CI&T SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

CI&T's agility and strong digital transformation expertise are clear strengths in today's market. However, understanding their competitive landscape and potential operational challenges is crucial for informed decision-making.

Want the full story behind CI&T's market position, growth drivers, and potential hurdles? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

CI&T's strength as a Global Digital Transformation Specialist is underscored by its extensive experience, having partnered with over 100 large enterprises and fast-growth clients. This broad client base demonstrates their ability to deliver comprehensive digital solutions across diverse industries.

Their end-to-end service portfolio, encompassing strategy, research, data science, design, and engineering, provides a significant competitive advantage. This holistic approach ensures clients receive integrated support throughout their digital journey.

Operating in 9-10 countries with a nearshore delivery model, CI&T leverages its global footprint to offer localized expertise and efficient service delivery. This strategic positioning allows them to cater effectively to a worldwide clientele.

CI&T's strategic emphasis on Artificial Intelligence, powered by its proprietary CI&T FLOW platform, is a significant strength. This platform is designed to enhance team productivity and ensure scalable, efficient solution delivery, directly accelerating client business transformations. Their proactive investment in emerging technologies like Generative AI further solidifies their innovative market positioning.

CI&T's financial health is a significant strength, evidenced by its impressive performance in early 2025. The company achieved a 13.7% net revenue growth at constant currency when comparing Q1 2025 to Q1 2024. This growth is complemented by a substantial 64.7% increase in net profit over the same period.

Further bolstering this strength, CI&T reported a 15.2% rise in Adjusted EBITDA in Q1 2025. The company's confidence in its trajectory is reflected in its reaffirmed guidance for the full year 2025, suggesting sustained operational efficiency and a solid business model.

High Client Satisfaction and Industry Recognition

CI&T boasts exceptional client satisfaction, evidenced by a remarkable 4.8 out of 5 customer rating in Gartner Peer Insights for Custom Software Development Services as of 2024. This high score is further bolstered by a 100% recommendation rate from their clients, underscoring their ability to consistently meet and exceed expectations.

The company's commitment to delivering tangible value and cultivating enduring client relationships has earned them significant industry recognition. Everest Group has acknowledged CI&T as both a 'Strong Performer' and a 'Major Contender,' validating their expertise and market position.

- Client Satisfaction: 4.8/5 rating in 2024 Gartner Peer Insights.

- Recommendation Rate: 100% of clients willing to recommend.

- Industry Recognition: Named 'Strong Performer' and 'Major Contender' by Everest Group.

Agile Delivery and Innovation Culture

CI&T's commitment to agile delivery and a culture of continuous innovation is a significant strength, enabling them to effectively address complex client challenges and create impactful digital solutions. This approach fosters speed and quality, crucial for success in today's fast-paced digital landscape.

Their lean digital methodology allows organizations to achieve rapid scalability while maintaining high product quality, a key differentiator in a crowded market. This focus on efficient, iterative development ensures clients can adapt quickly to evolving needs and market demands.

- Agile Delivery: Enables rapid iteration and adaptation to client needs.

- Innovation Culture: Fosters the development of cutting-edge digital products.

- Speed at Scale: Allows for efficient, high-volume production of quality solutions.

- 30-Year Track Record: Demonstrates deep expertise and proven adaptability in navigating market changes.

CI&T's deep expertise in digital transformation is a core strength, evidenced by its 30-year track record and partnerships with over 100 large enterprises. This extensive experience translates into a comprehensive understanding of client needs across various sectors.

The company's end-to-end service offering, from strategy to engineering, provides a significant advantage, ensuring seamless project execution. Furthermore, its global presence across 9-10 countries, coupled with a nearshore delivery model, allows for efficient and localized service.

CI&T's strategic focus on AI, powered by its CI&T FLOW platform, enhances productivity and accelerates client transformations. This commitment to innovation is further demonstrated by their investment in emerging technologies like Generative AI.

| Metric | Q1 2025 vs Q1 2024 | Significance |

|---|---|---|

| Net Revenue Growth (Constant Currency) | 13.7% | Demonstrates strong market demand and effective sales strategies. |

| Net Profit Growth | 64.7% | Indicates improved operational efficiency and profitability. |

| Adjusted EBITDA Growth | 15.2% | Shows healthy growth in core operational earnings. |

| Client Satisfaction (Gartner Peer Insights) | 4.8/5 (2024) | Highlights exceptional client experience and service quality. |

| Client Recommendation Rate | 100% | Underscores high client loyalty and trust in CI&T's capabilities. |

What is included in the product

Delivers a strategic overview of CI&T’s internal and external business factors, identifying key growth drivers and weaknesses.

Simplifies complex strategic challenges by highlighting key strengths and opportunities for growth.

Weaknesses

CI&T's forward outlook is increasingly influenced by macroeconomic uncertainty, which directly impacts IT spending and the pipeline of digital transformation projects. This global economic volatility could potentially dampen demand for their services, even as revenue growth remains positive, especially in key markets like the U.S. and Brazil.

CI&T is susceptible to wage inflation, a persistent issue in the competitive tech services industry, which directly squeezes profit margins. While the company saw improved profitability in Q1 2025, continued upward pressure on labor costs could make sustaining these margins challenging.

This dynamic necessitates stringent cost control measures and might limit the company's capacity for substantial investments in other growth areas without impacting its bottom line.

CI&T operates in a digital transformation market teeming with competition, from global IT giants to specialized boutiques. This crowded field puts constant pressure on pricing, which could impact CI&T's revenue and market standing if they struggle to stand out or offer compelling value. For instance, the global digital transformation market was valued at approximately USD 4.5 trillion in 2023 and is projected to grow significantly, highlighting the sheer number of participants vying for market share.

Dependency on Talent Retention

CI&T's success as a technology transformation specialist hinges on its ability to keep its highly skilled workforce, particularly in areas like AI, data science, design, and engineering. This reliance on specialized talent makes retention a critical factor for sustained growth and service quality.

While CI&T saw a substantial 21.6% increase in its employee base during the first quarter of 2025, demonstrating expansion, the ongoing competition for tech talent presents a significant risk. High attrition rates or an inability to attract and retain top professionals could directly impact the company's capacity to deliver on client projects and pursue new growth opportunities throughout 2025.

- Talent Dependency: CI&T's core offering relies on a deep pool of specialized tech expertise.

- Retention Challenge: The competitive landscape for AI, data science, and engineering talent is fierce.

- Growth Impact: High attrition or difficulty in hiring could hinder service delivery and expansion plans.

- 2025 Focus: Building and retaining future-ready tech talent is a paramount challenge for the company this year.

Acquisition Strategy Integration Risks

CI&T's growth through acquisitions, with eight completed by July 2025, the latest in October 2022, introduces significant integration risks. Successfully merging diverse company cultures, operational systems, and technological platforms is a complex undertaking. Failure to achieve seamless integration can lead to inefficiencies, loss of key talent, and a dilution of the expected synergies from these strategic moves.

The challenge lies in harmonizing distinct business processes and IT infrastructures. This is particularly critical for a company like CI&T, which relies on agile and integrated service delivery. Potential disruptions to existing client projects or a slowdown in innovation could arise if integration efforts are not meticulously managed.

Key integration risks include:

- Cultural Clashes: Mismatched corporate cultures can hinder collaboration and employee retention.

- Technological Incompatibility: Integrating different IT systems and software can be costly and time-consuming.

- Operational Disruptions: Merging workflows and supply chains might temporarily impact service delivery and efficiency.

- Loss of Key Personnel: Uncertainty during integration can lead to valuable employees seeking opportunities elsewhere.

CI&T faces significant challenges in retaining its specialized workforce, a critical component for its technology transformation services. The intense competition for talent in areas like AI, data science, and engineering means that high attrition rates or difficulties in attracting top professionals could directly impede the company's ability to deliver on client projects and pursue new growth avenues throughout 2025.

The company's growth strategy, which includes acquisitions, introduces substantial integration risks. Merging diverse company cultures, operational systems, and technological platforms is inherently complex. A failure to achieve seamless integration could result in inefficiencies, the loss of key personnel, and a dilution of expected synergies, potentially impacting service delivery and innovation throughout 2025.

Macroeconomic volatility remains a key weakness, directly impacting IT spending and the pipeline for digital transformation projects. This global economic uncertainty could dampen demand for CI&T's services, even as revenue growth shows resilience in markets like the U.S. and Brazil.

Wage inflation in the competitive tech services sector poses a persistent threat to CI&T's profit margins. While Q1 2025 showed improved profitability, sustained upward pressure on labor costs could make maintaining these margins difficult, potentially limiting investments in other growth areas.

What You See Is What You Get

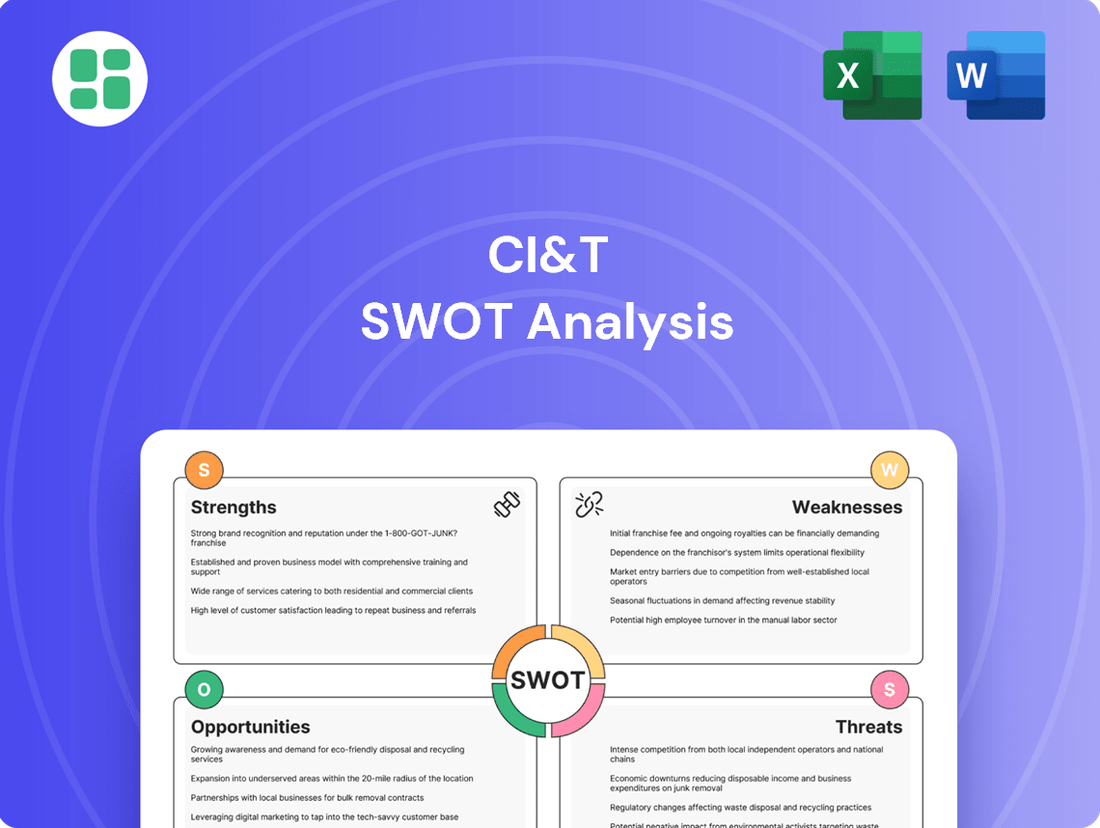

CI&T SWOT Analysis

This is the actual CI&T SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This preview showcases the core insights and structure you can expect in the complete report.

The preview below is taken directly from the full CI&T SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is a real excerpt from the complete CI&T SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to integrate it seamlessly into your own strategic planning.

Opportunities

The digital transformation market is booming, expected to hit close to $4 trillion by 2027. This massive growth, with a CAGR over 20% from 2024 to 2025, presents a significant chance for CI&T to bring on new clients. The expanding digital landscape means more businesses are seeking expert help to modernize their operations.

CI&T can leverage this trend to broaden its service portfolio, offering specialized solutions in areas like cloud migration, data analytics, and AI implementation. This allows the company to cater to a wider range of client needs within this dynamic market.

The increasing adoption of Artificial Intelligence and Machine Learning, especially Generative AI, is a major catalyst for the digital transformation sector. By 2025, it's projected that 75% of businesses will be actively implementing AI.

CI&T's proactive AI-driven strategy, coupled with its proprietary AI platform, CI&T FLOW, places the company in a strong position to leverage this growing demand for AI-powered solutions and services.

CI&T is well-positioned to grow its market share by entering new industry sectors or strengthening its foothold in existing, rapidly expanding verticals. This strategic expansion is crucial for sustained growth.

The recent appointment of a North America Leader for its Retail and Consumer Goods business underscores a deliberate push into key sectors and geographical markets. This move is designed to capitalize on emerging consumer trends and demand.

Leveraging its established global footprint across 10 countries, CI&T can tap into diverse market needs and client bases. This international presence provides a robust platform for scalable expansion and cross-border collaboration.

Strategic Partnerships and Acquisitions

CI&T can significantly boost its market position by forming strategic partnerships and pursuing further acquisitions. These moves would not only broaden its client roster but also unlock access to new geographical and service markets, enhancing its overall capabilities. While CI&T has not announced any acquisitions in 2024 or 2025 to date, its past acquisitions have demonstrably expanded its footprint in IT Services and Digital Transformation, demonstrating a proven strategy for growth.

Strategic alliances are particularly valuable for strengthening CI&T's service portfolio in high-demand areas such as cloud computing and advanced data analytics. For instance, a partnership with a leading cloud provider could enable CI&T to offer more integrated and comprehensive cloud migration and management solutions. Such collaborations can also provide access to specialized talent and cutting-edge technologies, further differentiating CI&T in a competitive landscape.

- Expand Service Offerings: Forge alliances with specialized technology firms to integrate niche solutions, such as AI-driven customer experience platforms, into CI&T's digital transformation suite.

- Market Penetration: Acquire smaller, regional IT consultancies in growth markets like Southeast Asia or Latin America to quickly establish a local presence and client base.

- Capability Enhancement: Partner with cybersecurity firms to offer robust security consulting alongside digital transformation projects, addressing a critical client need.

- Revenue Diversification: Explore acquisitions of companies with recurring revenue models in areas like managed cloud services to create more predictable income streams.

Demand for Cloud Migration and Application Modernization

The global cloud computing market is experiencing robust growth, with projections indicating a significant expansion through 2025 and beyond. This surge is driven by enterprises prioritizing cloud-native solutions to boost efficiency and gain a competitive edge. For instance, the worldwide spending on cloud services was expected to reach $678.8 billion in 2024, a 20.4% increase from 2023, according to Gartner. This trend underscores a massive opportunity for companies like CI&T.

CI&T is well-positioned to capitalize on this demand due to its proven expertise in application modernization. By integrating AI and leveraging strategic cloud partnerships, CI&T can effectively assist clients in transitioning their legacy systems to scalable, modern cloud environments. This capability directly addresses the market's need for enhanced operational agility and innovation.

Key aspects of this opportunity include:

- Accelerated Cloud Adoption: Businesses are fast-tracking their cloud migration strategies to achieve greater scalability and cost savings.

- Legacy System Modernization: A significant portion of enterprise IT infrastructure still relies on outdated systems, creating a substantial market for modernization services.

- AI Integration: The demand for embedding AI capabilities into modernized applications is rapidly increasing, offering a pathway for enhanced client value.

- Strategic Cloud Partnerships: Collaborations with major cloud providers enable CI&T to offer comprehensive and tailored migration solutions.

The burgeoning digital transformation market, projected to approach $4 trillion by 2027 with a robust CAGR exceeding 20% from 2024 to 2025, offers CI&T substantial client acquisition potential. This growth is fueled by an increasing number of businesses seeking expert assistance to modernize their operations, creating a fertile ground for CI&T's specialized services.

CI&T can strategically expand its service portfolio to include cloud migration, data analytics, and AI implementation, thereby catering to a broader spectrum of client requirements within this dynamic market. The company's proactive AI strategy and its proprietary platform, CI&T FLOW, are particularly advantageous in meeting the escalating demand for AI-powered solutions.

The global cloud computing market's expansion through 2025, driven by enterprises prioritizing cloud-native solutions for efficiency and competitive advantage, presents a significant opportunity. Worldwide cloud service spending was anticipated to reach $678.8 billion in 2024, a 20.4% increase from 2023, according to Gartner. CI&T's expertise in application modernization, coupled with AI integration and strategic cloud partnerships, positions it to effectively assist clients in transitioning to scalable cloud environments.

| Market Opportunity | Projected Growth (2024-2025) | CI&T's Advantage |

|---|---|---|

| Digital Transformation Market | Approaching $4 Trillion by 2027; CAGR >20% (2024-2025) | Leveraging expertise to onboard new clients seeking modernization. |

| AI Adoption in Business | 75% of businesses implementing AI by 2025 | Proprietary AI platform (CI&T FLOW) to meet AI-driven solution demand. |

| Global Cloud Computing Market | Worldwide cloud spending: $678.8 Billion (2024, +20.4% YoY) | Proven application modernization skills and strategic cloud partnerships. |

Threats

The digital transformation and custom software development sector is incredibly crowded, with numerous companies competing for projects. This intense rivalry often translates into significant pricing pressures, making it challenging for firms like CI&T to sustain premium margins if competitors undercut their pricing for comparable services.

For instance, the global digital transformation market was valued at approximately $679.5 billion in 2023 and is projected to reach $2.57 trillion by 2032, showcasing immense growth but also highlighting the sheer number of players entering the space. Companies that don't actively innovate or clearly define their unique value proposition are at a heightened risk of losing market share to more agile or cost-effective rivals.

Global economic uncertainties, including potential recessions, pose a significant threat by potentially curbing enterprise IT budgets. This could directly impact CI&T's revenue streams as businesses prioritize essential spending over digital transformation initiatives.

For instance, CI&T's widened forward outlook, as reported in their 2024 guidance, reflects an acknowledgment of increased macro uncertainty, signaling that clients might delay or reduce investments in projects.

The relentless pace of technological evolution, especially in AI and cloud services, demands substantial and ongoing R&D investment for CI&T to maintain its market position. For instance, the global AI market is projected to reach $1.8 trillion by 2030, highlighting the critical need for continuous innovation.

Failure to swiftly integrate new technologies or adapt to shifting client demands poses a significant threat, potentially eroding CI&T's competitive advantage. This could render their specialized platforms less impactful as the market adopts more advanced solutions.

Talent Shortage and Retention Challenges

The intense demand for digital transformation and AI expertise creates a significant talent shortage, impacting companies like CI&T. This scarcity makes attracting and keeping skilled professionals a major hurdle.

CI&T's expansion hinges on its ability to secure and retain top-tier talent. Intense competition for these in-demand skills, coupled with rising salary expectations, could slow down project execution and hinder operational scaling.

- High Demand for AI/Digital Transformation Talent: Reports indicate a persistent gap between the need for these skills and available professionals, with some estimates suggesting millions of unfilled roles globally by 2025.

- Increased Labor Costs: The competitive landscape for tech talent has driven up average salaries for specialized roles, potentially impacting CI&T's cost structure and profitability.

- Retention as a Key Challenge: Companies are investing heavily in retention strategies, including competitive compensation, professional development, and flexible work arrangements, to combat high turnover rates in the tech sector.

Data Privacy and Cybersecurity Risks

CI&T's reliance on handling sensitive client data and developing intricate digital solutions exposes it to significant cybersecurity threats and the ever-changing landscape of data privacy regulations like GDPR and CCPA. A data breach could result in severe reputational damage, hefty financial penalties, and a critical erosion of client trust.

The ongoing need for robust compliance with these regulations necessitates continuous investment in security infrastructure and vigilant operational practices. In 2024, the average cost of a data breach globally reached $4.45 million, highlighting the substantial financial implications for companies like CI&T.

- Cybersecurity Threats: CI&T is vulnerable to ransomware, phishing, and other cyberattacks targeting sensitive client information.

- Data Privacy Regulations: Non-compliance with GDPR, CCPA, and similar laws can lead to substantial fines, impacting profitability.

- Reputational Damage: A security incident can severely damage client trust and CI&T's market standing.

- Compliance Costs: Maintaining compliance requires ongoing investment in technology and personnel, adding to operational expenses.

The intense competition within the digital transformation sector, characterized by pricing pressures, threatens CI&T's profitability if rivals offer lower-cost alternatives for similar services. Furthermore, global economic instability, including potential recessions, could lead to reduced enterprise IT spending, directly impacting CI&T's revenue streams as clients might scale back on digital initiatives.

The rapid advancement of technologies like AI necessitates continuous and substantial R&D investment for CI&T to maintain its competitive edge. A failure to integrate new technologies swiftly or adapt to evolving client needs risks diminishing CI&T's market position and value proposition.

A critical threat for CI&T is the scarcity of specialized talent in digital transformation and AI, making recruitment and retention challenging and potentially slowing project execution. This talent shortage is exacerbated by rising labor costs, as evidenced by the increasing salaries for in-demand tech professionals, impacting CI&T's operational expenses and profitability.

CI&T faces significant cybersecurity risks and evolving data privacy regulations, such as GDPR and CCPA. A data breach could lead to severe reputational damage, substantial financial penalties, and a critical loss of client trust, with the average cost of a data breach globally reaching $4.45 million in 2024.

| Threat Category | Specific Threat | Impact on CI&T | Example Data/Statistic |

|---|---|---|---|

| Market Competition | Intense Rivalry & Pricing Pressure | Erosion of profit margins, loss of market share | Global digital transformation market valued at ~$679.5B in 2023, indicating high competition. |

| Economic Factors | Global Economic Uncertainty | Reduced client IT budgets, project delays/cancellations | CI&T's 2024 guidance acknowledged increased macro uncertainty. |

| Technological Disruption | Rapid Technological Evolution (AI, Cloud) | Risk of obsolescence, need for constant R&D investment | Global AI market projected to reach $1.8T by 2030. |

| Talent Management | Talent Shortage & Increased Labor Costs | Hinders project execution, impacts profitability | Millions of unfilled AI/digital transformation roles globally projected by 2025. |

| Cybersecurity & Compliance | Cyberattacks & Data Privacy Regulations | Reputational damage, financial penalties, loss of client trust | Average cost of a data breach in 2024 was $4.45M globally. |

SWOT Analysis Data Sources

This CI&T SWOT analysis is built upon a robust foundation of data, including verified financial reports, comprehensive market intelligence, and expert industry evaluations for a precise and actionable assessment.