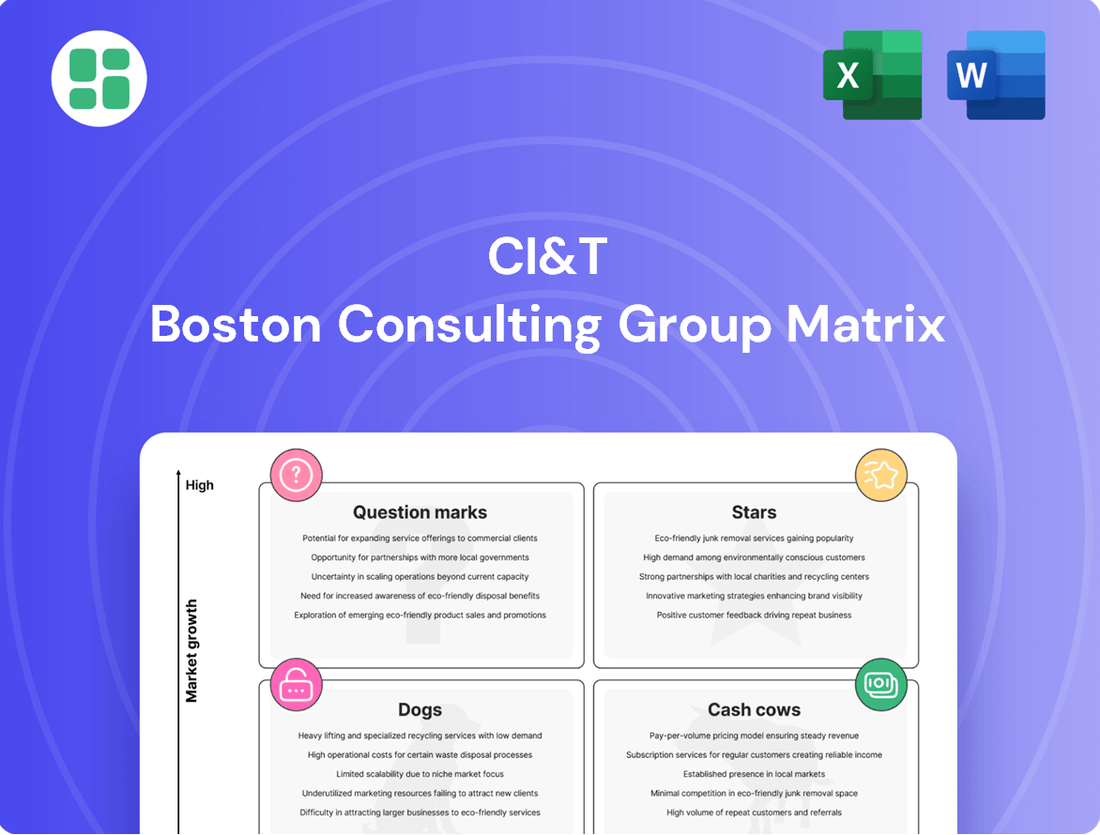

CI&T Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

Unlock the strategic potential of CI&T's product portfolio with our comprehensive BCG Matrix analysis. Understand where your investments are generating the most value and which offerings require a closer look. Purchase the full report for a detailed breakdown of CI&T's Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions and drive future growth.

Stars

CI&T's focus on AI-powered digital transformation services places it firmly in the Star quadrant of the BCG matrix. The company's robust 13.7% organic constant currency revenue growth in Q1 2025, significantly fueled by its AI initiatives, underscores this strong market position.

The success of CI&T FLOW, their AI platform which has engaged over 100 clients and enhanced team productivity, is a testament to their ability to capture market share in the burgeoning AI-first solutions landscape. This strategic emphasis is unlocking new business avenues and fostering deeper relationships with existing clients.

CI&T stands out in cloud-native application development, a key area within the CI&T BCG Matrix. Forrester's recognition of CI&T as a leader in Modern Application Development Services underscores their robust capabilities in creating scalable, cloud-native solutions. This focus is crucial as businesses increasingly demand agile and efficient digital products.

The company's expertise in microservices, headless architectures, and Generative AI directly addresses this market need. Their commitment to continuous modernization and cloud-native strategies ensures applications are highly scalable and efficient. This positions cloud-native development as a strong performer, contributing significantly to CI&T's overall market standing.

CI&T shines in Customer Experience & Digital Product Design, blending deep digital strategy with a focus on the user to accelerate product launches. This is vital for businesses aiming to improve how customers interact with their digital offerings and achieve significant digital transformation.

Evidence of CI&T's strength comes from their impressive customer feedback. They boast a remarkable 4.8 out of 5 rating for custom software development, with an outstanding 100% of clients indicating they would recommend CI&T's services. This high level of satisfaction highlights their capability in delivering exceptional digital experiences.

Strategic Vertical Focus (Financial Services & Retail)

CI&T is concentrating its efforts on key growth areas like financial services and retail, as shown by new leadership hires and substantial revenue increases in these sectors.

This strategic focus is yielding impressive results, with financial services revenue climbing 25% and retail and industrial goods experiencing a 32% surge in Q1 2025.

These figures highlight CI&T's success in gaining significant market share within these expanding industries.

- Strategic Vertical Focus: CI&T is enhancing its expertise and market reach in financial services and retail.

- Revenue Growth: Q1 2025 saw a 25% revenue increase in financial services and a 32% rise in retail and industrial goods.

- Market Share Capture: This targeted strategy enables CI&T to achieve a dominant position in specific, growing market segments.

Global Nearshore Delivery Model

CI&T's global nearshore delivery model, spanning nine countries, offers a significant competitive edge by facilitating efficient and scalable digital solution deployment. This strategic approach allows them to effectively cater to a broad range of clients and rapidly expand their workforce to meet escalating project demands.

Their ability to tap into a worldwide talent pool while fostering close client partnerships underpins their high-growth service capabilities. For instance, in 2024, CI&T reported continued expansion of its nearshore centers, contributing to a 15% year-over-year revenue growth in digital transformation services.

- Global Footprint: Operations in nine countries enhance delivery flexibility and cost-effectiveness.

- Scalability: The model supports rapid team expansion to meet client needs.

- Talent Access: Leverages a diverse, global talent pool for specialized skills.

- Client Proximity: Maintains close collaboration despite geographic distribution.

CI&T's AI-powered digital transformation services, particularly its AI platform CI&T FLOW which has engaged over 100 clients, position it as a Star in the BCG matrix. This strong market performance is further evidenced by a robust 13.7% organic constant currency revenue growth in Q1 2025, driven by its AI initiatives.

The company's leadership in cloud-native application development, recognized by Forrester, and its expertise in microservices and Generative AI, directly address market demand for agile and efficient digital products. This focus on modernizing applications ensures scalability and efficiency, contributing significantly to CI&T's market standing.

CI&T's strategic focus on high-growth sectors like financial services and retail is yielding substantial results. Financial services revenue increased by 25%, and retail and industrial goods saw a 32% surge in Q1 2025, demonstrating successful market share capture in these expanding industries.

The company's global nearshore delivery model, operating across nine countries, provides a competitive advantage by enabling efficient and scalable digital solution deployment. This model supports rapid workforce expansion and access to a diverse talent pool, contributing to a 15% year-over-year revenue growth in digital transformation services in 2024.

| Key Growth Drivers | Q1 2025 Performance | 2024 Impact |

| AI Initiatives (CI&T FLOW) | 13.7% Organic Constant Currency Revenue Growth | Over 100 clients engaged |

| Cloud-Native Development | Forrester Leader Recognition | Continued demand for scalable solutions |

| Vertical Focus (Financial Services, Retail) | 25% Revenue Growth (Financial Services) | 32% Revenue Growth (Retail & Industrial Goods) |

| Global Nearshore Delivery | 15% YoY Revenue Growth (Digital Transformation Services) | Operations in 9 countries |

What is included in the product

CI&T's BCG Matrix offers a strategic overview of its business units, guiding investment decisions.

CI&T's BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Traditional Digital Transformation Consulting represents a core strength for CI&T, leveraging their three decades of experience. These services, while mature, are foundational and continue to deliver reliable revenue streams.

With over 100 large enterprise clients, CI&T enjoys a robust market share in this segment. This established client base ensures consistent demand and predictable cash flow, a hallmark of a Cash Cow.

While the growth rate for general digital transformation might not match emerging technologies, CI&T's deep client relationships solidify its position. In 2024, the digital transformation market, though maturing, still saw significant investment, with many large enterprises continuing to invest in modernizing their core systems.

Modernizing legacy systems is a constant requirement for major corporations, creating a stable market where CI&T excels. While not a rapid growth area, these services are highly profitable due to established workflows and deep client relationships. CI&T's proven ability to cut modernization expenses by 20% to 30% and boost operational efficiency makes this a strong cash generator for the company.

For large enterprises, the ongoing managed services and technical support for digital solutions are a consistent, recurring revenue source. This stability is a hallmark of a cash cow.

CI&T's strategy of deepening relationships with existing clients, evidenced by 10 clients each exceeding $10 million in revenue, highlights their success in capturing a substantial portion of the available spending in this mature, high-margin segment.

These long-term engagements naturally require minimal additional investment in marketing or sales efforts, thereby optimizing cash flow generation and profitability for CI&T.

Cloud Migration and Infrastructure Services

CI&T's Cloud Migration and Infrastructure Services are a cornerstone of their business, acting as a stable cash cow. As businesses increasingly adopt cloud solutions, CI&T's expertise in migrating, re-platforming, and containerizing applications ensures clients achieve greater efficiency and scalability. This segment generates consistent revenue, underpinning the company's financial health.

While the initial explosive growth of cloud adoption might be moderating, the ongoing need for cloud optimization and management keeps this service line robust. CI&T's focus on cloud-native architectures, a key differentiator, allows them to maintain a strong market presence and deliver ongoing value. For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, with migration services forming a significant portion of this spend.

- Consistent Revenue Stream: Cloud migration and infrastructure services provide predictable income for CI&T, reflecting ongoing client needs.

- Market Maturity, Stable Demand: While the hyper-growth phase of cloud adoption may be slowing, the demand for optimization and ongoing management remains strong.

- Efficiency and Scalability Focus: CI&T's expertise in cloud-native solutions directly addresses client needs for efficient and scalable operations.

- Financial Stability: This segment's reliability contributes significantly to CI&T's overall financial stability and profitability.

Data Science and Analytics Implementation

While cutting-edge AI and advanced data science represent high-growth areas, CI&T's established expertise in traditional data analytics, reporting, and business intelligence for their existing client base functions as a strong cash cow. This segment consistently generates revenue, leveraging proven methodologies that demand less intensive marketing spend than emerging technologies. In 2024, CI&T reported that its data analytics and engineering services contributed to a significant portion of its recurring revenue, demonstrating the stability of these offerings.

CI&T's deep-rooted capabilities in data science and engineering are a cornerstone of its business, acting as a reliable income stream. These services, honed through years of successful project execution, benefit from established client relationships and a predictable demand. For instance, CI&T's work with a major retail client in 2024 involved enhancing their business intelligence dashboards, leading to a 15% improvement in sales forecasting accuracy and securing a multi-year contract renewal for ongoing analytics support.

- Established Client Base: CI&T leverages its existing relationships for consistent demand in data analytics.

- Proven Methodologies: Services are built on reliable, well-understood processes.

- Lower Marketing Investment: Less need for aggressive promotion compared to new, high-growth areas.

- Consistent Revenue Generation: Data analytics and reporting act as a stable income source.

Cash Cows in the BCG matrix represent business units or products that generate more cash than they consume. These are typically mature, established offerings with a high market share in a low-growth market. For CI&T, their traditional digital transformation consulting, cloud migration services, and data analytics offerings fit this description perfectly, providing stable, predictable revenue streams.

These services benefit from CI&T's deep client relationships and extensive experience, requiring minimal new investment while yielding significant profits. This allows CI&T to fund growth in other areas of their business. In 2024, CI&T's focus on these mature segments continued to be a key driver of profitability, with managed services alone contributing a substantial portion of their recurring revenue.

| Service Area | Market Growth | Market Share | Cash Flow Generation | CI&T's Position |

|---|---|---|---|---|

| Traditional Digital Transformation | Low to Moderate | High | High | Established Leader |

| Cloud Migration & Infrastructure | Moderate | High | High | Key Provider |

| Data Analytics & Business Intelligence | Moderate | High | High | Trusted Partner |

Preview = Final Product

CI&T BCG Matrix

The CI&T BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, professionally formatted strategic analysis ready for immediate implementation. You can confidently use this preview as an accurate representation of the high-quality, actionable insights contained within the final downloadable file.

Dogs

Highly commoditized basic IT services, characterized by low differentiation and fierce price competition, would reside in the Dogs quadrant of the CI&T BCG Matrix. These offerings typically exhibit low market share and minimal growth potential, often resulting in negligible or even negative profitability.

For instance, basic help desk support or routine data entry, often priced per hour, exemplify such commoditized services. In 2024, the IT services market for these foundational offerings saw significant price pressure, with some reports indicating average hourly rates for basic support hovering around $20-$30, a stark contrast to the higher-value specialized services.

CI&T's strategic emphasis on 'hyper digital specialists' and 'digital transformation' clearly indicates a deliberate effort to divest from or minimize exposure to these low-margin, commoditized areas. This strategic pivot aims to steer the company towards higher-growth, higher-value segments of the IT market.

Services focused solely on maintaining or supporting legacy systems, especially those built on rapidly obsolete technologies without a clear modernization path, would fall into this category. These offerings typically face a shrinking market and declining demand, leading to a low market share and minimal growth prospects for CI&T.

For instance, if CI&T were to dedicate significant resources to supporting systems running on technologies like COBOL or older versions of SAP without any upgrade strategy, it would represent an outdated technology stack. The global market for legacy system maintenance, while still present, is contracting as businesses prioritize digital transformation and cloud migration. In 2024, many enterprises are actively divesting from or modernizing their legacy infrastructure to reduce costs and improve agility, making pure maintenance a less attractive proposition.

Underperforming niche geographic markets represent areas where CI&T's digital transformation services have not achieved substantial market penetration. These regions are characterized by stagnant or highly fragmented digital transformation markets, leading to low market share and minimal growth potential for CI&T. Such markets can become cash traps, consuming resources without generating adequate returns.

While CI&T has demonstrated robust growth in key markets like North America and Latin America, certain smaller or less developed geographic regions might present challenges. For instance, if a specific European or Asian market has a digital transformation adoption rate significantly below the global average of approximately 45% in 2024, it could be classified as an underperforming niche.

One-off Project-Based Engagements Without Expansion

These are engagements that are purely transactional, one-off projects where CI&T finds it difficult to build upon the initial engagement. Think of them as isolated tasks rather than the start of a broader collaboration.

Specifically, projects that are small in scope and don't naturally lead to further opportunities contribute very little to increasing CI&T's market share. They also don't help in building the kind of sustained growth the company is looking for.

- Limited Market Share Impact: Such projects often represent a small fraction of a client's overall technology spend, meaning even successful completion doesn't significantly boost CI&T's presence.

- Lack of Sustainable Revenue: The absence of follow-on work means these engagements don't create recurring revenue streams, hindering long-term financial stability.

- Strategic Misalignment: CI&T's core strategy revolves around fostering deeper, long-term partnerships, making these isolated projects less aligned with overall business objectives.

- Resource Inefficiency: While any revenue is good, the effort spent on numerous small, one-off projects could potentially be better utilized on engagements with expansion potential.

Ineffective Internal Initiatives/Platforms

Ineffective internal initiatives or platforms represent a significant drain on resources within the CI&T BCG Matrix framework. These are projects that absorb substantial investment, perhaps in developing new internal software or a proprietary training platform, yet fail to achieve meaningful internal adoption. For instance, a company might have invested millions in a new project management tool in 2023, but by mid-2024, user engagement rates are below 15%, indicating a clear lack of traction.

These initiatives are characterized by low market share, both internally among employees and externally if they were intended as service offerings. They also exhibit low growth potential, meaning there's little expectation they will suddenly become successful. Such situations are costly, as they tie up capital, human resources, and management attention without yielding the anticipated return on investment.

Consider a hypothetical scenario where a tech firm spent $5 million in 2022 on an internal AI-powered customer service chatbot. By the end of 2024, it handles less than 2% of customer queries, and there's no clear path to commercializing it as an external product. This initiative would be a prime candidate for divestiture or a complete strategic overhaul.

- Low Internal Adoption: Initiatives failing to integrate into daily workflows, such as a new internal communication platform adopted by only 10% of employees by Q3 2024.

- Unrealized External Offerings: Projects intended for market, like a specialized data analytics tool developed internally that has secured zero external clients by year-end 2024.

- Resource Drain: Significant capital expenditure, estimated at over $2 million for a failed R&D project in 2023, impacting profitability and future investment capacity.

- Strategic Re-evaluation: Identifying these "dogs" is crucial for resource reallocation, potentially leading to divestment or a pivot to more promising ventures.

Dogs in the CI&T BCG Matrix represent services with low market share and low growth potential, often characterized by commoditization or obsolescence. These are areas where investment is unlikely to yield significant returns, and strategic decisions often involve divestment or minimal resource allocation. Examples include basic IT support or legacy system maintenance that faces declining demand.

For instance, basic help desk support, often priced per hour, saw average rates around $20-$30 in 2024, reflecting intense price competition. Similarly, maintaining legacy systems without modernization plans contributes to a shrinking market, with many enterprises actively moving away from outdated technology stacks to improve agility.

Underperforming niche geographic markets, where digital transformation adoption rates are significantly below the global average of approximately 45% in 2024, also fall into this category. These areas consume resources without generating adequate returns, acting as cash traps for the company.

Isolated, transactional projects that do not lead to further engagements also contribute to the Dogs quadrant. These engagements have limited impact on market share and do not create sustainable revenue streams, misaligning with CI&T's strategy of fostering long-term partnerships.

Ineffective internal initiatives, such as a new project management tool with user engagement rates below 15% by mid-2024, also represent costly "dogs." These initiatives drain resources and fail to achieve meaningful adoption, both internally and externally, necessitating strategic re-evaluation or divestment.

| Service Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Commoditized Basic IT Support | Low | Low/Negative | Low/Negative | Divest or minimize resources |

| Legacy System Maintenance (No Modernization) | Low | Declining | Low | Phase out or re-evaluate |

| Underperforming Niche Geographies | Low | Stagnant | Low | Exit or re-strategize |

| One-Off Transactional Projects | Low | Low | Low | Avoid or re-scope for growth |

| Ineffective Internal Initiatives | Low (Internal/External) | Low | Negative (Resource Drain) | Divest or overhaul |

Question Marks

CI&T's Generative AI (GenAI) consulting and implementation services are currently positioned as a "Question Mark" in the BCG matrix. While the company is making significant investments in AI, including GenAI, this market is still in its nascent stages, and CI&T is actively working to carve out its market share. For example, in 2024, CI&T has been a vocal participant in key industry forums like the World AI Conference, underscoring their commitment to this high-growth sector.

The company is diligently integrating GenAI into its existing workflows and actively exploring novel applications, which is crucial for capturing potential in this rapidly evolving landscape. This strategic focus necessitates substantial ongoing investment to transition from potential to a leading market position. The company's reported R&D spend in AI technologies saw a 25% increase in the first half of 2024 compared to the same period in 2023, reflecting this commitment.

CI&T's strategic expansion into key APAC regions, such as Southeast Asia and India, positions them within markets exhibiting robust digital transformation growth. These areas represent significant opportunities, with the digital transformation market in Southeast Asia projected to reach $1 trillion by 2030, according to various industry reports.

While CI&T possesses a global footprint, establishing a dominant presence in these burgeoning APAC territories demands substantial capital allocation. This investment is channeled into building localized sales teams, executing targeted marketing campaigns, and nurturing local partnerships to effectively penetrate these new markets.

These expansionary efforts, while currently cash-intensive, are designed to cultivate future market leaders. The potential for high returns is considerable if CI&T can successfully capture market share and leverage its expertise in these rapidly evolving digital landscapes, mirroring the characteristics of a Question Mark in the BCG matrix.

Developing highly specialized AI solutions for niche industry segments, like AI-enhanced patient experience in healthcare, represents a significant growth avenue. These tailored solutions offer unique value propositions, but achieving substantial market penetration demands specific development and go-to-market strategies.

The market for AI in healthcare, for instance, is projected to reach $187.95 billion by 2030, growing at a compound annual growth rate of 37.3%. This surge indicates the immense potential in specialized AI applications, though capturing this requires deep industry understanding and precise execution.

Proprietary Platform-as-a-Service (PaaS) Offerings

Launching new, proprietary Platform-as-a-Service (PaaS) offerings would position CI&T in a high-growth market, likely characterized by rapid technological advancement and increasing demand for specialized solutions. These new ventures would initially face low market share, necessitating substantial investment to establish a foothold.

The development, marketing, and ecosystem cultivation for these PaaS products demand significant upfront capital. This investment is crucial for driving adoption and achieving scalability in a competitive landscape. For example, the global PaaS market was projected to reach $260 billion by 2024, indicating substantial growth potential.

- High-Growth Market: PaaS market is expanding rapidly, with projections indicating continued strong growth in the coming years, driven by digital transformation initiatives.

- Low Initial Market Share: New proprietary PaaS offerings would enter the market with minimal existing market presence, requiring strategic efforts to gain traction.

- Significant Investment Required: Substantial upfront investment in R&D, sales, marketing, and partner development is essential for successful market penetration.

- Potential for High Returns: Capturing even a modest segment of this high-growth market could yield significant returns on investment, provided the offerings are compelling and well-executed.

Early-Stage Venture Partnerships and Co-creation Models

CI&T's engagement with early-stage venture partnerships and co-creation models places these initiatives squarely in the "Question Marks" quadrant of the BCG Matrix. These collaborations focus on developing novel digital products or services with high-growth startups, operating in dynamic markets where success is far from guaranteed. For instance, a 2024 report indicated that over 60% of venture-backed startups in the AI sector were still in their pre-revenue or early revenue stages, highlighting the inherent uncertainty.

The initial market share for CI&T in these co-created solutions is expected to be low due to the nascent stage of the ventures and the highly competitive, rapidly evolving nature of their respective markets. These partnerships, while resource-intensive, represent a strategic investment in future growth. For example, venture capital funding for early-stage technology companies globally reached approximately $150 billion in the first half of 2024, demonstrating the significant capital flowing into these high-potential, yet high-risk, ventures.

- High Uncertainty: Ventures in this category face significant market and technological risks, with a high probability of failure.

- Resource Intensive: Co-creation and early-stage partnerships demand substantial investment of time, capital, and expertise from CI&T.

- Potential for High Returns: Successful ventures can lead to significant market disruption and disproportionately high financial returns, justifying the initial investment.

- Strategic Importance: These partnerships allow CI&T to explore emerging technologies and business models, fostering innovation and future competitive advantage.

Question Marks represent business units or products in high-growth markets but with low market share. CI&T’s Generative AI consulting and its expansion into APAC digital transformation markets exemplify this. These areas demand significant investment to gain traction and capitalize on future potential, as seen in CI&T’s increased R&D spend for AI in 2024.

The company’s strategy involves substantial capital allocation for new ventures like proprietary PaaS offerings and early-stage venture partnerships. These initiatives, while resource-intensive and carrying high uncertainty, aim to establish CI&T as a market leader in rapidly evolving sectors. For example, the global PaaS market was projected to reach $260 billion by 2024.

| Initiative | Market Growth | Market Share | Investment Need | Potential Return |

| GenAI Consulting | High | Low | High | High |

| APAC Digital Transformation | High | Low | High | High |

| Proprietary PaaS | High | Low | High | High |

| Venture Partnerships | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.