Civeo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civeo Bundle

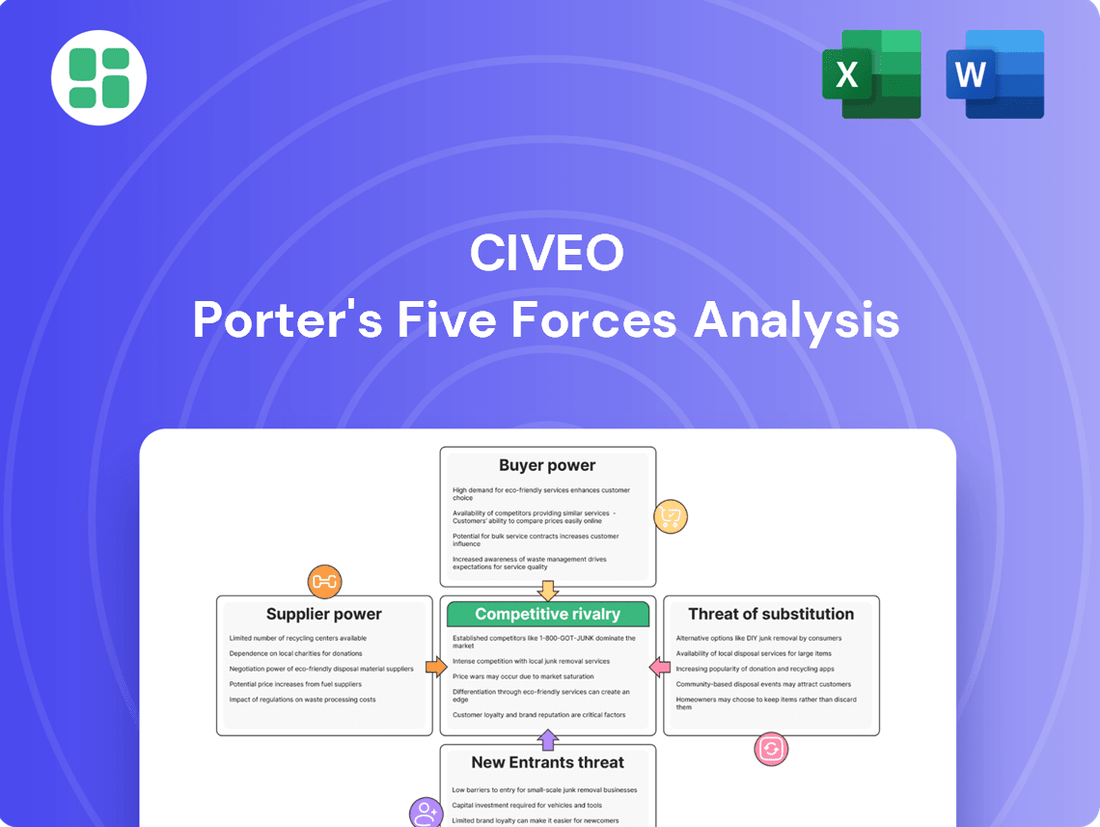

Civeo's competitive landscape is shaped by significant bargaining power from its diverse customer base, particularly large resource companies. The threat of substitutes, while present, is often mitigated by the specialized nature of Civeo's remote accommodation and services. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Civeo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for specialized goods and services, such as high-quality catering or remote site construction materials, directly influences Civeo's operational costs. When only a limited number of providers can offer these critical inputs, their leverage grows, potentially forcing Civeo to accept higher prices. For instance, in 2024, the global supply chain for specialized remote workforce accommodation modules experienced significant price increases due to a shortage of manufacturers and raw materials, impacting companies like Civeo.

Civeo might encounter significant costs if it needs to switch its primary suppliers, especially for services deeply integrated into its operations or for specialized equipment. These expenses can include the hassle of renegotiating agreements, the need to train employees on new equipment or processes, and potentially modifying current infrastructure to accommodate new suppliers. This situation tends to give suppliers more leverage.

For instance, if Civeo relies on a specific type of modular accommodation or a proprietary catering system, finding and integrating an alternative supplier could involve substantial upfront investment and operational disruption. The company's reliance on these specialized elements directly impacts its flexibility and the bargaining power of the entities providing them.

However, Civeo's substantial operational scale and its long-term contracts for providing essential services, such as remote workforce accommodation and logistics, can provide some degree of counter-leverage. Its consistent demand and established relationships may allow it to negotiate more favorable terms, mitigating some of the supplier's power.

Suppliers offering unique or highly differentiated inputs, like proprietary energy solutions for remote locations or specialized modular building components, hold significant bargaining power. Civeo's reliance on generic inputs generally lessens this power, but for specific, high-value components, supplier influence can be considerable, directly impacting Civeo's operational costs and project timelines.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into workforce accommodation services, like Civeo, is typically low. This is because establishing and managing such operations requires substantial capital and specialized know-how in developing, owning, and operating lodges and villages.

However, there's a potential for increased supplier power if specialized service providers, such as major catering or facilities management firms, decide to broaden their offerings into this sector. Civeo’s own integrated service model is a key strategy to mitigate this by maintaining control over critical supply chain elements.

For instance, in 2024, the global facilities management market was valued at approximately $1.2 trillion, indicating the significant resources large players could potentially reallocate.

- Capital Intensive Barriers: Developing and operating workforce accommodation facilities demands significant upfront investment in real estate, construction, and ongoing maintenance, creating a high barrier to entry for potential supplier forward integration.

- Operational Expertise: Success in this industry hinges on specialized operational expertise in logistics, hospitality, and remote site management, which many suppliers may not possess.

- Potential for Niche Expansion: While broad integration is unlikely, specialized service providers like large catering companies could expand their services to include accommodation management, thereby increasing their bargaining power.

- Civeo's Integrated Model: Civeo's strategy of offering comprehensive, integrated services helps it retain control over its supply chain and service delivery, reducing reliance on external suppliers and mitigating the threat of forward integration.

Importance of Civeo to Supplier Revenue

Civeo's substantial operational scale and consistent need for diverse supplies position it as a key client for many of its suppliers. This can translate into considerable negotiating power for Civeo, as suppliers often prioritize securing and retaining Civeo's business, particularly if it represents a significant portion of their overall income.

For instance, in 2023, Civeo reported revenues of approximately USD 700 million. A substantial portion of this revenue is derived from its core services, which necessitate a steady stream of goods and services from various suppliers, ranging from food and beverages to specialized equipment and maintenance. This reliance on Civeo's consistent demand can give suppliers an incentive to offer competitive pricing and favorable terms to maintain the relationship.

- Significant Customer Base: Civeo's large-scale operations mean it can represent a substantial portion of a supplier's revenue.

- Supplier Dependence: Suppliers may be motivated to offer better terms to retain Civeo's business due to its consistent demand.

- Long-Term Contracts: Civeo's use of long-term contracts provides stability and predictability for its suppliers, potentially reducing supplier bargaining power.

- Diversified Supply Chain: While Civeo is important to individual suppliers, its diversified supply chain can mitigate the bargaining power of any single supplier.

The bargaining power of suppliers for Civeo is influenced by the concentration of providers for specialized goods and services. When few suppliers can offer critical inputs, their leverage increases, potentially driving up Civeo's operational costs, as seen with price hikes for remote accommodation modules in 2024 due to shortages. Switching suppliers can also be costly for Civeo, involving renegotiation, training, and potential infrastructure changes, further empowering suppliers.

Civeo's significant operational scale and long-term contracts offer some counter-leverage, as suppliers often prioritize its consistent demand. However, suppliers of unique inputs, like proprietary energy solutions, hold considerable power, impacting Civeo's costs and timelines.

The threat of suppliers integrating forward into Civeo's core business is generally low due to high capital and specialized operational expertise requirements. While niche expansion by large catering or facilities management firms is possible, Civeo's integrated service model aims to mitigate this by controlling its supply chain.

| Factor | Impact on Civeo | 2024/2023 Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power, leading to higher costs. | Shortages in remote accommodation modules drove price increases in 2024. |

| Switching Costs | High costs to switch suppliers empower existing ones. | Costs include renegotiation, training, and infrastructure adaptation. |

| Civeo's Scale | Provides counter-leverage due to significant demand. | Civeo's 2023 revenue was approx. USD 700 million, representing substantial client value. |

| Supplier Differentiation | Unique inputs give suppliers significant power. | Proprietary energy solutions or specialized building components increase supplier leverage. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Civeo's remote workforce accommodation and services industry.

Instantly identify and address competitive threats with a clear, visual representation of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Civeo's customer base is heavily concentrated among a few large natural resource and construction companies. This concentration gives these major clients significant bargaining power, as they represent substantial portions of Civeo's revenue and can therefore demand competitive pricing and favorable terms.

The sheer volume of business these clients provide allows them to exert considerable leverage. For instance, Civeo's ability to secure long-term contracts, such as a six-year Australian integrated services contract valued at A$1.4 billion, demonstrates the importance of solidifying these relationships to mitigate the impact of customer concentration.

Customer price sensitivity is a major factor for Civeo, particularly given its focus on the natural resources and construction sectors. These industries often experience significant swings in commodity prices and project budgets, making clients acutely aware of costs. For instance, during periods of economic downturn or when commodity prices fall, companies in these sectors tend to scrutinize every expense, including accommodation services.

This heightened sensitivity directly impacts Civeo's revenue. In 2023, Civeo's Canadian segment revenues saw a decline, partly attributed to clients actively reducing their headcount and, consequently, the number of billed rooms. This demonstrates a clear instance where customer cost-reduction initiatives directly translated into lower business for Civeo, underscoring the pressure to offer competitive pricing.

Navigating this requires Civeo to strike a delicate balance. On one hand, offering competitive pricing is crucial to win and retain clients in these cost-conscious markets. On the other hand, the company must ensure that its pricing strategies allow for the maintenance of high service quality and, critically, profitability. Failing to do so could lead to a downward spiral of reduced margins and an inability to invest in service improvements.

The availability of alternative providers significantly impacts Civeo's bargaining power with its customers. Customers can readily switch to other large-scale workforce accommodation providers, modular building companies, or even consider in-house management or smaller regional suppliers. For instance, in 2024, the modular construction market continued to see growth, with companies offering flexible solutions that could compete with Civeo's integrated offerings.

While Civeo's established reputation and integrated services offer a competitive edge, the sheer number of viable alternatives in the non-residential accommodation market inherently grants customers considerable negotiating leverage. This competitive landscape means customers can often secure more favorable terms or pricing by leveraging the options available to them.

Switching Costs for Customers

Customers face moderate switching costs when moving away from an integrated service provider like Civeo. These costs stem from the logistical hurdles of relocating workforces, integrating new service providers into ongoing project operations, and maintaining the continuity of essential services, thereby limiting a customer's immediate leverage.

Civeo's strategy focuses on offering comprehensive solutions designed to make the prospect of switching less attractive. This approach aims to lock in customers by embedding Civeo's services deeply within their operational frameworks, making a transition more disruptive and costly.

- Logistical Complexity: Relocating personnel and re-establishing support infrastructure can be time-consuming and expensive.

- Operational Disruption: Integrating new vendors into existing workflows can lead to temporary inefficiencies and reduced productivity.

- Service Continuity: Ensuring uninterrupted essential services during a transition requires careful planning and can incur additional costs.

Information Asymmetry

Information asymmetry significantly impacts the bargaining power of customers, particularly for companies like Civeo that serve large corporate clients. These clients often have access to extensive market intelligence, understanding pricing benchmarks, service level expectations, and the competitive landscape. This deep knowledge reduces the information gap, giving them a distinct advantage when negotiating contracts.

For instance, a large resource company contracting Civeo's workforce accommodation services can readily compare Civeo's proposed rates and service offerings against those of its competitors. This is often facilitated by industry-specific benchmarking reports or direct engagement with multiple service providers. In 2023, the global workforce accommodation market was valued at approximately $25 billion, indicating a substantial and competitive sector where information transparency is key.

- Informed Negotiation: Corporate clients leverage their market intelligence to negotiate more favorable terms, pushing for competitive pricing and enhanced service standards.

- Reduced Information Gap: Civeo's ability to maintain transparency regarding its costs, operational efficiencies, and value proposition directly counters the client's information advantage.

- Value Demonstration: To retain strong relationships with these informed customers, Civeo must continuously demonstrate superior value, justifying its pricing and service quality through tangible benefits and reliable performance.

Civeo's customers, primarily large natural resource and construction firms, wield considerable bargaining power due to their significant revenue contribution. This concentration allows them to negotiate favorable pricing and terms, as demonstrated by Civeo's reliance on securing long-term contracts. The company must balance competitive pricing with profitability, a challenge amplified by customer price sensitivity during economic downturns, as seen in 2023 revenue declines in its Canadian segment due to client headcount reductions.

The availability of numerous alternative accommodation providers in 2024, including modular construction companies, grants customers significant leverage. While Civeo's integrated services offer some differentiation, customers can often find comparable solutions, pushing for better deals. Switching costs, though present due to logistical complexities and potential operational disruption, are not prohibitive enough to entirely negate customer negotiation power.

| Factor | Impact on Civeo | Customer Leverage |

|---|---|---|

| Customer Concentration | High reliance on few major clients | Clients can demand favorable terms |

| Price Sensitivity | Clients scrutinize costs, especially in volatile sectors | Pressure on Civeo's pricing and margins |

| Availability of Alternatives | Numerous competitors in the accommodation market | Customers can switch providers easily |

| Switching Costs | Moderate, due to logistical and operational factors | Limits immediate customer leverage, but not insurmountable |

Full Version Awaits

Civeo Porter's Five Forces Analysis

This preview showcases the complete Civeo Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that this professionally formatted analysis is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The workforce accommodation sector is populated by a varied group of companies. Major players like ATCO, Black Diamond, and Dexterra operate alongside numerous smaller, regional providers. This broad spectrum also includes specialized service firms such as Aramark and Sodexo, which focus on aspects like catering.

This mix of large, diversified entities and niche specialists creates a dynamic competitive landscape. Each competitor vies for market share, employing different strategies based on their scale and service offerings. For instance, in 2024, the global workforce accommodation market was valued at approximately $30 billion, with these diverse players all contributing to the overall competitive intensity.

The workforce accommodation market, especially the segment for non-residential student and worker lodging, is expected to see robust growth. This expansion, projected at a compound annual growth rate (CAGR) that industry analysts are closely watching, is largely fueled by increasing numbers of students and workers on the move globally.

However, this growth isn't uniform across all sectors. Segments heavily reliant on natural resources or large-scale construction projects can face significant volatility. When these specific areas experience downturns, the competition within those niches can become much more intense as companies fight for a smaller pool of demand.

Civeo distinguishes itself by providing a full suite of integrated services, encompassing lodging, facility management, and catering, all designed to boost employee well-being and operational efficiency for its clients. This comprehensive approach aims to create sticky customer relationships.

While competitors might offer individual services, Civeo's emphasis on building long-term partnerships and its extensive global presence offer a significant advantage. For instance, in 2023, Civeo reported revenue of $741.1 million, showcasing its scale and ability to serve diverse markets.

However, the market for basic accommodation services can become commoditized, potentially challenging Civeo's differentiation strategy. This means that while their integrated model is a strength, the underlying need for simple lodging can still lead to price-based competition.

Exit Barriers

Civeo, like many in the workforce accommodation sector, faces substantial exit barriers. These are primarily driven by the immense capital investment in large-scale, specialized lodging facilities. Think of it like owning a massive hotel designed specifically for remote workers; selling it off or repurposing it for something else is incredibly difficult and costly. This means companies are often locked into the business, even when market conditions turn unfavorable.

The high fixed costs associated with maintaining these extensive operations, including specialized equipment and infrastructure, further cement these exit barriers. For instance, Civeo's business model relies on owning and operating villages in remote locations, which are not easily transferable assets. This immobility of capital means that companies must fight to stay afloat, leading to a more intense competitive landscape.

These elevated barriers compel companies to compete fiercely for market share and occupancy. Even when demand dips, the cost of exiting is so high that firms are incentivized to continue operating and vying for revenue, often through aggressive pricing or service offerings. This can result in prolonged periods of intense rivalry among players in the workforce accommodation industry.

- High Capital Investment: The significant upfront costs for building and maintaining specialized workforce accommodation facilities create a substantial financial commitment.

- Asset Specificity: Civeo's assets, such as large lodges and villages in remote areas, have limited alternative uses, making them difficult to sell or repurpose.

- Operational Lock-in: Once established, the operational scale and contracts often make it challenging and expensive to wind down operations.

Acquisitions and Strategic Partnerships

Competitive rivalry within the accommodation services sector is significantly influenced by strategic maneuvers such as acquisitions and partnerships. These actions are crucial for companies aiming to bolster their market presence and operational capabilities.

Civeo’s recent acquisition of four villages in Australia's Bowen Basin is a prime example of this trend. This move not only expanded its footprint in a key resource-rich region but also consolidated its position against competitors. Furthermore, Civeo’s establishment of a limited partnership, CiveoSix, with the Six Nations of the Grand River Development Corporation demonstrates a strategic approach to service expansion and market penetration through collaboration.

- Acquisitions: Civeo acquired four villages in Australia's Bowen Basin, enhancing its operational scale.

- Strategic Partnerships: Formation of CiveoSix, a limited partnership with Six Nations of the Grand River Development Corporation, signals a collaborative growth strategy.

- Market Share: These strategic moves are indicative of a dynamic market where companies actively seek to increase their market share and competitive advantage.

- Service Enhancement: Consolidation and collaboration are key methods employed by industry players to improve their service offerings and operational efficiency.

The workforce accommodation sector is characterized by intense competition among a diverse range of players, from large, established firms to smaller, specialized providers. This rivalry is amplified by high exit barriers, primarily due to significant capital investments in specialized, remote facilities that are difficult to repurpose or sell. Companies are thus incentivized to remain in the market and compete aggressively for business, often through pricing strategies or enhanced service offerings.

Strategic moves like acquisitions and partnerships are common tactics used to gain market share and operational advantages. For instance, Civeo's acquisition of four villages in Australia's Bowen Basin in 2024 bolstered its presence in a key region. Similarly, the formation of CiveoSix, a partnership with the Six Nations of the Grand River Development Corporation, highlights a collaborative approach to expanding services and market reach. These actions underscore the dynamic nature of the industry where companies actively seek to differentiate themselves and secure their competitive standing.

| Company | 2023 Revenue (USD millions) | Key Strategic Move (2024) |

|---|---|---|

| Civeo | 741.1 | Acquired 4 villages in Bowen Basin, Australia; Formed CiveoSix partnership |

| ATCO | (Data not available for specific segment) | (Ongoing operations and service expansion) |

| Dexterra | (Data not available for specific segment) | (Focus on integrated facility management) |

SSubstitutes Threaten

The rise of remote and hybrid work presents a notable threat of substitutes for Civeo. As more companies embrace flexible work arrangements, the necessity for on-site housing for certain roles, particularly in administrative or support functions within the natural resources and construction sectors, could decline. This shift directly impacts the demand for Civeo's core service offering.

For instance, a significant portion of the workforce in sectors Civeo serves traditionally required physical presence. However, with advancements in technology and a cultural shift accelerated by the pandemic, many of these roles can now be performed effectively from home. This substitution of remote work for on-site presence directly reduces the need for the type of accommodation Civeo provides.

In 2024, the trend towards remote and hybrid work continues to solidify. While specific data for Civeo's direct impact is proprietary, broader labor market trends indicate a sustained preference for flexible work. For example, surveys in early 2024 showed that a substantial percentage of employees in professional services roles expressed a desire for continued remote or hybrid options, suggesting a persistent threat to traditional on-site accommodation models.

For Civeo, the threat of substitutes in local community accommodation is significant, especially for projects situated near established towns or cities. Clients may choose local hotels, rental properties, or even allow employees to arrange their own lodging, bypassing the need for specialized workforce accommodation services.

This can prove more cost-effective for clients, particularly for smaller-scale projects or those with shorter timelines. For instance, a short-term construction project might find it cheaper to book rooms in a local hotel than to contract Civeo's full camp services, directly impacting Civeo's market share in such scenarios.

For very short-term projects or smaller crews, alternative, less structured housing solutions like temporary trailers, RVs, or even glamping facilities can emerge as substitutes for Civeo's traditional lodge offerings. These options often present a lower cost structure and greater flexibility, making them attractive for specific, time-bound project requirements.

While these substitutes may not offer the full suite of services and robust infrastructure that Civeo provides, their cost-effectiveness can be a significant draw. For instance, the market for workforce accommodation, while dominated by established players, sees pockets of demand met by these more agile, albeit less comprehensive, solutions, particularly in industries with fluctuating labor needs.

Client Self-Provisioning

Large clients, especially those with substantial, ongoing operations, may explore building and operating their own workforce accommodation facilities. This alternative, while demanding significant initial investment and operational expertise, grants them enhanced control and the possibility of long-term cost reductions.

The threat of client self-provisioning is a notable factor for Civeo. Consider that in 2024, major resource companies often manage vast capital projects where controlling ancillary services like accommodation can be strategically advantageous. For instance, a mining giant undertaking a multi-decade project might find the economics of in-house accommodation compelling if their occupancy rates remain consistently high and predictable.

- Client Control: Self-provisioning allows clients to dictate service standards, security protocols, and amenity offerings directly, aligning them perfectly with their operational needs.

- Potential Cost Savings: Over the long term, especially with high utilization, clients might achieve lower per-diem costs compared to outsourcing accommodation services.

- High Barrier to Entry: The substantial upfront capital expenditure and the need for specialized operational management expertise create a significant hurdle for most clients to undertake self-provisioning.

- Strategic Alignment: For clients with core competencies in resource extraction rather than hospitality, the decision to self-provision is often driven by strategic integration rather than pure cost efficiency.

Technological Advancements in Logistics and Mobility

Technological advancements in logistics and mobility present a significant threat of substitutes for Civeo's core business. Improvements in transportation, like faster and more efficient crew rotation systems, could reduce the necessity for extended on-site accommodation. For instance, advancements in high-speed rail or autonomous vehicle technology could shorten travel times, making daily commutes or shorter stays more feasible for workers.

This shift could lead to a decrease in demand for Civeo's full-service, long-term accommodation villages. Companies might opt for more transient solutions or shorter booking periods if travel becomes less burdensome. In 2024, the global logistics market is projected to reach over $10 trillion, with ongoing investments in technology aimed at optimizing supply chains and workforce mobility.

The impact on Civeo's business model could be substantial, potentially leading to:

- Reduced average length of stay for clients.

- Increased competition from alternative accommodation providers catering to shorter durations.

- Pressure on pricing due to a wider array of accessible lodging options.

- A need for Civeo to adapt its service offerings to accommodate more flexible or shorter-term arrangements.

The increasing prevalence of remote and hybrid work models directly substitutes for Civeo's traditional on-site accommodation services. As companies in sectors like natural resources and construction adopt more flexible work arrangements, the demand for dedicated workforce housing diminishes, especially for roles that can be performed off-site.

In 2024, this trend continues to gain momentum, with many professional roles no longer requiring a physical presence at remote project locations. This shift means fewer workers need the comprehensive lodging solutions Civeo specializes in, impacting occupancy rates and revenue potential.

Furthermore, local accommodation options like hotels or rental properties can serve as substitutes for Civeo's services, particularly for shorter-term projects or when clients prioritize cost savings and flexibility over the full-service camp experience.

| Substitute Type | Description | Impact on Civeo | 2024 Trend Relevance |

| Remote/Hybrid Work | Performing job duties from a location other than the project site. | Reduces demand for on-site housing. | Continued strong adoption across industries. |

| Local Accommodation | Hotels, motels, apartments in nearby towns/cities. | Offers a lower-cost, more flexible alternative for clients. | Attractive for shorter projects and smaller crews. |

| Client Self-Provisioning | Clients building and managing their own accommodation. | Reduces reliance on third-party providers like Civeo. | Feasible for large, long-term projects with high occupancy. |

Entrants Threaten

Establishing a significant presence in the workforce accommodation industry demands considerable capital. Building and operating large-scale lodges and villages involves substantial costs for land, construction, and essential infrastructure, creating a high financial barrier that discourages many potential new competitors.

For instance, Civeo reported capital expenditures of $26.1 million in 2024 solely for maintenance, highlighting the continuous investment needed to sustain operations and facilities. This significant upfront and ongoing financial commitment acts as a strong deterrent against new entrants seeking to compete in this sector.

Civeo, like many established players in its industry, benefits significantly from economies of scale. This means they can spread their substantial fixed costs across a larger volume of services, leading to lower per-unit costs. For instance, their extensive network of accommodations and logistics in resource-rich regions allows for more efficient procurement of supplies and streamlined operational management.

New entrants would find it incredibly challenging to replicate these cost advantages. Building a comparable operational footprint and gaining the same level of experience takes considerable time and substantial capital investment. In 2024, the capital expenditure required to establish a similar operational scale in remote service provision would likely run into hundreds of millions of dollars, a prohibitive barrier for many potential competitors seeking to compete on price with established firms like Civeo.

Civeo and its competitors benefit from deeply entrenched client relationships, often solidified by multi-year, high-value contracts within the natural resources and construction industries. These long-standing partnerships represent a substantial hurdle for any new entrant aiming to capture market share.

For instance, Civeo's ability to secure a significant A$1.4 billion contract renewal underscores the loyalty and trust built over time. Such long-term commitments effectively lock in existing business, making it exceedingly difficult for newcomers to displace established providers and gain a foothold in the market.

Regulatory and Permitting Hurdles

Developing and operating workforce accommodation facilities, particularly in remote or environmentally sensitive locations, requires navigating intricate regulatory landscapes, comprehensive environmental impact assessments, and rigorous permitting procedures. These processes can be both time-consuming and expensive, presenting a significant barrier for newcomers who may not be well-versed in the specific regulations of various operating regions.

For instance, in 2024, the average time to secure all necessary permits for a new large-scale accommodation project in Western Australia, a key market for Civeo, could extend up to 18-24 months, with associated costs potentially reaching millions of dollars depending on the project's scale and environmental considerations. This lengthy and costly process inherently limits the number of new entities that can realistically enter the market.

- Regulatory Complexity: Navigating diverse local, regional, and national regulations for construction, health, safety, and environmental protection is a significant barrier.

- Environmental Assessments: Extensive environmental impact studies and approvals are often mandated, adding substantial time and cost to project development.

- Permitting Delays: Obtaining all required permits can be a lengthy process, with potential for unforeseen delays that impact project timelines and budgets.

- Jurisdictional Differences: New entrants must understand and comply with varying requirements across different geographical areas where Civeo operates, increasing operational complexity.

Specialized Operational Expertise and Logistics

The threat of new entrants is significantly mitigated by the specialized operational expertise and complex logistics required to serve remote and challenging locations. Companies like Civeo must possess deep knowledge in areas such as remote camp management, specialized catering, essential facilities maintenance, and robust emergency response protocols. Building this level of operational capability and a trained workforce represents a substantial barrier for newcomers. For instance, Civeo's strategic collaboration with the Six Nations of the Grand River Development Corporation in 2024 underscores the critical value of established local expertise and relationships, which are difficult for new entrants to replicate quickly.

New entrants face considerable hurdles in acquiring the necessary operational know-how and skilled personnel. This includes developing efficient supply chains for remote sites and ensuring compliance with stringent health and safety regulations in often harsh environments. Civeo's established track record and existing infrastructure provide a competitive advantage that is not easily overcome by new players entering the market.

- Specialized Expertise: Remote logistics, catering, and facility management require niche skills.

- Workforce Development: Training and retaining a specialized workforce is a significant undertaking.

- Local Partnerships: Civeo's 2024 collaboration with Six Nations highlights the importance of local integration.

- High Entry Costs: Establishing the necessary infrastructure and operational capabilities is capital-intensive.

The threat of new entrants in Civeo's workforce accommodation sector is considerably low due to substantial capital requirements for establishing and operating large-scale facilities, creating a significant financial barrier. Civeo's 2024 capital expenditures alone, which included $26.1 million for maintenance, illustrate the ongoing investment needed, deterring many potential competitors.

Economies of scale also present a formidable challenge for newcomers, as Civeo leverages its extensive network to achieve lower per-unit costs, a feat difficult to replicate without comparable infrastructure and experience. The estimated hundreds of millions of dollars required in 2024 to match Civeo's operational scale make entry prohibitive for many.

Entrenched client relationships, often secured through multi-year contracts like Civeo's A$1.4 billion renewal, create high switching costs and loyalty that new entrants struggle to overcome. Furthermore, navigating complex regulatory environments and obtaining necessary permits, a process that could take 18-24 months and cost millions in 2024 for projects in key markets like Western Australia, adds significant time and expense, further limiting new competition.

Porter's Five Forces Analysis Data Sources

Our Civeo Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including Civeo's annual reports and SEC filings, as well as industry-specific market research from firms like IBISWorld.

We supplement this with insights from macroeconomic data, competitor public disclosures, and news articles to provide a comprehensive understanding of the competitive landscape Civeo operates within.