CI&T Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

CI&T faces a dynamic competitive landscape, with moderate threats from new entrants and substitutes that require careful strategic navigation. Understanding the interplay of buyer power and supplier leverage is crucial for sustained growth.

The full Porter's Five Forces Analysis for CI&T offers a comprehensive, data-driven framework to dissect these market pressures. Unlock actionable insights and strategic recommendations to solidify CI&T's competitive edge and capitalize on emerging opportunities.

Suppliers Bargaining Power

The digital transformation sector thrives on specialized expertise, including AI specialists, data scientists, and seasoned software engineers. This high demand for unique skills creates a significant talent shortage, empowering these professionals with substantial bargaining power.

A notable skills gap, especially in data science, intensifies the need for external talent, further strengthening the leverage of these specialized individuals. CI&T's workforce expansion highlights its commitment to acquiring these in-demand capabilities to satisfy client needs.

Technology platform providers, such as those offering cloud computing or AI tools, wield significant bargaining power. This is particularly true when their services are specialized or have become industry standards, making it difficult for companies like CI&T to switch. For instance, major cloud providers often have complex integration processes, leading to high switching costs for deeply embedded solutions.

Enterprises are shifting their focus from mere cost savings to tangible business outcomes. This means suppliers who can demonstrate measurable results and offer comprehensive partner ecosystems, like CI&T, are in high demand.

This growing demand for value-driven partnerships with proven track records naturally concentrates power with a select group of high-quality vendors. Consequently, these leading suppliers are in a stronger position to negotiate better terms and conditions with their clients.

Switching costs for CI&T

Switching costs for CI&T can be substantial, particularly when it involves changing core technology platforms or replacing a large pool of specialized talent. This significant investment in integration and retraining creates a degree of dependence on existing supplier relationships, thereby increasing supplier leverage.

These switching costs empower suppliers by making it difficult and expensive for CI&T to move to alternatives. For instance, migrating from one cloud-based development platform to another might necessitate considerable upfront costs for data transfer, system re-architecture, and employee re-skilling. This inertia benefits suppliers who can then command higher prices or more favorable terms.

- High integration costs: Replacing specialized software or hardware often requires extensive customization and testing.

- Talent retraining expenses: Acquiring and training new personnel on different technologies can be a significant operational burden.

- Disruption to ongoing projects: A supplier change can interrupt project timelines and impact service delivery.

Forward integration by talent

Highly skilled individuals, particularly in fields like AI and data science, are increasingly opting to offer their expertise directly to clients. This bypasses traditional consulting firms, effectively acting as a form of forward integration by talent. For instance, in 2024, the demand for specialized AI consultants saw significant growth, with some niche firms reporting billable rates exceeding $500 per hour for top-tier talent.

This trend empowers individual specialists and small, agile consulting groups by allowing them to capture a larger share of the value chain. When these in-demand professionals can directly serve end-users, their bargaining power against larger organizations, which previously acted as intermediaries, is substantially enhanced.

- Talent as a Direct Service Provider: Skilled individuals can now bypass larger consulting firms and offer their services directly to clients.

- Forward Integration by Specialists: This strategy is particularly prevalent among in-demand AI and data specialists, allowing them to control their client relationships and pricing.

- Increased Bargaining Power: Direct client engagement enhances the leverage of individual talent within the broader consulting ecosystem.

- Market Dynamics in 2024: The market for specialized AI consultants in 2024 saw some niche providers commanding rates upwards of $500 per hour, reflecting this shift in power.

Suppliers of specialized technology platforms and highly skilled talent possess significant bargaining power. This is amplified when switching costs are high, such as with complex cloud integrations or the need for extensive retraining of personnel. In 2024, the demand for AI and data science expertise led to specialized consultants commanding rates exceeding $500 per hour, demonstrating the leverage of these individuals.

The trend of skilled professionals offering services directly to clients, bypassing larger firms, further enhances their bargaining power. This forward integration by talent means suppliers who can demonstrate clear business outcomes and offer robust ecosystems are in a stronger negotiating position.

| Supplier Type | Bargaining Power Factors | Example Impact (2024) |

|---|---|---|

| Technology Platform Providers | High switching costs, specialized services, industry standardization | Difficult to change cloud providers, impacting integration and costs. |

| Specialized Talent (AI/Data Science) | Unique skills, talent shortage, direct client engagement | Rates exceeding $500/hour for niche consultants, increased leverage. |

| Value-Driven Partners | Demonstrable business outcomes, comprehensive ecosystems | Concentrates power with high-quality vendors, enabling better terms. |

What is included in the product

Analyzes the competitive landscape for CI&T by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the digital transformation industry.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

CI&T's large enterprise customer base, exceeding 100 major clients, significantly impacts its bargaining power. These clients, often with substantial budgets and intricate requirements, wield considerable influence due to the sheer volume of business they represent.

The concentration of business with these large enterprises means their demands can shape market trends and service offerings. For instance, if a few key clients were to negotiate for lower pricing or specific service customizations, it could set a precedent for the entire industry, thereby increasing customer bargaining power.

The digital transformation market is highly competitive, offering clients a plethora of choices beyond CI&T. Major IT consulting giants like Deloitte, IBM, and Accenture, alongside specialized digital firms such as Globant and Epam, provide a wide spectrum of services.

This abundance of providers empowers customers, giving them significant leverage to compare pricing, service quality, and innovation capabilities. For instance, in 2024, the global IT services market was valued at over $1.3 trillion, indicating a vast landscape where clients can readily find alternatives.

Consequently, customers can negotiate more favorable terms and conditions, as providers must actively differentiate themselves to secure business. This competitive environment directly translates to a higher bargaining power for buyers in the digital transformation sector.

While customers certainly have options when selecting a digital transformation partner, the reality of switching providers for complex, ongoing projects can be a significant undertaking. Consider the substantial investment already made in integration, data migration, and personnel training; these elements create a powerful disincentive to change mid-stream.

For instance, a large enterprise undertaking a multi-year cloud migration with a partner has likely sunk millions into the initiative. The cost and disruption associated with extracting data, re-integrating systems, and onboarding a new vendor can easily run into the tens of millions, effectively locking them in for the project's duration and diminishing their immediate bargaining leverage.

Customer focus on measurable outcomes

Customers are increasingly demanding concrete results and a clear return on their investment from digital transformation projects. This focus on measurable outcomes empowers them to negotiate more effectively with providers like CI&T, pushing for agreements tied to performance rather than just service delivery.

This shift means clients are scrutinizing the tangible business benefits they receive, such as increased revenue, cost savings, or improved customer engagement. For instance, a recent survey of IT decision-makers in 2024 indicated that 75% consider demonstrable ROI a primary factor when selecting a digital transformation partner.

- Focus on ROI: Clients prioritize providers who can clearly articulate and deliver a quantifiable return on investment.

- Performance-based contracts: The trend is towards agreements where provider compensation is linked to achieving specific, agreed-upon business objectives.

- Accountability: Customers expect providers to be accountable for the business impact of their digital solutions.

- Value demonstration: Providers must effectively showcase the tangible value and business outcomes generated by their services.

Internal capabilities and multi-vendor strategies

Many large enterprises are actively building their internal digital capabilities, aiming to lessen reliance on external partners. This strategic shift empowers them with greater control and reduces their vulnerability to a single provider.

Furthermore, the adoption of multi-vendor strategies is a growing trend. By cultivating relationships with multiple specialized providers, companies create a competitive landscape, significantly boosting their bargaining power. For instance, in 2024, a survey of Fortune 500 companies revealed that 65% were actively diversifying their IT service providers to mitigate single-vendor risk.

- In-house development: Companies investing in digital talent and platforms gain leverage.

- Multi-vendor approach: Cultivating alternative suppliers creates competitive tension.

- Negotiation leverage: The ability to switch providers enhances customer power.

- Cost optimization: Diversification often leads to better pricing and service terms.

Customer bargaining power in the digital transformation sector is substantial, driven by the sheer volume of business large enterprises represent and the competitive market landscape. Clients can readily compare pricing and service quality among numerous providers, as evidenced by the over $1.3 trillion global IT services market value in 2024. This allows them to negotiate more favorable terms.

Despite the high switching costs for complex projects, customers are increasingly focused on demonstrable ROI, with 75% of IT decision-makers in 2024 prioritizing quantifiable business benefits. This emphasis on performance-based contracts and accountability further amplifies their negotiating leverage.

The trend of enterprises building internal digital capabilities and adopting multi-vendor strategies also bolsters customer power. In 2024, 65% of Fortune 500 companies were diversifying IT providers to mitigate single-vendor risk, enhancing their ability to negotiate effectively.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Customer Concentration | High (due to large enterprise clients) | CI&T has over 100 major clients |

| Availability of Alternatives | High (competitive market) | Global IT services market > $1.3 trillion |

| Switching Costs | Moderate to High (for complex projects) | Millions in sunk costs for cloud migration |

| Customer Focus on ROI | High (driving performance-based contracts) | 75% of IT decision-makers prioritize ROI |

| Internal Capabilities & Multi-Vendor Strategies | High (reducing reliance and creating competition) | 65% of Fortune 500 diversifying IT providers |

What You See Is What You Get

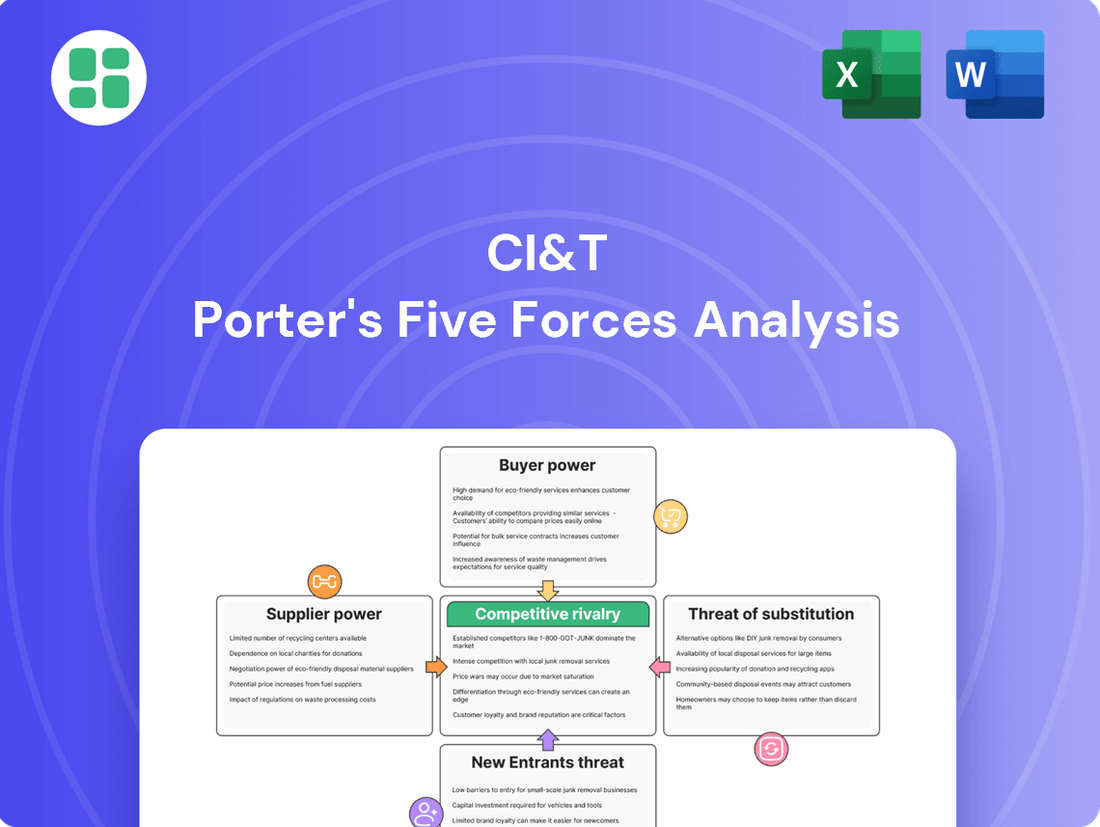

CI&T Porter's Five Forces Analysis

You're previewing the final version of our CI&T Porter's Five Forces Analysis. The document you see here is precisely the same comprehensive analysis that will be available to you instantly after completing your purchase, offering a detailed examination of competitive pressures within CI&T's industry landscape.

Rivalry Among Competitors

The digital transformation market is booming, expected to hit $2.11 trillion by 2025 and keep growing substantially. This rapid expansion acts like a magnet, drawing in a vast number of companies eager to capture a piece of the action.

As more players enter this lucrative space, the competition naturally heats up. Firms are constantly innovating and adapting to stand out and secure their market share in this dynamic environment.

CI&T operates within a highly competitive arena, contending with global IT consulting behemoths, agile niche digital agencies, and specialized software development firms. This broad spectrum of competitors means rivalry isn't confined to a single dimension; it spans the breadth of service offerings, depth of specialized expertise, and the extent of global operational reach.

For instance, while large players like Accenture and IBM offer comprehensive digital transformation services, smaller, specialized firms often excel in specific areas like AI or cloud migration, presenting a different kind of challenge. In 2023, the global IT services market was valued at approximately $1.3 trillion, indicating the sheer scale of this competitive environment and the diverse players vying for market share.

CI&T stands out in the competitive landscape by leveraging deep expertise across AI, strategy, design, data science, and agile delivery, a foundation built over 30 years. This specialization allows them to tackle complex challenges with tailored solutions, setting them apart from more generalized IT service providers.

A significant competitive advantage for CI&T is their proprietary AI platform, CI&T FLOW. This platform is designed to enhance operational efficiency and accelerate the delivery of tangible business outcomes for clients, directly impacting their ability to compete and innovate.

In 2024, the demand for AI-driven solutions and digital transformation services continued to surge, with many companies seeking specialized partners to navigate this complex terrain. CI&T's focus on these high-demand areas, coupled with their proven track record, positions them favorably against rivals who may lack such specialized capabilities.

Focus on large enterprises and complex challenges

CI&T's strategic focus on large enterprises and intricate, end-to-end digital transformation projects inherently steers them away from the most intense price wars. By concentrating on clients with complex needs, CI&T cultivates a value proposition centered on deep partnership and innovative solutions, rather than competing solely on cost. This approach effectively sidesteps the direct price-based competition often seen from smaller, more generalized IT service providers.

- Targeting high-value clients: Large enterprises often have substantial budgets for digital transformation, allowing CI&T to command premium pricing for specialized services.

- Differentiation through complexity: CI&T's ability to handle complex, multi-faceted projects sets them apart from competitors focused on simpler, commoditized IT tasks.

- Reduced direct competition: By specializing in end-to-end transformation, CI&T faces fewer direct rivals compared to firms offering a broader, less specialized service portfolio.

Ongoing innovation and strategic partnerships

The competitive landscape in technology services, especially around AI and cloud-native solutions, necessitates constant innovation. CI&T's focus on these cutting-edge areas is vital for staying ahead.

Strategic partnerships are key to accelerating development and expanding market reach. CI&T actively cultivates these alliances to enhance its offerings and drive growth.

- Innovation Focus: CI&T invests heavily in R&D, with a significant portion of its resources dedicated to exploring advancements in AI, machine learning, and cloud technologies.

- Partnership Ecosystem: The company collaborates with major cloud providers and technology firms, creating a robust network that allows for integrated solutions and faster go-to-market strategies.

- Market Responsiveness: CI&T's agility in adopting new technologies and forming strategic alliances allows it to quickly respond to evolving client needs and emerging market trends, a critical factor in the fast-paced tech sector.

The digital transformation market is intensely competitive, with numerous global IT consulting firms, specialized digital agencies, and software developers vying for market share. This broad competition means companies must differentiate themselves not just on price, but on specialized expertise and innovative solutions. In 2023, the global IT services market was valued at approximately $1.3 trillion, underscoring the scale of this rivalry. CI&T differentiates itself by focusing on complex, end-to-end digital transformation projects and leveraging deep expertise in areas like AI and cloud-native solutions, allowing them to target high-value clients and avoid direct price wars with less specialized competitors.

| Competitor Type | Key Differentiators | Market Share Impact |

|---|---|---|

| Global IT Consulting Behemoths (e.g., Accenture, IBM) | Broad service offerings, extensive global reach, established client relationships | Significant market presence, often compete on scale and comprehensive solutions |

| Niche Digital Agencies | Specialized expertise in specific areas (e.g., UX/UI design, digital marketing), agile approach | Can capture specific market segments, often partner with larger firms for broader projects |

| Specialized Software Development Firms | Deep technical skills in particular technologies (e.g., AI, blockchain), rapid development cycles | Compete on technical prowess and speed of delivery, crucial for innovation-driven clients |

SSubstitutes Threaten

Large enterprises are increasingly investing in their in-house digital transformation capabilities. This trend, driven by a desire for greater control and cost efficiency, can reduce reliance on external providers like CI&T for certain projects. For instance, many Fortune 500 companies have established dedicated digital innovation labs, aiming to bring core competencies in-house.

The increasing prevalence of low-code and no-code platforms presents a significant threat of substitutes for traditional custom software development. These platforms enable businesses to build applications and automate workflows with significantly less reliance on skilled programmers. For instance, Gartner projected that the low-code development market would reach $26.9 billion in 2023, a substantial increase from previous years, highlighting its growing adoption as an alternative to traditional coding.

For many straightforward digital solutions, these platforms offer a more accessible and cost-effective route compared to engaging in lengthy and expensive custom software projects. This can divert demand away from companies specializing in bespoke development, especially for less complex needs where speed and budget are primary concerns. The ease of use and reduced time-to-market offered by low-code solutions directly challenge the value proposition of traditional development services for a segment of the market.

The availability of off-the-shelf software and Software-as-a-Service (SaaS) presents a significant threat of substitution for custom-built digital products. For many common business functions, readily available commercial solutions can fulfill needs at a lower cost and with faster deployment. This is especially true for small and medium-sized enterprises (SMEs), which are increasingly adopting SaaS to reduce upfront investment and accelerate their digital transformation.

In 2024, the global SaaS market continued its robust growth, with revenue projected to reach over $200 billion. This widespread adoption of SaaS platforms for customer relationship management, enterprise resource planning, and marketing automation demonstrates a clear preference for accessible, subscription-based software over the development of bespoke solutions. The ease of integration and scalability offered by these platforms further enhances their appeal as substitutes.

Generic IT consulting or staff augmentation

The threat of substitutes, particularly generic IT consulting or staff augmentation, presents a challenge for CI&T. While CI&T offers comprehensive, end-to-end digital transformation solutions, clients may choose simpler, more cost-effective alternatives for specific needs.

These substitutes, such as hiring individual contractors or engaging with general IT service providers, can fulfill discrete technical requirements without the holistic strategic and design integration that CI&T provides. For instance, a company needing to quickly fill a gap in its software development team might opt for staff augmentation over CI&T's broader transformation services.

- Cost-effectiveness: Generic IT consulting and staff augmentation often come at a lower price point than CI&T's integrated services, appealing to budget-conscious clients.

- Task-specific focus: These substitutes are ideal for addressing narrowly defined technical tasks or skill shortages, offering a direct solution without the overhead of a full transformation engagement.

- Market availability: The IT consulting and staff augmentation market is highly fragmented, with numerous providers readily available to meet diverse client demands.

- Perceived simplicity: For clients with less complex needs, engaging with a generic provider may seem less daunting than navigating a comprehensive transformation project.

Evolution of AI tools

The increasing sophistication and accessibility of AI and generative AI tools pose a significant threat of substitution for certain digital transformation services. As these AI applications become more powerful, client teams with advanced AI capabilities might be able to perform tasks like automation and data analysis internally, reducing their reliance on external providers.

This trend is particularly relevant in areas where AI can directly replicate human-driven processes. For instance, by mid-2024, many enterprises were exploring or implementing AI-powered platforms for tasks that previously required extensive IT or consulting support. The market for AI development and deployment tools saw substantial growth, with some reports indicating a global market size exceeding $200 billion by the end of 2024, highlighting the rapid advancement and adoption of these technologies.

- AI-driven automation: Routine tasks in areas like customer service chatbots, data entry, and basic report generation can be increasingly handled by AI, potentially substituting for human resources and specialized service providers.

- Self-service analytics: Advanced AI platforms are enabling business users to perform complex data analysis and gain insights without needing dedicated data science teams or external analytics consultancies.

- Generative AI for content and code: Generative AI tools are becoming capable of producing marketing copy, code snippets, and even initial design concepts, which could reduce the need for specialized agencies or development teams for certain projects.

- Internal AI expertise development: As organizations invest in training and upskilling their workforces in AI, they build internal capacity to manage and implement AI solutions, diminishing the long-term need for external digital transformation partners for these specific functions.

The threat of substitutes for digital transformation services like those offered by CI&T stems from readily available, often lower-cost alternatives that can fulfill specific business needs. These substitutes range from in-house capabilities and off-the-shelf software to emerging AI technologies.

The growing adoption of low-code/no-code platforms and SaaS solutions directly challenges custom development. For instance, the global SaaS market was projected to exceed $200 billion in 2024, indicating a strong preference for accessible, subscription-based software over bespoke solutions for many common business functions.

Furthermore, the increasing power of AI and generative AI tools allows companies to automate tasks and perform analyses internally, reducing reliance on external providers for certain digital transformation components. By mid-2024, many enterprises were actively exploring AI platforms for tasks previously handled by IT departments or consultants, with the AI market size estimated to be over $200 billion.

Generic IT consulting and staff augmentation also act as substitutes, offering cost-effectiveness and task-specific solutions for clients with less complex needs or immediate skill gaps. The IT consulting market alone is vast, with global revenue expected to reach hundreds of billions in 2024, demonstrating the widespread availability of these alternative services.

Entrants Threaten

The digital transformation sector, where companies like CI&T operate, presents formidable barriers to new entrants, primarily due to the immense capital and talent required. Aspiring competitors must invest heavily to attract and retain top-tier professionals skilled in areas like artificial intelligence, cloud computing, and data science. For instance, building a global workforce comparable to CI&T's, which boasts over 7,400 professionals spread across 10 countries, represents a significant hurdle.

The threat of new entrants for CI&T is significantly mitigated by the substantial need for an established reputation and deep client relationships. CI&T, with its 30-year history, has cultivated these essential assets, serving over 100 large enterprises. This extensive track record provides a strong foundation of trust and credibility that newcomers struggle to replicate quickly.

New companies entering the digital transformation and technology services market face a steep uphill battle in building the necessary trust and demonstrating their capabilities to secure large enterprise clients. This process is not only time-consuming but also demands considerable financial and human resources, acting as a significant barrier to entry for potential competitors.

CI&T's formidable combination of deep expertise spanning strategy, research, data science, design, and engineering creates a substantial barrier for new entrants. This integrated skill set, honed over years of client engagements, is not easily replicated by newcomers aiming to compete in the same sophisticated digital transformation space.

The company's proprietary AI platform, CI&T FLOW, further solidifies this advantage. This platform represents significant intellectual property and a technological moat, making it exceptionally difficult for new players to quickly develop comparable capabilities and offer the same level of integrated, AI-driven solutions that CI&T provides to its clients.

Market growth attracting new players

The digital transformation market is experiencing robust expansion, with projections indicating continued strong growth. This upward trend is a significant magnet for new entrants, drawing both agile startups and established technology firms eager to capitalize on emerging opportunities.

Despite existing barriers to entry, the sheer size and rapid evolution of the digital transformation landscape present a compelling case for new players. The market's dynamism means that innovative solutions and business models can quickly gain traction, challenging incumbent players.

For instance, the global digital transformation market was valued at approximately $787.1 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of around 18.5% from 2024 to 2030. This substantial growth fuels the attractiveness of the sector.

- Market Growth: The digital transformation sector is projected to continue its rapid expansion, making it highly appealing.

- Attraction for Newcomers: This growth potential actively encourages new companies, including startups and tech incumbents, to enter the market.

- Opportunity for Innovation: The dynamic nature of the market allows for innovative approaches to disrupt existing players.

- Valuation Data: The global digital transformation market was valued at roughly $787.1 billion in 2024, highlighting its significant economic draw.

Potential for niche entrants and disruptive technologies

New players could carve out specialized areas within digital transformation, offering hyper-focused services that larger firms might overlook. For instance, a startup specializing solely in AI-driven customer experience for the retail sector could gain traction quickly.

Disruptive technologies represent another significant threat. Companies leveraging advanced AI, machine learning, or even emerging quantum computing capabilities could develop entirely new service models that render existing approaches obsolete. This could allow them to bypass traditional barriers like established client relationships or extensive infrastructure investments.

The potential for these niche or technology-driven entrants is underscored by the rapid pace of technological advancement. For example, the global AI market was valued at approximately $136.6 billion in 2022 and is projected to grow significantly, indicating a fertile ground for innovative new companies.

- Niche Specialization: Focus on underserved segments within digital transformation, such as AI ethics consulting or blockchain integration for supply chains.

- Disruptive Technology Adoption: Companies leveraging advanced AI, quantum computing, or edge computing can create novel service offerings.

- Lowered Barriers: Cloud computing and open-source technologies reduce the capital needed to start, enabling agile new entrants.

- Market Dynamics: The digital transformation market, projected to reach over $1 trillion by 2027, offers ample opportunity for innovative newcomers.

While CI&T benefits from high capital and talent requirements, a strong reputation, and integrated expertise, the significant growth and dynamism of the digital transformation market present opportunities for new entrants. Disruptive technologies and niche specialization can lower barriers, allowing agile newcomers to challenge established players.

| Factor | CI&T Advantage | New Entrant Threat Mitigation |

|---|---|---|

| Capital & Talent Needs | High barriers for newcomers | Startups can leverage cloud and open-source for lower initial investment. |

| Reputation & Client Relationships | 30-year history, 100+ enterprise clients | Niche players can build trust through specialized expertise and agile service. |

| Integrated Expertise | Strategy, data science, design, engineering | Focusing on specific disruptive technologies (e.g., AI ethics) can bypass broad capability requirements. |

| Market Growth (2024-2030 CAGR ~18.5%) | Attracts new players | Rapid market evolution allows innovative business models to gain traction quickly. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, competitor financial statements, and publicly available trade association data to provide a comprehensive view of competitive pressures.