Compagnie Industriali Riunite PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

Uncover the intricate web of external forces shaping Compagnie Industriali Riunite's trajectory. From evolving political landscapes to shifting economic tides and technological advancements, our PESTEL analysis provides critical insights. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full version now for a strategic advantage.

Political factors

Government healthcare policies and funding are crucial for Compagnie Industriali Riunite's (CIR) healthcare services segment, KOS, operating primarily in Italy and Germany. Fluctuations in national healthcare budgets, reimbursement rates, and long-term care regulations directly affect KOS's revenue streams, growth prospects, and overall profitability.

For instance, Italy's budget law for 2025 signals a potential increase in healthcare expenditure, allocating additional funds towards innovative medicines and efforts to reduce patient waiting lists. This could create favorable conditions for CIR's healthcare-related investments and operations within Italy.

The automotive components sector, including Sogefi, navigates a complex web of environmental and safety regulations, especially in the European Union. These rules are constantly changing, demanding significant adaptation from manufacturers.

For instance, the EU's ambitious CO2 emission standards and the mandated increase in electric vehicle (EV) sales targets for 2025 directly influence how companies like Sogefi must innovate and produce. This means focusing on components that support electrification and efficiency, while potentially seeing reduced demand for traditional parts.

Compliance with these evolving standards is not just a matter of good practice; it's a critical business imperative. Failure to meet these stringent requirements could result in substantial fines, impacting the financial health and operational capacity of companies within the automotive supply chain.

The media and publishing sector in Italy, a key area for Compagnie Industriali Riunite (CIR), faces a dynamic regulatory environment. New rules concerning content moderation, data privacy under GDPR, and potential antitrust actions against dominant digital platforms are actively shaping the landscape. For instance, the Italian Communications Authority (AGCOM) continues to monitor market concentration, which could impact future media acquisitions or partnerships.

Shifts in intellectual property rights and evolving regulations for digital platforms present both opportunities and challenges for CIR. The Italian government's approach to regulating online advertising, particularly concerning the market share of international tech giants, could influence the revenue streams and competitive strategies of traditional publishers within CIR's portfolio. As of early 2024, discussions around digital services taxes and platform accountability are ongoing, potentially altering the operational costs and investment decisions for companies like CIR.

Trade Policies and Geopolitical Stability

Compagnie Industriali Riunite (CIR), with its global footprint, is significantly influenced by international trade policies and geopolitical stability. Shifts in trade agreements, such as potential new tariffs or changes to existing ones, can directly affect the cost of goods and market access for CIR's diverse subsidiaries. For instance, ongoing trade tensions between major economic blocs could disrupt supply chains and increase operational expenses.

Geopolitical instability in regions where CIR operates or sources materials poses a substantial risk. Political unrest or conflict can lead to supply chain disruptions, damage to assets, and reduced consumer demand. The current global economic landscape, marked by persistent uncertainties and trade friction, underscores the importance of monitoring these political factors for effective strategic planning.

- Trade Agreements: Changes in trade pacts, like those affecting the automotive or consumer goods sectors where CIR has interests, can alter import/export duties.

- Tariffs: The imposition of tariffs by countries like the United States on goods from key manufacturing nations can increase costs for CIR's subsidiaries.

- Geopolitical Risks: Political instability in Eastern Europe or other regions critical for supply chains can impact raw material availability and logistics.

- Global Economic Uncertainty: The ongoing volatility in global markets, influenced by geopolitical events, creates a challenging environment for international business operations.

Corporate Sustainability Reporting Directives

The implementation of the EU Corporate Sustainability Reporting Directive (CSRD) in Italy, enacted via Legislative Decree 125/2024, imposes significant new environmental, social, and governance (ESG) reporting obligations on large enterprises, including Compagnie Industriali Riunite (CIR). This directive mandates a higher level of transparency regarding a company's impacts on sustainability matters, directly influencing operational reporting, compliance expenditures, and interactions with stakeholders.

Adherence to these updated ESG reporting standards is vital for CIR to sustain investor trust and ensure ongoing regulatory compliance. For instance, the CSRD expands the scope of reporting to cover a broader range of sustainability topics and requires assurance on reported data, a significant shift from previous frameworks. By 2025, many Italian companies will be subject to these enhanced requirements, necessitating robust data collection and verification processes.

- Mandatory ESG Reporting: The CSRD, implemented in Italy through Legislative Decree 125/2024, makes ESG reporting compulsory for large companies like CIR.

- Increased Transparency Demands: New regulations require detailed disclosure on environmental, social, and governance impacts, affecting how companies present their sustainability performance.

- Impact on Compliance and Stakeholders: These directives will increase compliance costs and alter how CIR engages with investors, creditors, and other stakeholders who rely on ESG data.

- Investor Confidence and Regulatory Adherence: Meeting these stringent reporting standards is crucial for maintaining investor confidence and avoiding regulatory penalties.

Government healthcare policies and funding are crucial for Compagnie Industriali Riunite's (CIR) healthcare services segment, KOS. Fluctuations in national healthcare budgets and reimbursement rates directly affect KOS's revenue. For instance, Italy's budget law for 2025 signals a potential increase in healthcare expenditure, allocating additional funds towards innovative medicines.

The automotive components sector, including Sogefi, navigates a complex web of environmental and safety regulations, especially in the European Union. The EU's ambitious CO2 emission standards and mandated increase in electric vehicle sales targets for 2025 directly influence how Sogefi must innovate. Compliance with these evolving standards is a critical business imperative.

The media and publishing sector faces dynamic regulatory environments concerning content moderation and data privacy. Shifts in intellectual property rights and evolving regulations for digital platforms present both opportunities and challenges for CIR. Discussions around digital services taxes and platform accountability are ongoing, potentially altering operational costs.

Compagnie Industriali Riunite (CIR) is significantly influenced by international trade policies and geopolitical stability. Shifts in trade agreements can directly affect the cost of goods and market access for CIR's diverse subsidiaries. Geopolitical instability poses a substantial risk, potentially leading to supply chain disruptions and reduced consumer demand.

What is included in the product

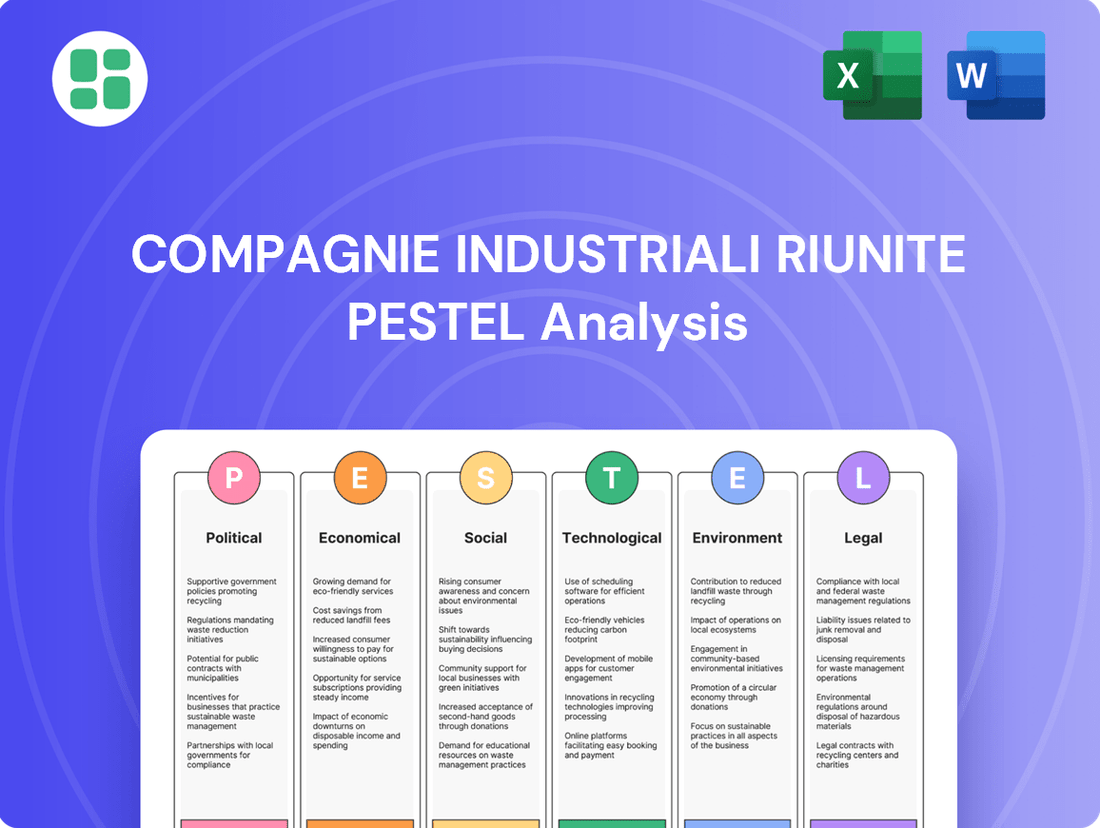

This PESTLE analysis delves into the external macro-environmental factors impacting Compagnie Industriali Riunite, offering a comprehensive view of Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by highlighting key trends and potential challenges or opportunities for the company.

Offers a clear, actionable PESTLE analysis of Compagnie Industriali Riunite, transforming complex external factors into manageable insights for strategic decision-making.

Economic factors

Italy's economic health, closely tied to the broader European market, directly impacts CIR's diverse portfolio by influencing consumer spending and industrial output. For 2025, Italy's real GDP growth is projected to be around 0.7%, with a slight uptick to 0.9% anticipated for 2026, driven by domestic demand and investment initiatives.

While these forecasts suggest moderate expansion, concerns about declining labor productivity and the potential for trade tariffs could act as headwinds, potentially moderating the pace of growth across the continent and within Italy.

Inflationary pressures and central bank interest rate policies directly impact Compagnie Industriali Riunite (CIR) by affecting operational costs, financing expenses, and the profitability of its financial investments. While inflation in Italy is projected to moderate and stay below 2% for 2025-2026, shifts in interest rates can significantly alter borrowing costs for CIR's subsidiaries and the returns generated from its liquid asset portfolio.

Consumer spending patterns and changes in disposable income are crucial for companies like KOS and Sogefi, as they directly influence demand for healthcare services and automotive components, respectively. In Italy, private consumption is expected to grow, bolstered by job market improvements and a recovery in real wages. This positive trend, projected for 2024 and into 2025, suggests a potentially favorable environment for increased consumer outlay on goods and services.

Automotive Market Demand and EV Transition

The automotive sector's health, especially the speed of the electric vehicle (EV) transition and overall vehicle sales volumes, directly impacts Sogefi's business. Factors like potential overcapacity in manufacturing, increased competition from new EV manufacturers, and the pace at which consumers embrace EVs are key determinants of demand for automotive components.

European automotive suppliers, including those like Sogefi, are navigating a period of considerable uncertainty regarding EV demand and the associated profitability for the 2024-2025 timeframe. This uncertainty stems from evolving consumer preferences, charging infrastructure development, and government incentives. For instance, while EV sales have seen growth, the profitability of producing EVs and their components remains a challenge for many established players.

- EV Sales Growth: Global EV sales are projected to continue their upward trajectory, with some forecasts suggesting they could reach over 15 million units in 2024, representing a significant portion of the total automotive market.

- Profitability Concerns: Reports from 2024 indicate that while EV sales are increasing, many automakers are still struggling to achieve the same profit margins on EVs as they do on traditional internal combustion engine vehicles, impacting component supplier pricing.

- Transition Pace: The varying pace of EV adoption across different regions and consumer segments creates a complex demand landscape for specialized automotive components.

Healthcare Expenditure and Demographic Trends

The aging population in Italy, a key demographic trend, is a significant driver for increased healthcare demand. This presents long-term opportunities for companies like KOS, which specialize in healthcare services. As the median age continues to rise, the need for specialized care, including nursing homes and rehabilitation facilities, is expected to grow substantially.

Government healthcare expenditure plays a crucial role in shaping the landscape for healthcare providers. Demographic shifts directly influence the utilization of services such as psychiatric care and long-term residential facilities. For instance, Italy's projected healthcare budget increase for 2025 underscores a continued commitment to investing in the sector, potentially benefiting companies aligned with these growing needs.

- Aging Population: Italy's population is aging, with the percentage of individuals over 65 projected to increase significantly by 2030, driving demand for elder care services.

- Healthcare Budget: Italy's national healthcare expenditure is anticipated to see a continued upward trend, with specific budget allocations for 2025 reflecting ongoing investment in healthcare infrastructure and services.

- Service Demand: The demand for nursing homes, rehabilitation centers, and psychiatric services is directly correlated with demographic trends, creating a sustained market for specialized healthcare providers.

Italy's economic trajectory, with a projected real GDP growth of 0.7% in 2025, influences CIR's diverse operations by shaping consumer spending and industrial activity. While moderate growth is anticipated, potential headwinds like declining labor productivity could temper expansion across the continent.

Inflation is expected to remain below 2% in Italy for 2025-2026, but shifts in central bank interest rates will directly affect CIR's borrowing costs and the profitability of its financial holdings.

Improved job markets and recovering real wages in Italy are likely to boost private consumption in 2024 and into 2025, benefiting companies like KOS and Sogefi through increased demand for their services and products.

The automotive sector's transition to electric vehicles presents both opportunities and challenges for Sogefi. While global EV sales are projected to exceed 15 million units in 2024, profitability concerns for EV production persist, creating a complex demand landscape for component suppliers.

| Economic Factor | 2025 Projection (Italy) | Impact on CIR |

|---|---|---|

| Real GDP Growth | 0.7% | Influences consumer spending and industrial output across CIR's portfolio. |

| Inflation Rate | Below 2% | Affects operational costs, financing expenses, and investment returns. |

| Interest Rates | Variable (Central Bank Policy Dependent) | Impacts borrowing costs for subsidiaries and returns on liquid assets. |

| Private Consumption Growth | Positive trend expected | Drives demand for KOS (healthcare) and Sogefi (automotive components). |

Preview the Actual Deliverable

Compagnie Industriali Riunite PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Compagnie Industriali Riunite delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Italy's demographic trend of an aging population is a significant factor for Compagnie Industriali Riunite (CIR). This societal shift directly translates into a heightened demand for long-term care, rehabilitation services, and specialized healthcare, areas where CIR's KOS subsidiary operates. As of early 2024, Italy's median age continues to rise, with a substantial portion of the population over 65, creating a consistently growing market for KOS's services.

This demographic reality provides a stable and expanding market for healthcare investments, directly influencing KOS's strategic expansion plans and the development of its service portfolio. By 2025, projections indicate this trend will only intensify, making a deep understanding of the evolving needs of the elderly population paramount for KOS's sustained growth and market positioning.

The way people consume media has changed dramatically, moving from traditional newspapers and TV to online streaming and digital content. This shift directly affects companies like Compagnie Industriali Riunite (CIR) that have interests in media and publishing. For instance, in 2024, global digital ad spending was projected to reach over $600 billion, underscoring the dominance of online platforms.

This means CIR needs to adapt its strategies as print media sales continue to decline. The rise of international tech giants in online advertising presents both a challenge and an opportunity, requiring CIR to find new ways to reach audiences and generate revenue in a digital-first world.

Across Compagnie Industriali Riunite's (CIR) varied industries, the availability of skilled workers, their specific competencies, and the associated labor expenses are paramount considerations. In the healthcare sector, persistent staff shortages and recruitment difficulties are being tackled by Italian budget legislation through financial incentives aimed at bolstering the workforce.

The automotive industry, in particular, faces a significant need to upskill its workforce to accommodate emerging technologies such as electric vehicles (EVs). This technological shift directly impacts CIR's strategies for employee training and retention, ensuring they can meet the demands of a rapidly evolving market.

Health and Wellness Awareness

Growing public awareness of health and wellness is a significant sociological driver for Compagnie Industriali Riunite (CIR). This heightened awareness translates into increased demand for preventative care, specialized medical treatments, and overall higher quality healthcare services, directly benefiting CIR's healthcare-focused operations.

The societal emphasis on quality of life and accessibility to advanced medical facilities fuels investment in high-standard care provisions. For instance, in 2024, global healthcare spending was projected to reach over $10 trillion, reflecting this strong societal value placed on health.

- Increased Demand: Consumers are actively seeking more proactive health management solutions.

- Investment Focus: Companies like CIR are incentivized to invest in cutting-edge medical technologies and services.

- Market Growth: The wellness industry, including fitness and nutrition, saw significant growth in 2024, with projections indicating continued expansion.

- Societal Values: A society prioritizing longevity and well-being directly supports businesses in the health sector.

Environmental and Social Consciousness of Consumers

Consumers are increasingly factoring environmental and social considerations into their buying habits, a trend particularly noticeable in sectors like automotive and potentially healthcare. This heightened awareness means companies with robust Environmental, Social, and Governance (ESG) practices are likely to see a boost in their brand image and consumer loyalty. For instance, a 2024 report indicated that 65% of consumers consider sustainability when making purchase decisions, a significant jump from previous years.

This shift directly impacts how companies like Compagnie Industriali Riunite operate and are perceived. Businesses that actively showcase their commitment to sustainability and ethical practices can carve out a distinct competitive edge. This is further amplified by a growing regulatory push for transparent ESG reporting, with many jurisdictions implementing stricter guidelines for companies by 2025.

- Consumer Preference Shift: A substantial majority of consumers now prioritize sustainability in their purchasing decisions, influencing brand choice and market share.

- ESG as a Competitive Differentiator: Strong ESG performance is evolving from a 'nice-to-have' to a critical factor for gaining market advantage and building brand equity.

- Regulatory Tailwinds: The increasing emphasis on ESG reporting by governments worldwide necessitates greater transparency and accountability in corporate environmental and social impact.

The evolving consumer preference for sustainable and ethically produced goods is a significant sociological factor impacting Compagnie Industriali Riunite (CIR). This trend influences purchasing decisions across various sectors, including automotive and healthcare, with a notable 65% of consumers in 2024 considering sustainability when buying. Companies demonstrating strong Environmental, Social, and Governance (ESG) practices are likely to experience enhanced brand loyalty and market advantage, especially as regulatory bodies increasingly mandate transparent ESG reporting by 2025.

| Sociological Factor | Impact on CIR | Supporting Data (2024/2025) |

|---|---|---|

| Consumer Preference for Sustainability | Increased demand for ESG-compliant products and services; potential brand differentiation. | 65% of consumers consider sustainability in purchase decisions (2024). |

| Growing Health & Wellness Awareness | Boosts demand for preventative care, specialized medical treatments, and higher quality healthcare services. | Global healthcare spending projected to exceed $10 trillion (2024); wellness industry growth. |

| Aging Population | Creates sustained demand for long-term care, rehabilitation, and specialized healthcare services. | Italy's median age continues to rise, with a significant portion of the population over 65 (early 2024). |

| Media Consumption Shift | Necessitates adaptation of media strategies due to declining print sales and rise of digital platforms. | Global digital ad spending projected to exceed $600 billion (2024). |

Technological factors

Technological advancements are reshaping the healthcare landscape, with innovations like electronic health records (EHR), telemedicine, and sophisticated medical equipment becoming crucial. These developments present both significant opportunities and essential requirements for companies like KOS to adapt and thrive.

Italy's national recovery plan is channeling substantial investment into technological and digital upgrades for its hospitals, with a specific focus on accelerating EHR adoption and replacing outdated equipment. This initiative aims for widespread implementation by 2025-2026, making it imperative for KOS to integrate these digital solutions.

The automotive sector is rapidly shifting towards electric vehicles (EVs) and autonomous driving, a trend Sogefi, as a component supplier, must actively address. This necessitates significant investment in research and development to reorient its product offerings towards EV-specific components and advanced driver-assistance systems (ADAS). For instance, by the end of 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years, highlighting the urgency for suppliers like Sogefi to innovate.

The increasing integration of Artificial Intelligence and sophisticated data analytics presents significant opportunities for Compagnie Industriali Riunite (CIR) to streamline its operations and develop innovative services across its diverse business units. In the healthcare sector, AI-driven tools are poised to revolutionize diagnostics and patient management, while in media, these technologies can enable highly personalized content delivery and deeper audience understanding.

Despite the global surge in AI adoption, Italian businesses, including those within CIR's operational sphere, are reportedly lagging. This gap suggests a substantial runway for growth and competitive advantage for companies that can effectively leverage these advanced technological capabilities. For instance, a 2024 report indicated that only 15% of Italian SMEs had implemented AI solutions, highlighting the untapped potential.

Media Digitization and Streaming Technologies

The media landscape is rapidly transforming due to digitization and the widespread adoption of streaming. This shift profoundly impacts how content is produced, delivered, and monetized, presenting both challenges and opportunities for companies like CIR. For instance, global streaming revenue is projected to reach over $200 billion by 2025, highlighting the immense growth in this sector.

CIR's media and publishing divisions need to adapt by embracing digital-first strategies. This involves creating content tailored for online consumption and actively engaging audiences across diverse digital platforms. The company must explore innovative revenue models, moving beyond traditional advertising to incorporate subscription services and direct-to-consumer offerings, mirroring the success seen by major streaming players.

- Digital Content Dominance: By 2024, digital advertising spending is expected to surpass traditional media advertising globally, underscoring the need for CIR to prioritize digital content creation.

- Subscription Growth: The subscription video-on-demand (SVOD) market, a key indicator of streaming success, saw a significant increase in subscriber numbers throughout 2023 and is anticipated to continue its upward trajectory.

- Audience Engagement: Platforms are increasingly focused on personalized content delivery and interactive experiences to retain viewers in a competitive streaming environment.

- Monetization Diversification: Beyond subscriptions, companies are exploring advertising-supported video on demand (AVOD) and transactional video on demand (TVOD) to broaden revenue streams.

Cybersecurity and Data Protection

As Compagnie Industriali Riunite (CIR) increasingly relies on digital systems across its diverse sectors, cybersecurity and data protection are critical technological factors. The company must implement robust measures to safeguard sensitive information, from patient data in its healthcare divisions to proprietary designs in automotive manufacturing and personal details in its media operations.

Failure to do so not only risks significant financial penalties under evolving data privacy laws but also erodes customer trust, a vital asset in all CIR's business segments. For instance, the global cybersecurity market was valued at approximately $270 billion in 2024 and is projected to grow substantially, highlighting the increasing investment and importance of these capabilities.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, a figure CIR must actively mitigate.

- Regulatory Compliance: Adherence to regulations like GDPR and CCPA is non-negotiable, with substantial fines for non-compliance.

- Reputational Risk: A single significant breach can severely damage CIR's brand image and customer loyalty across all its operating sectors.

- Operational Continuity: Effective cybersecurity ensures the uninterrupted operation of digital infrastructure, essential for service delivery in healthcare and manufacturing.

The integration of Artificial Intelligence (AI) and advanced data analytics offers Compagnie Industriali Riunite (CIR) significant avenues for operational enhancement and new service development across its varied business units. AI is set to transform diagnostics and patient care in healthcare, while in media, it facilitates personalized content delivery and deeper audience insights.

Despite a global push for AI adoption, Italian businesses, including those within CIR's operational scope, are noted to be lagging, presenting a clear opportunity for competitive advantage for early adopters. For example, a 2024 report indicated that only about 15% of Italian small and medium-sized enterprises had implemented AI solutions, underscoring this untapped potential.

The media industry's evolution, driven by digitization and the widespread adoption of streaming services, profoundly impacts content creation, distribution, and monetization strategies for companies like CIR. Global streaming revenue is projected to exceed $200 billion by 2025, showcasing the sector's substantial growth.

| Technology Area | Impact on CIR | 2024/2025 Data Point |

|---|---|---|

| Artificial Intelligence & Data Analytics | Operational efficiency, personalized services, market insights | 15% of Italian SMEs adopted AI in 2024 |

| Digitalization & Streaming | Content strategy, audience engagement, new revenue models | Global streaming revenue projected >$200 billion by 2025 |

| Cybersecurity | Data protection, regulatory compliance, brand reputation | Global cybersecurity market valued at ~$270 billion in 2024 |

Legal factors

Compagnie Industriali Riunite's (CIR) healthcare arm, KOS, navigates a complex web of Italian and European healthcare regulations. This includes stringent licensing mandates, quality assurance protocols, and patient safety standards, all of which are fundamental to its operations.

Adherence to regulations concerning medical device approvals and robust data privacy laws, such as the General Data Protection Regulation (GDPR), is paramount for KOS. These frameworks directly impact how patient information is handled and how medical technologies are integrated.

Looking ahead, the Italian government's budget law for 2025 signals a shift, introducing new governance structures for medical devices. This will likely necessitate updated compliance strategies for KOS, potentially affecting product lifecycle management and market access.

Sogefi operates within a landscape shaped by stringent automotive emission and safety standards globally. Navigating these complex regulations, which dictate everything from exhaust gas composition to the materials used in components, is crucial for market access and product development.

The European Union's commitment to reducing CO2 emissions is a prime example, with targets for new cars set to average 93.6g CO2/km by 2025. This directly impacts the design and manufacturing of components like air filters and cooling systems, pushing for lighter and more efficient solutions.

Furthermore, ongoing discussions around future fleet emissions and the durability of electric vehicle batteries, particularly concerning battery materials and recycling, will continue to influence component specifications and Sogefi's research and development focus in the coming years.

As a listed entity, Compagnie Industriali Riunite (CIR) navigates a complex web of corporate governance and financial reporting laws, primarily dictated by Italian regulations and broader European Union directives. These frameworks ensure transparency and accountability to shareholders and the market.

The recent implementation of the Corporate Sustainability Reporting Directive (CSRD) in Italy, effective from January 1, 2024, for large listed companies, significantly elevates CIR's disclosure obligations. This directive mandates detailed reporting on environmental, social, and governance (ESG) matters, requiring robust internal systems and rigorous external auditing to ensure accuracy and compliance, impacting CIR's reporting costs and strategic focus.

Competition Law and Anti-Trust Regulations

Compagnie Industriali Riunite's (CIR) broad investment approach, which includes potential acquisitions and divestitures across its various industries, is significantly shaped by competition and anti-trust laws. These regulations are designed to maintain a level playing field, preventing any single entity from dominating markets and stifling fair competition. Any major strategic shifts by CIR, such as acquiring a significant stake in a competitor or divesting a substantial business unit, would necessitate thorough legal scrutiny to ensure compliance with these frameworks. For instance, in 2024, the European Commission continued to actively scrutinize large mergers, with several high-profile deals facing in-depth investigations to assess their potential impact on market competition.

Navigating these legal requirements is crucial for CIR to execute its growth and restructuring plans effectively. Failure to adhere to anti-trust regulations can result in substantial fines and operational disruptions. For example, in 2024, several technology companies faced significant regulatory challenges and penalties across different jurisdictions for alleged anti-competitive practices, highlighting the global enforcement trends.

- Merger Control: CIR must assess whether proposed acquisitions or mergers meet thresholds that trigger notification and approval requirements from competition authorities, such as the Italian Competition Authority (AGCM) or the European Commission.

- Abuse of Dominance: CIR must ensure its operations, particularly in sectors where it holds a strong market position, do not involve practices that unfairly disadvantage competitors or consumers.

- Cartel Prohibition: Agreements with competitors that fix prices, allocate markets, or rig bids are strictly prohibited and carry severe penalties.

- State Aid Rules: If CIR receives any form of government support, it must ensure compliance with EU state aid regulations to avoid distorting competition within the single market.

Labor Laws and Employment Regulations

Compagnie Industriali Riunite (CIR) must navigate a complex web of Italian and international labor laws. This includes adhering to strict regulations on working conditions, minimum wages, employee rights, and workplace health and safety across all its global operations. For instance, in 2024, Italy's minimum wage discussions continued, with potential impacts on operational costs for companies like CIR.

Changes in labor legislation or significant new union agreements can directly affect CIR's bottom line and how it manages its workforce. For example, upcoming EU directives on worker protections, expected to be implemented in 2025, could necessitate adjustments in employment contracts and benefits, potentially increasing HR management costs.

Key considerations for CIR include:

- Compliance with Italian Labor Law: Adherence to national legislation governing employment contracts, working hours, and social security contributions.

- International Labor Standards: Ensuring operations in other countries meet or exceed local labor laws and international conventions.

- Health and Safety Regulations: Maintaining rigorous safety protocols to prevent workplace accidents and comply with occupational health standards, a critical area given industrial operations.

- Union Relations and Collective Bargaining: Managing relationships with labor unions and adapting to new collective bargaining agreements, which can influence wage structures and working conditions.

Compagnie Industriali Riunite (CIR) must navigate evolving intellectual property laws, particularly concerning patents and trademarks for its technological advancements in healthcare and automotive sectors. Protecting its innovations is vital for maintaining competitive advantage and market share.

The increasing focus on digital data protection, with GDPR remaining a cornerstone, means CIR must ensure robust cybersecurity measures and transparent data handling practices across all its operations. This is critical for building trust and avoiding significant penalties, with fines for GDPR breaches potentially reaching 4% of global annual turnover.

CIR's adherence to evolving environmental regulations, such as those concerning waste management and emissions, is also legally mandated. For instance, the EU's Circular Economy Action Plan, with ongoing updates in 2024 and 2025, influences how CIR designs products and manages its supply chains to minimize environmental impact.

Environmental factors

Compagnie Industriali Riunite (CIR) faces escalating pressures from climate change and sustainability demands across its diverse operations. For instance, its automotive sector faces increasing scrutiny to decarbonize manufacturing processes, a trend amplified by the EU's ambitious Green Deal, which aims for climate neutrality by 2050. This regulatory environment is already impacting supply chains and operational costs.

The healthcare segment within CIR must also contend with growing expectations for waste reduction and the implementation of eco-friendly practices. Globally, there's a significant push for circular economy principles, meaning CIR's subsidiaries will need to invest in sustainable material sourcing and end-of-life product management to maintain competitiveness and regulatory compliance.

Sogefi, a key player in the automotive components sector, faces significant impacts from evolving emissions regulations. The European Union's ambitious CO2 targets for 2025, aiming for an average of 95 grams of CO2 per kilometer for new cars, are accelerating the transition to electric vehicles (EVs). This regulatory push directly influences Sogefi's product development, requiring substantial investment in components suitable for low-emission and zero-emission powertrains.

The company must adapt its manufacturing processes to support this shift, potentially investing in new technologies for EV components like battery cooling systems or lightweight materials. Failure to comply with these stringent standards not only risks market share but also carries the threat of substantial financial penalties, as seen with previous emissions-related fines levied across the automotive industry.

Compagnie Industriali Riunite's healthcare division, KOS, faces significant environmental scrutiny, particularly concerning medical waste management. In 2024, the European Union continued to strengthen regulations on hazardous medical waste, with member states like Italy, where KOS operates, implementing stricter disposal protocols. Failure to comply can result in substantial fines and reputational damage.

KOS's operational compliance hinges on effective pollution control, including managing water usage and energy consumption. For instance, hospitals are major water consumers, and initiatives to reduce wastewater discharge and improve water treatment are becoming increasingly important. In 2025, energy efficiency targets for healthcare facilities are expected to tighten further across Europe, impacting operational costs and investment decisions.

Beyond regulatory compliance, a robust approach to waste management and pollution control enhances KOS's environmental footprint. This is increasingly a factor for investors and stakeholders who prioritize sustainability. Reports from 2024 indicated a growing trend of ESG (Environmental, Social, and Governance) considerations influencing investment in the healthcare sector, making KOS's environmental performance a key metric.

Resource Scarcity and Raw Material Costs

The availability and cost of raw materials, crucial for automotive components, are directly affected by environmental factors and growing resource scarcity. For instance, the price of key metals like lithium and cobalt, essential for EV batteries, saw significant volatility in 2024 due to supply chain disruptions and increased demand. This trend is projected to continue, with forecasts indicating further price pressures on critical minerals through 2025.

Geopolitical tensions and evolving environmental policies significantly impact supply chains and the pricing of essential materials. The ongoing global focus on sustainability and carbon neutrality is leading to stricter regulations on mining and extraction processes, potentially increasing operational costs. Diversifying suppliers and investing in efficient resource management are therefore critical strategies for companies like Compagnie Industriali Riunite to mitigate these risks.

- Lithium prices experienced a surge of over 40% in early 2024 compared to the previous year.

- Cobalt, another critical battery material, faced supply chain vulnerabilities due to its concentration in specific geopolitical regions.

- Environmental regulations are increasingly mandating the use of recycled materials, impacting virgin resource demand.

- Industry reports from late 2024 highlighted a growing need for companies to secure long-term supply agreements for key raw materials to ensure price stability.

ESG Reporting and Investor Expectations

Growing investor demand for robust Environmental, Social, and Governance (ESG) performance necessitates that Compagnie Industriali Riunite (CIR) move beyond basic environmental compliance. This shift is underscored by the increasing integration of ESG metrics into investment decision-making, with global sustainable investment assets projected to reach $50 trillion by 2025, according to Morningstar data. CIR's ability to articulate and demonstrate its environmental stewardship is therefore paramount for attracting capital from this expanding investor base.

The evolving regulatory landscape, particularly new EU directives and forthcoming Italian legislation on ESG reporting, places a premium on transparency and comprehensive disclosure. CIR must ensure its reporting is not only compliant but also insightful, providing investors with clear data on environmental impact, resource management, and climate risk mitigation. Failure to do so could hinder access to capital and damage the company's standing among socially conscious investors.

CIR's commitment to strong ESG reporting directly influences its corporate reputation and its ability to attract and retain responsible investors. Demonstrating proactive environmental management, such as reducing carbon emissions or improving waste management, can differentiate CIR in a competitive market. For instance, companies with superior ESG scores often experience lower costs of capital and higher valuations.

- Investor Scrutiny: Investors are increasingly scrutinizing environmental performance, with a significant portion now integrating ESG factors into their primary investment criteria.

- Regulatory Drivers: New EU and Italian regulations are mandating more detailed and standardized ESG disclosures, requiring companies like CIR to enhance their reporting capabilities.

- Capital Access: Strong ESG credentials can improve access to capital, as evidenced by the growth of ESG-focused funds and the increasing allocation of assets towards sustainable investments.

- Reputational Impact: Transparent and effective ESG reporting enhances corporate reputation, fostering trust with stakeholders and potentially leading to improved market performance.

Environmental regulations are a significant factor for Compagnie Industriali Riunite (CIR), particularly impacting its automotive component subsidiary, Sogefi. The EU's stringent CO2 emission standards, targeting 95g/km for new cars by 2025, are driving the shift towards electric vehicles. This necessitates substantial investment from Sogefi in components for EVs, affecting its product development and manufacturing processes.

CIR's healthcare division, KOS, faces increasing pressure regarding medical waste management and operational efficiency. Stricter disposal protocols for hazardous medical waste, as seen in Italy, and tightening energy efficiency targets for healthcare facilities in 2025 will impact KOS's operational costs and require investments in sustainable practices. This focus on environmental performance is also a key metric for attracting ESG-conscious investors.

The availability and cost of raw materials are increasingly influenced by environmental concerns and resource scarcity. For instance, lithium and cobalt prices, critical for EV batteries, experienced volatility in 2024 due to supply chain issues and rising demand, with continued price pressures expected through 2025. Geopolitical factors and environmental policies on mining also add to supply chain risks and operational costs.

| Factor | Impact on CIR/Subsidiaries | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Sustainability Demands | Increased scrutiny on decarbonization, waste reduction, and eco-friendly practices across all sectors. | EU Green Deal aiming for climate neutrality by 2050. |

| Emissions Regulations (Automotive) | Sogefi must adapt to EV transition, investing in new components and manufacturing technologies. | EU CO2 target of 95g/km for new cars by 2025. |

| Waste Management (Healthcare) | KOS needs to comply with stricter medical waste disposal protocols and enhance water/energy efficiency. | Tightening energy efficiency targets for healthcare facilities in Europe expected in 2025. |

| Raw Material Availability & Cost | Volatility in prices of critical minerals like lithium and cobalt due to supply chain and demand. | Lithium prices surged over 40% in early 2024; cobalt supply chain vulnerabilities persist. |

| ESG Investor Demand | CIR must demonstrate strong environmental stewardship to attract capital from a growing ESG-focused investor base. | Global sustainable investment assets projected to reach $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Compagnie Industriali Riunite is built on a comprehensive review of official government publications, economic databases from institutions like Eurostat and national statistical offices, and leading industry reports. We meticulously gather data on regulatory changes, market trends, and technological advancements impacting the industrial sector.