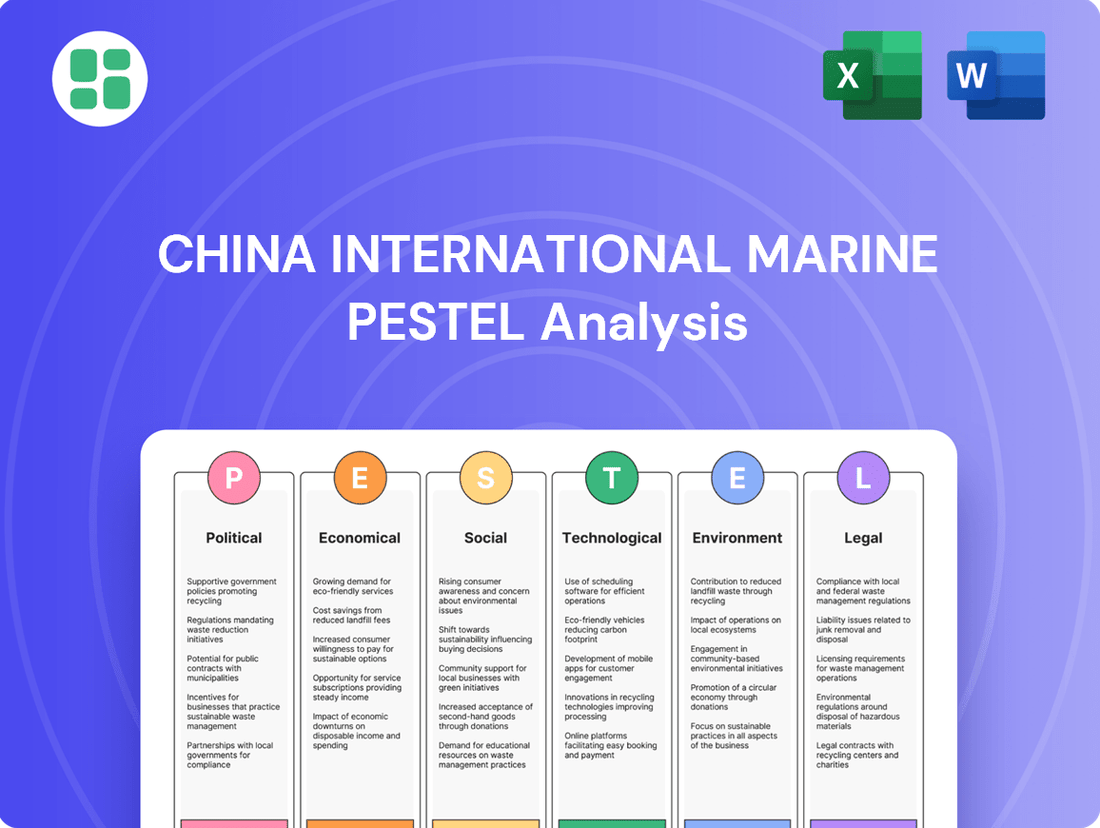

China International Marine PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China International Marine Bundle

Navigate the complex global waters impacting China International Marine with our expert PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a competitive edge by leveraging these actionable insights for your own strategic planning. Download the full analysis now for a comprehensive understanding.

Political factors

US-China trade tensions remain a significant headwind for global trade, with tariffs impacting Chinese manufacturing exports and potentially raising logistics costs for international shipping. In 2024, the ongoing dispute continued to affect the flow of goods, with analysts projecting further volatility in freight rates due to these trade frictions.

China's economic strategy, prioritizing its manufacturing prowess, has led to overcapacity in certain sectors. This situation prompts other nations to implement trade defense measures, such as anti-dumping duties, which can disrupt established trade routes and increase the cost of importing goods from China.

Geopolitical competition is driving a noticeable fragmentation of global supply chains. This trend, evident throughout 2024 and projected into 2025, raises concerns about a potential escalation into a more widespread trade war, further complicating international marine logistics and investment.

China's government is actively steering its industrial development through initiatives like the 14th Five-Year Plan, which concludes in 2025. This plan prioritizes strengthening domestic demand, fostering innovation, and promoting sustainability across key sectors. These government-backed strategies can offer significant advantages to companies like China International Marine (CIMC) operating in advanced manufacturing and environmentally friendly industries, enhancing their competitive edge and technological capabilities.

The Belt and Road Initiative (BRI) continues to be a cornerstone of China's foreign policy, fostering economic development and infrastructure connectivity across vast regions. For China International Marine (CIM), this presents a substantial avenue for growth, as the initiative necessitates significant investment in logistics and infrastructure development.

The BRI's emphasis on building railways, ports, and other critical infrastructure directly translates into increased demand for CIM's core products, such as containers and specialized transport equipment. For instance, by the end of 2023, China had signed BRI cooperation agreements with over 150 countries and 30 international organizations, indicating a broad geographical scope for potential projects.

Geopolitical Conflicts and Supply Chain Fragmentation

Persistent geopolitical tensions, exemplified by the ongoing disruptions in the Red Sea, are significantly impacting global trade. These conflicts have led to increased energy prices and elevated freight costs, with some shipping routes experiencing surcharges of up to 100% in early 2024. This instability necessitates that companies like China International Marine Containers (CIMC) actively diversify their supply chains to mitigate risks associated with single-source dependencies.

The need to build more resilient supply networks is driving a reevaluation of manufacturing and logistics strategies worldwide. This includes exploring alternative sourcing and production locations, which can alter established global trade flows. For CIMC, this could mean adapting its operational strategies to accommodate shifts in where goods are produced and how they are transported, potentially impacting demand for its container manufacturing and logistics services.

- Red Sea shipping disruptions led to a surge in container freight rates, with some spot rates doubling in late 2023 and early 2024.

- Major shipping lines rerouted vessels around the Cape of Good Hope, adding an average of 10-14 days to transit times and increasing fuel consumption.

- Companies are increasingly investing in supply chain visibility and risk management tools to navigate these volatile geopolitical landscapes.

- The trend towards nearshoring and friend-shoring, accelerated by geopolitical instability, could reshape global manufacturing footprints and logistics demands.

Domestic Regulatory Environment

China's domestic regulatory environment is a dynamic landscape, with ongoing adjustments to policies governing foreign investment and industry standards. These shifts directly impact companies like CIMC, shaping their operational landscape and market entry strategies within the country.

Recent regulatory actions, such as the updated 2024 Negative List, have notably relaxed constraints on foreign capital involvement in manufacturing sectors. Concurrently, new directives are prioritizing the growth of eco-friendly industries and the achievement of decarbonization targets, signaling a significant shift in national economic priorities.

These evolving regulations have tangible consequences for CIMC's business operations:

- Market Access: Eased foreign investment rules can open new avenues for CIMC's product and service deployment.

- Operational Compliance: Increased emphasis on environmental standards necessitates adaptation in manufacturing processes and supply chain management.

- Strategic Alignment: Policies promoting green industries may create opportunities for CIMC to align its offerings with national development goals, potentially securing preferential treatment or new market segments.

China's proactive stance on global trade, including its engagement with the Belt and Road Initiative, continues to shape international marine logistics. The initiative, which had signed cooperation agreements with over 150 countries by the end of 2023, fuels demand for infrastructure and transport equipment, directly benefiting companies like CIMC.

Geopolitical competition is driving a fragmentation of global supply chains, a trend that intensified through 2024 and is projected into 2025. This fragmentation raises concerns about potential trade wars, further complicating international marine logistics and investment decisions.

US-China trade tensions, marked by tariffs and ongoing disputes, impacted Chinese manufacturing exports and logistics costs throughout 2024. Analysts projected continued volatility in freight rates due to these trade frictions.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the China International Marine sector, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both opportunities and threats.

It is designed to equip stakeholders with actionable insights, enabling strategic decision-making and proactive adaptation to the dynamic landscape of China's marine industry.

Provides a concise, actionable summary of the China International Marine PESTLE analysis, enabling swift identification of external challenges and opportunities to inform strategic decision-making and mitigate risks.

Economic factors

Global trade is expected to pick up speed in 2024 and 2025, thanks to cooling inflation and a growing appetite for manufactured products. This positive outlook for trade bodes well for companies like CIMC, which are deeply involved in global supply chains.

While the global manufacturing sector is predicted to see slow growth in 2024, a more robust rebound is anticipated for 2025. This suggests a gradual improvement in the demand for industrial goods and equipment, which are key to CIMC's operations.

Despite a generally sluggish global manufacturing environment in 2024, CIMC demonstrated remarkable strength, achieving record revenue and profit. This performance, especially in its container manufacturing division, highlights the company's ability to navigate economic headwinds and capitalize on market opportunities.

The shipping container market saw surprisingly strong rates in 2024, fueled by early cargo movements ahead of anticipated US tariffs on Chinese goods and ongoing disruptions in the Red Sea. This surge has created a unique dynamic as the industry looks towards the next year.

For 2025, demand growth is forecast at around 2%, a figure notably lower than projected global GDP growth. This differential is a key concern, as it could lead to an oversupply situation given the new container ships entering the market.

Reflecting these market shifts, CIMC's chairman has signaled expectations for a downturn in container demand in 2025, following the exceptionally high volumes recorded in 2024. This suggests a potential recalibration after an unusually robust period.

China's manufacturing sector, including companies like CIMC, is experiencing heightened cost pressures. Rising labor wages and more stringent environmental policies are directly impacting operational expenses.

For CIMC, the cost of key inputs like steel and aluminum, essential for marine equipment manufacturing, is a significant concern. These raw material price fluctuations, coupled with increased compliance costs due to environmental regulations, directly influence profitability and require continuous strategic adjustments in sourcing and efficiency.

In 2024, the average manufacturing wage in China saw an estimated increase of 5-7%, while the cost of steel, a primary input for CIMC's products, experienced volatility, with benchmarks like the Rebar futures contract showing price swings of up to 10% in certain periods due to global demand and supply chain dynamics.

Inflation and Interest Rates

Easing inflation and potential interest rate reductions globally are anticipated to boost consumer spending and demand for manufactured goods, which directly benefits China International Marine Container (CIMC) Group's operations. For instance, China's Consumer Price Index (CPI) saw a modest increase in early 2024, suggesting a more stable inflationary environment.

However, the persistence of inflation, especially in services, and the current elevated interest rate environment could still temper investment decisions and consumer confidence. As of mid-2024, while some central banks have signaled potential rate cuts, borrowing costs remain relatively high in many key markets, impacting capital expenditure for CIMC's clients in sectors like logistics and real estate.

- Global Inflation Trends: China's CPI averaged around 0.5% year-on-year in the first half of 2024, significantly lower than the peaks seen in previous years, indicating a disinflationary trend.

- Interest Rate Environment: While the US Federal Reserve held rates steady through mid-2024, market expectations for cuts in late 2024 or early 2025 are influencing global financial conditions.

- Impact on Demand: Lower inflation and interest rates generally support higher demand for CIMC's products, such as shipping containers and specialized vehicles, by reducing costs for businesses and increasing disposable income for consumers.

- Sector-Specific Influences: CIMC's real estate segment, in particular, is sensitive to interest rate movements, with lower rates typically stimulating property development and sales.

Global Supply Chain Resilience and Diversification

Global supply chain resilience is a major focus, driven by geopolitical shifts and past disruptions like the COVID-19 pandemic. This has spurred a move towards diversification, often termed the 'China+1' strategy, where companies establish manufacturing operations in multiple countries to mitigate risks. For instance, a 2024 survey by McKinsey indicated that 93% of supply chain leaders planned to increase their supply chain resilience. This strategic pivot could potentially impact China International Marine's (CIMC) manufacturing volumes as international clients diversify their production away from China.

This trend toward diversification presents both challenges and opportunities for CIMC. While some customers might reduce their reliance on Chinese manufacturing, others may still require specialized components or services that CIMC provides, even as they build out alternative production sites. The ongoing investment in supply chain diversification is expected to continue through 2025, with companies actively seeking to de-risk their operations.

- Geopolitical Tensions: Heightened global political instability is a primary driver for supply chain diversification.

- Past Disruptions: Events like the pandemic have underscored the vulnerability of single-source supply chains.

- 'China+1' Strategy: Companies are actively seeking alternative manufacturing hubs outside of China.

- McKinsey Survey (2024): 93% of supply chain leaders are prioritizing resilience, indicating a significant industry-wide shift.

China's economic landscape is shaped by global trade dynamics and domestic manufacturing trends. While global trade is set to improve in 2024 and 2025, China's manufacturing sector faces cost pressures from rising wages and environmental regulations, impacting key inputs like steel.

Despite a challenging 2024 for global manufacturing, CIMC achieved record revenue, showcasing resilience. However, the shipping container market, after a strong 2024 driven by tariff anticipation and Red Sea disruptions, forecasts a demand slowdown in 2025 with potential oversupply.

Easing inflation and potential interest rate cuts globally could boost demand for CIMC's products. Yet, persistent inflation and elevated borrowing costs in mid-2024 continue to influence investment and consumer confidence, particularly impacting CIMC's real estate segment.

Geopolitical shifts are driving supply chain diversification, with 93% of supply chain leaders prioritizing resilience in 2024, potentially affecting CIMC's manufacturing volumes as clients seek alternative hubs.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | Impact on CIMC | Source/Note |

|---|---|---|---|---|

| Global Trade Growth | Picking up speed | Continued improvement | Positive for supply chain involvement | General economic forecast |

| Global Manufacturing Growth | Slow growth | More robust rebound | Gradual improvement in demand for industrial goods | General economic forecast |

| Shipping Container Market Demand | Strong rates, high volumes | Forecasted 2% growth, potential oversupply | Expectation of downturn after 2024 peak | CIMC Chairman's outlook |

| China Manufacturing Costs | Rising wages (5-7% avg. increase in 2024), volatile steel prices (up to 10% swings) | Continued pressure expected | Impacts profitability, requires efficiency adjustments | Industry data, Rebar futures |

| Inflation (China CPI) | Averaged 0.5% YoY (H1 2024) | Stable/low | Supports consumer spending and demand | National Bureau of Statistics of China |

| Interest Rates | Elevated globally (mid-2024) | Potential cuts in late 2024/early 2025 | Affects capital expenditure, sensitive for real estate segment | Federal Reserve, market expectations |

| Supply Chain Resilience Focus | 93% of leaders prioritizing resilience (McKinsey 2024) | Continued investment | Potential impact from 'China+1' strategy | McKinsey survey |

Full Version Awaits

China International Marine PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive China International Marine PESTLE Analysis provides an in-depth look at the political, economic, social, technological, legal, and environmental factors impacting the industry.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed breakdown of the Chinese marine sector. You'll gain valuable insights into the opportunities and challenges within this dynamic market.

Sociological factors

China's e-commerce market is booming, with online retail sales reaching an estimated 15.4 trillion yuan in 2023, a 11.0% increase year-on-year. This surge fuels demand for sophisticated logistics, including specialized containers for rapid, direct-to-consumer shipments. CIMC must adapt its offerings to support this trend, focusing on speed and last-mile efficiency to remain competitive.

Labor availability and costs in China present a dynamic challenge for companies like China International Marine (CIM) as manufacturing hubs evolve. Rising wages, particularly in coastal manufacturing regions, are a significant factor. For instance, average monthly wages for manufacturing workers in major Chinese cities have seen consistent increases, with some estimates showing a compound annual growth rate of over 5% in recent years leading up to 2024.

New labor policies and stricter enforcement of existing regulations, including those related to social security contributions and working hours, further contribute to escalating operational costs for businesses. This necessitates strategic workforce planning for CIM, potentially involving investments in automation and efficiency improvements to offset these rising labor expenses.

China's rapid urbanization, with an estimated 65% of its population living in urban areas by the end of 2024, fuels a constant need for construction and logistics. This trend, coupled with the ambitious Belt and Road Initiative, which involves infrastructure projects in over 150 countries, directly boosts demand for CIMC's specialized vehicles and equipment. For instance, the sheer scale of infrastructure investment, projected to reach trillions of dollars globally through BRI, translates into significant market opportunities for road transportation and construction machinery.

Workforce Safety and Welfare

The global emphasis on ethical labor practices is intensifying, making workforce safety and welfare a paramount concern for international businesses. China International Marine Container (CIMC), as a major player in the global supply chain, must prioritize stringent adherence to evolving labor regulations and uphold robust safety protocols across its facilities. This commitment is crucial not only for maintaining a positive corporate image but also for attracting and retaining skilled talent in a competitive market.

In 2024, China's Ministry of Human Resources and Social Security continued to enforce stricter workplace safety regulations, with penalties for non-compliance increasing. For instance, reports from early 2025 indicate a rise in inspections focusing on manufacturing sectors, including those relevant to CIMC's operations, highlighting a government drive towards improved worker protection. Companies failing to meet these standards faced fines and operational disruptions.

- Global Scrutiny: Multinational corporations face increased pressure from consumers and investors to demonstrate commitment to fair labor practices.

- Regulatory Compliance: CIMC must navigate and comply with China's updated labor laws and international standards for worker safety.

- Reputation Management: Strong safety records and ethical treatment of employees are vital for CIMC's brand reputation and market trust.

- Talent Acquisition: A safe and supportive work environment is a key factor in attracting and retaining a high-quality workforce, essential for CIMC's long-term success.

Societal Expectations for Sustainability

Societal expectations for sustainability are increasingly shaping business practices in China, influencing companies like CIMC to integrate eco-friendly solutions. Consumers and the public are demanding more environmentally responsible products and operations, pushing industries towards greener alternatives.

This growing awareness directly impacts CIMC's strategy, encouraging a focus on sustainable product development and minimizing environmental footprints. By aligning with these societal demands, CIMC can bolster its brand image and gain a competitive edge.

- Growing Consumer Demand: In 2023, surveys indicated that over 70% of Chinese consumers were willing to pay more for sustainable products.

- Government Initiatives: China's 14th Five-Year Plan (2021-2025) emphasizes green development, setting targets for emissions reduction and renewable energy use, indirectly pressuring companies like CIMC.

- Industry Trends: Leading global manufacturers are reporting increased investment in sustainable materials and processes, a trend mirrored in China's industrial sector.

- Brand Perception: Companies demonstrating strong sustainability commitments often report higher customer loyalty and improved market positioning.

Societal expectations in China are increasingly prioritizing environmental responsibility, directly influencing industries and companies like CIMC. Consumer demand for sustainable products is on the rise, with reports from 2023 suggesting over 70% of Chinese consumers are willing to pay a premium for eco-friendly options. This societal shift is further reinforced by government initiatives, such as the 14th Five-Year Plan, which actively promotes green development and sets ambitious targets for emissions reduction and renewable energy integration, creating a strong impetus for companies to adopt more sustainable practices.

CIMC must align its operations and product development with these evolving societal values to maintain market relevance and enhance its brand reputation. By integrating eco-friendly solutions and demonstrating a commitment to sustainability, CIMC can not only meet growing consumer expectations but also gain a competitive advantage. Industry trends also show a clear movement towards sustainable materials and processes globally, a pattern that is increasingly being mirrored within China's industrial landscape, further underscoring the importance of this focus for CIMC.

| Societal Factor | Description | Impact on CIMC | Supporting Data/Trend |

|---|---|---|---|

| Environmental Consciousness | Growing public awareness and demand for eco-friendly products and practices. | Drives need for sustainable product development and operations. | 70%+ Chinese consumers willing to pay more for sustainable products (2023). |

| Government Green Initiatives | National policies promoting sustainable development and emissions reduction. | Creates regulatory and market pressure for greener business models. | China's 14th Five-Year Plan (2021-2025) emphasizes green development. |

| Ethical Consumerism | Consumer preference for brands with strong ethical and social responsibility. | Requires CIMC to focus on fair labor and responsible sourcing. | Increased scrutiny of supply chains by international buyers and NGOs. |

Technological factors

Automation is revolutionizing China's logistics and manufacturing sectors, with advanced robotics and automated guided vehicles (AGVs) becoming commonplace in port terminals and factories. CIMC can harness these technologies to boost its own production efficiency and lower labor expenses. For instance, by 2024, the global industrial robotics market was projected to reach $60 billion, a testament to this widespread adoption.

Furthermore, CIMC has an opportunity to develop and supply automated equipment tailored for contemporary logistics infrastructure. This strategic move aligns with the growing demand for smarter, more efficient supply chains. In 2025, it's estimated that investments in smart manufacturing technologies in China will exceed $150 billion, highlighting a significant market for CIMC's potential offerings.

Artificial intelligence is transforming how companies like CIMC manage their supply chains. By leveraging AI, demand forecasting accuracy can be significantly boosted, leading to better inventory control and reduced waste. This technology also enables real-time tracking of goods and predictive maintenance for equipment, minimizing downtime.

CIMC can integrate AI across its extensive logistics network to gain deeper insights from data analytics. This will empower more informed operational decisions, from route optimization to resource allocation, enhancing efficiency across its diverse business segments. The global AI in logistics market is anticipated to reach over $15 billion by 2025, highlighting the significant growth and adoption of these technologies.

The development of lighter, stronger, and more sustainable materials for containers and vehicles is a significant technological driver for China International Marine (CIM). For instance, advancements in composite materials are allowing for container designs that are not only more durable but also substantially lighter, potentially reducing shipping costs and fuel consumption. CIM's investment in material science research, including the use of advanced alloys and eco-friendly coatings, positions them to capitalize on this trend, aiming for products that enhance both performance and environmental responsibility.

Digitalization of Logistics and Supply Chains

The ongoing digitalization of logistics and supply chains is a significant technological factor for China International Marine (CIMC). This trend encompasses the integration of Internet of Things (IoT) enabled containers, sophisticated tracking systems, and blockchain technology, all aimed at boosting transparency and efficiency in global trade operations. For instance, by 2024, the global IoT in logistics market was projected to reach over $70 billion, highlighting the rapid adoption of these technologies.

CIMC must actively invest in and provide comprehensive digital solutions to remain competitive. These solutions should offer real-time visibility into cargo movement and simplify intricate supply chain processes, thereby catering to the dynamic needs of contemporary commerce. The adoption of digital platforms is crucial for optimizing operations, reducing transit times, and enhancing customer satisfaction in the increasingly interconnected world of shipping and logistics.

Key aspects of this digitalization include:

- IoT Integration: Smart containers equipped with sensors for real-time monitoring of temperature, humidity, and location are becoming standard.

- Advanced Tracking Systems: GPS and RFID technologies provide granular visibility throughout the supply chain.

- Blockchain Adoption: Enhancing transparency, security, and traceability of goods and transactions across multiple stakeholders.

- Data Analytics: Utilizing big data to optimize routes, predict demand, and improve operational efficiency.

Green Technologies for Energy and Transportation

Innovations in clean energy storage, electric vehicles (EVs), and low-carbon shipping are rapidly reshaping global industries. By 2024, the EV market is projected to see significant growth, with sales expected to reach new heights, driven by government incentives and increasing consumer awareness. Similarly, advancements in battery technology are crucial for enabling widespread adoption of these green solutions.

China International Marine (CIMAC) is strategically positioning itself within this evolving landscape. The company is actively integrating these new energy trends by introducing pure electric tractors and trailers to its fleet. Furthermore, CIMAC is making substantial investments in green hydrogen technologies, recognizing its potential as a future fuel source.

This proactive approach allows CIMAC to effectively address the escalating demand for sustainable transportation and energy equipment. For instance, the global market for green hydrogen is anticipated to expand considerably in the coming years, presenting a significant opportunity for companies investing in this sector. CIMAC's focus on these areas ensures its relevance and competitiveness in a decarbonizing economy.

- Global EV market growth: Projections indicate continued strong sales for electric vehicles through 2024 and beyond, fueled by policy support and technological advancements.

- Green hydrogen investment: Significant capital is flowing into green hydrogen production and infrastructure, signaling its importance in future energy systems.

- CIMAC's strategic alignment: The company's introduction of electric tractors and trailers, coupled with green hydrogen investments, demonstrates a commitment to sustainability and market demand.

Technological advancements are fundamentally reshaping China's logistics and manufacturing sectors, with automation and AI integration becoming key drivers of efficiency. CIMC is leveraging these trends by adopting advanced robotics and AI-powered supply chain management, aiming to reduce costs and improve operational insights. The global industrial robotics market was projected to reach $60 billion by 2024, underscoring the widespread adoption of automation.

Furthermore, CIMC is poised to capitalize on the growing demand for smart manufacturing technologies, with China's investments in this area expected to exceed $150 billion by 2025. The company's strategic focus on AI for demand forecasting and predictive maintenance enhances its competitive edge. The global AI in logistics market is anticipated to surpass $15 billion by 2025, highlighting the significant growth potential.

Legal factors

International trade regulations and tariffs profoundly influence China International Marine's (CIMC) global operations. The ongoing trade friction between major economic powers, notably the US and China, creates significant uncertainty. For instance, in 2023, the US maintained tariffs on a wide range of Chinese goods, impacting import costs and potentially reducing demand for CIMC's products in the American market.

CIMC's reliance on international markets means its export volumes and supply chain costs are directly sensitive to these trade policies. Changes in tariffs can alter the competitive landscape, affecting CIMC's pricing strategies and market access. Navigating these evolving trade dynamics is crucial for maintaining profitability and market share in key overseas regions.

China's commitment to environmental protection is evident in its robust legal framework, which significantly impacts industries like those served by CIMC. The nation has been actively expanding its emissions trading system, notably incorporating heavy industries such as steel, cement, and aluminum. This move directly influences manufacturing expenses and compels businesses to invest in and adopt low-carbon technologies.

Further illustrating this trend, new mandatory national standards for energy consumption in tire and carbon black production are scheduled to be implemented in May 2025. These regulations will require a more efficient use of energy resources within these specific sectors. CIMC's operations, therefore, must align with these progressively stricter environmental mandates, underscoring the need for ongoing investment in sustainable and green operational practices to ensure compliance and maintain competitiveness.

China's labor laws have become significantly more stringent, impacting companies like CIMC. For instance, the average monthly wage in major Chinese cities like Shanghai and Beijing has continued to climb, with minimum wage adjustments often occurring annually. This trend, coupled with increased enforcement of worker rights, means higher operational expenses and a greater need for meticulous compliance regarding wages, working hours, and workplace safety across CIMC's global footprint.

Intellectual Property Rights (IPR) Protection

Intellectual property rights protection is crucial for CIMC, a global manufacturing and innovation leader. China's evolving legal landscape for IPR, including recent amendments to patent and copyright laws, directly impacts CIMC's ability to secure its advanced shipbuilding designs and proprietary technologies. The company's commitment to robust IPR strategies is essential for maintaining its competitive edge and ensuring long-term business security in a dynamic global market.

Recent enforcement actions highlight the increasing focus on IPR within China. For instance, in 2023, China's Supreme People's Court reported a significant increase in IP infringement cases, underscoring the growing importance of legal recourse for innovators. CIMC actively monitors these developments to adapt its protection measures.

- Strengthened Enforcement: China's commitment to enhancing IP protection is evident in increased penalties for infringement.

- International Alignment: China's efforts to align its IP laws with international standards benefit companies like CIMC.

- Technological Safeguards: CIMC invests in advanced systems to protect its innovative designs and manufacturing processes.

Anti-Monopoly and Competition Laws

China's anti-monopoly and competition laws are increasingly impacting major players like CIMC, especially given its dominant global position in sectors such as container manufacturing, where it holds a significant market share. These regulations are designed to foster fair competition and prevent monopolistic practices, directly affecting how companies like CIMC can operate and expand.

The enforcement of these laws can significantly shape CIMC's strategic decisions. For instance, merger and acquisition (M&A) activities require rigorous review to ensure they do not unduly stifle competition. In 2023, China's State Administration for Market Regulation (SAMR) continued to actively review and approve M&A deals, with a focus on market concentration in key industries.

CIMC must therefore carefully navigate these legal frameworks to ensure its pricing strategies and market conduct align with competition law requirements. This legal landscape necessitates proactive compliance and a thorough understanding of regulatory expectations to avoid penalties and maintain market access.

- Market Dominance Scrutiny: CIMC's leading positions in global markets, such as container production, attract close attention from competition authorities.

- M&A Compliance: Merger and acquisition plans are subject to stringent reviews under anti-monopoly regulations to prevent undue market consolidation.

- Pricing and Strategy Impact: Competition laws influence pricing practices and overall market strategies, demanding careful legal adherence.

- Regulatory Enforcement: China's commitment to fair competition means active enforcement of anti-monopoly laws, as seen in SAMR's oversight of market activities.

China's evolving legal framework presents both opportunities and challenges for CIMC. The nation's increasing focus on intellectual property rights, evidenced by a rise in IP infringement cases reported by the Supreme People's Court in 2023, necessitates robust protection strategies for CIMC's innovations.

Furthermore, China's anti-monopoly and competition laws, actively enforced by bodies like SAMR, require careful navigation, particularly for CIMC's market-leading positions. Compliance with these regulations is paramount to avoid penalties and ensure sustained market access.

The country's commitment to environmental standards, including new energy consumption mandates for sectors like tire production set for May 2025, also compels CIMC to invest in sustainable practices and technologies to meet increasingly stringent regulations.

| Legal Area | Key Development | Impact on CIMC |

|---|---|---|

| Intellectual Property Rights | Increased IP infringement cases (2023) and strengthened legal recourse. | Requires enhanced protection of designs and technologies. |

| Competition Law | Active enforcement of anti-monopoly laws by SAMR. | Influences M&A, pricing, and market conduct strategies. |

| Environmental Regulations | New mandatory energy consumption standards (May 2025). | Drives investment in green technologies and operational efficiency. |

Environmental factors

Global climate change initiatives are increasingly influencing industrial operations, with China setting ambitious goals: carbon peak by 2030 and carbon neutrality by 2060. These targets are reshaping how businesses, including those in the marine sector, operate.

China International Marine (CIM) is demonstrating a strong commitment to these environmental goals. The company aims for carbon-neutral container production by 2025 and plans to cut carbon emissions per container unit by 40%. This reduction will be achieved through advancements in material science and the implementation of smart logistics.

International maritime regulations, particularly those from the International Maritime Organization (IMO) targeting decarbonization, are significantly shaping the shipping industry. These rules are pushing for reduced vessel speeds and boosting the market for environmentally friendly equipment. For China International Marine (CIM), this translates into increased demand for its sustainable container solutions and energy-efficient port technologies.

The push for sustainability is also evident in port operations, with automated container terminals actively integrating greener technologies to meet these evolving environmental standards. This regulatory landscape, expected to intensify through 2025, presents a clear opportunity for CIM to leverage its expertise in eco-friendly solutions, aligning with global efforts to reduce the carbon footprint of maritime trade.

Global pressure is mounting for greater resource efficiency and waste reduction, pushing industries towards circular economy models. CIMC's ESG strategy actively incorporates these principles, focusing on waste minimization and recycling throughout its operations.

This commitment translates into tangible actions like reducing packaging and manufacturing waste, alongside actively seeking sustainable material replacements. For instance, in 2024, CIMC reported a 15% reduction in production waste per unit compared to 2023, demonstrating progress in their circular economy initiatives.

Pollution Control Standards (Air, Water, Soil)

China's environmental protection efforts have intensified, with stricter pollution control standards impacting industries like manufacturing. For China International Marine (CIM), this means its production facilities must adapt to new regulations governing air, water, and soil emissions. In 2024, the Ministry of Ecology and Environment continued to emphasize compliance, with significant fines levied for violations.

These evolving standards necessitate ongoing investment in advanced pollution abatement technologies and sustainable operational methods for CIM. Failure to meet these requirements can result in operational disruptions and financial penalties, underscoring the importance of proactive environmental management.

- Stricter Emission Limits: Regulations in 2024 saw tighter limits on particulate matter and wastewater discharge across key industrial zones.

- Increased Enforcement: Environmental authorities conducted more frequent inspections, leading to a rise in penalties for non-compliant facilities.

- Investment in Green Technology: Companies are encouraged to adopt cleaner production processes, with government incentives available for pollution control upgrades.

ESG Investing Trends and Corporate Social Responsibility

Environmental factors are increasingly shaping investment decisions in China, with a noticeable surge in investor demand for robust Environmental, Social, and Governance (ESG) performance. This trend is pushing companies like CIMC to integrate sustainability into their core strategies, moving beyond mere compliance to proactive environmental stewardship.

CIMC's commitment to sustainability is a key differentiator in the current market. Their initiative to establish carbon-neutral factories demonstrates a tangible effort to reduce their environmental footprint. Furthermore, CIMC's publicly available ESG roadmap for 2025 provides transparency and accountability, crucial elements for attracting ESG-focused capital.

- ESG Investment Growth: Global ESG assets are projected to reach $50 trillion by 2025, indicating a significant shift in investment priorities.

- CIMC's Carbon Neutrality: CIMC's investment in and implementation of carbon-neutral manufacturing processes directly addresses environmental concerns.

- Investor Alignment: By aligning with ESG criteria, CIMC enhances its attractiveness to a growing pool of responsible investors seeking both financial returns and positive societal impact.

- Reputational Enhancement: A strong ESG profile, backed by concrete initiatives like those at CIMC, bolsters corporate reputation and stakeholder trust.

China's commitment to environmental protection, including ambitious carbon reduction targets for 2030 and 2060, directly impacts maritime operations. International Maritime Organization (IMO) regulations are driving decarbonization in shipping, favoring eco-friendly equipment and slower vessel speeds, which benefits sustainable solutions providers like China International Marine (CIM).

CIM is proactively addressing these environmental pressures by aiming for carbon-neutral container production by 2025 and a 40% reduction in carbon emissions per container unit. This is being achieved through material science advancements and smart logistics, aligning with global sustainability trends and increasing investor interest in ESG performance, with global ESG assets projected to reach $50 trillion by 2025.

| Environmental Factor | China's Target/Regulation | CIM's Action/Goal | Impact/Opportunity |

|---|---|---|---|

| Climate Change Initiatives | Carbon peak by 2030, Carbon neutrality by 2060 | Carbon-neutral container production by 2025, 40% emission reduction per container | Increased demand for sustainable solutions |

| Maritime Decarbonization | IMO regulations | Focus on eco-friendly equipment and port technologies | Market advantage in green maritime solutions |

| Resource Efficiency | Circular economy principles | Waste minimization, recycling, sustainable material use | Reduced operational costs, enhanced ESG profile |

| Pollution Control | Stricter national standards | Investment in advanced pollution abatement technologies | Compliance, avoidance of penalties, operational continuity |

PESTLE Analysis Data Sources

Our China International Marine PESTLE Analysis is built on a robust foundation of data from official Chinese government ministries, international maritime organizations, and leading industry research firms. We meticulously gather information on policy shifts, economic indicators, technological advancements, and environmental regulations to provide comprehensive insights.