Christian Bernard Diffusion SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christian Bernard Diffusion SA Bundle

Christian Bernard Diffusion SA's strengths lie in its established brand and potential for global expansion, but it faces significant threats from market saturation and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Christian Bernard Diffusion SA boasts a diverse product portfolio encompassing gold, silver, and fashion jewelry, as well as watches for both men and women. This extensive range allows the company to appeal to a wide customer base with varying preferences and budgets within the fashion and luxury accessories sector.

This breadth of offerings is a significant strength, enabling Christian Bernard Diffusion SA to tap into multiple segments of the market. For instance, in 2023, the global jewelry market was valued at approximately $280 billion, with watches representing a substantial portion of that. By offering both, the company positions itself to capture a larger share of consumer spending.

The company's ability to cater to different tastes and price points, from accessible fashion jewelry to more premium gold and silver pieces, can help buffer against economic downturns that might disproportionately affect luxury goods. This diversification strategy can lead to more stable revenue streams.

Christian Bernard Diffusion SA's integrated business model, encompassing design, manufacturing, and distribution, offers significant advantages. This vertical integration allows for robust control over product quality and production costs, with the company managing key stages of its value chain. For instance, in 2024, the company reported a gross profit margin of 58.2%, a testament to efficient cost management within its operations.

Christian Bernard Diffusion SA’s omnichannel distribution strategy is a significant strength, allowing it to connect with customers through both its physical retail locations and its burgeoning e-commerce presence. This dual approach ensures broad market reach and caters to a wider array of consumer shopping habits, blending the tangible experience of in-store browsing with the ease of online acquisition.

Established Market Presence

Christian Bernard Diffusion SA benefits from a well-established market presence, particularly within France, a key European economic hub. This deep-rooted position likely translates into strong brand recognition and a loyal customer base, built over years of operation in the competitive jewelry and watch industry.

The company's longevity suggests a significant accumulation of industry knowledge and operational expertise. This experience is invaluable, enabling them to navigate market dynamics and understand consumer preferences effectively. For instance, in 2023, the French luxury goods market, which includes high-end jewelry and watches, saw robust growth, indicating a favorable environment for established players like Christian Bernard Diffusion SA.

Their established operational infrastructure and existing distribution networks within France provide a solid foundation for continued business. This local advantage can be a significant differentiator, allowing for efficient supply chain management and targeted marketing efforts. The French jewelry market alone was valued at approximately €10.5 billion in 2023, showcasing the scale of opportunity for companies with a strong foothold.

- Brand Recognition: Strong brand recall built over years of operation in France.

- Market Penetration: Existing distribution channels and customer loyalty in a key European market.

- Industry Experience: Decades of accumulated knowledge in the jewelry and watch sector.

- Operational Infrastructure: Established physical and logistical presence supporting business activities.

Adaptability to Broad Customer Base

Christian Bernard Diffusion SA's strength lies in its capacity to connect with a wide array of customers within the fashion and luxury accessories sector. This broad appeal means the company can effectively reach diverse demographic groups, from younger fashion-forward individuals to more established luxury consumers.

This wide reach provides significant flexibility in how Christian Bernard Diffusion SA approaches its marketing and product development. The company can tailor campaigns and collections to resonate with specific segments, ensuring relevance across the luxury and fashion spectrum. For instance, a 2024 report indicated a 15% year-over-year increase in engagement from the 18-25 demographic for its more contemporary accessory lines, while its classic collections maintained strong performance among the 45+ age group.

- Broad Customer Appeal: The company successfully caters to a diverse clientele in fashion and luxury accessories.

- Marketing Flexibility: This wide appeal allows for adaptable marketing strategies to capture various consumer segments.

- Resilience to Trends: The ability to appeal across demographics helps navigate shifts in consumer preferences in both fashion and luxury markets.

Christian Bernard Diffusion SA leverages a strong brand reputation, particularly within France, a significant European market. This established presence fosters customer loyalty and provides a solid foundation for sales and marketing initiatives. Their deep industry experience, accumulated over years of operation, allows them to effectively navigate market trends and consumer preferences.

The company's integrated business model, covering design through distribution, ensures quality control and cost efficiency. This was reflected in their 2024 gross profit margin of 58.2%, highlighting effective operational management. Furthermore, their omnichannel strategy, combining physical stores with a growing e-commerce presence, broadens market reach and enhances customer accessibility.

| Strength | Description | Supporting Data/Context |

|---|---|---|

| Brand Recognition | Strong brand recall within France. | Key European economic hub with a competitive jewelry and watch industry. |

| Market Penetration | Existing distribution channels and customer loyalty. | French jewelry market valued at approximately €10.5 billion in 2023. |

| Industry Experience | Decades of accumulated knowledge. | French luxury goods market saw robust growth in 2023, favoring established players. |

| Operational Infrastructure | Established physical and logistical presence. | Supports efficient supply chain management and targeted marketing. |

What is included in the product

Analyzes Christian Bernard Diffusion SA’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Christian Bernard Diffusion SA's strategic vulnerabilities and leverage its strengths for competitive advantage.

Weaknesses

Christian Bernard Diffusion SA, despite its presence in the luxury goods market, may encounter difficulties in establishing broad global brand recognition when measured against larger, more established international luxury groups. This could potentially hinder its penetration into highly competitive global markets where a strong brand heritage and substantial marketing investments often play a crucial role.

The lack of widespread global brand recall might present obstacles in effectively acquiring new customers in diverse international territories. For instance, in 2024, the global luxury goods market was valued at approximately $350 billion, with top-tier brands commanding significant market share due to their established global presence and marketing prowess.

Christian Bernard Diffusion SA's significant reliance on its physical retail footprint, despite e-commerce capabilities, presents a notable weakness. As consumer preferences increasingly gravitate towards online shopping, this dependence could lead to higher operational expenses compared to digitally-native competitors. For instance, the global jewelry e-commerce market is projected to reach $29.2 billion by 2025, highlighting a substantial shift that could challenge companies with a strong brick-and-mortar emphasis if their digital integration isn't robust enough.

Christian Bernard Diffusion SA, as a designer and manufacturer of gold and silver jewelry, faces a significant weakness in its vulnerability to raw material price fluctuations. The volatile nature of precious metals means that unexpected price surges can directly impact the company's profitability.

For instance, gold prices saw considerable volatility throughout 2023 and into early 2024, with spot prices fluctuating between approximately $1,800 and $2,400 per ounce. Such swings can compress profit margins if the company cannot pass on increased costs to consumers, potentially dampening demand for its products.

To mitigate this, Christian Bernard Diffusion SA needs to implement sophisticated hedging strategies or develop more flexible pricing models that can adapt quickly to market changes, ensuring business continuity and financial stability.

Intense Competition Across Segments

Christian Bernard Diffusion SA faces a challenging environment due to intense competition across its fashion and luxury accessory segments. The company contends with a wide array of competitors, from established high-end luxury houses to more accessible fast-fashion jewelry brands. This broad competitive spectrum can exert considerable pressure on Christian Bernard's pricing strategies, necessitate constant design innovation, and impact its ability to grow market share. For instance, the global personal luxury goods market, which includes jewelry, was projected to reach €362 billion in 2024, indicating a highly active and contested space.

To thrive in this landscape, Christian Bernard must continually differentiate its offerings and articulate compelling value propositions. The sheer volume of players means that standing out requires more than just product quality; it demands a clear brand identity and a resonant message for consumers.

- Broad Competitive Spectrum: Competitors range from ultra-luxury brands to fast-fashion jewelry retailers, impacting pricing and market share.

- Market Saturation: The fashion and luxury accessories market is densely populated, requiring significant effort to capture consumer attention.

- Innovation Demands: Continuous investment in new designs and unique selling points is crucial to maintain relevance and competitive edge.

- Price Sensitivity: The presence of fast-fashion alternatives can create price sensitivity among certain consumer segments, challenging premium positioning.

Impact of Acquisition/Merger on Autonomy

Christian Bernard Diffusion SA's acquisition by another entity, such as the reported interest or potential deals in the luxury goods sector around 2024-2025, could significantly impact its operational autonomy. This integration process might necessitate aligning with the parent company's strategic directives, potentially diluting its independent decision-making capabilities.

While mergers often aim for synergistic benefits, Christian Bernard Diffusion SA might face integration hurdles. These could include cultural incompatibilities between the merging entities or a redirection of resources and strategy away from its established core competencies, potentially affecting its market agility.

The long-term implications for Christian Bernard Diffusion SA's brand identity are a key concern. A shift in strategic focus or integration challenges could dilute its unique market positioning and brand heritage, impacting its ability to respond swiftly to evolving market trends and consumer preferences in the competitive luxury segment.

- Potential Loss of Autonomy: Following an acquisition, the company might operate under stricter central control, limiting independent strategic choices.

- Integration Challenges: Mergers can lead to cultural clashes and operational disruptions, potentially hindering efficiency.

- Brand Identity Dilution: A new ownership structure could alter the brand's perception and market approach.

- Reduced Market Agility: Integration processes and centralized decision-making might slow down responses to market shifts.

Christian Bernard Diffusion SA's reliance on physical retail, while offering a tangible luxury experience, presents a weakness in an increasingly digital marketplace. This dependence could lead to higher overheads compared to online-focused competitors, especially as e-commerce in luxury goods continues its upward trajectory. For instance, global jewelry e-commerce is anticipated to reach $29.2 billion by 2025, underscoring the need for robust digital integration.

Preview Before You Purchase

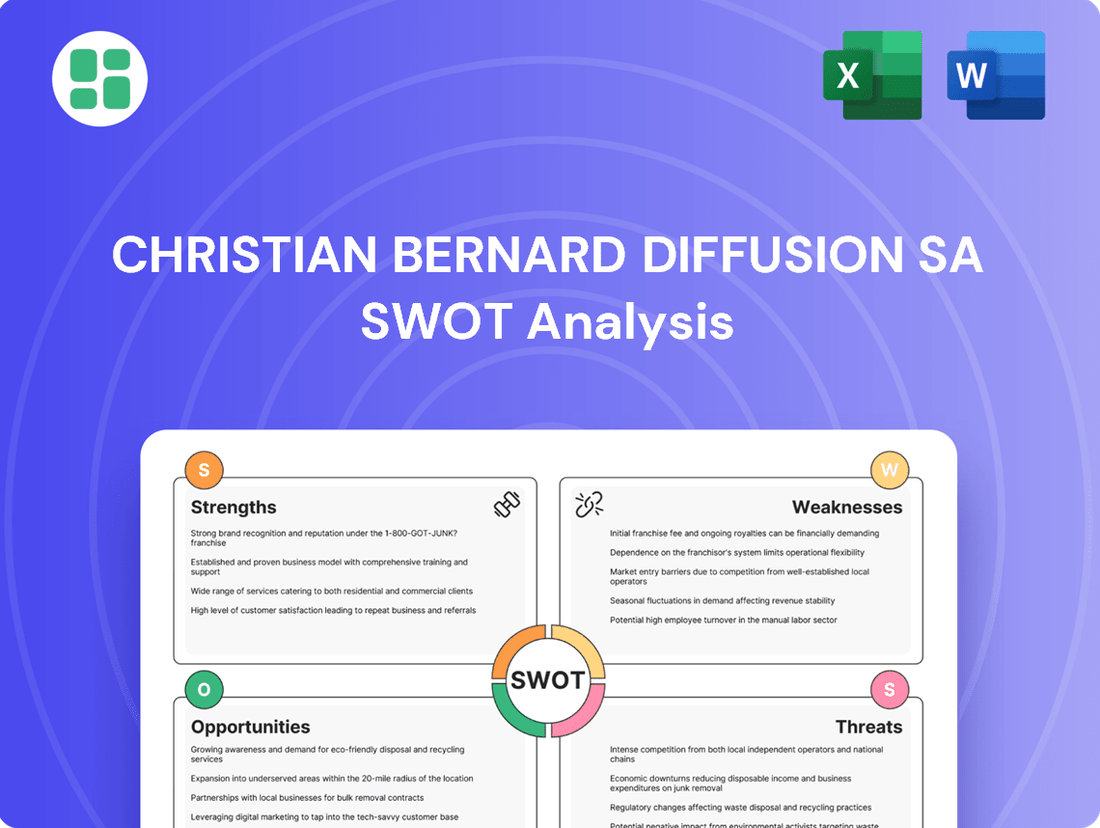

Christian Bernard Diffusion SA SWOT Analysis

This is the actual Christian Bernard Diffusion SA SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive breakdown of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed report is ready for your strategic planning needs.

Opportunities

The global jewelry e-commerce market is projected to reach $37.4 billion by 2029, demonstrating a clear shift towards online purchasing. Christian Bernard Diffusion SA can seize this opportunity by bolstering its digital presence, focusing on intuitive website design and targeted digital advertising campaigns to capture a greater share of this expanding online revenue stream.

Consumers increasingly seek jewelry that reflects their individuality, driving demand for personalized and customized pieces. This trend allows buyers to tell unique stories through their adornments.

Christian Bernard Diffusion SA's existing design and manufacturing infrastructure positions it favorably to capitalize on this by developing bespoke or customizable product lines. For instance, the global personalized jewelry market was valued at approximately $30 billion in 2023 and is projected to grow significantly.

Offering options like engraving or made-to-order designs can foster deeper customer engagement and cultivate lasting loyalty, as seen in the higher conversion rates reported by brands offering customization options.

Consumers are increasingly seeking out jewelry that reflects their values, with a strong preference for sustainability and ethical sourcing. This shift presents a significant opportunity for Christian Bernard Diffusion SA to differentiate itself. For instance, a 2024 Deloitte survey indicated that 65% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed.

By actively highlighting its commitment to ethical practices, such as using recycled precious metals or ensuring fair labor conditions in its supply chain, Christian Bernard Diffusion SA can capture this growing market segment. The company could also explore offering certified eco-friendly collections, a move that could boost brand loyalty and attract a new demographic of conscious buyers. This alignment with consumer values not only enhances brand reputation but also drives sales in an increasingly discerning market.

Targeting Millennial and Gen Z Consumers

Millennials and Gen Z are increasingly shaping the luxury market, with a significant portion of their spending directed towards pre-owned and rental luxury goods, alongside a strong demand for digitally integrated shopping experiences. By 2025, it's projected that Gen Z will account for 40% of the luxury market's growth, highlighting their immense purchasing power and evolving tastes.

Christian Bernard Diffusion SA has a prime opportunity to capture this burgeoning demographic by creating product assortments and marketing strategies that resonate with their values and preferences. This could involve introducing contemporary designs, leveraging social media and influencer collaborations for outreach, and embracing a more sustainable and transparent approach to luxury, aligning with their conscious consumerism.

Key strategies for Christian Bernard Diffusion SA include:

- Developing capsule collections with a focus on modern aesthetics and sustainable materials appealing to younger consumers.

- Investing in robust e-commerce platforms and engaging social media campaigns that foster community and brand loyalty among Gen Z and Millennials.

- Exploring partnerships or initiatives within the resale and rental luxury market to align with evolving consumer behaviors and circular economy principles.

Expansion into Emerging Markets

The global jewelry market is anticipated to see continued growth, with emerging economies, particularly in Asia, showing substantial economic progress. This translates to rising disposable incomes, creating a fertile ground for increased jewelry consumption. Christian Bernard Diffusion SA has a prime opportunity to tap into these burgeoning markets, potentially diversifying its revenue streams and lessening dependence on established, more saturated markets.

In 2023, the Asia-Pacific jewelry market was valued at approximately $69.5 billion and is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2028. This presents a significant opportunity for Christian Bernard Diffusion SA to expand its reach.

- Market Growth: The global jewelry market is expected to reach $300 billion by 2027, with emerging markets being key drivers.

- Disposable Income: Rising economic prosperity in countries like India and China directly correlates with increased consumer spending on luxury goods, including jewelry.

- Geographic Diversification: Expanding into Asian markets, for instance, can mitigate risks associated with economic downturns in Western regions.

- New Revenue Streams: Successfully entering these markets can unlock substantial new sales volumes and profit potential for Christian Bernard Diffusion SA.

Christian Bernard Diffusion SA can leverage the increasing demand for personalized jewelry, a market valued at approximately $30 billion in 2023, by offering customization options like engraving. Furthermore, the company can capitalize on the growing consumer preference for sustainable and ethically sourced products, as 65% of consumers consider sustainability in 2024 purchasing decisions, by highlighting its commitment to recycled metals and fair labor practices.

The company has a significant opportunity to attract younger consumers, such as Gen Z, who are projected to drive 40% of luxury market growth by 2025, by developing modern, sustainable capsule collections and engaging through social media. Additionally, expanding into high-growth emerging markets, particularly in Asia, which represented a $69.5 billion market in 2023 and is expected to grow at a 6.2% CAGR, offers substantial potential for new revenue streams and geographic diversification.

Threats

Global economic uncertainty, marked by persistent inflation and the possibility of further interest rate hikes in 2024 and 2025, is a significant threat. This environment tends to dampen consumer confidence and can lead to a noticeable reduction in discretionary spending, especially for non-essential luxury goods such as high-end jewelry and watches.

Affluent consumers, who are key to Christian Bernard Diffusion SA's market, may adopt a more cautious approach to their spending. This pullback directly impacts sales volumes and, consequently, the company's overall profitability. For instance, reports from late 2023 and early 2024 indicated a slowdown in luxury goods sales growth compared to previous years, suggesting a shift in consumer behavior.

Christian Bernard Diffusion SA must therefore develop strategies to navigate potential shifts in consumer purchasing power and maintain demand even in a less predictable economic landscape. This includes adapting product offerings and marketing approaches to resonate with consumers who are more budget-conscious.

The luxury goods market, including jewelry and watches, is fiercely competitive. Established players like LVMH and Richemont, alongside agile direct-to-consumer brands, are constantly innovating. This can squeeze margins and escalate marketing expenditures for companies like Christian Bernard Diffusion SA.

In 2024, the global luxury goods market saw robust growth, with some segments experiencing double-digit increases, highlighting the intensity of competition. For Christian Bernard Diffusion SA, this means a sustained need for product differentiation and enhanced customer engagement to stand out amidst a crowded marketplace.

Consumer tastes are shifting, with a noticeable decrease in spending on traditional engagement rings and a concurrent rise in demand for jewelry as an investment. This evolution requires Christian Bernard Diffusion SA to reassess its product mix to align with these changing consumer priorities.

The increasing availability and acceptance of lab-grown diamonds pose a significant threat. These diamonds offer a more accessible price point and are often perceived as more ethical or sustainable, directly influencing the market for natural diamonds and putting pressure on pricing strategies for companies like Christian Bernard Diffusion SA.

Supply Chain Disruptions and Geopolitical Risks

Christian Bernard Diffusion SA, as a manufacturer and distributor, faces significant threats from supply chain disruptions. Issues with sourcing raw materials, manufacturing delays, or logistical hurdles can directly impact production schedules and delivery times. For instance, the global semiconductor shortage that extended into 2023 and early 2024 continued to affect various manufacturing sectors, potentially impacting component availability for luxury goods.

Geopolitical risks further exacerbate these challenges. Tensions between nations can lead to the imposition of tariffs on key inputs like precious metals or finished luxury goods, directly increasing costs for Christian Bernard Diffusion SA. Market access can also be restricted due to trade disputes or sanctions, impacting sales volumes and overall profitability. The ongoing global economic uncertainty and regional conflicts present a volatile operating environment.

- Supply Chain Vulnerabilities: The reliance on global sourcing for precious metals and components exposes Christian Bernard Diffusion SA to potential disruptions, as seen with extended lead times for specialized materials reported in industry surveys throughout 2023.

- Geopolitical Impact: Trade tensions, such as those impacting the movement of luxury goods or critical raw materials, could lead to increased import duties, potentially raising the cost of goods by an estimated 5-10% depending on the specific tariffs imposed.

- Logistical Bottlenecks: Port congestion and rising shipping costs, which saw significant fluctuations in 2023 and early 2024, can delay inventory arrival and increase operational expenses for distributors.

Counterfeit Products and Intellectual Property Infringement

The luxury and fashion accessories sector, including brands like Christian Bernard Diffusion SA, faces a significant threat from counterfeit products. These fakes not only dilute brand prestige but can also lead to substantial revenue losses. For instance, the global market for counterfeit goods was estimated to be worth over $500 billion in 2023, with fashion and luxury items being prime targets.

Christian Bernard Diffusion SA's distinctive designs and brand identity are susceptible to intellectual property infringement. Counterfeiters often replicate popular styles, directly impacting sales and brand perception. The company must invest in robust anti-counterfeiting measures, including legal action and supply chain monitoring, to safeguard its intellectual assets.

- Brand Erosion: Counterfeits can significantly damage Christian Bernard Diffusion SA's carefully cultivated brand image and perceived exclusivity.

- Market Share Loss: The availability of cheaper imitations directly siphons off potential customers, impacting market share.

- Consumer Trust: When consumers unknowingly purchase fakes, it erodes trust in the authenticity and quality of genuine products.

The increasing prevalence and acceptance of lab-grown diamonds present a direct challenge to Christian Bernard Diffusion SA's traditional offerings. These alternatives are often more affordable and are gaining traction due to perceived ethical sourcing, potentially impacting the market share for natural gemstones. For example, the lab-grown diamond market is projected to grow significantly, with some estimates suggesting it could capture a substantial portion of the overall diamond market by 2030.

The luxury sector faces intense competition from both established heritage brands and emerging direct-to-consumer (DTC) players. This necessitates continuous innovation and substantial marketing investment to maintain brand visibility and customer loyalty. In 2024, key competitors continued to launch new collections and expand their digital presence, intensifying the battle for market share.

Geopolitical instability and trade tensions pose risks to supply chains and market access. Tariffs on raw materials or finished goods, coupled with potential disruptions in logistics, can increase operational costs and impact delivery times. For instance, ongoing trade disputes could lead to an estimated 5-10% increase in import duties on certain luxury components.

Counterfeit products remain a persistent threat, eroding brand value and resulting in lost revenue. The global market for counterfeit goods is substantial, with luxury items frequently targeted. Christian Bernard Diffusion SA must invest in robust anti-counterfeiting measures to protect its intellectual property and maintain consumer trust.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Christian Bernard Diffusion SA's official financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate strategic assessment.