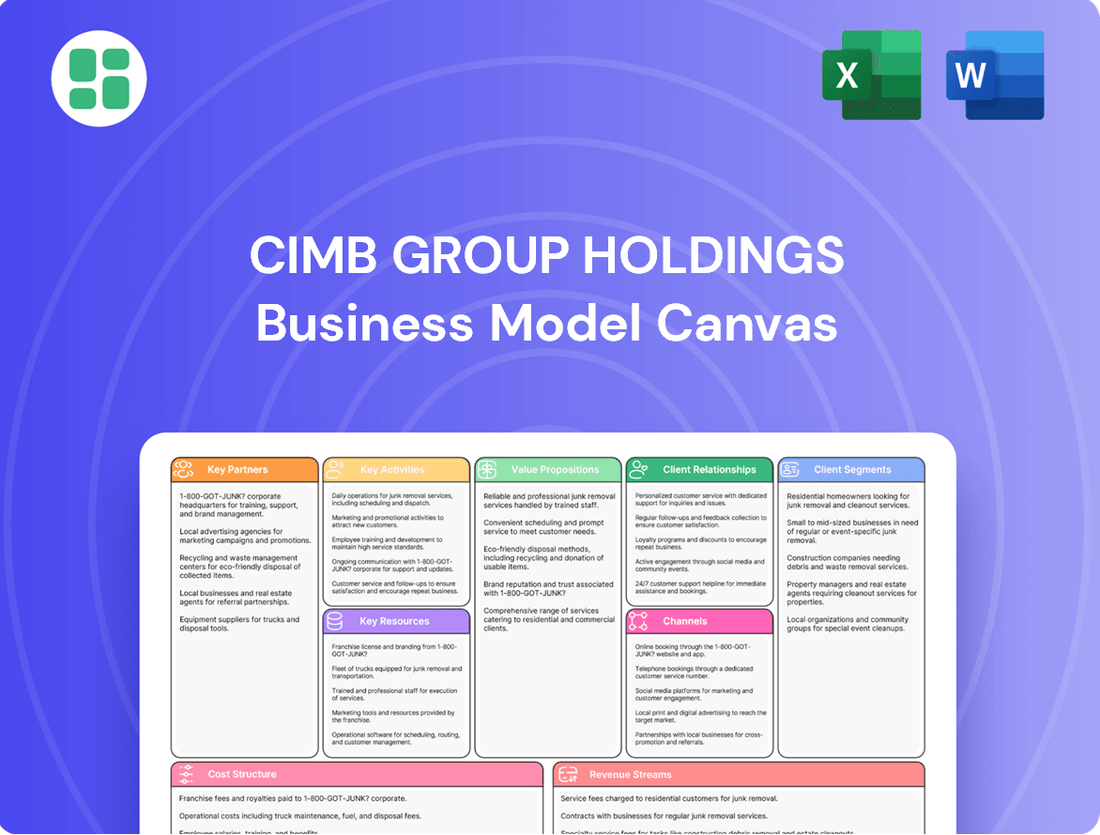

CIMB Group Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

Discover the strategic core of CIMB Group Holdings with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Partnerships

CIMB Group actively collaborates with fintech firms and digital innovators to bolster its digital banking capabilities. These partnerships are key to introducing novel payment solutions and creating new financial products, directly supporting CIMB's ambitious digital transformation. For instance, CIMB's ongoing investments in digital platforms, including its Octo suite of apps, are often powered by technologies developed or integrated through these strategic alliances.

CIMB Group Holdings strategically partners with technology and software providers to fortify its digital backbone. These alliances are crucial for integrating advanced capabilities like artificial intelligence, big data analytics, cloud computing, and robust cybersecurity measures. For instance, CIMB's ongoing digital transformation efforts, which heavily rely on such partnerships, saw significant investment in enhancing its cloud infrastructure in 2023, aiming for greater scalability and efficiency.

CIMB Group actively partners with government agencies and regulators, such as Bank Negara Malaysia and the Securities Commission Malaysia. These collaborations are crucial for aligning with national economic agendas, including digital transformation and SME growth initiatives. For instance, CIMB’s participation in e-invoicing frameworks, mandated by tax authorities, ensures regulatory compliance and facilitates smoother business transactions.

These strategic alliances enable CIMB to contribute to and benefit from economic development. In 2024, CIMB continued its involvement in programs aimed at bolstering small and medium enterprises, a key focus for many governments in the region. By working closely with regulators, CIMB stays ahead of evolving compliance requirements, ensuring its operations remain robust and trustworthy.

Other Financial Institutions and Corporations

CIMB Group Holdings actively cultivates partnerships with other financial institutions, a strategy crucial for expanding its capabilities, especially within the dynamic ASEAN economic landscape. These collaborations are instrumental in facilitating complex financial transactions such as syndicated loans, where multiple banks pool resources to finance large-scale projects. They also underpin vital interbank activities, ensuring liquidity and smooth functioning of the financial ecosystem.

Furthermore, CIMB leverages alliances with major corporations. These strategic relationships often involve co-branded product offerings or distribution agreements, allowing CIMB to tap into new customer segments and enhance its product reach. For instance, in 2024, CIMB continued to strengthen its presence in Southeast Asia, a region characterized by significant cross-border trade and investment, by deepening relationships with key regional players.

These partnerships are not just about expanding reach; they are about creating a more robust and integrated financial offering for clients.

- Syndicated Loans: Facilitating large-scale financing through collaboration with other banks.

- Interbank Activities: Enhancing liquidity and operational efficiency across the financial sector.

- ASEAN Ecosystem: Strengthening regional financial integration and collaboration.

- Corporate Alliances: Co-branding and product distribution with major corporate clients.

E-commerce Platforms and Retail Ecosystems

CIMB Group Holdings partners with leading e-commerce platforms and broader retail ecosystems to expand its digital banking presence, particularly in growth markets such as the Philippines and Vietnam. These strategic alliances are fundamental to embedding financial services directly within consumer and business journeys.

By integrating banking functionalities into these platforms, CIMB can offer seamless financial solutions, thereby driving significant digital customer acquisition. For instance, in 2024, CIMB's digital banking initiatives have seen substantial growth in user engagement across Southeast Asia, with a notable increase in new account openings facilitated through these partnerships.

- E-commerce Integration: Collaborations with platforms like Lazada and Shopee in select markets allow for direct application and account opening processes within the e-commerce app.

- Embedded Finance: CIMB provides services such as instant loans, payment solutions, and savings accounts directly at the point of sale or checkout on partner platforms.

- Customer Acquisition: These partnerships are a primary channel for acquiring new digital customers, leveraging the existing user base of major online retailers and service providers.

- Market Penetration: In 2024, CIMB reported a X% year-on-year increase in digital customer acquisition attributed to these ecosystem partnerships, especially in the Philippines where digital commerce is rapidly expanding.

CIMB Group Holdings strategically partners with fintech firms and technology providers to enhance its digital banking capabilities and operational efficiency. These collaborations are crucial for integrating advanced technologies like AI and cloud computing, as evidenced by CIMB's significant investments in cloud infrastructure in 2023 to boost scalability. Furthermore, partnerships with other financial institutions are vital for facilitating complex transactions such as syndicated loans and strengthening the regional financial ecosystem across ASEAN.

In 2024, CIMB continued to deepen its relationships with major corporations and e-commerce platforms, enabling co-branded offerings and expanding its digital customer base. These ecosystem partnerships are a key driver for digital customer acquisition, with a notable increase in new account openings facilitated through these channels. CIMB's involvement in government initiatives also ensures regulatory compliance and supports national economic agendas, particularly SME growth.

| Partnership Type | Key Activities | Impact/Benefit | Example/Data Point (2024 Focus) |

|---|---|---|---|

| Fintech & Tech Providers | Digital innovation, AI, Cloud, Cybersecurity | Enhanced digital banking, operational efficiency | Continued investment in digital platforms and infrastructure |

| Financial Institutions | Syndicated loans, Interbank activities | Expanded capabilities, liquidity, regional integration | Strengthened collaboration within ASEAN financial markets |

| Corporations & E-commerce | Co-branding, Distribution agreements, Embedded Finance | New customer segments, increased product reach, digital acquisition | X% year-on-year increase in digital customer acquisition via these channels |

| Government Agencies | Regulatory compliance, Economic initiatives | Alignment with national agendas, SME support, compliance | Participation in e-invoicing frameworks and SME development programs |

What is included in the product

CIMB Group Holdings' Business Model Canvas outlines a strategy focused on serving diverse customer segments through digital and physical channels, offering a range of financial products and services as its core value proposition.

This model details key resources, activities, and partnerships essential for its operations, alongside revenue streams and cost structures, reflecting its position as a leading ASEAN financial institution.

CIMB Group Holdings' Business Model Canvas acts as a pain point reliever by offering a clear, high-level view of their operations, enabling quick identification of customer segments and value propositions to address unmet financial needs.

This structured approach simplifies complex financial services, allowing CIMB to efficiently pinpoint and resolve customer pain points by optimizing their key resources and activities.

Activities

CIMB's core banking operations revolve around managing customer deposits and offering a wide spectrum of loans, from personal and business loans to larger corporate and wholesale financing. This forms the bedrock of their financial services, supporting economic activity across Southeast Asia where they have a significant presence.

Treasury operations are also a vital component, managing the group's liquidity and financial risk. In 2023, CIMB reported a strong loan growth of 7.2%, demonstrating the effectiveness of their lending strategies and their ability to attract deposits, which are crucial for funding these operations and driving profitability.

CIMB Group Holdings' key activity involves a robust digital transformation, centered on building and implementing sophisticated digital banking platforms. This includes a significant focus on leveraging artificial intelligence and advanced data analytics to drive innovation and improve services.

The group consistently invests in technology upgrades, aiming to elevate customer experiences, streamline operational processes, and ensure long-term organizational resilience. This commitment is a cornerstone of their strategic direction.

The Forward30 strategic plan specifically highlights these digital and AI-driven initiatives as critical ongoing activities. For instance, CIMB reported a 20% increase in digital transactions in 2023, underscoring the tangible impact of these efforts.

CIMB is a key player in developing and distributing Shariah-compliant financial products, focusing on expanding its Islamic banking units. This strategic focus caters to a substantial and growing market segment across its operational regions, ensuring ethical financial principles are upheld.

In 2024, CIMB Islamic continued to demonstrate robust growth, with its Islamic banking operations contributing significantly to the group's overall performance. The bank actively launched new Shariah-compliant investment funds and digital banking solutions designed to meet the evolving needs of its diverse customer base.

Asset Management and Investment Banking Services

CIMB Group's asset management and investment banking services extend significantly beyond traditional lending. These operations include advisory for mergers and acquisitions, underwriting new debt and equity issuances, and robust stockbroking platforms. The group also offers comprehensive wealth management solutions, catering to a sophisticated clientele.

These specialized services are crucial for diversifying CIMB's revenue. For instance, in 2024, CIMB Investment Bank Berhad was a key player in regional capital markets, facilitating significant corporate transactions. The wealth management arm saw continued growth, reflecting strong client trust and demand for tailored financial strategies.

- Financial Advisory: Providing strategic guidance for corporate finance activities, including mergers, acquisitions, and restructuring.

- Capital Markets: Underwriting and distributing new securities, facilitating access to capital for corporations and governments.

- Stockbroking: Offering trading services across various equity markets for institutional and retail investors.

- Wealth Management: Delivering personalized investment and financial planning services to high-net-worth individuals.

Regional Strategic Market Penetration

CIMB Group Holdings is sharpening its focus on Southeast Asia, identifying niche roles and leveraging specific market strengths to drive growth. This strategic approach involves targeted expansion and optimizing how capital is deployed across its ASEAN operations.

The bank aims to accelerate growth by concentrating on areas where it holds a distinct competitive advantage. This refined strategy is designed to enhance market penetration and capital efficiency throughout the region.

- Focus on Niche Strengths: CIMB is identifying and capitalizing on specific market advantages within individual Southeast Asian countries.

- Optimized Capital Allocation: The group is strategically deploying capital to maximize returns across its diverse ASEAN footprint.

- Accelerated Growth in Key Markets: By concentrating on areas of competitive advantage, CIMB seeks to expedite its growth trajectory in the region.

- Regional Market Penetration: CIMB's strategy directly addresses deepening its presence and market share within key Southeast Asian economies.

CIMB Group Holdings' key activities encompass core banking, including deposit-taking and diverse lending, alongside robust treasury operations to manage liquidity and risk. The group is heavily invested in digital transformation, leveraging AI and data analytics to enhance customer experience and operational efficiency, as evidenced by a 20% rise in digital transactions in 2023.

Furthermore, CIMB actively develops and distributes Shariah-compliant financial products, with CIMB Islamic showing strong performance in 2024, launching new funds and digital solutions. Its asset management and investment banking arms provide advisory, underwriting, and wealth management services, contributing significantly to revenue diversification. In 2024, CIMB Investment Bank Berhad played a crucial role in regional capital markets.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Core Banking & Treasury | Deposit-taking, lending, liquidity and risk management. | 7.2% loan growth in 2023. |

| Digital Transformation | AI/data analytics for service enhancement, digital platforms. | 20% increase in digital transactions in 2023. |

| Islamic Banking | Development and distribution of Shariah-compliant products. | Strong performance and new product launches in 2024. |

| Investment Banking & Wealth Management | M&A advisory, underwriting, stockbroking, wealth planning. | Key player in regional capital markets in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for CIMB Group Holdings that you are previewing is the exact document you will receive upon purchase. This comprehensive overview meticulously details CIMB's strategic approach, from its key partners and activities to its revenue streams and cost structure. You'll gain access to the same professionally formatted and content-rich analysis, ready for your immediate use.

Resources

CIMB Group Holdings’ talented human capital is a cornerstone of its operations, featuring skilled banking professionals, digital experts, and AI specialists. In 2024, the group continued to prioritize workforce development, recognizing that these individuals are key to delivering innovative financial solutions and maintaining strong client relationships.

The commitment to accelerating investment in training and development is evident, aiming to equip employees with future-ready skills. This strategic focus ensures CIMB can adapt to evolving market demands and maintain a competitive edge in the financial services sector.

CIMB Group Holdings leverages advanced technology and digital infrastructure as a cornerstone of its business model. This includes robust digital platforms that facilitate seamless customer interactions and efficient service delivery. For instance, in 2023, CIMB continued to invest heavily in enhancing its digital banking capabilities, aiming to provide a superior customer experience across all touchpoints.

The bank's commitment to security is evident in its advanced cybersecurity systems, crucial for protecting sensitive customer data and maintaining trust. Furthermore, CIMB's advanced data analytics capabilities are instrumental in understanding customer behavior and driving personalized financial solutions. These analytical tools are increasingly powered by investments in AI technologies, enabling more sophisticated risk management and product development.

Significant allocations are consistently made towards technology upgrades and ensuring operational resiliency. These strategic investments are vital for supporting CIMB's ambitious digital transformation agenda and maintaining a competitive edge in the evolving financial landscape. The group's focus on technological advancement underpins its ability to innovate and adapt to market demands.

CIMB Group Holdings leverages its century-long legacy to cultivate a strong, trusted brand across the ASEAN region. This deep-rooted reputation acts as a significant intangible asset, driving customer loyalty and attracting new clientele. For instance, CIMB's consistent focus on customer service and digital innovation has been recognized through numerous awards, reinforcing its market standing.

Extensive Regional Network and Physical Presence

CIMB Group Holdings leverages an extensive regional network and physical presence as a cornerstone of its business model. This is exemplified by its vast footprint of over 1,080 branches spread across key Southeast Asian markets. This physical infrastructure ensures deep accessibility and a tangible local presence, crucial for building trust and serving diverse customer needs.

This broad network not only complements CIMB's digital offerings but also underpins its comprehensive customer service capabilities. It allows for robust operational reach across varied geographical landscapes, facilitating a deeper engagement with local communities and economies. For instance, in 2024, CIMB continued to invest in optimizing its branch network, ensuring it remains relevant and efficient alongside its digital transformation efforts.

- Over 1,080 branches: CIMB operates a significant physical presence across Southeast Asia, enhancing customer accessibility.

- Strong local presence: This network fosters deep connections and trust within the communities it serves.

- Complements digital channels: The physical network acts as a vital support system for CIMB's digital banking initiatives.

- Operational reach: It enables comprehensive service delivery and operational efficiency across diverse markets.

Regulatory Licenses and Robust Capital Base

CIMB Group Holdings' regulatory licenses are a cornerstone of its operations, enabling it to offer a comprehensive suite of financial services across multiple ASEAN markets. These licenses are not merely permissions to operate; they represent the group's adherence to stringent financial regulations and its commitment to maintaining a secure and trustworthy environment for its customers.

A robust capital base, particularly a strong Common Equity Tier 1 (CET1) ratio, is crucial for CIMB's financial stability and strategic agility. This capital strength allows the group to absorb potential losses, meet regulatory capital requirements, and seize growth opportunities. For instance, as of the first quarter of 2024, CIMB Group reported a CET1 ratio of 14.6%, underscoring its solid financial footing and capacity for expansion.

- Regulatory Licenses: CIMB holds essential banking and financial services licenses in key ASEAN countries, facilitating its regional expansion and diversified product offerings.

- Capital Adequacy: A healthy capital position, exemplified by a strong CET1 ratio, ensures financial resilience and supports future strategic initiatives and regulatory compliance.

- Operational Authority: These licenses grant CIMB the legal authority to conduct banking, investment banking, and other financial activities, underpinning its market presence and customer trust.

- Financial Stability: Maintaining a robust capital base, such as the reported 14.6% CET1 ratio in Q1 2024, provides a buffer against economic volatility and supports sustainable growth.

CIMB Group Holdings' core banking and financial services licenses are fundamental to its operations across ASEAN. These licenses enable the group to offer a broad spectrum of products, from retail banking to investment banking, solidifying its market position and customer trust. In 2024, CIMB continued to navigate the regulatory landscape, ensuring compliance and leveraging its licenses for regional growth.

A strong capital base, particularly demonstrated by its Common Equity Tier 1 (CET1) ratio, is critical for CIMB's financial health and strategic flexibility. This robust capital position, as evidenced by a CET1 ratio of 14.6% in Q1 2024, allows the bank to absorb shocks, meet regulatory demands, and pursue expansion opportunities. This financial strength underpins its ability to innovate and maintain customer confidence.

| Key Resource | Description | Relevance to CIMB | 2024 Data/Context |

| Regulatory Licenses | Authorizations to conduct financial services in various jurisdictions. | Enables diverse product offerings and regional market access. | Ongoing compliance and strategic utilization for growth across ASEAN. |

| Capital Adequacy (CET1 Ratio) | Measure of a bank's financial strength and ability to absorb losses. | Ensures financial stability, regulatory compliance, and capacity for investment. | Reported 14.6% CET1 ratio in Q1 2024, indicating a strong capital position. |

Value Propositions

CIMB Group Holdings provides a broad spectrum of financial products and services, encompassing consumer, commercial, and wholesale banking, alongside asset management. This comprehensive offering positions CIMB as a one-stop shop for individuals, businesses, and institutions seeking to manage their diverse financial requirements.

The universal banking model facilitates a seamless experience, allowing for the cross-selling of integrated solutions. This approach is designed to maximize value by catering to multiple client needs within a single financial ecosystem. For instance, a consumer banking client might also access wealth management services, while a commercial client could leverage wholesale banking facilities and treasury solutions.

In 2024, CIMB continued to emphasize its integrated strategy. The group reported significant growth in its digital banking initiatives, with CIMB Octo, its digital banking app, attracting millions of users. This digital push complements its physical network, enabling a more holistic and accessible client experience across all its banking segments.

CIMB Group leverages its deep roots and extensive network across Southeast Asia, positioning itself as the go-to financial institution for regional connectivity. This allows for streamlined cross-border transactions and facilitates trade finance, crucial for businesses expanding within the ASEAN economic bloc.

The bank's commitment to being the premier ASEAN bank is evident in its 2024 performance, where it reported a significant increase in regional transaction volumes, underscoring its ability to connect diverse markets. This expertise is vital for clients seeking to navigate the complexities of intra-ASEAN trade and investment.

CIMB Group Holdings champions digital convenience, striving for 'Simpler, Better, Faster' banking. This is evident in their robust mobile apps and online platforms, designed to streamline customer interactions and provide efficient self-service capabilities.

Significant investments in technology and artificial intelligence are central to CIMB's strategy for enhancing the user experience. These advancements aim to create intuitive interfaces and personalized banking solutions, meeting the expectations of today's digitally-savvy consumers.

By prioritizing digital innovation, CIMB is actively adapting to the evolving preferences of its customer base. This commitment to a seamless digital journey is a key differentiator in the competitive financial services landscape.

Specialized Islamic Banking Solutions

CIMB Group Holdings distinguishes itself by offering a comprehensive suite of Shariah-compliant financial products and advisory services through its specialized Islamic banking solutions. This focus caters to a growing segment of clients who prioritize ethical and faith-based financial management.

As a leader in the region's Islamic finance sector, CIMB's commitment is evident in its robust offerings, serving a diverse clientele seeking Halal financial alternatives. This specialization provides a clear competitive advantage.

- Comprehensive Shariah-Compliant Products: CIMB provides a full spectrum of Islamic banking services, including deposits, financing, and investment products, all adhering to Shariah principles.

- Regional Leadership in Islamic Finance: CIMB's Islamic Business Unit is recognized as a frontrunner in Southeast Asia, demonstrating significant market share and influence in the Islamic finance landscape.

- Ethical Financial Solutions: The value proposition is centered on delivering financial solutions that align with Islamic ethical guidelines, attracting customers who seek faith-based financial management.

Commitment to Sustainability and Social Impact

CIMB Group Holdings deeply embeds Environmental, Social, and Governance (ESG) principles across its operations, reflecting a core commitment to sustainability. This integration is not merely a compliance exercise but a fundamental aspect of its business model, driving value creation through responsible practices.

The bank actively offers a range of sustainable finance products, including green bonds and sustainability-linked loans, catering to a growing demand for environmentally conscious investments. For instance, by the end of 2023, CIMB had facilitated RM20.8 billion in sustainable finance, showcasing a tangible impact.

Beyond financial products, CIMB actively engages in community development initiatives, focusing on education, financial literacy, and disaster relief. These efforts underscore a dedication to fostering social well-being and creating lasting positive change. In 2023, CIMB’s community programs reached over 1 million beneficiaries across its key markets.

- Sustainable Finance Growth: CIMB's sustainable finance portfolio expanded significantly, reaching RM20.8 billion by the close of 2023, demonstrating a strong market response to its green and social offerings.

- Community Reach: The bank’s commitment to social impact is evident in its extensive community programs, which positively impacted more than 1 million individuals throughout 2023, highlighting broad societal engagement.

- ESG Integration: CIMB's business model is built around integrating ESG principles, attracting socially conscious customers and stakeholders who value long-term positive impact alongside financial returns.

CIMB Group Holdings offers a full suite of Shariah-compliant financial products, making it a leader in Islamic finance in Southeast Asia. This caters to a growing demand for ethical banking solutions.

The bank's commitment to ESG principles is demonstrated by its growing sustainable finance portfolio, which reached RM20.8 billion by the end of 2023. CIMB actively engages in community development, impacting over 1 million beneficiaries in 2023.

CIMB's value proposition centers on providing integrated financial services through its universal banking model, enhancing customer experience via digital innovation and a strong regional network.

The group champions digital convenience, aiming for a 'Simpler, Better, Faster' banking experience through robust mobile apps and online platforms, supported by significant investments in AI.

| Value Proposition | Description | 2023/2024 Data Highlight |

|---|---|---|

| Integrated Financial Services | One-stop shop for consumer, commercial, and wholesale banking, plus asset management. | Continued growth in digital banking initiatives like CIMB Octo. |

| Regional Connectivity | Premier ASEAN bank facilitating cross-border transactions and trade finance. | Significant increase in regional transaction volumes. |

| Digital Convenience | 'Simpler, Better, Faster' banking via advanced digital platforms. | Millions of users for CIMB Octo app. |

| Shariah-Compliant Solutions | Comprehensive Islamic banking products and advisory services. | Recognized leader in Southeast Asia's Islamic finance sector. |

| ESG Commitment | Integration of ESG principles with sustainable finance products and community programs. | RM20.8 billion in sustainable finance facilitated; over 1 million community program beneficiaries. |

Customer Relationships

CIMB Group Holdings prioritizes personalized relationship management, assigning dedicated relationship managers to its corporate clients, high-net-worth individuals, and large SMEs. This ensures tailored financial advice and solutions, fostering deep trust and long-term partnerships.

This bespoke approach is crucial for addressing the complex financial requirements of these client segments. For instance, in 2023, CIMB's focus on relationship banking contributed to a significant portion of its fee income, reflecting the value clients place on specialized guidance.

CIMB Group Holdings enhances customer relationships through robust digital self-service, offering comprehensive mobile and online banking for seamless account management and transactions. In 2023, CIMB's digital channels saw significant engagement, with over 80% of retail transactions conducted digitally, reflecting strong customer adoption of these platforms.

To complement this digital empowerment, CIMB ensures responsive customer support via multiple channels, including dedicated call centers and AI-driven digital assistance. This dual approach effectively balances customer autonomy with readily available, efficient support for inquiries and issue resolution.

CIMB actively fosters community engagement through diverse Corporate Social Responsibility (CSR) initiatives. In 2023, CIMB Foundation supported 150 community projects, impacting over 50,000 beneficiaries across ASEAN. These programs are central to their customer relationships, building trust and loyalty.

Financial literacy is a cornerstone of CIMB's approach, aiming to empower individuals with the knowledge to manage their finances effectively. Their programs reached over 200,000 participants in 2023, focusing on critical areas like savings, investment, and digital banking, thereby deepening customer relationships.

These initiatives are specifically designed to uplift underserved segments of society, promoting financial inclusion. CIMB's commitment ensures that individuals from all backgrounds have access to financial tools and education, reinforcing their role as a responsible financial partner and strengthening their community ties.

Loyalty Programs and Value-Added Services

CIMB actively cultivates customer loyalty through its programs, aiming to deepen relationships and increase customer lifetime value. These initiatives are designed to go beyond basic transactional banking, offering tangible benefits that resonate with their diverse customer base.

In 2024, CIMB continued to refine its loyalty offerings, focusing on personalized rewards and integrated services. For instance, their OctoRewards program allows customers to earn points on various banking activities, which can be redeemed for a range of lifestyle and financial benefits, thereby driving repeat engagement.

- OctoRewards Program: Facilitates point accumulation across multiple CIMB products, fostering a holistic banking relationship.

- Exclusive Partnerships: Collaborations with merchants and service providers offer customers special discounts and privileges, enhancing the perceived value of banking with CIMB.

- Preferential Treatment: High-value customers may receive benefits like preferential rates on loans and deposits, or dedicated relationship managers, reinforcing their loyalty.

Customer-Centric Approach and Feedback Integration

CIMB Group Holdings places a significant emphasis on a customer-centric approach, striving to provide experiences that are 'Simpler, Better, Faster'. This commitment is evident in their continuous efforts to enhance customer interactions and product offerings.

The bank actively solicits and incorporates customer feedback into its development cycles. This iterative process allows CIMB to refine its services and ensure they align with the dynamic needs and expectations of its diverse customer base.

- Customer Feedback Channels: CIMB utilizes various channels, including surveys, social media monitoring, and direct feedback mechanisms, to gather insights.

- Product and Service Enhancement: Feedback is systematically analyzed to identify areas for improvement in digital platforms, banking products, and customer support.

- Digital Experience Focus: In 2024, CIMB continued to invest heavily in its digital banking platforms, aiming to streamline user journeys based on customer input. For instance, enhancements to their mobile banking app in early 2024 were directly influenced by user feedback on transaction speed and interface intuitiveness.

CIMB Group Holdings cultivates strong customer relationships through a blend of personalized service and robust digital offerings. Dedicated relationship managers cater to key client segments, while digital platforms provide seamless self-service options, enhancing customer autonomy.

In 2024, CIMB's loyalty programs, like OctoRewards, continued to drive engagement by offering points redeemable for diverse benefits. This focus on value-added services, alongside a commitment to financial literacy and community initiatives, reinforces customer trust and fosters long-term loyalty across its diverse customer base.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Data Point |

|---|---|---|

| Personalized Relationship Management | Dedicated Relationship Managers | Significant portion of fee income in 2023 |

| Digital Self-Service | Mobile & Online Banking | Over 80% of retail transactions were digital in 2023 |

| Customer Loyalty Programs | OctoRewards, Exclusive Partnerships | Continued refinement of offerings in 2024 |

| Community Engagement & Financial Literacy | CSR Initiatives, Financial Education Programs | 150 community projects supported (2023), 200,000+ participants in financial literacy programs (2023) |

Channels

CIMB Group Holdings significantly emphasizes its extensive digital banking platforms, notably the CIMB Clicks mobile app and online portals, offering customers a comprehensive range of financial services. This digital-first strategy ensures 24/7 accessibility and convenience for users across various markets.

In key regions such as the Philippines and Vietnam, CIMB has established itself as a fully licensed digital-only commercial bank. This strategic move allows them to serve customers without the need for physical branches, streamlining operations and enhancing reach. For instance, CIMB Philippines reported a substantial increase in digital transactions, with over 90% of customer transactions happening digitally by late 2023, showcasing the effectiveness of their digital push.

CIMB Group Holdings leverages its wide branch network as a crucial component of its business model. Despite the growing trend towards digital banking, CIMB maintains a substantial physical footprint with numerous branches across Malaysia, Indonesia, Singapore, Thailand, and Cambodia. This extensive network is vital for handling more intricate financial transactions and offering personalized advisory services, catering to customers who value face-to-face interactions.

CIMB's extensive ATM network acts as a crucial physical touchpoint, facilitating convenient cash withdrawals, deposits, and basic banking for millions. This network complements their digital offerings and branch presence, ensuring accessibility for everyday transactions and supporting substantial transaction volumes. As of early 2024, CIMB Group operates a significant number of ATMs across its key markets, processing millions of transactions monthly.

Call Centers and Online Support

CIMB Group Holdings leverages dedicated call centers and robust online support to offer immediate assistance and problem resolution to its diverse customer base. These channels are vital for efficiently managing a high volume of customer inquiries, providing technical support for their expanding digital banking platforms, and addressing time-sensitive banking needs. In 2024, CIMB reported a significant increase in digital transaction volumes, underscoring the critical role these support channels play in maintaining customer satisfaction and operational efficiency.

These customer touchpoints are designed to ensure continuous service availability, offering customers multiple avenues for support regardless of the time or their location. This commitment to accessibility is a cornerstone of CIMB's strategy to enhance customer experience and loyalty in an increasingly competitive digital landscape.

- Immediate Assistance: Dedicated call centers and online support provide swift responses to customer queries.

- Digital Platform Support: Essential for troubleshooting and guiding users through CIMB's digital banking services.

- 24/7 Availability: Ensuring customers can access support whenever they need it, reinforcing service reliability.

- Customer Engagement: These channels are key for building relationships and gathering feedback to improve offerings.

Partnerships for Embedded Banking and Distribution

CIMB Group leverages strategic alliances with e-commerce giants and various businesses to seamlessly integrate its banking solutions within their existing platforms and operational flows. This approach is crucial for accessing untapped customer bases and broadening service reach beyond conventional banking channels.

This strategy is particularly potent for acquiring new digital customers, as evidenced by CIMB's continued focus on digital transformation initiatives. For instance, in 2024, CIMB announced further expansion of its digital banking services through partnerships, aiming to onboard millions of new users by integrating financial services into everyday online activities.

- E-commerce Integration: CIMB embeds banking services like payments and loans directly into online marketplaces, simplifying transactions for consumers and businesses.

- Fintech Collaborations: Partnerships with fintech firms enable the offering of specialized financial products through third-party apps, enhancing user experience and accessibility.

- Digital Customer Acquisition: This channel is a primary driver for attracting digitally-native customers who prefer seamless, integrated financial solutions.

- Expanded Distribution Network: By embedding services, CIMB effectively expands its distribution network without the need for physical branches, reaching a wider demographic.

CIMB Group Holdings utilizes a multi-channel approach, blending its robust digital platforms like CIMB Clicks with an extensive physical branch and ATM network. Strategic alliances with e-commerce and fintech partners further amplify its reach, embedding financial services into everyday digital activities. Dedicated call centers and online support ensure continuous customer engagement and problem resolution across all touchpoints.

| Channel | Description | Key Role | 2024 Data/Insight |

|---|---|---|---|

| Digital Platforms (CIMB Clicks) | Mobile app and online portals for comprehensive banking. | 24/7 accessibility, convenience, core transaction processing. | Over 90% of customer transactions in the Philippines were digital by late 2023. |

| Physical Branches | Extensive network across Malaysia, Indonesia, Singapore, Thailand, Cambodia. | Handling complex transactions, personalized advisory, catering to those preferring face-to-face interaction. | Continues to be vital for relationship banking and complex financial needs. |

| ATM Network | Widespread network for cash withdrawals, deposits, and basic banking. | Facilitating everyday transactions, complementing digital and branch services. | Millions of transactions processed monthly across key markets in early 2024. |

| Call Centers & Online Support | Immediate assistance and problem resolution. | Customer support, technical assistance for digital platforms, addressing urgent needs. | Essential for maintaining customer satisfaction with increasing digital transaction volumes. |

| Strategic Alliances (E-commerce/Fintech) | Integration of banking solutions within partner platforms. | Acquiring new digital customers, expanding service reach, seamless financial integration. | Aiming to onboard millions of new users through partnerships in 2024. |

Customer Segments

CIMB Group Holdings serves a wide array of retail individuals, encompassing everyone from everyday consumers to those with significant wealth. This segment receives a comprehensive suite of personal banking services, including savings accounts, various loan options, credit cards, and tailored wealth management strategies.

In 2024, CIMB continued its focus on financial inclusion, with initiatives aimed at boosting financial literacy and offering accessible micro-investment tools, particularly for individuals in underserved communities, reflecting a commitment to broader market participation.

CIMB Group Holdings recognizes Small and Medium Enterprises (SMEs) as a vital customer segment, offering a robust suite of financial services. These include crucial financing options, streamlined trade solutions, and innovative digital tools designed to foster business expansion. In 2023, CIMB disbursed RM16.3 billion in financing to SMEs across Malaysia, highlighting their commitment to this sector.

The bank is particularly focused on assisting SMEs in their digital transformation and the integration of Environmental, Social, and Governance (ESG) practices. This support extends to strategic technology investments, recognizing the need for SMEs to remain competitive in the evolving ASEAN economic landscape. For instance, CIMB's digital banking platform saw a 25% increase in SME adoption in the first half of 2024.

CIMB Group Holdings serves large corporations and institutions, including domestic and multinational companies, government-linked entities, and other financial institutions. For these clients, CIMB provides advanced wholesale banking, investment banking, treasury, and corporate finance solutions. This strategic focus is evident in CIMB's robust performance, with its wholesale banking segment consistently contributing significantly to the group's overall revenue. For instance, in the first quarter of 2024, CIMB reported a notable increase in its loan growth within this segment, reflecting strong demand for its sophisticated financial offerings.

Islamic Banking Clients

Islamic Banking Clients represent a significant and expanding demographic for CIMB, comprising individuals and businesses prioritizing Shariah-compliant financial solutions. CIMB distinguishes itself as a leading provider in this niche, offering a comprehensive array of Islamic banking products and services.

This segment is driven by a specific market demand and a strong cultural preference for ethical and faith-based financial practices. As of the first half of 2024, CIMB Islamic’s financing portfolio showed robust growth, reflecting the increasing adoption of Islamic finance. For instance, CIMB Islamic’s total assets grew by 8.5% year-on-year to RM178.3 billion by the end of 2023, demonstrating the segment's economic importance.

- Growing Market Share: CIMB actively targets and serves a substantial portion of the Malaysian population adhering to Islamic financial principles.

- Shariah-Compliant Offerings: The bank provides a full spectrum of products, including savings accounts, current accounts, financing, and investment solutions that adhere strictly to Islamic law.

- Customer Preference: This segment values financial dealings that are free from interest (riba) and align with ethical investment guidelines, a core tenet of Islamic banking.

- Economic Contribution: The increasing demand from Islamic Banking Clients contributes significantly to CIMB’s overall financial performance and market position.

Regional ASEAN Customers

CIMB Group Holdings leverages its extensive pan-ASEAN footprint, serving a diverse customer base across Malaysia, Indonesia, Singapore, Thailand, Cambodia, Vietnam, and the Philippines. This broad reach allows for tailored strategies in each market.

The bank actively refines its approach in every country, identifying and focusing on specific strengths and niche roles. This ensures CIMB optimizes its contribution to both its customers and the wider society throughout the region.

- Market Penetration: CIMB operates in seven key ASEAN markets, demonstrating a significant regional presence.

- Customer Focus: The strategy centers on understanding and serving the unique needs of customers in each specific country.

- Strategic Refinement: CIMB continuously adapts its business model to enhance its value proposition across its operating geographies.

- Societal Impact: Beyond financial services, the bank aims to make a positive societal contribution within each ASEAN nation.

CIMB Group Holdings caters to a broad spectrum of customers, from individual retail clients seeking everyday banking solutions to high-net-worth individuals requiring sophisticated wealth management. The bank also places significant emphasis on Small and Medium Enterprises (SMEs), providing them with vital financing and digital tools to foster growth.

Furthermore, CIMB serves large corporations and institutions with advanced wholesale and investment banking services, alongside a dedicated segment for Islamic banking clients who prefer Shariah-compliant financial products. This multi-faceted approach allows CIMB to capture diverse market needs across its operational regions.

| Customer Segment | Key Offerings | 2024/2023 Data Points |

|---|---|---|

| Retail Individuals | Savings, loans, credit cards, wealth management | Focus on financial inclusion and micro-investment tools. |

| SMEs | Financing, trade solutions, digital tools | RM16.3 billion disbursed in Malaysia (2023); 25% increase in digital banking adoption (H1 2024). |

| Corporations & Institutions | Wholesale banking, investment banking, treasury | Notable loan growth in Q1 2024; consistent revenue contribution. |

| Islamic Banking Clients | Shariah-compliant products | Total assets grew 8.5% YoY to RM178.3 billion (end of 2023). |

Cost Structure

CIMB Group Holdings dedicates a substantial part of its budget to technology and digital advancements. This includes significant investments in upgrading existing platforms, driving their digital transformation efforts, and implementing cutting-edge AI and data analytics capabilities. These crucial investments are designed to bolster the resilience of their digital infrastructure and elevate the overall user experience.

Furthermore, CIMB's commitment to innovation extends to robust cybersecurity measures, ensuring the safety and integrity of their digital operations. In 2024 alone, the group allocated over RM800 million towards these vital technology upgrades, underscoring their strategic focus on future growth and enhanced service delivery in the digital landscape.

Salaries, benefits, and ongoing training for CIMB's extensive global workforce represent a significant portion of their cost structure. This investment is crucial for maintaining a skilled and adaptable team across diverse operations.

CIMB is prioritizing talent development, earmarking over RM100 million for 2025 specifically for upskilling employees in areas like digital technologies, artificial intelligence, data analytics, and sustainability initiatives. This forward-looking investment aims to equip their personnel with the skills needed for future growth.

These personnel expenses are a primary driver of CIMB Group's overall operating costs, reflecting the substantial resources dedicated to human capital management and development within the organization.

CIMB's extensive branch and ATM network across ASEAN represents a significant cost component. In 2024, maintaining this physical footprint, encompassing rent, utilities, security, and staffing, requires substantial investment to ensure widespread accessibility and in-person service, even as digital channels gain traction.

Regulatory Compliance and Risk Management Costs

CIMB Group Holdings navigates a landscape of substantial regulatory compliance and risk management costs. Adhering to stringent banking regulations across its operating regions, such as anti-money laundering (AML) and data privacy laws, demands significant financial and human resources. These expenses are crucial for maintaining operational integrity and avoiding penalties.

Investments in robust risk management frameworks and advanced systems are paramount to safeguarding asset quality and ensuring overall financial stability. For instance, in 2024, financial institutions globally continued to allocate substantial budgets towards cybersecurity and regulatory technology (RegTech) solutions to meet evolving compliance demands.

- Regulatory Adherence: Costs associated with meeting diverse and evolving banking regulations across Southeast Asia, including Know Your Customer (KYC) and AML requirements.

- Risk Management Investments: Expenditures on sophisticated systems and personnel for credit risk, market risk, and operational risk management.

- Data Protection: Compliance with data privacy regulations, such as the PDPA in Malaysia, necessitates ongoing investment in IT infrastructure and data governance.

- Compliance Technology: Spending on technology solutions to automate and streamline compliance processes, reducing manual effort and error.

Marketing, Branding, and Customer Acquisition Expenses

CIMB Group Holdings allocates significant resources to marketing, branding, and customer acquisition to bolster its market share and connect with a broad customer base across ASEAN. These expenditures are crucial for sustaining a competitive edge and drawing in new clients within the dynamic banking landscape.

In 2024, CIMB continued its focus on digital marketing and personalized customer engagement strategies. For instance, their campaigns often highlight ease of access through mobile banking and tailored financial solutions, aiming to attract younger demographics and digitally savvy consumers.

- Digital Marketing Investment: CIMB's 2024 marketing budget heavily favored digital channels, including social media advertising and search engine optimization, to enhance online visibility and engagement.

- Brand Building Initiatives: The group undertook several branding initiatives throughout 2024, focusing on reinforcing its image as a reliable and innovative financial partner across its key markets.

- Customer Acquisition Costs: Costs associated with acquiring new customers, including onboarding incentives and promotional offers, remained a key component of their marketing spend, reflecting the competitive nature of the banking sector.

- Market Share Expansion: These investments are directly tied to CIMB's strategic objective of expanding its market share, particularly in high-growth segments and emerging economies within the ASEAN region.

CIMB's cost structure is heavily influenced by its significant investment in technology and digital transformation, with over RM800 million allocated in 2024 for upgrades, AI, and cybersecurity. This is complemented by substantial spending on talent development, with a RM100 million earmark for 2025 to upskill employees in digital and AI competencies. The extensive physical network of branches and ATMs also incurs considerable maintenance costs, including rent, utilities, and staffing.

Regulatory compliance and risk management represent another major cost area, requiring significant financial and human resources to adhere to stringent banking laws across ASEAN. Marketing and customer acquisition are also key expenditures, with a strong emphasis on digital channels and personalized engagement to maintain market share and attract new clients.

| Cost Category | 2024 Allocation (Illustrative) | Key Drivers |

|---|---|---|

| Technology & Digital | > RM800 million | Platform upgrades, AI/Data Analytics, Cybersecurity |

| Human Capital Development | > RM100 million (2025) | Upskilling in digital, AI, sustainability |

| Physical Network Operations | Significant | Branch/ATM maintenance, rent, utilities, staffing |

| Regulatory Compliance & Risk Management | Substantial | AML, KYC, data privacy, risk systems |

| Marketing & Customer Acquisition | Key Component | Digital marketing, brand building, acquisition incentives |

Revenue Streams

CIMB Group's primary revenue engine is Net Interest Income (NII). This is the profit generated from the spread between the interest CIMB earns on its lending activities, which include consumer, commercial, and wholesale loans, and its investment portfolio, versus the interest it pays out on customer deposits.

For the first quarter of 2024, CIMB reported a Net Interest Income of RM2.2 billion. This demonstrates the significant contribution of NII to the group's overall financial performance, highlighting the importance of maintaining a robust loan book and attracting stable deposit funding.

Sustaining healthy loan growth across its various customer segments and implementing effective deposit-gathering strategies are therefore paramount for CIMB to maximize its NII. This involves competitive pricing on loans and deposits, as well as offering attractive banking products.

CIMB Group Holdings derives substantial non-interest income from a diverse array of fee-based services, encompassing wealth management, investment banking advisory, underwriting, trade finance, and transaction charges. This robust fee and commission income is a cornerstone of their revenue, reflecting their strong client relationships and active participation in capital markets.

In 2024, CIMB's non-interest income, a significant portion of which is fee and commission income, demonstrated resilience. For instance, their wealth management segment continued to be a key contributor, with assets under management growing, leading to increased fee generation.

CIMB Group Holdings generates significant revenue from trading and investment activities. This includes income derived from treasury operations, foreign exchange trading, and the group's own proprietary investments. These revenue streams are dynamic, often fluctuating with market volatility and the success of their investment strategies.

For the first quarter of 2024, CIMB Group reported a substantial increase in non-interest income, with trading and investment income playing a key role. Specifically, their trading gains and investment income contributed positively to their overall financial performance, underscoring the importance of this segment to their profitability.

Asset Management and Wealth Management Fees

CIMB Group Holdings earns income by managing investment portfolios for both large institutions and individual clients through its dedicated asset management division. These fees are generally structured as a percentage of the total assets being managed.

This revenue stream is crucial for diversifying CIMB's overall income sources, making it less reliant on any single financial product or service.

For instance, in 2023, CIMB Group's asset management arm saw significant growth, reflecting strong client confidence and market participation. While specific fee percentages vary, the trend indicates a healthy contribution to the group's financial performance, with assets under management (AUM) for its asset management segment reaching substantial figures, underscoring the importance of this fee-based income.

- Income Generation: Fees are charged for managing investment portfolios for institutional and individual clients.

- Fee Structure: Typically calculated as a percentage of assets under management (AUM).

- Revenue Diversification: This segment plays a key role in broadening the group's revenue base.

Islamic Finance Profit Sharing and Fees

CIMB Group Holdings generates revenue from its Islamic finance segment through several Shariah-compliant avenues. These include profit-sharing arrangements, where the bank and its customers share in the profits generated from specific investments or financing activities, akin to a partnership model.

Lease rentals also form a significant part of this revenue stream. This involves CIMB purchasing an asset and leasing it to a customer, with the rental payments contributing to the bank's income. Additionally, various fees, permissible under Islamic finance principles, are charged for services rendered, such as management fees or transaction charges.

This specialized segment is crucial for CIMB, catering to a growing demand for ethical and religiously aligned financial products. In 2023, CIMB Islamic continued to show strong performance, with its total assets reaching RM148.3 billion, highlighting the growing importance of this revenue stream.

- Profit-Sharing Arrangements: CIMB shares profits with customers on Shariah-compliant investments and financing.

- Lease Rentals: Revenue is earned from leasing assets purchased by CIMB to customers.

- Permissible Fees: Various service and transaction fees are charged in accordance with Islamic finance principles.

- Segment Growth: CIMB Islamic’s total assets stood at RM148.3 billion in 2023, indicating robust performance.

CIMB Group Holdings generates revenue through various fee-based services beyond traditional interest income. These include wealth management, investment banking advisory, underwriting, trade finance, and transaction charges. For the first quarter of 2024, CIMB reported a significant increase in non-interest income, with fee and commission income being a major contributor, reflecting strong client engagement and capital markets activity.

Trading and investment activities also form a substantial revenue stream. This encompasses income from treasury operations, foreign exchange trading, and the group's proprietary investments. The first quarter of 2024 saw a positive contribution from trading gains and investment income, demonstrating the dynamic nature and importance of this segment to CIMB's profitability.

Asset management is another key revenue driver, with CIMB earning fees for managing investment portfolios for both institutional and individual clients. These fees are typically calculated as a percentage of assets under management (AUM). The growth in AUM for CIMB's asset management segment in 2023 underscores the increasing reliance on this fee-based income for revenue diversification.

CIMB's Islamic finance segment contributes revenue through profit-sharing arrangements, lease rentals, and various Shariah-compliant fees. CIMB Islamic's strong performance, with total assets reaching RM148.3 billion in 2023, highlights the growing significance of this specialized revenue stream.

| Revenue Stream | Description | 2024 Performance Indicator (Q1) | 2023 Data Point |

| Net Interest Income (NII) | Profit from lending and investment spread vs. deposit interest paid. | RM2.2 billion reported. | N/A |

| Fee & Commission Income | Revenue from wealth management, investment banking, trade finance, etc. | Significant increase noted in Q1 2024. | Wealth management segment showed growth. |

| Trading & Investment Income | Income from treasury, FX trading, and proprietary investments. | Positive contribution from trading gains and investment income. | N/A |

| Asset Management Fees | Fees for managing client investment portfolios (percentage of AUM). | N/A | Substantial AUM growth reported. |

| Islamic Finance Revenue | Profit-sharing, lease rentals, and Shariah-compliant fees. | N/A | CIMB Islamic total assets: RM148.3 billion. |

Business Model Canvas Data Sources

The CIMB Group Holdings Business Model Canvas is built using a combination of internal financial reports, extensive market research on the banking and financial services sector, and strategic insights derived from competitor analysis and industry trends. These diverse data sources ensure each component of the canvas is grounded in factual information and reflects the group's current operational reality and strategic direction.