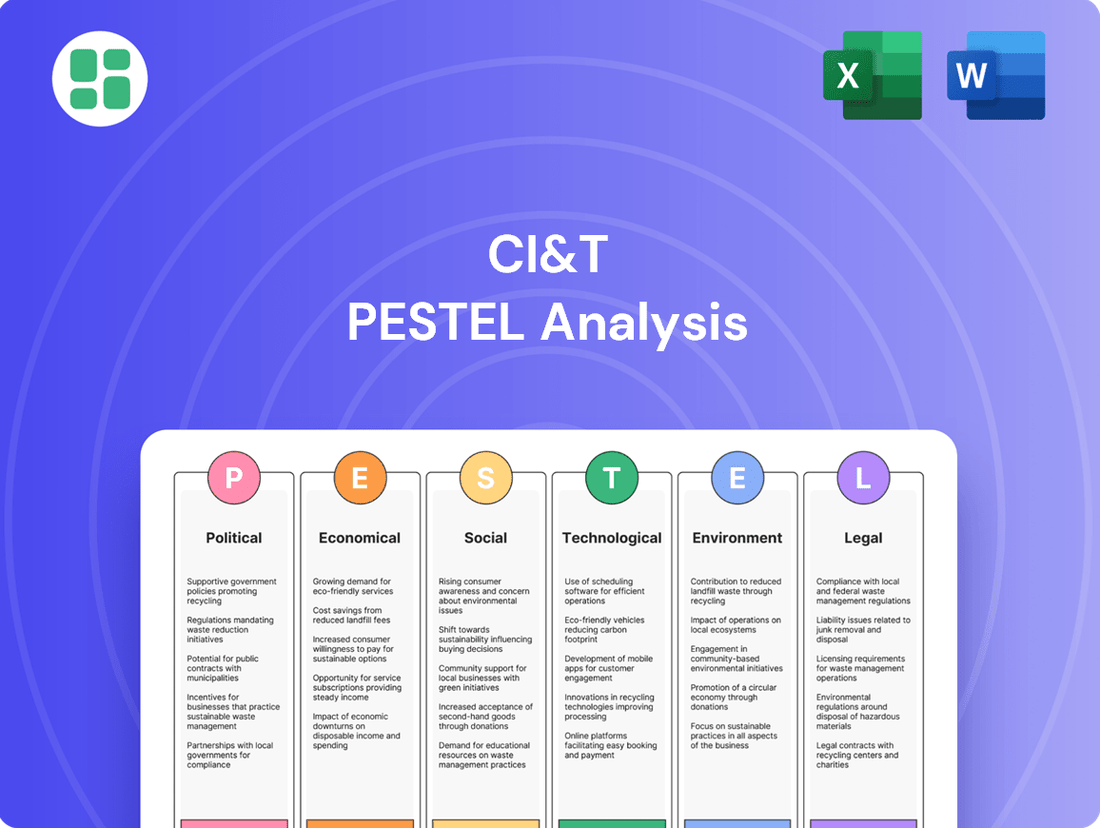

CI&T PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

Unlock the external forces shaping CI&T's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. This expert-crafted report provides actionable intelligence to inform your strategic decisions and gain a competitive advantage. Download the full PESTLE analysis now for critical insights.

Political factors

Governments worldwide are actively pushing digital transformation, pouring billions into upgrading public services and digital infrastructure. For instance, the US government's 2024 budget included significant allocations for federal IT modernization, aiming to improve citizen engagement and cybersecurity. This trend directly fuels demand for companies like CI&T, which specialize in helping organizations navigate these complex digital shifts.

These government-led initiatives, such as enhancing e-governance platforms or developing smart city solutions, create substantial market opportunities. In Europe, the Digital Decade targets aim for widespread digital adoption by 2030, with member states investing heavily in digital skills and infrastructure. Such policies foster an environment ripe for growth for digital transformation service providers.

Furthermore, policies that champion digital adoption and innovation, including tax incentives for tech investments or regulatory frameworks that support cloud computing, can directly benefit CI&T. For example, many nations are implementing digital identity frameworks, requiring robust technological solutions that companies like CI&T are well-positioned to provide, thereby driving their business expansion.

Political stability in Brazil, a key market for CI&T, is essential. For instance, Brazil's presidential election in late 2022 brought a new administration, and the market is closely watching its economic policies and regulatory approach throughout 2024 and into 2025. A stable political landscape in both Brazil and the United States, where CI&T also has significant operations, directly influences investor confidence and the company's ability to secure long-term contracts.

Predictable regulations are vital for CI&T's business environment. Changes in tax laws or foreign investment policies in Brazil could impact CI&T's profitability and expansion plans. Similarly, in the US, evolving data privacy regulations or digital transformation incentives can create both opportunities and challenges for technology service providers like CI&T.

Global trade agreements and geopolitical relationships significantly impact CI&T's cross-border operations and its capacity to serve a worldwide clientele. Favorable trade policies streamline talent movement and service provision, whereas protectionist stances or international disagreements can hinder CI&T's global delivery framework and growth aspirations.

CI&T's operational footprint in 10 countries exposes it to these fluctuating international trade dynamics. For instance, the World Trade Organization (WTO) reported a 0.4% decline in global merchandise trade volume in 2023, highlighting the sensitivity of international business to policy shifts.

Data Sovereignty and Local Content Laws

Governments worldwide are tightening data sovereignty rules, demanding that data generated within their borders remain within national borders. This trend directly affects global digital service providers like CI&T, potentially increasing operational complexity and costs for cross-border data management. For instance, Brazil's General Data Protection Law (LGPD) mandates specific data processing and storage requirements, impacting how companies handle user information.

Local content mandates are also on the rise, particularly in government procurement and strategic sectors. These laws can compel companies to establish local infrastructure, hire local talent, or form partnerships with domestic firms to gain market access. In 2024, many nations are reviewing or implementing such policies to foster domestic digital economies, which could necessitate adjustments to CI&T's operational footprint and business development strategies.

- Data Localization Mandates: Many countries are enforcing laws requiring sensitive data to be stored and processed domestically, impacting cloud service providers and global IT firms.

- Local Content Requirements: Government contracts and specific industry regulations often stipulate a minimum percentage of local content, influencing supply chain and operational decisions.

- Regulatory Compliance Costs: Adhering to diverse national data sovereignty and local content laws can lead to significant compliance expenses for multinational corporations.

- Market Access Barriers: Non-compliance with these regulations can result in restricted market entry or substantial penalties, making adherence critical for global business operations.

Taxation Policies on Digital Services

Changes in corporate tax rates or the introduction of specific digital services taxes in countries where CI&T operates or serves clients can significantly impact its profitability and pricing strategies. For example, as of early 2024, many nations are actively debating or implementing digital services taxes, aiming to capture revenue from the digital economy. This evolving landscape necessitates careful financial planning and adaptation.

Companies like CI&T must navigate increasingly complex international tax frameworks to ensure compliance and optimize their financial performance. The global push for tax harmonization, such as initiatives by the OECD on base erosion and profit shifting (BEPS), means that cross-border transactions and profit allocation are under greater scrutiny. Staying ahead of these changes is crucial for financial health.

Brazil, a key market for many technology firms, has been at the forefront of considering new digital taxes. Discussions around taxing large technology companies, including those providing digital services similar to CI&T's offerings, have been ongoing. Such measures, if enacted, could directly affect the cost of services and operational expenses for businesses operating within or serving the Brazilian market.

- Digital Services Tax (DST) Debates: Many countries, including those in Europe and Asia, have introduced or are considering DSTs, potentially impacting revenue streams for digital service providers.

- OECD's Pillar One and Pillar Two: These global tax reforms aim to reallocate taxing rights and establish a global minimum corporate tax, influencing multinational companies' tax liabilities.

- Brazil's Digital Economy Taxation: Ongoing discussions in Brazil regarding new levies on digital services highlight the potential for increased tax burdens in key emerging markets.

- Compliance Costs: Navigating diverse international tax regulations requires significant investment in tax advisory services and internal compliance infrastructure.

Government initiatives to boost digital infrastructure and services are creating significant opportunities for companies like CI&T. For example, the US government's 2024 budget allocated substantial funds for federal IT modernization. Similarly, Europe's Digital Decade targets are driving investment in digital skills and infrastructure, fostering growth for digital transformation providers.

Political stability is crucial for CI&T's operations, particularly in key markets like Brazil and the United States. Fluctuations in economic policies and regulatory approaches, especially following Brazil's 2022 presidential election, directly influence investor confidence and contract security through 2024 and 2025.

Evolving regulations, such as data localization mandates and local content requirements, present both challenges and opportunities. Brazil's LGPD, for instance, impacts data handling, while rising local content demands may necessitate adjustments to CI&T's global operational strategies to ensure market access and compliance in 2024 and beyond.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CI&T across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights by detailing how these factors create both threats and opportunities, guiding strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring everyone is aligned on external factors impacting strategy.

Economic factors

The global economic climate is a significant factor for CI&T, as corporate IT spending, a key revenue source, is directly tied to economic health. When economies are growing, companies tend to boost their investments in digital transformation, which benefits CI&T. Conversely, economic slowdowns can result in reduced IT budgets and postponed projects.

CI&T's performance in the first quarter of 2025 reflects this dynamic. The company reported net revenue of US$110.9 million, marking a 4.9% increase compared to the same period in the previous year. This growth suggests that demand for CI&T's services remains robust, even amidst varied global economic conditions.

Rising inflation, a persistent concern through 2024 and into 2025, directly impacts CI&T's bottom line by increasing operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw significant increases in 2023, and while forecasts for 2024 suggest moderation, persistent cost pressures remain. This translates to higher costs for talent acquisition, cloud infrastructure, and software licensing, potentially squeezing profit margins.

Simultaneously, fluctuating interest rates, driven by central bank policies aimed at controlling inflation, present a dual challenge. Higher borrowing costs can deter clients from undertaking large digital transformation projects, which often require substantial upfront investment. Moreover, for CI&T itself, increased interest rates can make financing new ventures or acquisitions more expensive, impacting strategic growth initiatives.

The interplay of these economic factors creates a challenging environment. For example, if inflation remains elevated, central banks might maintain higher interest rates, leading to a prolonged period of increased borrowing costs. This could force CI&T and its clients to re-evaluate project timelines and budgets, potentially delaying or scaling back digital initiatives that are crucial for long-term competitiveness.

Currency exchange rate volatility, particularly between the Brazilian Real and the U.S. Dollar, poses a significant challenge for CI&T, a global company with substantial operations in Brazil. These fluctuations directly affect how CI&T's financial performance is reported. For instance, in the first quarter of 2025, while net revenue grew by a healthy 13.7% when measured in constant currency, the reported growth in U.S. dollars was a more modest 4.9%, clearly illustrating the impact of currency movements on its top-line figures.

Client Industry Economic Health

The financial health of the industries CI&T serves is a critical determinant of demand for its technology and consulting services. Sectors like retail, banking, automotive, and consumer packaged goods (CPG) are currently navigating a complex economic landscape. For example, the automotive sector, where CI&T has a presence, saw global light vehicle sales projected to reach 90 million units in 2025, indicating continued, albeit moderate, growth. This recovery and ongoing digital transformation within these industries directly translate into opportunities for CI&T.

CI&T's engagement in these key sectors is highlighted by strategic partnerships. Their collaboration with Volkswagen of America, announced in July 2025, exemplifies their deep involvement in the automotive industry's push towards connected vehicles and digital customer experiences. This partnership underscores the growing need for specialized technology solutions to address evolving consumer expectations and operational efficiencies within these client industries.

Economic factors influencing these sectors include inflation rates, consumer spending power, and interest rate environments. For instance, in the retail and CPG sectors, persistent inflation through early 2025 has impacted consumer discretionary spending, necessitating greater efficiency and innovation, areas where CI&T provides value. Similarly, the banking sector's digital transformation is driven by the need to enhance customer service and streamline operations amidst a competitive, digitally-native landscape.

- Automotive Sector Growth: Global light vehicle sales projected around 90 million units in 2025, signaling demand for digital transformation services.

- Retail & CPG Challenges: Continued inflation in early 2025 impacting discretionary spending, driving demand for efficiency solutions.

- Banking Digitalization: Ongoing need for enhanced customer service and operational streamlining in a competitive digital market.

- CI&T's Strategic Role: Partnerships like the one with Volkswagen of America in July 2025 demonstrate direct engagement in client industry digital evolution.

Competitive Landscape and Pricing Pressure

The digital transformation sector is intensely competitive, featuring a vast array of global and local providers. This crowded market naturally creates significant pricing pressure, requiring companies like CI&T to constantly justify their worth. For instance, the global digital transformation market was valued at approximately $15.1 trillion in 2023 and is projected to reach $36.1 trillion by 2030, growing at a CAGR of 13.2% according to some analyses, highlighting both the opportunity and the intense competition.

To thrive, CI&T must clearly articulate its unique value proposition, emphasizing its specialized expertise in Artificial Intelligence (AI) and its capability for agile project delivery. This differentiation is crucial for maintaining healthy profit margins amidst aggressive competitor strategies. The company's strategic emphasis on AI-driven solutions is designed to expedite client business transformations and deliver more profound, measurable impacts.

- Intense Competition: The digital transformation market is characterized by a high number of global and local players.

- Pricing Pressure: This competitive environment often leads to downward pressure on pricing for services.

- Differentiation Strategy: CI&T must highlight its AI expertise and agile delivery to stand out.

- AI-Driven Impact: The company's focus on AI aims to accelerate client business transformation and deliver deeper results.

Global economic growth directly impacts CI&T's IT spending, a crucial revenue driver. While CI&T reported a 4.9% increase in net revenue to US$110.9 million in Q1 2025, persistent inflation and fluctuating interest rates throughout 2024-2025 pose challenges to operational costs and client investment capacity.

Currency volatility, particularly the Brazilian Real against the U.S. Dollar, affects reported earnings, as seen in Q1 2025 where constant currency growth was 13.7% but reported U.S. dollar growth was 4.9%. The financial health of key sectors like automotive, projected to see global light vehicle sales around 90 million units in 2025, and retail, facing inflation-driven consumer spending shifts, directly influences demand for CI&T's digital transformation services.

The digital transformation market, valued at approximately $15.1 trillion in 2023 and projected to reach $36.1 trillion by 2030, is highly competitive, leading to pricing pressures. CI&T's differentiation through AI expertise and agile delivery is vital for maintaining profitability in this dynamic landscape.

| Economic Factor | 2024-2025 Trend/Impact | CI&T Relevance | Data Point |

| Global Economic Growth | Varied, impacting IT spending | Directly affects revenue | Q1 2025 Net Revenue: US$110.9M (+4.9% YoY) |

| Inflation | Persistent concern, increasing costs | Raises operational expenses, squeezes margins | U.S. CPI saw significant increases in 2023; moderation expected in 2024 |

| Interest Rates | Fluctuating, potentially higher | Deters client investment, increases financing costs | Central bank policies aimed at inflation control |

| Currency Exchange Rates | Volatile (BRL vs. USD) | Impacts reported financial performance | Q1 2025 Constant Currency Growth: 13.7% vs. Reported: 4.9% |

| Sectoral Financial Health | Mixed, with some growth | Drives demand for digital transformation | Global light vehicle sales projected ~90M units in 2025 (Automotive) |

Preview Before You Purchase

CI&T PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CI&T PESTLE Analysis covers all key external factors influencing the company's strategic decisions. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects, providing a complete picture for informed business planning.

Sociological factors

Consumers now expect digital interactions to be effortless, tailored to them, and easy to navigate. This constant shift in expectations pushes companies to seriously upgrade their digital capabilities. For instance, a 2024 study indicated that 70% of consumers are more likely to switch brands if they have a poor digital experience.

CI&T's core offerings, which blend strategic thinking with creative design and robust engineering, are perfectly positioned to help businesses respond to these evolving demands. They enable clients to build digital products that truly resonate with users, creating those seamless experiences customers now anticipate.

Furthermore, CI&T's 2025 Connected Retail Report shed light on key consumer attitudes, revealing that 65% of shoppers are increasingly concerned about data privacy, while 55% report being more price-sensitive than in previous years. These insights are crucial for businesses looking to optimize their digital strategies.

CI&T's expansion, marked by a 21.6% employee increase in Q1 2025 to 7,399, highlights the critical importance of accessing a global talent pool. The company's ability to tap into skilled tech professionals across various regions directly fuels its growth trajectory.

Emerging workforce trends significantly shape CI&T's talent strategy. The rise of remote work, the prevalence of the gig economy, and a heightened demand for specialized skills, such as AI literacy, necessitate adaptive approaches to attracting and retaining top talent.

Societal expectations increasingly demand that companies prioritize Diversity, Equity, and Inclusion (DEI). This focus influences everything from how businesses recruit talent to how they build their internal culture and engage with clients.

CI&T reflects this trend by actively working to create a more inclusive workplace. In 2024, the company reported that 51% of its employees identify with underrepresented groups. Furthermore, 47.2% of new hires in the same year came from these same demographics, demonstrating a tangible commitment to fostering a diverse environment.

Importance of Ethical AI and Data Privacy Awareness

Societal concerns about ethical AI and data privacy are escalating as artificial intelligence becomes more integrated into daily life. For CI&T, a specialist in AI-driven digital transformation, this means prioritizing ethical frameworks and transparent data handling to build and maintain trust with clients and end-users. A recent survey indicated that over 70% of consumers are concerned about how their data is used by AI systems, highlighting the critical need for robust data governance and responsible AI practices.

Ensuring solutions align with ethical AI principles is paramount. This includes actively addressing algorithmic bias, which can perpetuate societal inequalities. For instance, studies in 2024 have shown significant disparities in AI-driven hiring tools, underscoring the importance of rigorous testing and mitigation strategies. CI&T's commitment to responsible AI development directly impacts its reputation and client confidence in its digital transformation capabilities.

- Growing Public Scrutiny: Over 65% of individuals in a 2024 Pew Research Center study expressed worry about the potential for AI to be biased.

- Regulatory Landscape: The EU's AI Act, fully implemented in 2025, sets stringent requirements for AI systems, particularly concerning data privacy and risk management, impacting global tech providers.

- Brand Reputation: Companies demonstrating strong ethical AI practices and data privacy commitments are increasingly favored by consumers and business partners, with studies showing a 20% preference for ethically aligned brands.

- Client Trust: CI&T’s ability to assure clients of secure data handling and unbiased AI outputs is a key differentiator in the competitive digital transformation market.

Corporate Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) are growing, pushing businesses beyond profit to demonstrate positive impact. Consumers and investors alike are scrutinizing companies' ethical practices and environmental footprints.

CI&T's proactive stance on sustainability, as detailed in its 2024 ESG Report, directly addresses these evolving demands. The company's achievement of 100% renewable energy operations in Brazil is a significant differentiator, bolstering its brand reputation and stakeholder trust.

- Consumer Demand: A 2024 study indicated that 65% of consumers consider a company's sustainability efforts when making purchasing decisions.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are increasingly integrated into investment analysis, with a growing number of funds prioritizing sustainable businesses.

- Brand Reputation: CI&T's commitment to renewable energy in Brazil, a key market, enhances its image as a responsible and forward-thinking technology partner.

- Employee Engagement: Employees are more likely to be engaged and loyal to companies that align with their personal values, including environmental and social responsibility.

Societal expectations are increasingly shaping how businesses operate, particularly concerning ethical practices and inclusivity. As of 2024, a significant majority of consumers, around 70%, expressed concern about the ethical implications of AI, driving demand for transparent and unbiased technology solutions. Companies are also facing pressure to demonstrate tangible progress in Diversity, Equity, and Inclusion (DEI), with 2024 data showing that 51% of CI&T's workforce identified with underrepresented groups, reflecting a broader societal shift.

The growing emphasis on corporate social responsibility (CSR) means businesses must go beyond profit to create positive societal impact, influencing consumer purchasing decisions. For instance, a 2024 study found that 65% of consumers consider a company's sustainability efforts when buying products. This societal trend directly impacts brand reputation and investor confidence, making initiatives like CI&T's 100% renewable energy operations in Brazil a key differentiator.

| Societal Factor | Impact on Businesses | CI&T's Response (2024-2025) |

|---|---|---|

| Ethical AI & Data Privacy | Increased demand for transparency, bias mitigation, and secure data handling. | Prioritizing ethical frameworks; 70%+ consumer concern about AI data usage. |

| Diversity, Equity, Inclusion (DEI) | Focus on inclusive hiring and workplace culture. | 51% of workforce from underrepresented groups; 47.2% of new hires from these demographics. |

| Corporate Social Responsibility (CSR) | Scrutiny of ethical practices and environmental impact. | 100% renewable energy operations in Brazil; 65% of consumers consider sustainability. |

Technological factors

CI&T's strategy is heavily influenced by the rapid advancements in Artificial Intelligence, especially Generative AI. This technology is not just a trend; it's a core driver for how CI&T aims to accelerate client business transformations and deliver greater impact. The company's own AI platform, CI&T FLOW, is a testament to this, designed to significantly boost productivity.

To stay at the forefront, CI&T must commit to ongoing investment in research and development. Equally critical is the continuous upskilling of its workforce to harness the full potential of these evolving AI capabilities. This commitment ensures they can leverage AI for competitive advantage.

The accelerating adoption of cloud computing is a significant technological factor for CI&T. Businesses are increasingly migrating their operations to cloud-based infrastructures, seeking greater scalability, flexibility, and cost efficiency. This trend directly fuels the demand for CI&T's expertise in cloud migration and management services.

Furthermore, the growing necessity for modern, robust data platforms is a key driver. Companies are recognizing the critical importance of effectively managing and leveraging their data to gain competitive advantages. CI&T's proficiency in designing and deploying scalable data architectures and developing data pipelines for AI/ML initiatives positions them to capitalize on this demand.

For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, with significant growth expected in data modernization services. This expansion highlights the substantial opportunity for companies like CI&T that offer specialized solutions in these areas.

The digital world is growing rapidly, and with it, the dangers of cyberattacks are becoming more complex and common. This means cybersecurity is absolutely essential for any company undergoing digital transformation. For CI&T, this translates to building strong security into everything they offer to keep client information and systems safe.

In 2024, global cybercrime costs are projected to reach $10.5 trillion annually, highlighting the immense financial and reputational risks. CI&T's commitment to robust security measures is therefore not just a technical necessity but a core element of maintaining client trust and ensuring regulatory adherence in this ever-changing environment.

Emergence of New Digital Platforms and Ecosystems

The rapid evolution of digital platforms and ecosystems, including advancements in the Internet of Things (IoT) and blockchain technology, necessitates continuous adaptation for CI&T. These emerging technologies are reshaping industries, demanding that companies like CI&T remain flexible to integrate new solutions and maintain a competitive edge.

Strategic alliances with major technology providers such as Google, Microsoft, and Amazon Web Services (AWS) are crucial for CI&T. These partnerships enable access to a wide array of cutting-edge technologies, allowing CI&T to build and offer robust, integrated solutions that address complex client needs across various sectors.

- IoT Market Growth: The global IoT market was projected to reach over $1.6 trillion by 2025, indicating a significant demand for integrated IoT solutions.

- Cloud Adoption: In 2024, businesses are increasingly adopting multi-cloud strategies, with AWS, Azure, and Google Cloud being dominant players, highlighting the importance of CI&T's partnerships.

- Blockchain Integration: While still evolving, blockchain technology is finding applications in supply chain management and secure data sharing, areas where CI&T can leverage its partnerships.

Automation and Productivity Tools

The relentless pursuit of operational efficiency and heightened productivity is a defining technological force impacting businesses today. Automation and sophisticated productivity tools are at the forefront of this movement, enabling companies to optimize workflows and accelerate output.

CI&T is strategically positioned to capitalize on this trend, emphasizing agile delivery methodologies and leveraging its proprietary AI platform, CI&T FLOW. This technological integration is designed to significantly boost team productivity and streamline the execution of client projects, ensuring rapid and scalable delivery of solutions.

The impact of these tools is substantial. For instance, studies in 2024 indicated that companies investing in automation saw an average productivity increase of 15-20%. CI&T FLOW specifically aims to reduce project cycle times by up to 30% through intelligent task automation and resource optimization.

- Automation drives efficiency: Businesses are increasingly adopting automated processes to reduce manual labor and minimize errors, leading to significant cost savings and improved output quality.

- AI platforms enhance productivity: CI&T's FLOW platform exemplifies how AI can optimize project management, code generation, and testing, directly contributing to faster delivery cycles and higher team output.

- Agile delivery is key: The combination of automation and agile methodologies allows companies like CI&T to respond swiftly to market changes and client demands, ensuring competitive advantage.

- Scalability is a major benefit: These technological advancements enable businesses to scale their operations effectively without a proportional increase in resources, facilitating growth.

Technological advancements, particularly in Artificial Intelligence and cloud computing, are central to CI&T's strategy. The company's own AI platform, CI&T FLOW, aims to boost productivity and accelerate client transformations. This focus on AI is critical as the global AI market is expected to see substantial growth, with generative AI solutions becoming increasingly integrated into business operations.

The increasing reliance on cloud infrastructure by businesses worldwide directly benefits CI&T, as companies seek scalable and flexible solutions. Furthermore, the demand for robust data platforms to leverage data for competitive advantage is a significant trend. In 2024, cloud spending by enterprises was projected to exceed $1 trillion globally, underscoring the market opportunity.

Cybersecurity remains a paramount concern, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. CI&T's commitment to integrating strong security measures into its offerings is essential for client trust and regulatory compliance.

Emerging technologies like the Internet of Things (IoT) and blockchain are also shaping industries, requiring CI&T to remain adaptable. The global IoT market alone was projected to surpass $1.6 trillion by 2025, highlighting the demand for integrated solutions.

| Technology Area | 2024/2025 Projection/Data | Impact on CI&T |

|---|---|---|

| Artificial Intelligence (AI) | Generative AI adoption accelerating | Drives demand for AI-powered transformation and productivity solutions. |

| Cloud Computing | Global enterprise cloud spending > $1 trillion (2024) | Fuels demand for cloud migration, management, and optimization services. |

| Cybersecurity | Global cybercrime costs ~$10.5 trillion annually (by 2025) | Necessitates robust security integration in all client solutions. |

| Internet of Things (IoT) | Global IoT market > $1.6 trillion (by 2025) | Creates opportunities for integrated IoT solutions and data management. |

Legal factors

Strict and evolving global data privacy regulations, like GDPR and CCPA, significantly influence CI&T's operations and their clients' digital strategies. CI&T must ensure their services and solutions are compliant, which includes implementing robust data governance practices. This focus on compliance not only ensures regulatory adherence but also enhances overall data security for their clients.

Protecting intellectual property is paramount for CI&T, a technology services firm. This involves safeguarding its proprietary platforms and bespoke client solutions. In 2024, the global software market, valued at over $700 billion, underscores the immense value of such IP.

Compliance with a myriad of software licensing agreements is a continuous legal challenge. Furthermore, CI&T must diligently protect its trade secrets, which are vital for maintaining a competitive edge. Failure to adhere to IP laws can lead to significant financial penalties and reputational damage.

Ensuring all developed solutions align with evolving intellectual property legislation across different jurisdictions is a key focus. This proactive approach helps mitigate risks and supports CI&T's global operations and client engagements.

As a global entity, CI&T must meticulously adhere to diverse labor and employment legislation across its operating countries, impacting everything from recruitment practices to employee dismissals. These regulations, covering aspects like minimum wage, working hours, and statutory benefits, differ substantially by jurisdiction, directly influencing workforce planning and operational costs.

For instance, in 2024, the European Union's directives on worker rights and the UK's updated employment tribunal rules present ongoing compliance challenges. Companies like CI&T need to stay abreast of these evolving legal landscapes to ensure fair treatment and avoid potential penalties, which can be substantial.

Anti-Trust and Competition Regulations

CI&T operates in a tech services landscape experiencing significant consolidation. This means the company must carefully navigate anti-trust and competition regulations, especially as it considers acquisitions or its growing market influence. Regulators are keenly watching larger consolidation trends within the IT services sector, making compliance a critical factor for CI&T's strategic moves.

The IT services market saw substantial merger and acquisition activity leading up to 2024. For instance, the global IT services market was valued at approximately $1.2 trillion in 2023 and is projected to grow, with consolidation being a key driver. CI&T's own acquisition activity, with its most recent significant acquisition in 2022, places it within this broader trend that attracts regulatory scrutiny.

- Regulatory Scrutiny: Increased M&A activity in IT services means regulators are more closely examining market share and potential monopolies.

- Compliance Burden: CI&T must ensure its growth strategies, particularly acquisitions, adhere to competition laws to avoid penalties and operational disruptions.

- Market Dynamics: The competitive environment necessitates a balanced approach to growth, leveraging opportunities without triggering anti-trust concerns.

Industry-Specific Digital Compliance

CI&T's engagement with sectors like financial services and healthcare necessitates navigating a complex web of industry-specific digital compliance. Beyond broad data privacy mandates like GDPR or CCPA, these industries face unique regulatory landscapes. For instance, financial institutions must adhere to regulations such as the Gramm-Leach-Bliley Act (GLBA) in the US, which governs the privacy of financial information, and the Payment Card Industry Data Security Standard (PCI DSS) for handling cardholder data. In 2024, ongoing updates to these regulations, coupled with increasing cybersecurity threats, mean that compliance is not static but a continuous process requiring robust digital solutions.

For CI&T, this translates to ensuring their digital product development and experience design not only meet general privacy laws but also specific sector requirements. This includes obtaining and maintaining relevant certifications, such as ISO 27001 for information security management, which are often prerequisites for working with sensitive data in these fields. As of early 2025, the global financial services sector is projected to spend over $150 billion annually on cybersecurity and compliance, highlighting the significant investment required to meet these legal benchmarks.

Key considerations for CI&T in these high-compliance industries include:

- Data Security & Encryption: Implementing advanced encryption protocols and secure data handling practices to comply with financial and healthcare data protection standards.

- Regulatory Adherence: Ensuring all digital solutions align with specific industry regulations like HIPAA for healthcare data privacy or banking regulations for financial services.

- Auditability & Transparency: Building systems that allow for clear audit trails and transparent data processing, crucial for regulatory oversight.

- Continuous Monitoring: Establishing ongoing processes to monitor for compliance changes and adapt digital offerings accordingly, given the dynamic regulatory environment.

CI&T must navigate a complex web of global data privacy laws, such as GDPR and CCPA, impacting digital strategies and requiring robust data governance. Protecting intellectual property, including proprietary platforms and client solutions, is critical, especially in a software market exceeding $700 billion in 2024. Compliance with software licensing and trade secret protection are ongoing legal challenges, with IP law violations carrying significant financial and reputational risks.

Environmental factors

Investors, clients, and regulators are increasingly demanding that companies showcase robust environmental, social, and governance (ESG) performance. This trend is reshaping corporate strategy and reporting practices globally.

CI&T has proactively addressed these demands by releasing its 2024 ESG Report. This report details the company's dedication to environmental stewardship and its alignment with key international frameworks like the UN Global Compact and the Sustainable Development Goals (SDGs).

Clients are increasingly prioritizing digital solutions that align with their sustainability objectives, creating a significant demand for 'green IT' and eco-conscious digital services. This trend is reshaping how businesses approach technology adoption, pushing for efficiency and reduced environmental impact.

CI&T is strategically positioned to meet this growing demand by utilizing its digital expertise to accelerate clients' Environmental, Social, and Governance (ESG) initiatives. This includes offering specialized services such as carbon emissions mapping and robust ESG data reporting, directly addressing the need for measurable sustainability progress.

The global green IT market is projected to reach $36.1 billion by 2026, indicating a substantial growth opportunity driven by this client-centric shift. Companies that integrate sustainable practices into their digital strategies, like CI&T, are likely to see increased client acquisition and retention.

The IT sector, encompassing data centers and software development, carries a substantial energy demand. CI&T has proactively addressed this by securing 100% renewable energy for its Brazilian offices in 2024, demonstrating a clear commitment to reducing its environmental impact.

Further solidifying its dedication, CI&T has pledged to offset all measured global emissions, aligning with increasing stakeholder expectations for corporate environmental responsibility and contributing to broader carbon footprint reduction efforts.

Climate Change Regulations and Policies

Evolving climate change regulations, including carbon pricing mechanisms and stricter environmental protection laws, directly impact CI&T's operational expenses and long-term strategic planning. For instance, many nations are implementing or enhancing carbon taxes, which could increase energy and production costs for companies not actively reducing their emissions.

CI&T's proactive stance is evident in its commitment to the Science Based Targets initiative (SBTi) and its ambitious net-zero emissions goals. This strategy positions the company to better navigate anticipated regulatory shifts and potential market pressures related to sustainability.

- Global Carbon Pricing: As of early 2024, over 70 jurisdictions have implemented some form of carbon pricing, with the World Bank reporting an increase in the number of schemes and their coverage.

- SBTi Targets: Companies setting SBTi-approved targets commit to emissions reductions aligned with climate science, often leading to operational efficiencies and reduced regulatory risk.

- Net-Zero Commitments: Over 4,000 companies globally have made net-zero commitments, signaling a broad market trend towards decarbonization driven by both policy and investor expectations.

Supply Chain Sustainability Expectations

Clients and stakeholders are increasingly scrutinizing the environmental impact of entire supply chains, a trend that extends to digital service providers like CI&T. This means looking beyond direct operations to understand the footprint of every component, including software development and cloud infrastructure. For instance, a 2024 report by the Carbon Disclosure Project highlighted that companies are facing mounting pressure to disclose and reduce Scope 3 emissions, which encompass supply chain activities.

CI&T's commitment to sustainability necessitates ensuring responsible practices throughout its operations. This involves evaluating the environmental performance of its own digital infrastructure and services. Furthermore, this commitment influences vendor selection and partnerships, pushing for suppliers who also demonstrate strong environmental stewardship.

The growing demand for supply chain sustainability translates into tangible expectations for companies in 2024 and 2025:

- Increased Transparency: Stakeholders expect detailed reporting on environmental metrics across the entire value chain.

- Supplier Audits: Companies are increasingly auditing their suppliers' environmental practices to ensure compliance with sustainability goals.

- Preference for Green Providers: Businesses are more likely to partner with or select vendors demonstrating a commitment to reducing their environmental impact.

- Digital Carbon Footprint Awareness: A growing focus on the energy consumption and carbon emissions associated with digital services and data centers.

Environmental factors significantly influence business operations and strategy, with a growing emphasis on sustainability. CI&T's 2024 ESG Report underscores its commitment to environmental responsibility, aligning with global frameworks like the UN Global Compact. The company is actively addressing the demand for 'green IT' by offering services that reduce clients' environmental impact.

CI&T has demonstrated its commitment to renewable energy by securing 100% renewable power for its Brazilian offices in 2024 and has pledged to offset all measured global emissions. This proactive approach is crucial as evolving climate regulations, such as carbon pricing, directly affect operational costs and strategic planning. The company's adherence to Science Based Targets initiative (SBTi) and net-zero goals positions it to navigate these regulatory shifts effectively.

Stakeholder scrutiny of supply chain environmental impact is intensifying, pushing companies like CI&T to ensure responsible practices throughout their value chains. This includes evaluating the environmental performance of digital infrastructure and selecting suppliers with strong environmental stewardship. The expectation for increased transparency and supplier audits is a key trend for 2024 and 2025.

| Environmental Factor | CI&T's Action/Commitment | Market Trend/Data |

|---|---|---|

| Renewable Energy Use | 100% renewable energy for Brazilian offices (2024) | Growing demand for sustainable data center operations. |

| Emissions Reduction | Pledged to offset all measured global emissions; SBTi targets; Net-zero goals | Over 4,000 companies globally have made net-zero commitments (as of early 2024). |

| Green IT Demand | Offering carbon emissions mapping and ESG data reporting services | Global green IT market projected to reach $36.1 billion by 2026. |

| Regulatory Impact | Navigating evolving climate change regulations and carbon pricing | Over 70 jurisdictions have implemented carbon pricing schemes (as of early 2024). |

| Supply Chain Scrutiny | Evaluating supplier environmental performance | Increasing pressure for Scope 3 emissions disclosure and reduction. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on comprehensive data from reputable market research firms, governmental statistical agencies, and leading economic publications. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a robust overview.