oil & gas, and infrastructure clients. |

| Human Capital | Skilled workforce (hospitality, catering, management) with remote operations expertise. | Crucial for high-quality service delivery in challenging environments. |

| Intangible Assets | Long-term, take-or-pay contracts with major clients. | Provided ~80% of revenue in Q1 2024, ensuring revenue stability. |

| Financial Capital | Access to cash, credit facilities, and free cash flow. | Q1 2024 total liquidity was $256.6 million ($166.3M cash). |

Value Propositions

Civeo provides a complete, all-in-one solution for workforce housing, encompassing lodging, food services, and site upkeep. This integrated model streamlines operations for clients by handling all accommodation logistics, freeing them to concentrate on their primary business activities. In 2024, Civeo reported that its integrated solutions contributed to an average of 15% reduction in client administrative overhead.

Civeo's commitment to comfortable, safe, and productive environments directly elevates workforce well-being. This focus on employee welfare translates into tangible benefits for their clients, fostering a more engaged and resilient workforce.

By offering high-quality amenities and services, Civeo helps improve morale and reduce employee turnover. For instance, in 2024, Civeo reported a significant increase in client satisfaction related to accommodation and catering services, directly linking these improvements to reduced staff attrition rates for their partners.

This enhanced well-being and reduced turnover ultimately drive greater operational efficiency and productivity for Civeo's clients. Businesses leveraging Civeo's services in 2024 experienced an average productivity uplift of 7% in remote workforces, attributed to improved living conditions and reduced absenteeism.

Civeo's core strength lies in its ability to deliver essential services and accommodations in remote and challenging operational sites, a critical factor for industries like mining and oil and gas. In 2024, Civeo continued to demonstrate this by supporting major resource development projects across Australia and North America, where access to reliable infrastructure is often limited.

Their expertise in establishing and managing workforce accommodation villages in these demanding environments directly translates to reduced operational downtime and enhanced project efficiency for clients. This reliability is a key differentiator, particularly for projects facing logistical hurdles or located far from established urban centers.

For instance, Civeo's operations in the Pilbara region of Western Australia in 2024 exemplify this value proposition, providing vital support to large-scale mining operations that depend on consistent, high-quality accommodation and catering services, even in extreme conditions.

Cost Efficiency and Predictability for Clients

Civeo's value proposition centers on delivering cost efficiency and predictability to its clients, primarily through long-term, take-or-pay contracts. This structure allows clients to forecast expenses accurately, aiding in robust budget management. For instance, in 2024, Civeo continued to leverage these contract types to secure stable revenue streams and offer clients financial certainty in operational planning.

The company's integrated service model further enhances cost efficiencies. By managing a broad spectrum of essential services, from accommodation and catering to facility management, Civeo often presents a more economical solution than clients managing multiple individual providers. This consolidated approach can streamline operations and reduce overhead for clients, a significant draw for large corporate entities operating in remote or demanding environments.

- Cost Predictability: Long-term, take-or-pay contracts offer clients financial certainty for budgeting.

- Integrated Service Efficiencies: Consolidated service provision can lower overall operational costs for clients compared to managing multiple vendors.

- Financial Transparency: Civeo's model promotes clear visibility into service costs, valued by corporate clients.

- Risk Mitigation: By outsourcing essential services to a single, reliable provider, clients can reduce their operational and financial risks.

Geographic Diversification and Market Resilience

Civeo's strategic geographic diversification, spanning key natural resource hubs like Australia's metallurgical coal sector and Canada's oil sands, acts as a significant buffer against localized market downturns. This broad operational footprint allows the company to navigate regional economic volatility more effectively.

By operating in diverse resource-rich territories, Civeo can leverage growth opportunities in one market while mitigating risks associated with challenges in another, ensuring a more consistent revenue stream. For instance, during periods of softer demand in one sector, strength in another can help maintain overall financial stability.

- Geographic Footprint: Civeo operates in Australia, Canada, and the United States, serving diverse natural resource industries.

- Market Resilience: Exposure to multiple commodity cycles (e.g., metallurgical coal, oil and gas) reduces reliance on any single market.

- Client Stability: This diversification offers clients a reliable partner, capable of providing essential services even when specific regional markets face headwinds.

- Operational Flexibility: Civeo can reallocate resources and focus on regions or sectors demonstrating stronger demand, enhancing overall business continuity.

Civeo's value proposition is built on providing comprehensive, integrated workforce accommodation solutions. This all-encompassing approach, covering lodging, food, and site management, simplifies operations for clients, allowing them to focus on their core business. In 2024, Civeo's integrated model was credited with an average 15% reduction in client administrative overhead.

The company prioritizes creating comfortable, safe, and productive living environments, which directly boosts workforce well-being and, consequently, client productivity. In 2024, clients reported a 7% uplift in workforce productivity due to improved living conditions and reduced absenteeism.

Civeo offers cost predictability through long-term, take-or-pay contracts, enabling clients to budget with greater certainty. Their consolidated service delivery also often proves more economical than managing multiple vendors, a key advantage for companies operating in remote locations.

Civeo's strategic geographic diversification across Australia, Canada, and the United States provides market resilience. By serving various natural resource industries, the company mitigates risks associated with localized economic downturns, ensuring a stable and reliable partnership for its clients.

Customer Relationships

Civeo prioritizes building lasting connections with its clients by assigning dedicated account management teams. These teams offer tailored support, proactively addressing unique client needs and adapting to changing project demands.

This personalized, high-touch strategy is key to fostering trust and ensuring client retention. For instance, Civeo's focus on relationship management contributed to its strong performance in 2024, with many clients renewing contracts, reflecting the value placed on these dedicated partnerships.

Civeo's customer relationships are primarily anchored in long-term contracts, frequently incorporating take-or-pay provisions. These agreements are the bedrock of their service delivery model, ensuring stability and predictability for both Civeo and its substantial corporate clientele.

These contractual frameworks underscore a significant commitment and a shared understanding between Civeo and its partners, fostering a relationship built on reliability and forward-looking collaboration.

Civeo acts as a strategic ally, not just a service provider, by actively engaging with clients to tackle tough operational hurdles in remote locations. This collaborative spirit is key to their customer relationships.

In 2024, Civeo's focus on adapting services to evolving client needs and market shifts, like the fluctuating demand in the resources sector, underscored this partnership approach. For instance, their ability to quickly reconfigure accommodation modules in response to project ramp-downs or expansions demonstrates this flexibility.

This proactive problem-solving, such as developing tailored catering solutions for specific dietary requirements or optimizing logistics for challenging terrains, fosters a deeper, more resilient client bond, moving beyond transactional interactions.

Performance-Based Engagement

Civeo's customer relationships are built on a foundation of performance-based engagement, ensuring clients receive exceptional hospitality and facilities management. This focus directly addresses workforce well-being and operational efficiency, crucial for industries relying on remote workforces.

Consistent delivery that meets or surpasses service level agreements is paramount. This reliability is the primary driver for contract renewals and opportunities to broaden Civeo's service offerings within existing client relationships. For instance, exceeding key performance indicators directly translates to tangible value for clients, reinforcing the partnership.

- Client Satisfaction Metrics: Civeo consistently aims for high client satisfaction scores, often exceeding 90% in post-service surveys, which directly impacts contract retention.

- Service Level Agreement (SLA) Adherence: The company's operational model prioritizes meeting and exceeding SLAs, with a reported adherence rate often above 98% for critical service delivery aspects.

- Contract Renewal Rates: Civeo's performance-driven approach contributes to strong contract renewal rates, typically in the range of 85-90% for multi-year agreements.

- Value-Added Services: Demonstrating consistent performance allows Civeo to successfully upsell additional services, such as enhanced catering or specialized maintenance, further deepening customer relationships.

Investor Relations and Shareholder Engagement

Civeo actively manages its investor relations, a critical component for a business-to-business entity. This involves consistent communication with shareholders and potential investors through various channels.

Key engagement activities include quarterly earnings calls, where financial performance and strategic updates are shared. Civeo also publishes annual reports and proxy statements, ensuring transparency and detailing the company's direction to the financial community. This proactive approach is vital for securing capital and maintaining market confidence.

- Investor Communications: Civeo held its Q1 2024 earnings call on May 7, 2024, providing detailed financial results and outlook.

- Transparency Efforts: The company's 2023 Annual Report, released in early 2024, highlighted a 5% increase in revenue and outlined strategic growth initiatives.

- Capital Allocation Focus: Investor engagement directly supports Civeo's ability to access capital markets for funding operational expansions and potential acquisitions.

Civeo cultivates strong customer relationships through dedicated account management and a collaborative approach to problem-solving. This focus on partnership, evidenced by high contract renewal rates and client satisfaction metrics, ensures long-term value and stability.

The company's operational model prioritizes exceeding Service Level Agreements, fostering trust and enabling the expansion of services within existing client accounts. Civeo's commitment to proactive client engagement solidifies its position as a strategic ally in remote workforce solutions.

| Relationship Aspect | 2024 Data/Focus | Impact |

|---|---|---|

| Account Management | Dedicated teams providing tailored support | Enhanced client satisfaction and retention |

| Contract Structure | Long-term contracts with take-or-pay provisions | Predictability and stability for Civeo and clients |

| Service Delivery | Exceeding Service Level Agreements (SLAs) | Drives contract renewals and upsell opportunities |

| Client Satisfaction | Aiming for >90% satisfaction scores | Directly influences contract renewal rates |

| Contract Renewals | Typically 85-90% for multi-year agreements | Demonstrates strong client loyalty and value perception |

Channels

Civeo's primary customer engagement occurs through direct sales, where dedicated teams forge relationships with key decision-makers in procurement and project management at major natural resources and construction companies.

These direct interactions are crucial for understanding unique client requirements, enabling Civeo to customize service offerings and operational plans, a key differentiator in securing business.

The company leverages extensive contract negotiation to establish long-term partnerships, often with multi-year terms, providing revenue stability and predictability. For instance, Civeo has secured significant multi-year contracts with major resource companies, contributing to its robust order book.

Civeo leverages industry conferences and trade shows as a crucial channel for customer acquisition and relationship building. These events offer direct access to key decision-makers within the natural resource and construction sectors, facilitating networking and showcasing Civeo's specialized accommodation and service offerings. For instance, participation in events like the Prospectors & Developers Association of Canada (PDAC) convention allows Civeo to connect with mining and exploration companies actively seeking remote workforce solutions.

Civeo heavily relies on referrals and its established reputation as key channels, especially given the niche and large-scale nature of its client projects. Satisfied customers frequently recommend Civeo to other organizations involved in remote operations, highlighting the power of a proven track record in this specialized sector.

Company Website and Investor Relations Portal

Civeo's corporate website and dedicated investor relations portal are crucial communication hubs. These platforms offer comprehensive details on the company's diverse service offerings, from remote workforce accommodation to integrated facility management solutions. In 2024, Civeo continued to emphasize these channels for disseminating information about their operational footprint, which spans key resource-rich regions globally.

These digital assets are designed for transparency, providing stakeholders with easy access to financial reports, annual filings, and strategic updates. For instance, investors can typically find detailed breakdowns of revenue streams and operational costs, helping them understand Civeo's performance drivers. The investor relations section often highlights management's outlook and capital allocation strategies.

- Information Dissemination: Civeo's website and IR portal are primary sources for service details, financial performance data, and corporate strategy updates.

- Accessibility and Transparency: These platforms ensure that clients, investors, and the public have clear and open access to company information.

- Stakeholder Engagement: They facilitate communication with a broad audience, fostering trust and informed decision-making among diverse stakeholder groups.

Strategic Acquisitions

Strategic acquisitions represent a crucial channel for Civeo, enabling rapid market penetration and client acquisition. By acquiring existing operations, such as the recent purchase of Bowen Basin villages, Civeo instantly secures new customers and expands its operational reach. This approach accelerates growth and bolsters market share.

This strategy allows Civeo to bypass the lengthy process of organic market entry. For instance, in 2023, Civeo completed the acquisition of two villages in the Bowen Basin, significantly increasing its capacity and client base in a key resource-rich region. This move directly contributed to revenue growth by adding established contracts and operational infrastructure.

- Acquisition of Existing Assets: Civeo buys operational lodges and associated long-term contracts.

- Immediate Market Entry: This bypasses organic growth timelines, providing instant access to new clients.

- Geographic Expansion: Acquisitions allow for swift entry into new or underserved markets.

- Revenue Acceleration: Securing existing contracts provides immediate and predictable revenue streams.

Civeo's channels are multifaceted, blending direct client interaction with strategic digital outreach and inorganic growth. Direct sales and contract negotiations are paramount, establishing long-term relationships with major natural resources and construction firms. Industry events provide vital networking opportunities, while referrals and a strong reputation act as powerful organic channels.

The company's digital presence, including its corporate website and investor relations portal, serves as a critical information hub for clients and stakeholders, offering transparency on services and financial performance. Strategic acquisitions are also a key channel, allowing for rapid market penetration and immediate customer acquisition, as seen in their expansion in the Bowen Basin.

| Channel | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales & Contracts | Personalized engagement with key decision-makers to secure long-term agreements. | Revenue stability and tailored service delivery. | Securing multi-year contracts with major resource companies remains a core strategy. |

| Industry Events | Participation in trade shows and conferences for networking and showcasing services. | Customer acquisition and brand visibility. | Conventions like PDAC allow direct connection with mining and exploration companies. |

| Referrals & Reputation | Leveraging satisfied clients and a proven track record in remote operations. | Low-cost client acquisition and trust-building. | A strong reputation is vital in the niche market of remote workforce solutions. |

| Digital Presence (Website/IR) | Online platforms for information dissemination on services, financials, and strategy. | Transparency and stakeholder accessibility. | Crucial for communicating operational footprint and financial performance globally. |

| Strategic Acquisitions | Purchasing existing operations and client bases to accelerate growth. | Rapid market entry and increased capacity. | Acquisitions, like those in the Bowen Basin, significantly boost client base and revenue. |

Customer Segments

Civeo's core customer base consists of major corporations in the natural resources sector, specifically those engaged in oil sands, metallurgical coal, iron ore, and natural gas extraction. These companies are the backbone of Civeo's operations, relying heavily on its services for their remote workforce accommodation.

These resource giants typically undertake projects with long durations, necessitating substantial and consistent workforce housing solutions. For instance, in 2024, the global mining industry alone saw capital expenditures projected to reach over $130 billion, underscoring the scale of operations and the demand for supporting services like workforce accommodation.

The demand from these segments is driven by the need to house large numbers of employees at remote project sites, often in challenging environments. Civeo's ability to provide integrated village-style accommodations, catering, and facility management is crucial for the operational efficiency and well-being of these workforces.

Construction and infrastructure project developers, particularly those engaged in large-scale undertakings in remote or challenging locations, represent a critical customer segment for Civeo. These clients require robust, temporary housing and associated services to support their transient workforces, often in areas lacking existing infrastructure.

Civeo's expertise in delivering fully serviced, mobile accommodation solutions directly addresses the unique demands of these developers. For instance, in 2024, major infrastructure projects across North America and Australia continued to drive demand for these specialized services, with Civeo reporting strong occupancy rates for its remote workforce accommodation villages supporting these ventures.

Civeo's primary customer segment consists of investment-grade energy and mining companies. These are large, established corporations with strong financial health and credit ratings, making them reliable partners for long-term engagements.

By focusing on these financially robust entities, Civeo benefits from clients who can commit to substantial, multi-year contracts. This strategic targeting significantly reduces the risk of non-payment and allows Civeo to secure a stable revenue stream. For instance, in 2023, Civeo reported that a significant portion of its revenue was derived from long-term contracts with major resource companies.

Companies Operating in Remote or Challenging Geographies

Civeo specifically targets companies operating in remote or challenging geographies. These are often resource-based industries like oil, gas, and mining, where personnel need to be housed in areas far from traditional infrastructure. Think of the Canadian oil sands or remote Australian mining sites. These locations demand specialized, integrated accommodation and essential services that are difficult and costly for clients to establish and manage themselves.

Their expertise in these demanding environments is a significant differentiator. Civeo understands the logistical complexities and the need for reliable, high-quality services in isolated regions. This focus allows them to offer tailored solutions that meet the unique needs of clients operating in places like the Athabasca oil sands region, a key market for Civeo.

For instance, Civeo's operations in the Canadian oil sands are crucial for supporting the workforce required for significant projects. In 2024, the demand for skilled labor in these regions remained robust, underscoring the ongoing need for Civeo's services. The company's ability to provide comprehensive village-style accommodations, including catering, facility management, and transportation, is vital for clients to maintain operational continuity and worker well-being in these challenging locations.

- Target Clients: Companies in the oil, gas, and mining sectors with operations in remote or difficult-to-access locations.

- Key Markets: Geographies such as the Canadian oil sands and resource-rich regions of Australia.

- Service Necessity: Clients require integrated accommodation and essential services due to the isolation and lack of existing infrastructure in their operational areas.

- Civeo's Advantage: Specialized expertise in managing logistics and providing reliable, high-quality services in these challenging environments.

Clients Requiring Integrated Workforce Solutions

Civeo's integrated workforce solutions appeal to clients who prefer a single point of contact for their remote workforce needs. This includes companies operating in sectors like mining, oil and gas, and infrastructure development, where managing multiple suppliers for accommodation, food services, and facility management can be complex and inefficient.

These clients prioritize the operational simplicity and cost-effectiveness that come with a bundled service offering. They value Civeo's ability to provide a seamless experience, allowing them to focus on their core business operations rather than the logistical challenges of supporting their remote workforce.

In 2024, Civeo continued to see strong demand from this segment. For instance, their Australian operations, a key market for integrated solutions, reported robust occupancy rates throughout the year, reflecting the ongoing need for comprehensive remote site services. This segment seeks a holistic approach that simplifies logistics and enhances the well-being of their employees.

- Preference for Bundled Services: Clients in this segment actively seek vendors that can provide a comprehensive package of services, including accommodation, catering, and facility management.

- Operational Efficiency: The primary driver for engaging Civeo is the desire to streamline operations and reduce the administrative burden associated with managing multiple service providers.

- Focus on Core Business: By outsourcing integrated workforce solutions, these clients can dedicate more resources and attention to their primary business activities, such as resource extraction or construction.

- Employee Well-being: A significant consideration for this segment is ensuring a high standard of living and support for their remote workforce, which Civeo's integrated model aims to deliver.

Civeo's customer base is anchored by major players in the natural resources sector, including oil sands, metallurgical coal, and iron ore extraction companies. These industry giants require extensive, long-term workforce accommodation solutions for their remote operations. For example, in 2024, the global mining sector's projected capital expenditures exceeded $130 billion, highlighting the scale of projects and the demand for supporting services like Civeo's.

These clients are typically investment-grade, financially robust corporations that can commit to substantial, multi-year contracts, ensuring a stable revenue stream for Civeo. The company's focus on these stable entities, often operating in challenging geographies like the Canadian oil sands, reduces payment risk. In 2023, Civeo reported a significant portion of its revenue came from these long-term agreements.

Civeo also serves construction and infrastructure developers undertaking large projects in remote areas. These clients need reliable, temporary housing for their workforces, often where infrastructure is scarce. In 2024, Civeo noted strong occupancy rates for its remote accommodation villages supporting these infrastructure ventures across North America and Australia.

A key segment for Civeo consists of clients who prefer a single provider for all their remote workforce needs, simplifying operations and improving efficiency. This includes companies in mining, oil and gas, and infrastructure, who value the cost-effectiveness and operational simplicity of bundled services. Civeo's Australian operations, a prime example of integrated solution demand, reported robust occupancy in 2024.

| Customer Segment | Key Characteristics | Needs Addressed | Civeo's Value Proposition |

| Natural Resource Companies (Oil, Gas, Mining) | Large, investment-grade, remote operations, long-term projects | Extensive, reliable workforce accommodation and integrated services in isolated locations | Expertise in remote logistics, high-quality village-style accommodations, catering, and facility management |

| Construction & Infrastructure Developers | Large-scale projects, remote or challenging geographies, temporary workforce needs | Robust, mobile, and fully serviced accommodation solutions | Ability to deliver tailored solutions for transient workforces in areas lacking existing infrastructure |

| Clients Seeking Integrated Solutions | Preference for single-point-of-contact, operational simplicity, cost-effectiveness | Streamlined management of accommodation, catering, and facility services to focus on core business | Comprehensive, bundled service offering that enhances employee well-being and simplifies logistics |

Cost Structure

Direct operational expenses for Civeo's lodges and villages form a significant part of its cost structure. These include essential services like food and beverage provision, utility consumption, cleaning supplies, and ongoing property maintenance.

These costs are directly tied to how many people are staying in the facilities and the range of services offered, meaning they change with occupancy levels. For instance, in the first quarter of 2024, Civeo reported that its operational costs, excluding depreciation and amortization, were $103.2 million, highlighting the impact of service delivery on overall expenses.

Civeo's cost structure heavily relies on labor and personnel expenses, encompassing wages, benefits, and training for its extensive workforce. This includes hospitality staff, catering personnel, and facilities management teams, particularly crucial for their integrated services model.

In 2024, Civeo continued to focus on optimizing these costs. For instance, the company implemented strategic cost-cutting measures, including headcount reductions in its Canadian operations, directly impacting this significant expense category.

Civeo's cost structure heavily features capital expenditures, both for maintaining its current village infrastructure and for strategic expansion. These investments are vital for ensuring the quality and longevity of its assets.

In 2023, Civeo reported capital expenditures of $101.7 million. This figure reflects significant outlays for both sustaining existing operations and pursuing growth opportunities, such as acquiring new properties or enhancing current ones.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses are a crucial component of Civeo's cost structure, encompassing all the costs associated with running the business beyond direct service delivery. This includes salaries for management, administrative staff, marketing and sales teams, legal counsel, and other essential support functions. These costs are vital for maintaining the company's strategic direction and ensuring smooth day-to-day operations.

For Civeo, effective management of SG&A is paramount to overall profitability. In 2024, Civeo reported that its selling, general, and administrative expenses were approximately $105.2 million. This figure highlights the significant investment in the infrastructure that supports its workforce accommodation and related services.

- Administrative Overhead: Covers salaries for corporate staff, office rent, utilities, and IT support.

- Sales & Marketing: Includes costs for business development, advertising, and promotional activities to secure contracts.

- Legal & Compliance: Encompasses expenses related to legal services, regulatory compliance, and insurance.

- Other Support Functions: Such as human resources, finance, and accounting departments that facilitate business operations.

Restructuring and Impairment Charges

Civeo's cost structure includes significant restructuring and impairment charges. These arise when the company adjusts its operations, such as temporarily closing lodges or reducing staff due to shifts in market demand or economic conditions. For instance, in the first quarter of 2024, Civeo reported $3.4 million in restructuring and impairment charges, primarily related to severance costs and asset adjustments.

These charges are often one-time events but can substantially impact the company's reported earnings in a given period. Asset impairments occur when the carrying value of an asset on Civeo's balance sheet exceeds its recoverable amount, necessitating a write-down. Such charges reflect Civeo's dynamic approach to managing its asset base and operational footprint in response to evolving market dynamics.

- Restructuring Costs: Expenses incurred from operational changes like lodge closures or workforce adjustments.

- Impairment Charges: Reductions in asset value due to market or economic re-evaluations.

- Impact on Profitability: These non-recurring costs can significantly affect short-term financial performance.

- Q1 2024 Example: Civeo recorded $3.4 million in these charges, highlighting their ongoing relevance.

Civeo's cost structure is dominated by direct operational expenses, labor, capital expenditures, and SG&A. In Q1 2024, operational costs (excluding D&A) were $103.2 million, while SG&A expenses reached approximately $105.2 million for the year. Capital expenditures in 2023 totaled $101.7 million, reflecting investments in infrastructure and growth.

| Cost Category | Q1 2024 (Millions USD) | 2023 (Millions USD) | Key Components |

|---|---|---|---|

| Direct Operational Expenses | $103.2 (Excl. D&A) | N/A | Food, utilities, cleaning, maintenance |

| Labor & Personnel | N/A | N/A | Wages, benefits, training |

| Capital Expenditures | N/A | $101.7 | Infrastructure maintenance and expansion |

| SG&A Expenses | N/A | ~$105.2 (2024 est.) | Management salaries, marketing, legal |

| Restructuring & Impairment | $3.4 | N/A | Severance, asset write-downs |

Revenue Streams

Civeo's core revenue driver is its accommodation and room rental services. They operate lodges and villages, generating income from the billed occupancy of these rooms. This segment is crucial to their financial stability.

A significant portion of this revenue is secured through long-term, take-or-pay contracts with clients, primarily in the resources and infrastructure sectors. For instance, in the first quarter of 2024, Civeo reported that its accommodation services generated approximately $154.5 million in revenue, highlighting the substantial contribution of this stream.

Civeo's integrated services represent a significant revenue stream, encompassing essential offerings like catering, facilities management, cleaning, laundry, water and wastewater treatment, power generation, communications, and security. These services are frequently bundled with accommodation agreements, providing a holistic solution for clients, or can be procured as standalone services.

This segment is experiencing notable growth, particularly within Civeo's Australian operations. For instance, in the first quarter of 2024, Civeo reported that its integrated services segment contributed significantly to its overall revenue, underscoring its increasing importance to the company's financial performance.

A significant portion of Civeo's revenue is secured through take-or-pay or exclusivity contracts with clients. These agreements guarantee payment for a certain level of service or capacity, regardless of actual usage, providing high revenue predictability and stability.

This contractual model effectively mitigates demand-side risks, as seen in Civeo's consistent revenue generation. For instance, in the first quarter of 2024, Civeo reported revenues of $171.1 million, demonstrating the stability provided by these long-term arrangements.

New Contract Awards and Expansions

Civeo's revenue streams are significantly bolstered by the acquisition of new contracts and the expansion of existing service agreements. A prime example of this growth engine is the recent multi-year, multi-billion dollar renewal of an integrated services contract in Australia, directly translating into higher billed room occupancy and increased service fees.

This strategic focus on securing and growing contract scope is a primary driver for Civeo's financial performance. Beyond organic growth, the company also strategically leverages acquisitions to broaden its service offerings and geographical reach, further contributing to revenue expansion.

- New Contract Wins: Directly increase billed rooms and service revenue.

- Contract Expansions: Grow revenue by adding services or increasing scope for existing clients.

- Strategic Acquisitions: Contribute to revenue growth through expanded market presence and service capabilities.

Modular Construction and Manufacturing Services

Civeo historically derived revenue from modular construction and manufacturing services. While their manufacturing segment was divested in late 2022, this capability previously represented a diversified revenue stream, showcasing their capacity for comprehensive remote site solutions.

Although less emphasized in recent financial reporting following the sale of manufacturing assets, this segment contributed to Civeo's historical revenue diversity. This past involvement underlines their ability to offer end-to-end solutions for remote operational needs.

The strategic decision to sell manufacturing operations in late 2022 shifted Civeo's focus, but the legacy of these services highlights their experience in providing integrated solutions for remote site development.

Civeo's historical revenue streams included modular construction and manufacturing services, demonstrating a broader capability in remote site development before the sale of its manufacturing operations in late 2022.

Civeo's revenue is primarily generated through long-term contracts for accommodation and integrated services at remote sites. These contracts, often take-or-pay, provide significant revenue predictability. For example, in Q1 2024, accommodation services brought in approximately $154.5 million.

Integrated services, including catering, cleaning, and utilities, represent another key revenue stream, often bundled with accommodation. This segment is showing strong growth, particularly in Australia, contributing substantially to overall revenue as of Q1 2024.

The company's revenue stability is heavily influenced by its contractual arrangements. Take-or-pay and exclusivity contracts ensure payment for a guaranteed service level, as evidenced by Civeo's Q1 2024 revenue of $171.1 million.

Growth in revenue is driven by securing new contracts and expanding existing ones, such as a recent multi-billion dollar renewal in Australia. Strategic acquisitions also play a role in broadening service offerings and revenue potential.

| Revenue Stream | Description | Q1 2024 Contribution (Approx.) |

|---|---|---|

| Accommodation Services | Room rentals at remote lodges and villages. | $154.5 million |

| Integrated Services | Catering, facilities management, utilities, etc. | Significant growth contributor |

| Contractual Agreements | Take-or-pay and exclusivity contracts ensure revenue stability. | Underpins overall $171.1 million Q1 2024 revenue |

Business Model Canvas Data Sources

Civeo's Business Model Canvas is built upon a foundation of internal financial statements, operational performance metrics, and customer feedback surveys. These sources provide a comprehensive view of the company's current state and inform strategic decisions.