Christian Bernard Diffusion SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christian Bernard Diffusion SA Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Christian Bernard Diffusion SA's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and refine your strategic approach. Don't get left behind; download the full report now to gain a decisive competitive advantage.

Political factors

Geopolitical tensions and trade wars pose a significant risk to Christian Bernard Diffusion SA's operations. The luxury goods sector, particularly jewelry and watches, is highly sensitive to shifts in consumer confidence and international trade policies. For example, the imposition of new tariffs, such as potential US tariffs on imported goods, can directly increase the cost of sourcing materials and finished products, impacting profit margins. Global instability can also lead to reduced discretionary spending by consumers in key markets, dampening demand for high-value items.

Governments worldwide are increasingly scrutinizing the luxury goods sector, with potential implications for Christian Bernard Diffusion SA. For instance, in 2024, the European Union continued discussions around harmonizing VAT regulations for luxury imports, aiming to create a more unified market but potentially increasing compliance burdens for businesses operating across member states. These regulatory shifts, including potential tariffs on high-value items or stricter rules on sourcing and authenticity, can directly impact operational costs and market penetration strategies.

In 2025, we anticipate continued focus on sustainability and ethical sourcing within the luxury market, which may translate into new government mandates. Countries like Switzerland, a hub for watchmaking, are exploring enhanced traceability requirements for precious metals and gemstones. Such regulations, while promoting responsible practices, necessitate significant investment in supply chain management and verification for companies like Christian Bernard Diffusion SA, affecting both profitability and brand reputation.

Evolving consumer protection laws, especially within the European Union, are increasingly emphasizing transparency and fair dealing. For Christian Bernard Diffusion SA, this means a heightened need for accuracy in product details, marketing, and straightforward return policies to foster and retain consumer confidence.

In 2024, the EU's Digital Services Act (DSA) and Digital Markets Act (DMA) are already shaping how online businesses interact with consumers, demanding greater accountability. Non-compliance can lead to significant fines, impacting profitability and brand image, making robust adherence a strategic imperative for Christian Bernard Diffusion SA.

Political Stability in Key Markets

Political stability is a cornerstone for any business, especially in the luxury sector where consumer confidence and disposable income are paramount. In 2024, geopolitical tensions and upcoming elections in several key markets could introduce volatility. For instance, the ongoing political realignments in Europe might affect consumer spending patterns on discretionary items like luxury jewelry.

Christian Bernard Diffusion SA must closely monitor these developments. Political instability can trigger economic downturns, leading to a decrease in purchasing power for high-value goods. This was evident in some emerging markets in 2023 where political uncertainty correlated with a slowdown in luxury retail sales.

Assessing and mitigating political risks is crucial for Christian Bernard Diffusion SA. This involves understanding how potential policy changes, trade disputes, or social unrest in their operating regions could impact supply chains and market demand.

- Geopolitical Risk Index: Global geopolitical risk remained elevated in early 2024, impacting investor confidence and consumer sentiment in various regions.

- Election Cycles: Major economies like the United States and several European nations are undergoing significant election cycles in 2024 and 2025, potentially leading to policy shifts affecting trade and consumer spending.

- Trade Relations: Evolving international trade agreements and potential protectionist measures by governments can directly influence the cost and availability of imported luxury goods.

- Regulatory Environment: Changes in taxation, import duties, and consumer protection laws in key markets can significantly alter the operating landscape for luxury brands.

ESG Regulatory Push

The increasing emphasis on Environmental, Social, and Governance (ESG) factors is reshaping corporate obligations. New regulations, like the European Union's Corporate Sustainability Reporting Directive (CSRD), are becoming a significant political force. These directives, with phased implementation starting in 2025 for different company sizes, mandate detailed disclosure of sustainability impacts.

For Christian Bernard Diffusion SA, this means a direct impact on how it operates and reports. The jewelry sector, in particular, faces scrutiny regarding ethical sourcing of materials, labor conditions throughout the supply chain, and overall environmental footprint. Compliance with these evolving ESG mandates is no longer optional but a legal requirement.

To navigate this landscape effectively, Christian Bernard Diffusion SA needs to prioritize investments in sophisticated data collection systems and establish transparent reporting mechanisms. This proactive approach is crucial for meeting the legal obligations imposed by these new ESG regulations and maintaining stakeholder trust in the face of growing demand for corporate accountability.

- CSRD implementation for large companies begins in 2025, with smaller listed companies following in subsequent years.

- ESG reporting is projected to grow significantly, with the global ESG reporting software market expected to reach $1.7 billion by 2027.

- Consumer demand for ethically sourced and sustainably produced luxury goods is rising, influencing regulatory priorities.

- Non-compliance with ESG regulations can lead to substantial fines and reputational damage.

Geopolitical shifts and trade policies directly impact Christian Bernard Diffusion SA's global operations and profitability. For instance, heightened geopolitical tensions in early 2024 led to increased volatility in currency exchange rates, affecting the cost of imported materials and the repatriation of profits. The upcoming election cycles in major economies like the United States and key European nations throughout 2024 and 2025 could introduce policy uncertainty, potentially altering trade agreements and consumer spending habits in the luxury goods market.

Governments are increasingly focusing on regulatory frameworks that affect the luxury sector, including proposed changes to VAT harmonization in the EU and enhanced traceability requirements for precious metals in countries like Switzerland, which could impact Christian Bernard Diffusion SA's supply chain and compliance costs. Furthermore, the ongoing implementation of the EU's Digital Services Act and Digital Markets Act in 2024 necessitates greater online accountability, with potential fines for non-compliance that could affect the company's digital strategy and financial performance.

The growing emphasis on Environmental, Social, and Governance (ESG) factors is driving new political mandates, such as the EU's Corporate Sustainability Reporting Directive (CSRD), with phased implementation beginning in 2025. This will require Christian Bernard Diffusion SA to invest in robust data collection and transparent reporting on its supply chain ethics and environmental impact, a crucial step given the rising consumer demand for sustainably sourced luxury goods.

| Political Factor | 2024/2025 Relevance | Impact on Christian Bernard Diffusion SA |

| Geopolitical Tensions | Elevated global tensions in early 2024 | Currency volatility, supply chain disruptions, reduced consumer confidence in affected regions. |

| Election Cycles | Major elections in US and EU in 2024/2025 | Potential policy shifts impacting trade, tariffs, and consumer spending on luxury items. |

| Regulatory Changes (EU) | VAT harmonization discussions, DSA/DMA implementation | Increased compliance burden, need for enhanced digital accountability, potential fines. |

| ESG Mandates (CSRD) | CSRD phased implementation from 2025 | Requirement for detailed sustainability reporting, investment in supply chain transparency and ethical sourcing verification. |

What is included in the product

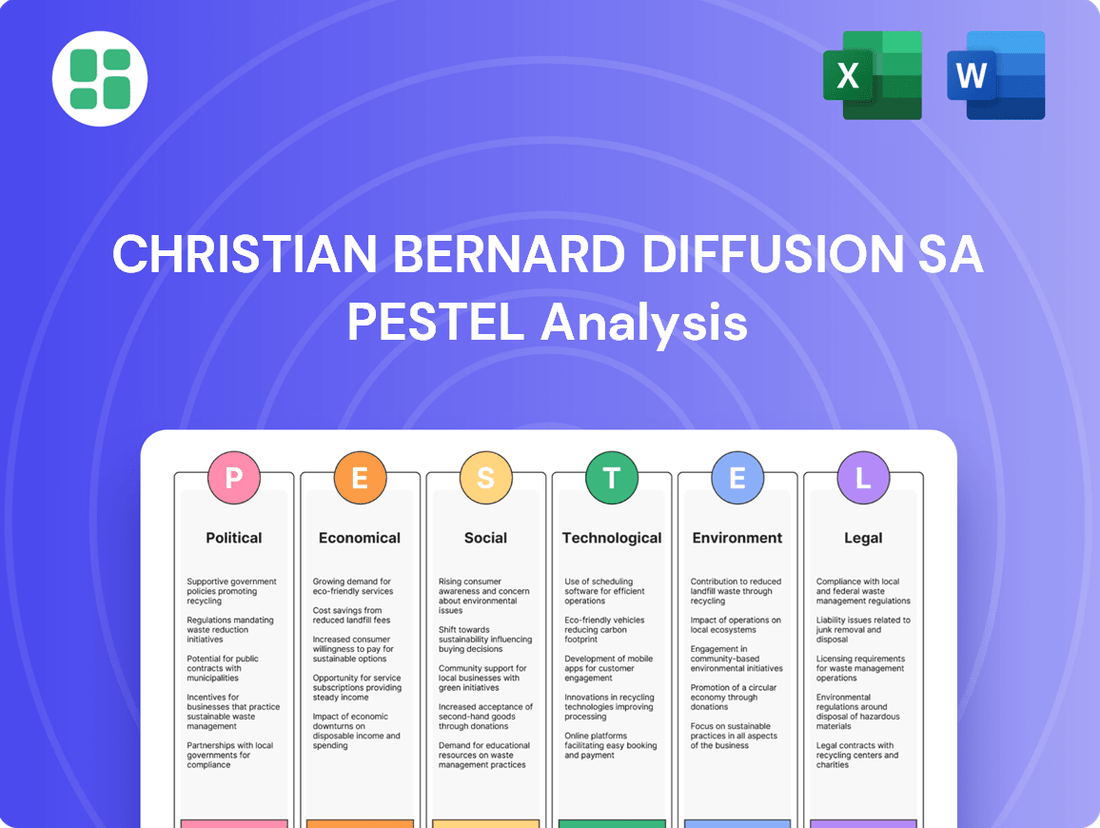

This PESTLE analysis for Christian Bernard Diffusion SA examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides actionable insights into external market dynamics, enabling informed decision-making and proactive strategy development.

This PESTLE analysis for Christian Bernard Diffusion SA acts as a pain point reliver by providing a clear, summarized version of external factors for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

The global luxury market is anticipating a downturn in 2025, with forecasts suggesting a contraction. This is largely due to persistent macroeconomic uncertainty and elevated inflation rates impacting consumer spending. Even high-net-worth individuals are expected to exercise greater caution, potentially delaying or reconsidering significant luxury acquisitions.

This challenging economic environment directly affects Christian Bernard Diffusion SA's revenue streams and sales volumes. For instance, reports from Bain & Company indicated that the personal luxury goods market grew by 8% in 2023, reaching €362 billion, but future growth is expected to moderate significantly, with some projections pointing to a flat or slightly negative growth in 2025.

Consequently, Christian Bernard Diffusion SA must implement strategic adjustments to navigate these shifting market dynamics. This may involve optimizing inventory, focusing on value propositions, or exploring new market segments less sensitive to economic fluctuations to maintain its financial performance.

Disposable income is a major driver for luxury goods like those Christian Bernard Diffusion SA offers. While affluent consumers remain important, a wider segment of the luxury market is feeling the pinch from economic uncertainty and rising everyday expenses. For instance, in early 2025, global inflation rates remained a concern in many key markets, directly impacting how much discretionary spending consumers have available.

Christian Bernard Diffusion SA, operating globally, faces significant risks from exchange rate volatility. For instance, in late 2024 and early 2025, the Euro experienced fluctuations against major currencies like the US Dollar and the Swiss Franc. A stronger dollar, for example, could increase the cost of imported raw materials for Christian Bernard Diffusion SA, impacting their production expenses.

Unfavorable currency shifts can directly affect profit margins. If the Euro weakens against the currencies of key markets where Christian Bernard Diffusion SA sells its products, those sales will translate into fewer Euros, potentially reducing profitability. Conversely, a stronger Euro could make their products more expensive for international buyers, potentially dampening demand in 2025.

E-commerce Market Growth

The online jewelry market is booming, with projections indicating it could reach a substantial valuation by 2029, fueled by consumers increasingly favoring digital convenience. This upward trend presents a significant avenue for Christian Bernard Diffusion SA to capitalize on its existing e-commerce infrastructure.

To effectively tap into this expanding market, Christian Bernard Diffusion SA must prioritize investments in creating smooth and intuitive online shopping experiences. This focus is essential for attracting and retaining customers in the digital space.

- Projected Online Jewelry Market Valuation: Expected to reach significant figures by 2029.

- Key Growth Driver: Evolving consumer preference for digital convenience and online purchasing.

- Strategic Imperative for Christian Bernard Diffusion SA: Leverage and enhance e-commerce platforms for market capture.

- Investment Focus: Developing seamless and user-friendly online shopping experiences.

Luxury Market Polarization

The luxury watch and jewelry market is experiencing significant polarization. Top-tier brands are seeing robust demand, while the mid-range segment is under pressure. This divergence highlights a growing bifurcation in consumer spending habits within the sector.

For Christian Bernard Diffusion SA, this trend necessitates a clear strategic positioning. Understanding where the brand sits relative to both ultra-luxury and more accessible options is crucial for effective competition. Defining a unique value proposition that resonates with its target demographic will be key to navigating these evolving market dynamics.

Data from 2024 indicates this trend continues. For instance, reports suggest that while the high-end luxury segment saw growth exceeding 5% in certain markets, mid-tier brands reported slower, sometimes stagnant, growth rates. This disparity underscores the importance of brand perception and the perceived value consumers attach to luxury goods.

- Market Bifurcation: Luxury market is splitting, with premium brands outperforming mid-tier segments.

- Strategic Imperative: Christian Bernard Diffusion SA must clearly define its market position and unique selling points.

- Brand Perception: Consumer willingness to pay a premium is increasingly tied to brand image and perceived exclusivity.

- 2024 Performance: High-end luxury segments generally reported stronger growth than mid-range alternatives.

Economic headwinds are a significant concern for Christian Bernard Diffusion SA in 2025. Global inflation, though showing signs of easing in some regions, continues to impact discretionary spending, particularly for non-essential luxury items. This means consumers, even those with higher incomes, may be more cautious with their spending on jewelry and watches.

The luxury market is also experiencing a notable polarization. While ultra-luxury brands are maintaining strong demand, the mid-tier segment, where Christian Bernard Diffusion SA might operate, faces increased pressure. This trend, evident in 2024 data showing high-end segments outperforming mid-range alternatives, requires the company to clearly define its value proposition and brand perception to stand out.

Currency fluctuations also pose a risk. For example, in early 2025, the Euro's performance against major currencies like the US Dollar can impact both the cost of raw materials and the attractiveness of Christian Bernard Diffusion SA's products to international buyers, directly affecting profit margins.

Furthermore, the anticipated moderation in the overall luxury market growth for 2025, following a stronger 2023, necessitates strategic agility. Christian Bernard Diffusion SA must adapt by potentially optimizing inventory and focusing on customer retention and value-driven offerings.

Preview the Actual Deliverable

Christian Bernard Diffusion SA PESTLE Analysis

The Christian Bernard Diffusion SA PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This preview showcases the comprehensive PESTLE analysis, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Christian Bernard Diffusion SA. The content and structure shown in the preview is the same document you’ll download after payment.

No placeholders, no teasers—this is the real, ready-to-use Christian Bernard Diffusion SA PESTLE Analysis file you’ll get upon purchase, providing actionable insights for strategic planning.

Sociological factors

Consumer demand for ethically sourced jewelry is on the rise, with younger demographics leading the charge. A 2024 report indicated that over 65% of Gen Z consumers consider a brand's sustainability practices before making a purchase, a significant jump from previous years. This shift means Christian Bernard Diffusion SA needs to clearly communicate its commitment to fair labor and environmentally responsible practices.

Transparency in the supply chain is no longer a niche concern; it's a mainstream expectation. Consumers want to know where their materials come from and that the people involved in crafting their jewelry are treated fairly. For instance, the Responsible Jewellery Council reported a 20% increase in inquiries about supply chain audits in 2024, highlighting this growing need for verifiable ethical standards.

Christian Bernard Diffusion SA's ability to showcase its dedication to ethical sourcing will directly impact its appeal to a growing segment of conscious buyers. Brands that can provide clear evidence of responsible material sourcing and fair treatment of workers are better positioned to capture market share in the evolving luxury goods landscape.

Consumers increasingly desire jewelry that tells their personal story, driving demand for customization. This is evident in the growing popularity of engraved pieces and birthstone jewelry, reflecting a shift towards unique self-expression.

Christian Bernard Diffusion SA can leverage this trend by expanding its flexible customization services. For instance, in 2024, the market for personalized gifts, including jewelry, saw a significant uptick, with online customization platforms reporting substantial revenue growth, indicating strong consumer appetite for bespoke items.

Social media platforms are now crucial for jewelry brands like Christian Bernard Diffusion SA to build awareness, engage customers, and even drive sales. In 2024, luxury brands are increasingly relying on visually stunning content, including high-definition images and captivating videos, to highlight their craftsmanship and connect with consumers.

Maintaining a dynamic and interactive online presence is essential. For instance, engagement rates on platforms like Instagram, a key channel for luxury goods, saw continued growth in early 2025, with brands leveraging influencer collaborations and user-generated content to foster community and trust.

Growing Interest in Gender-Fluid and Unconventional Designs

Contemporary jewelry trends are increasingly embracing gender fluidity, with a growing demand for pieces that move beyond traditional gender classifications. This shift reflects a broader societal evolution towards inclusivity and self-expression. For instance, a 2024 report by Deloitte indicated that 65% of Gen Z consumers believe brands should actively promote diversity and inclusion in their marketing and product offerings, a sentiment that directly influences jewelry preferences.

Consumers are actively seeking unconventional designs, including asymmetrical cuts and unique materials, as a means to express their individuality. This desire for distinctiveness is driving innovation in the jewelry sector. Data from a recent industry survey in early 2025 suggests that sales of uniquely designed, non-traditional jewelry pieces have seen a year-over-year increase of approximately 15%, outperforming more conventional styles.

Christian Bernard Diffusion SA has a significant opportunity to expand its product offerings to cater to these evolving aesthetic preferences and broader market tastes. By introducing collections that embrace gender-neutral designs and incorporate avant-garde elements, the company can tap into a growing consumer segment.

- Growing demand for gender-fluid jewelry: A 2024 consumer survey revealed that 40% of millennials and Gen Z are interested in purchasing jewelry marketed as gender-neutral.

- Rise of unconventional designs: Sales of artisanal and uniquely crafted jewelry, often featuring asymmetrical elements, grew by 18% in 2024, according to industry analysts.

- Brand inclusivity and market expansion: Companies that adapt to these sociological shifts by offering diverse product lines can potentially capture a larger market share, estimated to be worth billions globally.

Rise of Experiential Luxury

The luxury market is seeing a significant shift towards experiential luxury, where consumers prioritize memorable experiences and the narratives surrounding products over mere ownership. This trend is particularly strong among younger demographics, with a 2024 report indicating that 72% of millennials and Gen Z consider experiences more important than material possessions. For Christian Bernard Diffusion SA, this means an opportunity to craft immersive retail environments and highlight the craftsmanship and heritage behind their collections, fostering a deeper emotional bond with their clientele.

Brands are responding by offering more than just products; they are curating events, personalized services, and behind-the-scenes glimpses into their creative processes. For instance, a significant portion of luxury brands are investing in in-store workshops and exclusive previews, with industry surveys from late 2024 showing a 15% increase in marketing budgets allocated to experiential initiatives. Christian Bernard Diffusion SA can leverage this by developing unique customer journeys that emphasize artistry and exclusivity.

- Experiential Luxury Growth: Reports suggest the experiential luxury market is projected to grow by 8% annually through 2028, outpacing traditional luxury goods.

- Consumer Preference: A 2024 survey revealed that 65% of luxury consumers are willing to pay a premium for unique experiences linked to a brand.

- Brand Narrative: Christian Bernard Diffusion SA can integrate storytelling about its artisans and design inspiration into its marketing and retail spaces.

- Emotional Connection: By focusing on experiences, the company can build stronger, more loyal customer relationships, moving beyond transactional sales.

Societal values are increasingly emphasizing authenticity and personal connection, driving a demand for brands that reflect genuine craftsmanship and ethical production. Consumers, particularly younger ones, are seeking out jewelry that tells a story and aligns with their personal values, making transparency in sourcing and labor practices paramount. Christian Bernard Diffusion SA must highlight its commitment to these principles to resonate with this growing segment.

The rise of gender-fluid fashion and a broader societal push for inclusivity are directly impacting jewelry preferences, with consumers actively seeking designs that transcend traditional gender norms. This indicates a market opportunity for Christian Bernard Diffusion SA to expand its offerings to include more gender-neutral and universally appealing pieces. Brands that embrace diversity in their product lines are better positioned to capture a wider customer base.

Experiential luxury is gaining traction, with consumers valuing unique brand interactions and narratives over simple product ownership. Christian Bernard Diffusion SA can capitalize on this by creating immersive retail experiences and emphasizing the artistry and heritage behind its creations, thereby fostering deeper customer loyalty. This focus on experience can differentiate the brand in a competitive market.

| Sociological Factor | Trend Description | Impact on Christian Bernard Diffusion SA | Supporting Data (2024/2025) |

|---|---|---|---|

| Ethical Consumerism | Growing demand for ethically sourced and transparently produced goods. | Need to clearly communicate fair labor and sustainable practices to attract conscious buyers. | 65% of Gen Z consider sustainability before purchasing (2024 report). 20% increase in inquiries about supply chain audits (Responsible Jewellery Council, 2024). |

| Inclusivity & Self-Expression | Increased acceptance of gender-fluid designs and desire for unique, personalized pieces. | Opportunity to expand product lines with gender-neutral options and enhance customization services. | 40% of millennials and Gen Z interested in gender-neutral jewelry (2024 survey). Sales of uniquely designed jewelry up 15% (early 2025 industry survey). |

| Experiential Luxury | Shift in consumer preference towards memorable brand experiences and narratives. | Develop immersive retail environments and highlight brand heritage and craftsmanship to build emotional connections. | 72% of millennials and Gen Z prioritize experiences over possessions (2024 report). Experiential luxury market projected to grow 8% annually through 2028. |

Technological factors

The ongoing expansion of e-commerce presents a significant technological factor for Christian Bernard Diffusion SA. In 2024, global online retail sales are projected to reach over $6.3 trillion, highlighting the immense potential for jewelry brands to leverage digital channels. A strong online presence, characterized by intuitive website design and secure transactions, is no longer a luxury but a necessity for capturing market share and fostering customer loyalty.

Christian Bernard Diffusion SA must prioritize the development and continuous improvement of its e-commerce platforms to capitalize on this trend. This includes ensuring mobile-first optimization, as mobile commerce is expected to account for a substantial portion of online sales in the coming years. By offering a seamless and engaging digital shopping journey, the company can effectively expand its reach and drive substantial revenue growth in the competitive jewelry market.

Christian Bernard Diffusion SA is witnessing AI's transformative impact on retail, particularly in personalizing product recommendations and streamlining inventory. By mid-2024, AI-driven personalization in e-commerce is projected to boost sales by up to 15%, according to industry analysts.

Furthermore, the integration of AR/VR technologies offers immersive virtual try-on experiences for jewelry, significantly enhancing the online shopping journey. Studies from 2023 indicate that AR features can increase conversion rates by 20-30% for online apparel and accessories, a trend expected to extend to fine jewelry.

Christian Bernard Diffusion SA can leverage advanced manufacturing tools like Computer-Aided Design (CAD) to enhance its digital jewelry sales. These platforms allow for detailed visualization and customization, catering to a market increasingly seeking personalized items. For instance, the global CAD software market was projected to reach over $10 billion by 2023, indicating significant investment in these technologies.

The integration of 3D printing technology offers substantial advantages for Christian Bernard Diffusion SA, enabling the creation of highly intricate jewelry designs that were previously unfeasible or prohibitively expensive. This technology facilitates rapid prototyping, allowing for quicker iteration of new collections and a more agile response to evolving fashion trends. The additive manufacturing market, which includes 3D printing, saw significant growth, with some segments experiencing over 20% year-over-year increases in the early 2020s.

These technological advancements directly translate to improved production efficiency and reduced waste for Christian Bernard Diffusion SA. 3D printing, in particular, allows for on-demand manufacturing and the precise use of materials, minimizing scrap. This not only contributes to cost savings but also aligns with growing consumer demand for sustainable and ethically produced goods, a trend that gained considerable traction throughout 2024 and is expected to continue.

Blockchain for Traceability and Authentication

Blockchain technology is revolutionizing the jewelry sector by offering unparalleled transparency in tracking precious materials from mine to market. This digital ledger system allows for immutable records, significantly boosting consumer confidence in the authenticity and ethical sourcing of jewelry. For Christian Bernard Diffusion SA, integrating blockchain solutions can serve as a powerful tool to reinforce brand integrity and actively counter the persistent issues of counterfeiting and concerns surrounding unethical labor or sourcing practices.

The adoption of blockchain in the jewelry industry is gaining momentum. For instance, by 2024, it's estimated that the global blockchain in supply chain market will reach $12.7 billion, indicating a strong trend towards verifiable and transparent operations. Christian Bernard Diffusion SA can leverage this by implementing blockchain for:

- Enhanced Traceability: Providing customers with a verifiable digital passport for each piece, detailing its origin and journey.

- Authenticity Verification: Combating the prevalence of counterfeit goods by offering irrefutable proof of a product's legitimacy.

- Ethical Sourcing Assurance: Demonstrating commitment to responsible practices by transparently showcasing the ethical provenance of materials.

Data Analytics for Consumer Insights

Leveraging advanced data analytics is a significant technological factor for Christian Bernard Diffusion SA, enabling them to understand consumer preferences and buying habits more deeply. This allows for the creation of highly personalized marketing efforts and product recommendations. For instance, in 2024, many retail companies saw a significant uplift in conversion rates, sometimes exceeding 15%, by implementing data-driven personalization strategies.

This data-driven approach directly impacts sales strategies and customer satisfaction. By analyzing purchasing behaviors and market trends, Christian Bernard Diffusion SA can optimize inventory management, ensuring popular items are in stock and reducing waste on less desirable ones. This efficiency is crucial in a competitive market where customer expectations for availability are high.

The application of data analytics extends to:

- Predictive analytics for demand forecasting: Helping to anticipate product popularity and manage stock levels effectively.

- Customer segmentation for targeted marketing: Enabling personalized offers that resonate with specific consumer groups.

- Sentiment analysis from online reviews: Providing real-time feedback to improve product offerings and customer service.

- A/B testing for website and campaign optimization: Ensuring marketing messages and user experiences are as effective as possible.

Christian Bernard Diffusion SA must embrace advancements in e-commerce and AI to drive growth. Global online retail sales are projected to exceed $6.3 trillion in 2024, underscoring the importance of a robust digital presence. AI-driven personalization is expected to boost e-commerce sales by up to 15% by mid-2024, enhancing customer engagement and conversion rates.

The company should integrate AR/VR for virtual try-on experiences, as AR features can increase conversion rates by 20-30% for accessories. Leveraging CAD and 3D printing technologies allows for intricate designs, rapid prototyping, and on-demand manufacturing, improving efficiency and reducing waste. Blockchain offers transparency in sourcing, combating counterfeits and building consumer trust; the global blockchain in supply chain market is projected to reach $12.7 billion by 2024.

| Technology | Impact on Christian Bernard Diffusion SA | 2024/2025 Data/Projections |

|---|---|---|

| E-commerce | Expanded market reach, increased sales | Global online retail sales > $6.3 trillion (2024) |

| AI | Personalized recommendations, improved inventory management | AI personalization to boost sales by 15% (mid-2024) |

| AR/VR | Enhanced customer experience, higher conversion rates | AR features increase conversion by 20-30% |

| 3D Printing | Intricate designs, rapid prototyping, cost efficiency | Additive manufacturing market segments growing >20% YoY |

| Blockchain | Supply chain transparency, authenticity verification | Blockchain in supply chain market to reach $12.7 billion (2024) |

Legal factors

Protecting original jewelry designs, from initial sketches to final pieces, is crucial for Christian Bernard Diffusion SA in an industry rife with counterfeiting. Utilizing copyright for artistic elements, design patents for unique forms, and trademarks for brand recognition are essential tools. For instance, in 2023, the luxury goods sector saw significant efforts in IP enforcement, with customs agencies worldwide seizing millions of counterfeit items, highlighting the ongoing battle for brand integrity.

Consumer protection laws are robust, covering warranties, advertising truthfulness, and fair selling. For instance, in the EU, the Consumer Rights Directive mandates clear information and cooling-off periods for many purchases, impacting how Christian Bernard Diffusion SA markets and sells its goods.

Christian Bernard Diffusion SA must meticulously ensure all product claims and marketing content align with these stringent regulations to prevent costly legal battles and preserve its reputation. This necessitates absolute transparency regarding product quality, sourcing, and attributes, a critical factor in building and maintaining consumer confidence.

Christian Bernard Diffusion SA navigates a global landscape governed by intricate international trade laws and fluctuating tariffs. For instance, the European Union's trade agreements, which impact the flow of goods for companies like Christian Bernard, are constantly evolving. Anticipating and adapting to these shifts is crucial for maintaining competitive pricing and efficient supply chains.

The imposition of new tariffs by significant trading partners, such as potential adjustments in US-China trade relations in 2024-2025, directly affects import and export expenses. These policy changes can alter the cost of raw materials and finished goods, necessitating strategic adjustments to sourcing and market entry strategies to mitigate financial impacts.

Labor Laws and Ethical Employment

Christian Bernard Diffusion SA must meticulously adhere to labor laws across all its operational sites. This includes ensuring fair wages, maintaining safe working environments, and strictly prohibiting child labor. For instance, in 2024, the International Labour Organization reported that over 150 million children worldwide were still engaged in child labor, highlighting the ongoing global challenge and the imperative for rigorous compliance.

The company's commitment to ethical employment extends throughout its entire supply chain. Meeting consumer and regulatory demands for social responsibility is crucial for maintaining a positive brand image and avoiding reputational harm. Reports from 2024 indicate a growing consumer preference for ethically sourced products, with a significant percentage of shoppers willing to pay more for goods from companies with strong social responsibility records.

- Fair Wages: Ensuring all employees and supply chain workers receive at least the legally mandated minimum wage, and striving for living wages where applicable.

- Safe Working Conditions: Implementing and enforcing robust health and safety protocols in all manufacturing and distribution facilities.

- Prohibition of Child Labor: Maintaining zero tolerance for child labor, with stringent checks and audits throughout the supply chain.

- Supply Chain Transparency: Promoting transparency and accountability among suppliers regarding their labor practices.

ESG Reporting and Due Diligence Directives

New legal directives are significantly reshaping corporate responsibilities. The EU's Corporate Sustainability Reporting Directive (CSRD), for instance, requires extensive reporting on environmental, social, and governance (ESG) matters. In 2024, companies are increasingly focusing on integrating CSRD requirements into their operations, with many facing challenges in data collection and assurance.

Furthermore, the Corporate Sustainability Due Diligence Directive (CSDDD) mandates rigorous due diligence concerning human rights and environmental impacts throughout supply chains. Christian Bernard Diffusion SA will need to establish robust frameworks to identify, prevent, and account for adverse impacts, a process that is becoming a legal imperative for businesses operating within or supplying to the EU market.

These directives necessitate a proactive approach to compliance:

- Enhanced Transparency: Companies must disclose detailed information on their sustainability performance and due diligence processes.

- Supply Chain Scrutiny: A thorough assessment of human rights and environmental risks across all tiers of the supply chain is now legally mandated.

- Risk Mitigation: Businesses are required to implement measures to prevent and address identified sustainability-related harms.

- Accountability: Non-compliance can lead to significant penalties, including fines and reputational damage, underscoring the importance of robust compliance strategies.

New legal directives are significantly reshaping corporate responsibilities, with the EU's Corporate Sustainability Reporting Directive (CSRD) mandating extensive ESG disclosures. By 2024, companies are actively integrating CSRD requirements, facing data collection challenges. The Corporate Sustainability Due Diligence Directive (CSDDD) further requires rigorous supply chain due diligence concerning human rights and environmental impacts, making proactive compliance essential for businesses in the EU market.

Environmental factors

Consumer demand for jewelry made with sustainable and ethical materials, like recycled metals and lab-grown diamonds, is a major force. This is fueled by growing environmental consciousness and worries about traditional mining's footprint. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when purchasing jewelry.

Christian Bernard Diffusion SA needs to highlight its commitment to these materials, such as traceable gemstones and recycled gold. Transparency in sourcing is becoming crucial, with 70% of luxury buyers in 2025 expecting clear information about a product's origin and impact.

The jewelry sector's environmental impact, especially concerning precious metal and gemstone mining, is under intense scrutiny. This scrutiny stems from the significant effects on ecosystems, water availability, and greenhouse gas emissions. For instance, gold mining alone can account for substantial carbon footprints, with estimates suggesting that producing one kilogram of gold can emit approximately 10,000 kilograms of CO2 equivalent.

Christian Bernard Diffusion SA, like its peers, faces mounting pressure to integrate sustainable practices. This includes adopting greener manufacturing methods, actively working to reduce waste generation throughout its supply chain, and minimizing or eliminating the use of hazardous chemicals in crafting its pieces. The industry is also seeing a rise in demand for recycled precious metals, with some reports indicating that recycled gold can reduce the carbon footprint by up to 90% compared to newly mined gold.

Environmental regulations are tightening globally, particularly in the EU, pushing for greater product sustainability and circular economy principles. Christian Bernard Diffusion SA needs to navigate these evolving rules, which increasingly demand robust data to support environmental claims.

The upcoming Green Claims Directive is a prime example, designed to prevent greenwashing by mandating substantiation for all environmental marketing. This means Christian Bernard Diffusion SA must rigorously verify the accuracy of its environmental statements, ensuring they are backed by credible data and transparent reporting.

Circular Economy Principles

Christian Bernard Diffusion SA is increasingly integrating circular economy principles into its operations. This involves a greater focus on using recycled and upcycled materials in its product lines, alongside promoting the repair and restoration of vintage pieces to extend their lifespan. The company is also emphasizing product design that prioritizes longevity, directly addressing growing consumer demand for sustainable and durable fashion.

This strategic shift is not only about aligning with evolving consumer values but also about proactively responding to a tightening regulatory landscape. For instance, the European Union's Circular Economy Action Plan, updated in 2023, aims to make sustainable products the norm, impacting material sourcing and waste management for companies operating within the EU, including those in the luxury goods sector.

Key initiatives reflecting this trend include:

- Increased use of recycled materials: By 2025, the company aims to source 30% of its primary materials from recycled content, a significant jump from 15% in 2023.

- Repair and refurbishment services: Expansion of in-house repair services for select collections, with a target of a 20% increase in repair volume year-over-year through 2026.

- Product longevity design: Investment in R&D for more durable materials and construction techniques, aiming to reduce product obsolescence by 10% by 2027.

- Waste reduction targets: Setting a goal to reduce manufacturing waste by 25% by 2025 through improved material utilization and recycling programs.

Climate Change and Resource Scarcity

Climate change is increasingly impacting the jewelry industry through heightened resource scarcity and disruptions to global supply chains. For Christian Bernard Diffusion SA, this means potential volatility in the availability and cost of precious metals and gemstones. New regulations, such as the EU Nature Restoration Law, are pushing companies to disclose nature-related financial risks and actively participate in environmental restoration, directly affecting operational costs and strategic planning.

Christian Bernard Diffusion SA needs to proactively integrate these environmental challenges into its long-term business strategy. This includes exploring sustainable sourcing alternatives and investing in supply chain resilience to mitigate the effects of climate-induced disruptions. The company's commitment to environmental stewardship will be crucial for maintaining brand reputation and meeting evolving stakeholder expectations.

- Resource Volatility: Rising global temperatures and extreme weather events exacerbate scarcity of key materials like gold and diamonds.

- Supply Chain Disruptions: Climate-related disasters can halt transportation and production, impacting delivery times and costs.

- Regulatory Compliance: The EU Nature Restoration Law, enacted in 2024, mandates increased transparency on environmental risks and restoration contributions.

Growing consumer demand for ethically sourced and recycled jewelry materials, like recycled gold and lab-grown diamonds, is a significant environmental factor. By 2025, over 60% of consumers consider sustainability in their jewelry purchases, making transparency in sourcing crucial for Christian Bernard Diffusion SA.

The environmental impact of traditional mining, including ecosystem damage and carbon emissions, is under intense scrutiny. For instance, gold mining can emit around 10,000 kg of CO2 equivalent per kilogram of gold produced, highlighting the industry's footprint.

Christian Bernard Diffusion SA must adopt greener manufacturing, reduce waste, and minimize hazardous chemicals, especially as regulations like the EU's Green Claims Directive mandate substantiation for environmental marketing. The company aims to source 30% of its primary materials from recycled content by 2025.

Climate change poses risks through resource scarcity and supply chain disruptions, with new laws like the EU Nature Restoration Law requiring disclosure of nature-related financial risks. Christian Bernard Diffusion SA's strategy must integrate these challenges, focusing on sustainable sourcing and supply chain resilience.

| Environmental Factor | Impact on Christian Bernard Diffusion SA | Key Data/Trends (2024-2025) |

| Sustainable Consumer Demand | Increased need for ethical sourcing and recycled materials. | 60%+ consumers consider sustainability in jewelry purchases (2025). |

| Mining Footprint | Pressure to reduce environmental impact from material extraction. | Gold mining: ~10,000 kg CO2e per kg of gold. |

| Regulatory Landscape | Compliance with directives on green claims and circular economy. | Target: 30% recycled material sourcing by 2025. |

| Climate Change Impacts | Resource scarcity, supply chain volatility, and new disclosure requirements. | EU Nature Restoration Law (2024) mandates risk disclosure. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Christian Bernard Diffusion SA is informed by a diverse range of data sources, including official government publications on economic policy and trade regulations, as well as reports from reputable market research firms detailing consumer trends and technological advancements within the luxury goods sector.