CIMB Group Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

CIMB Group Holdings strategically tailors its diverse product offerings, from digital banking to investment solutions, to meet varied customer needs. Its pricing strategies aim for competitive advantage while its extensive digital and physical distribution network ensures accessibility across Southeast Asia. The group's promotional efforts leverage digital channels and partnerships to build brand awareness and customer loyalty.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

CIMB Group's comprehensive retail banking services cover every individual's financial journey, from basic current and savings accounts to diverse fixed deposit options. Their extensive credit and debit card portfolio offers tailored rewards and benefits, reflecting a deep understanding of consumer spending habits. For instance, in the first quarter of 2024, CIMB reported a significant increase in its retail loan portfolio, indicating strong customer uptake of their financing solutions.

Beyond transactional accounts, CIMB provides robust financing for major life events, including home, auto, personal, and education loans, solidifying their role as a financial partner. This broad offering is further amplified by their digital strategy, with the CIMB OCTO app receiving continuous enhancements. The app's focus on intuitive design and advanced security, a key differentiator in the 2024 digital banking landscape, aims to provide a seamless and trustworthy customer experience.

CIMB's Specialized Wholesale Banking Solutions cater to corporate and institutional clients with tailored conventional and Islamic offerings, including investment banking and advanced financing. These services are designed to meet the intricate needs of large-scale businesses, ensuring comprehensive financial support. For instance, CIMB's investment banking division advised on significant M&A deals in Southeast Asia throughout 2024, demonstrating its market presence.

CIMB Group Holdings offers a comprehensive suite of commercial banking solutions, supporting businesses from small startups to large enterprises with its strong transaction banking capabilities. A notable program, SMEBizReady, launched in 2023, has already assisted over 5,000 SMEs in adopting digital tools and advanced operational methods, as reported in their Q3 2024 performance review.

Further underscoring its commitment to growth and responsible business, CIMB actively provides financial and advisory services to SMEs aiming to enhance their Environmental, Social, and Governance (ESG) performance. In 2024, the bank facilitated over RM200 million in green financing for SMEs specifically targeting sustainability improvements, demonstrating a tangible impact on their market positioning.

Islamic Banking and Finance

CIMB Islamic, a significant component of CIMB Group's 4Ps marketing mix, stands as a leading provider of Shariah-compliant financial solutions across Southeast Asia. Their product offering is extensive, covering consumer, commercial, and wholesale banking needs, ensuring a comprehensive suite for those seeking ethical finance. This commitment to Shariah principles extends beyond mere product provision, deeply embedding Islamic finance within CIMB's corporate citizenship initiatives.

The integration of Islamic banking across CIMB's diverse segments is a key product strategy, catering to a growing market segment that prioritizes faith-based financial dealings. This approach ensures that customers have access to a full spectrum of Shariah-compliant services, from everyday banking to complex corporate finance. CIMB Islamic's active promotion of economic inclusion and community empowerment through its Islamic finance offerings further solidifies its product differentiation.

- Comprehensive Shariah-Compliant Offerings: CIMB Islamic provides a wide array of banking and financial products that adhere strictly to Islamic principles, serving individual and corporate clients.

- Integrated Financial Solutions: These Shariah-compliant products are seamlessly integrated across CIMB's consumer, commercial, and wholesale banking operations, offering a unified experience.

- Corporate Citizenship Alignment: Islamic banking is a cornerstone of CIMB's corporate social responsibility, driving economic inclusion and community development in line with Islamic values.

- Market Position: As of early 2024, CIMB Islamic continues to strengthen its position as a key player in the Islamic finance landscape, with a strong focus on digital innovation and customer-centric Shariah solutions.

Asset Management and Investment s

CIMB Group Holdings offers a comprehensive suite of asset management and investment solutions designed to meet diverse client needs across ASEAN. These products are crucial for wealth growth and achieving financial goals, serving both individual and institutional investors.

In fiscal year 2024, CIMB's wealth assets under management (AUM) reached an impressive MYR 300 billion. This significant figure underscores the effectiveness of their cross-selling strategies and the strong demand for their investment products throughout the region.

- Diverse Product Range: CIMB provides a wide array of investment products, including mutual funds, structured products, and alternative investments, catering to varying risk appetites and financial objectives.

- Regional Reach: With a strong presence across ASEAN, CIMB's asset management arm effectively serves a broad client base, facilitating wealth accumulation and financial planning.

- FY2024 Performance: The Group's wealth AUM exceeding MYR 300 billion in FY2024 demonstrates robust client trust and successful market penetration in the competitive investment landscape.

- Client-Centric Approach: The focus on enabling clients to grow wealth and achieve financial objectives is a core element of CIMB's product strategy, driving engagement and long-term relationships.

CIMB's product strategy is built on a foundation of comprehensive financial solutions that cater to a broad spectrum of needs, from everyday banking for individuals to specialized services for corporations and institutions. This includes a robust offering of retail banking products like savings accounts and credit cards, alongside financing options such as home and auto loans, with a notable increase in retail loan portfolios reported in Q1 2024.

The bank also emphasizes its digital product development, exemplified by the continuous enhancements to the CIMB OCTO app, focusing on user experience and security. For businesses, CIMB provides tailored wholesale and commercial banking solutions, including investment banking and transaction banking, with programs like SMEBizReady supporting over 5,000 SMEs in 2024.

Furthermore, CIMB Islamic offers a complete suite of Shariah-compliant products across all banking segments, reinforcing its commitment to ethical finance and economic inclusion, while its asset management division manages over MYR 300 billion in wealth AUM as of FY2024, offering diverse investment products across ASEAN.

| Product Category | Key Offerings | 2024/2025 Highlights | Target Audience |

|---|---|---|---|

| Retail Banking | Current/Savings Accounts, Fixed Deposits, Credit/Debit Cards, Personal/Auto/Home Loans | Significant increase in retail loan portfolio (Q1 2024) | Individuals, Families |

| Digital Banking | CIMB OCTO App | Continuous enhancements for intuitive design and security | All Customer Segments |

| Wholesale & Commercial Banking | Investment Banking, Transaction Banking, Corporate Finance, Islamic Banking | Advised on significant M&A deals (2024); SMEBizReady supported >5,000 SMEs | Corporates, Institutions, SMEs |

| Islamic Banking | Shariah-compliant accounts, financing, investments | Key player in Islamic finance, focus on digital innovation | Individuals & Businesses seeking Shariah compliance |

| Asset Management | Mutual Funds, Structured Products, Alternative Investments | Wealth AUM exceeded MYR 300 billion (FY2024) | Individual & Institutional Investors |

What is included in the product

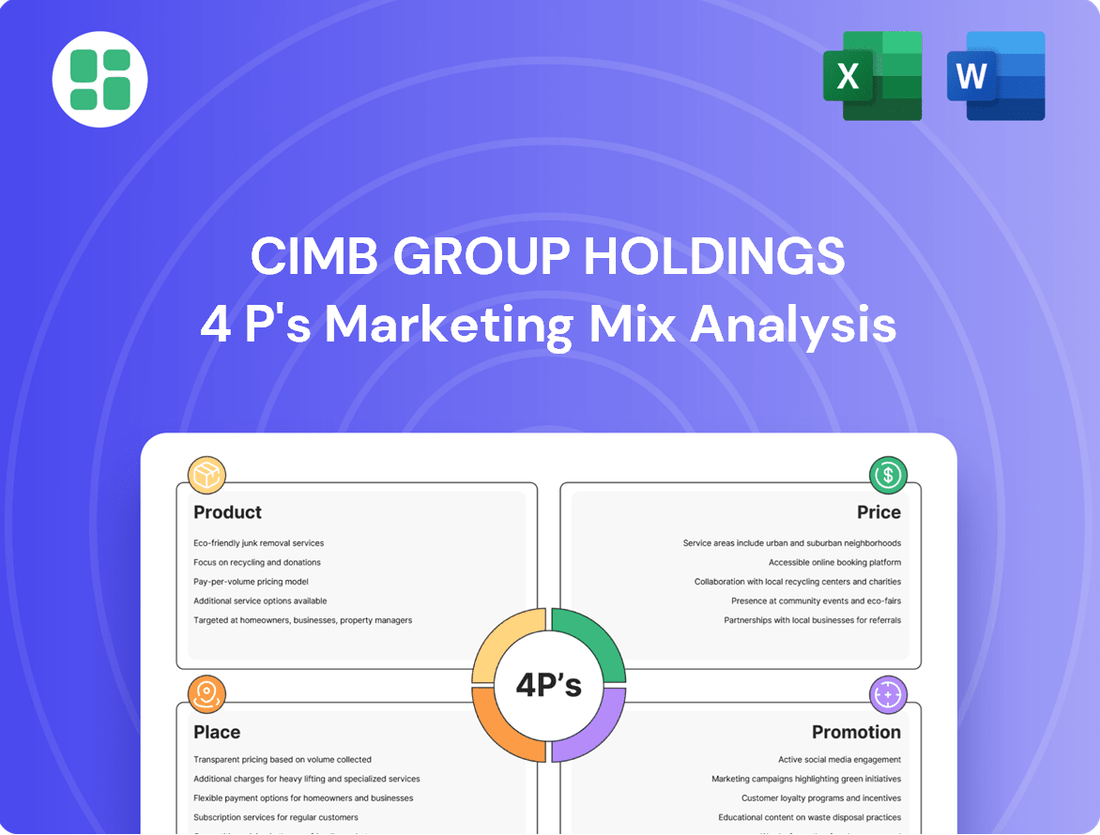

This analysis delves into CIMB Group Holdings' marketing strategies, examining their diverse product offerings, competitive pricing, extensive digital and physical distribution channels, and multifaceted promotional activities to understand their market positioning.

It provides a comprehensive overview for stakeholders seeking to grasp CIMB's approach to product development, value perception, accessibility, and customer engagement.

This CIMB Group Holdings 4P's analysis provides a concise overview of how their marketing strategies address customer pain points, offering a clear, actionable roadmap for enhancing customer satisfaction and loyalty.

It serves as a vital tool for identifying and resolving key customer challenges by dissecting CIMB's product, price, place, and promotion strategies, making it ideal for strategic planning and customer-centric initiatives.

Place

CIMB Group Holdings boasts an extensive regional network, a cornerstone of its marketing strategy. This network spans eight key ASEAN nations: Malaysia, Indonesia, Singapore, Thailand, Cambodia, Vietnam, Myanmar, and the Philippines. This broad geographic footprint ensures significant market penetration and accessibility for its diverse customer base.

As of the first quarter of 2024, CIMB Group reported a total of 835 branches across these markets, demonstrating its commitment to a strong physical presence. This widespread network is vital for facilitating regional financial activities and serving a broad spectrum of customers, from individual retail clients to large corporate entities.

CIMB's commitment to digitalization is evident in its robust digital banking platforms, like the CIMB OCTO app in Malaysia. This focus allows for enhanced customer engagement and more efficient operations across the group.

The group's fully digital banking operations in the Philippines and Vietnam are prime examples of this strategy in action. These platforms are crucial for expanding reach and acquiring new customers, particularly in developing markets.

By leveraging these advanced digital channels, CIMB effectively streamlines its distribution strategy. This approach not only improves customer experience but also acts as a cost-effective method for market penetration and growth.

CIMB Group Holdings maintains a robust physical presence through its extensive branch and ATM network, even as it champions digital advancements. This physical infrastructure is crucial for offering traditional banking services, handling intricate transactions, and catering to customers who prefer face-to-face interactions. For instance, as of the first quarter of 2024, CIMB operated over 700 branches and more than 10,000 ATMs across its key markets, ensuring broad accessibility.

This strategic blend of physical accessibility and digital convenience allows CIMB to effectively reach a wider customer base. The network supports essential services like cash withdrawals, deposits, and account inquiries, complementing its digital offerings. This dual approach aims to maximize market penetration by meeting diverse customer needs and preferences.

Strategic Partnerships and Ecosystems

CIMB Group Holdings actively cultivates strategic partnerships and embeds itself within diverse business ecosystems to broaden its distribution reach and bolster the relevance of its offerings. This approach is a cornerstone of its commercial banking operations, ensuring seamless and unified solutions that span multiple business verticals.

In the digital banking sphere, CIMB strategically aligns with leading e-commerce platforms. This allows for accelerated market penetration and expanded customer acquisition in critical geographical markets. For instance, by integrating with popular online marketplaces, CIMB can offer tailored financial products directly at the point of sale, enhancing convenience for consumers and businesses alike.

These collaborations are not merely about expanding reach; they are about creating value. By leveraging the extensive customer bases and established networks of its partners, CIMB can introduce innovative financial services more efficiently. This symbiotic relationship allows both parties to benefit from shared growth and enhanced customer engagement.

- E-commerce Integration: CIMB's digital banking strategy includes partnerships with major e-commerce platforms, enabling seamless financial transactions and product offerings directly within these ecosystems.

- Ecosystem Expansion: The group actively seeks to integrate with various fintech and digital service providers to create a more comprehensive and interconnected financial ecosystem for its customers.

- Cross-Industry Collaborations: CIMB engages in strategic alliances across different industries, such as retail and logistics, to provide bundled solutions that cater to the evolving needs of businesses and consumers.

Direct Sales and Relationship Management

CIMB Group Holdings prioritizes direct sales and robust relationship management for its high-value customer segments, such as wholesale banking clients and mass affluent individuals. This tailored approach ensures the delivery of customized financial solutions, aiming to cultivate enduring client partnerships. The focus here is on building trust and providing a superior experience, which is crucial for long-term loyalty and satisfaction.

This strategy is particularly evident in CIMB's efforts to deepen engagement with its affluent customer base. For instance, as of the first quarter of 2024, CIMB reported a significant increase in its wealth management assets, underscoring the effectiveness of its relationship-driven sales model. The bank actively employs dedicated relationship managers who understand the unique financial needs of these clients, offering personalized advice and access to exclusive products and services.

- Targeted Engagement: Direct sales teams and dedicated relationship managers are assigned to high-net-worth individuals and corporate clients.

- Bespoke Solutions: The focus is on crafting financial packages that precisely match individual client requirements, from investment strategies to lending facilities.

- Client Retention: By fostering strong personal connections, CIMB aims to achieve higher customer retention rates within these lucrative segments.

- Growth in Wealth Management: CIMB's wealth management division saw a notable uptick in assets under management in early 2024, reflecting successful relationship management.

CIMB Group Holdings leverages a multi-channel approach for its "Place" strategy, combining a strong physical branch network with advanced digital platforms. This ensures accessibility across its eight key ASEAN markets, catering to diverse customer preferences.

As of Q1 2024, CIMB maintained 835 branches and over 10,000 ATMs, providing essential in-person services. Simultaneously, digital channels like the CIMB OCTO app and fully digital operations in the Philippines and Vietnam expand reach and customer acquisition, streamlining distribution.

Strategic partnerships with e-commerce platforms and fintech providers further enhance CIMB's distribution, embedding financial services directly into customer ecosystems. This integrated approach, alongside dedicated relationship management for affluent clients, drives market penetration and customer loyalty.

| Channel | Description | Q1 2024 Data/Focus |

|---|---|---|

| Physical Network | Branches and ATMs | 835 Branches, 10,000+ ATMs across 8 ASEAN markets |

| Digital Platforms | Mobile apps, online banking | CIMB OCTO app (Malaysia), Digital banks (Philippines, Vietnam) |

| Partnerships | E-commerce, Fintech | Integration with online marketplaces, digital service providers |

| Direct Sales | Relationship Managers | Focus on wholesale banking and mass affluent segments |

What You Preview Is What You Download

CIMB Group Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CIMB Group Holdings 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

CIMB Group Holdings leverages sophisticated digital marketing, including 3D Digital Out-of-Home (DOOH) advertising and augmented reality (AR) activations, to connect with customers. Their Chinese New Year campaigns in 2024, for instance, showcased these innovative techniques, aiming to create memorable brand interactions.

These initiatives are central to CIMB's digital transformation, targeting a younger, digitally-native audience. By embracing cutting-edge technology, CIMB aims to boost brand awareness and engagement, reflecting a strategic shift towards more immersive and interactive customer experiences in the evolving financial landscape.

CIMB Group Holdings consistently invests in integrated advertising and brand campaigns to solidify its image as a premier financial institution. These efforts are crucial for communicating their value proposition across various customer segments.

A prime example is the 'Travel Only With CIMB' campaign, which effectively showcases the breadth of their financial products and services designed for specific travel-related needs. This demonstrates a targeted approach to product promotion within their broader marketing strategy.

Furthermore, CIMB's 'Kita Bagi Jadi' (We Make It Happen) initiative exemplifies how their campaigns align with societal aspirations, fostering a sense of optimism and encouraging proactive engagement among Malaysians. This strategy enhances their brand perception as a supportive and forward-thinking partner.

CIMB Group Holdings strategically weaves Public Relations and Corporate Social Responsibility (CSR) into its promotional fabric, demonstrating a commitment that extends beyond core financial services. This approach highlights their dedication to societal betterment and reinforces their brand image. For instance, their 2024 sustainability report outlines significant efforts in areas like education and economic empowerment, further solidifying their role as a responsible corporate citizen.

Initiatives such as the CIMB Flood Relief Assistance Plan exemplify their proactive engagement in addressing community needs. These CSR activities are not merely philanthropic; they actively contribute to enhancing CIMB's reputation and fostering public trust. By investing in societal well-being, CIMB cultivates stronger relationships with stakeholders, which in turn supports their long-term business objectives and brand loyalty.

Sales s and Customer Loyalty Programs

CIMB Group Holdings actively uses sales promotions and customer loyalty programs to boost customer acquisition and retention. These initiatives often feature incentives like cashback, prize draws, and special interest rates on savings and loans.

For instance, in 2024, CIMB's "Spend & Win" campaigns offered customers chances to win significant prizes like vehicles or travel packages with qualifying transactions. These promotions aim to create immediate engagement and encourage deeper product usage.

Furthermore, loyalty programs are designed to reward consistent banking behavior. By offering tiered benefits and exclusive deals, CIMB seeks to cultivate long-term relationships and increase customer lifetime value.

- Cashback Promotions: Offering direct monetary rewards on spending.

- Prize Draws: Engaging customers with the chance to win high-value items.

- Preferential Interest Rates: Providing better returns on deposits or lower rates on loans for loyal customers.

- Loyalty Tiers: Rewarding customers based on their engagement and transaction volume with exclusive benefits.

Financial Literacy and Community Engagement

CIMB Group Holdings actively fosters financial literacy and community engagement, recognizing their importance in building trust and promoting sustainable growth. Programs like Be$MART and JagaDuit are specifically designed to equip individuals with essential financial knowledge. These initiatives are vital for enhancing financial inclusion across the communities CIMB serves.

Beyond financial education, CIMB’s commitment extends to broader community development. In 2024, the group continued its environmental conservation efforts, including mangrove planting initiatives, contributing to ecological preservation. Furthermore, CIMB actively supports access to quality education for underprivileged communities, underscoring a holistic approach to social responsibility.

These community-centric activities are instrumental in strengthening CIMB's brand reputation and fostering deeper connections with stakeholders. By investing in financial literacy and community well-being, CIMB not only fulfills its corporate social responsibility but also cultivates a more financially resilient and engaged society, which indirectly supports its long-term business objectives.

Key aspects of CIMB's community engagement include:

- Financial Literacy Programs: Be$MART and JagaDuit aim to improve financial management skills.

- Environmental Initiatives: Continued mangrove planting projects in 2024 highlight a commitment to sustainability.

- Educational Support: Providing access to quality education for disadvantaged groups addresses social equity.

- Brand Enhancement: These efforts collectively bolster CIMB's image as a responsible corporate citizen.

CIMB Group Holdings employs a multi-faceted promotional strategy, blending digital innovation with traditional outreach. Their 2024 Chinese New Year campaigns, featuring 3D Digital Out-of-Home and AR activations, exemplify a commitment to engaging younger, tech-savvy demographics. Targeted campaigns like 'Travel Only With CIMB' highlight specific product benefits, reinforcing their value proposition.

Beyond direct product promotion, CIMB integrates Public Relations and Corporate Social Responsibility (CSR) to enhance brand image. Initiatives like the Flood Relief Assistance Plan and sustainability efforts, detailed in their 2024 report, underscore their commitment to societal well-being and foster public trust.

Sales promotions and loyalty programs are key drivers for customer acquisition and retention. In 2024, 'Spend & Win' campaigns offered tangible incentives, while loyalty tiers reward consistent engagement, aiming to increase customer lifetime value.

CIMB also prioritizes financial literacy and community development through programs like Be$MART and JagaDuit, alongside environmental and educational support. These efforts, including mangrove planting in 2024, bolster their reputation as a responsible corporate citizen.

| Promotional Tactic | 2024 Focus/Example | Objective |

|---|---|---|

| Digital Marketing | 3D DOOH, AR activations (CNY 2024) | Enhance brand engagement, target younger demographics |

| Integrated Campaigns | 'Travel Only With CIMB' | Showcase product breadth, communicate value proposition |

| CSR & PR | Flood Relief Assistance, Sustainability Report 2024 | Build trust, enhance brand image, societal contribution |

| Sales Promotions | 'Spend & Win' campaigns | Drive immediate engagement, boost transactions |

| Loyalty Programs | Tiered benefits, exclusive deals | Foster long-term relationships, increase customer lifetime value |

Price

CIMB strategically positions its interest rates to build a strong deposit foundation, crucial for funding its loan portfolio. They aim for attractive deposit rates, such as the up to 3.3% offered on savings accounts, to draw in substantial funds.

This approach supports their lending activities, with the bank targeting loan growth of 5-7% for 2025. CIMB also considers how potential regional policy rate reductions might impact their profit margins.

Fee-based services form a significant part of CIMB Group's revenue, encompassing foreign exchange transactions and advisory services. This diversification is crucial for financial stability, especially when interest margins fluctuate. For instance, in the first quarter of 2024, CIMB reported a notable increase in non-interest income, driven by these fee-generating activities.

CIMB's strategic initiative, Forward30, targets an increase in its non-interest income ratio to 33-34% by 2030. This ambitious goal underscores the group's commitment to building a more resilient revenue structure. By expanding its fee-based offerings, CIMB aims to reduce its reliance on traditional interest income, thereby enhancing its overall financial performance.

CIMB likely utilizes a tiered pricing strategy, segmenting its offerings for retail, commercial, and wholesale clients. This allows for customized pricing based on factors like transaction volume and the complexity of services provided. For instance, premium banking packages might have higher fees but offer exclusive benefits, reflecting the differentiated value proposition for affluent customers.

Product bundling is another key element, where CIMB might combine services such as savings accounts, credit cards, and investment products into attractive packages. This strategy aims to increase customer stickiness and drive revenue through cross-selling. For example, a bundled mortgage and insurance package could offer a slight discount compared to purchasing them separately, enhancing the overall perceived value for the customer.

Shariah-Compliant Profit Rates and Fees

CIMB Islamic's pricing strategy is rooted in Shariah compliance, utilizing profit rates and fees instead of conventional interest. This approach directly addresses the increasing demand for ethically sourced financial products, aligning with Islamic law. For instance, in 2024, CIMB Islamic reported significant growth in its Islamic banking segment, reflecting customer trust in its transparent and principle-based pricing models.

The bank's commitment to Shariah principles extends to all its offerings, ensuring fairness and ethical conduct in every transaction. This focus on value-based pricing differentiates CIMB Islamic in the market.

- Shariah-Compliant Profit Rates: CIMB applies profit rates on financing products, adhering to Islamic finance principles.

- Transparent Fee Structure: Fees for services are clearly defined and aligned with ethical financial practices.

- Growing Islamic Finance Market: This strategy caters to a substantial and expanding customer base seeking Shariah-adherent solutions.

Dynamic Pricing influenced by Market Conditions

CIMB Group Holdings' pricing strategies are acutely sensitive to market dynamics, including competitor actions, demand fluctuations, and overarching economic trends. For instance, in 2024, the Bank of Thailand maintained its policy rate at 2.50% for much of the year, a key factor influencing CIMB Thai's net interest margins.

The bank actively tracks policy rate shifts across its ASEAN footprint, recognizing their direct impact on profitability. For example, Bank Negara Malaysia's decision to hold its policy rate at 3.00% throughout 2024 would have been a significant consideration for CIMB's Malaysian operations.

Effective management of funding costs and an agile response to market shifts are paramount for maintaining healthy margins and offering competitive products. In 2024, average deposit rates across the region remained a key focus, with CIMB needing to balance attracting deposits against the cost of funds to ensure competitive lending rates.

- Policy Rate Sensitivity: CIMB's pricing is directly linked to central bank policy rates, such as the Bank of Indonesia's rate, which hovered around 6.00% in 2024, impacting lending and deposit costs.

- Competitive Landscape: The bank must constantly benchmark its pricing against regional peers, considering factors like the average lending rates offered by major banks in the Philippines, which were in the range of 6-7% in 2024.

- Demand-Driven Adjustments: Pricing for products like personal loans or mortgages is adjusted based on prevailing demand, which can be influenced by economic growth forecasts for countries like Vietnam in 2024.

- Economic Conditions: Broader economic factors, such as inflation rates in Singapore, which averaged around 3-4% in 2024, also play a role in determining the appropriate pricing for financial services to maintain real returns.

CIMB's pricing strategy balances attracting deposits with competitive lending rates, evidenced by their aim for 3.3% on savings accounts and targeting 5-7% loan growth for 2025. They also leverage fee-based income, which saw a notable increase in Q1 2024, contributing to their Forward30 goal of a 33-34% non-interest income ratio by 2030.

The bank employs tiered pricing for different customer segments and product bundling to enhance customer loyalty and revenue. CIMB Islamic's Shariah-compliant profit rates and transparent fees cater to a growing demand for ethical finance, with significant growth reported in its Islamic banking segment in 2024.

Pricing is highly sensitive to regional policy rates, such as Bank of Thailand's 2.50% and Bank Negara Malaysia's 3.00% in 2024, directly impacting net interest margins and funding costs. CIMB actively monitors competitor pricing, like Philippine lending rates around 6-7% in 2024, and adjusts based on demand and economic conditions, including Singapore's 3-4% inflation in 2024.

| Pricing Strategy Element | 2024/2025 Data Point | Impact |

|---|---|---|

| Deposit Rates | Up to 3.3% on savings accounts | Attracts substantial funds for lending |

| Loan Growth Target | 5-7% for 2025 | Drives interest income |

| Non-Interest Income Ratio Target | 33-34% by 2030 (Forward30) | Diversifies revenue, reduces reliance on interest income |

| Policy Rate Influence (Example) | Bank of Thailand: 2.50% (2024) | Affects net interest margins |

| Competitive Lending Rates (Example) | Philippines: 6-7% (2024) | Informs pricing adjustments |

4P's Marketing Mix Analysis Data Sources

Our CIMB Group Holdings 4P's Marketing Mix Analysis is grounded in a comprehensive review of public company disclosures, including annual reports, investor presentations, and press releases. We also incorporate insights from industry reports and competitive analyses to ensure a robust understanding of their market strategies.