Commercial International Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

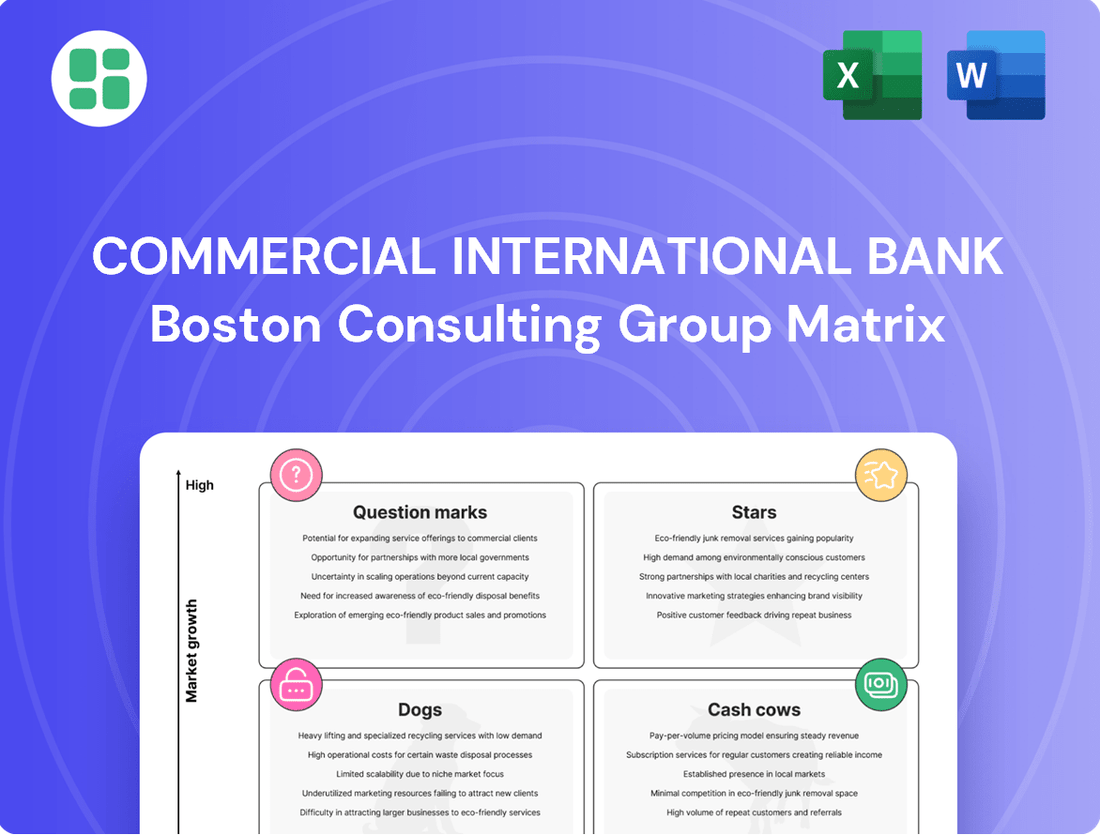

Unlock the strategic potential of Commercial International Bank (CIB) with a comprehensive BCG Matrix analysis. Understand which of CIB's offerings are market leaders (Stars), reliable income generators (Cash Cows), resource drains (Dogs), or potential future successes (Question Marks).

This preview offers a glimpse into CIB's product portfolio positioning. For a complete, actionable understanding of their market share and growth potential, purchase the full BCG Matrix report and gain the insights needed to optimize your investment and strategic decisions.

Stars

CIB's digital banking platforms are clearly in the Stars quadrant. In the first half of 2025, these platforms saw over 1.9 million active users, a significant 17% jump from the prior year. This rapid user expansion points to strong market demand and CIB's successful strategy in capturing digital banking customers.

The transactional volume further solidifies this position. By H1 2025, transaction values across CIB's digital channels soared by an impressive 58%, reaching EGP 2.3 trillion. This substantial increase in financial activity underscores the high engagement and growing reliance on CIB's digital offerings by its customer base.

The mobile app, a key component of CIB's digital strategy, experienced a remarkable 59% annual growth in 2024. This surge in mobile app usage is a clear indicator of the accelerating shift towards digital financial services in Egypt, and CIB's strong performance within this trend.

Local Currency Corporate Lending represents a significant strength for Commercial International Bank (CIB), positioning it as a dominant force in Egypt's private sector. The bank’s commitment to this segment is evident in its impressive growth figures.

In 2024, CIB's local currency loan portfolio experienced a remarkable surge, increasing by a record 47%. This substantial expansion played a crucial role in bolstering the bank's overall gross loan portfolio, which reached EGP 496 billion by the end of the first half of 2025.

The services sector, in particular, has been a primary beneficiary and a key driver of this growth. This strong performance in local currency corporate lending underpins CIB's robust financial health and its commanding market share within Egypt.

Commercial International Bank (CIB) launched its Sustainable Finance Loan for Small and Medium-sized Enterprises (SMEs) in July 2024, marking a significant move into a rapidly expanding market. This program aims to bolster SMEs by facilitating investments in crucial areas like renewable energy and resource efficiency.

CIB's commitment is further evidenced by its collaborations with organizations such as the European Bank for Reconstruction and Development (EBRD) and the German Corporation for International Cooperation (GIZ). These partnerships underscore the bank's dedication to fostering sustainable business practices among its SME clientele.

Demonstrating a proactive approach, CIB has surpassed its regulatory targets for SME lending, achieving a 27% penetration. This strategic focus highlights CIB's ambition to capture a larger share of this essential market segment.

Retail Personal Loans and Credit Cards

Commercial International Bank (CIB) demonstrates robust performance in its retail personal loans and credit cards sector, a key component of its overall business strategy.

The bank has seen significant expansion in its retail lending, particularly with personal loans and credit cards. This segment is a vital contributor to CIB's market presence and customer engagement.

- Retail Lending Growth: CIB has maintained strong momentum in its retail lending, especially in personal loans and credit cards.

- Credit Card Portfolio Surge: The credit card portfolio experienced a substantial 38% increase from the first half of 2024 to the first half of 2025.

- Market Capture: This growth aligns with Egypt's financial inclusion initiatives and highlights CIB's success in capturing a significant share of the growing consumer credit market.

Green Assets and Sustainable Finance Initiatives

Commercial International Bank (CIB) is a leader in sustainable finance, with green assets making up 12% of its portfolio as of June 2024. This figure is notably higher than the global average, showcasing CIB's commitment to environmental responsibility.

The bank is making green financing more accessible to individuals. For example, they offer solar energy loans, simplifying the adoption of renewable energy for homeowners.

CIB's strong emphasis on Environmental, Social, and Governance (ESG) integration places it favorably in the burgeoning sustainable finance market. This strategic focus is expected to drive significant growth.

- Green Assets: 12% of CIB's portfolio as of June 2024.

- Key Initiative: Development of accessible green financing products, like solar energy loans.

- Market Position: Strong standing in the high-growth ESG investment sector.

CIB's digital banking platforms are clearly in the Stars quadrant, experiencing substantial growth and high customer engagement. The rapid user expansion, with over 1.9 million active users in H1 2025, a 17% year-over-year increase, demonstrates strong market demand. Transactional volumes further solidify this position, with values soaring by 58% to EGP 2.3 trillion in H1 2025, indicating high customer reliance on these digital offerings.

| Category | Metric | Value (H1 2025) | Growth (YoY) |

|---|---|---|---|

| Digital Banking Platforms | Active Users | 1.9 million+ | 17% |

| Digital Banking Platforms | Transaction Value | EGP 2.3 trillion | 58% |

| Mobile App Usage | Annual Growth (2024) | 59% | N/A |

What is included in the product

Analysis of CIB's business units across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Commercial International Bank BCG Matrix provides a clear, one-page overview placing each business unit in a quadrant, alleviating the pain of strategic uncertainty.

Cash Cows

Commercial International Bank (CIB) holds a dominant position in Egypt’s banking sector, boasting the largest customer deposit base among private institutions. By the close of the first quarter of 2025, this base had swelled to an impressive EGP 996 billion.

A key driver of CIB's financial strength is its strategic emphasis on low-cost funding. Current and savings accounts (CASA) represent a significant 56% of its total deposits, demonstrating the bank's success in attracting stable, inexpensive funding.

This substantial and cost-effective deposit base acts as a reliable liquidity reservoir, fundamentally supporting CIB's consistent profitability and its capacity for further strategic investments and lending activities.

Commercial International Bank's (CIB) traditional corporate banking relationships are a cornerstone of its operations, serving as a prime example of a cash cow. With CIB being the bank of choice for over 800 of Egypt's largest corporations, this segment demonstrates a mature and highly profitable market position.

These deep-rooted relationships with major Egyptian enterprises guarantee a consistent and substantial revenue stream. This is generated through a wide array of financial products and services, including lending, trade finance, and treasury solutions, solidifying its role as a reliable income generator.

While the growth rate in this established segment might be more moderate compared to newer, high-potential areas, its significant market share and consistent cash generation capabilities are undeniable. This makes CIB's traditional corporate banking relationships a vital 'cash cow' that fuels the bank's overall financial strength and strategic investments.

Commercial International Bank's (CIB) core retail transactional services are a definite cash cow. With a vast network of 201 branches and 13 units as of Q1 2025, CIB serves over two million customers in this segment. This extensive reach allows them to capture a significant market share in essential banking activities like account management and payments.

These foundational services, while perhaps not the most exciting, are incredibly valuable. They generate a consistent stream of fee income for CIB and are crucial for maintaining their large deposit base. The stability of this segment means it requires relatively little additional investment to keep running smoothly, making it a reliable source of cash flow.

Treasury and Cash Management Services

Commercial International Bank's (CIB) Treasury and Cash Management Services firmly reside in the Cash Cows quadrant of the BCG Matrix. This is evidenced by CIB's consistent recognition, including Global Finance's 'Best Overall Bank for Cash Management' and 'Market Leader for Treasury and Cash Management'. These awards highlight a strong, established market presence and a high market share in a mature sector.

These services are fundamental for corporate clients, providing stable and profitable revenue streams. In 2024, the demand for efficient cash flow optimization and liquidity management remained robust, with CIB's offerings being a go-to solution for businesses navigating complex financial landscapes.

- Dominant Market Position: CIB's repeated accolades confirm its leadership in a well-developed market.

- High, Stable Revenue: Treasury and cash management services generate consistent, high-margin income for the bank.

- Mature Market Dynamics: While growth may be moderate, the established nature of these services ensures predictable cash flow.

- Critical Business Function: These services are essential for corporate clients, underpinning their operational efficiency and financial health.

Established Trade Finance Solutions

Commercial International Bank's established trade finance solutions are a prime example of a Cash Cow within its BCG Matrix. These offerings are fundamental to supporting Egypt's trade-dependent economy, demonstrating a high market share in a stable, mature industry.

The bank's trade service fees saw a significant increase of 29% in Q1 2025, underscoring the robust and consistent revenue generation from this segment. This performance is further validated by CIB's recognition with the 'Best Trade Finance Award' from Global Finance, highlighting its leadership and operational excellence.

- High Market Share: CIB holds a dominant position in the trade finance market.

- Stable Industry: Trade finance is a mature and predictable sector.

- Consistent Revenue: Generates reliable fee and interest income.

- Award-Winning Services: Recognized for excellence by Global Finance.

Commercial International Bank's (CIB) mortgage lending operations represent a significant Cash Cow. This segment benefits from a mature market with established demand for home financing, where CIB has cultivated a strong and recognizable brand presence.

The bank's consistent focus on risk management and its deep understanding of the Egyptian real estate market have allowed it to maintain a healthy loan portfolio and generate stable interest income. As of Q1 2025, CIB reported a robust mortgage portfolio, contributing steadily to its overall profitability.

This business line, while not experiencing rapid expansion, provides a reliable and predictable source of cash flow due to its established customer base and the ongoing need for housing finance solutions.

| Segment | BCG Category | Key Strengths | Financial Contribution (Illustrative) |

|---|---|---|---|

| Mortgage Lending | Cash Cow | Mature Market, Strong Brand, Risk Management Expertise | Stable Interest Income, Consistent Portfolio Growth |

Full Transparency, Always

Commercial International Bank BCG Matrix

The Commercial International Bank BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately available for your use. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy BCG Matrix report you'll acquire. No alterations or additional content will be present in the final download, ensuring a seamless integration into your business planning.

Dogs

Services that are stuck in the past, only available at physical branches, are becoming a real drag. Think about things like certain types of account openings or complex transaction processing that haven't made the leap to online. These are the services that are starting to feel outdated.

As more and more customers, and we're talking millions, are opting for digital banking – CIB saw a significant jump in digital transactions in 2024, exceeding previous years' volumes – these branch-dependent services are losing their appeal. They're not just less convenient; they're also becoming more expensive to operate on a per-transaction basis. This means resources might be tied up in areas that aren't delivering the same bang for the buck anymore.

Commercial International Bank (CIB) faces challenges with certain niche foreign currency loan portfolios. In 2024, these segments have experienced a notable decline in their Net Interest Margins (NIM), alongside net repayments, indicating reduced profitability and asset shrinkage.

These underperforming portfolios, often concentrated in sectors vulnerable to currency volatility or experiencing specific market contractions, are likely characterized by low growth prospects and diminished profitability. Such situations necessitate vigilant oversight to prevent them from becoming liabilities that drain resources without generating adequate returns.

Less adopted legacy payment systems within Commercial International Bank (CIB) likely fall into the Dogs category of the BCG matrix. These systems, often bypassed by the surge in digital payment adoption, may struggle to justify their continued operational expenses. For instance, a significant portion of older, less integrated systems might represent a declining market share in payment processing, especially as newer, more user-friendly digital alternatives gain traction.

The challenge for CIB is managing these legacy systems, which could be incurring maintenance costs that outweigh their minimal revenue generation. In 2024, the ongoing investment in supporting these older platforms, while newer digital solutions are actively being promoted, presents a clear case of low growth and low market share. This situation demands a strategic review to determine if divestment or a targeted upgrade is more financially prudent.

Inefficiently Located or Underutilized Branches

While Commercial International Bank (CIB) boasts a substantial branch network, certain locations might be experiencing underutilization. This is often due to operating in areas with limited economic expansion or lower population concentrations. For instance, if a branch is situated in a region experiencing a decline in key industries, its customer traffic and transaction volumes could be significantly lower than anticipated.

These underperforming branches can represent a drain on resources, with operational costs like rent, utilities, and staffing outweighing the revenue they generate. For example, a branch in a rural area with minimal new business development might have a high cost-to-income ratio compared to its peers in more dynamic urban centers. CIB's strategy might involve evaluating these branches for potential consolidation or even divestiture if their market share and future growth projections remain consistently weak.

The bank's approach to these "question marks" in its portfolio involves a careful analysis of their financial performance and strategic importance. Key metrics considered would include:

- Revenue generated versus operational expenses

- Customer acquisition and retention rates in the local market

- Proximity and potential overlap with other CIB branches

- Long-term economic outlook and demographic trends of the branch's service area

Highly Specialized, Low-Demand Investment Banking Sub-segments

Within Commercial International Bank's (CIB) investment banking division, certain highly specialized areas might be considered question marks. These are segments where demand is inherently low, perhaps due to their niche nature or evolving market trends. For instance, advisory services for very specific, emerging technologies or financing for extremely specialized infrastructure projects might fall into this category.

If CIB's market share in these particular sub-segments is minimal, and the bank is investing significant resources without generating substantial revenue, these could be candidates for re-evaluation. For example, a report from early 2024 indicated that while overall M&A advisory fees were robust, fees from sectors like specialized aerospace components saw a decline of nearly 15% year-over-year due to reduced deal flow.

These low-demand, specialized areas might consume valuable human capital and capital without yielding proportional returns, potentially impacting overall profitability. CIB's strategy might involve assessing whether these niche offerings align with long-term growth objectives or if resources could be better allocated elsewhere.

- Niche Market Focus: Sub-segments like advising on rare earth mineral extraction financing or specialized biotech IPOs might have limited deal volume.

- Resource Allocation: Investing in teams and research for these areas could divert resources from higher-demand, more profitable investment banking services.

- Performance Metrics: A review of 2024 data might show that these specialized units generated less than 1% of the total investment banking revenue, despite employing a dedicated team.

- Strategic Alignment: The bank needs to determine if maintaining a presence in these low-demand areas supports a broader strategic vision or if divestment or reduced focus is more prudent.

Certain legacy payment systems at Commercial International Bank (CIB) likely represent "Dogs" in the BCG matrix. These systems, often bypassed by the increasing adoption of digital payment methods, may struggle to justify their ongoing operational costs. For example, a significant portion of older, less integrated systems might hold a declining market share in payment processing, especially as newer, more user-friendly digital alternatives gain prominence.

The challenge for CIB is managing these legacy systems, which could incur maintenance costs exceeding their minimal revenue generation. In 2024, continued investment in supporting these older platforms, while actively promoting newer digital solutions, clearly indicates low growth and low market share. This situation calls for a strategic review to determine if divestment or a targeted upgrade is more financially sound.

Less adopted legacy payment systems within Commercial International Bank (CIB) likely fall into the Dogs category of the BCG matrix. These systems, often bypassed by the surge in digital payment adoption, may struggle to justify their continued operational expenses. For instance, a significant portion of older, less integrated systems might represent a declining market share in payment processing, especially as newer, more user-friendly digital alternatives gain traction.

The bank's approach to these "dogs" involves a careful analysis of their financial performance and strategic importance. Key metrics considered would include:

- Revenue generated versus operational expenses

- Market share in payment processing

- Customer adoption rates for these systems

- Ongoing maintenance and support costs

Question Marks

Commercial International Bank (CIB) is actively pursuing emerging fintech ventures and strategic partnerships as part of its digital transformation strategy. These initiatives are positioned as high-growth potential areas, even if their current market share is minimal.

These ventures, while requiring substantial upfront investment, are designed to capture new market segments and disrupt traditional banking models. CIB's investment in areas like AI-driven customer service platforms and blockchain-based transaction solutions exemplifies this forward-looking approach. For instance, CIB's 2024 digital banking investments are projected to reach EGP 2 billion, signaling a strong commitment to these nascent but potentially lucrative fields.

Commercial International Bank's (CIB) strategic push into new East African markets, beyond its established operations in Kenya and Ethiopia, positions it for high growth. This expansion targets regions with significant untapped potential, reflecting a forward-looking approach to market penetration.

Initially, CIB will likely face a low market share in these new territories. This necessitates considerable investment in building out essential infrastructure, cultivating brand awareness, and aggressively acquiring new customers to carve out a competitive niche.

For instance, the East African banking sector is projected to grow, with mobile banking adoption reaching over 80% in countries like Rwanda by 2024, presenting a key channel for CIB's expansion efforts. This rapid digital adoption underscores the potential for rapid customer acquisition if CIB leverages appropriate technologies.

Commercial International Bank (CIB) is likely exploring specialized green finance products to tap into emerging markets, such as sustainable agriculture technology or circular economy initiatives. These niche offerings, while capitalizing on the burgeoning global demand for eco-friendly solutions, would initially represent a small fraction of the market. For instance, the global green bond market reached an estimated USD 1.2 trillion in 2023, indicating substantial growth potential for specialized segments.

Advanced Data Analytics-Driven Personalized Financial Solutions

Commercial International Bank (CIB) is actively exploring the creation of highly advanced, personalized financial solutions powered by sophisticated data analytics and artificial intelligence. These offerings are designed to cater to specific, underserved customer micro-segments, aiming for significant market disruption and growth. For instance, in 2024, CIB continued to invest in its digital transformation, with a substantial portion of its IT budget allocated to data analytics infrastructure and AI development, aiming to identify these niche opportunities.

The potential for these data-driven personalized financial solutions is immense, promising to unlock new revenue streams and enhance customer loyalty. However, their current market penetration remains limited, necessitating substantial research and development investment. CIB's strategic focus in 2024 included pilot programs for AI-driven personalized investment advice, targeting a small but growing segment of digitally-savvy investors.

- High Growth Potential: These solutions target niche markets with unmet financial needs, offering a significant opportunity for expansion.

- Limited Current Penetration: Despite the potential, these advanced offerings are in the early stages of adoption and market presence.

- Significant R&D Investment: Developing and refining these sophisticated AI and data analytics capabilities requires considerable upfront capital and ongoing expenditure.

- Data-Driven Personalization: CIB's strategy emphasizes leveraging customer data to create bespoke financial products and services.

Blockchain-Based Cross-Border Payment Solutions

Blockchain-based cross-border payment solutions for Commercial International Bank (CIB) would likely be positioned as a question mark in the BCG matrix. This is due to the high growth potential of blockchain technology in revolutionizing financial transactions, offering increased speed and reduced costs compared to traditional methods. For instance, the global cross-border payments market was projected to reach over $156 trillion in 2022, with significant growth expected as digital solutions gain traction.

However, CIB's market share in this nascent area would initially be low. Significant investment would be required to develop, pilot, and scale these blockchain solutions, navigating regulatory hurdles and ensuring robust security. The bank would need to commit substantial resources to research and development, infrastructure upgrades, and talent acquisition to establish a competitive presence.

- High Growth Potential: Blockchain technology offers a transformative approach to cross-border payments, promising greater efficiency and lower transaction fees.

- Nascent Market Adoption: While promising, the integration of blockchain in traditional banking for payments is still in its early stages, indicating a developing market.

- Low Initial Market Share: CIB would likely start with a minimal share of this emerging market, necessitating strategic investments to gain traction.

- Investment Requirement: Significant capital outlay is expected for R&D, infrastructure, and regulatory compliance to successfully implement and scale blockchain payment solutions.

Commercial International Bank (CIB) is likely exploring specialized green finance products, such as those supporting sustainable agriculture or circular economy initiatives. These niche offerings tap into growing global demand for eco-friendly solutions, representing a significant growth opportunity despite their current small market share. For example, the global green bond market was estimated at USD 1.2 trillion in 2023, highlighting the expansive potential within this segment.

These green finance ventures, while requiring substantial upfront investment, are designed to capture new market segments and align with CIB's commitment to sustainability. CIB's 2024 strategy includes piloting green loan products, aiming to attract environmentally conscious clients and build a strong reputation in this evolving sector.

The bank's push into these specialized areas, while promising high future returns, currently represents a small portion of its overall business. This necessitates significant investment in product development, marketing, and regulatory compliance to establish a foothold.

The potential for these data-driven personalized financial solutions is immense, promising to unlock new revenue streams and enhance customer loyalty. However, their current market penetration remains limited, necessitating substantial research and development investment. CIB's strategic focus in 2024 included pilot programs for AI-driven personalized investment advice, targeting a small but growing segment of digitally-savvy investors.

| BCG Category | CIB's Initiatives | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | Fintech Ventures (AI, Blockchain) | High | Low | Invest selectively, monitor closely, divest if not gaining traction. |

| Question Marks | East African Expansion | High | Low | Invest to build market share, aim to become a star. |

| Question Marks | Green Finance Products | High | Low | Invest for future growth, build expertise. |

| Question Marks | Personalized Data-Driven Solutions | High | Low | Invest heavily in R&D and technology. |

BCG Matrix Data Sources

Our Commercial International Bank BCG Matrix leverages a blend of internal financial disclosures, global market growth data, and competitor performance benchmarks to provide a comprehensive strategic overview.