China International Marine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China International Marine Bundle

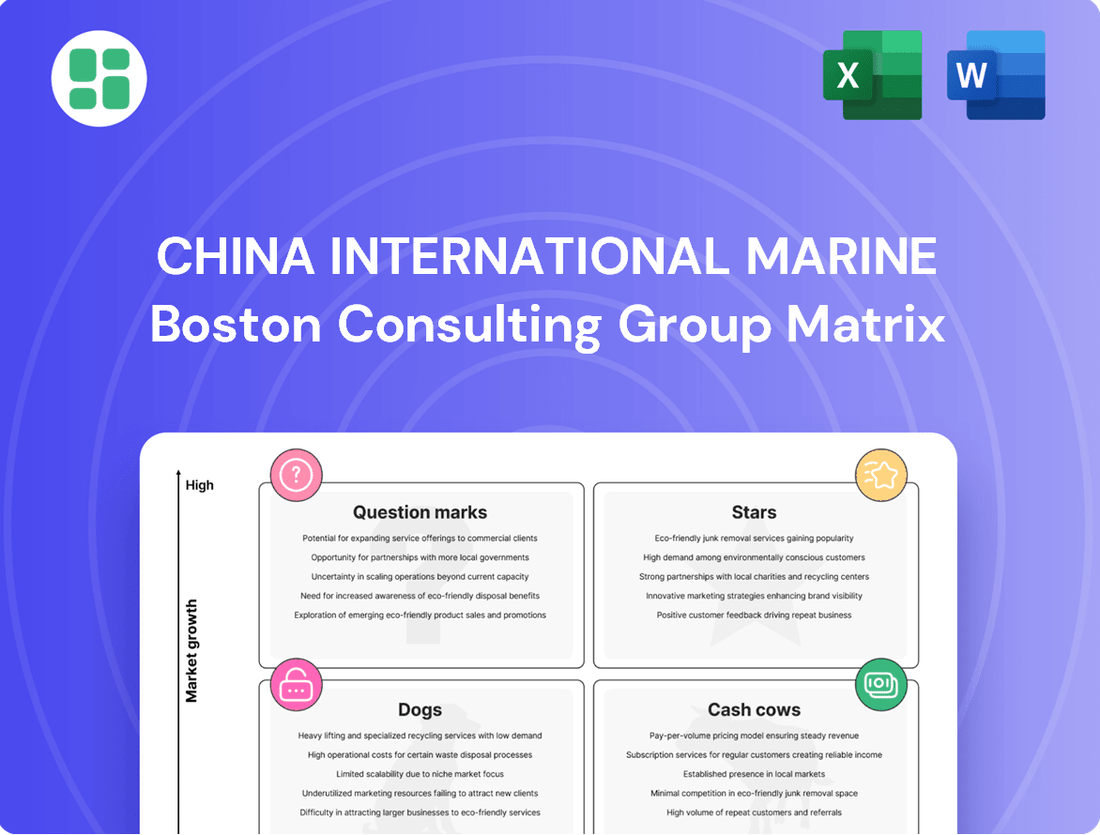

Uncover the strategic positioning of China International Marine's product portfolio with our insightful BCG Matrix preview. See which ventures are poised for growth and which require careful consideration. Ready to transform this data into actionable strategy? Purchase the full BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with expert recommendations to guide your investment decisions and optimize your market approach.

Stars

CIMC Raffles, a key player in CIMC's offshore engineering, demonstrated a remarkable turnaround in 2024. The segment shifted from a loss to a profit, driven by a substantial 58% revenue increase to RMB 16.556 billion and a net profit of RMB 224 million.

This strong performance was fueled by a significant surge in new orders, which jumped 93.5% to a record US$3.25 billion. This indicates robust market recovery and strong demand for CIMC Raffles' capabilities.

The company's accumulated order book grew by 27% to US$6.92 billion by the close of 2024, with production commitments extending through 2027. This substantial backlog provides excellent long-term visibility and underscores the sustained demand in the offshore engineering sector.

CIMC Enric's clean energy equipment business is a strong performer, likely a Star in the BCG matrix. Its revenue surged by 26.2% year-on-year in the first three quarters of 2024, hitting RMB 12.599 billion. This growth is fueled by rising domestic natural gas use and imports, demonstrating robust market acceptance.

The company secured over RMB 10 billion in new orders for its marine clean energy segment in 2024, a record high. This indicates substantial future revenue potential and a dominant market position in a rapidly expanding sector.

With a strategic focus on hydrogen energy, including successful co-production projects, CIMC Enric is well-positioned for the ongoing energy transition. This segment's high growth and strategic importance solidify its Star status.

CIMC is a leader in AI-powered smart containers, revolutionizing global supply chains with enhanced efficiency. These advanced solutions offer predictive maintenance and real-time error code fixes, significantly boosting logistics reliability and reducing operational downtime. The company's recognition, such as being named among the 'Top 50 Smart Logistics' companies, underscores its significant impact and expertise in this rapidly expanding field.

Modular Building Systems (CIMC MBS)

CIMC Modular Building Systems (CIMC MBS) stands out as a prominent player in the modular construction sector, a market experiencing robust growth driven by the need for speed, sustainability, and efficiency in building. The company's innovative approach, which emphasizes factory prefabrication and streamlined ocean shipping for its modular units, has been recognized with significant accolades, including awards for notable projects such as the world's largest modular student housing and transitional housing initiatives in Hong Kong in 2025. This strategic focus on advanced modular technology allows CIMC MBS to substantially cut down construction timelines and minimize waste, positioning it favorably to address escalating global demands for housing and infrastructure solutions.

- Market Growth Driver: The global modular construction market is projected to reach USD 257.1 billion by 2027, growing at a CAGR of 7.3% from 2020, according to Grand View Research.

- Efficiency Gains: CIMC MBS's methods can reduce construction periods by up to 50% compared to traditional methods.

- Sustainability Focus: Factory-based production leads to an estimated 30% reduction in construction waste.

- Global Reach: The company's expertise in modular ocean shipping facilitates international project delivery.

Specialized Reefer and Tank Containers

While the broader container manufacturing sector might be considered a cash cow, specialized segments like reefer and tank containers are showing significantly higher growth. This is a key differentiator for China International Marine (CIM) within the BCG framework.

Reefer container sales experienced a substantial surge, increasing by nearly 50% in 2024. This impressive growth underscores the escalating demand for robust cold chain logistics, essential for transporting temperature-sensitive goods like pharmaceuticals and fresh produce.

CIM's continued dominance as the world's leading producer of tank containers and other special-purpose containers highlights its strong market leadership in these high-value niches. This specialization enables the company to achieve higher profit margins.

- Specialized Segments Drive Growth: Reefer and tank containers are outperforming the general container market.

- 2024 Reefer Surge: Reefer container sales saw nearly a 50% increase in 2024.

- Market Leadership: CIM remains the top global producer of tank and special-purpose containers.

- Higher Margins: Specialization in these areas leads to increased profitability and addresses specific market needs.

CIMC Enric's clean energy equipment business is a strong performer, likely a Star in the BCG matrix, with revenue up 26.2% year-on-year in the first three quarters of 2024. The company secured over RMB 10 billion in new orders for its marine clean energy segment in 2024, a record high, solidifying its position in the expanding energy transition market.

CIMC Raffles also demonstrated a remarkable turnaround in 2024, shifting from loss to profit with a 58% revenue increase to RMB 16.556 billion. This was driven by a 93.5% surge in new orders to US$3.25 billion, indicating strong market recovery and robust demand for its offshore engineering capabilities.

CIMC Modular Building Systems (CIMC MBS) is well-positioned in the growing modular construction sector, with its methods reducing construction timelines by up to 50% and waste by an estimated 30%. The company's expertise in modular ocean shipping facilitates international project delivery, addressing global demand for efficient and sustainable building solutions.

China International Marine's (CIM) specialized segments, particularly reefer and tank containers, are outperforming the general container market. Reefer container sales surged by nearly 50% in 2024, highlighting the increasing demand for cold chain logistics, while CIM's continued dominance in tank containers ensures higher profit margins.

What is included in the product

This BCG Matrix overview will detail China's marine industry units, categorizing them by market share and growth.

The China International Marine BCG Matrix offers a clear visual representation of market share and growth, simplifying complex strategic decisions.

Cash Cows

CIMC's dry cargo container manufacturing segment is a quintessential cash cow, holding its title as the world's largest producer. In 2024, this segment saw an astounding 417.03% surge in sales year-on-year, highlighting robust market demand. The segment's net profit reached RMB 4.088 billion in 2024, a remarkable 128% increase from the previous year, underscoring its significant profitability and consistent cash generation capabilities.

CIMC Vehicles stands as a strong Cash Cow within China International Marine's BCG Matrix, primarily due to its dominant position in the Chinese semi-trailer market. In 2024, the company solidified its No.1 market share for the sixth year running, demonstrating remarkable resilience with domestic sales increasing by 12.02% even as the broader market faced headwinds.

The business's financial performance in 2024 underscores its cash-generating prowess, with an operating net profit of RMB 1.35 billion. Crucially, it generated substantial net cash from its operating activities, a clear indicator of its ability to convert profits into readily available funds. This robust cash flow generation is a hallmark of a mature and highly profitable business unit.

While a normalization in the North American market led to a dip in overall revenue and net profit for CIMC Vehicles, its unwavering leadership in the crucial Chinese market ensures a consistent and reliable stream of cash. This steady inflow of cash is vital, providing the financial fuel for other, potentially higher-growth ventures within the broader China International Marine portfolio.

CIMC's logistics services emerged as a strong Cash Cow in 2024, demonstrating impressive growth. Operating revenue surged by 55.65% to RMB 31.389 billion, while net profit more than doubled to RMB 437 million. This robust performance was fueled by a resurgence in global trade and elevated freight rates.

The segment's operational prowess is further highlighted by its yard business, which achieved a record high, processing over 7.5 million TEUs. Additionally, CIMC Wetrans secured the third spot among Chinese companies on the 2024 Top 50 Ocean Freight Forwarders list, underscoring its significant market standing and efficiency within the logistics sector.

Financial and Asset Management Division

China International Marine (CIMC)'s Financial and Asset Management division demonstrated robust performance in 2024, with its net profit seeing a substantial increase of around RMB 640 million. This segment plays a vital role in diversifying CIMC's revenue streams and providing essential financial support by effectively utilizing the group's existing assets and financial acumen.

The division's success is partly driven by strong asset utilization, exemplified by drilling platforms achieving 100% rental rates. This high occupancy translates into reliable and consistent income, underscoring the division's contribution to CIMC's overall financial health.

- Net Profit Growth: Approximately RMB 640 million improvement in 2024.

- Strategic Importance: Provides diversification and crucial support to the broader group.

- Asset Monetization: Leverages existing assets and financial expertise for income generation.

- High Utilization Rates: Drilling platforms, including jack-up types, maintained 100% rental rates, ensuring consistent revenue.

Conventional Energy Equipment (CIMC Enric)

CIMC Enric's conventional energy, chemical, and liquid food equipment segments are performing as reliable cash cows. These mature businesses, benefiting from an established customer base and infrastructure, consistently generate stable revenue and profits. In 2024, this segment brought in RMB 12.121 billion, showing healthy, steady growth.

The strength of these segments is further underscored by their order book. With orders on hand reaching a record RMB 29.35 billion, it's clear that demand remains robust. This substantial backlog ensures sustained revenue streams and provides the company with predictable cash flow, which is crucial for funding its expansion into newer, growth-oriented areas like clean energy.

- Revenue Generation: RMB 12.121 billion in 2024, demonstrating stable performance.

- Order Backlog: Record RMB 29.35 billion, indicating strong future demand.

- Profitability: Provides reliable profits and cash flow due to established market position.

- Strategic Importance: Supports expansion into clean energy through consistent financial contribution.

CIMC's dry cargo container manufacturing segment is a prime example of a cash cow, holding its position as the world's largest producer. In 2024, this segment experienced a significant 417.03% year-on-year sales increase, reflecting strong market demand. Its net profit reached RMB 4.088 billion in 2024, marking a substantial 128% rise from the prior year, underscoring its profitability and consistent cash generation.

| Segment | 2024 Revenue (RMB billions) | 2024 Net Profit (RMB billions) | Key Metric |

|---|---|---|---|

| Dry Cargo Containers | N/A | 4.088 | 417.03% YoY Sales Growth |

| Vehicles (China Market) | N/A | 1.35 | No. 1 Market Share (6th year) |

| Logistics Services | 31.389 | 0.437 | 55.65% Revenue Growth |

| Financial & Asset Management | N/A | ~0.640 (Profit Improvement) | 100% Drilling Platform Rental Rate |

| Conventional Energy, Chemical, Liquid Food Equipment | 12.121 | N/A | RMB 29.35 billion Order Backlog |

What You See Is What You Get

China International Marine BCG Matrix

The China International Marine BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the final, professionally formatted analysis, ready for immediate strategic application without any watermarks or demo content. The comprehensive insights and data presented here are exactly what you will download, ensuring no surprises and full readiness for your business planning needs.

Dogs

Certain legacy real estate holdings within CIMC could be classified as Dogs in the BCG Matrix, particularly given the ongoing challenges in China's property market. These older or less strategically important assets may be experiencing low growth and generating minimal returns on invested capital.

For instance, while specific CIMC asset performance isn't detailed, China's real estate sector saw a significant slowdown in 2024, with property investment declining by 9.8% year-on-year in the first four months of the year. This broader market context suggests that some of CIMC's older developments might be tying up capital without strong prospects for future appreciation or rental income.

Within China International Marine's logistics operations, some regional hubs function as question marks on the BCG matrix. While the broader logistics sector shows strength, specific container yards or smaller hubs may be experiencing low profitability or just breaking even. These facilities, if they aren't crucial for strategic network integration or haven't been modernized, can become cash drains due to consistent operating expenses without significant market share gains.

Within China International Marine's (CIMC) portfolio, older, less efficient manufacturing facilities can be viewed as potential 'Dogs' in a BCG matrix analysis. These sites often struggle with lower production output and higher operational expenses compared to newer, modernized plants. For instance, a facility primarily focused on legacy shipbuilding components might face challenges with outdated machinery, leading to increased repair costs and slower turnaround times.

These older facilities typically exhibit a low market share in their respective segments due to their reduced competitiveness and may also operate in markets experiencing stagnant or declining growth. The strategic decision for CIMC regarding these assets often boils down to whether the cost of modernization or significant investment for a turnaround outweighs the potential benefits. Divesting or phasing out these less productive units might be a more prudent approach to reallocate capital towards CIMC's strategic focus on 'light tower plants' and high-end manufacturing.

Non-Core, Low-Growth Ancillary Businesses

China International Marine BCG Matrix analysis suggests that CIMC likely possesses non-core, low-growth ancillary businesses. These segments might represent legacy operations with a low market share in mature or even declining industries, diverging from CIMC's strategic emphasis on advanced equipment and smart logistics.

Such ancillary units could be a drain on resources, generating little cash flow or even operating at a loss, demanding management attention that is not justified by their overall contribution to the conglomerate. While specific examples were not detailed in available information, it's a common scenario for large, diversified companies like CIMC.

- Low Market Share: These ancillary businesses typically hold a small percentage of their respective markets.

- Mature or Declining Markets: They operate in industries that are no longer experiencing significant growth.

- Resource Drain: These units may consume management time and capital without generating substantial returns.

- Strategic Misalignment: They often do not fit with the company's core, high-growth strategic objectives.

Segments Heavily Reliant on Outdated Technologies

Segments within China International Marine (CIM) that remain heavily reliant on outdated technologies face significant risks in today's dynamic market. Without substantial investment in innovation, these areas could become question marks in the BCG matrix, characterized by low market share and minimal growth potential. For instance, if CIM's traditional container manufacturing processes haven't been modernized to incorporate advancements in material science or automated production, they might struggle to compete on cost and efficiency against rivals utilizing newer methods.

The imperative for continuous technological upgrades cannot be overstated. Failing to adapt means product lines risk obsolescence, diminishing their market relevance and profitability. Consider the shift towards smart logistics; segments of CIM that do not integrate IoT sensors or advanced tracking systems into their marine equipment, for example, will likely see their value proposition erode. In 2023, the global logistics technology market was valued at over $50 billion, highlighting the significant investment and adoption of modern solutions.

- Risk of becoming question marks: Segments heavily reliant on outdated technologies risk declining market share and stagnant growth.

- Need for technological upgrades: Continuous innovation is crucial to prevent product lines from becoming obsolete and losing competitive edge.

- Impact of smart logistics and clean energy: CIM's traditional segments must adapt to evolving industry standards to maintain relevance.

- Market trends: The global logistics technology market's growth underscores the necessity for technological modernization.

Within China International Marine's portfolio, certain legacy assets or business units can be categorized as 'Dogs' in the BCG matrix. These are typically characterized by low market share and operate in low-growth or declining industries, demanding resources without generating significant returns.

For instance, older, less efficient manufacturing facilities that struggle with outdated machinery and higher operational costs fit this description. These units may face challenges in competitiveness, leading to reduced market presence and stagnant growth prospects, potentially requiring divestment or significant modernization to avoid becoming a drain on capital.

Such 'Dog' segments often represent ancillary businesses or regional operations that have not kept pace with industry advancements or strategic shifts. Their low profitability and minimal contribution to overall growth highlight the need for careful evaluation, with a focus on reallocating capital towards more promising 'Stars' or 'Cash Cows' within CIMC's broader strategy.

Question Marks

Beyond its established hydrogen energy equipment, CIMC Enric's ventures into novel distribution and storage infrastructure, such as advanced liquid hydrogen transport or underground storage solutions, represent potential stars. These areas are poised for rapid expansion due to the global push for decarbonization, with the hydrogen market projected to reach $1.8 trillion by 2028, according to BloombergNEF. However, CIMC's current market penetration in these nascent segments might be limited, demanding substantial capital to secure a leading position.

The challenge lies in nurturing these emerging infrastructure segments. Significant R&D and capital expenditure are necessary to scale up these unproven technologies and capture market share. Failure to do so, or a slower-than-anticipated market uptake, could see these high-potential areas regress into question marks or even dogs within the BCG matrix, especially if competitors with more established solutions gain traction.

CIMC Vehicles is making strides in the burgeoning new energy semi-trailer market, having introduced its first pure electric tractors and trailers. This strategic move positions them within a high-growth sector fueled by global decarbonization efforts in transportation.

While the market for these eco-friendly vehicles is expanding rapidly, CIMC Vehicles' current market share in this nascent segment is likely modest. Significant investment in research and development, production capabilities, and market penetration will be crucial for these products to ascend from their current position and become market leaders, akin to 'Stars' in a BCG matrix.

By 2024, China's new energy vehicle (NEV) market, including commercial vehicles, has seen substantial growth, with NEV sales projected to reach over 10 million units. This trend underscores the immense potential for new energy semi-trailers, a segment where CIMC Vehicles is actively seeking to establish a strong foothold.

CIMC's move into AI-driven smart containers is just the beginning; extending this intelligence to fully automated warehouses and advanced supply chain optimization platforms positions them in a high-growth tech segment. This strategic push acknowledges the burgeoning demand for efficiency in logistics, a sector projected to see significant AI adoption. For instance, the global smart logistics market was valued at approximately $26.3 billion in 2023 and is anticipated to reach over $100 billion by 2030, showcasing the immense potential.

However, these broader AI logistics initiatives, while promising, face challenges of low initial market penetration and demand substantial capital and specialized expertise for scaling. CIMC's success will hinge on how quickly the market embraces these advanced solutions and their ability to stand out against a competitive landscape. The company's 2024 financial reports will likely reflect these early investments and the ongoing efforts to capture market share in this evolving technological frontier.

International Expansion into New Geographic Markets

CIMC's international expansion into new geographic markets, particularly in Southeast Asia and the Middle East, positions its vehicles and clean energy segments as potential Stars or Question Marks. These regions offer substantial growth prospects, evidenced by the increasing demand for infrastructure and sustainable energy solutions. However, CIMC faces the challenge of establishing a strong foothold and brand presence in these developing markets.

To navigate this, CIMC is focusing on strategic initiatives:

- Partnerships: Forging local alliances to leverage existing networks and market knowledge.

- Distribution: Investing in robust distribution channels to ensure product availability and service.

- Adaptation: Tailoring products and marketing strategies to meet specific regional demands and regulations.

For instance, in 2023, CIMC Vehicles reported a significant increase in overseas sales, with emerging markets playing a crucial role in this growth. The success of these ventures hinges on effectively managing the initial low market share and brand awareness, ensuring they transition from Question Marks to Stars rather than becoming Dogs.

Digitalization and Intelligent Manufacturing Initiatives

CIMC's commitment to digitalization and intelligent manufacturing, including the development of 'light tower plants,' is designed to boost technological capabilities and production efficiency. This focus aligns with the significant growth trend in industrial automation, a key area for future competitiveness.

While these broad digitalization efforts are crucial for long-term advantage, their immediate impact on market share and short-term returns may be modest. Sustained investment is necessary to fully realize the transformative potential of these initiatives.

- Focus on Light Tower Plants: CIMC is actively building 'light tower plants' to serve as hubs for advanced manufacturing and digitalization.

- Efficiency Gains: These initiatives aim to significantly improve production efficiency across CIMC's diverse operations.

- Industrial Automation Trend: The company's strategy directly addresses the high-growth trend in industrial automation, a critical sector for future industrial development.

- Long-Term Investment Horizon: Realizing substantial market share gains and competitive advantages from broad digitalization requires a sustained investment approach, with immediate returns potentially being lower.

CIMC's ventures into cutting-edge areas like AI-driven smart containers and automated warehouses represent significant potential but are currently in their nascent stages. These initiatives require substantial capital and expertise to scale, facing the risk of low market penetration if adoption lags or competition intensifies. The success of these high-growth, high-risk ventures hinges on CIMC's ability to secure early market share and overcome technological hurdles.

Similarly, CIMC Vehicles' entry into the new energy semi-trailer market, while tapping into a rapidly expanding sector, is characterized by a modest current market share. Significant investment is needed to solidify its position and compete effectively. The company's international expansion also falls into this category, with potential growth in emerging markets offset by the challenges of building brand recognition and distribution networks.

| CIMCs BCG Matrix: Question Marks | Market Growth | Market Share | Strategic Considerations | Example Segments |

|---|---|---|---|---|

| AI-driven smart logistics | High | Low | Requires significant R&D and capital investment; focus on early market adoption and differentiation. | Automated warehouses, supply chain optimization platforms |

| New energy semi-trailers | High | Low | Needs investment in production, R&D, and market penetration to capture growth. | Pure electric tractors and trailers |

| International expansion (emerging markets) | High | Low | Leverage partnerships, build distribution, and adapt products to local needs. | Southeast Asia, Middle East vehicle and energy segments |

BCG Matrix Data Sources

Our China International Marine BCG Matrix leverages official government data, industry association reports, and company financial disclosures to provide a comprehensive view of market dynamics.