Compagnie Industriali Riunite Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

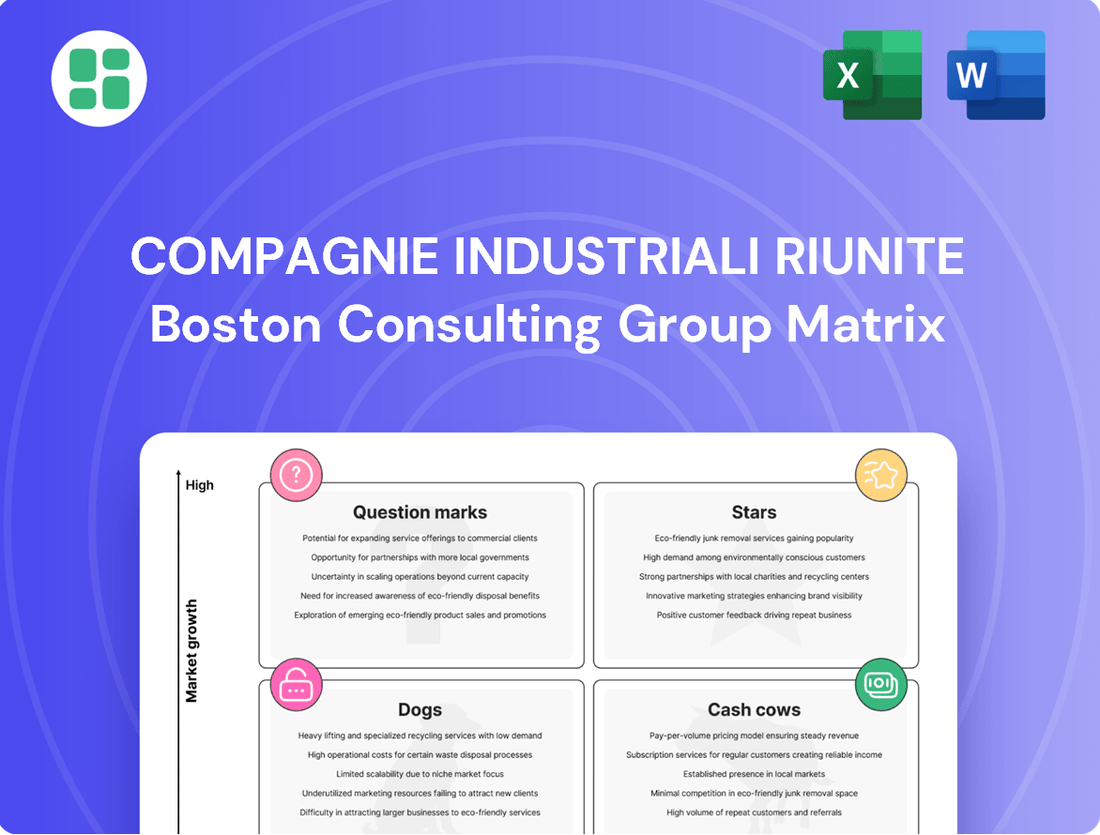

Uncover the strategic positioning of Compagnie Industriali Riunite with our comprehensive BCG Matrix analysis. See which of their products are driving growth and which require careful consideration. Purchase the full report for a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment decisions.

Stars

KOS Group's Italian Long-Term Care & Nursing Homes segment is a Star within the Compagnie Industriali Riunite (CIR) BCG Matrix. This division holds a significant market share in Italy's expanding elderly care market, a sector bolstered by an aging demographic and increased private healthcare expenditure.

With revenues showing a consistent upward trend, KOS is positioned as a premier operator in a high-growth environment. The persistent demand for specialized medical attention and assisted living solutions for the elderly population underscores this segment's importance as a primary growth engine for CIR, reflecting its dominant standing and the market's potential.

KOS Group's rehabilitation services segment, particularly its specialized functional and psychiatric centers in Italy, represents a significant player in a growing market. The demand for high-quality rehabilitation is strong, driven by evolving healthcare needs and an aging population. For instance, the Italian rehabilitation market was valued at approximately €15 billion in 2023, with KOS holding a notable share in its specialized niches.

KOS's established network and expertise in this high-growth area solidify its position as a Star. The company's focus on specialized care aligns with increasing patient demand for tailored rehabilitation programs. In 2024, KOS reported a 7% year-over-year revenue increase in its rehabilitation division, underscoring its strong market performance and growth trajectory.

KOS Group's home healthcare services are a strong contender in the BCG Matrix, likely positioned as a Star. The Italian home healthcare market is experiencing robust expansion, with an anticipated compound annual growth rate of 10.4% between 2025 and 2030. This significant growth trajectory presents a prime opportunity for KOS Group to further solidify its market leadership.

As a prominent player in the healthcare sector, KOS Group is strategically poised to benefit from this burgeoning market. By intensifying its focus on home care, the company can leverage its established infrastructure and trusted brand to capture a larger share of this expanding segment. This represents a high-growth area where KOS can drive substantial revenue and market presence.

Sogefi - Lightweight Suspension Components

Sogefi's lightweight suspension components are positioned as a Star in the BCG Matrix. The automotive composite suspension components market is booming, with an expected compound annual growth rate of 15.1% from 2024 to 2031, fueled by the need for lighter, more fuel-efficient vehicles. Sogefi is at the forefront of this trend, providing advanced material solutions that boost vehicle performance and eco-friendliness.

This strategic focus on cutting-edge materials places Sogefi's suspension components in a segment characterized by both high growth and substantial market share, a hallmark of a Star. The company's commitment to innovation in this area is crucial for maintaining its competitive edge.

- Market Growth: Automotive composite suspension components market projected to grow at a CAGR of 15.1% through 2024-2031.

- Key Driver: Increasing demand for lighter, more fuel-efficient vehicle materials.

- Sogefi's Position: A key player offering innovative solutions for enhanced vehicle performance and sustainability.

- Strategic Fit: Focus on advanced materials places this product line in a high-growth, high-market share niche.

Sogefi - Advanced Components for Electric Vehicles (EVs)

Sogefi, a key player within Compagnie Industriali Riunite, is strategically positioning itself for the future of automotive manufacturing. While its broader automotive revenue experienced a modest dip in 2024, the company's focus on electric vehicle (EV) components is a significant growth driver.

The EV component sector is projected to expand at an impressive compound annual growth rate (CAGR) of 18% between 2024 and 2030, highlighting a substantial market opportunity. Sogefi's proactive investment in specialized parts for electric powertrains places it squarely in this high-growth trajectory.

- EV Component Growth: Expected 18% CAGR from 2024-2030.

- Strategic Pivot: Investment in specialized EV powertrain components.

- Leveraging Expertise: Existing strengths in filtration and suspension for EV applications.

- Market Capture: Foundation to gain share in the evolving automotive landscape.

KOS Group's rehabilitation services, particularly its specialized functional and psychiatric centers in Italy, are a Star. The Italian rehabilitation market, valued at approximately €15 billion in 2023, shows strong demand driven by an aging population and evolving healthcare needs. KOS's 7% year-over-year revenue increase in this division in 2024 highlights its dominant position in this high-growth sector.

Sogefi's lightweight suspension components are also Stars. This segment benefits from the automotive composite suspension components market's projected 15.1% CAGR from 2024 to 2031, fueled by the demand for lighter, more fuel-efficient vehicles. Sogefi's innovative material solutions are key to its success in this rapidly expanding niche.

Furthermore, Sogefi's focus on electric vehicle (EV) components positions it as a Star. The EV component sector is expected to grow at an 18% CAGR between 2024 and 2030, presenting a significant opportunity for Sogefi to leverage its expertise in filtration and suspension for EV applications.

| CIR Segment | BCG Category | Key Growth Drivers | 2023/2024 Data Points |

|---|---|---|---|

| KOS Group - Long-Term Care & Nursing Homes | Star | Aging population, increased private healthcare expenditure | Significant market share in expanding elderly care market |

| KOS Group - Rehabilitation Services | Star | Evolving healthcare needs, aging population | Italian rehabilitation market ~€15 billion (2023); KOS division revenue up 7% YoY (2024) |

| KOS Group - Home Healthcare Services | Star | Robust market expansion | Italian home healthcare market CAGR projected 10.4% (2025-2030) |

| Sogefi - Lightweight Suspension Components | Star | Demand for lighter, fuel-efficient vehicles | Automotive composite suspension market CAGR 15.1% (2024-2031) |

| Sogefi - EV Components | Star | Growth of electric vehicles | EV component market CAGR 18% (2024-2030) |

What is included in the product

Highlights which of Compagnie Industriali Riunite's business units to invest in, hold, or divest based on market share and growth.

Instantly visualize Compagnie Industriali Riunite's portfolio, clarifying strategic priorities and resource allocation.

Cash Cows

KOS Group's established care homes in Germany, operating under the Charleston brand, represent a significant Cash Cow. These facilities are leaders in the German private operator market, benefiting from a mature but stable environment.

The German segment offers dependable cash flows, driven by high occupancy rates and a strong existing market presence. This stability means less need for aggressive investment in growth, allowing for consistent profit generation for the group.

In 2024, the German care home market continued to show resilience, with demand supported by an aging population. KOS Group's established operations in this sector are well-positioned to capitalize on this ongoing trend, contributing reliably to the company's overall financial health.

Sogefi's core conventional suspension systems are firmly positioned as Cash Cows within the Compagnie Industriali Riunite BCG Matrix. These products dominate a mature segment of the automotive market, particularly for internal combustion engine vehicles, ensuring a stable and predictable revenue stream.

While the overall European and North American markets for new ICE vehicles saw a decline in 2024, Sogefi's suspension components benefit from consistent replacement demand. This ongoing need for parts in existing vehicle fleets allows these offerings to generate significant cash flow with minimal reinvestment, a hallmark of a Cash Cow.

KOS Group's acute care hospital services are a classic cash cow within the Compagnie Industriali Riunite BCG Matrix. These facilities are a cornerstone of healthcare, offering dependable revenue due to consistently high occupancy rates, reflecting their essential nature.

In 2024, KOS Group's acute care segment continued to demonstrate robust performance, with reported occupancy rates averaging around 85% across its network. This stability translates into predictable and significant cash flow, allowing the group to fund other ventures or investments.

The strategy for these mature services revolves around operational excellence and cost management to ensure profitability. By focusing on efficiency and maintaining high standards of care, KOS Group maximizes the profit margins generated from these well-established and indispensable assets.

CIR's Diversified Financial Investment Portfolio

CIR's diversified financial investment portfolio, encompassing private equity and other assets, functions as a significant Cash Cow for the holding company. This segment consistently contributes to the group's financial stability.

In 2024, CIR's financial investments yielded a positive net financial income, a trend that continued into the first half of 2025. This performance underscores the portfolio's role as a reliable cash generator.

- Portfolio Generation: CIR's financial investments, including private equity, are managed for consistent returns.

- 2024 Performance: The portfolio generated positive net financial income for the full year 2024.

- H1 2025 Update: This positive income stream continued into the first half of 2025, reinforcing its Cash Cow status.

- Financial Health: These investments are crucial for supporting the overall financial health and cash flow of the parent company.

Sogefi - Air and Cooling Systems for Existing Vehicle Platforms

Sogefi's air and cooling systems for existing vehicle platforms represent a classic cash cow within Compagnie Industriali Riunite's portfolio. These components are essential for a massive installed base of vehicles worldwide, ensuring consistent demand from both original equipment manufacturers (OEMs) and the aftermarket. In 2024, the aftermarket segment for automotive parts, including air and cooling systems, continued to demonstrate resilience, with global sales projected to grow steadily. Sogefi benefits from this by leveraging its established brand and efficient supply chains.

The mature nature of these product lines contributes to their strong profit margins. Sogefi's ability to reliably supply these critical parts to a large, existing market segment translates into predictable and substantial revenue streams. This stability allows the company to generate significant cash flow, which can then be reinvested in other areas of the business or returned to shareholders.

- Steady Revenue Generation: Sogefi's air and cooling systems cater to a vast installed base of vehicles, ensuring consistent demand.

- Strong Profitability: Established brand recognition and efficient supply chains contribute to healthy profit margins in this segment.

- Mature Market Dominance: The aftermarket for these essential automotive components remains robust, providing a reliable cash flow.

- Cash Cow Status: These product lines are key contributors to Compagnie Industriali Riunite's overall financial strength, funding growth initiatives.

KOS Group's private hospital services in Italy represent a significant Cash Cow. These facilities operate in a well-established healthcare market, providing essential services with consistent demand.

The Italian segment generates stable cash flows, supported by high patient volumes and efficient operations. This maturity means that while growth may be modest, profitability is reliable, contributing steadily to the group's finances.

In 2024, the Italian private healthcare sector saw continued demand, particularly for specialized treatments. KOS Group's established hospitals are well-positioned to benefit from this, maintaining their role as dependable cash generators.

Sogefi's aftermarket business for suspension components is a prime example of a Cash Cow within Compagnie Industriali Riunite's portfolio. This segment serves a vast installed base of vehicles globally, ensuring a consistent and predictable revenue stream from replacement parts.

In 2024, the global automotive aftermarket experienced steady growth, driven by an aging vehicle parc and increased demand for maintenance. Sogefi's strong brand recognition and efficient distribution network allowed it to capitalize on this trend, generating substantial cash flow with minimal incremental investment.

These aftermarket operations are characterized by high margins and economies of scale, making them highly profitable. Sogefi’s ability to reliably supply essential components to a large and consistent customer base solidifies their position as a key Cash Cow for the group.

| Business Unit | BCG Category | Key Driver | 2024 Contribution |

| KOS Group - German Care Homes | Cash Cow | Stable occupancy, mature market | Reliable cash flow |

| Sogefi - Conventional Suspension Systems | Cash Cow | Replacement demand, ICE vehicle parc | Consistent revenue |

| KOS Group - Acute Care Hospitals | Cash Cow | High occupancy, essential service | Predictable profit |

| CIR - Financial Investments | Cash Cow | Positive net financial income | Financial stability |

| Sogefi - Air & Cooling Systems (Aftermarket) | Cash Cow | Installed vehicle base, aftermarket demand | Substantial revenue streams |

| KOS Group - Italian Private Hospitals | Cash Cow | Consistent demand, efficient operations | Dependable cash generation |

Full Transparency, Always

Compagnie Industriali Riunite BCG Matrix

The Compagnie Industriali Riunite BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and absolutely no surprises – just a professionally crafted strategic analysis ready for immediate implementation. You'll gain access to the complete, unedited report, allowing you to seamlessly integrate its insights into your business planning and decision-making processes.

Dogs

CIR's former media and publishing assets, notably GEDI Gruppo Editoriale, were divested in 2020. This strategic move suggests these businesses were likely positioned in a low-growth sector facing intense competition.

The divestment of GEDI, a significant player in Italian media, points to these assets being classified as cash cows or potentially dogs within CIR's portfolio. In 2020, GEDI's revenue was approximately €500 million, but the publishing industry has been grappling with declining print circulation and advertising revenue for years.

Sogefi's divestment of its Filtration Business Unit in May 2024 strongly indicates its classification as a 'Dog' within the BCG Matrix. This strategic move implies the unit faced challenges with low market growth and likely a weak competitive position, making it a drain on resources.

By exiting this segment, Sogefi aimed to unlock capital and redirect management attention towards higher-potential ventures. This aligns with the core principle of the BCG Matrix, which advises shedding underperforming assets to bolster stronger business areas.

KOS Group's divestiture of its Diagnostics and Cancer Care business in India in June 2023 signals a strategic move away from what were likely underperforming assets. This action suggests these ventures were considered question marks within the BCG matrix, struggling to gain significant traction in a crowded market.

The decision to exit this sector, which had generated approximately INR 250 crore in revenue in the fiscal year ending March 2023, allows KOS Group to stem financial losses. By shedding these operations, the company can redirect capital and management focus towards its more robust and promising business segments, thereby enhancing overall portfolio performance.

Legacy Sogefi Products with Declining ICE Relevance

Certain legacy automotive components manufactured by Sogefi, particularly those solely designed for older internal combustion engine (ICE) vehicles, are experiencing a shrinking market. This trend is driven by the automotive industry's accelerating pivot towards electric vehicle (EV) technology.

These ICE-dependent products are characterized by limited growth potential and often a diminishing market share. For example, in 2024, the global market for ICE-specific automotive filters, a segment where Sogefi has historical strength, is projected to see a year-over-year contraction of approximately 3-5% as EV adoption accelerates.

Continued capital allocation to these declining segments without a strategic plan for adaptation or eventual divestment poses a significant risk of becoming 'cash traps.' Companies must carefully evaluate these product lines to avoid draining resources that could be better utilized in growth areas.

- Declining Market Share: Sogefi's legacy ICE products face reduced demand as the automotive sector transitions to electrification.

- Low Growth Potential: Segments tied exclusively to ICE technology offer minimal prospects for future expansion.

- Risk of Cash Traps: Continued investment in these areas without a clear adaptation or divestment strategy can lead to inefficient capital allocation.

- Industry Shift: The global automotive market saw EV sales increase by over 30% in 2023, further pressuring ICE-reliant component suppliers.

Underperforming Real Estate Assets

Compagnie Industriali Riunite's sale of a Milan real estate property in June 2024, which resulted in a capital gain, signals a strategic move to divest assets that may not be performing optimally. This action aligns with classifying such properties as potential 'Dogs' within a broader portfolio if they offer limited growth prospects or fail to generate substantial returns, thereby immobilizing capital.

Underperforming real estate assets can represent a drag on financial performance. For instance, if a property's rental yield is significantly below market averages or if its appreciation potential is stagnant, it might be a candidate for divestment. This is particularly relevant in 2024 as economic conditions can influence property valuations and rental income streams.

- Divestment Strategy: CIR's June 2024 sale of a Milan property indicates a proactive approach to managing its asset base.

- Capital Immobilization: Properties with low returns or limited growth tie up capital that could be deployed in more lucrative ventures.

- Portfolio Optimization: Identifying and divesting underperforming real estate is crucial for enhancing overall portfolio efficiency and returns.

- Market Conditions: Current economic and real estate market trends in 2024 play a significant role in evaluating asset performance.

Compagnie Industriali Riunite has strategically divested several assets that align with the 'Dog' category of the BCG Matrix. These include GEDI Gruppo Editoriale, a media and publishing business, and Sogefi's Filtration Business Unit. The divestment of KOS Group's Diagnostics and Cancer Care business in India also points to this classification.

These 'Dogs' are characterized by low market share and low growth potential, often requiring significant capital to maintain their position or facing declining demand. For instance, Sogefi's ICE-specific automotive filters are in a segment projected to contract by 3-5% in 2024 due to the EV transition.

CIR's sale of a Milan real estate property in June 2024 also suggests an effort to move away from assets that may be immobilizing capital with limited returns or growth prospects. Such divestitures are crucial for portfolio optimization and redirecting resources to more promising ventures.

The classification of these businesses as 'Dogs' underscores CIR's proactive management of its portfolio, aiming to shed underperforming units and focus on areas with higher potential for growth and profitability.

| Business Unit/Asset | BCG Category | Rationale | Key Financial Indicator (Approximate) | Market Trend Impact |

|---|---|---|---|---|

| GEDI Gruppo Editoriale (Divested 2020) | Dog | Low growth sector, intense competition in publishing. | Revenue ~€500 million (2020) | Declining print circulation and advertising revenue. |

| Sogefi Filtration Business Unit (Divested May 2024) | Dog | Low market growth, weak competitive position. | N/A (specific unit financials not readily available) | Shrinking market for ICE-specific automotive components. |

| KOS Group Diagnostics & Cancer Care (India, Divested June 2023) | Dog | Underperforming, struggling in a crowded market. | Revenue ~INR 250 crore (FY ending March 2023) | Intense competition in the healthcare diagnostics sector. |

| Milan Real Estate Property (Sold June 2024) | Dog | Limited growth prospects, potential capital immobilization. | N/A (Capital gain reported) | Market conditions influencing property valuations and returns. |

Question Marks

KOS Group's development of new digital health platforms fits the profile of a question mark in the BCG matrix. The Italian healthcare market is indeed embracing digital solutions, with telemedicine seeing significant growth. For instance, a 2024 report indicated a substantial increase in the adoption of remote patient monitoring systems across Italy, signaling a strong demand for such innovations.

These digital health initiatives represent a high-potential, high-investment area. While they tap into a growing market, KOS Group is likely facing substantial upfront costs for research, development, and market penetration. Achieving a significant market share in this nascent but rapidly evolving sector will require sustained capital infusion and strategic execution to overcome early-stage challenges and build a competitive moat.

Sogefi's engagement with emerging technologies for autonomous driving components places it squarely in the Question Mark quadrant of the BCG Matrix. This segment of the automotive industry, particularly for advanced driver-assistance systems (ADAS) and fully autonomous capabilities, is experiencing a significant growth trajectory. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating its high-growth nature.

If Sogefi is channeling resources into the research and development of sophisticated electronic control units, LiDAR sensors, or advanced camera systems, its current market share in these specific, cutting-edge areas is likely to be minimal. This aligns with the characteristics of a Question Mark: a business unit with low market share in a high-growth market. The company's strategic challenge is to nurture these nascent technologies to achieve greater market penetration and eventually become Stars.

CIR Ventures, as part of Compagnie Industriali Riunite's strategic portfolio, actively engages in early-stage startup investments. These ventures, by their nature, represent high-growth potential but also carry substantial risk, often starting with minimal market share. For instance, in 2024, a significant portion of CIR Ventures' capital was allocated to seed and Series A rounds, reflecting a commitment to nurturing nascent technologies and business models.

The inherent volatility of these early-stage companies necessitates a rigorous evaluation process. CIR must carefully assess whether to inject further capital, aiming to elevate these startups to 'Star' status within the BCG matrix, or to cut losses and divest. This strategic decision-making is crucial, as a single successful early-stage investment can yield outsized returns, while multiple failures can drain resources. The fund’s performance in 2024 showed a mixed bag, with some early bets showing promising traction, while others faced significant headwinds, underscoring the high-stakes nature of this investment category.

KOS Group - Expansion into Underserved Italian Healthcare Regions

KOS Group, a prominent player in the Italian healthcare sector, is strategically eyeing expansion into underserved regions within Italy, a move that aligns with its potential positioning as a 'Question Mark' within the Compagnie Industriali Riunite BCG Matrix. While KOS boasts a strong leadership position nationally, these new territories represent areas with significant deficits in long-term care facilities, indicating substantial unmet demand and thus, high growth potential.

However, entering these nascent markets means KOS would initially hold a low market share, necessitating considerable investment to build brand recognition, operational capacity, and a competitive foothold. For instance, in 2024, reports highlighted that certain southern Italian regions, like Calabria and Basilicata, faced a deficit of over 15,000 long-term care beds compared to national averages, presenting a clear opportunity for expansion.

- High Growth Potential: Underserved Italian regions exhibit a significant gap between demand for long-term care and existing supply, signaling a fertile ground for KOS's expansion.

- Low Initial Market Share: Entering these new territories means KOS will start with a negligible market presence, characteristic of a Question Mark.

- Substantial Investment Required: Establishing dominance in these underserved areas will demand significant capital outlay for infrastructure, staffing, and market penetration.

- Strategic Importance: This expansion aligns with KOS's mission to address national healthcare needs and could lead to future market leadership if managed effectively.

Sogefi - Niche Advanced Material Applications for Next-Gen Vehicles

Sogefi's strategic positioning in niche advanced material applications for next-generation vehicles could classify it as a Question Mark within the Compagnie Industriali Riunite BCG Matrix. This segment, characterized by significant R&D investment and nascent market demand, presents both high growth potential and substantial risk.

The company's focus on specialized materials, potentially for areas like advanced thermal management systems or novel structural components in electric and autonomous vehicles, requires a careful balance of innovation and market penetration. For instance, Sogefi's 2024 efforts in developing next-generation filtration solutions utilizing advanced polymers for EV battery cooling systems exemplify this approach.

- High Growth Potential: The market for advanced materials in next-gen vehicles is projected to grow rapidly, driven by electrification and new vehicle architectures.

- Significant R&D Investment: Developing and validating these specialized materials demands substantial capital expenditure and technical expertise from Sogefi.

- Market Development Needs: Establishing market share in these niche applications requires significant effort in customer education and partnership building.

- Uncertain Market Share: While potential is high, current market share in these specific advanced material applications may be limited, necessitating strategic investment to capture future demand.

CIR Ventures' investment in early-stage biotechnology startups exemplifies a Question Mark in the BCG matrix. These ventures operate in a high-growth sector, with the global biotech market projected to reach over $3 trillion by 2030, according to 2024 industry forecasts.

However, these startups typically have limited market share and require substantial capital for research, development, and clinical trials. CIR Ventures must strategically decide which of these promising but unproven entities to support, aiming to transform them into future market leaders.

| Business Unit | Market Growth | Market Share | BCG Category | Strategic Focus |

| CIR Ventures (Biotech Startups) | High | Low | Question Mark | Capital Injection & Strategic Development |

BCG Matrix Data Sources

Our Compagnie Industriali Riunite BCG Matrix is constructed using robust data from annual reports, market share analysis, and industry growth forecasts to provide strategic clarity.