Civeo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Civeo Bundle

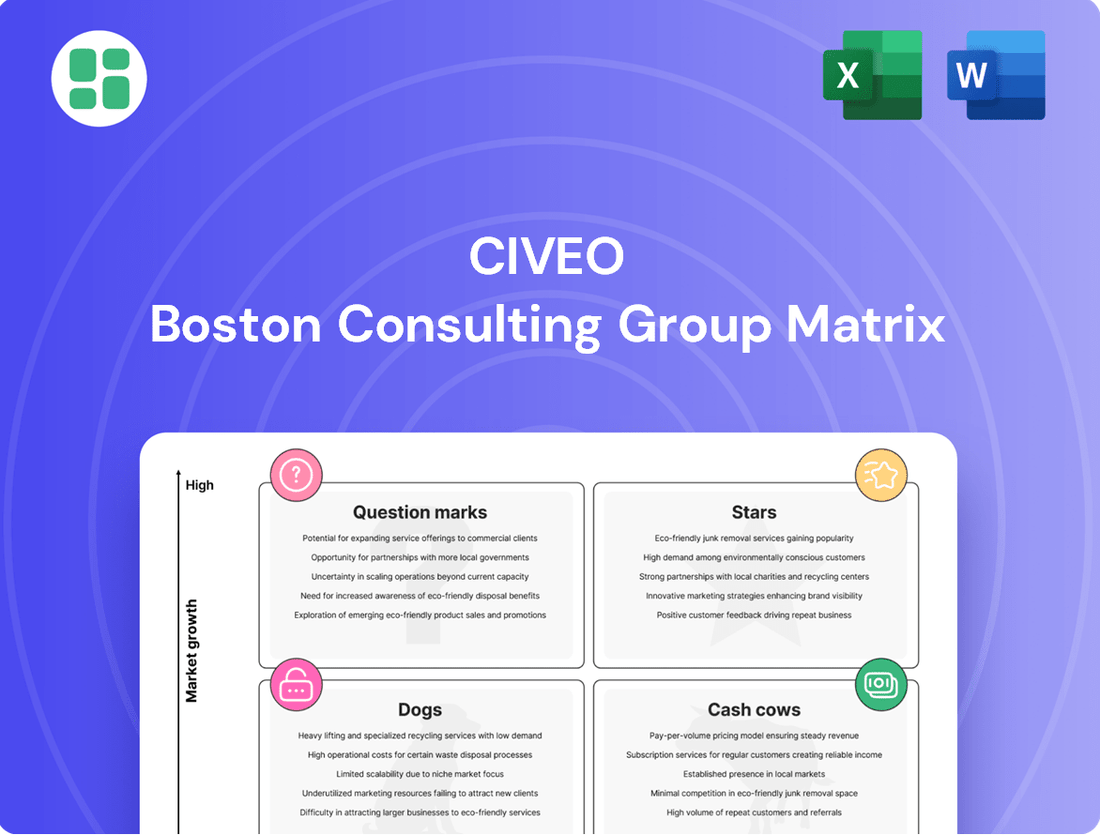

Curious about Civeo's strategic positioning? Our preview highlights key product categories, but the full BCG Matrix unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report for actionable insights and a clear roadmap to optimizing Civeo's portfolio and driving future growth.

Stars

Civeo's Australian integrated services are experiencing a significant expansion, highlighted by a substantial A$1.4 billion contract renewal set to commence in January 2025. This six-year agreement underscores Civeo's strong market position and its potential for high growth in providing comprehensive remote workforce solutions.

The expanded scope of these integrated services not only deepens Civeo's client relationships but also broadens its service offerings, solidifying its role as a key player in a market demanding efficient and all-encompassing operational support for remote workforces.

Bowen Basin Village Acquisitions represent a significant strategic move for Civeo, placing it firmly in the Stars category of the BCG Matrix. The acquisition of four additional villages in the Australian Bowen Basin, finalized in Q2 2025, immediately boosted revenue and solidified Civeo's position in a critical metallurgical coal hub.

This expansion highlights Civeo's substantial market share within a specific, expanding niche. For instance, the Bowen Basin is a cornerstone of Australia's coal exports, with the region accounting for a significant portion of the country's metallurgical coal production, a key ingredient for steelmaking.

Civeo's long-term Australian contract renewals demonstrate a strong market position. A recent four-year contract in the Bowen Basin is valued at A$250 million, showcasing significant client commitment and revenue stability. This highlights Civeo's ability to secure high-value, long-duration agreements in a key growth region.

Further reinforcing this strength, Civeo also secured a three-year integrated services contract worth A$64 million in the same Australian region. These renewals are crucial for maintaining a high market share and underscore the continued demand for Civeo's services, reflecting a robust competitive standing.

Diversification into New Australian Segments

Civeo's recent diversification into new Australian segments, particularly its first integrated services contract in Queensland, marks a significant strategic move. This contract, awarded by a leading metallurgical coal producer, encompasses two villages and signifies Civeo's entry into previously untapped areas within a high-growth region.

This expansion into new market segments within Australia, especially in resource-rich areas like Queensland, positions Civeo to capitalize on emerging opportunities. The company's proactive approach to market penetration in these promising segments suggests potential for significant growth, aligning with the characteristics of a 'Star' in the BCG matrix.

- New Market Penetration: Civeo secured its first integrated services contract in Queensland, Australia, targeting two villages for a major metallurgical coal producer.

- High-Growth Region Focus: This venture into previously untapped areas within Queensland indicates Civeo's strategy to leverage growth in a key Australian resource sector.

- Market Share Expansion: The move demonstrates Civeo's intent to actively expand its market share by entering new and promising segments within its operational landscape.

Strategic Focus on Australian Growth

Civeo's strategic focus on Australian growth is evident in its ambitious revenue targets. The company aims to reach A$500 million in Australian integrated services revenue by 2027. This represents a substantial increase and signals a strong commitment to expanding its presence in this key market.

This aggressive growth objective is supported by consistent investment in the Australian segment, positioning it as a crucial driver for Civeo's overall expansion. The company's existing strong market positions in Australia provide a solid foundation for achieving these elevated revenue goals.

- Strategic Revenue Target: A$500 million in Australian integrated services revenue by 2027.

- Growth Objective: High-growth focus, indicating significant expansion plans.

- Investment Commitment: Consistent capital allocation to the Australian market.

- Market Position: Leveraging existing strong market share to fuel growth.

Civeo's Australian operations, particularly in the Bowen Basin, are firmly positioned as Stars within the BCG Matrix. The company's recent A$1.4 billion contract renewal, commencing January 2025, and its strategic acquisitions of four villages in Q2 2025 highlight significant market share in a high-growth sector.

These developments, coupled with a stated aim of reaching A$500 million in Australian integrated services revenue by 2027, underscore Civeo's strong market position and its potential for continued high growth. The company's diversification into new segments, such as its first integrated services contract in Queensland, further solidifies its Star status.

Civeo's Australian integrated services are demonstrating robust growth, evidenced by a significant A$1.4 billion contract renewal set to begin in January 2025. This six-year agreement, along with other recent contract wins like a four-year, A$250 million deal in the Bowen Basin, clearly indicates Civeo's strong market standing and high growth potential in providing comprehensive remote workforce solutions.

The company's strategic expansion, including the acquisition of four villages in the Australian Bowen Basin in Q2 2025, has immediately boosted revenue and solidified its position within a critical metallurgical coal hub. This move, along with securing a three-year integrated services contract worth A$64 million, reinforces Civeo's ability to secure high-value, long-duration agreements.

Civeo's entry into new Australian market segments, exemplified by its first integrated services contract in Queensland for a leading metallurgical coal producer, signifies a proactive strategy to capitalize on emerging opportunities in high-growth regions. This expansion into previously untapped areas, aiming for A$500 million in Australian integrated services revenue by 2027, clearly positions these operations as Stars.

| Key Metric | Value | Year/Period | Implication for Star Status |

| Australian Integrated Services Revenue Target | A$500 million | By 2027 | Demonstrates strong growth ambitions and market penetration potential. |

| Bowen Basin Village Acquisitions | 4 villages | Q2 2025 | Immediate revenue boost and solidified market share in a key growth hub. |

| Major Australian Contract Renewal | A$1.4 billion | Commencing January 2025 (6-year term) | Confirms strong market position and long-term revenue visibility. |

| Bowen Basin Contract | A$250 million | 4-year term | Highlights client commitment and revenue stability in a growth region. |

| New Queensland Integrated Services Contract | Undisclosed value | Recent | Entry into new, high-growth market segments, indicating expansion potential. |

What is included in the product

The Civeo BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment strategies.

A Civeo BCG Matrix offers a clear, visual roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Civeo's established Australian-owned villages, particularly those in the Bowen Basin, are prime examples of Cash Cows. These mature assets are operating at full capacity, signifying a stable and highly profitable segment of their portfolio.

These operations consistently generate robust revenue and strong Adjusted EBITDA, a testament to their established market positions and high occupancy rates. The need for significant promotional investment is minimal, further contributing to their profitability and cash-generating ability.

For the fiscal year 2023, Civeo reported a significant portion of its revenue and EBITDA stemming from its Australian operations, with occupancy rates in key Bowen Basin villages consistently exceeding 90%, underscoring their Cash Cow status.

Civeo's long-standing client relationships in Australia are a clear indicator of its Cash Cow business segment. The renewal of significant, multi-year contracts with major resource companies, like the A$1.4 billion integrated services extension, highlights the company's deep integration and trust with its clientele.

These long-term agreements are crucial as they provide a stable and predictable revenue stream. This stability minimizes the need for extensive sales and marketing efforts to acquire new business, thereby reducing operational costs and boosting profitability. This is a hallmark of a Cash Cow, generating substantial cash flow with minimal investment.

Civeo's integrated facilities management services in Australia represent a classic cash cow. This segment, which includes catering, cleaning, maintenance, and logistics, has a well-established presence, generating stable, high-margin revenue. The company has successfully expanded margins in this area, meaning it throws off significant cash without requiring substantial new investment.

Stable Occupancy in Core Australian Regions

Civeo's Australian owned villages are demonstrating remarkable stability with consistently high occupancy rates, even amidst broader economic shifts. This resilience points to a dependable demand for accommodation in key natural resource hubs across Australia.

This sustained high utilization of Civeo's Australian assets is a direct driver of significant and predictable cash flow. For instance, in the first quarter of 2024, Civeo reported an average occupancy rate of 91% across its Australian portfolio, a testament to the ongoing demand.

- Strong Occupancy Levels: Civeo's Australian villages maintained robust occupancy, averaging 91% in Q1 2024.

- Resilient Demand: High utilization reflects consistent demand in established natural resource regions.

- Reliable Cash Generation: Sustained occupancy directly translates into predictable and substantial cash flows for the company.

Historically Strong Free Cash Flow Generation

Civeo's consistent ability to generate positive free cash flow every year since its spin-off in 2014 underscores its financial resilience. The company's commitment to using 100% of its annual free cash flow for share repurchases further emphasizes this strength.

This robust cash generation, largely driven by its stable and profitable Australian operations, firmly establishes these segments as cash cows for the overall business. For instance, in 2023, Civeo reported a free cash flow of $158.8 million, a significant increase from $104.7 million in 2022, demonstrating this consistent performance.

- Consistent Free Cash Flow: Civeo has generated positive free cash flow annually since its 2014 spin-off.

- Shareholder Returns: 100% of annual free cash flow is allocated to share repurchases.

- Australian Operations: These are the primary drivers of Civeo's strong cash generation.

- 2023 Performance: Free cash flow reached $158.8 million, up from $104.7 million in 2022.

Civeo's Australian operations, particularly its established villages in resource-rich regions like the Bowen Basin, are clear examples of cash cows. These mature assets consistently deliver strong revenue and profitability due to high occupancy rates and long-term client contracts, requiring minimal new investment.

The company's integrated services, including catering and maintenance, further solidify these segments as cash cows, generating high-margin, stable income. This strong performance is reflected in Civeo's consistent generation of positive free cash flow, with 100% of it being allocated to share repurchases.

For instance, Civeo's Australian villages maintained an average occupancy rate of 91% in Q1 2024, underscoring the reliable demand in these key resource hubs. This sustained high utilization directly translates into predictable and substantial cash flows.

Civeo's financial performance highlights the strength of these cash cow operations, with free cash flow reaching $158.8 million in 2023, an increase from $104.7 million in 2022.

| Segment | Key Characteristic | 2023 Performance Indicator | 2024 Q1 Occupancy |

|---|---|---|---|

| Australian Villages (Bowen Basin) | Mature, high occupancy, long-term contracts | Strong revenue and Adjusted EBITDA contribution | 91% average |

| Integrated Services (Australia) | High-margin, stable revenue, low investment | Significant cash generation | N/A (service based) |

Delivered as Shown

Civeo BCG Matrix

The Civeo BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get a complete, analysis-ready strategic tool without any alterations or watermarks. The report is designed for immediate use in your business planning and decision-making processes. You can confidently expect the same professional quality and actionable insights in the downloaded file.

Dogs

Civeo's Canadian oil sands lodge operations are currently in a challenging position, reflecting a low-growth market. In the first half of 2025, this segment saw substantial revenue drops and negative Adjusted EBITDA, a direct result of decreased customer investment and reduced turnaround project work. This performance suggests a segment with diminishing market share and limited expansion prospects.

Civeo's decision to cold-close two Canadian lodges and reduce its Canadian workforce by 25% signifies a strategic retreat from underperforming assets. This move is characteristic of a Dogs category, where ongoing investment is unlikely to generate sufficient returns, and the priority becomes mitigating further losses.

In 2023, Civeo reported a significant decline in its Canadian operations, with revenue decreasing by 18% compared to 2022. This underperformance directly contributed to the classification of these lodges within the Dogs quadrant of the BCG Matrix, necessitating decisive action to protect overall company profitability.

Civeo's mobile camp activity in Canada is experiencing a downturn, largely attributed to the winding down of major pipeline construction projects. This signals a segment with diminished demand and limited potential for future growth, placing it firmly in the 'Dog' category of the BCG matrix.

In 2024, the slowdown in energy infrastructure development directly impacted Civeo's Canadian operations. While specific figures for mobile camp activity are not publicly broken down, the broader Canadian oil and gas capital expenditure forecast for 2024 indicated a more cautious approach from major players, suggesting reduced demand for the very services Civeo provides in this segment.

Legacy North American Assets with Low Utilization

Legacy North American lodges with consistently low occupancy rates, often due to being older or in less strategic locations, are considered Civeo's Dogs. These assets typically require ongoing maintenance expenditures but fail to generate adequate returns, making them a drain on resources. For instance, in 2024, Civeo continued to evaluate its portfolio for underperforming assets, with a focus on optimizing its North American footprint.

These underutilized facilities present a challenge as they consume cash without contributing significantly to profitability. The strategic decision for such assets often involves either divesting them to free up capital or undertaking substantial restructuring to improve their viability. Civeo's commitment to portfolio optimization means these 'Dog' assets are prime candidates for such actions.

- Low Occupancy Rates: Assets with persistently low billed room numbers in North America.

- Cash Consumption: Maintenance costs outweighing revenue generation.

- Strategic Review: Candidates for divestiture or significant operational changes.

- Portfolio Optimization: Focus on improving overall asset performance and capital allocation.

Services Tied to Declining Canadian Capital Spending

Civeo's services tied to reduced capital and operational spending in Canada's oil sands are facing serious challenges. This reliance on a shrinking market, where Civeo's market share is also under pressure, places these particular service offerings in a 'Dog' category within the BCG matrix.

- Reduced Demand: Canadian oil sands capital expenditures have seen significant declines, impacting demand for Civeo's related services. For instance, in 2023, capital spending in the oil and gas sector in Canada was projected to be around CAD 69 billion, a decrease from previous years, directly affecting service providers like Civeo.

- Market Share Erosion: Increased competition and a contracting market mean Civeo is likely losing ground in these specific service segments.

- Low Growth, Low Share: These services operate in a low-growth or declining market with a potentially low or shrinking market share, characteristic of a 'Dog' in the BCG matrix.

Civeo's Canadian oil sands operations, particularly those experiencing reduced customer investment and project work, are firmly positioned as Dogs. These segments are characterized by low growth and diminishing returns, as evidenced by revenue drops and negative EBITDA in the first half of 2025. The strategic decision to cold-close lodges and reduce the Canadian workforce underscores the company's approach to managing these underperforming assets.

The underutilization of certain North American lodges, often due to age or location, also places them in the Dog category. These assets consume capital for maintenance without generating sufficient profits, making them candidates for divestiture or significant restructuring. Civeo's ongoing portfolio optimization efforts in 2024 aimed to address such underperforming segments, seeking to improve overall capital allocation.

The downturn in mobile camp activity in Canada, driven by the winding down of major pipeline projects, further exemplifies a Dog segment. The forecast for Canadian energy infrastructure development in 2024 suggested a cautious spending environment, directly impacting demand for Civeo's services in this area and reinforcing its Dog classification.

Civeo's services linked to decreased capital and operational spending within Canada's oil sands represent another Dog segment. A shrinking market, coupled with potential market share erosion, means these services operate with low growth prospects and limited profitability, necessitating careful management or divestment.

| Segment | BCG Category | Key Indicators (2023-2025) | Strategic Implication |

| Canadian Oil Sands Lodges | Dog | Low growth market, revenue drops (H1 2025), negative Adjusted EBITDA (H1 2025), reduced customer investment | Cold-closing lodges, workforce reduction, focus on mitigating losses |

| Legacy North American Lodges | Dog | Low occupancy rates, cash consumption (maintenance vs. revenue), older assets | Portfolio optimization, potential divestiture or restructuring |

| Canadian Mobile Camp Activity | Dog | Downturn due to pipeline project wind-downs, reduced demand (2024 infrastructure spending forecast) | Asset evaluation, managing declining demand |

| Services tied to reduced Canadian oil sands spending | Dog | Shrinking market, potential market share erosion, low growth, low profitability | Strategic review, focus on capital efficiency |

Question Marks

For Civeo, new technology integration for remote services presents a prime opportunity to move into the "Stars" quadrant of the BCG matrix. Think about advancements in energy management for remote sites; Civeo's investment in, for example, advanced solar or hybrid power solutions could significantly reduce operational costs and environmental impact. These technologies, while potentially having a nascent market share for Civeo currently, represent high-growth potential.

Consider the potential for AI-driven predictive maintenance in facilities management. Civeo could leverage this to proactively address equipment failures in remote camps, minimizing downtime and enhancing service delivery. This strategic adoption of emerging tech could solidify Civeo's position as a leader in remote workforce accommodation solutions, transforming nascent capabilities into dominant market share.

Civeo's expansion into renewable energy support services, particularly accommodation and integrated services for wind and solar farms in emerging regions, represents a potential 'Question Mark' in the BCG matrix. This sector is experiencing robust growth, with global renewable energy capacity additions reaching record levels. For instance, in 2023, the International Energy Agency reported that renewable energy sources accounted for over 80% of new global power capacity.

While Civeo's current market share in this niche is likely minimal, the sheer scale of the renewable energy build-out presents a significant opportunity. The market for supporting infrastructure and services for these projects is projected to grow substantially in the coming years. This strategic move, however, necessitates considerable upfront investment in specialized assets and operational capabilities to compete effectively and capture market share.

Geographic expansion into untapped resource frontiers represents Civeo's potential 'Question Marks' in the BCG matrix. These ventures, venturing into undeveloped regions beyond Australia and Canada, offer significant growth prospects but come with considerable risk and a low initial market presence.

These are speculative undertakings, demanding substantial initial capital to assess their feasibility and market reception. For instance, Civeo's foray into new mining or energy project locations in regions like South America or Africa would fit this category, requiring extensive groundwork and investment before generating significant returns.

Development of Sustainable Accommodation Solutions

Investing in and promoting advanced sustainable or modular accommodation technologies can capture the increasing demand from environmentally conscious clients. This area represents a high-growth niche where Civeo’s current market share is likely low, necessitating substantial investment in research and development alongside dedicated marketing initiatives.

- Sustainable technologies: Focus on eco-friendly materials and energy-efficient designs for accommodations.

- Modular solutions: Develop prefabricated, rapidly deployable units that minimize environmental impact.

- Market niche: Target clients prioritizing environmental, social, and governance (ESG) factors in their procurement.

- Investment required: Allocate capital for R&D, pilot projects, and targeted marketing campaigns to build brand awareness in this specialized sector.

Strategic Partnerships in Adjacent Services

Forming strategic partnerships, like the limited partnership with Six Nations of the Grand River Development Corporation to create CiveoSix, represents Civeo's move into adjacent services. This suggests an effort to tap into new business models or specialized markets.

These ventures are characterized by high growth potential but currently hold a low market share. They necessitate substantial nurturing and investment to demonstrate their scalability and long-term profitability, aligning with the characteristics of question marks in a BCG matrix.

- Strategic Alliance: The partnership with Six Nations of the Grand River Development Corporation for CiveoSix exemplifies a strategic move into adjacent service areas.

- Niche Market Exploration: This collaboration indicates Civeo's exploration of new business models and niche markets within its operational sphere.

- High Growth, Low Share: These adjacent services are positioned as having high growth potential but currently represent a small portion of Civeo's market share.

- Investment Required: Significant investment and focused development are needed to prove the scalability and profitability of these new ventures.

Civeo's expansion into renewable energy support services, particularly for wind and solar farms in emerging regions, fits the 'Question Mark' category. This sector shows strong growth, with global renewable capacity additions reaching record highs. For instance, in 2023, renewables accounted for over 80% of new global power capacity according to the IEA.

While Civeo's current market share in this niche is likely small, the massive build-out of renewables presents a significant opportunity. The market for supporting infrastructure and services is projected for substantial growth. However, this requires considerable upfront investment in specialized assets and capabilities to compete effectively.

Geographic expansion into untapped resource frontiers also represents potential 'Question Marks'. Ventures into undeveloped regions beyond Australia and Canada offer growth but carry significant risk and a low initial market presence. These require substantial capital for feasibility assessment and market reception, such as entering new mining or energy project locations in South America or Africa.

Strategic partnerships, like the one with Six Nations of the Grand River Development Corporation for CiveoSix, indicate a move into adjacent services with high growth potential but low current market share. These ventures need significant nurturing and investment to prove scalability and long-term profitability.

| Potential Question Mark Area | Market Growth Potential | Current Market Share (Estimated) | Investment Requirement | Key Considerations |

|---|---|---|---|---|

| Renewable Energy Support Services | High (driven by global energy transition) | Low | Significant (specialized assets, operational capabilities) | Capturing market share in a rapidly expanding sector. |

| Untapped Resource Frontiers (Geographic Expansion) | High (new project locations) | Low | Substantial (feasibility studies, infrastructure development) | Navigating risks and establishing presence in new territories. |

| Adjacent Services (e.g., CiveoSix partnership) | High (new business models, niche markets) | Low | Focused (proving scalability and profitability) | Nurturing new ventures for long-term success. |

BCG Matrix Data Sources

Our Civeo BCG Matrix is informed by comprehensive market data, encompassing Civeo's financial disclosures, industry growth forecasts, and competitor performance benchmarks to provide strategic clarity.