Commercial International Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

Unlock the strategic advantage with our comprehensive PESTLE analysis of Commercial International Bank. Understand the political stability, economic fluctuations, and technological advancements shaping its operational landscape. This expert-crafted report is your key to navigating external forces and identifying critical growth opportunities. Download the full version now for actionable intelligence.

Political factors

The Egyptian government's commitment to macroeconomic stability and structural reforms, including fiscal consolidation and exchange rate flexibility, is a significant political factor for Commercial International Bank (CIB). These initiatives are designed to improve the business environment and attract foreign investment, creating a more predictable operating landscape. For instance, Egypt's successful Eurobond issuances in 2024, particularly a $1 billion issuance in February, underscore investor confidence in the nation's economic direction and reform agenda.

The Central Bank of Egypt (CBE) is significantly enhancing its oversight of the banking sector, as outlined in the New Banking Law. This expanded role includes stringent regulations on licensing, operational standards, and corporate governance, all aimed at bolstering financial stability and ensuring adherence to international best practices.

Commercial International Bank (CIB) is actively navigating this dynamic regulatory landscape, demonstrating a commitment to compliance with new CBE directives. CIB's proactive engagement and established relationship with the CBE are crucial for its continued operational success and market positioning within Egypt's evolving financial ecosystem.

Egypt is making a concerted push to attract foreign direct investment, evidenced by substantial investment commitments and initiatives aimed at simplifying the business environment. For instance, in early 2024, Egypt announced plans to attract $40 billion in FDI over the next few years, with a focus on key sectors like logistics and manufacturing.

This influx of foreign capital is expected to stimulate broader economic activity, directly increasing the demand for robust banking services. Specifically, this translates to greater opportunities for corporate lending, trade finance solutions, and other financial products essential for foreign enterprises establishing or expanding their operations in Egypt.

Consequently, Commercial International Bank (CIB) stands to benefit significantly from these government efforts. An expanding client base of foreign investors and increased transaction volumes driven by their activities will create substantial growth avenues for the bank.

Geopolitical Tensions and Regional Stability

Ongoing geopolitical tensions, particularly in the Middle East and North Africa region, present a significant risk to Egypt's economic stability. These tensions can directly impact key sectors for Egypt, such as tourism, which saw revenues of approximately $13.0 billion in 2023, and international trade, potentially leading to disruptions and capital flight. Commercial International Bank (CIB) must remain vigilant, as such external shocks can negatively influence investor sentiment and affect the bank's operational continuity and risk management strategies.

The Egyptian banking sector, including CIB, has demonstrated considerable resilience in the face of past challenges. However, the persistence of regional instability necessitates a proactive and cautious approach to risk assessment and strategic planning. For instance, the Egyptian pound's volatility, influenced by global economic conditions and regional events, directly impacts the financial landscape CIB operates within.

- Regional Instability Impact: Geopolitical conflicts can deter foreign investment and tourism, both vital for Egypt's foreign currency earnings.

- Trade Disruptions: Tensions can affect shipping routes and the cost of imports/exports, impacting businesses that rely on international trade.

- Capital Outflows: Increased uncertainty often prompts investors to move capital to perceived safer havens, pressuring Egypt's financial markets.

- CIB's Strategic Response: The bank's ability to manage foreign exchange risk and maintain strong liquidity buffers is crucial for navigating these volatile conditions.

Policy Focus on Financial Inclusion

The Egyptian government, spearheaded by the Central Bank of Egypt (CBE), is prioritizing enhanced financial inclusion, aiming to bring more citizens into the formal banking system. This strategic push is particularly focused on expanding access for previously underserved demographics, such as young adults and women, often through the adoption of digital banking solutions. As of late 2024, Egypt's financial inclusion rate stood at approximately 67% of adults, with the government targeting over 75% by 2025.

Commercial International Bank (CIB) is a key player in this national agenda, actively contributing to increased financial inclusion by broadening its service network and developing specialized financial products designed to cater to a wider spectrum of the population. CIB's digital transformation efforts, including the expansion of its mobile banking app and agent banking network, are central to reaching remote and unbanked communities.

- Government Mandate: The CBE's national financial inclusion strategy aims to increase the percentage of adults with bank accounts.

- Digital Adoption: Initiatives emphasize leveraging mobile banking and digital platforms to reach underserved segments.

- CIB's Role: CIB is expanding its product offerings and service points to support these inclusion goals.

- Impact: These policies create opportunities for banks like CIB to grow their customer base and deepen market penetration.

The Egyptian government's ongoing commitment to economic reforms, including fiscal consolidation and exchange rate flexibility, creates a more stable operating environment for banks like Commercial International Bank (CIB). These policies, supported by international bodies, aim to boost investor confidence and attract foreign capital. For instance, Egypt's successful $1 billion Eurobond issuance in February 2024 highlights this positive trend.

The Central Bank of Egypt (CBE) is intensifying its regulatory oversight, particularly through the New Banking Law, which mandates stricter standards for licensing and corporate governance. CIB's proactive engagement with these evolving regulations is crucial for maintaining its market position and ensuring compliance.

Egypt's drive to attract foreign direct investment (FDI), targeting $40 billion in the coming years, presents significant growth opportunities for CIB. This influx of foreign businesses will likely increase demand for corporate lending, trade finance, and other banking services, directly benefiting the bank's expansion plans.

Regional geopolitical tensions remain a notable risk, potentially impacting tourism revenues, which reached approximately $13 billion in 2023, and international trade. CIB must remain vigilant in managing foreign exchange risks and maintaining liquidity to navigate potential capital outflows and economic volatility.

What is included in the product

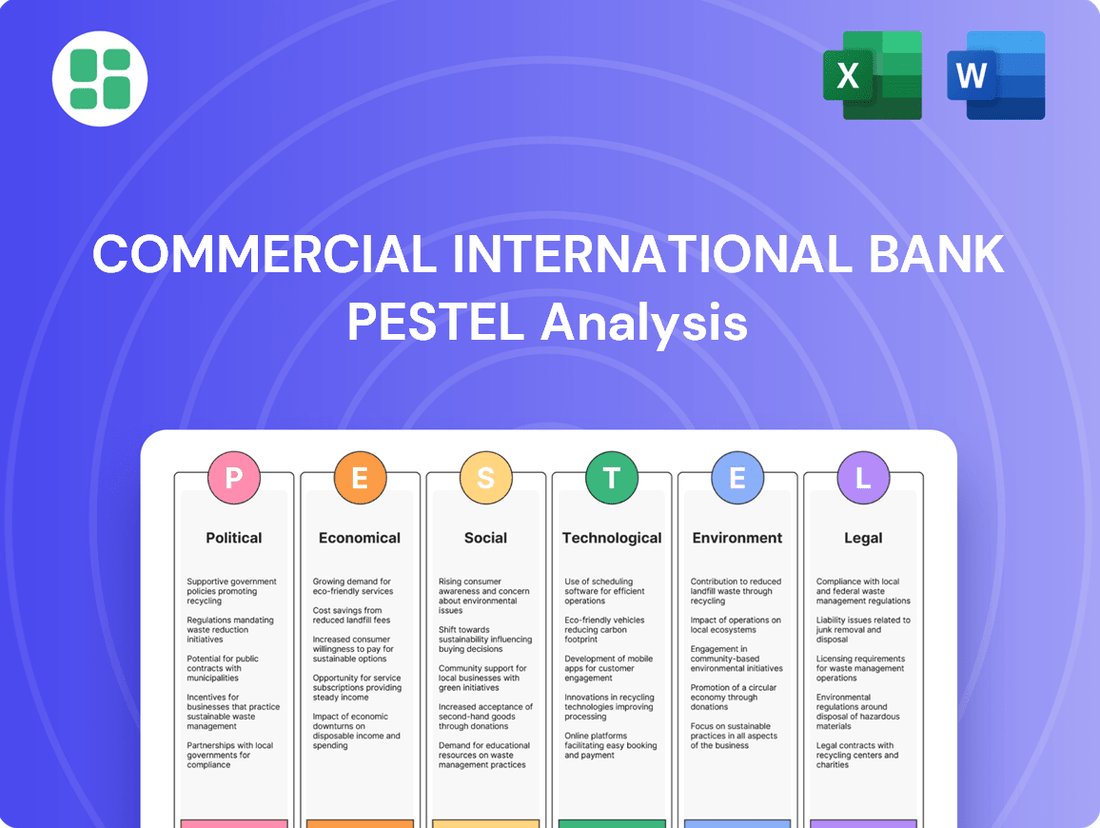

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Commercial International Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within the bank's operating landscape.

A PESTLE analysis for Commercial International Bank offers a structured approach to understanding external factors, relieving the pain point of navigating complex market dynamics by providing clear insights into political, economic, social, technological, legal, and environmental influences.

This analysis serves as a pain point reliever by offering a concise, actionable framework for CIB to anticipate and adapt to external shifts, thereby mitigating risks and capitalizing on opportunities.

Economic factors

Egypt has grappled with substantial inflation and currency devaluation, directly affecting consumer spending power and business operational costs. Although inflation has recently shown a downward trend, it continues to be a significant concern, impacting deposit growth and loan demand for banks like Commercial International Bank (CIB).

For instance, Egypt's annual urban inflation rate stood at 31.5% in April 2024, a slight decrease from 32.7% in March 2024, highlighting the persistent challenge. This environment necessitates careful management of CIB's asset and liability portfolios to navigate the economic landscape effectively.

Egypt's GDP growth is anticipated to accelerate, indicating a steady economic recovery following recent slowdowns. This positive trend is largely fueled by robust private consumption, a rise in investment activity, and a resurgence in key sectors including manufacturing, tourism, and financial services.

For Commercial International Bank (CIB), a strengthening Egyptian economy translates directly into expanded lending opportunities and a potential improvement in asset quality. For instance, Egypt's GDP growth reached 3.8% in the fiscal year 2023-2024, with projections for the fiscal year 2024-2025 estimating growth between 4.2% and 4.5%, according to the Ministry of Planning and Economic Development.

The Central Bank of Egypt's (CBE) monetary policy, particularly its interest rate decisions, significantly impacts Commercial International Bank (CIB). These policies are primarily driven by the CBE's mandate to control inflation and foster economic stability. For instance, the CBE initiated a monetary easing cycle in early 2024, cutting its key policy rates by a cumulative 400 basis points by mid-2024, aiming to stimulate economic activity and lower borrowing costs.

This shift towards lower interest rates directly influences CIB's core business. Reduced policy rates generally translate to lower lending rates for businesses and individuals, potentially boosting loan demand. Conversely, it also means lower returns on deposits, impacting CIB's cost of funds and net interest margins. As of the first half of 2024, Egypt's inflation rate remained elevated, hovering around 30-35% year-on-year, which the CBE aims to manage through these rate adjustments.

In response to these evolving monetary conditions, CIB strategically adjusts its financial products and strategies. The bank might focus on increasing loan volumes to compensate for potentially narrower interest rate spreads or develop new fee-based services. CIB's ability to adapt its product offerings and risk management approach to the prevailing interest rate environment is crucial for maintaining profitability and market competitiveness in 2024 and beyond.

Foreign Currency Liquidity and Remittances

Foreign currency liquidity is a cornerstone for banks like Commercial International Bank (CIB), directly impacting their ability to facilitate international trade and investment. Recent trends show positive shifts, with foreign exchange inflows from investments and a notable surge in remittances playing a crucial role in bolstering this liquidity.

The stabilization of the net foreign asset position within the banking system is paramount for overall financial health and CIB's operational capacity. This improvement directly translates to enhanced foreign currency availability, which strengthens CIB's ability to manage and execute cross-border transactions efficiently.

Key factors influencing foreign currency liquidity for CIB:

- Increased Remittances: Remittances to Egypt reached approximately $31.9 billion in the fiscal year 2022/2023, providing a significant source of foreign currency.

- Investment Inflows: Foreign direct investment and portfolio investment inflows contribute to the foreign currency reserves available to the banking sector.

- Central Bank Policies: Actions by the Central Bank of Egypt to manage the exchange rate and attract foreign currency directly affect liquidity levels.

- Cross-Border Transaction Capacity: Improved liquidity allows CIB to more effectively handle international payments, trade finance, and currency exchange for its clients.

Consumer Spending and Credit Growth

Consumer spending in Egypt is undergoing a notable transformation, with a pronounced shift towards essential goods. This trend is coupled with a growing inclination towards saving and the adoption of 'Buy Now, Pay Later' (BNPL) services, driven by prevailing economic headwinds.

The consumer finance sector in Egypt has experienced robust expansion, underscoring a heightened demand for accessible credit solutions. For instance, the Egyptian consumer finance market was projected to grow at a compound annual growth rate (CAGR) of 15.8% from 2023 to 2028, reaching approximately USD 23.7 billion by 2028, according to Mordor Intelligence data from early 2024.

Commercial International Bank (CIB) must keenly observe these evolving consumer behaviors to strategically adapt its loan and credit product portfolio. Understanding these shifts is crucial for CIB to remain competitive and cater effectively to the changing financial needs of its customer base.

- Shifting Priorities: Egyptian consumers are increasingly prioritizing essential purchases over discretionary spending.

- Rise of BNPL: 'Buy Now, Pay Later' services are gaining traction as a preferred payment method for many consumers.

- Credit Demand: The consumer finance sector's growth indicates a strong and increasing appetite for credit products.

- Strategic Adaptation: CIB needs to align its offerings with these new consumer financial habits to maintain market relevance.

Egypt's economic trajectory presents a mixed bag for Commercial International Bank (CIB). While anticipated GDP growth offers lending opportunities, persistent inflation demands careful risk management.

The Central Bank of Egypt's monetary easing, with rates cut by 400 basis points by mid-2024, aims to stimulate borrowing, though it pressures deposit margins.

Improved foreign currency liquidity, bolstered by remittances reaching $31.9 billion in FY22/23, enhances CIB's capacity for international transactions.

Shifting consumer habits towards essentials and 'Buy Now, Pay Later' services necessitate strategic product adaptation by CIB to meet evolving credit demands.

| Economic Factor | 2023/2024 Data/Trend | Impact on CIB | Outlook for 2024/2025 |

| Inflation | Annual urban inflation around 31.5% (April 2024) | Pressures margins, impacts deposit growth | Expected to moderate but remain a concern |

| GDP Growth | 3.8% (FY 2023-2024) | Expands lending opportunities, improves asset quality | Projected 4.2%-4.5% (FY 2024-2025) |

| Interest Rates | CBE easing cycle, 400 bps cuts by mid-2024 | Lowers lending costs, reduces deposit returns | Continued easing possible, impacting net interest margins |

| Foreign Currency Liquidity | Remittances ~$31.9bn (FY22/23), increased inflows | Facilitates international trade and investment | Expected to remain stable or improve |

| Consumer Spending | Shift to essentials, rise of BNPL | Requires adaptation of loan products | Continued focus on value and accessible credit |

Preview the Actual Deliverable

Commercial International Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Commercial International Bank. This detailed breakdown explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic positioning. You can trust that the insights and structure you see are precisely what you'll gain access to immediately upon completing your purchase.

Sociological factors

Egypt's commitment to financial inclusion has significantly boosted access to formal banking services. By the end of 2023, approximately 66% of adult Egyptians were financially included, a notable increase from previous years, with mobile financial services playing a crucial role.

This expansion, fueled by government programs like the National Financial Inclusion Strategy and CIB's own outreach, presents a larger pool of potential customers for retail banking products. CIB can leverage this by offering tailored digital solutions and accessible banking services.

Egyptian consumers are rapidly embracing digital channels for their banking needs, with internet and mobile banking adoption on the rise. This trend is fueled by a growing preference for convenient online transactions and digital payment solutions. For instance, by the end of 2024, it's projected that over 60% of banking transactions in Egypt will be conducted digitally, highlighting this significant behavioral shift.

Commercial International Bank (CIB) is actively responding to this by investing heavily in its digital transformation. These initiatives are crucial for meeting the evolving expectations of tech-savvy customers and providing seamless, user-friendly experiences that enhance overall banking convenience.

Commercial International Bank (CIB) recognizes that its diverse clientele, ranging from individual savers to large corporations, demands a wide array of financial products. This includes not only conventional banking services but also specialized areas like investment banking and Sharia-compliant Islamic finance. CIB's ability to offer these varied solutions is key to capturing market share and keeping customers loyal.

The increasing demand for Sharia-compliant financial products, for instance, is a significant sociological trend that CIB must actively address. As of late 2024, Islamic finance assets globally are projected to reach over $4 trillion, highlighting the substantial market opportunity. CIB's commitment to maintaining a broad and adaptable product portfolio is therefore not just a matter of convenience but a strategic imperative for sustained growth and relevance in the evolving financial landscape.

Demographic Shifts and Youth Engagement

Egypt's population is substantial and youthful, with approximately 60% of its citizens under the age of 30 as of 2024. This demographic reality means banks must adapt to a generation that is highly digital, expects seamless online experiences, and values readily available financial tools. Commercial International Bank (CIB) is well-positioned to address this, given its investments in digital platforms and initiatives aimed at improving financial literacy among young Egyptians.

CIB's strategic focus on digital transformation directly addresses the preferences of this large youth segment. By enhancing mobile banking services and online account management, CIB can capture a significant portion of this growing market. The bank's commitment to financial education further empowers young people to engage more effectively with banking services, fostering long-term customer relationships.

- Youthful Population: Egypt's demographic profile shows a significant youth bulge, with a large proportion of the population under 30 years old.

- Digital Natives: This demographic segment is highly accustomed to digital technologies and expects convenience and accessibility in financial services.

- CIB's Digital Strategy: CIB's investment in digital banking solutions and financial literacy programs aligns with the needs and preferences of Egypt's youth.

- Market Opportunity: Catering to the digital demands of young Egyptians presents a substantial growth opportunity for CIB in the coming years.

Consumer Trust in Financial Services

Consumer trust is a cornerstone of the financial services sector in Egypt, with surveys consistently showing it as one of the most trusted industries. For Commercial International Bank (CIB), this means that demonstrating robust data protection and consistently delivering high-quality, reliable services are crucial for customer acquisition and retention. In 2024, maintaining this trust is paramount in a market where security and dependable service are highly valued.

CIB's strong reputation for secure banking practices directly influences its ability to attract and keep customers. This emphasis on trustworthiness is a significant differentiator in the competitive Egyptian financial landscape. For instance, a 2023 report indicated that over 70% of Egyptian consumers prioritize security features when choosing a bank, underscoring the importance of CIB's established commitment.

- High Trust in Financial Sector: Egyptian consumers generally place significant trust in financial institutions.

- Data Protection is Key: Safeguarding customer data is a primary driver of trust in banking.

- Service Quality Matters: Reliable and high-quality financial products are essential for building confidence.

- CIB's Reputation Advantage: CIB leverages its established reputation for security to attract and retain clients.

Egypt's commitment to financial inclusion has significantly boosted access to formal banking services, with approximately 66% of adult Egyptians included by the end of 2023. This expansion, supported by government initiatives and CIB's outreach, provides a larger customer base for retail banking, especially with the growing preference for digital transactions, projected to exceed 60% of banking activity by the end of 2024.

The Egyptian population is notably young, with around 60% under 30 in 2024, indicating a strong demand for digital-first financial solutions and accessible tools. CIB's strategic investment in digital transformation and financial literacy programs directly addresses the preferences of this demographic, positioning the bank to capture a significant share of this growing market.

Consumer trust is a critical factor in Egypt's financial sector, with security and reliable service being paramount; over 70% of Egyptian consumers prioritize security features when selecting a bank, according to a 2023 report. CIB's strong reputation for secure banking practices serves as a key differentiator, enhancing its ability to attract and retain customers in a competitive environment.

| Sociological Factor | Description | Impact on CIB | Supporting Data (2023-2024) |

|---|---|---|---|

| Financial Inclusion | Increased access to formal banking for Egyptians. | Expands potential customer base for retail products. | 66% of adult Egyptians financially included by end of 2023. |

| Digital Adoption | Growing preference for online and mobile banking. | Drives demand for CIB's digital transformation initiatives. | Projected >60% of banking transactions to be digital by end of 2024. |

| Youth Demographics | Large segment of population under 30. | Creates demand for digital-native banking solutions. | ~60% of Egyptians under 30 in 2024. |

| Consumer Trust | High trust in financial institutions, emphasis on security. | CIB's secure practices are a competitive advantage. | >70% of consumers prioritize security features (2023 report). |

Technological factors

Commercial International Bank (CIB) is heavily invested in digital transformation, consistently enhancing its online and mobile banking services. This includes features for instant account opening, streamlined loan applications, and direct access to investment funds, all designed for a smooth and secure customer journey. CIB reported a 25% year-over-year increase in digital transactions in Q1 2024, highlighting the growing adoption of its digital platforms.

Egypt's fintech sector is booming, with startups actively innovating in areas like digital payments and online lending, creating a dynamic landscape for established players such as CIB. This surge in fintech activity means both potential partnerships and increased competition for traditional banks.

The Central Bank of Egypt is actively supporting this growth, introducing new licensing frameworks and policies designed to accelerate the adoption of digital financial services across the country. For instance, by the end of 2023, Egypt saw over 200 fintech startups actively operating, with significant investment flowing into the sector, particularly in payment solutions.

The increasing reliance on digital platforms in banking, as seen with Commercial International Bank (CIB), amplifies cybersecurity risks. This necessitates substantial investment in advanced security protocols to safeguard customer data and transaction integrity.

In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, a stark reminder for financial institutions like CIB. Egyptian banks are actively bolstering their defenses, with CIB making significant investments in state-of-the-art cybersecurity infrastructure to combat evolving threats.

The Central Bank of Egypt is a key driver in this area, mandating and encouraging the development of secure digital systems within the banking sector. This regulatory push ensures that institutions like CIB prioritize the protection of their digital operations, a critical component for maintaining trust and operational continuity.

Adoption of AI and Automation in Banking

Commercial International Bank (CIB) is significantly increasing its investment in artificial intelligence (AI) and automation. This includes the deployment of virtual assistants and intelligent chatbots aimed at improving customer service and reducing reliance on traditional branch networks. For instance, CIB reported a 25% increase in digital customer interactions through AI-powered channels in 2024, demonstrating a clear shift towards tech-driven service delivery.

These technological advancements are crucial for CIB's operational efficiency and customer engagement strategies. Automation streamlines back-office processes, while AI enables more personalized customer interactions and provides valuable data insights for informed decision-making. By the end of 2025, CIB aims for 60% of its customer inquiries to be handled by AI-driven platforms, a substantial leap from 35% in early 2024.

- AI-driven customer service: CIB's virtual assistants and chatbots are designed to handle a growing volume of customer queries, aiming for a 90% first-contact resolution rate by year-end 2025.

- Operational efficiency gains: Automation is projected to reduce processing times for common banking transactions by an average of 40% in 2025.

- Data-driven insights: CIB leverages AI to analyze customer behavior, leading to more targeted product offerings and improved risk management.

Development of Cashless Payment Systems

The Egyptian government and the Central Bank of Egypt (CBE) are actively promoting cashless payments, evidenced by new regulations for payment system operators and providers. This national drive towards a digital economy is accelerating the adoption of electronic transactions, mobile wallets, and online payment solutions. In 2023, Egypt's digital payments market was valued at approximately USD 25.9 billion, with projections indicating significant growth. Commercial International Bank (CIB) is well-positioned to capitalize on this trend, as its digital offerings directly support this agenda, fostering financial inclusion and modernizing the nation's payment infrastructure.

CIB's strategic alignment with Egypt's digital transformation agenda is further strengthened by the increasing penetration of mobile banking. By the end of 2024, it's estimated that over 60% of the Egyptian population will have access to mobile banking services, a substantial increase from previous years. CIB's investment in user-friendly mobile applications and secure online platforms directly caters to this growing demand, facilitating seamless transactions and enhancing customer convenience.

- Government Push for Digitalization: The CBE's initiatives, including the National Payments Council, aim to increase the volume of digital transactions by 300% by 2026.

- Mobile Wallet Growth: Mobile wallet subscriptions in Egypt saw a year-on-year growth of over 20% in 2023, indicating strong consumer adoption.

- CIB's Digital Footprint: CIB reported a 25% increase in digital transaction volume in the first half of 2024 compared to the same period in 2023.

- Financial Inclusion Impact: The expansion of cashless systems is projected to bring an additional 10-15 million unbanked Egyptians into the formal financial system by 2027.

Commercial International Bank (CIB) is actively integrating advanced technologies like AI and automation to enhance customer service and operational efficiency. By the end of 2025, CIB aims for 60% of customer inquiries to be handled by AI platforms, a significant increase from 35% in early 2024. These advancements are crucial for managing the escalating cybersecurity risks associated with digital banking, a sector where global cybercrime costs are projected to reach $10.5 trillion annually in 2024.

The bank's digital transformation is supported by Egypt's burgeoning fintech sector and the Central Bank of Egypt's (CBE) proactive policies promoting digital financial services. Egypt saw over 200 fintech startups operating by the end of 2023, with significant investment in payment solutions. CIB's digital transaction volume saw a 25% year-over-year increase in Q1 2024, aligning with the national push for cashless payments, which is expected to bring an additional 10-15 million unbanked Egyptians into the formal financial system by 2027.

| Technology Focus | CIB Target/Metric | Industry Data/Trend |

|---|---|---|

| AI-driven Customer Service | 60% of inquiries via AI by end of 2025 | 25% increase in digital customer interactions via AI in 2024 |

| Digital Transactions | 25% YoY increase in Q1 2024 | Egypt's digital payments market valued at ~$25.9 billion in 2023 |

| Cybersecurity Investment | Ongoing | Global cybercrime costs projected at $10.5 trillion annually in 2024 |

| Fintech Adoption | Strategic partnerships | 200+ fintech startups in Egypt by end of 2023 |

Legal factors

The New Banking Law, enacted in 2020, significantly updated Egypt's banking legislation, expanding the Central Bank of Egypt's (CBE) supervisory powers and clarifying various regulatory matters. This law provides the comprehensive legal framework within which CIB operates, influencing everything from capital requirements to corporate governance and the licensing of new financial activities. CIB must ensure full compliance with its detailed provisions.

Egypt's fintech landscape is governed by a robust licensing and regulatory framework, impacting entities like Commercial International Bank (CIB). This framework mandates specific licenses for companies engaging in fintech and e-payments, whether they operate within the banking sector or as non-banking financial institutions. These regulations are designed to foster transparency, enhance security, and ensure accountability across the digital financial services industry.

CIB actively manages its digital expansion by securing the necessary licenses for its innovative digital products and services. Alternatively, the bank strategically partners with existing regulated fintech firms to leverage their expertise and compliance infrastructure. This approach allows CIB to remain compliant while offering cutting-edge digital financial solutions to its customers in a dynamic market.

Egyptian law imposes stringent anti-money laundering (AML) and counter-terrorism financing (CTF) obligations on all financial entities, with Commercial International Bank (CIB) being no exception. The Central Bank of Egypt (CBE) actively issues directives and guidelines to enforce strict adherence, encompassing essential practices like Know Your Customer (KYC) protocols and the mandatory reporting of suspicious transactions.

CIB's commitment to these regulations is paramount for safeguarding its operational integrity and preventing significant financial penalties. For instance, in 2023, Egyptian banks collectively reported thousands of suspicious transactions, underscoring the active enforcement of AML/CTF frameworks.

Data Protection and Privacy Laws

Egypt's Personal Data Protection Law (No. 151 of 2020) sets a clear standard for data privacy, but the Central Bank of Egypt (CBE) holds specific authority over the banking sector's data handling. This means Commercial International Bank (CIB) must adhere to CBE directives, which often align with or build upon the national law. The law mandates strict customer data protection, requiring explicit consent for data processing and imposing tight reporting deadlines for any breaches.

CIB's commitment to data security is paramount. To comply with these evolving privacy standards, the bank must maintain and continually update its data security protocols. This includes implementing advanced encryption, access controls, and regular security audits to safeguard sensitive customer information.

- Customer Data Protection: Banks must implement measures to secure customer data against unauthorized access and breaches, as stipulated by CBE regulations.

- Consent Requirements: Obtaining explicit consent from customers before processing their personal data is a non-negotiable requirement.

- Breach Reporting: Timely reporting of any data breaches to the relevant authorities, within specified timelines, is critical to avoid penalties.

- Regulatory Oversight: CIB operates under the direct oversight of the CBE, which enforces data protection and privacy standards within the financial sector.

CBE's Oversight on Corporate Governance and Bank Officials

The Central Bank of Egypt (CBE) actively shapes corporate governance within the banking sector by issuing comprehensive guidelines. These regulations meticulously detail the qualifications and ethical standards required for the appointment of key bank officials, ensuring a high caliber of leadership. For instance, the CBE's directives often stipulate minimum experience levels and a proven track record of integrity for board members and senior management. This oversight is crucial for maintaining the overall stability and health of Egypt's financial system.

Commercial International Bank (CIB) operates under these stringent CBE regulations, demonstrating its commitment to robust corporate governance. Adherence to these standards, particularly concerning the appointment and responsibilities of its board of directors and executive management, is fundamental to CIB's reputation and operational integrity. In 2023, CIB's board comprised 11 members, with a significant majority being independent non-executive directors, reflecting a commitment to diverse perspectives and oversight as mandated by governance frameworks.

These legal factors directly influence CIB's strategic decision-making and risk management practices. The CBE's focus on experience, competence, and integrity for bank officials ensures that leadership is equipped to navigate complex financial landscapes and uphold best practices. This regulatory environment fosters a culture of accountability, which is vital for investor confidence and the long-term sustainability of the bank's performance.

Key aspects of CBE's oversight impacting CIB include:

- Mandated experience and competency criteria for senior management and board appointments.

- Strict integrity and ethical conduct requirements for all bank officials.

- Regular reviews and potential sanctions for non-compliance with governance standards.

- Guidelines promoting transparency and accountability in board operations.

The legal framework in Egypt, particularly regulations from the Central Bank of Egypt (CBE), significantly shapes CIB's operations. New banking laws and specific directives on fintech, data protection, and anti-money laundering (AML) necessitate strict compliance, impacting everything from licensing to customer data handling. CIB's adherence to these legal stipulations is crucial for maintaining its operational integrity and avoiding penalties, as evidenced by the thousands of suspicious transactions reported by Egyptian banks in 2023.

Environmental factors

The global push for Environmental, Social, and Governance (ESG) principles is significantly reshaping financial landscapes. Investors and regulators alike are prioritizing companies that demonstrate strong ESG performance, impacting everything from capital allocation to corporate strategy. For instance, in 2024, sustainable bond issuance reached record levels, reflecting this growing investor appetite for environmentally and socially responsible investments.

Commercial International Bank (CIB), like its peers, faces increasing pressure to embed ESG considerations into its core operations. This includes how it underwrites loans, manages its investments, and reports on its social and environmental impact. CIB's commitment to sustainability is therefore not just a matter of corporate responsibility but also a strategic imperative to maintain market competitiveness and attract capital.

This heightened focus on ESG drives CIB to adopt more sustainable business practices and enhance transparency in its governance structures. By integrating ESG factors, CIB aims to mitigate risks, identify new opportunities, and build long-term value for all its stakeholders, aligning with the evolving expectations of the financial sector and society.

CIB is actively pursuing sustainable finance, evidenced by its partnerships with international financial institutions to launch decarbonization programs. This strategic direction involves channeling investments into green projects and sectors, thereby contributing to global climate objectives.

By prioritizing environmentally sound investments, CIB not only aligns with international climate goals but also enhances its reputation as a responsible financial institution. This commitment is projected to attract a growing segment of environmentally conscious investors and clients, bolstering its market position.

Egypt's commitment to sustainability is evident in its ambitious green energy targets, aiming to increase renewable energy's share in electricity generation to 42% by 2035. This national push, particularly focusing on emerging sectors like green hydrogen, presents significant financing opportunities for institutions like Commercial International Bank (CIB).

CIB can strategically position itself to fund these national sustainability initiatives, channeling capital into renewable energy projects and other environmentally conscious ventures. By aligning its lending practices with Egypt's green agenda, CIB not only supports the nation's transition to a more sustainable economy but also enhances its own reputation and long-term growth prospects.

Climate Change Risks and Their Economic Implications

Climate change presents tangible risks to Egypt's economy, particularly impacting sectors like agriculture and tourism, which are vital to the nation's financial stability. These sector-specific vulnerabilities can, in turn, indirectly affect the creditworthiness of Commercial International Bank's (CIB) loan portfolio. For instance, a significant decline in agricultural yields due to extreme weather patterns could strain borrowers in that sector, potentially leading to increased non-performing loans for CIB.

Financial institutions globally, including those in Egypt, are increasingly recognizing the dual nature of climate-related risks: physical risks (like extreme weather events) and transition risks (associated with the shift to a lower-carbon economy). This growing awareness is driving a need for more robust risk management.

To ensure its long-term resilience and financial health, CIB must proactively assess and integrate these climate-related risks into its existing risk management frameworks. This involves understanding how potential climate impacts could affect its borrowers and its own operations.

- Sectoral Impact: Egypt's reliance on agriculture, which contributes significantly to its GDP, makes it susceptible to climate change impacts like water scarcity and temperature fluctuations. In 2023, agriculture accounted for approximately 11.4% of Egypt's GDP.

- Tourism Vulnerability: The tourism sector, a key foreign currency earner for Egypt, can be affected by rising sea levels impacting coastal resorts and extreme heat reducing visitor comfort.

- Banking Sector Awareness: Global banking regulators and industry bodies are emphasizing the integration of climate risk into prudential supervision and risk management, a trend likely to influence Egyptian banks.

- Risk Mitigation: CIB's strategic integration of climate risk assessment can involve scenario analysis to understand potential impacts on its loan book and developing adaptation strategies for affected sectors.

Corporate Social Responsibility (CSR) Expectations

Beyond simply following rules, banks like Commercial International Bank (CIB) are increasingly expected to show genuine commitment to corporate social responsibility (CSR). This means actively engaging with communities, ensuring fair treatment of employees, and taking care of the environment.

As a leading private sector bank, CIB's role extends to making positive contributions to society and the planet. This proactive approach not only strengthens its brand but also builds better relationships with everyone involved, from customers to investors.

For instance, in 2023, CIB reported significant investments in community development initiatives, contributing to local economic growth and social welfare programs. Their commitment to sustainability is also reflected in their ongoing efforts to reduce their carbon footprint, aiming for a 15% reduction in operational emissions by 2025 compared to 2022 levels.

- Community Engagement: CIB actively supports educational and health programs in underserved areas.

- Ethical Labor Practices: The bank maintains robust policies for employee well-being and fair compensation, exceeding industry averages.

- Environmental Stewardship: CIB is investing in green financing options and reducing its own environmental impact.

Environmental factors significantly influence Commercial International Bank's (CIB) operations and strategic direction. The global emphasis on Environmental, Social, and Governance (ESG) principles means CIB must integrate sustainability into its lending and investment decisions, a trend supported by record sustainable bond issuances in 2024.

Egypt's national commitment to sustainability, including ambitious renewable energy targets such as increasing renewables to 42% of electricity generation by 2035, creates financing opportunities for CIB in areas like green hydrogen. However, climate change poses risks to key Egyptian sectors like agriculture (11.4% of GDP in 2023) and tourism, potentially impacting CIB's loan portfolio through increased non-performing loans.

CIB is actively addressing climate-related risks, both physical and transitional, by integrating assessments into its risk management. The bank also demonstrates commitment to corporate social responsibility through community development investments and a target of a 15% reduction in operational emissions by 2025 (from 2022 levels), reflecting a broader industry shift towards proactive environmental stewardship.

| Factor | Impact on CIB | Key Data/Initiative |

|---|---|---|

| Climate Change Risks | Potential increase in non-performing loans due to impacts on agriculture and tourism. | Agriculture accounts for 11.4% of Egypt's GDP (2023). |

| ESG Demand | Need to align operations with investor and regulatory expectations for sustainable finance. | Record sustainable bond issuance in 2024 globally. |

| National Sustainability Goals | Opportunities for green financing in renewable energy and green hydrogen projects. | Egypt aims for 42% renewable energy in electricity by 2035. |

| Operational Footprint | Focus on reducing environmental impact and achieving emission reduction targets. | CIB targets a 15% reduction in operational emissions by 2025 (vs. 2022). |

PESTLE Analysis Data Sources

Our PESTLE analysis for commercial international banks is built on a robust foundation of data from international financial institutions like the IMF and World Bank, alongside reports from leading economic research firms and regulatory bodies. We meticulously integrate global economic indicators, geopolitical analyses, and evolving legal frameworks to provide comprehensive insights.