CIMB Group Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

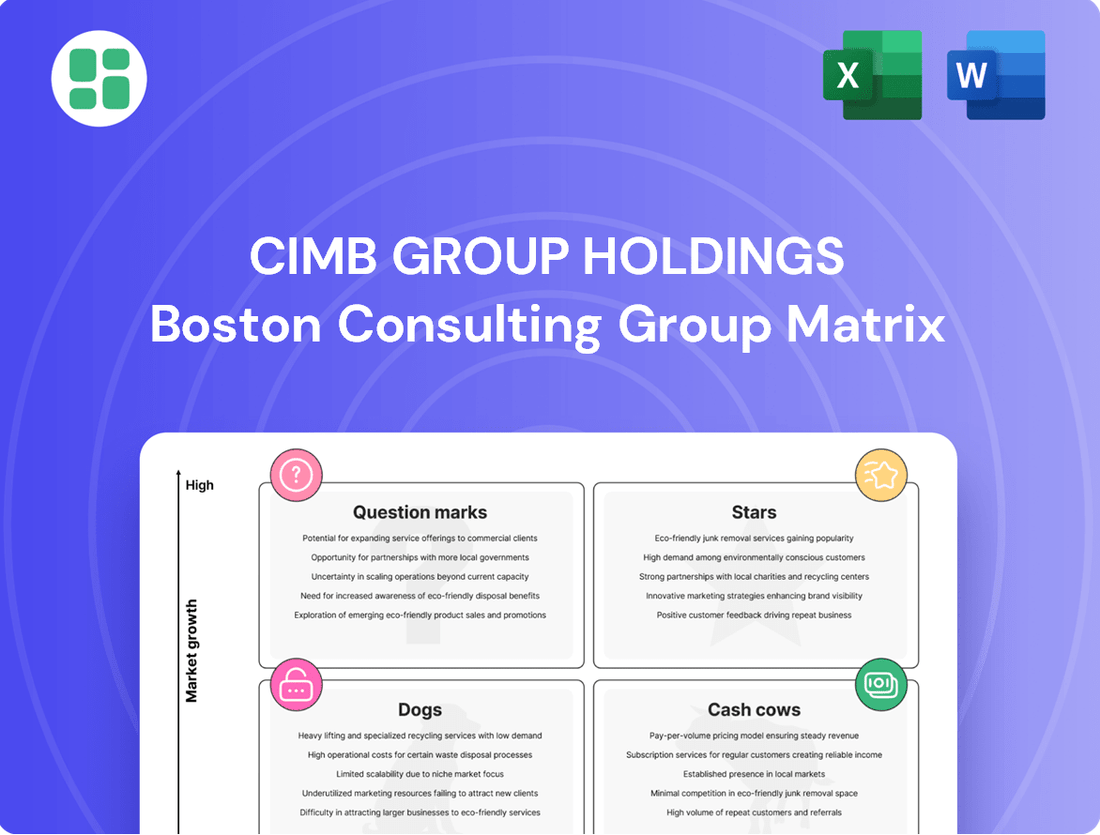

Curious about CIMB Group Holdings' strategic positioning? Our BCG Matrix preview highlights key areas, but to truly unlock their competitive advantage, you need the full picture. Discover which segments are Stars, Cash Cows, Dogs, or Question Marks, and gain actionable insights to guide your investment decisions.

This sneak peek is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for CIMB Group Holdings.

Stars

CIMB's fully digital banks in the Philippines and Vietnam are prime examples of Stars within the BCG matrix, showcasing robust growth. CIMB Bank Philippines, for instance, achieved a remarkable 45-fold increase in profit before tax in 2024 compared to 2023, alongside a customer base expansion to over 9 million. This rapid customer acquisition and transaction volume underscore high market growth and a strengthening market share for CIMB in these dynamic emerging markets.

CIMB is actively using its broad ASEAN presence to offer cross-border services, especially in treasury, trade, and wealth management. This focus on regional integration is seen as a significant growth driver for the bank.

The goal is to create a unified ASEAN banking platform, providing clients with seamless financial solutions across all customer segments. This strategy is designed to unlock value by connecting financial services throughout the region.

By strengthening regional connectivity, CIMB is well-positioned to benefit from increasing intra-ASEAN trade, a trend expected to gain momentum in the evolving global economic landscape.

CIMB Group Holdings is aggressively pursuing sustainable finance, setting a target of MYR300 billion (around $63 billion) in ESG financing by 2030. This substantial commitment highlights the immense growth potential and strategic importance of sustainable solutions in the current market landscape.

The group's initiatives, including transition finance and GreenBizReady programs for SMEs, are designed to guide clients through ESG compliance and unlock new business avenues. This focus on a burgeoning and vital sector firmly establishes CIMB as a frontrunner in sustainable finance.

Wealth Management and Affluent Customer Segments

CIMB Group's wealth management arm is a significant growth engine, demonstrating robust performance in FY2024. The bank's wealth assets under management (AUM) surpassed MYR 300 billion across the ASEAN region, highlighting strong customer adoption and trust.

The affluent customer segment, specifically targeted through CIMB Preferred, is experiencing accelerated growth. New-to-CIMB Preferred customer acquisition saw a notable 40% year-on-year increase as of November 2023, underscoring the effectiveness of its tailored offerings.

- Wealth Assets Under Management (AUM): Exceeded MYR 300 billion across ASEAN in FY2024.

- CIMB Preferred Growth: New-to-CIMB Preferred customer acquisition up 40% YoY as of November 2023.

- Strategic Focus: Capitalizing on Singapore's position as a growing ASEAN wealth hub.

Digital Transformation via CIMB OCTO App and AI Adoption

The enhanced CIMB OCTO app in Malaysia is a prime example of CIMB's strategic investment in digital transformation. In fiscal year 2024, the app facilitated over 110 million transactions, marking a substantial 70% surge compared to the prior year, underscoring its growing user adoption and importance.

CIMB is also strategically integrating artificial intelligence (AI) across its operations. This adoption aims to refine processes, bolster risk analytics, enhance fraud detection capabilities, and elevate client servicing standards, demonstrating a forward-looking approach to operational excellence.

- Digital Engagement: Over 110 million transactions monthly on CIMB OCTO app in FY2024, a 70% increase year-on-year.

- AI Integration: Exploring AI for process improvement, risk analytics, fraud detection, and client servicing.

- Strategic Alignment: These initiatives are core to the Forward30 strategic plan launched in March 2025, focusing on efficiency and customer experience.

CIMB's digital banking initiatives, particularly in the Philippines and Vietnam, are performing as Stars. CIMB Bank Philippines saw its profit before tax surge 45-fold in 2024, reaching over 9 million customers. This rapid growth in customer base and transaction volume indicates high market growth and a strengthening market share for CIMB in these key emerging markets.

CIMB's wealth management segment is also a Star, with ASEAN wealth assets under management exceeding MYR 300 billion in FY2024. The targeted growth in CIMB Preferred customers, up 40% year-on-year by November 2023, further solidifies its position in a high-growth market.

The group's commitment to sustainable finance, aiming for MYR300 billion in ESG financing by 2030, highlights a significant growth opportunity. Initiatives like transition finance and GreenBizReady programs for SMEs are establishing CIMB as a leader in this expanding sector.

| Business Unit/Initiative | BCG Category | Key Performance Indicators (2024 Data) | Strategic Rationale |

| Digital Banks (Philippines, Vietnam) | Star | 45x profit growth (PH), 9M+ customers (PH) | High market growth, increasing market share |

| Wealth Management (ASEAN) | Star | MYR 300B+ AUM, 40% YoY growth in CIMB Preferred customers | Strong customer adoption, targeted affluent segment growth |

| Sustainable Finance | Star | MYR 300B ESG financing target by 2030 | Burgeoning market, leadership in ESG solutions |

What is included in the product

The CIMB Group Holdings BCG Matrix would highlight strategic insights for its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The CIMB Group Holdings BCG Matrix offers a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Its export-ready design for quick PowerPoint integration simplifies communication, relieving the pain of complex data visualization for C-level executives.

Cash Cows

CIMB's core consumer banking in Malaysia is a definite cash cow. It consistently churns out profits and holds a dominant spot in the market. This strength is underscored by accolades like being named Best Retail Bank in Malaysia by Alpha Southeast Asia in 2024 and Domestic Retail Bank of the Year by Asian Banking & Finance in 2025.

This segment thrives thanks to its extensive and loyal customer base. Its significant contribution to CIMB Group's overall financial health makes it a bedrock of the company's success.

CIMB's wholesale banking in established markets, such as Malaysia and Singapore, acts as a significant cash cow. This division offers high-value services to major corporations and institutions, leveraging CIMB's extensive regional network and expertise in treasury and trade solutions.

This segment consistently generates substantial net interest income and non-interest income, reflecting its maturity and strong market position. For instance, in 2024, CIMB's wholesale banking segment continued to be a bedrock of its financial performance, demonstrating resilience and consistent profitability in these key markets.

CIMB's Islamic banking solutions, operating under CIMB Islamic Bank Berhad, represent a significant cash cow for the group. This segment enjoys a high market share in the rapidly expanding Islamic finance sector.

As of December 31, 2024, CIMB Islamic held its leading position in Indonesia, with total financing growing by 9.1% year-on-year to 60.3 trillion rupiah. Deposits also saw substantial growth, increasing by 21.7% year-on-year, underscoring the segment's robust performance and customer trust.

The established competitive advantage in this niche market translates into stable and high-profit margins, making CIMB Islamic a consistent contributor to the group's overall profitability and a prime example of a successful cash cow.

Traditional Deposit-Led Strategy

CIMB's emphasis on cultivating a low-cost deposit base, especially through current and savings accounts (CASA), represents a significant cash cow, ensuring dependable and cost-effective funding. This strategic focus allows CIMB to manage its cost of funds effectively, thereby supporting robust net interest margins.

By the close of 2024, CIMB's CASA ratio was reported at 43.1%. Concurrently, total deposits experienced a year-on-year increase of 5.2% when measured on a constant currency basis, underscoring the success of their deposit-led strategy.

- Deposit Franchise Strength: CIMB's core strategy revolves around building a robust, low-cost deposit franchise, primarily through CASA.

- Funding Efficiency: This approach provides stable and cost-efficient funding, crucial for maintaining healthy net interest margins.

- 2024 Performance: CIMB's CASA ratio reached 43.1% by the end of 2024, with total deposits growing 5.2% year-on-year (constant currency).

CIMB Niaga (Indonesia)

PT Bank CIMB Niaga Tbk, the Indonesian arm of CIMB Group Holdings, is a prime example of a Cash Cow within the conglomerate's portfolio. It reliably generates a substantial chunk of the group's earnings, typically contributing between 20% and 25% of the pre-tax profit. This consistent profitability underscores its mature and stable market position.

In the first half of 2025, CIMB Niaga demonstrated its enduring strength by posting a profit before tax of IDR4.4 trillion. This performance highlights the bank's ability to navigate a competitive landscape through a combination of prudent lending practices and effective cost management, solidifying its role as a key revenue driver.

- CIMB Niaga's Profit Contribution: Consistently accounts for 20-25% of CIMB Group's pre-tax profit.

- First Half 2025 Performance: Achieved a profit before tax of IDR4.4 trillion.

- Key Drivers: Healthy loan growth and strong cost discipline are central to its success.

- Market Position: Operates as a reliable cash generator in the Indonesian banking sector.

CIMB's core consumer banking in Malaysia is a definite cash cow, consistently generating profits and holding a dominant market position. This strength is reinforced by accolades such as being named Best Retail Bank in Malaysia by Alpha Southeast Asia in 2024 and Domestic Retail Bank of the Year by Asian Banking & Finance in 2025. The segment thrives due to its extensive and loyal customer base, making it a bedrock of CIMB Group's financial health.

CIMB's wholesale banking in established markets like Malaysia and Singapore also functions as a significant cash cow. This division serves major corporations with high-value services, leveraging CIMB's regional network and expertise. In 2024, this segment continued to be a bedrock of financial performance, demonstrating resilience and consistent profitability in these key markets.

CIMB Islamic Bank Berhad is a notable cash cow, capitalizing on the growing Islamic finance sector with a high market share. As of December 31, 2024, CIMB Islamic's total financing in Indonesia grew 9.1% year-on-year to 60.3 trillion rupiah, with deposits increasing by 21.7%, highlighting robust performance and customer trust.

PT Bank CIMB Niaga Tbk, CIMB Group's Indonesian subsidiary, consistently contributes between 20% and 25% to the group's pre-tax profit. In the first half of 2025, CIMB Niaga posted a profit before tax of IDR4.4 trillion, underscoring its stable market position and effective management.

| Business Segment | Cash Cow Status | Key Performance Indicators (2024/H1 2025) |

|---|---|---|

| Malaysian Consumer Banking | Cash Cow | Best Retail Bank in Malaysia (Alpha Southeast Asia, 2024); Domestic Retail Bank of the Year (Asian Banking & Finance, 2025) |

| Wholesale Banking (Malaysia & Singapore) | Cash Cow | Consistent profitability, strong net interest income, and non-interest income contribution in 2024. |

| CIMB Islamic | Cash Cow | Indonesia Financing Growth: 9.1% (YoY) to IDR 60.3T (Dec 2024); Deposit Growth: 21.7% (YoY) (Dec 2024) |

| PT Bank CIMB Niaga Tbk (Indonesia) | Cash Cow | Profit Before Tax: IDR 4.4T (H1 2025); Contributes 20-25% to Group Pre-Tax Profit. |

Delivered as Shown

CIMB Group Holdings BCG Matrix

The CIMB Group Holdings BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, detailing CIMB's strategic positioning across its diverse business units, is ready for your immediate use without any watermarks or demo content. You can confidently expect to download this professionally designed document, which provides actionable insights into CIMB's Stars, Cash Cows, Question Marks, and Dogs, directly after completing your purchase.

Dogs

Areas within CIMB Group Holdings still reliant on outdated legacy systems or inefficient manual processes, despite ongoing digital transformation efforts, would likely fall into the 'Dogs' quadrant of the BCG Matrix. These segments consume resources without contributing significantly to growth or market share. For instance, as of early 2024, CIMB has publicly acknowledged that certain operational areas still faced challenges with legacy IT infrastructure, impacting efficiency and customer experience.

These underperforming segments represent a drag on the group's overall performance, requiring ongoing maintenance and investment without generating substantial returns. CIMB's strategic focus on technology upgrades, including significant capital expenditure planned for 2024-2025, is specifically aimed at addressing these inefficiencies and improving the resiliency of its core banking and digital platforms.

CIMB Group Holdings faces challenges in certain niche markets within ASEAN where its market share is low, and competition is fierce with limited growth potential. For example, in the digital payments sector in a specific Southeast Asian country, CIMB might hold a small percentage of the market against larger, more established players, with the overall market growth slowing down.

The bank's Forward30 strategy aims to concentrate resources on areas where it's already performing well, meaning it's likely to reduce focus on these less promising segments. These underperforming niches might barely break even or even drain cash without generating substantial returns, making them candidates for divestment or significant strategic shifts.

Consider the small business lending segment in a particular ASEAN nation. If CIMB has a minimal presence and faces entrenched competitors, and the overall SME loan growth in that region is projected to be only 2-3% annually through 2025, it represents a low-growth, highly competitive niche where CIMB struggles for scale.

CIMB Group's traditional financial products, such as basic savings accounts or physical branch services, may be experiencing declining relevance. These offerings often struggle to compete with the convenience and features of digital-first fintech solutions, leading to reduced customer adoption. For instance, while CIMB has invested heavily in digital transformation, a significant portion of its legacy customer base might still rely on these older products, which are likely generating minimal returns and consuming resources that could be better allocated to growth areas.

Non-Strategic or Divested Assets/Minority Holdings

CIMB Group Holdings' strategy involves divesting non-strategic or minority holdings that do not align with its core objectives. This approach aims to optimize capital allocation and concentrate on areas offering higher growth potential and market share. For instance, if CIMB were to hold a small stake in a technology startup with limited synergy to its banking operations, it might consider divesting this minority holding.

The group's focus on purposeful growth means shedding assets that are either underperforming or outside its strategic purview. While current specific examples of such divested assets are not publicly detailed, the principle remains consistent: non-core or low-performing units are candidates for divestiture. This aligns with CIMB's broader aim to streamline operations and enhance financial performance by focusing resources on its primary business segments.

- Divestment of Non-Core Assets: CIMB aims to shed units with low strategic alignment.

- Capital Optimization: Focus on allocating capital to core, high-growth areas.

- Minority Holdings Review: Smaller equity stakes not contributing to group strategy are considered for divestment.

- Strategic Focus: Shedding underperforming or non-core assets to enhance overall group performance.

Segments with Persistent Net Interest Margin (NIM) Compression without Offset

Segments experiencing persistent Net Interest Margin (NIM) compression without adequate offsetting growth or cost efficiencies would fall into the Dogs category within CIMB Group Holdings' BCG Matrix. This indicates a business unit that is not generating sufficient returns and is unlikely to improve its competitive position.

For instance, if a particular loan portfolio within CIMB consistently faces intense competition, leading to lower interest income, and this pressure isn't balanced by an increase in loan volume or better cost control, it would represent a Dog. While CIMB's overall NIM management might be effective, such isolated segments highlight areas of underperformance.

Consider a scenario where a specific deposit product, perhaps one with high interest payouts to attract funds, experiences significant NIM erosion due to a rising cost of funds without a corresponding increase in profitable lending activities. This segment would struggle to contribute positively to the group's profitability and growth trajectory.

- Low Profitability: These segments generate minimal profit due to squeezed margins.

- Limited Growth Prospects: The competitive landscape or market conditions offer little opportunity for expansion.

- Need for Strategic Review: Management must assess whether to divest, restructure, or invest minimally in these areas.

- Example: A portfolio of legacy loans with fixed, low-interest rates in a rising rate environment, where competition for new, higher-yielding assets is fierce.

Segments within CIMB Group Holdings that are characterized by low market share and low growth potential, often requiring significant investment to maintain their position, would be classified as Dogs. These are typically mature or declining business units that do not offer a strong competitive advantage. For example, certain legacy IT systems, despite ongoing modernization efforts, might fall into this category as they consume resources without contributing to CIMB's strategic growth objectives.

These 'Dog' segments can also include niche markets where CIMB has a minimal presence and faces intense competition, with little prospect for significant expansion. As of early 2024, CIMB's digital transformation efforts are aimed at improving efficiency, but some older operational areas or products may still represent these low-performing units, demanding attention without yielding substantial returns.

CIMB's Forward30 strategy emphasizes resource concentration on high-performing areas, implying a potential reduction in focus or divestment of these underperforming segments. These units might barely break even or even incur losses, making them candidates for strategic reassessment to optimize capital allocation and enhance overall group performance.

For instance, a specific legacy loan portfolio with declining Net Interest Margins (NIM) in a highly competitive market, where growth is minimal and cost efficiencies are hard to achieve, would exemplify a Dog. While CIMB's overall financial health is robust, these specific segments highlight areas needing strategic intervention.

Question Marks

CIMB Group's commitment to digital transformation is evident through its pursuit of new digital ventures and fintech partnerships, a cornerstone of its Forward30 strategy. These ventures, such as early-stage AI integration for risk analytics or the development of embedded banking solutions, represent high-growth potential but currently hold a low market share, necessitating substantial upfront investment.

For instance, CIMB's investment in digital platforms and collaborations with fintechs in 2024 are designed to capture future market demand, even though their immediate revenue contribution is modest. This strategic positioning aligns with the characteristics of a question mark in the BCG matrix, where significant resources are allocated to nurture nascent but promising business areas.

Expanding into challenging regional markets, where CIMB is still establishing its footprint and market share, represents a strategic move with significant potential but also inherent risks. These markets, often characterized by intense competition or less developed banking infrastructure, demand considerable investment. For instance, entering a market like Myanmar, despite its long-term growth prospects, requires navigating a complex regulatory environment and building trust from the ground up, a process that yields uncertain immediate returns.

While CIMB benefits from a robust ASEAN network, scaling operations in these nascent or highly contested banking landscapes places them in a position akin to a question mark on the BCG matrix. These are areas with high growth potential, but where CIMB is not yet a dominant player. For example, in 2024, while many ASEAN economies saw steady GDP growth, specific frontier markets faced volatility, impacting the pace of new banking entrants' market penetration.

CIMB Group is actively developing specialized lending and investment products tailored for emerging market segments, such as green finance and innovative SME financing. These offerings target high-growth areas where CIMB's current market share may be modest, necessitating significant investment in marketing and customer acquisition.

For instance, CIMB's commitment to sustainable finance saw them participate in the issuance of a significant sustainability-linked bond in Southeast Asia during 2024, demonstrating their proactive approach to new financial instruments. The group aims to capture a larger share of these rapidly evolving markets by introducing novel solutions designed to meet dynamic customer needs.

Leveraging Generative AI and Advanced Analytics in New Applications

CIMB Group is strategically focusing on integrating generative AI and advanced analytics into novel applications, aiming to unlock new avenues for growth. This includes exploring their use in previously untapped customer segments, accelerating product development cycles, and optimizing internal operational efficiencies.

These cutting-edge technologies represent significant future growth potential, though CIMB's current market share in their widespread application is still nascent. The bank recognizes the substantial investment required to build robust capabilities in this domain.

- Generative AI & Advanced Analytics: CIMB is investing in these high-potential technologies to create new applications.

- Strategic Focus: Expansion into new customer segments, product development, and operational enhancements are key areas.

- Market Position: While future prospects are high, current market share in these advanced applications is low, reflecting early adoption stages.

- Investment Needs: Significant capital outlay is necessary to develop and implement these advanced analytical and AI capabilities effectively.

Unproven Cross-Sell Initiatives with New Customer Segments

CIMB Group Holdings is exploring new cross-selling initiatives targeting customer segments that haven't traditionally engaged with certain CIMB products. This strategy aims to tap into high-growth opportunities in previously underserved or resistant markets, recognizing that current market penetration is low.

These ventures, while promising, are currently unproven. They require substantial investment in marketing and sales to build awareness and drive adoption. For instance, CIMB's 2024 digital banking push saw significant marketing spend, with early adoption rates in new segments still being closely monitored for conversion success.

- Targeting new customer segments for cross-selling represents a high-growth, low-penetration opportunity.

- Significant marketing and sales investments are necessary for these initiatives.

- Returns are not guaranteed in the short term, consuming cash without immediate high returns.

- CIMB's 2024 digital strategy highlights the investment required to penetrate new user bases.

CIMB's ventures into generative AI and advanced analytics, alongside new cross-selling initiatives targeting underserved segments, exemplify its 'question mark' positioning. These areas offer high growth potential but require substantial investment due to low current market share and unproven returns, as seen in their 2024 digital marketing spend.

Expanding into frontier ASEAN markets also places CIMB in a question mark category. While these regions present long-term growth prospects, they demand significant capital for market penetration and navigating complex regulatory environments, with uncertain immediate financial outcomes.

CIMB's strategic focus on specialized lending, like green finance, and innovative SME financing further aligns with question marks. These initiatives target rapidly evolving, high-growth areas where the group's market share is still developing, necessitating considerable investment in marketing and customer acquisition to capture future demand.

The group's commitment to digital transformation and fintech partnerships, while crucial for future growth, represents significant upfront investment in areas with currently low market penetration, characteristic of question marks needing nurturing.

| BCG Category | CIMB Group Example | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | Generative AI & Advanced Analytics | High | Low | High |

| Question Mark | Frontier ASEAN Market Expansion | High | Low | High |

| Question Mark | Green Finance & SME Lending | High | Developing | High |

| Question Mark | New Customer Segment Cross-selling | High | Low | High |

BCG Matrix Data Sources

Our CIMB Group Holdings BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market research, and internal performance data, ensuring a data-driven strategic assessment.