China International Marine Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China International Marine Bundle

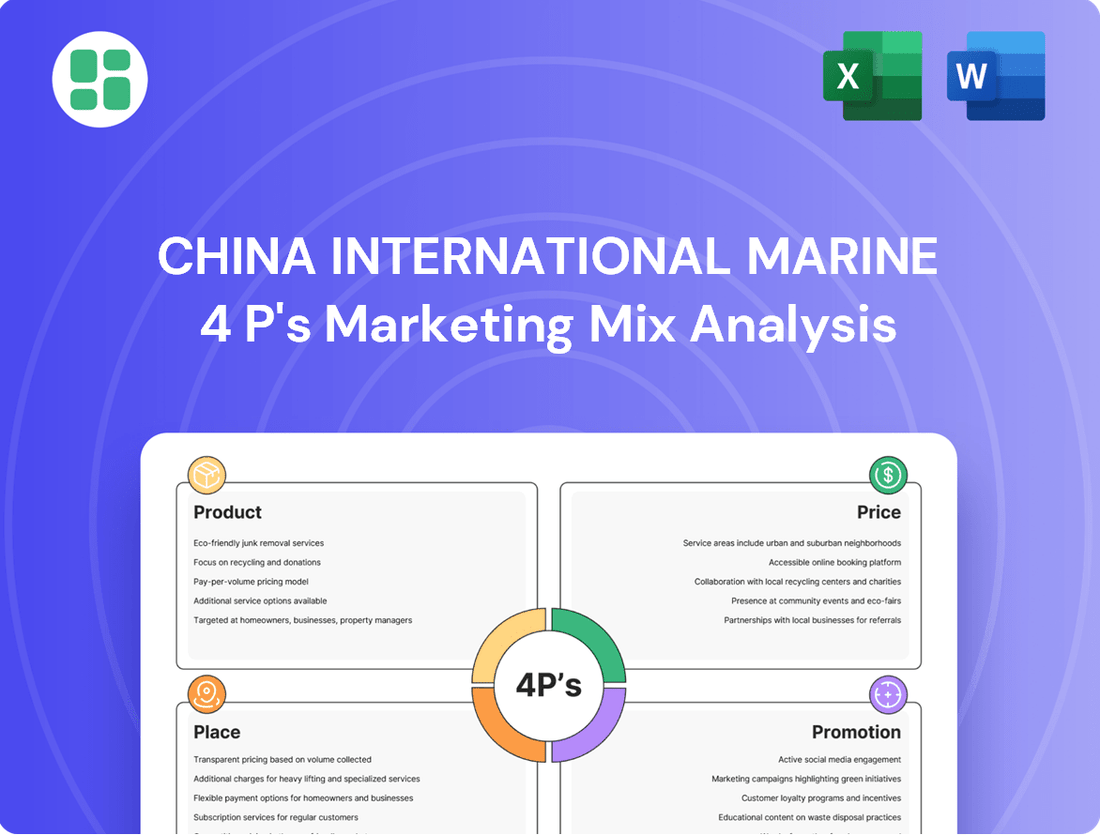

Discover the strategic brilliance behind China International Marine's market dominance by exploring their meticulously crafted 4Ps marketing mix. This analysis delves into their innovative product development, competitive pricing, expansive distribution channels, and impactful promotional campaigns.

Uncover the secrets to their success and gain actionable insights into how they leverage Product, Price, Place, and Promotion for maximum market penetration. This comprehensive report is your key to understanding their winning strategy.

Elevate your own marketing acumen by accessing the full, in-depth analysis of China International Marine's 4Ps. Get ready to transform your understanding of effective market engagement and drive your business forward.

Product

CIMC's product strategy centers on a diverse portfolio of logistics and energy equipment, offering both physical goods and integrated solutions. This broad range includes globally leading positions in various container types like dry cargo and reefer units, alongside specialized containers.

The company also provides comprehensive road transportation solutions, encompassing a wide array of semi-trailers. Notably, CIMC is innovating in this space with its development and deployment of electric tractors and trailers, aligning with global sustainability trends and the evolving needs of the logistics sector.

The company is pushing the boundaries in container material science, with significant R&D investment aimed at boosting both product value and environmental credentials. This focus on innovation directly addresses growing market demand for sustainable shipping solutions.

A key advancement is the use of Continuous Fibre Reinforced Thermo Plastic (CFRTP) panels in container walls. This cutting-edge material slashes container weight, contributing to a projected 5-10% reduction in CO2 emissions during manufacturing, aligning with global decarbonization efforts. Furthermore, the enhanced corrosion resistance translates to extended warranties, a strong selling point for eco-conscious clients.

CIMC's product strategy extends beyond standard container logistics, focusing on highly specialized equipment crucial for sectors like energy, chemicals, and food. This includes advanced solutions for marine clean energy, such as cryogenic storage and tank container logistics for natural gas and hydrogen, reflecting a commitment to emerging energy markets.

The company's offshore engineering division is a key contributor, manufacturing critical equipment like semi-submersible and jack-up drilling rigs. This segment demonstrated significant growth, securing record new orders in 2023, highlighting strong demand for their offshore infrastructure capabilities.

Modular Building Systems for Urban Solutions

CIMC's foray into modular building systems marks a strategic diversification, capitalizing on its established expertise in container manufacturing to address urban development challenges. These systems are proving instrumental in projects like large-scale student accommodations and adaptable affordable housing initiatives, showcasing their versatility.

The key advantage of these modular solutions lies in their ability to significantly accelerate project timelines and minimize construction waste, offering a compelling alternative to conventional building practices. For instance, by 2024, the global modular construction market was projected to reach USD 200 billion, highlighting the growing demand for efficient building methods.

- Product: Modular Building Systems

- Leveraged Expertise: Container Manufacturing

- Key Applications: Student Dormitories, Affordable Housing

- Market Trend: Growing demand for efficient, sustainable construction

Integrated Financial and Asset Management Services

CIMC's integrated financial and asset management services act as a key element in its marketing mix, specifically supporting its Product and Promotion strategies by offering comprehensive capital solutions. These services, which include professional capital management and financing, directly complement CIMC's core equipment manufacturing, creating a more robust value proposition for its diverse customer base. This approach aims to provide a holistic experience, addressing not just the physical product needs but also the financial complexities associated with large-scale industrial investments.

The financial services segment is designed to facilitate customer access to capital, thereby boosting sales of CIMC's primary equipment offerings. For instance, by providing tailored financing options, CIMC can make its high-value assets more attainable for businesses, particularly in emerging markets or during periods of economic uncertainty. This strategic integration enhances customer loyalty and expands market reach by removing financial barriers to entry. In 2024, global industrial equipment financing saw significant activity, with many companies leveraging specialized financial arms to drive sales and support infrastructure development projects.

- Financial Services Complement Core Equipment: CIMC's finance and asset management offerings directly support the sale and utilization of its manufacturing products.

- Holistic Value Proposition: Integration provides customers with end-to-end solutions, covering both asset acquisition and financial management.

- Facilitating Capital Access: These services aim to ease the financial burden on customers, making larger investments more feasible.

- Market Expansion Driver: By addressing financing needs, CIMC can penetrate new markets and strengthen relationships with existing clients.

CIMC's product innovation is evident in its advanced container materials, like Continuous Fibre Reinforced Thermo Plastic (CFRTP) panels. These panels reduce container weight, potentially cutting CO2 emissions by 5-10% during manufacturing. This focus on sustainability, coupled with enhanced corrosion resistance leading to extended warranties, strongly appeals to environmentally conscious buyers and supports CIMC's leadership in specialized equipment for sectors like energy and chemicals.

| Product Innovation | Material Example | Environmental Benefit | Customer Benefit |

|---|---|---|---|

| Advanced Container Materials | CFRTP Panels | 5-10% CO2 reduction (manufacturing) | Extended Warranty (Corrosion Resistance) |

| Specialized Energy Equipment | Cryogenic Storage, Hydrogen Tanks | Supports Clean Energy Transition | Access to Emerging Markets |

| Modular Building Systems | Accelerated Project Timelines | Reduced Construction Waste | Adaptable Housing Solutions |

What is included in the product

This analysis offers a comprehensive examination of China International Marine's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics. It provides actionable insights into their market positioning and competitive landscape.

Unpacks the complex China International Marine 4P's marketing mix, offering clear, actionable solutions to common market entry challenges.

Provides a strategic roadmap to overcome competitive pressures and navigate regulatory hurdles in the Chinese marine industry.

Place

CIMC strategically positions its manufacturing facilities in vital port locations throughout mainland China and internationally. This expansive production network is crucial for optimizing supply chain logistics and maintaining close proximity to significant maritime trade lanes.

This global manufacturing presence allows CIMC to achieve substantial production capacities, exemplified by their container manufacturing division which reported a record output in 2024, delivering over 5.5 million TEUs. Such a widespread footprint is a cornerstone of their ability to meet global demand efficiently.

China International Marine leverages a vast global sales network, reaching over 100 countries and regions in Asia, North America, Europe, and Australia. This extensive international footprint is crucial for its market penetration strategy.

In 2024, the company's revenue reflected this broad reach, with approximately 54% generated from overseas operations and 46% from its domestic market. This demonstrates a strong, balanced presence in both international and local arenas.

CIMC's strategic advantage is amplified by its integrated multimodal logistics network, primarily managed through its subsidiary, CIMC Wetrans. This extensive network is crucial for the global distribution of CIMC's diverse product portfolio, ensuring timely and secure delivery to a worldwide customer base.

The network's reach is impressive, spanning across China, key Belt and Road Initiative (BRI) partner countries, and extending to numerous other international markets. This broad geographical coverage is facilitated by a sophisticated blend of ocean freight, international rail services, and air cargo, providing flexibility and resilience in supply chain operations.

By seamlessly integrating these various transportation modes, CIMC Wetrans enhances the efficiency and reliability of its logistics. This multimodal approach allows CIMC to optimize transit times and costs, a critical factor in maintaining competitiveness in the global market, especially for large-scale infrastructure projects that rely on timely equipment delivery.

Strategic Distribution Channels for Specialized Products

For China's specialized marine products, such as offshore engineering equipment and large-scale industrial solutions, distribution heavily relies on direct sales models and intricate project-based logistics. This approach is essential for managing the complex delivery and installation requirements of high-value assets. For instance, in 2024, major Chinese offshore equipment manufacturers reported that over 85% of their sales for custom-built platforms and subsea systems were handled through direct engagement with clients, bypassing traditional intermediaries.

This direct engagement facilitates the creation of highly tailored solutions, addressing the unique technical specifications of each project. It also fosters robust, high-level client relationship management, which is paramount for securing and executing multi-billion dollar contracts in the global offshore sector. Such relationships are key to navigating the long sales cycles and technical negotiations characteristic of these specialized markets.

Key aspects of this distribution strategy include:

- Direct Sales Force: Employing highly technical sales teams capable of understanding and articulating complex product capabilities to sophisticated industrial buyers.

- Project-Specific Logistics: Managing the end-to-end supply chain, including manufacturing, transportation, customs clearance, and on-site installation support for massive equipment.

- After-Sales Support & Service: Providing specialized technical assistance, maintenance, and training, which are critical components of the value proposition for long-term client partnerships.

- Strategic Partnerships: Collaborating with engineering, procurement, and construction (EPC) firms to integrate specialized equipment into larger project frameworks.

Digital Platforms and Customer Service Hubs

CIMC leverages digital platforms to enhance its global reach and customer engagement. These platforms serve as crucial hubs for order processing, technical support, and sharing vital company information, extending their services beyond physical locations. For instance, by mid-2024, many industrial equipment manufacturers reported a significant uptick in online customer inquiries, with digital self-service options becoming a primary channel for support.

These digital channels are essential for CIMC's international customer base, offering a streamlined and accessible way to interact with the company. They facilitate efficient communication and provide a centralized point for accessing product catalogs, service manuals, and company news. The trend towards digitalization in B2B services saw a notable acceleration in 2024, with companies investing heavily in customer relationship management (CRM) systems and online portals to improve user experience.

- Digital Order Management: Streamlining the procurement process for international clients.

- Online Customer Support: Providing accessible technical assistance and query resolution.

- Information Dissemination: Offering a central repository for product details and company updates.

- Enhanced Accessibility: Bridging geographical gaps for a global clientele.

CIMC's strategic placement of manufacturing facilities in key port locations across China and internationally is a critical element of its 'Place' strategy. This network ensures proximity to major shipping routes, optimizing logistics and reducing transit times for its diverse product range. The company's extensive global sales network, reaching over 100 countries, further solidifies its market presence.

The integration of CIMC Wetrans, its logistics subsidiary, creates a multimodal distribution system that efficiently moves goods worldwide. This network is vital for delivering everything from standard containers to specialized offshore equipment, underscoring CIMC's commitment to reliable global supply chains.

CIMC's distribution strategy heavily relies on direct sales for specialized marine products, fostering strong client relationships crucial for large-scale projects. Digital platforms enhance this reach, providing accessible order processing and customer support globally, a trend that saw significant investment in 2024.

| Aspect | Description | 2024 Data/Trend |

|---|---|---|

| Manufacturing Footprint | Strategic port locations in China and internationally | Optimized supply chain, close to trade lanes |

| Global Sales Network | Presence in over 100 countries | 54% revenue from overseas operations |

| Logistics Network | CIMC Wetrans multimodal system | Efficient global distribution of products |

| Sales Model (Specialized) | Direct sales for offshore equipment | 85%+ sales via direct client engagement for custom platforms |

| Digital Engagement | Online platforms for sales and support | Increased online inquiries and self-service adoption |

What You See Is What You Get

China International Marine 4P's Marketing Mix Analysis

The preview you see here is the actual, complete China International Marine 4P's Marketing Mix Analysis document you'll receive instantly after purchase. You can be confident that what you're viewing is precisely the content you'll download, ready for immediate use, with no hidden surprises.

Promotion

CIMC actively cultivates an image of global leadership and industry authority, consistently highlighting its position as a premier provider in logistics and energy equipment sectors. This strategy is powerfully communicated through the public declaration of impressive financial achievements and significant market share advantages. For instance, CIMC's dominance is evident in its status as the world's largest producer of various container types and semi-trailers, a fact underscored by its reported revenue of approximately RMB 150 billion in 2023.

This emphasis on market leadership and robust financial performance serves to build substantial credibility and showcase deep expertise to a diverse audience, including potential clients and investors. By consistently demonstrating its capabilities and market dominance, CIMC reinforces its reputation as a reliable and authoritative player in the international marine and logistics industry.

CIMC Enric's strategic presence at international exhibitions like the World Gas Conference 2025 is a cornerstone of its marketing efforts. These events are crucial for showcasing its comprehensive clean energy solutions directly to a global audience of industry professionals and potential clients.

Participation in these high-profile gatherings allows CIMC Enric to demonstrate its latest technological innovations and capabilities firsthand. It also serves as a vital platform for networking, fostering new business relationships, and solidifying its position as a leader in the clean energy sector.

For instance, at the World Gas Conference 2025, CIMC Enric can directly engage with key decision-makers, gather market intelligence, and identify emerging trends. This direct interaction is invaluable for understanding customer needs and adapting its product offerings accordingly, driving future sales and market penetration.

CIMC's commitment to transparency is evident in its detailed annual and sustainability reports, which are vital for stakeholder trust. These reports, often released in the second half of the year following fiscal year-end, provide a clear view of financial performance and strategic direction. For instance, their 2023 annual report, published in mid-2024, highlighted a significant increase in revenue and outlined ambitious plans for green shipping initiatives, demonstrating their dedication to both financial health and environmental stewardship.

Strategic Partnerships and Collaborative Initiatives

CIMC actively pursues strategic partnerships and collaborative initiatives to drive innovation and market penetration. For instance, their work with industry leaders like Maersk Line and COSCO Shipping on testing novel container materials underscores a commitment to advancing supply chain efficiency. These alliances, including joint ventures for developing green methanol and hydrogen solutions with entities such as Towngas, serve as powerful endorsements, amplifying CIMC's technological prowess and fostering positive industry sentiment.

These collaborations are crucial for CIMC's market acceptance and brand building. By pooling resources and expertise, CIMC can accelerate the development and validation of new technologies, such as eco-friendly fuel solutions. In 2024, CIMC's investment in green shipping technologies, often facilitated through these partnerships, is expected to reach significant figures as the industry pivots towards sustainability.

- Testing advanced container materials with Maersk Line and COSCO Shipping.

- Developing green methanol and hydrogen solutions with Towngas.

- Leveraging partnerships for positive industry buzz and market validation.

- Enhancing technological innovation through collaborative R&D efforts.

Digital Presence and Corporate Communications

China International Marine's digital presence is crucial for its corporate communications. Their official website serves as a primary hub for company information, news releases, and investor relations, reaching a global audience. While specific social media engagement isn't detailed, a strong online footprint is vital for disseminating milestones and product launches effectively.

This digital strategy supports the broader marketing mix by ensuring CIMC's message is accessible and widely distributed. For instance, in 2024, companies with strong digital engagement often see improved brand recognition and investor confidence. A well-maintained website can directly impact how potential clients and partners perceive CIMC's professionalism and reach.

- Website as a Central Information Hub: CIMC leverages its official website to share key corporate updates, financial reports, and product information.

- News Releases for Broad Dissemination: Timely news releases ensure that significant company achievements and strategic directions reach media outlets and stakeholders efficiently.

- Global Audience Reach: The digital platform enables CIMC to communicate its value proposition and corporate story to a diverse international customer base and investor community.

CIMC's promotional strategy centers on showcasing its global leadership and technological prowess, particularly in clean energy solutions. This is achieved through active participation in major industry events like the World Gas Conference 2025, where they can directly engage with stakeholders and demonstrate innovations. Furthermore, strategic partnerships and transparent reporting, including detailed annual and sustainability reports, build credibility and foster positive industry sentiment.

| Promotional Activity | Key Focus | 2024/2025 Relevance |

|---|---|---|

| Industry Exhibitions (e.g., World Gas Conference 2025) | Showcasing clean energy solutions, networking | Direct engagement with global clients, market intelligence gathering |

| Strategic Partnerships | Accelerating innovation, market validation | Joint development of green solutions, enhancing brand reputation |

| Financial & Sustainability Reporting | Transparency, stakeholder trust | Demonstrating financial health and commitment to ESG goals |

| Digital Presence (Website, News Releases) | Information dissemination, global reach | Communicating milestones and value proposition to a wide audience |

Price

CIMC's pricing strategy is firmly rooted in value-based principles, a direct consequence of its global market leadership. This allows the company to price its offerings based on the superior quality, cutting-edge technology, and integrated solutions it provides, rather than solely on production costs.

This strategy is particularly evident in its world-leading container and offshore engineering equipment segments. For instance, CIMC's extensive market share in dry freight containers, often exceeding 40% globally, enables them to command premium pricing that reflects the durability and advanced design of their products, contributing to their robust financial performance in 2024.

China International Marine's pricing strategy is deeply intertwined with market demand and the pursuit of profitability. This is clearly demonstrated by the company's financial performance in 2024, where revenue and net profit saw substantial growth. The container manufacturing segment, in particular, experienced a significant uplift, suggesting a pricing model that effectively adjusts to capitalize on periods of high demand to boost financial returns.

China International Marine (CIMC) can leverage premium pricing for its innovative and sustainable offerings. For instance, containers utilizing CFRTP (Continuous Fiber Reinforced Thermoplastic) panels, a material known for its durability and lighter weight, can command a higher price. This advanced material contributes to a longer product lifespan and potentially lower operational costs for users, justifying a premium.

Furthermore, CIMC's investments in clean energy solutions, such as those involving green methanol and hydrogen, are well-positioned for premium pricing. These technologies address growing environmental regulations and corporate sustainability goals, offering significant long-term benefits that appeal to environmentally conscious buyers. For example, the global market for green methanol is projected to reach substantial growth, indicating a strong demand for such sustainable fuel alternatives.

Hedging Strategies to Mitigate Exchange Rate Risks

CIMC actively manages its exposure to currency volatility through a dynamic hedging approach. This is crucial as a substantial portion of its revenue is generated internationally, making it susceptible to fluctuations in exchange rates like the USD/CNY or EUR/CNY.

By employing hedging strategies, CIMC aims to create a more stable pricing environment for its global customers. This financial foresight shields its profit margins from adverse currency movements, ensuring that its competitive pricing in international markets remains consistent and predictable.

For instance, during periods of significant RMB appreciation against major currencies, CIMC might increase its use of forward contracts to lock in favorable exchange rates for future transactions. Conversely, during periods of RMB depreciation, it might adjust its hedging intensity to capture potential benefits while still mitigating downside risk.

- Forward Contracts: CIMC likely utilizes forward contracts to lock in exchange rates for anticipated foreign currency revenues and expenses, providing certainty for future cash flows.

- Currency Options: The company may also employ currency options to provide flexibility, allowing them to benefit from favorable currency movements while setting a floor against unfavorable ones.

- Natural Hedging: Where possible, CIMC might engage in natural hedging by matching revenues and expenses in the same foreign currencies to reduce the need for financial instruments.

- Diversification: Operating in multiple international markets naturally diversifies currency exposure, lessening the impact of any single currency's volatility.

Differentiated Pricing Across Diverse Business Segments

China International Marine's pricing strategy is highly differentiated, reflecting its diverse business portfolio. For instance, its container division, a significant revenue driver, likely uses market-based pricing influenced by global trade volumes and container shortages, as seen in the strong demand and price increases observed in late 2021 and early 2022.

The energy equipment segment, on the other hand, might employ cost-plus or project-based pricing for large-scale infrastructure projects, considering the substantial capital investment and technological complexity involved. Similarly, financial services and real estate ventures would adopt pricing models specific to those industries, such as interest rates for financing or market value for property sales.

- Container Division: Pricing sensitive to global shipping rates and demand fluctuations.

- Energy Equipment: Project-specific pricing reflecting high R&D and manufacturing costs.

- Financial Services: Interest rate and fee-based structures aligned with market benchmarks.

- Real Estate: Valuation and sales prices determined by location, market conditions, and property type.

CIMC's pricing strategy is multifaceted, directly influenced by its market position and product innovation. The company leverages its global leadership, particularly in containers, to implement value-based pricing, reflecting superior quality and technology. This approach is evident in its robust financial performance, with significant revenue and profit growth reported in 2024, driven by strong demand in segments like container manufacturing.

The company also employs premium pricing for its advanced and sustainable offerings. For example, containers made with CFRTP panels or those incorporating green energy solutions like methanol and hydrogen can command higher prices due to their durability, lighter weight, and environmental benefits. This aligns with the growing market demand for sustainable technologies, with projections indicating substantial growth in sectors like green methanol.

CIMC's pricing is also dynamically managed to account for currency fluctuations, a critical aspect given its extensive international operations. By utilizing hedging strategies such as forward contracts and currency options, the company aims to stabilize its pricing for global customers and protect its profit margins against adverse exchange rate movements, ensuring consistent and predictable international market competitiveness.

| Segment | Pricing Strategy | Key Influences | 2024 Financial Impact |

|---|---|---|---|

| Containers | Value-based, Market-driven | Global trade volumes, container shortages, product durability | Strong revenue growth, premium pricing leveraged |

| Energy Equipment | Cost-plus, Project-based | Capital investment, technological complexity, R&D costs | Contribution to overall profitability |

| Sustainable Offerings (e.g., CFRTP, Green Fuels) | Premium Pricing | Innovation, environmental benefits, regulatory compliance | Potential for higher margins, capitalizing on growing market demand |

4P's Marketing Mix Analysis Data Sources

Our China International Marine 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, industry-specific trade publications, and reputable market research firms. We meticulously gather information on product portfolios, pricing strategies, distribution networks, and promotional activities to provide an accurate and actionable overview.