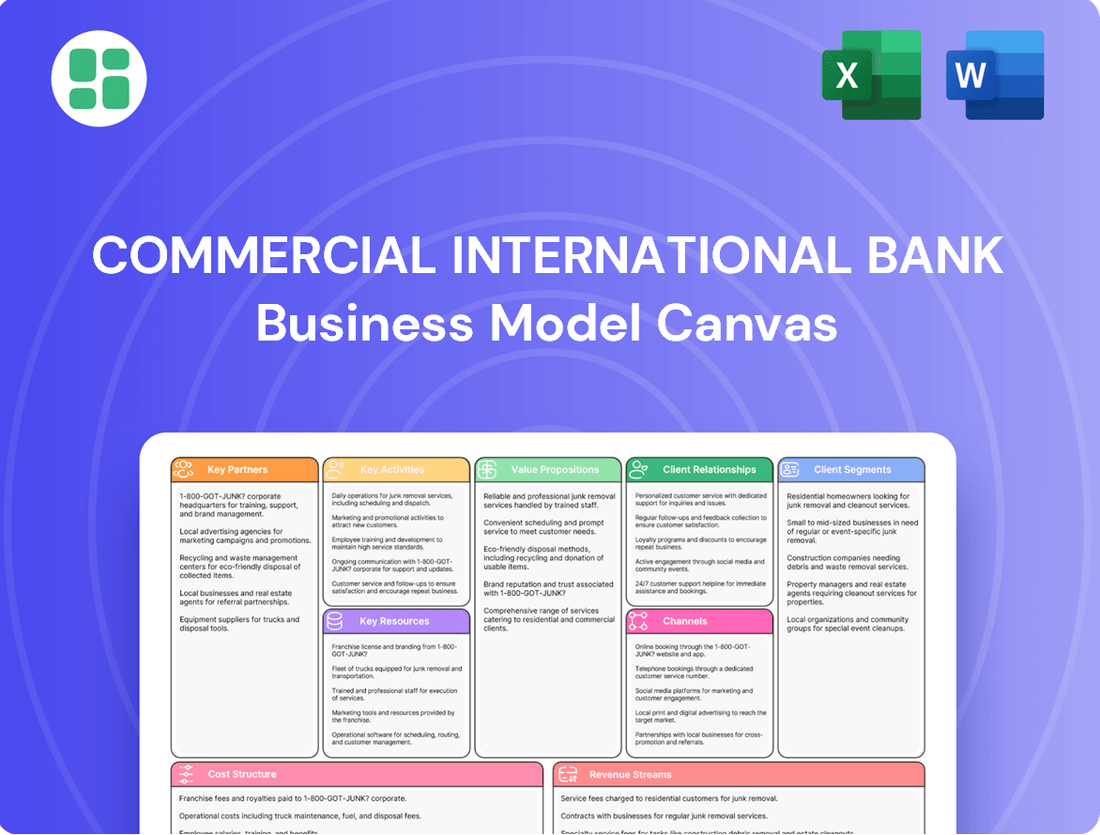

Commercial International Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

Uncover the strategic core of Commercial International Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how CIB effectively serves its diverse customer segments and leverages key partnerships to deliver unique value propositions. Gain actionable insights into their revenue streams and cost structures.

Partnerships

Commercial International Bank (CIB) actively cultivates strategic alliances with leading technology and fintech companies. These partnerships are designed to bolster CIB's digital banking capabilities, introduce cutting-edge payment solutions, and elevate the overall customer experience. A prime example is CIB's collaboration with WE, Egypt's prominent telecommunications provider, to integrate financial services into their extensive digital ecosystem.

These collaborations are instrumental in CIB's ambitious digital transformation agenda. By leveraging the expertise of tech and fintech partners, CIB aims to streamline mobile banking applications and enhance digital payment platforms. This strategic approach is also vital for broadening financial inclusion across Egypt, reaching a wider segment of the population with accessible digital financial tools.

Commercial International Bank (CIB) actively partners with international financial institutions such as the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD). These collaborations are vital for bolstering CIB's capital, enabling increased lending to crucial sectors like Small and Medium-sized Enterprises (SMEs), and advancing sustainable finance practices. For instance, in 2023, the IFC provided CIB with a significant funding facility to support its green finance initiatives, demonstrating a commitment to environmental, social, and governance (ESG) principles.

Commercial International Bank (CIB) actively partners with the Central Bank of Egypt (CBE) and various government entities. These collaborations are crucial for ensuring adherence to Egypt's banking regulations and contribute significantly to national financial stability. For instance, CIB's participation in initiatives aligned with the CBE's goals supports broader economic agendas, including enhancing financial inclusion across the nation.

CIB's engagement extends to its role within the Federation of Egyptian Banks. This partnership allows CIB to contribute to and influence the overall legal and operational framework of the Egyptian banking sector. Such involvement is vital for fostering a robust and evolving financial landscape, reflecting CIB's commitment to industry development and regulatory alignment.

Industry Associations and Export Councils

Collaborating with industry-specific councils, like the Food Export Council and the Chemical & Fertilizers Export Council, allows CIB to provide specialized financial and advisory services. These partnerships are crucial for supporting vital economic sectors and fostering international trade.

These alliances directly contribute to Egyptian exporters gaining access to new global markets. This, in turn, plays a significant role in helping the nation achieve its ambitious export growth targets.

- Facilitating Trade: Partnerships with export councils streamline international transactions for businesses.

- Market Access: CIB helps Egyptian companies tap into new export opportunities.

- Economic Growth: These collaborations directly support national export development goals.

Large Corporations and Enterprise Clients

Commercial International Bank (CIB) cultivates deep relationships with large corporations and enterprise clients, offering a full suite of financial services. This includes crucial support through syndicated loans, vital for large-scale investments, and robust trade finance solutions that facilitate international commerce. CIB also provides sophisticated investment banking services, advising on mergers, acquisitions, and capital raising.

These strategic alliances are fundamental to CIB's business model, reinforcing its standing as a premier financial partner. A prime example of this commitment is CIB's involvement in financing significant infrastructure and development projects. For instance, CIB played a key role in the financing of the Four Seasons development, demonstrating its capacity to support major ventures that drive economic growth.

CIB's engagement with these large clients is characterized by tailored financial solutions designed to meet complex business needs. The bank's ability to structure and execute large-value transactions underscores its expertise and reliability. This focus on enterprise-level partnerships is a cornerstone of CIB's strategy to maintain a leading position in the Egyptian financial market.

- Syndicated Loans: CIB actively participates in and leads syndicated loan facilities for major corporate clients, providing substantial capital for diverse projects.

- Trade Finance: The bank offers comprehensive trade finance solutions, including letters of credit and guarantees, supporting the international trade activities of its corporate partners.

- Investment Banking: CIB's investment banking arm provides advisory services for capital markets transactions, mergers, acquisitions, and corporate restructuring.

- Key Project Financing: CIB's commitment is evident in its financing of landmark projects, such as its significant contribution to the Four Seasons development, facilitating substantial economic impact.

CIB's key partnerships with technology firms and fintech innovators are crucial for enhancing its digital offerings and customer experience. Collaborations with telecom providers like WE integrate financial services into broader digital ecosystems, expanding reach and accessibility. These alliances are fundamental to CIB's digital transformation, aiming to streamline mobile banking and payment platforms, thereby fostering greater financial inclusion across Egypt.

What is included in the product

This Business Model Canvas for Commercial International Bank (CIB) outlines its strategy for serving diverse customer segments through multiple channels, delivering tailored financial products and services as its core value proposition.

It details CIB's operational structure, revenue streams, and key resources, reflecting its market position and competitive advantages in the banking sector.

The Commercial International Bank Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex banking operations, allowing for rapid identification of inefficiencies and areas for improvement.

Activities

Commercial International Bank's core banking operations are centered on providing essential financial services. This includes taking deposits from customers and offering a range of lending products, such as loans for corporations, individuals, small and medium-sized enterprises, and mortgages. The bank also manages credit card services, all of which are fundamental to its revenue generation and customer engagement.

These traditional banking activities are the engine driving CIB's business, primarily generating income through net interest. In 2024, Egyptian banks, including CIB, continued to navigate a dynamic economic landscape, with interest rate policies playing a crucial role in net interest margin performance. CIB's ability to effectively manage its deposit base and loan portfolio remains paramount to its financial health.

Commercial International Bank (CIB) prioritizes the ongoing enhancement of its digital banking platforms, encompassing mobile and internet banking. This focus ensures customers receive secure and convenient 24/7 access to services, a critical component of their strategy to meet evolving customer expectations.

Significant investment in robust digital infrastructure underpins CIB's commitment to innovation. This includes the implementation of features like digital onboarding and the promotion of cashless transactions, directly contributing to a superior customer experience and increased operational efficiency. For instance, in 2023, CIB reported a substantial increase in digital transactions, highlighting the success of these initiatives.

Commercial International Bank (CIB) actively participates in investment banking and advisory services, offering crucial financial guidance, asset management, and capital market solutions. These services are primarily geared towards large corporations and institutional clients, addressing their intricate financial requirements.

This strategic focus on investment banking allows CIB to generate significant non-interest income. For instance, in 2023, CIB's investment banking and advisory fees contributed substantially to its overall revenue, demonstrating the profitability of these specialized offerings and their role in supporting corporate expansion and significant transactions.

Risk Management and Regulatory Compliance

Commercial International Bank (CIB) prioritizes robust risk management and strict regulatory compliance as core activities. This involves maintaining sophisticated frameworks to oversee credit, market, and operational risks, ensuring the bank's financial health and stability.

Adherence to directives from the Central Bank of Egypt and international financial regulations is paramount. CIB actively implements measures for Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, crucial for maintaining trust and operational integrity. For instance, in 2023, CIB reported a capital adequacy ratio of 17.8%, well above the regulatory minimum, demonstrating its strong risk-absorbing capacity.

- Credit Risk Management: Implementing rigorous credit assessment processes and continuous portfolio monitoring to mitigate potential loan defaults.

- Market Risk Mitigation: Employing hedging strategies and diversification to manage exposures arising from fluctuations in interest rates, foreign exchange, and equity markets.

- Operational Resilience: Investing in technology and processes to prevent and manage operational failures, fraud, and cyber threats.

- Regulatory Adherence: Ensuring full compliance with all local and international banking laws, including AML, counter-terrorism financing, and data privacy regulations.

Financial Inclusion and SME Development

Commercial International Bank (CIB) actively champions financial inclusion by bringing essential banking services to previously underserved communities across Egypt. This commitment extends to fostering the growth of Small and Medium-sized Enterprises (SMEs), recognizing their crucial role in economic expansion and job creation.

CIB's strategy involves delivering specialized financing options designed to meet the unique needs of SMEs, thereby simplifying their access to much-needed capital. By forging strategic alliances, the bank aims to amplify its impact, driving economic development and creating employment opportunities throughout the nation.

- Financial Inclusion Focus: CIB's efforts to extend banking services to underserved populations are a cornerstone of its business model, aiming to bring more Egyptians into the formal financial system.

- SME Support: The bank provides tailored financing solutions and advisory services to SMEs, recognizing their vital contribution to the Egyptian economy. For instance, in 2023, CIB continued its robust support for SMEs, reflecting a consistent strategy to empower this sector.

- Economic Development Contribution: By facilitating access to credit and financial tools, CIB directly contributes to economic development and job creation, particularly within the SME segment.

CIB's key activities revolve around core banking, digital innovation, and specialized financial services. This includes deposit-taking and lending across various customer segments, alongside robust investment banking and advisory for corporate clients. The bank also emphasizes digital platform enhancement and financial inclusion initiatives, particularly supporting SMEs.

| Key Activity | Description | 2023/2024 Relevance |

| Core Banking Operations | Deposit taking, lending (corporate, retail, SME, mortgage), credit cards. | Primary revenue driver through net interest income, influenced by interest rate policies in 2024. |

| Digital Banking Enhancement | Improving mobile and internet banking platforms, digital onboarding, cashless transactions. | Ensures 24/7 secure access, meeting evolving customer expectations and driving operational efficiency. Significant increase in digital transactions noted in 2023. |

| Investment Banking & Advisory | Financial guidance, asset management, capital market solutions for large corporations. | Generates substantial non-interest income, contributing significantly to overall revenue as seen in 2023. |

| Risk Management & Compliance | Overseeing credit, market, and operational risks; adhering to AML/KYC regulations. | Maintains financial health and stability; CIB reported a capital adequacy ratio of 17.8% in 2023, exceeding regulatory requirements. |

| Financial Inclusion & SME Support | Extending services to underserved communities, providing tailored financing for SMEs. | Fosters economic development and job creation; CIB continued robust SME support in 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Commercial International Bank that you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the comprehensive analysis you will gain access to, providing a clear and actionable blueprint for CIB's strategic operations.

Upon completing your purchase, you will instantly receive the full, unedited version of this Business Model Canvas, mirroring the structure and content you see here. This ensures you get precisely what you expect – a professionally formatted and detailed overview of CIB's business model, ready for immediate use and strategic planning.

Resources

Commercial International Bank (CIB) leverages its strong financial capital and liquidity as a cornerstone of its business model. This robust capital base, evidenced by a Tier 1 capital ratio that consistently outperforms regulatory requirements, allows CIB to extend credit effectively and absorb potential economic downturns. For instance, as of the first quarter of 2024, CIB reported a healthy liquidity coverage ratio well above the regulatory minimum, underscoring its ability to meet short-term obligations.

A significant and stable deposit base, a key component of CIB's liquidity, provides a reliable funding source for its lending activities. This deep pool of customer deposits, growing by approximately 15% year-over-year in 2023, not only supports ongoing operations but also fuels expansion into new markets and product offerings. The bank's consistently high profitability, with a return on equity exceeding 25% in recent fiscal years, further bolsters its financial resilience and capacity for strategic investment.

Commercial International Bank (CIB) leverages its extensive physical footprint as a key resource. As of early 2024, CIB boasts over 200 branches and a significant ATM network exceeding 1,300 machines across Egypt. This wide reach is vital for customer engagement, facilitating transactions, and ensuring accessibility to banking services, particularly in a market where physical interactions remain important for many customers.

This robust network of branches and ATMs acts as a primary channel for both traditional banking activities and supporting digital service delivery. It allows CIB to manage cash efficiently and provides numerous touchpoints for customers to interact with the bank, reinforcing its market presence and customer loyalty.

Commercial International Bank (CIB) leverages state-of-the-art IT systems and secure digital banking platforms, including robust mobile and internet banking services, as core technological resources. These platforms are critical for delivering efficient operations and personalized customer experiences.

CIB's significant investment in data analytics capabilities allows for deep customer insights, fueling the rapid deployment of innovative digital products and services. This technological prowess underpins their position as a digital leader in the banking sector.

In 2024, CIB continued to enhance its digital infrastructure, focusing on advanced cybersecurity measures and scalable cloud solutions to support its expanding digital offerings and ensure data integrity.

Skilled Human Capital and Experienced Management

Commercial International Bank (CIB) relies heavily on its skilled human capital and experienced management as a core resource. This includes a robust team of financial professionals, IT specialists, and a strategically diverse board of directors. For instance, as of the first quarter of 2024, CIB reported a workforce of over 7,000 employees, many possessing specialized financial certifications and advanced degrees.

Continuous investment in employee training and development is paramount. This focus ensures that CIB's staff remains at the forefront of banking innovations, operational efficiencies, and customer service standards. In 2023 alone, CIB allocated significant resources to internal training programs, covering areas from digital banking advancements to regulatory compliance, directly impacting their ability to adapt and thrive in a dynamic market.

- Highly Qualified Workforce: CIB employs a substantial number of professionals with expertise in finance, technology, and risk management, critical for complex banking operations.

- Experienced Leadership: The bank benefits from a board of directors and senior management team with deep industry knowledge and strategic foresight, guiding CIB through evolving market landscapes.

- Investment in Training: Ongoing commitment to employee development, evidenced by substantial training budgets, ensures a continuously upskilled workforce capable of driving innovation and service excellence.

- IT and Digital Expertise: A strong contingent of IT specialists is essential for maintaining and enhancing CIB's digital platforms, a key driver of customer engagement and operational efficiency.

Reputable Brand and Market Leadership

Commercial International Bank (CIB) leverages its esteemed brand and dominant market position as a cornerstone of its business model. As Egypt's largest private sector bank, CIB's reputation for consistent profitability and substantial market share is a critical intangible asset.

This strong brand equity cultivates deep customer trust, which is essential for attracting and retaining clients in the competitive financial landscape. It also significantly bolsters CIB's competitive edge, not only within Egypt but also across the broader regional financial markets.

- Market Leadership: CIB consistently holds the largest market share among private sector banks in Egypt.

- Brand Recognition: The bank is widely recognized for its financial strength and customer-centric services.

- Profitability: CIB has a proven track record of strong financial performance and profitability.

- Customer Trust: Its established reputation fosters significant trust among its diverse customer base.

CIB’s financial strength, characterized by robust capital ratios and substantial liquidity, serves as a primary resource. As of Q1 2024, the bank maintained a Tier 1 capital ratio significantly above regulatory minimums, enabling strong lending capacity and resilience. Its extensive deposit base, which saw a notable increase in 2023, provides a stable and cost-effective funding source for operations and growth initiatives.

The bank’s expansive physical network, comprising over 200 branches and more than 1,300 ATMs across Egypt as of early 2024, is a crucial resource for customer accessibility and engagement. This widespread presence facilitates transactions and reinforces CIB's market penetration, acting as a vital touchpoint for both traditional and digital service delivery.

CIB’s investment in advanced IT systems and secure digital platforms, including sophisticated mobile and internet banking services, represents a core technological asset. These systems are instrumental in driving operational efficiency, delivering personalized customer experiences, and supporting the rapid deployment of innovative digital products, as evidenced by ongoing enhancements in cybersecurity and cloud solutions in 2024.

The bank’s human capital, including over 7,000 employees as of Q1 2024, many with specialized financial certifications, and its experienced management team, are indispensable resources. Continuous investment in training, such as the substantial programs in 2023 covering digital banking and compliance, ensures a skilled workforce adept at navigating market dynamics and driving innovation.

CIB's dominant market position and strong brand equity, built on a reputation for profitability and customer trust, are vital intangible assets. As Egypt's largest private sector bank, this recognition fosters customer loyalty and provides a significant competitive advantage in the financial sector.

| Resource Category | Key Resources | Supporting Data/Facts (as of early 2024) |

|---|---|---|

| Financial Strength | Capital Base & Liquidity | Tier 1 Capital Ratio exceeding regulatory requirements; Liquidity Coverage Ratio well above minimum. |

| Funding | Deposit Base | Consistent year-over-year growth (e.g., ~15% in 2023); stable funding for lending. |

| Physical Presence | Branch & ATM Network | Over 200 branches; Over 1,300 ATMs across Egypt. |

| Technology | Digital Platforms & IT Systems | Advanced cybersecurity measures; scalable cloud solutions; robust mobile/internet banking. |

| Human Capital | Skilled Workforce & Management | Over 7,000 employees; significant investment in training (e.g., 2023 programs). |

| Brand & Market Position | Brand Equity & Market Share | Largest private sector bank in Egypt; established customer trust and recognition. |

Value Propositions

Commercial International Bank (CIB) provides a broad spectrum of financial products and services designed for individuals, small and medium-sized enterprises (SMEs), and large corporations. This extensive offering encompasses traditional banking, specialized investment banking, and Sharia-compliant Islamic banking solutions, ensuring a holistic approach to financial management.

This comprehensive financial ecosystem allows CIB to address the diverse and evolving needs of its clientele, offering a convenient one-stop shop for all banking requirements. In 2024, CIB reported a net profit of EGP 21.6 billion, underscoring its capacity to deliver robust financial solutions across its customer segments.

Commercial International Bank (CIB) prioritizes digital convenience, offering customers 24/7 access to a full suite of banking services through its advanced mobile and internet platforms. This allows for remote financial management, payments, and even loan applications, streamlining everyday banking tasks.

In 2024, CIB continued to invest heavily in its digital infrastructure, aiming to provide a seamless and secure banking experience that meets the evolving demands of its clientele. This digital-first approach is key to enhancing customer satisfaction and operational efficiency.

Commercial International Bank (CIB) provides businesses with a suite of tailored financial products and advisory services. This includes specialized financing programs, comprehensive trade services, and expert advisory support, catering to a wide range of business needs.

From small and medium-sized enterprises (SMEs) looking for growth capital to large corporations requiring sophisticated syndicated loans and investment banking capabilities, CIB's offerings are designed for customization. For instance, in 2024, CIB continued to support Egyptian SMEs, which represent a significant portion of the nation's economy, by offering accessible credit lines and financial guidance.

This personalized approach empowers businesses to not only thrive and expand their operations but also to efficiently manage their complex financial activities. CIB's commitment to understanding individual business challenges ensures they can effectively navigate market dynamics and achieve their strategic objectives.

Financial Inclusion and Economic Empowerment

Commercial International Bank (CIB) champions financial inclusion by actively reaching out to underserved populations and boosting financial literacy. This commitment directly fuels Egypt's wider economic development and inclusion efforts.

CIB's accessible financial services, particularly its financing options for micro, small, and medium-sized enterprises (MSMEs), are instrumental in empowering local entrepreneurs. This, in turn, fosters job creation throughout Egypt.

- MSME Financing: CIB's dedicated MSME financing programs are a cornerstone of its inclusion strategy. In 2023, CIB reported a significant increase in its MSME loan portfolio, demonstrating its commitment to this vital sector.

- Financial Literacy Initiatives: The bank actively engages in programs designed to enhance financial understanding among various segments of the population, contributing to more informed financial decision-making.

- Economic Impact: By supporting MSMEs, CIB plays a crucial role in driving economic growth and creating employment opportunities, thereby uplifting communities across Egypt.

- Accessibility: CIB strives to make its banking services readily available to a broader customer base, breaking down traditional barriers to financial participation.

Trust, Stability, and International Standards

Commercial International Bank (CIB) anchors its business model on a core value proposition of trust, stability, and adherence to international standards. As Egypt's premier private sector bank, CIB's enduring legacy and commitment to robust governance and risk management frameworks provide a bedrock of confidence for its diverse clientele.

This focus on stability is particularly crucial in Egypt's evolving economic landscape, offering both individual customers and institutional investors a reliable and secure financial partner. CIB's dedication to international best practices in areas like corporate governance and regulatory compliance reassures stakeholders of its sound operational footing.

- Trust: CIB's long history and market leadership in Egypt foster deep customer trust.

- Stability: Adherence to international standards in governance and risk management ensures operational stability.

- International Standards: Compliance with global best practices attracts both local and international investors seeking secure banking partnerships.

CIB offers a comprehensive suite of financial solutions, from personal banking to corporate finance and Sharia-compliant options, serving individuals, SMEs, and large corporations. In 2024, CIB achieved a net profit of EGP 21.6 billion, demonstrating its strong financial performance across all customer segments.

The bank's value proposition centers on trust and stability, underpinned by its adherence to international governance and risk management standards, making it a reliable partner in Egypt's dynamic economic environment.

CIB champions financial inclusion through accessible MSME financing and financial literacy programs, fostering economic growth and job creation. Its digital platforms provide 24/7 access, enhancing customer convenience and operational efficiency, as evidenced by continued investment in digital infrastructure in 2024.

| Value Proposition | Description | Key Metric/Fact (2024) |

|---|---|---|

| Comprehensive Financial Solutions | Serving individuals, SMEs, and corporations with diverse banking needs. | Net Profit: EGP 21.6 billion |

| Digital Convenience | 24/7 access to banking services via advanced mobile and internet platforms. | Continued investment in digital infrastructure for enhanced customer experience. |

| Tailored Business Support | Specialized financing, trade services, and advisory for businesses. | Support for Egyptian SMEs with accessible credit lines and guidance. |

| Financial Inclusion & Economic Impact | Empowering underserved populations and fostering job creation. | Significant increase in MSME loan portfolio (data from 2023, reflecting ongoing commitment). |

| Trust & Stability | Adherence to international standards in governance and risk management. | Market leadership and long history fostering deep customer trust. |

Customer Relationships

Commercial International Bank (CIB) prioritizes personalized relationship management for its key client segments, including corporate, institutional, and high-net-worth individuals. Dedicated relationship managers provide tailored advice and financial solutions, fostering deep trust and understanding of intricate client needs.

Commercial International Bank (CIB) champions digital self-service through its advanced mobile and internet banking platforms, enabling customers to conduct a vast array of transactions and manage their accounts without human intervention. This focus on digital empowerment is crucial, especially as CIB reported a significant increase in digital transactions, with over 90% of retail transactions occurring on digital channels by the end of 2023.

To further enhance customer experience, CIB complements its self-service capabilities with readily available online support. This includes comprehensive Frequently Asked Questions (FAQs) sections and sophisticated virtual assistants designed to address common customer queries instantly, boosting convenience and ensuring 24/7 accessibility for essential banking needs.

Commercial International Bank (CIB) continues to invest in its physical presence, operating a robust network of customer service centers and branches across Egypt. This commitment ensures that customers have access to face-to-face support for complex transactions and personalized advice, complementing its digital offerings. As of early 2024, CIB maintained over 200 branches nationwide, demonstrating its dedication to traditional banking channels.

Community Engagement and Financial Literacy Programs

Commercial International Bank (CIB) actively fosters community engagement through dedicated financial literacy programs. These initiatives are designed to boost financial inclusion, with a particular focus on Small and Medium Enterprises (SMEs) and individuals new to the formal banking sector. By offering educational resources and support, CIB aims to empower these segments with the knowledge needed for effective financial management and to understand the breadth of banking services available.

These programs serve a dual purpose: building positive community relationships and cultivating a pipeline of future customers. For instance, in 2024, CIB's financial literacy workshops reached over 15,000 participants across various governorates. Such efforts not only enhance the financial well-being of individuals and businesses but also solidify CIB's reputation as a socially responsible institution.

- Financial Literacy Workshops: CIB conducted 50 workshops in 2024 focused on budgeting, saving, and investment basics.

- SME Empowerment Programs: Supported 100 SMEs with tailored financial education and access to credit information.

- Digital Banking Awareness: Educated 5,000 individuals on utilizing digital banking channels for secure and convenient transactions.

- Partnerships for Reach: Collaborated with 5 NGOs to extend financial literacy outreach to remote and underserved areas.

Feedback Mechanisms and Continuous Improvement

Commercial International Bank (CIB) actively gathers customer insights through various channels, including post-transaction surveys and dedicated customer service lines. This feedback loop is crucial for identifying areas of improvement in their offerings and service delivery.

In 2024, CIB reported a significant increase in customer satisfaction scores, with over 85% of surveyed customers indicating a positive experience. This data directly informs product development and service enhancements, ensuring the bank stays aligned with evolving market expectations and customer preferences.

- Customer Feedback Channels: CIB utilizes online surveys, in-branch feedback forms, and direct communication platforms to solicit customer opinions.

- Data-Driven Improvement: Feedback data is systematically analyzed to pinpoint service gaps and opportunities for innovation.

- Enhanced Customer Experience: Continuous improvement initiatives, driven by customer feedback, have led to a more personalized and efficient banking experience.

- Market Responsiveness: CIB's proactive approach to feedback allows it to adapt quickly to changing customer needs and competitive pressures in the financial sector.

CIB nurtures strong customer relationships through a blend of personalized service for key segments and robust digital self-service options. This dual approach ensures accessibility and caters to diverse customer needs, evidenced by over 90% of retail transactions occurring on digital channels by the end of 2023.

The bank actively engages in financial literacy programs, reaching over 15,000 participants in 2024 through workshops and SME support, fostering community ties and future customer growth. Customer feedback, gathered through surveys and service lines, drives continuous improvement, contributing to an 85% positive customer experience rating in 2024.

| Relationship Aspect | Key Initiatives/Data (2023-2024) | Impact/Focus |

|---|---|---|

| Personalized Management | Dedicated managers for corporate, institutional, HNW clients | Deep trust, tailored solutions |

| Digital Self-Service | Mobile & Internet Banking Platforms | Over 90% retail transactions digital (end 2023) |

| Support & Accessibility | Online FAQs, virtual assistants, 200+ branches (early 2024) | 24/7 support, physical presence |

| Financial Literacy | 15,000+ participants (2024), 50 workshops | Financial inclusion, community building |

| Customer Feedback | Surveys, service lines; 85% positive experience (2024) | Service enhancement, market responsiveness |

Channels

Commercial International Bank (CIB) leverages its extensive branch network, boasting over 200 locations across Egypt, as a cornerstone of its customer engagement strategy. These physical hubs are crucial for facilitating essential banking transactions such as deposits, withdrawals, and loan processing, offering a tangible point of contact for clients. The strategic placement of these branches ensures widespread accessibility, catering to a broad spectrum of customer needs and preferences throughout the country.

Commercial International Bank (CIB) leverages its extensive network of over 1,300 Automated Teller Machines (ATMs) as a primary channel for customer transactions. This robust ATM infrastructure ensures customers have continuous, 24/7 access to essential banking services such as cash withdrawals, deposits, and fund transfers. In 2024, CIB's ATMs processed millions of transactions, highlighting their significance in providing transactional convenience and reducing the need for customers to visit physical branches for everyday banking needs.

The Commercial International Bank (CIB) mobile banking application stands as a cornerstone of its digital strategy, acting as a primary customer interaction channel. This app offers a full spectrum of banking services, from basic account management and bill payments to sophisticated features like fund transfers and digital loan origination.

This digital platform significantly enhances customer convenience and security, facilitating a large volume of daily transactions. In 2024, CIB reported that its mobile app handled over 70% of all customer transactions, underscoring its critical role in driving digital engagement and operational efficiency.

Internet Banking Platform

Commercial International Bank's (CIB) internet banking platform serves as a secure digital gateway, enabling customers to efficiently manage their finances. This portal allows for account oversight, statement retrieval, and transaction initiation, offering a comprehensive suite of services for both individual and business clients. In 2024, CIB reported a significant increase in digital transactions, with over 70% of customer interactions occurring through their online and mobile channels, highlighting the platform's critical role in customer engagement and service delivery.

The platform is designed to meet the diverse needs of its user base, providing robust financial management and detailed reporting capabilities. It supports a wide array of banking functions, from fund transfers and bill payments to loan applications and investment management. This digital accessibility ensures customers can conduct their banking activities conveniently and securely, anytime and anywhere.

- Digital Reach: In 2024, CIB's internet banking platform facilitated over 150 million transactions, demonstrating its extensive use by millions of customers.

- Service Expansion: The platform continually evolves, integrating new features like personalized financial insights and seamless integration with third-party payment services.

- Security Focus: Robust security measures, including multi-factor authentication and advanced fraud detection systems, are central to maintaining customer trust and data integrity on the platform.

- Customer Convenience: CIB's internet banking offers 24/7 access, allowing customers to manage their accounts and perform banking operations without needing to visit a physical branch.

Partnership Networks and Digital Ecosystems

CIB actively cultivates partnerships with key players in the digital space, including telecommunication giants like WE. This strategic alliance allows CIB to embed its financial services directly into the platforms and applications that customers use daily, effectively bringing banking to where people already are. For instance, CIB's collaboration with WE aims to offer seamless mobile financial solutions.

This 'Banking-as-a-Service' model is crucial for expanding CIB's market reach and enhancing customer convenience. By integrating financial offerings into external digital ecosystems, CIB makes banking more accessible and less of a separate activity, fitting it into the natural flow of users' digital interactions. This strategy is part of CIB's broader digital transformation efforts, aiming to capture a larger share of the digital economy.

- Strategic Alliances: Partnerships with telecom providers like WE are central to embedding financial services.

- Digital Ecosystem Integration: CIB leverages existing digital platforms to offer its services.

- Banking-as-a-Service (BaaS): This model enhances accessibility and customer engagement by integrating banking into daily digital life.

- Expanded Reach: BaaS strategies aim to tap into new customer segments and increase transaction volumes through non-traditional channels.

CIB's channel strategy is multi-faceted, combining a strong physical presence with robust digital offerings. The bank's extensive branch network and ATM fleet ensure widespread accessibility for traditional banking needs. Simultaneously, CIB heavily promotes its digital channels, including a user-friendly mobile app and an advanced internet banking platform, which collectively handle the majority of customer transactions.

| Channel | Key Features | 2024 Transaction Volume (Illustrative) | Customer Reach |

|---|---|---|---|

| Branches | In-person transactions, advisory services | Millions (deposits, withdrawals, loans) | Broad, geographically diverse |

| ATMs | 24/7 cash access, deposits, transfers | Millions of transactions | Extensive nationwide coverage |

| Mobile App | Full-service banking, payments, loan origination | Over 70% of total customer transactions | Growing digital user base |

| Internet Banking | Account management, bill payments, fund transfers | Over 150 million transactions | Significant online customer base |

| Partnerships (e.g., WE) | Embedded financial services, BaaS | Growing, focused on digital integration | New customer segments via partner ecosystems |

Customer Segments

Commercial International Bank (CIB) serves a wide spectrum of individual retail clients, encompassing both mass-market consumers and high-net-worth individuals. These customers rely on CIB for essential banking services such as savings and current accounts, credit cards, personal loans, and mortgages, reflecting their diverse everyday financial needs and lifestyle aspirations.

Commercial International Bank (CIB) places significant emphasis on Small and Medium-sized Enterprises (SMEs), acknowledging their foundational role in Egypt's economic landscape. The bank offers specialized financing and credit facilities designed to foster the growth and operational stability of these businesses, alongside valuable advisory services aimed at enhancing financial inclusion.

CIB demonstrates a strong commitment to the SME sector, consistently surpassing mandated lending targets. For instance, in 2023, CIB’s SME loan portfolio saw a substantial increase, reflecting its dedication to empowering this critical segment of the Egyptian economy.

Commercial International Bank (CIB) serves Egypt's largest corporations, multinational companies, and government institutions with a full spectrum of corporate and investment banking services. These clients rely on CIB for sophisticated solutions to manage their complex financial needs.

CIB's offerings for this segment are extensive, including corporate loans, vital for expansion and operations, and robust trade finance solutions that facilitate international commerce. Additionally, their cash management services streamline financial operations, while specialized financial advisory supports strategic decision-making.

In 2024, CIB continued to be a dominant force in Egyptian corporate banking. For instance, the bank reported a net profit of EGP 20.5 billion for the first nine months of 2024, demonstrating its strong financial performance and ability to serve large-scale clients effectively.

Non-Resident Egyptians (NREs)

Commercial International Bank (CIB) actively targets Non-Resident Egyptians (NREs), recognizing their unique financial needs and potential. This segment is crucial for growth, with CIB offering specialized remote banking services and products designed to facilitate their financial activities in Egypt and attract remittances.

CIB's strategy for NREs aligns with national objectives to support Egyptians living abroad. By providing accessible and tailored financial solutions, the bank aims to foster stronger ties and encourage investment and capital flow back into Egypt. This focus is particularly relevant given the significant contribution of remittances to the Egyptian economy.

- Remittance Inflows: Egypt's remittances from Egyptians abroad reached approximately $31.9 billion in the fiscal year 2022-2023, highlighting the economic importance of this segment.

- Remote Service Models: CIB offers digital platforms and dedicated support to enable NREs to manage their accounts, make investments, and conduct transactions seamlessly from overseas.

- Tailored Financial Solutions: Products may include specialized savings accounts, investment opportunities, and financing options designed to meet the specific circumstances of NREs.

Public Sector and Government Entities

Commercial International Bank (CIB) actively engages with public sector and government entities, offering a comprehensive suite of banking services. This includes facilitating transactions, managing government accounts, and providing financing solutions for critical national infrastructure and development projects. In 2024, CIB continued its role in supporting Egypt's economic agenda, participating in government-backed initiatives aimed at boosting key sectors.

This segment is crucial for CIB's institutional presence and its ability to influence market dynamics. By partnering with government bodies, CIB strengthens its position as a key financial player within the nation. For instance, CIB's involvement in financing large-scale projects underscores its commitment to national development and solidifies its reputation among public sector clients.

- Government Deposits: CIB manages significant deposit balances from various ministries and state-owned enterprises, providing a stable funding source.

- Project Financing: The bank participates in syndications and direct lending for major national projects, contributing to economic growth.

- Treasury Services: CIB offers sophisticated treasury and cash management solutions tailored to the specific needs of public sector clients.

CIB strategically segments its customer base, catering to a broad range of individuals, from everyday consumers to affluent clients, with essential banking products. The bank also prioritizes Small and Medium-sized Enterprises (SMEs), offering tailored financial support and advisory services to fuel their growth and stability, as evidenced by its consistent surpassing of lending targets.

Furthermore, CIB serves major corporations, multinational firms, and government entities with comprehensive corporate and investment banking solutions. Its commitment to Non-Resident Egyptians (NREs) is also a key focus, providing specialized remote banking services to leverage remittance inflows, which reached approximately $31.9 billion in FY 2022-2023.

| Customer Segment | Key Needs & CIB Offerings | 2024 Performance Indicators (Illustrative) |

|---|---|---|

| Retail Banking | Everyday banking, loans, credit cards. | Continued growth in retail deposit base. |

| SMEs | Financing, credit facilities, advisory. | Exceeded SME lending targets for the year. |

| Corporates & Institutions | Corporate loans, trade finance, cash management. | Reported strong net profit growth, indicating robust corporate client engagement. |

| Non-Resident Egyptians (NREs) | Remote banking, remittances, investment. | Focus on digital platforms to facilitate overseas transactions. |

| Public Sector & Government | Transaction facilitation, project financing. | Active participation in government-backed economic initiatives. |

Cost Structure

Commercial International Bank’s (CIB) operating expenses are significantly driven by its substantial personnel costs, encompassing salaries, benefits, and ongoing training for its large workforce. In 2024, CIB reported operating expenses of EGP 24.3 billion, with personnel and administrative costs forming a substantial portion of this figure, reflecting the bank's commitment to its human capital and efficient operations.

Beyond personnel, administrative overheads and the extensive physical infrastructure, including its widespread branch and ATM network, represent considerable operational costs for CIB. These costs are largely fixed or semi-fixed, impacting the bank's cost structure and requiring careful management to maintain profitability.

Commercial International Bank (CIB) dedicates significant resources to its technology and digital infrastructure. These investments are vital for maintaining and enhancing their digital banking platforms, core IT systems, and robust cybersecurity defenses. For instance, in 2023, CIB reported substantial spending on technology upgrades aimed at improving customer experience and operational efficiency.

These technology-related expenditures are not merely operational costs; they are foundational to CIB's ongoing digital transformation strategy. By investing in advanced data analytics capabilities and secure IT infrastructure, CIB aims to gain a competitive edge in the rapidly evolving financial services landscape, ensuring they can offer innovative digital products and services to their diverse customer base.

Interest paid on customer deposits and other borrowings is a core variable expense for Commercial International Bank (CIB). This cost directly impacts the bank's profitability by reducing the net interest income it generates.

CIB's strategy to manage funding costs focuses on increasing its proportion of low-cost current and savings accounts (CASA). For instance, in 2023, CIB reported a significant CASA ratio, a key indicator of its ability to attract stable, low-cost funding, which is crucial for maintaining strong net interest margins in a competitive market.

Loan Loss Provisions and Impairment Charges

Loan loss provisions and impairment charges represent a significant cost for Commercial International Bank (CIB), directly tied to the inherent risks of its lending operations. These provisions are set aside to cover potential losses from borrowers defaulting on their loans. For instance, in 2023, CIB’s provisions for expected credit losses amounted to EGP 4.4 billion, a figure that underscores the importance of managing credit risk within its cost structure.

While CIB is recognized for its robust asset quality, maintaining adequate provisions is crucial for financial stability and regulatory compliance. These charges are not merely an accounting entry but a forward-looking measure to absorb potential non-performing loans. The bank's commitment to strong underwriting practices helps mitigate these costs, but they remain a necessary component to ensure resilience against economic downturns.

- Provisioning for Credit Losses: CIB allocates funds to cover potential defaults on its loan portfolio.

- Impact of Asset Quality: Strong asset quality helps to moderate the size of these provisions.

- 2023 Data: Provisions for expected credit losses were EGP 4.4 billion in 2023.

- Risk Management: These charges are a direct reflection of the credit risk inherent in banking.

Marketing, Sales, and Brand Management

Commercial International Bank (CIB) invests significantly in marketing, sales, and brand management to attract new customers and solidify its market position. These expenditures are crucial for growth, encompassing everything from digital advertising campaigns to broader brand-building initiatives aimed at enhancing customer loyalty and awareness in a highly competitive financial landscape.

In 2024, CIB's commitment to these areas remained a cornerstone of its commercial strategy. The bank allocated substantial resources to customer acquisition, ensuring a steady influx of new clients. These efforts are directly tied to CIB's objective of maintaining and expanding its market leadership, demonstrating a clear understanding of the costs associated with sustained growth and brand prominence.

- Marketing Expenditures: CIB's budget for marketing campaigns and advertising in 2024 was substantial, focusing on digital channels and targeted promotions to reach a wider audience.

- Customer Acquisition Costs: The bank actively manages costs associated with acquiring new customers, employing data-driven strategies to optimize spending on onboarding and initial engagement.

- Brand Building Initiatives: Significant investment went into strengthening CIB's brand image and reputation, fostering trust and recognition among existing and potential clients.

- Sales Force Support: Costs related to maintaining and supporting a robust sales team are included, as they are instrumental in converting leads generated by marketing efforts into active customers.

Commercial International Bank (CIB) incurs significant costs related to its extensive physical and digital infrastructure, including branches, ATMs, and core banking systems. These operational expenses are essential for providing accessible banking services and maintaining a competitive edge. In 2024, CIB's operating expenses were reported at EGP 24.3 billion, with a notable portion attributed to maintaining this widespread network and its technological backbone.

Personnel costs, encompassing salaries, benefits, and training for its large workforce, represent a substantial fixed expense for CIB. The bank also allocates considerable resources to technology and digital infrastructure upgrades to enhance customer experience and operational efficiency. These investments are critical for CIB's ongoing digital transformation strategy, ensuring it remains competitive in the evolving financial services landscape.

Interest paid on customer deposits and borrowings constitutes a core variable cost for CIB, directly impacting its net interest income. The bank actively manages these funding costs by increasing its proportion of low-cost current and savings accounts (CASA), a strategy that proved successful in 2023 with a significant CASA ratio. Loan loss provisions and impairment charges, such as the EGP 4.4 billion in provisions for expected credit losses in 2023, are also key costs reflecting the inherent credit risk in lending operations.

| Cost Category | Description | 2023/2024 Impact |

| Personnel Costs | Salaries, benefits, training for employees | Substantial portion of EGP 24.3 billion operating expenses in 2024 |

| Infrastructure & Technology | Branch network, ATMs, IT systems, cybersecurity | Significant investments in upgrades and maintenance |

| Interest Expenses | Payments on deposits and borrowings | Managed through increasing CASA ratio; impacts net interest income |

| Loan Loss Provisions | Covering potential loan defaults | EGP 4.4 billion in provisions for expected credit losses in 2023 |

Revenue Streams

Net Interest Income (NII) is Commercial International Bank's (CIB) cornerstone revenue generator. It represents the profit CIB makes from the spread between the interest it earns on its assets, like loans and securities, and the interest it pays out on its liabilities, such as customer deposits and borrowed funds. This fundamental banking activity is the engine driving the majority of CIB's financial performance.

In 2023, CIB reported a significant Net Interest Income. For instance, the bank's Net Interest Income reached approximately EGP 30.6 billion for the nine months ending September 30, 2023, showcasing the substantial contribution of its lending and deposit operations to its overall profitability. This figure highlights the bank's ability to effectively manage its interest-earning assets and interest-bearing liabilities to generate consistent income.

Commercial International Bank (CIB) generates substantial revenue through a diverse array of fees and commissions. These income streams are crucial for diversifying its earnings beyond traditional interest income.

Key revenue drivers include fees from trade finance services, which are vital for businesses engaged in international commerce. Additionally, commission income from credit card transactions and loan processing fees contribute significantly, reflecting the bank's extensive customer base and lending activities.

CIB also earns from account maintenance fees and foreign exchange services, highlighting the breadth of its banking operations. For instance, in 2023, CIB reported a net fee and commission income of EGP 11.1 billion, a notable increase from the previous year, underscoring the importance of these non-interest revenue streams.

Commercial International Bank (CIB) generates significant revenue from investment banking and advisory services. This includes fees earned from advising corporations on mergers, acquisitions, and capital raising, as well as underwriting new debt and equity issuances. For instance, in 2023, CIB’s investment banking division played a crucial role in facilitating major corporate transactions within Egypt, contributing substantially to the bank's overall fee income.

Treasury and Capital Markets Operations

Commercial International Bank (CIB) generates revenue from its Treasury and Capital Markets operations through various trading activities. These include dealing in foreign exchange, government securities, and other financial instruments, which are crucial for managing the bank's liquidity and investment portfolio.

This segment is a significant contributor to CIB's overall profitability. It leverages strategic asset and liability management, alongside market-making capabilities, to capture trading gains and provide liquidity to the market. For instance, in 2023, CIB’s net interest income, a key component influenced by treasury activities, reached EGP 34.5 billion, demonstrating the segment's importance.

- Foreign Exchange Trading: Profits earned from buying and selling currencies.

- Government Securities Trading: Income from the purchase and sale of bonds and other government debt.

- Financial Instrument Trading: Revenue generated from trading derivatives, equities, and other financial products.

- Asset and Liability Management: Optimizing the bank's balance sheet to enhance net interest margin and manage risk.

Digital Service Fees and Transaction Charges

Commercial International Bank (CIB) is increasingly leveraging digital service fees and transaction charges as a significant revenue stream, reflecting its robust digital transformation. As more customers embrace online banking and mobile applications, CIB earns from digital transaction fees, online payment gateway services, and other value-added digital offerings. This shift highlights the bank's successful adaptation to the growing trend of cashless transactions.

In 2024, CIB reported substantial growth in its digital banking segment. For instance, the bank's digital channels facilitated a significant portion of its overall transactions, with digital service fees contributing a notable percentage to its non-interest income. This growth is directly tied to the increasing adoption of its digital platforms, which offer convenience and efficiency to its customer base.

- Digital Transaction Fees: CIB earns revenue from fees associated with various digital transactions, including fund transfers, bill payments, and ATM withdrawals processed through its online and mobile platforms.

- Online Payment Services: The bank generates income from providing secure and efficient online payment solutions for both individuals and businesses, including merchant services and e-commerce gateway fees.

- Value-Added Digital Offerings: Revenue is also derived from premium digital services such as advanced financial management tools, personalized financial advice accessed digitally, and specialized digital banking packages.

Commercial International Bank (CIB) diversifies its revenue through various fee-based services beyond its core net interest income. These include income generated from trade finance, credit cards, loan processing, account maintenance, and foreign exchange services. In the first nine months of 2023, CIB's net fee and commission income reached approximately EGP 11.1 billion, demonstrating a significant contribution to its overall financial performance and a growth from the previous year.

| Revenue Stream | Description | 2023 (9M) Approx. (EGP Billion) |

|---|---|---|

| Net Interest Income (NII) | Profit from interest spread on loans and deposits. | 30.6 |

| Net Fee & Commission Income | Income from trade finance, cards, loans, FX, etc. | 11.1 |

| Investment Banking & Advisory | Fees from M&A, capital raising, underwriting. | (Not explicitly stated as a separate figure but contributes to fee income) |

| Treasury & Capital Markets | Trading gains from FX, securities, financial instruments. | (Influences NII, significant contributor to profitability) |

| Digital Service Fees | Charges from online/mobile transactions and services. | (Significant growth, contributes to non-interest income) |

Business Model Canvas Data Sources

The Commercial International Bank Business Model Canvas is informed by a blend of internal financial data, extensive market research on customer needs and competitor strategies, and expert strategic insights from industry analysis. These diverse sources ensure a comprehensive and actionable framework for the bank's operations.