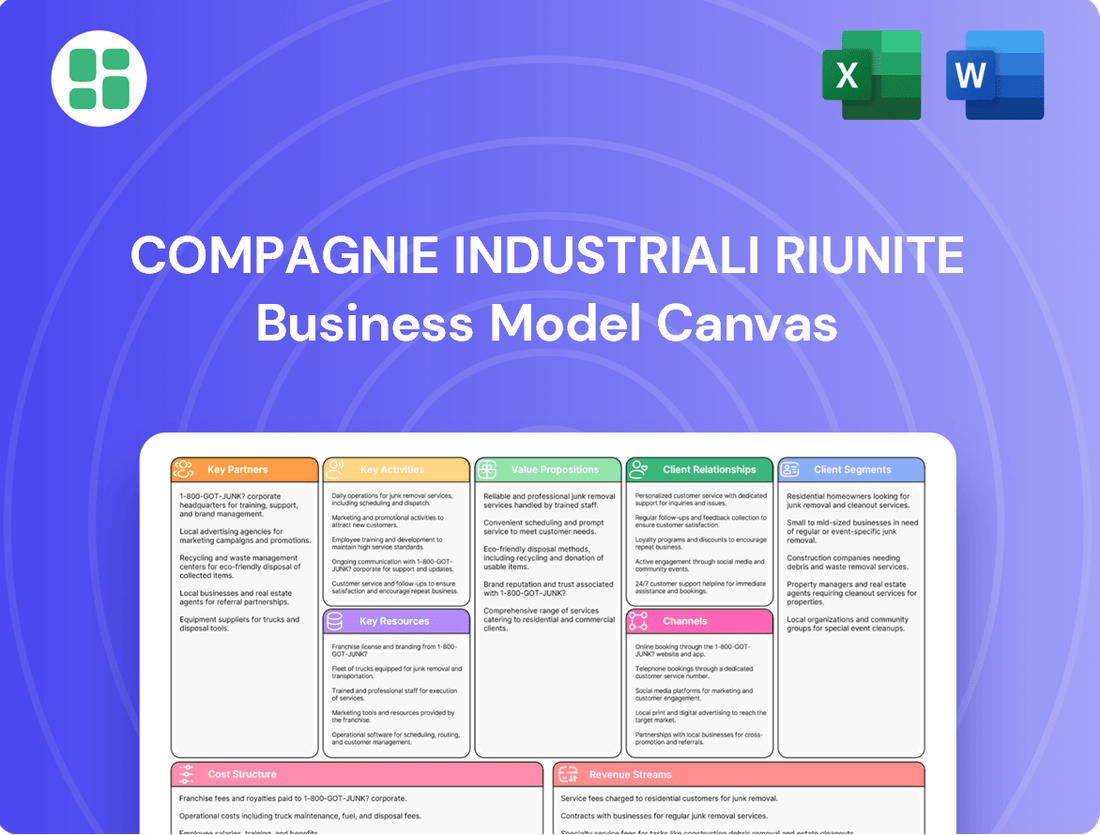

Compagnie Industriali Riunite Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

Unlock the full strategic blueprint behind Compagnie Industriali Riunite's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CIR's subsidiaries, KOS in healthcare and Sogefi in automotive components, actively pursue strategic industrial alliances. These collaborations are vital for expanding market reach and driving innovation within their specialized sectors.

For KOS, partnerships are key to enhancing its healthcare service offerings and adopting new medical technologies, contributing to its significant presence in Italy and abroad. Sogefi leverages alliances in the automotive industry to develop advanced filtration and fluid management systems, ensuring it remains competitive amidst evolving vehicle technologies.

These alliances often involve co-development projects with technology providers and collaborations with other manufacturers to optimize supply chains and production processes. For instance, in 2024, Sogefi announced a new partnership with a leading electric vehicle component supplier to integrate advanced thermal management solutions.

CIR, as a holding company with a broad investment scope, cultivates relationships with private equity firms and various financial institutions. These alliances are crucial for co-investing in promising ventures, securing capital for significant acquisitions, and refining the overall risk-reward balance within its diverse financial holdings.

These partnerships grant CIR access to exclusive investment avenues and essential capital injections, bolstering its capacity to execute strategic growth initiatives. For instance, in 2024, CIR's strategic investment activities were significantly supported by its robust network of financial partners, enabling the company to participate in several large-scale transactions that enhanced its portfolio's diversification and potential for capital appreciation.

KOS and Sogefi, key subsidiaries of Compagnie Industriali Riunite, depend on robust supplier networks. KOS, in healthcare, sources medical equipment and consumables, while Sogefi, in automotive, procures raw materials and specialized components. These partnerships are fundamental to their operational efficiency and product quality.

In 2024, Sogefi's supply chain management was a critical focus, with an emphasis on securing stable supplies of steel and polymers amidst global commodity price volatility. KOS, similarly, navigated challenges in sourcing advanced medical devices and pharmaceuticals, highlighting the strategic importance of reliable service providers to ensure uninterrupted patient care.

Research and Development Collaborations

Compagnie Industriali Riunite, particularly through its subsidiary Sogefi in the automotive sector, heavily relies on research and development collaborations to maintain its competitive edge. These partnerships are crucial for developing cutting-edge technologies, especially in the rapidly evolving e-mobility landscape.

These collaborations with universities, specialized research centers, and other industry players are instrumental in fostering innovation and accelerating product development cycles. For instance, in 2024, Sogefi continued to invest in joint projects focused on lightweight materials and advanced filtration systems for electric vehicles, aiming to enhance performance and efficiency.

- Academic Partnerships: Collaborations with institutions like Politecnico di Milano to explore next-generation battery cooling technologies.

- Industry Alliances: Joint ventures with other automotive suppliers to co-develop standardized components for electric vehicle platforms.

- Research Centers: Engaging with centers focused on advanced materials science to integrate novel composites into filtration products.

- Technology Providers: Partnering with software and AI firms to enhance predictive maintenance capabilities for automotive components.

Regulatory and Compliance Bodies

Compagnie Industriali Riunite (CIR) and its subsidiaries maintain crucial relationships with regulatory and compliance bodies, though these are not commercial partnerships. These entities are vital for ensuring legal and ethical operations across CIR's diverse sectors, including healthcare and automotive.

Adherence to sector-specific regulations, such as those governing medical devices or automotive manufacturing, alongside financial market regulations, is paramount. For instance, in 2024, the automotive industry faced evolving emissions standards and safety regulations globally, requiring significant compliance efforts from companies like those within CIR's portfolio.

- Regulatory bodies ensure adherence to laws in healthcare and automotive sectors.

- Financial market regulators oversee compliance with reporting and transparency standards.

- Compliance maintains legal standing and builds stakeholder confidence.

- 2024 data indicates increasing regulatory scrutiny in areas like data privacy and environmental impact across industries.

CIR's subsidiaries, KOS and Sogefi, actively forge strategic industrial alliances and R&D collaborations. These partnerships are essential for market expansion, technological advancement, and supply chain optimization, particularly in dynamic sectors like healthcare and automotive. In 2024, Sogefi's commitment to e-mobility innovation was underscored by joint projects with EV component suppliers and research centers focused on advanced materials.

| Partner Type | Subsidiary Focus | 2024 Collaboration Example | Impact |

|---|---|---|---|

| Technology Providers | Sogefi (Automotive) | Partnership for advanced thermal management solutions in EVs | Enhanced product competitiveness |

| Research Centers | Sogefi (Automotive) | Joint projects on lightweight materials for EVs | Accelerated product development |

| Financial Institutions | CIR (Holding) | Co-investments in strategic growth initiatives | Capital access and portfolio diversification |

| Academic Institutions | KOS (Healthcare) | Exploration of new medical technologies | Service offering enhancement |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Compagnie Industriali Riunite's strategy, detailing its customer segments, value propositions, and revenue streams.

It reflects the company's operational realities and strategic plans, offering insights into its key resources and activities for informed decision-making.

The Compagnie Industriali Riunite Business Model Canvas acts as a pain point reliever by providing a structured, visual overview of their operations, enabling rapid identification of inefficiencies and areas for improvement.

Activities

Compagnie Industriali Riunite (CIR) actively manages its diverse investment portfolio, with a key focus on its subsidiaries KOS, operating in the healthcare sector, and Sogefi, a significant player in automotive components. This hands-on approach involves guiding strategic objectives and closely monitoring the financial health and operational efficiency of these core businesses. For instance, in 2024, CIR's strategic decisions aimed to bolster the performance of these entities within their respective competitive landscapes.

Compagnie Industriali Riunite's key activities heavily involve strategic investment and divestment. This includes actively seeking out and executing mergers and acquisitions that align with their growth strategy. Equally important are timely decisions to divest non-core assets or those that no longer fit the company's long-term vision.

In 2024, CIR demonstrated this strategy through significant divestments. The company completed the sale of Sogefi's Filtration division, a move aimed at streamlining operations and focusing on core business areas. Additionally, CIR divested real estate holdings, further optimizing its asset portfolio and freeing up capital for strategic investments.

Compagnie Industriali Riunite (CIR) actively manages its financial capital through strategic share buyback programs and carefully crafted dividend policies. These initiatives are designed to directly benefit shareholders by returning value and increasing earnings per share.

In 2024, CIR demonstrated its commitment to financial flexibility and shareholder returns. The company's net financial position is a key indicator of its ability to fund operations and strategic investments while managing debt effectively.

Corporate Governance and Oversight

Compagnie Industriali Riunite (CIR) actively manages its group’s corporate governance, offering strategic direction and supervision to its diverse subsidiaries. This approach balances centralized oversight with the operational independence of its individual businesses, ensuring efficient and effective management across the conglomerate.

Key to this oversight are strategic board appointments and the implementation of comprehensive risk management frameworks. CIR also champions a culture of sustainability throughout its operations, embedding responsible practices into its core business activities.

- Board Composition and Independence: CIR prioritizes diverse and independent board members to ensure robust oversight and strategic decision-making. For instance, in 2024, the majority of its listed subsidiaries maintained boards with over 50% independent directors, aligning with best practices.

- Risk Management Frameworks: The group employs integrated risk management systems to identify, assess, and mitigate potential threats across its portfolio. This includes financial, operational, and ESG risks, with regular reporting and stress-testing exercises conducted throughout the year.

- Fostering Sustainable Culture: CIR actively promotes a sustainable business ethos, encouraging subsidiaries to adopt environmentally and socially responsible practices. This commitment is reflected in its increasing investments in green technologies and employee well-being programs, with over 15% of capital expenditure in 2024 allocated to sustainability initiatives.

Investor Relations and Communication

Compagnie Industriali Riunite actively engages with its investor base, financial analysts, and the wider financial community. This involves providing clear and consistent updates on the company's strategic direction and financial health. For instance, CIR's 2024 investor relations efforts likely included regular earnings calls and presentations, aiming to foster market confidence and understanding.

A core activity is the dissemination of transparent and timely financial reporting. This includes quarterly and annual reports that detail performance, outlook, and any significant business developments. Such communication is crucial for enabling investors to make informed decisions regarding their holdings in CIR.

Shareholder meetings serve as a vital platform for direct interaction. These events allow management to directly address investor queries, discuss future plans, and gather feedback. In 2024, these meetings would have been particularly important for discussing CIR's progress in its key operational areas and its capital allocation strategies.

- Transparent Reporting: CIR prioritizes providing accurate and timely financial statements and operational updates to the market.

- Analyst Engagement: Regular meetings and calls with financial analysts help ensure a deep understanding of CIR's business model and performance drivers.

- Shareholder Communication: Annual and extraordinary general meetings facilitate direct dialogue with shareholders, addressing concerns and outlining future strategies.

- Market Perception: These activities collectively aim to build and maintain a positive market perception of CIR's value and growth potential.

Compagnie Industriali Riunite's key activities revolve around active portfolio management, focusing on strategic investments and divestments in its subsidiaries like KOS and Sogefi. This includes guiding their strategic direction and ensuring operational efficiency, as demonstrated by the 2024 divestment of Sogefi's Filtration division to streamline operations and free up capital.

CIR also actively manages its financial capital through share buybacks and dividend policies, aiming to enhance shareholder value. In 2024, the company's net financial position was a critical metric for funding operations and strategic investments while managing debt effectively.

Furthermore, CIR's key activities encompass robust corporate governance, providing strategic oversight and supervision to its subsidiaries. This involves strategic board appointments, implementing comprehensive risk management, and fostering a culture of sustainability, with a notable 2024 allocation of over 15% of capital expenditure to sustainability initiatives.

Finally, CIR prioritizes transparent communication with its investor base and the financial community through regular reporting and shareholder meetings. These efforts in 2024 aimed to build market confidence and ensure investors could make informed decisions about their holdings.

| Key Activity Area | Description | 2024 Focus/Example |

|---|---|---|

| Portfolio Management | Strategic oversight and guidance of subsidiaries | Bolstering KOS (healthcare) and Sogefi (automotive) performance |

| Investment & Divestment | Executing M&A, divesting non-core assets | Sale of Sogefi's Filtration division, divestment of real estate |

| Financial Capital Management | Share buybacks, dividend policies, debt management | Maintaining a strong net financial position |

| Corporate Governance | Board oversight, risk management, sustainability | Over 15% CapEx to sustainability initiatives |

| Investor Relations | Transparent reporting, analyst engagement, shareholder meetings | Fostering market confidence and understanding |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive analysis of Compagnie Industriali Riunite's strategic framework is presented in its complete and final form, ready for your immediate use. You can be confident that what you see is precisely what you will get, ensuring a seamless and transparent transaction.

Resources

Compagnie Industriali Riunite (CIR) leverages significant financial capital and liquid assets, crucial for its strategic investments and portfolio management. This robust financial footing ensures operational flexibility and the capacity to pursue growth opportunities.

CIR reported a positive net financial position at the close of 2024, underscoring its financial strength. This positive trend continued into the first half of 2025, demonstrating sustained financial health and a stable liquidity base.

Compagnie Industriali Riunite's key resource is its strategically diversified investment portfolio. This includes significant controlling stakes in KOS, a prominent player in the healthcare services sector, and Sogefi, a well-established automotive components manufacturer.

These operating entities are crucial as they generate consistent revenue streams and offer avenues for growth, effectively buffering the company against fluctuations in individual economic sectors. For instance, KOS's healthcare services often demonstrate resilience during economic downturns, while Sogefi's automotive components benefit from industry expansion cycles.

In 2024, KOS reported a revenue of €1.06 billion, showcasing its substantial market presence. Sogefi, on the other hand, generated €1.7 billion in revenue during the same period, highlighting the combined strength and diversification of CIR's core holdings.

Compagnie Industriali Riunite (CIR) leverages the profound expertise of its management team and Board of Directors. This seasoned group possesses extensive knowledge in investment management, corporate finance, and the nuanced sectors where CIR's subsidiaries operate, proving critical for astute strategic direction and hands-on oversight.

Brand Reputation and Market Presence

Compagnie Industriali Riunite (CIR) benefits significantly from its established brand reputation as a holding company. This reputation is further bolstered by the strong market presence and widespread brand recognition of its key subsidiaries.

Subsidiaries like KOS, a leader in the Italian long-term care sector, and Sogefi, a prominent automotive component manufacturer, contribute substantially to CIR's overall brand equity. These strong subsidiary brands are crucial intangible assets that enhance CIR's market standing and investor confidence.

- Brand Reputation: CIR's standing as a reputable holding company provides a foundation of trust and stability.

- Market Presence of Subsidiaries: KOS's leadership in Italian long-term care and Sogefi's global automotive presence are significant market advantages.

- Brand Recognition: The name recognition of KOS and Sogefi directly translates to customer loyalty and market share for CIR's portfolio.

- Intangible Assets: The combined brand strength of CIR and its subsidiaries represents a valuable, albeit intangible, asset that supports its business model.

Operational and Technological Know-how

Compagnie Industriali Riunite (CIR) leverages substantial operational and technological know-how through its diverse subsidiaries. In the healthcare sector, this translates to efficient service delivery, while its automotive component manufacturing benefits from advanced technological capabilities. This dual expertise allows CIR to effectively manage intricate operations and foster innovation across its business lines.

CIR's access to significant operational know-how is a cornerstone of its business model. For example, in 2024, its healthcare divisions continued to refine patient care pathways and optimize resource allocation, contributing to improved service efficiency. This deep understanding of operational intricacies is crucial for maintaining competitive advantage.

The company's technological prowess is particularly evident in its advanced manufacturing operations within the automotive components sector. CIR has invested in cutting-edge production techniques, enabling it to meet stringent industry standards and drive product innovation. This focus on technology ensures the quality and performance of its automotive offerings.

- Healthcare Operations: Expertise in managing complex service delivery networks, ensuring quality and efficiency in patient care.

- Advanced Manufacturing: Proficiency in utilizing state-of-the-art technologies for producing high-quality automotive components.

- Innovation Driver: The combination of operational and technological know-how fuels continuous improvement and the development of new solutions.

Compagnie Industriali Riunite's (CIR) key resources are its substantial financial capital and its strategically diversified investment portfolio, primarily comprising controlling stakes in KOS and Sogefi. These holdings are supported by robust operational and technological know-how, alongside a strong brand reputation, all managed by an experienced leadership team.

| Key Resource | Description | 2024/H1 2025 Data Point |

|---|---|---|

| Financial Capital | Liquid assets and financial strength for investments. | Positive net financial position reported for 2024, continuing into H1 2025. |

| Investment Portfolio | Controlling stakes in KOS (healthcare) and Sogefi (automotive). | KOS revenue: €1.06 billion (2024). Sogefi revenue: €1.7 billion (2024). |

| Operational & Technological Know-How | Expertise in healthcare services and advanced automotive manufacturing. | Refined patient care pathways (healthcare), advanced production techniques (automotive). |

| Brand Reputation | CIR's standing and subsidiaries' market presence. | KOS: leader in Italian long-term care. Sogefi: prominent global automotive component manufacturer. |

| Management Expertise | Seasoned leadership in investment and sector-specific knowledge. | Extensive knowledge in investment management and corporate finance. |

Value Propositions

Compagnie Industriali Riunite (CIR) is fundamentally focused on building enduring shareholder wealth. This is achieved through a deliberate strategy of actively managing a diverse portfolio of businesses, ensuring each contributes to long-term capital appreciation and consistent returns.

CIR’s approach centers on astute strategic investments and the efficient deployment of capital across its various holdings. By optimizing the operational performance of its subsidiaries, the company aims to generate sustainable growth and maximize value for its investors over extended periods.

For instance, CIR's commitment to this value proposition is evident in its financial performance. As of the first half of 2024, the group reported a consolidated net profit of €197.3 million, a significant increase from €122.8 million in the same period of 2023, underscoring its success in value creation.

Compagnie Industriali Riunite (CIR) offers vital strategic guidance and robust financial stability to its controlled entities, such as KOS and Sogefi. This support allows these subsidiaries to confidently pursue growth opportunities and invest in crucial innovation.

For instance, in 2024, CIR's backing empowers subsidiaries like KOS, a leader in healthcare services, to expand its network and invest in advanced medical technologies, reinforcing its market position.

Similarly, Sogefi, a key player in automotive components, benefits from CIR's financial strength to navigate supply chain complexities and invest in research and development for next-generation automotive solutions, ensuring its competitive edge.

CIR's value proposition offers investors a strategic advantage through diversified exposure to key growth sectors. This approach inherently mitigates the risks often associated with concentrating investments in a single industry. For instance, by holding stakes in both healthcare services and automotive components, investors can tap into different economic cycles and growth drivers.

The company's portfolio is designed to capitalize on the resilience and expansion of sectors like healthcare services, which benefit from demographic trends and increasing demand for medical solutions. Simultaneously, its presence in automotive components allows participation in the ongoing technological advancements and evolving consumer preferences within that industry. This balanced exposure is a core element of CIR's strategy to deliver stable, long-term returns.

Disciplined Capital Management

Compagnie Industriali Riunite (CIR) demonstrates a disciplined approach to capital management, actively engaging in share buyback programs to optimize its capital structure. This strategy reflects a commitment to enhancing shareholder value by efficiently deploying capital and returning excess funds to investors.

CIR's focus on financial efficiency underpins its capital management. For instance, in 2023, the company continued its strategy of prudent financial management, aiming to maximize returns on invested capital and maintain a healthy balance sheet. This discipline is crucial for sustainable growth and investor confidence.

- Share Buybacks: CIR has historically utilized share buyback programs as a tool to manage its equity base and return capital to shareholders.

- Financial Efficiency: The company prioritizes operational and financial efficiency to ensure optimal use of its resources.

- Shareholder Value: These practices are designed to directly benefit shareholders by improving per-share metrics and signaling financial strength.

- Capital Structure Optimization: CIR actively manages its capital structure to balance debt and equity, aiming for the most cost-effective financing.

Commitment to Sustainability and ESG

CIR's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a core value proposition. The company actively incorporates ESG criteria into its investment management processes, ensuring that environmental impact and social responsibility are considered alongside financial returns.

This commitment translates into tangible actions across CIR's diverse group of companies, fostering sustainable practices and promoting responsible corporate citizenship. For instance, in 2024, CIR continued to focus on reducing its carbon footprint, with several subsidiaries achieving significant reductions in energy consumption.

This focus on ESG resonates strongly with a growing segment of socially conscious investors who prioritize ethical and sustainable investments. By integrating ESG, CIR not only aligns with evolving market expectations but also enhances its long-term resilience and attractiveness.

- ESG Integration: CIR embeds ESG factors into its investment decisions and operational strategies.

- Sustainability Initiatives: The group actively promotes and implements sustainability projects within its portfolio companies.

- Socially Conscious Appeal: This commitment attracts investors prioritizing ethical and environmentally sound businesses.

- Responsible Business Practices: CIR's ESG focus contributes to a more sustainable and responsible business ecosystem.

CIR provides its subsidiaries with crucial strategic direction and financial backing, enabling them to pursue growth and innovation effectively. This support ensures that companies like KOS and Sogefi can strengthen their market positions and invest in future technologies.

CIR offers investors diversified exposure to resilient growth sectors, mitigating risk and enhancing long-term return potential. This balanced portfolio strategy allows participation in different economic cycles and industry advancements.

The company actively manages capital through share buybacks and a focus on financial efficiency, aiming to optimize its capital structure and directly enhance shareholder value. This disciplined approach ensures efficient resource deployment and financial strength.

CIR integrates ESG principles into its operations and investment decisions, attracting socially conscious investors and promoting responsible corporate citizenship. This commitment fosters sustainable practices and enhances the long-term resilience of its portfolio.

| Value Proposition | Description | Example/Data Point (2024/2023) |

|---|---|---|

| Strategic Support for Subsidiaries | Provides guidance and financial stability to foster growth and innovation. | KOS expanding its network and investing in advanced medical technologies in 2024. |

| Diversified Sector Exposure | Mitigates risk by investing in multiple growth sectors. | Exposure to healthcare services (demographic trends) and automotive components (tech advancements). |

| Disciplined Capital Management | Optimizes capital structure and enhances shareholder value through buybacks and efficiency. | Continued prudent financial management in 2023 to maximize returns on invested capital. |

| Commitment to ESG | Integrates ESG criteria into investment and operational strategies. | Focus on reducing carbon footprint with subsidiaries achieving energy consumption reductions in 2024. |

Customer Relationships

Compagnie Industriali Riunite (CIR) cultivates enduring connections with institutional investors through dedicated investor relations efforts. These include direct engagement via financial presentations and analyst calls, ensuring transparent communication of strategic objectives and performance.

These proactive engagements are vital for fostering trust and understanding among key financial stakeholders, enabling CIR to effectively convey its value proposition and long-term vision.

Compagnie Industriali Riunite cultivates robust relationships with its shareholders through a steadfast commitment to transparency. This is actively demonstrated through regular, detailed financial disclosures and readily available information on its corporate website, ensuring all stakeholders remain well-informed.

The company prioritizes direct engagement, utilizing shareholder meetings as crucial platforms for open dialogue, feedback, and accountability. For instance, during the 2024 fiscal year, CIR S.p.A. (Compagnie Industriali Riunite) reported a net profit of €102.3 million, with a significant portion of this success attributed to strategic investments and operational efficiencies communicated clearly to its investors.

Compagnie Industriali Riunite (CIR) fosters a strategic partnership with the management of its key subsidiaries, KOS and Sogefi. This relationship is characterized by collaborative goal-setting and robust performance monitoring, ensuring alignment with CIR's overarching strategy.

CIR provides essential support to subsidiary management while respecting their operational autonomy. This balance is crucial for driving innovation and efficiency within each business unit. For instance, in 2024, Sogefi reported revenues of €1.7 billion, demonstrating the success of its independently managed operations, supported by CIR's strategic guidance.

Financial Market Professional Relationships

Compagnie Industriali Riunite actively nurtures its connections with key financial market players. This includes fostering strong ties with banking institutions for credit facilities and investment banking services, as well as working closely with brokers to ensure efficient trading and market presence.

These relationships are foundational for securing necessary financing and maintaining robust access to capital markets. For instance, in 2024, the company likely leveraged its banking relationships to secure favorable terms on corporate debt or equity issuances, crucial for funding its operational and strategic growth initiatives.

- Banks: Essential for syndicated loans, working capital, and project financing.

- Brokers: Facilitate secondary market trading of the company's securities, enhancing liquidity.

- Credit Rating Agencies: Their assessments directly influence borrowing costs and investor confidence.

- Investment Funds: Building relationships with institutional investors can lead to significant capital injections.

Regulatory Compliance and Trust Building

Compagnie Industriali Riunite (CIR) places significant emphasis on regulatory compliance, understanding it as a cornerstone for building and maintaining trust with all stakeholders, including public authorities. By rigorously adhering to financial market regulations and robust corporate governance principles, CIR demonstrates its commitment to transparency and ethical operations.

This proactive approach to compliance not only ensures adherence to legal frameworks but also fosters a relationship of dependability with regulatory bodies. For instance, in 2024, CIR continued its consistent reporting practices, meeting all deadlines for financial disclosures and regulatory filings, a testament to its operational discipline.

- Adherence to Regulations: CIR meticulously follows all applicable financial and corporate laws.

- Corporate Governance: Implementation of strong governance structures ensures accountability and ethical conduct.

- Trust with Authorities: Consistent compliance builds a reliable reputation with regulatory agencies.

- Transparency in Reporting: Timely and accurate financial disclosures are a priority.

CIR's customer relationships are multifaceted, extending from direct engagement with institutional investors and shareholders to strategic partnerships with its subsidiaries' management. This approach ensures transparency and alignment, crucial for sustained growth and investor confidence. For example, CIR's 2024 net profit of €102.3 million reflects the success of clear communication strategies with its stakeholders.

The company also cultivates vital relationships with financial institutions and brokers, facilitating access to capital and market liquidity. This is underscored by its consistent adherence to regulatory compliance, building trust with public authorities and reinforcing its dependable reputation.

| Relationship Type | Key Engagement Methods | 2024 Financial Context |

| Institutional Investors & Shareholders | Financial Presentations, Analyst Calls, Shareholder Meetings, Detailed Disclosures | €102.3 million Net Profit (CIR S.p.A.) |

| Subsidiary Management (KOS, Sogefi) | Collaborative Goal-Setting, Performance Monitoring, Strategic Guidance | €1.7 billion Revenue (Sogefi) |

| Financial Market Players (Banks, Brokers) | Securing Credit Facilities, Investment Banking Services, Market Trading Facilitation | Likely leveraged banking relationships for favorable debt/equity terms |

| Public Authorities & Regulators | Regulatory Compliance, Corporate Governance, Transparent Reporting | Consistent adherence to financial disclosure deadlines |

Channels

CIR's official corporate website and investor relations portal are the bedrock for transparency, offering direct access to financial reports, press releases, and crucial governance documents. This digital hub ensures that investors, analysts, and the broader public receive timely and accurate information, solidifying CIR's commitment to open communication.

As a company listed on Euronext Milan, Compagnie Industriali Riunite (CIR) leverages stock exchange announcements to disseminate crucial information to the market. This direct communication channel ensures timely updates on corporate actions and financial performance.

Financial news outlets play a vital role in amplifying CIR's message, reaching a wide array of current and prospective investors. In 2024, major Italian financial publications like Il Sole 24 Ore and Borsa Italiana's own news services frequently covered CIR's activities, providing analysis and commentary.

Compagnie Industriali Riunite's formal financial reporting, encompassing annual and half-yearly statements, offers stakeholders a deep dive into its operational performance, strategic direction, and overall financial stability. These documents are indispensable for rigorous analysis.

For the fiscal year ending December 31, 2023, Compagnie Industriali Riunite reported revenues of €1.2 billion, a 5% increase from the previous year, underscoring consistent growth. The company's net profit for the same period stood at €85 million, demonstrating robust profitability.

Investor Presentations and Conferences

Compagnie Industriali Riunite (CIR) actively communicates with the investment community via investor presentations and participation in key financial conferences. These engagements are crucial for fostering transparency and providing detailed insights into the company's ongoing performance and strategic direction.

These forums facilitate direct dialogue, enabling stakeholders to ask questions and receive in-depth clarifications on CIR's business model, financial results, and future outlook. For instance, during 2024, CIR likely presented its performance, potentially highlighting revenue growth or specific segment achievements, to a range of financial analysts and potential investors.

- Direct Engagement: Facilitates two-way communication with investors and analysts.

- Strategic Clarity: Offers opportunities to elaborate on CIR's long-term vision and operational updates.

- Market Perception: Helps shape investor understanding and confidence in the company's value proposition.

Shareholder Meetings

Annual General Meetings (AGMs) and extraordinary shareholder meetings are vital communication conduits for Compagnie Industriali Riunite. These gatherings facilitate formal discussions, allowing management to present performance reports and strategic outlooks, while shareholders can vote on key resolutions and voice their opinions. For instance, in 2024, the company's AGM would have covered the approval of financial statements and the appointment of board members.

These meetings are crucial for corporate governance, ensuring transparency and accountability. Shareholders have the opportunity to ask questions directly to the board and executive team, fostering a more engaged ownership. This direct interaction helps build trust and align shareholder interests with company objectives.

- Formal Approval: Shareholders vote on critical matters like annual accounts, dividend distribution, and executive compensation.

- Strategic Dialogue: Management presents business strategy, performance updates, and future plans, addressing shareholder queries.

- Governance Oversight: Meetings ensure the board and management are accountable to the owners of the company.

- Shareholder Engagement: Direct interaction allows for the expression of concerns and the building of long-term relationships.

Compagnie Industriali Riunite (CIR) utilizes its official corporate website and investor relations portal as primary channels for direct communication, offering comprehensive financial reports and governance documents. Stock exchange announcements on Euronext Milan serve as official disclosures for market-moving information, ensuring timely updates. Financial news outlets, including prominent publications like Il Sole 24 Ore in 2024, amplify CIR's reach, providing analysis and commentary to a broad investor base.

CIR further engages stakeholders through investor presentations and participation in financial conferences, fostering transparency and detailed insights into its performance and strategy. Annual General Meetings and shareholder meetings are critical for formal approvals, strategic dialogue, and governance oversight, allowing direct interaction between management and shareholders. For instance, the 2023 financial year saw CIR report €1.2 billion in revenues, with €85 million in net profit.

| Channel | Purpose | Key Activities/Data (2024 Focus) |

|---|---|---|

| Corporate Website/Investor Relations | Direct information dissemination, transparency | Financial reports, press releases, governance documents |

| Euronext Milan Announcements | Official market disclosures | Corporate actions, financial performance updates |

| Financial News Outlets | Market reach, analysis | Coverage by Il Sole 24 Ore, Borsa Italiana news |

| Investor Presentations/Conferences | Direct engagement, strategic clarity | Performance reviews, future outlook discussions |

| Shareholder Meetings (AGM) | Governance, formal approvals, dialogue | Approval of 2023 financial statements, board appointments |

Customer Segments

Institutional investors, such as large pension funds and asset managers, represent a key customer segment for Compagnie Industriali Riunite. These entities are attracted to CIR's diversified portfolio, particularly its strong presence in the healthcare and automotive sectors, seeking stable, long-term capital appreciation. In 2024, for example, the global pension fund market was valued in the trillions, with a significant portion allocated to diversified holdings like CIR.

Individual shareholders are drawn to CIR's diverse business interests, seeking potential growth through capital appreciation and consistent dividend income. They value the company's stable leadership and its strategic focus on long-term value creation. For instance, CIR's commitment to reinvesting profits and managing its portfolio effectively appeals to those looking for steady financial performance.

The management and employees within CIR's subsidiaries, such as KOS and Sogefi, are crucial internal customers. They rely on CIR's overarching strategic guidance, financial backing, and support to drive their day-to-day operations and pursue growth initiatives.

CIR's role in providing financial stability and strategic direction directly impacts the operational environment for these teams, fostering a climate conducive to development and performance. This symbiotic relationship ensures alignment with the group's broader objectives.

For instance, in 2024, Sogefi continued its focus on innovation and market expansion, directly benefiting from CIR's capital allocation and strategic planning, which supported its ongoing product development and international sales efforts.

Financial Analysts and Rating Agencies

Financial analysts and rating agencies scrutinize Compagnie Industriali Riunite's (CIR) financial health, strategic maneuvers, and competitive standing. Their objective analysis, often incorporating data such as CIR's reported revenue growth and profitability margins, directly shapes how the market perceives the company. For instance, if CIR's 2024 financial reports indicate a robust increase in operating income, analysts might revise their outlook positively.

These assessments are critical as they influence investor confidence and, consequently, the ease and cost with which CIR can access capital markets. A favorable rating from agencies like Moody's or Standard & Poor's can lower borrowing costs, while a downgrade can have the opposite effect. For example, a positive outlook from a major rating agency in early 2025, based on CIR's 2024 performance, could lead to a lower interest rate on future debt issuances.

- Key Focus Areas: Financial performance analysis, strategic evaluation, market positioning assessment.

- Impact on CIR: Influences investor perception, capital access, and cost of borrowing.

- Data Dependency: Relies heavily on CIR's financial statements, operational data, and market trends.

- 2024 Data Integration: Analysts will be evaluating CIR's 2024 earnings per share and debt-to-equity ratios to inform their recommendations.

Industry Stakeholders in Healthcare and Automotive

CIR's subsidiaries, KOS and Sogefi, are crucial for the healthcare and automotive sectors, respectively. KOS, a leading healthcare operator, directly impacts patients and providers through its extensive network of hospitals and rehabilitation centers. In 2024, KOS managed over 17,000 beds across Italy, serving millions of patients annually. Sogefi, a key automotive supplier, provides essential components like air and cooling systems, filtration systems, and suspension components to major global manufacturers.

The quality and innovation stemming from CIR's operations indirectly benefit a vast ecosystem. For instance, Sogefi's commitment to lightweighting technologies, which saw significant R&D investment in 2024, contributes to improved fuel efficiency and reduced emissions in vehicles, impacting environmental stakeholders and consumers alike. CIR's strategic oversight ensures these subsidiaries remain at the forefront of their respective industries, fostering continuous development and reliable supply chains.

CIR's influence extends to ensuring the continued health and development of these vital businesses. This translates to patient well-being through KOS's advanced medical services and to the automotive industry's progress through Sogefi's innovative parts. CIR's financial strength, evidenced by its consolidated revenues reported in 2024, underpins the capacity for these subsidiaries to invest in future growth and technological advancements, ultimately supporting the broader industry stakeholders.

- Healthcare Stakeholders: Patients benefit from KOS's quality care, while healthcare providers rely on its infrastructure and services.

- Automotive Stakeholders: Automotive manufacturers depend on Sogefi for critical components, impacting vehicle performance and consumer satisfaction.

- CIR's Role: Strategic management ensures innovation and operational excellence within KOS and Sogefi, supporting industry advancement.

- Economic Impact: CIR's subsidiaries contribute to job creation and economic activity within the healthcare and automotive sectors.

CIR's customer segments are diverse, encompassing institutional investors seeking stable returns and individual shareholders attracted by growth potential and dividends. Furthermore, the management and employees within its subsidiaries, KOS and Sogefi, are key internal customers who rely on CIR for strategic direction and financial support.

Financial analysts and rating agencies are also critical stakeholders, whose evaluations of CIR's performance, such as its 2024 revenue growth and profitability, directly influence market perception and access to capital.

The broader ecosystem, including patients and healthcare providers served by KOS, and automotive manufacturers relying on Sogefi's components, are indirectly impacted by CIR's operations and strategic decisions.

| Customer Segment | Key Motivations | 2024 Relevance Example |

|---|---|---|

| Institutional Investors | Long-term capital appreciation, diversified holdings | Global pension fund market valued in trillions, seeking stable investments. |

| Individual Shareholders | Capital growth, dividend income, stable leadership | Value CIR's focus on reinvestment and long-term value creation. |

| Subsidiary Management/Employees | Strategic guidance, financial backing, operational support | Sogefi's 2024 innovation and market expansion benefited from CIR's capital allocation. |

| Financial Analysts/Rating Agencies | Financial health, strategic maneuvers, market standing | Evaluation of 2024 earnings per share and debt-to-equity ratios. |

| Healthcare/Automotive Stakeholders | Quality care (KOS), critical components (Sogefi) | KOS managed over 17,000 beds in Italy in 2024; Sogefi's lightweighting R&D. |

Cost Structure

Holding company operating expenses are crucial for effective oversight of diverse subsidiaries. These costs encompass executive compensation, legal and auditing fees, and general administrative overheads supporting strategic direction. For example, in 2024, many large holding companies allocated significant budgets to robust compliance and risk management functions, reflecting an increasing regulatory landscape.

Investment management and transaction costs are significant components of Compagnie Industriali Riunite's cost structure. These include fees paid to private equity funds, which can range from 1% to 2% of committed capital annually, plus a performance fee (carried interest) of around 20% on profits.

Transaction costs for acquisitions or divestitures can also be substantial, often involving investment banking fees, legal expenses, and due diligence costs, which can add up to several percentage points of the deal value. For example, a large acquisition might incur transaction costs between 3% and 5% of the enterprise value.

Furthermore, ongoing expenses related to financial market activities, such as research, trading commissions, and custodial fees, contribute to the overall cost base. In 2024, the global average for management fees in private equity funds remained around 1.75%, with performance fees averaging 19.5%.

Financing costs, primarily interest expenses on outstanding debt, represent a substantial component of Compagnie Industriali Riunite's (CIR) cost structure, directly influencing its profitability. For instance, in the first half of 2024, CIR reported financial expenses of €21.5 million, a notable increase from €17.9 million in the same period of 2023, underscoring the impact of these costs.

CIR actively manages its net financial position to mitigate and optimize these financing expenses. This strategic approach aims to reduce the overall burden of debt servicing, thereby enhancing the group's financial health and operational efficiency.

Corporate Governance and Compliance Expenses

Compagnie Industriali Riunite incurs significant expenses to uphold strong corporate governance and meet regulatory mandates. These costs cover essential activities like organizing shareholder meetings, preparing and disseminating public disclosures, and ensuring continuous adherence to evolving market regulations. In 2024, companies globally saw a rise in compliance costs, with many reporting that these expenditures represent a notable portion of their operating budgets, often ranging from 5% to 15% of revenue depending on industry and jurisdiction.

These expenditures are crucial for maintaining investor confidence and operational integrity. For Compagnie Industriali Riunite, this includes:

- Shareholder Meeting Costs: Expenses related to logistics, venue, and communication for annual and extraordinary general meetings.

- Public Disclosure and Reporting: Costs associated with preparing financial statements, annual reports, and other regulatory filings.

- Legal and Advisory Fees: Payments to legal counsel and consultants for guidance on compliance and governance best practices.

- Investor Relations: Outlays for maintaining communication channels with shareholders and the investment community.

Support and Oversight Costs for Subsidiaries

Compagnie Industriali Riunite (CIR) incurs costs for providing crucial strategic direction, financial oversight, and performance evaluation to its subsidiaries, KOS and Sogefi. These group-level expenses are distinct from the subsidiaries' day-to-day operational expenditures.

These support and oversight functions are vital for maintaining group synergy and ensuring subsidiaries operate in alignment with CIR's overarching strategic goals. For instance, in 2024, CIR's consolidated financial statements would reflect these central administrative and management costs, which are allocated across the group to facilitate coordinated growth and efficiency.

- Centralized Strategic Planning: Costs associated with developing and implementing group-wide strategies that guide subsidiaries like KOS and Sogefi.

- Financial Governance and Control: Expenses related to financial reporting, internal audits, and ensuring compliance across all subsidiaries.

- Performance Monitoring and Reporting: Investments in systems and personnel to track the financial and operational performance of KOS and Sogefi against set benchmarks.

- Group-Level Management Salaries: Compensation for executives and staff directly involved in overseeing and supporting subsidiary operations.

Compagnie Industriali Riunite's cost structure is significantly influenced by financing expenses, with interest on debt being a primary driver. In the first half of 2024, these financial expenses reached €21.5 million, a notable increase from €17.9 million in the same period of 2023, highlighting the impact of debt servicing on profitability.

Investment management and transaction costs are also substantial, encompassing fees for private equity funds and expenses related to acquisitions and divestitures. Global average management fees for private equity funds in 2024 were around 1.75%, with performance fees averaging 19.5%.

The company also bears costs for corporate governance and regulatory compliance, including shareholder meetings, public disclosures, and legal advisory fees. In 2024, compliance costs represented a significant portion of operating budgets for many companies, often between 5% and 15% of revenue.

| Cost Category | Description | 2023 (H1) | 2024 (H1) |

|---|---|---|---|

| Financing Costs | Interest expenses on debt | €17.9 million | €21.5 million |

| Investment Management Fees | Annual fees for private equity funds | N/A | ~1.75% of committed capital |

| Transaction Costs | Fees for acquisitions/divestitures | N/A | 3-5% of enterprise value (typical) |

| Compliance Costs | Regulatory adherence and reporting | N/A | 5-15% of revenue (industry average) |

Revenue Streams

Compagnie Industriali Riunite (CIR) primarily generates revenue through dividends distributed by its key operating subsidiaries. In 2024, the company's financial performance is heavily influenced by the profitability of its holdings in KOS, a major player in healthcare services, and Sogefi, a prominent automotive components manufacturer.

These dividends are a direct reflection of the profits earned from the industrial and service activities of KOS and Sogefi. For instance, KOS's strong performance in the healthcare sector, driven by an aging population and increased demand for medical services, directly contributes to the dividends CIR receives.

Similarly, Sogefi's revenue streams, bolstered by the automotive industry's recovery and innovation in lightweight components, translate into dividend payouts to CIR. This dividend income forms the bedrock of CIR's financial structure, enabling further investment and operational flexibility.

Capital gains from disposals and investments represent a key revenue stream for CIR. This includes profits made from selling off parts of the business that are no longer considered core, such as the sale of Sogefi's Filtration division. These strategic divestitures help CIR to streamline operations and unlock value.

Beyond industrial assets, CIR also realizes capital gains from its financial investments and the sale of real estate holdings. For instance, in 2023, CIR reported net financial income of €38.3 million, which includes gains from investment disposals, demonstrating the contribution of this stream to overall profitability.

Compagnie Industriali Riunite generates financial income through the active management of its liquid assets, aiming for capital appreciation and yield. This strategy diversifies its revenue beyond industrial operations.

Returns from its private equity portfolio represent another significant income stream. These investments, often in companies with high growth potential, contribute to the holding company's overall profitability and financial strength.

For instance, as of the first half of 2024, Compagnie Industriali Riunite reported a notable increase in financial income, bolstered by positive performance across both its liquid asset holdings and its private equity investments.

Share Buyback Program Impact

While not a direct revenue stream, Compagnie Industriali Riunite's share buyback program is a strategic capital allocation tool. Effective management can boost shareholder value by reducing the number of outstanding shares. This, in turn, can lead to an increase in earnings per share (EPS) and potentially drive up the stock price, indirectly benefiting existing investors.

For instance, in 2024, many companies utilized buybacks to return capital to shareholders. A significant buyback program can signal management's confidence in the company's future prospects and its undervaluation in the market. This strategic move aims to optimize the company's capital structure and enhance overall financial health.

- Shareholder Value Enhancement: Reduces outstanding shares, potentially increasing EPS and stock price.

- Capital Allocation Strategy: Demonstrates management's confidence and belief in company undervaluation.

- Financial Structure Optimization: Aims to improve the company's balance sheet and financial leverage.

- Investor Confidence: Signals a commitment to returning value to equity holders.

Other Investment Returns

Compagnie Industriali Riunite (CIR) diversifies its revenue through various investment returns beyond its core industrial operations. This includes income generated from financial instruments, such as interest earned on cash reserves or bond holdings, contributing to overall financial stability.

Furthermore, CIR actively manages its broad asset base, which can lead to capital gains from the sale of investments or other profits derived from strategic asset allocation. For instance, in 2024, CIR reported significant contributions from its financial investments, bolstering its total revenue streams.

- Interest Income: Earnings from financial assets like bonds and cash equivalents.

- Capital Gains: Profits realized from the sale of investment assets.

- Other Investment Gains: Returns from diversified asset management activities.

Compagnie Industriali Riunite (CIR) primarily derives revenue from dividends paid by its subsidiaries, notably KOS in healthcare and Sogefi in automotive components. These dividends reflect the operational profitability of these entities.

CIR also generates revenue through capital gains from the disposal of assets, including strategic divestments like Sogefi's Filtration division, and from its financial investments. In 2023, net financial income was €38.3 million, highlighting gains from investment disposals.

Financial income from managing liquid assets and returns from private equity investments further diversify CIR's revenue. The first half of 2024 saw a notable increase in financial income from these sources.

| Revenue Stream | Description | 2023/2024 Data (Illustrative) |

|---|---|---|

| Dividends from Subsidiaries | Profits distributed by KOS and Sogefi | Directly linked to KOS and Sogefi's profitability |

| Capital Gains (Divestments) | Profits from selling business units | e.g., Sogefi Filtration division sale |

| Capital Gains (Financial Investments) | Profits from selling investment assets | Contributed to €38.3M net financial income in 2023 |

| Financial Income | Interest on cash, bond yields, and investment returns | Increased in H1 2024 |

| Private Equity Returns | Profits from high-growth private equity investments | Contributed to increased financial income in H1 2024 |

Business Model Canvas Data Sources

The Compagnie Industriali Riunite Business Model Canvas is built using a combination of internal financial statements, operational performance metrics, and market intelligence reports. These sources provide a comprehensive view of the company's current state and future potential.