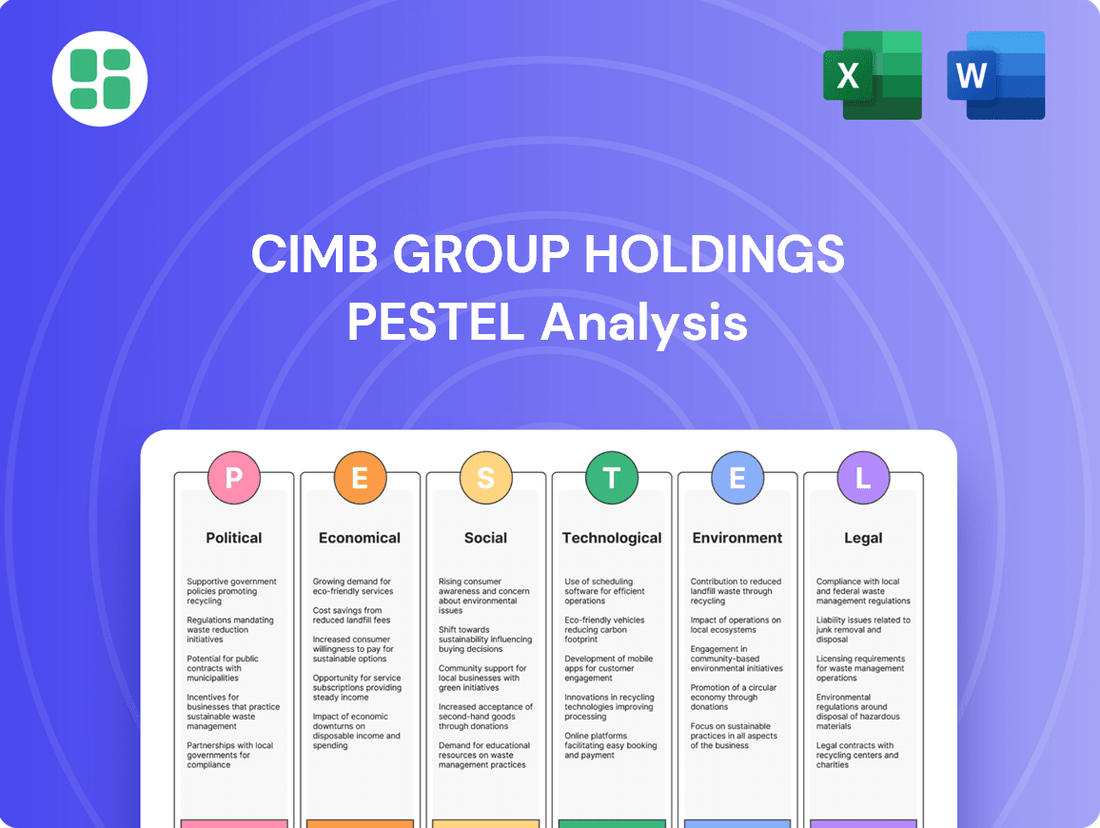

CIMB Group Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

Navigate the complex external environment impacting CIMB Group Holdings with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, social shifts, environmental regulations, and legal frameworks are shaping the banking giant's trajectory. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a strategic advantage by delving into the critical PESTLE factors affecting CIMB Group Holdings. Our meticulously researched analysis provides a clear roadmap of the external forces at play, empowering you to make informed decisions. Download the full PESTLE analysis now and unlock the insights you need to stay ahead of the curve.

Political factors

Government stability and policy consistency are paramount for CIMB Group Holdings, as the bank operates across several ASEAN nations. A stable political landscape in countries like Malaysia, Indonesia, and Thailand directly correlates with investor confidence and predictable regulatory environments. This predictability is vital for CIMB's long-term strategic planning and operational efficiency in the banking sector.

Conversely, political volatility or abrupt shifts in government policy can significantly disrupt banking operations. For instance, changes in monetary policy, capital controls, or banking regulations introduced by an unstable government could increase operational risks and impact CIMB's profitability. The ASEAN region has seen varying degrees of political stability; for example, Malaysia experienced a change in government in late 2022, which can lead to a period of policy review.

CIMB Group Holdings operates within a dynamic regulatory environment across its key markets in Southeast Asia. For instance, in 2024, Bank Negara Malaysia continued to emphasize robust capital adequacy ratios, with the total capital ratio for Malaysian banks generally remaining well above the regulatory minimums, providing a stable operating base. These evolving prudential regulations, including potential adjustments to capital requirements and licensing frameworks by central banks, directly influence CIMB's operational costs and risk management strategies.

Geopolitical tensions within ASEAN and globally significantly impact CIMB Group's cross-border operations. For instance, increased trade disputes or regional instability can disrupt investment flows and affect demand for loans, potentially impacting CIMB's asset quality. In 2023, global geopolitical risks remained elevated, influencing investment sentiment across Southeast Asia.

Conversely, efforts to strengthen regional integration, like the ASEAN Economic Community (AEC), present substantial opportunities for CIMB. The AEC aims to facilitate freer movement of goods, services, and capital, which can expand CIMB's reach for financial services and boost cross-border transaction volumes. As of early 2024, progress on AEC initiatives continued, underscoring the potential for enhanced intra-regional trade and investment.

Government Initiatives and Sectoral Support

Government initiatives aimed at boosting economic growth and supporting key sectors present significant opportunities for CIMB Group Holdings. For instance, Malaysia's recent focus on digital transformation and the SME sector, with programs like the Malaysian Digital Economy Corporation (MDEC) initiatives and various SME financing schemes, allows CIMB to expand its digital banking services and offer tailored financial products to small and medium-sized enterprises. This alignment with national development agendas can foster growth and create a competitive edge.

CIMB can capitalize on these government-backed programs through strategic partnerships and targeted lending. For example, in 2024, the Malaysian government announced increased allocations for green technology financing and incentives for sustainable industries. CIMB can leverage this by developing specific green financing products and advisory services, positioning itself as a key financial partner in the nation's transition towards a more sustainable economy. This proactive approach can unlock new revenue streams and enhance its corporate social responsibility profile.

- Digital Economy Support: Malaysia's National Digital Economy Blueprint aims to increase the digital adoption rate among SMEs, providing a fertile ground for CIMB's digital banking solutions and fintech collaborations.

- SME Financing Initiatives: Government-backed loan guarantees and subsidized interest rates for SMEs, such as those offered by Credit Guarantee Corporation Malaysia Berhad (CGC), can be leveraged by CIMB to de-risk lending and increase its SME loan portfolio.

- Green Industry Incentives: Tax exemptions and grants for businesses investing in renewable energy and green technologies, as promoted by the Malaysian Green Technology and Climate Change Corporation (MGTC), offer CIMB opportunities in sustainable finance.

- Financial Inclusion Programs: Government efforts to promote financial literacy and access to banking services in underserved communities can be supported by CIMB through community banking initiatives and accessible digital platforms.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

CIMB Group Holdings, like all financial institutions, operates within a stringent global and regional framework of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules are designed to combat financial crime and ensure the integrity of the financial system. Adherence is not optional; it's a fundamental requirement for operating legally and maintaining trust.

Meeting these obligations necessitates ongoing, significant investment. CIMB must continuously enhance its compliance infrastructure, which includes sophisticated systems for customer due diligence, transaction monitoring, and the reporting of suspicious activities. Furthermore, robust training programs for all staff are crucial to ensure awareness and proper execution of AML/CTF protocols. For instance, in 2023, financial institutions globally faced increased scrutiny, with regulators imposing substantial fines for compliance failures. The Financial Action Task Force (FATF) continues to update its recommendations, impacting how banks like CIMB must adapt their practices.

The consequences of non-compliance are severe and multifaceted. Beyond hefty financial penalties, which can run into millions of dollars, regulatory breaches lead to significant reputational damage, eroding customer and investor confidence. Operational restrictions, such as limitations on certain business activities or enhanced supervisory oversight, can also be imposed, hindering growth and profitability. For example, a major European bank faced a €1.5 billion fine in early 2024 due to AML deficiencies, highlighting the substantial financial risk involved.

- Regulatory Landscape: CIMB must navigate evolving AML/CTF laws globally and regionally, including those from bodies like the FATF and local financial regulators.

- Investment in Compliance: Significant capital and resources are allocated annually to maintain and upgrade compliance systems, data analytics, and employee training for AML/CTF adherence.

- Risk of Non-Compliance: Penalties can include substantial fines, reputational damage, operational restrictions, and potential loss of banking licenses, impacting market standing and profitability.

- Key Compliance Areas: Focus areas include Know Your Customer (KYC) procedures, suspicious transaction reporting (STR), and transaction monitoring to detect and prevent illicit financial flows.

Government stability and policy continuity are crucial for CIMB Group Holdings' operations across ASEAN. For instance, Malaysia's 2024 budget prioritized economic growth and digital transformation, aligning with CIMB's strategic focus. Conversely, political shifts can introduce regulatory uncertainty, impacting investment decisions and operational frameworks.

What is included in the product

This PESTLE analysis of CIMB Group Holdings examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of the external landscape.

A clear, actionable PESTLE analysis for CIMB Group Holdings that highlights key external factors, enabling proactive strategy development and mitigating potential risks.

Economic factors

Central bank decisions on interest rates significantly impact CIMB Group Holdings' net interest margin and overall profitability across its operating regions. For instance, the Monetary Authority of Singapore's (MAS) policy rate, which influences lending and deposit rates, directly affects CIMB's NIM. Similarly, Bank Negara Malaysia's Overnight Policy Rate (OPR) adjustments shape the cost of funds and loan pricing for CIMB in Malaysia.

Rising interest rates, as seen in various Asian economies during 2023 and early 2024, generally boost lending income for banks like CIMB. However, this benefit is often counterbalanced by increased funding costs for deposits and other liabilities. For example, a sustained higher OPR in Malaysia could lead to higher borrowing costs for CIMB, potentially narrowing its NIM if lending rate increases lag deposit rate hikes.

The prevailing monetary policy stance, whether tightening or easing, creates the broader economic backdrop for CIMB's banking operations. A tightening cycle, characterized by rate hikes, can temper loan demand due to higher borrowing costs, impacting CIMB's loan growth. Conversely, an easing cycle might stimulate loan demand but compress margins further.

CIMB Group Holdings operates within the dynamic ASEAN region, where economic growth is a critical driver for its banking and financial services. In 2024, projections for ASEAN GDP growth hovered around 4.5% to 5.0%, indicating a generally positive economic environment. This expansion fuels demand for various banking products, from loans to investment services, directly benefiting CIMB's revenue streams.

However, the economic outlook is subject to global headwinds and regional specificities. For instance, a slowdown in major export markets or a rise in commodity prices could temper growth in certain ASEAN economies, impacting CIMB's asset quality and loan growth potential. The group's performance is therefore closely tied to the sustained, albeit sometimes uneven, economic expansion across its key operating markets.

Inflation significantly impacts CIMB Group Holdings by directly affecting consumer purchasing power. For instance, with Malaysia's inflation rate hovering around 2.0% to 3.0% in early 2025, consumers may find their disposable income stretched, potentially reducing demand for discretionary financial products like personal loans or credit cards. This also impacts the real value of CIMB's loan portfolios and the cost of its funding.

Higher inflation can also increase CIMB's operational expenses, from staff costs to technology investments. Managing the real value of its assets and liabilities becomes crucial; for example, while loan interest rates might rise with inflation, the real return on fixed-income investments could diminish, necessitating a strategic approach to balance sheet management to preserve profitability.

Foreign Exchange Rate Fluctuations

CIMB Group Holdings, operating across Southeast Asia, faces significant exposure to foreign exchange rate fluctuations. For instance, during the first quarter of 2024, the Malaysian Ringgit experienced periods of weakening against major currencies like the US Dollar, impacting the translated value of CIMB's earnings and assets denominated in foreign currencies. This volatility directly affects the group's reported financial performance and capital adequacy ratios.

The impact of currency volatility can be substantial. A stronger US Dollar, for example, can reduce the Ringgit value of CIMB's US Dollar-denominated loans and investments. Conversely, a weaker Ringgit can increase the cost of funding sourced in foreign currencies. Managing these exposures through sophisticated hedging techniques is therefore a critical component of CIMB's financial strategy to mitigate potential downside risks.

Key considerations for CIMB regarding foreign exchange rates include:

- Currency Volatility Impact: Fluctuations in exchange rates directly affect the translated value of foreign currency assets and liabilities, impacting CIMB's reported earnings and capital adequacy.

- Regional Exposure: As a regional bank with operations in multiple countries, CIMB is exposed to currency movements across various markets, including Malaysia, Singapore, Indonesia, and Thailand.

- Hedging Strategies: Proactive management of currency risk through financial instruments like forward contracts and currency options is essential to protect profitability and financial stability.

Credit Growth and Non-Performing Loan (NPL) Trends

Credit growth is a key indicator of economic vitality, and for CIMB Group Holdings, robust expansion in lending signals healthy demand for financial services, directly supporting its loan portfolio growth. For instance, in 2023, Malaysia’s total loan growth reached 4.4%, indicating a positive environment for banks like CIMB.

However, the flip side of credit growth is the management of non-performing loans (NPLs). Rising NPLs, often a consequence of economic slowdowns or sector-specific distress, pose a significant risk to asset quality and profitability. CIMB’s prudent risk management strategies are therefore crucial in navigating these potential headwinds.

- Malaysia's total loan growth in 2023 was 4.4%, reflecting a generally healthy lending environment.

- The NPL ratio for Malaysian banks remained relatively stable, hovering around 1.5% to 1.7% in late 2023 and early 2024, indicating manageable asset quality.

- Sustained credit growth supports CIMB's revenue streams through increased interest income and fee generation.

- Effective NPL management is vital for maintaining CIMB's capital adequacy and profitability in the face of economic uncertainties.

Economic growth is a primary driver for CIMB Group Holdings, with ASEAN GDP projected to grow between 4.5% and 5.0% in 2024. This expansion fuels demand for banking services, benefiting CIMB's revenue. However, global economic headwinds and regional specificities, such as commodity price fluctuations, can impact loan growth and asset quality across its operating markets.

Inflationary pressures, with Malaysia's inflation around 2.0%-3.0% in early 2025, affect consumer spending and the real value of CIMB's loan portfolios. Higher inflation also increases operational costs, necessitating careful balance sheet management to maintain profitability.

Interest rate decisions by central banks, like Bank Negara Malaysia's OPR, directly influence CIMB's net interest margins. While rising rates can boost lending income, they also increase funding costs, requiring strategic management to preserve profitability, especially if deposit rate hikes lag lending rate adjustments.

Credit growth, evidenced by Malaysia's 4.4% total loan growth in 2023, is vital for CIMB's revenue. Maintaining a low Non-Performing Loan (NPL) ratio, which remained stable around 1.5%-1.7% for Malaysian banks in late 2023/early 2024, is crucial for asset quality and profitability.

Preview the Actual Deliverable

CIMB Group Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CIMB Group Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the financial institution. Understand the critical external forces shaping CIMB's strategic landscape.

Sociological factors

Shifting demographics in ASEAN are significantly reshaping consumer preferences for banking services. For example, a growing segment of the population in countries like Indonesia and Malaysia is young and tech-savvy, driving a strong demand for digital banking solutions. CIMB noted in its 2023 annual report that over 70% of its customer transactions were conducted digitally, highlighting this trend.

Concurrently, an aging demographic, particularly in markets like Singapore, presents a different set of needs. This group is increasingly seeking sophisticated wealth management and retirement planning services. CIMB's focus on expanding its wealth management offerings, as seen with the launch of new investment platforms in late 2024, directly addresses this evolving demand.

CIMB operates in markets with diverse financial literacy and inclusion levels. For instance, in Malaysia, while banking penetration is high, a significant portion of the population still requires enhanced financial education to fully leverage financial products. In Indonesia, a country with a large unbanked population, efforts to boost financial inclusion through digital channels present a substantial growth opportunity for CIMB's basic banking and microfinance offerings.

Income inequality across ASEAN nations significantly shapes CIMB's market segmentation. For instance, while countries like Singapore boast high per capita incomes, others in the region present a broader spectrum of wealth. This necessitates a dual approach for CIMB, developing premium services for affluent clients and accessible, affordable banking solutions for the mass market.

In 2024, the Gini coefficient for Malaysia, a key market for CIMB, stood at approximately 0.40, indicating a moderate level of income inequality. This data underscores the need for CIMB to offer a diverse product suite, ranging from wealth management for high-net-worth individuals to micro-financing and digital banking for lower-income segments, ensuring broad market penetration and customer inclusion.

Workforce Skills and Talent Availability

The availability of skilled talent, especially in digital banking, data analytics, and cybersecurity, is a critical sociological factor for CIMB Group Holdings. As of early 2024, the demand for these specialized skills continues to outpace supply globally, impacting recruitment efforts across the financial sector.

CIMB's success in its technological transformation hinges on its capacity to attract, nurture, and retain individuals with these in-demand competencies. For instance, a report from January 2024 indicated that the cybersecurity skills gap is projected to affect over 3.5 million jobs worldwide by the end of 2025, directly influencing operational security and customer trust.

Shortages in these key areas can significantly hinder innovation, reduce operational efficiency, and erode CIMB's competitive edge. In 2024, financial institutions are increasingly investing in upskilling existing employees and forging partnerships with educational institutions to bridge these talent gaps, with CIMB actively participating in such initiatives.

- Digital Banking Expertise: CIMB needs a robust pipeline of talent skilled in developing and managing digital platforms and customer experiences.

- Data Analytics Proficiency: The ability to leverage data for insights and decision-making requires professionals adept at data science and analytics.

- Cybersecurity Professionals: A critical shortage exists for cybersecurity experts to protect sensitive financial data and systems.

- Talent Retention: CIMB's strategy must focus on retaining top talent through competitive compensation, career development, and a strong organizational culture.

Shifting Societal Values Towards Ethical and Sustainable Banking

Societal values are increasingly leaning towards ethical and sustainable practices, directly impacting the banking sector. Consumers and investors are no longer just looking at financial returns; they are scrutinizing a bank's Environmental, Social, and Governance (ESG) performance. This shift means institutions like CIMB Group Holdings must actively demonstrate their commitment to responsible business operations to retain trust and attract a growing segment of values-driven customers.

CIMB's commitment to sustainability is evident in its initiatives. For instance, by the end of 2023, CIMB had disbursed RM2.3 billion in sustainable finance, exceeding its initial target. This focus on ethical lending, community development, and environmental stewardship is crucial for maintaining appeal in a market where ESG factors are becoming paramount for stakeholder engagement and long-term viability.

- Growing ESG Awareness: A significant majority of consumers, often cited in surveys around 70-80%, express a preference for banking with institutions that demonstrate strong ESG credentials.

- Investor Scrutiny: Institutional investors are increasingly incorporating ESG metrics into their investment decisions, with global sustainable investment assets projected to reach over $50 trillion by 2025.

- Reputational Risk: Banks failing to align with societal expectations on ethical and sustainable practices face reputational damage, potentially leading to customer attrition and reduced market share.

Societal values are increasingly leaning towards ethical and sustainable practices, directly impacting the banking sector, with consumers and investors scrutinizing a bank's Environmental, Social, and Governance (ESG) performance. CIMB's commitment to sustainability is evident in its initiatives, having disbursed RM2.3 billion in sustainable finance by the end of 2023, exceeding its target.

Growing ESG awareness means a significant majority of consumers, often cited in surveys around 70-80%, express a preference for banking with institutions demonstrating strong ESG credentials. Investor scrutiny is also rising, with global sustainable investment assets projected to reach over $50 trillion by 2025, making ESG factors paramount for stakeholder engagement and long-term viability.

| Societal Factor | Description | Impact on CIMB | Supporting Data/Examples |

| ESG Consciousness | Increasing societal demand for ethical and sustainable business practices. | Drives need for responsible operations, influences customer choice and investor decisions. | CIMB disbursed RM2.3 billion in sustainable finance by end-2023, exceeding targets. Global sustainable investment assets projected to exceed $50 trillion by 2025. |

| Financial Literacy & Inclusion | Varying levels of financial understanding and access across ASEAN markets. | Creates opportunities for digital banking and microfinance in underserved segments, necessitates financial education initiatives. | Malaysia has high banking penetration but requires enhanced financial education. Indonesia has a large unbanked population. |

Technological factors

CIMB Group is navigating a significant technological shift, with digital transformation and mobile banking adoption accelerating. The group must continue to invest in user-friendly mobile applications and online services to keep pace with customer expectations. For instance, as of late 2024, mobile banking transactions represented a substantial portion of overall banking activities for many financial institutions in Southeast Asia, with some reporting over 70% of customer interactions occurring digitally.

Cybersecurity threats are a growing concern for financial institutions like CIMB. The increasing digitalization of banking services means more sensitive customer data is handled online, making robust protection against cyberattacks essential. For instance, the ASEAN region is seeing a rise in sophisticated phishing and ransomware attacks, underscoring the need for CIMB to invest heavily in advanced security infrastructure to safeguard its operations and customer information.

Fintech competition is intensifying, with startups and tech giants like Grab and Sea Group increasingly offering financial services in Southeast Asia, a key market for CIMB. For instance, Grab Financial Group reported a significant increase in its digital lending and insurance offerings in 2024, directly impacting traditional banking revenue streams.

However, these disruptive forces also present collaboration opportunities for CIMB. By partnering with or acquiring promising fintechs, CIMB can integrate innovative technologies, such as AI-driven customer service or blockchain-based payment solutions, to enhance its own digital offerings and reach new customer segments, potentially boosting its digital banking revenue by an estimated 15-20% by 2025.

Blockchain and Distributed Ledger Technology Adoption

CIMB Group is actively exploring blockchain and distributed ledger technology (DLT) to enhance transaction security and efficiency. The potential for these technologies to streamline cross-border payments and trade finance is significant, offering avenues for cost reduction and increased transparency. By mid-2024, global investment in blockchain solutions for financial services was projected to reach tens of billions of dollars, indicating a strong industry trend towards adoption.

The adoption of DLT could revolutionize several banking processes for CIMB, paving the way for new product development and improved operational workflows. For instance, a successful pilot of blockchain for trade finance in Southeast Asia in late 2023 demonstrated a reduction in processing times by up to 80% and a decrease in documentation errors.

- Blockchain for Secure Transactions: Enhancing the integrity and immutability of financial records.

- Cross-Border Payment Efficiency: Reducing settlement times and costs for international transfers.

- Trade Finance Revolution: Digitizing and automating complex trade finance processes, improving transparency and reducing fraud.

- New Product Development: Creating innovative financial products and services leveraging DLT capabilities.

Investment in IT Infrastructure and Cloud Computing

CIMB Group Holdings continues to prioritize significant investments in upgrading its IT infrastructure and embracing cloud computing. This strategic focus is crucial for modernizing its core systems, enhancing scalability, and improving operational efficiency. By leveraging cloud technologies, CIMB aims to bolster its data analytics capabilities, which are vital for understanding customer behavior and developing new digital services.

The bank's commitment to a robust and flexible IT backbone is directly linked to its digital transformation agenda. This infrastructure is designed to handle the increasing volumes of data generated daily and to facilitate the swift introduction of innovative financial products and services. For instance, CIMB's digital banking initiatives, such as CIMB Octo, rely heavily on this modernized infrastructure to ensure seamless user experiences and operational resilience in a highly competitive market.

In 2024, CIMB announced plans to further invest in its digital capabilities, with a substantial portion allocated to IT modernization and cloud migration. While specific figures for 2025 are still emerging, the trend indicates continued high spending. For example, CIMB's digital transformation efforts in previous years saw significant capital expenditure, with a notable increase in technology-related spending to support platforms like its mobile banking app, which serves millions of customers across Southeast Asia.

- IT Infrastructure Modernization: Ongoing upgrades to core banking systems and data centers to enhance performance and security.

- Cloud Computing Adoption: Strategic migration of applications and data to cloud platforms for greater agility, cost-efficiency, and advanced analytics.

- Digital Service Deployment: Enabling the rapid launch and scaling of new digital products and customer-facing platforms.

- Data Analytics Capabilities: Strengthening the capacity to process and analyze large datasets for personalized customer offerings and risk management.

Technological advancements are reshaping CIMB's operational landscape, driving a need for continuous investment in digital infrastructure and cybersecurity. The increasing reliance on mobile and online platforms, evidenced by over 70% of customer interactions happening digitally in Southeast Asian banking by late 2024, necessitates robust IT modernization and cloud adoption for enhanced agility and data analytics. Furthermore, the rise of fintech competition and the potential of blockchain technology for secure transactions and payment efficiency present both challenges and opportunities for CIMB to innovate and expand its service offerings.

| Technology Area | Impact on CIMB | Key Developments/Data (2024-2025) |

|---|---|---|

| Digital Transformation & Mobile Banking | Enhanced customer engagement, increased transaction volumes | Mobile banking transactions represent over 70% of customer interactions in SEA (late 2024). CIMB Octo relies on modern infrastructure for seamless user experience. |

| Cybersecurity | Mitigating risks, protecting sensitive data | ASEAN region experiencing rise in sophisticated phishing and ransomware attacks. Heavy investment in advanced security infrastructure is essential. |

| Fintech Competition | Disruption of traditional revenue streams, collaboration opportunities | Grab Financial Group saw increased digital lending and insurance offerings in 2024. Potential to boost digital banking revenue by 15-20% by 2025 through partnerships. |

| Blockchain & DLT | Improving transaction security, efficiency, and enabling new products | Global investment in blockchain for financial services projected in tens of billions of dollars (mid-2024). Pilot in trade finance reduced processing times by up to 80% (late 2023). |

| IT Infrastructure & Cloud Computing | Modernization, scalability, improved operational efficiency, advanced analytics | Significant investment in IT modernization and cloud migration planned for 2024. Continued high spending expected for 2025. |

Legal factors

CIMB Group operates under a complex web of banking laws and prudential regulations across its key markets, including Malaysia, Indonesia, Singapore, and Thailand. These regulations, overseen by entities like Bank Negara Malaysia and the Monetary Authority of Singapore, dictate crucial aspects of operations such as capital adequacy ratios, liquidity requirements, and risk management protocols. For instance, Basel III standards, which have been progressively implemented globally, mandate higher capital buffers, directly impacting CIMB's ability to lend and invest.

In 2024, financial regulators continue to emphasize robust risk management frameworks and cybersecurity measures, given the increasing digitalization of banking services. CIMB's compliance with these evolving prudential standards, including those related to Anti-Money Laundering (AML) and Know Your Customer (KYC) directives, is paramount for maintaining its license to operate and ensuring financial stability. Failure to adhere can result in significant penalties and reputational damage.

Data protection and privacy laws are critical for CIMB Group Holdings. Malaysia's Personal Data Protection Act (PDPA) and similar regulations across ASEAN countries dictate how customer data is handled. Failure to comply can result in significant penalties, impacting financial performance and reputation. For instance, a breach could lead to substantial fines and a loss of customer confidence, a crucial asset in the banking sector.

Consumer protection laws are paramount for financial institutions like CIMB Group Holdings. These regulations, designed to shield customers, mandate fair lending, clear product disclosures, and robust dispute resolution processes. For instance, in 2024, regulators across Southeast Asia continued to emphasize data privacy and security, impacting how financial institutions handle customer information, with fines for breaches potentially reaching significant percentages of annual revenue.

Adherence to these consumer protection frameworks is not merely a compliance exercise but a critical element in maintaining customer trust and avoiding costly legal battles. In 2025, increased scrutiny on digital financial services means CIMB must ensure its online platforms and mobile applications fully comply with transparency and fairness standards, preventing predatory practices and ensuring accessible recourse for any customer grievances.

Competition Laws and Anti-Trust Regulations

Competition laws and anti-trust regulations are critical for CIMB Group Holdings, especially given its significant presence across Southeast Asia. These laws aim to prevent monopolies and ensure a level playing field, meaning CIMB must carefully navigate its market practices, mergers, and acquisitions to avoid penalties. For instance, in 2024, regulators in various ASEAN nations continued to scrutinize large financial institutions for potential anti-competitive behavior, a trend expected to persist into 2025.

CIMB's compliance with these regulations is paramount to maintaining its operational integrity and avoiding legal challenges that could impact its financial performance. Failure to adhere to anti-trust rules, particularly in markets where CIMB holds a substantial market share, could result in hefty fines and reputational damage. For example, a hypothetical merger that significantly concentrates market power could trigger investigations by bodies like the Malaysia Competition Commission (MyCC) or its regional counterparts.

- Regulatory Scrutiny: CIMB must ensure all mergers and acquisitions comply with competition laws in all operating jurisdictions, as regulators actively monitor market concentration.

- Market Practices: The group needs to avoid practices that could be deemed anti-competitive, such as price-fixing or abuse of dominant market positions, to prevent legal action and penalties.

- Regional Compliance: With operations spanning multiple countries, CIMB faces a complex web of differing competition laws, requiring robust internal compliance frameworks.

- Impact on Growth: Strict adherence to competition laws is essential for CIMB's strategic growth, as non-compliance can lead to significant financial and operational disruptions.

Cross-Border Legal Frameworks and Compliance

Operating across the ASEAN region presents CIMB Group Holdings with significant legal complexities, as each country possesses its unique legal system. This necessitates meticulous adherence to diverse regulations governing everything from financial product offerings to data privacy. For instance, in 2024, the varying AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) regulations across Southeast Asian nations require constant monitoring and adaptation to prevent financial crime and maintain compliance with international standards like those set by the Financial Action Task Force (FATF).

Navigating these cross-border legal frameworks is crucial for CIMB's seamless regional operations. This includes ensuring compliance with differing rules for cross-border transactions, remittances, and international financial crime prevention. Failure to do so can result in substantial penalties and reputational damage. For example, the implementation of new data localization laws in several ASEAN countries in 2024-2025 impacts how financial institutions manage customer information, demanding robust compliance strategies.

- Diverse Regulatory Landscapes: CIMB must manage compliance with distinct legal systems across ASEAN, impacting financial product development and customer interactions.

- Cross-Border Transaction Compliance: Adherence to varied regulations for international remittances and payments is essential for efficient regional banking operations.

- Financial Crime Prevention: Staying abreast of and complying with evolving AML/CFT laws in each jurisdiction is critical to mitigate risks and maintain international credibility.

- Data Privacy and Localization: Adapting to new data protection and localization requirements in countries like Vietnam and Indonesia in 2024-2025 is a key legal challenge.

CIMB Group Holdings faces stringent regulatory oversight across its operating regions, with particular emphasis in 2024-2025 on cybersecurity and data protection. For instance, Malaysia's Personal Data Protection Act (PDPA) and similar regulations in Singapore and Indonesia impose strict rules on handling customer information, with potential fines for breaches. Furthermore, evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) directives require continuous adaptation to prevent financial crime.

Environmental factors

Climate change presents significant financial risks for CIMB Group Holdings, encompassing both physical and transition impacts on its lending portfolios. Physical risks, such as increased frequency of extreme weather events like floods and typhoons, could directly impair the value of assets collateralizing loans, particularly in sectors like agriculture and property. For instance, the ASEAN region, where CIMB has a strong presence, is highly vulnerable to climate-related disasters, with estimated economic losses from natural catastrophes reaching billions annually.

Transition risks arise from the global shift towards a low-carbon economy, potentially devaluing assets in carbon-intensive industries like fossil fuels. CIMB must proactively assess and manage its exposure to these sectors, which could face stricter regulations, carbon pricing mechanisms, and changing consumer preferences. By 2024, many financial institutions were already recalibrating their strategies to align with net-zero commitments, indicating a growing imperative for banks like CIMB to reduce lending to high-emission activities.

Consequently, CIMB is increasingly focused on integrating climate risk assessment into its credit evaluation processes. This involves identifying and potentially reducing exposure to sectors most vulnerable to climate change impacts and transition risks. Simultaneously, there's a strategic push to increase financing for green and sustainable projects, such as renewable energy and climate-resilient infrastructure, which aligns with global sustainability goals and offers new avenues for growth while mitigating climate-related financial vulnerabilities.

CIMB Group Holdings faces increasing pressure to enhance its ESG reporting, driven by global mandates and investor demand. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming de facto standards, requiring detailed climate risk assessments. This push for transparency means CIMB must clearly articulate its environmental stewardship, social impact, and governance practices to attract and retain capital.

Investors are actively integrating ESG factors into their decision-making processes, with sustainable investment assets projected to reach $50 trillion globally by 2025. CIMB's ability to demonstrate robust ESG performance, evidenced by clear metrics and actionable initiatives, directly influences its attractiveness to this growing investor base. Failure to meet these evolving expectations can lead to a decline in investor confidence and potentially impact the group's valuation.

The global green finance market is experiencing significant growth, with green bond issuance projected to reach over $1 trillion in 2024, according to industry reports. This trend presents a substantial opportunity for CIMB Group Holdings to expand its sustainable banking offerings, including green loans and environmental, social, and governance (ESG) linked financing.

CIMB can strategically position itself by actively supporting renewable energy projects and providing financial solutions that encourage clients to adopt more sustainable business practices. This aligns with the increasing investor demand for ESG-compliant investments and CIMB's commitment to contributing to a low-carbon economy.

Resource Scarcity and Operational Footprint

CIMB Group Holdings faces environmental challenges related to resource scarcity and its operational footprint. This includes managing energy consumption in its extensive network of branches and data centers, as well as addressing waste generation across its operations. For instance, in 2023, the banking sector globally saw increased scrutiny on its energy usage, with many institutions setting targets for renewable energy adoption in their facilities.

By implementing energy efficiency measures, such as upgrading to LED lighting and optimizing cooling systems in its buildings, CIMB can reduce its reliance on non-renewable resources. Similarly, focusing on waste reduction through recycling programs and sustainable procurement practices for office supplies and technology can significantly lessen its environmental impact. These initiatives not only contribute to environmental protection but also offer tangible cost savings and bolster CIMB's reputation as a responsible corporate citizen.

- Energy Efficiency: CIMB aims to reduce energy consumption in its physical and digital infrastructure.

- Waste Management: Initiatives focus on minimizing waste generation through recycling and responsible disposal.

- Sustainable Procurement: Prioritizing environmentally friendly suppliers and materials in its operations.

- Operational Footprint: Continuously seeking ways to lessen the environmental impact of its day-to-day activities.

Reputational Risks Associated with Environmental Controversies

CIMB Group Holdings faces reputational risks if its financing activities are linked to environmentally damaging practices. Public perception of environmental responsibility is crucial for maintaining trust and brand value. For instance, a significant environmental incident involving a client financed by CIMB could lead to widespread negative publicity and a decline in customer confidence. By 2024, financial institutions globally are increasingly scrutinized for their environmental, social, and governance (ESG) performance, with a growing expectation for transparency and accountability.

To mitigate these risks, CIMB must conduct rigorous due diligence on its clients' environmental impact and ensure strict adherence to environmental safeguards in its lending practices. Proactive communication about its sustainability initiatives and commitments is also vital. For example, in 2023, many banks enhanced their ESG reporting frameworks to better demonstrate their commitment to sustainable finance, a trend expected to continue and intensify through 2025.

- Reputational Damage: Involvement in or financing of environmentally harmful activities can significantly damage CIMB's brand image and public trust.

- Stakeholder Scrutiny: Investors, customers, and regulators are increasingly focused on a company's environmental footprint and sustainability practices.

- Due Diligence is Key: Thorough assessment of clients' environmental practices is essential to avoid association with controversial projects.

- Proactive Communication: Transparency about sustainability efforts helps build and maintain a positive environmental reputation.

The increasing focus on environmental, social, and governance (ESG) factors significantly impacts CIMB Group Holdings. Investors are channeling more capital into sustainable investments, with global sustainable assets projected to reach $50 trillion by 2025, making CIMB's ESG performance crucial for attracting investment. The growing green finance market, with green bond issuance exceeding $1 trillion in 2024, presents opportunities for CIMB to expand its sustainable banking products.

CIMB must manage its operational environmental footprint, including energy consumption and waste generation, to enhance efficiency and its corporate image. For instance, global banks in 2023 increased scrutiny on energy usage, setting renewable energy adoption targets. Successfully integrating ESG principles and transparently reporting on environmental initiatives is vital for maintaining stakeholder trust and mitigating reputational risks associated with financing environmentally sensitive projects.

| Environmental Factor | Impact on CIMB | Data/Trend |

|---|---|---|

| Climate Change Risks | Financial risks from physical and transition impacts on loan portfolios. | ASEAN region vulnerable to climate disasters; global shift to low-carbon economy intensifies. |

| ESG Reporting & Investor Demand | Need for transparency in environmental stewardship to attract capital. | Sustainable investment assets to reach $50 trillion by 2025; TCFD recommendations becoming standards. |

| Green Finance Market Growth | Opportunity to expand sustainable banking offerings. | Green bond issuance projected over $1 trillion in 2024. |

| Operational Footprint | Need to manage energy consumption and waste. | Increased scrutiny on bank energy usage in 2023; focus on energy efficiency and waste reduction. |

| Reputational Risk | Damage from association with environmentally damaging practices. | Growing expectation for transparency and accountability in ESG performance through 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for CIMB Group Holdings is grounded in data from reputable financial institutions like the World Bank and IMF, alongside official government reports and leading industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting CIMB.