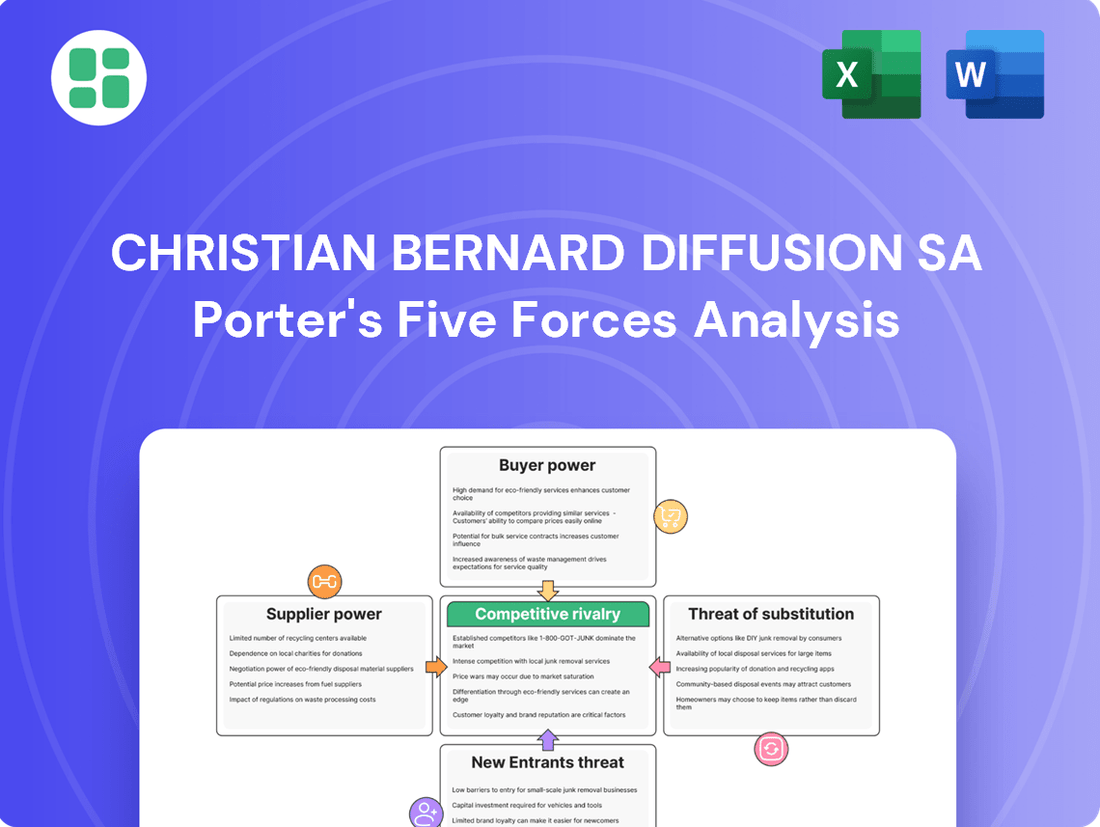

Christian Bernard Diffusion SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christian Bernard Diffusion SA Bundle

Christian Bernard Diffusion SA operates in a market shaped by moderate buyer power and intense rivalry among existing players. The threat of substitutes is a significant consideration, while the bargaining power of suppliers presents a manageable challenge.

The complete report reveals the real forces shaping Christian Bernard Diffusion SA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The jewelry and watch sector, including companies like Christian Bernard Diffusion SA, depends heavily on specialized suppliers for critical components. These include providers of precious metals such as gold and silver, and essential gemstones like diamonds and rubies, as well as intricate watch movements. The concentration of these suppliers, or their high degree of specialization, directly translates into increased bargaining power, which can drive up input costs for Christian Bernard Diffusion SA.

This supplier concentration is a significant factor in the bargaining power of suppliers. For instance, the market for high-quality, ethically sourced diamonds is dominated by a limited number of major players. Similarly, the production of sophisticated watch movements often requires highly specialized manufacturing capabilities found in only a few countries or companies. This limited supply base gives these suppliers considerable leverage when negotiating prices and terms with jewelry and watch manufacturers.

Looking ahead, the financial landscape for 2025 suggests potential upstream cost pressures. Projections indicate a continued upward trend in the prices of gold and silver. This forecast directly impacts Christian Bernard Diffusion SA, as raw material costs represent a substantial portion of their production expenses, and rising commodity prices will likely translate into increased demands from their metal suppliers.

The increasing availability of lab-grown diamonds (LGDs) significantly impacts the bargaining power of natural diamond suppliers. LGDs are becoming a viable alternative, particularly in the bridal sector, offering Christian Bernard Diffusion SA more flexibility in sourcing.

With LGDs capturing a growing market share, estimated to be around 10% of the global diamond jewelry market by 2024, their lower price point compared to natural diamonds provides Christian Bernard Diffusion SA with a stronger negotiating position.

For Christian Bernard Diffusion SA, the bargaining power of suppliers is significantly influenced by switching costs. If the company needs to change its suppliers for essential materials such as gold, silver, or specialized watch movements, it faces substantial expenses. These costs can include retooling manufacturing equipment, obtaining new certifications for materials, and building relationships with alternative providers.

These switching costs directly bolster the bargaining power of current suppliers. Christian Bernard Diffusion SA would face financial outlays and potential disruptions to its production schedule if it decided to change its supply chain. For instance, a shift in a key component supplier could lead to weeks of production downtime, impacting revenue.

To counter this, maintaining a diversified network of suppliers is a crucial strategy. This approach helps to reduce reliance on any single supplier and provides leverage during negotiations, mitigating the impact of high switching costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Christian Bernard Diffusion SA's market, meaning they start making and selling jewelry or watches themselves, is a significant concern. This is particularly relevant if specialized component manufacturers, like those providing intricate watch movements or unique gemstone settings, decide to bypass existing brands and sell directly to consumers or retailers. Such a move would transform them from suppliers into direct rivals, potentially disrupting Christian Bernard Diffusion SA's market share and pricing power.

While the raw materials sector might see less of this, the high-value component manufacturers are the real potential threat. If these specialized suppliers, who possess critical technical expertise and access to unique materials, decide to launch their own brands, they could leverage their existing supply chain advantages. This could put Christian Bernard Diffusion SA in a difficult position, facing competition from entities that understand the production process intimately.

- Forward Integration Threat: Suppliers entering the jewelry and watch manufacturing/distribution market directly.

- Key Competitor Type: Specialized component makers with unique technical expertise.

- Impact on Christian Bernard Diffusion SA: Potential loss of market share and pricing leverage.

- Industry Example: A high-end watch movement supplier launching its own luxury watch line.

Importance of Supplier's Input to Product Quality

The quality and craftsmanship of Christian Bernard Diffusion SA's jewelry and watches are critical for its brand image, particularly in the competitive luxury and fashion accessories sector. Suppliers who can provide superior, ethically sourced materials or intricate watch components wield significant influence because their contributions directly affect the perceived value and consumer confidence in the final product.

In 2024, the demand for traceable and ethically sourced precious metals and gemstones continued to rise, with reports indicating that over 70% of luxury consumers consider sustainability when making purchasing decisions. This trend amplifies the bargaining power of suppliers who can guarantee such standards, as Christian Bernard Diffusion SA relies on them to meet these evolving consumer expectations and maintain its brand integrity.

- Supplier Leverage: Suppliers of high-grade diamonds, precious metals, and specialized watch movements possess strong bargaining power due to the critical nature of their inputs to product quality and brand reputation.

- Ethical Sourcing Imperative: The growing consumer emphasis on ethical sourcing and supply chain transparency in 2024 empowers suppliers who can provide verifiable certifications for their materials, directly impacting Christian Bernard Diffusion SA's ability to command premium pricing and maintain consumer trust.

- Impact on Value: The direct correlation between supplier input quality and the final product's perceived value means that Christian Bernard Diffusion SA is susceptible to price increases from suppliers whose materials are essential for maintaining its luxury positioning.

Christian Bernard Diffusion SA faces considerable bargaining power from its suppliers, particularly those providing essential raw materials like gold, silver, and high-quality gemstones, as well as specialized watch movements. The limited number of suppliers for these critical components, coupled with the high switching costs for Christian Bernard Diffusion SA, grants these suppliers significant leverage in price negotiations. This dynamic is further amplified by the growing consumer demand for ethically sourced and traceable materials, empowering suppliers who can meet these stringent requirements.

| Supplier Characteristic | Impact on Christian Bernard Diffusion SA | 2024/2025 Data/Trend |

|---|---|---|

| Concentration of Suppliers | High leverage for suppliers, potentially increasing input costs. | Limited number of high-quality diamond and watch movement manufacturers globally. |

| Switching Costs | Deters Christian Bernard Diffusion SA from changing suppliers, reinforcing current supplier power. | Significant costs associated with retooling, certifications, and relationship building. |

| Ethical Sourcing Demand | Empowers suppliers with verifiable certifications, allowing for premium pricing. | Over 70% of luxury consumers consider sustainability in 2024; LGDs offer alternatives, impacting natural diamond supplier power. |

| Forward Integration Threat | Potential for specialized suppliers to become direct competitors. | High-value component makers with unique expertise pose a risk to market share. |

What is included in the product

This analysis details the competitive forces impacting Christian Bernard Diffusion SA, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its market.

Effortlessly identify and mitigate competitive threats with a visually intuitive Porter's Five Forces analysis, empowering Christian Bernard Diffusion SA to navigate market complexities with confidence.

Customers Bargaining Power

Customers in the jewelry and watch market, especially those looking for fashion and affordable luxury items like those offered by Christian Bernard Diffusion SA, can be quite sensitive to price. The sheer volume of choices available, ranging from inexpensive fashion accessories to other established jewelry brands, means consumers have a lot of power to shop around and find the best deals.

The explosion of e-commerce and digital marketplaces has dramatically amplified customer access to product details, user feedback, and price comparisons. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, a testament to consumers’ growing preference for online channels due to their convenience and competitive pricing.

This heightened transparency effectively empowers consumers, enabling them to make more educated purchasing choices and thereby strengthening their bargaining leverage against retailers like Christian Bernard Diffusion SA.

Consumers, particularly younger generations like millennials and Gen Z, are increasingly seeking jewelry that is personalized and reflects their unique style. This growing demand for customization, whether through engravings or entirely bespoke designs, compels Christian Bernard Diffusion SA to offer adaptable product lines. For instance, a 2024 survey indicated that over 60% of Gen Z consumers would pay a premium for personalized products.

Brands that successfully meet this desire for individuality foster stronger customer relationships and loyalty. Conversely, companies that fail to provide these tailored options risk losing customers to competitors who are more agile in offering customization services, potentially impacting market share.

Impact of Lab-Grown Diamonds

The increasing acceptance and affordability of lab-grown diamonds significantly bolster the bargaining power of customers. These diamonds offer a compelling alternative, often perceived as more ethical and budget-friendly, directly influencing purchasing decisions. For instance, by mid-2024, the price difference between comparable mined and lab-grown diamonds could range from 50% to 80%, allowing consumers to opt for larger stones or more intricate settings.

This shift empowers consumers to demand more value, thereby increasing their leverage with traditional jewelers. Customers can now acquire higher-quality or larger carat-weight diamonds for the same expenditure, forcing retailers to compete more aggressively on price and value proposition. The market for lab-grown diamonds saw substantial growth, with some projections indicating a market value exceeding $10 billion by 2025, underscoring its growing influence.

- Increased Consumer Choice: Lab-grown diamonds provide a viable, often more affordable, alternative to mined diamonds, expanding consumer options.

- Price Sensitivity: The significant price differential empowers customers to negotiate or seek out better deals, as they have readily available, less expensive substitutes.

- Ethical Considerations: Growing consumer awareness regarding the ethical sourcing of diamonds favors lab-grown options, further strengthening the customer's position.

- Market Growth: The expanding market share of lab-grown diamonds, projected to reach substantial figures in the coming years, demonstrates their increasing appeal and customer acceptance.

Shift Towards Experiential Spending

Affluent consumers are increasingly prioritizing experiences over material possessions. For instance, a 2024 report indicated that spending on travel and leisure grew by 15% year-over-year, while spending on luxury goods saw a more modest 8% increase. This shift suggests that customers may perceive less intrinsic value in physical luxury items like jewelry, potentially increasing their bargaining power.

Christian Bernard Diffusion SA must acknowledge this evolving consumer preference. The company could enhance the perceived value of its jewelry by highlighting the emotional resonance, craftsmanship, and heritage associated with its pieces. Alternatively, integrating experiential elements, such as exclusive in-store events or personalized styling consultations, can create a more engaging and memorable customer journey, thereby mitigating the impact of this trend.

- Experiential Spending Growth: 15% year-over-year increase in travel and leisure spending in 2024.

- Luxury Goods Growth: 8% year-over-year increase in luxury goods spending in 2024.

- Customer Value Perception: Potential decrease in perceived intrinsic value of physical luxury items.

- Strategic Response: Emphasize emotional/symbolic value or integrate experiential elements into the customer journey.

Customers in the jewelry market, particularly for fashion and affordable luxury items, possess significant bargaining power due to high price sensitivity and abundant alternatives. The widespread availability of information through e-commerce platforms, where global sales are projected to exceed $6.3 trillion in 2024, allows consumers to easily compare prices and product details, effectively strengthening their negotiating position.

| Factor | Description | Impact on Christian Bernard Diffusion SA |

|---|---|---|

| Price Sensitivity & Abundant Alternatives | Customers can easily find comparable or lower-priced items from numerous competitors, both online and offline. | Forces competitive pricing strategies and value-added services to retain customers. |

| E-commerce & Transparency | Online platforms provide easy access to price comparisons, reviews, and product specifications. Global e-commerce sales are expected to surpass $6.3 trillion in 2024. | Increases customer knowledge and demands greater transparency from retailers. |

| Demand for Customization | A growing trend, especially among younger demographics, with over 60% of Gen Z willing to pay a premium for personalized products in 2024. | Requires flexible product offerings and potentially higher production costs to meet individual preferences. |

| Lab-Grown Diamonds | Offer a more affordable and ethically perceived alternative, with price differences potentially ranging from 50% to 80% by mid-2024. The market is projected to exceed $10 billion by 2025. | Puts pressure on traditional diamond pricing and necessitates a strong value proposition for mined diamonds. |

What You See Is What You Get

Christian Bernard Diffusion SA Porter's Five Forces Analysis

This preview shows the exact Christian Bernard Diffusion SA Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive evaluation of competitive forces within the luxury watch market. You'll gain insight into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your immediate use.

Rivalry Among Competitors

The global jewelry market is expected to see consistent growth, with projections indicating a compound annual growth rate (CAGR) of around 5.3% through 2028, reaching an estimated value of $306.8 billion. Similarly, the watch market is also experiencing expansion, though intense competition, particularly in established regions like the U.S. and Europe, remains a significant factor.

This robust growth, while offering opportunities, also fuels a highly competitive landscape. Christian Bernard Diffusion SA operates within this environment, where numerous players, ranging from heritage luxury brands to nimble fashion jewelry companies, constantly strive to capture market share and customer loyalty.

Christian Bernard Diffusion SA operates in a highly competitive landscape, contending with established global luxury jewelry houses like Cartier and Tiffany & Co., which command significant brand loyalty and market share. The market also includes fast fashion brands that offer trendy, lower-priced accessories, creating price-based competition. Furthermore, a growing number of independent designers and direct-to-consumer (DTC) brands are entering the market, further fragmenting the competitive environment and demanding continuous innovation from Christian Bernard Diffusion SA.

In the competitive jewelry and watch sector, Christian Bernard Diffusion SA thrives on product differentiation. This is achieved through distinctive designs, meticulous craftsmanship, and a rich brand heritage that cultivates significant customer loyalty. For instance, in 2024, the luxury watch market saw brands emphasizing unique complications and artisanal techniques, with a significant portion of consumers willing to pay a premium for these attributes, reinforcing the importance of these differentiators.

Marketing Intensity and Digital Presence

The luxury fragrance and cosmetics industry is characterized by intense marketing efforts. Companies like Christian Bernard Diffusion SA invest heavily in advertising across various channels, including digital platforms, print media, and television. For instance, in 2024, major players in the beauty sector saw their marketing budgets increase, with a significant portion allocated to digital campaigns and influencer partnerships, reflecting the growing importance of online engagement.

A robust digital presence and sophisticated e-commerce operations are no longer optional but essential for survival and growth. Brands are actively enhancing their online shopping experiences to attract and retain customers. This includes developing features like virtual try-on tools and leveraging AI for personalized product recommendations, aiming to replicate the in-store experience online.

- High Marketing Spend: The beauty industry consistently ranks among the top sectors for advertising expenditure, with a substantial portion directed towards digital marketing.

- Digital Dominance: E-commerce sales in the beauty sector are projected to continue their upward trajectory, with digital channels becoming primary revenue drivers for many brands.

- Innovation in Online Experience: Investments in augmented reality (AR) for virtual try-ons and AI-driven personalization are key differentiators in the competitive online landscape.

- Influencer Impact: Social media influencers play a crucial role in brand visibility and consumer purchasing decisions, driving significant marketing ROI for brands that effectively collaborate with them.

Industry Cost Structure and Exit Barriers

Christian Bernard Diffusion SA operates in an industry where significant upfront investment in manufacturing facilities, maintaining extensive inventory, and establishing a premium retail presence contribute to high fixed costs. For instance, luxury watch brands often invest millions in specialized machinery and highly skilled labor for intricate movements.

Exit barriers for companies like Christian Bernard Diffusion SA are substantial. These include the difficulty in divesting specialized manufacturing equipment, the erosion of brand equity if operations are ceased abruptly, and the significant investment in building and maintaining a global retail network. These factors can trap companies in the market even when profitability is low, thereby increasing competitive intensity.

The need for continuous innovation is paramount. Companies must constantly invest in research and development for new materials, such as advanced ceramics or lab-grown diamonds, and in creating novel designs to stay ahead. For example, the global jewelry market was valued at approximately $280 billion in 2023 and is projected to grow, underscoring the importance of staying current.

- High Fixed Costs: Manufacturing, inventory, and retail infrastructure demand substantial capital.

- Significant Exit Barriers: Specialized assets and brand reputation make exiting the market difficult.

- Continuous Innovation: Investment in new materials and designs is crucial for competitive advantage.

Christian Bernard Diffusion SA faces fierce competition from established luxury houses and emerging direct-to-consumer brands. The market is fragmented, with numerous players vying for customer attention through design, quality, and brand storytelling. In 2024, the luxury jewelry segment alone was valued at over $70 billion globally, highlighting the intense battle for market share.

SSubstitutes Threaten

Consumers have a wide range of fashion accessories to choose from beyond Christian Bernard Diffusion SA's core offerings. Scarves, handbags, belts, and eyewear can all serve the purpose of personal adornment and self-expression. For instance, the global handbag market was valued at approximately $35.5 billion in 2023, demonstrating a substantial alternative for consumers seeking to accessorize.

Smart devices and wearable technology present a significant threat of substitution for traditional watches. For instance, smartwatches, like the Apple Watch Series 9 launched in late 2023, offer not only timekeeping but also advanced health monitoring and seamless smartphone integration, directly competing with the core functionality of many timepieces. This technological convergence means consumers increasingly see a single device fulfilling multiple needs previously met by separate items, impacting the demand for standalone watches, particularly among younger, tech-oriented demographics.

The rise of Do-It-Yourself (DIY) jewelry presents a significant threat of substitutes for Christian Bernard Diffusion SA. The increasing accessibility of online tutorials and craft supplies empowers consumers to design and assemble their own pieces, often at a lower cost and with a unique, personalized touch. This trend is particularly impactful in the fashion jewelry segment, where customization and individuality are highly valued.

In 2024, the global DIY craft market was estimated to be worth over $50 billion, with jewelry making being a substantial component. Platforms like Etsy reported a significant increase in sales of jewelry-making supplies and finished DIY pieces, indicating a strong consumer engagement with this alternative. This DIY movement directly competes with mass-produced fashion jewelry by offering a more authentic and often budget-friendly option for self-expression.

Experiential Gifts and Non-Material Luxuries

The rise of experiential gifts and non-material luxuries presents a significant threat of substitution for Christian Bernard Diffusion SA. As consumer preferences increasingly lean towards memorable experiences, such as travel, wellness retreats, or unique events, these offerings directly compete with traditional luxury goods like jewelry and watches. This shift is particularly pronounced among affluent demographics who often prioritize personal growth and unique memories over tangible assets. For instance, a 2024 report indicated that spending on experiences, including travel and entertainment, grew by 15% year-over-year, outpacing the growth in luxury goods. This trend necessitates that brands like Christian Bernard Diffusion SA must effectively communicate the emotional resonance and lasting symbolic value embedded within their products to remain competitive.

Brands must adapt by highlighting the enduring sentiment and personal significance that their jewelry and watches represent, framing them as investments in personal legacy and cherished moments. This strategic emphasis can help counter the allure of fleeting experiences by underscoring the timeless nature of their offerings.

- Growing Demand for Experiences: Consumer spending on experiences, such as travel and wellness, saw a notable increase in 2024, directly competing for discretionary income that might otherwise be allocated to luxury goods.

- Emotional Value Proposition: The threat necessitates a stronger focus on the emotional and symbolic value of jewelry and watches, positioning them as keepers of memories and personal milestones.

- Shifting Affluent Preferences: Affluent consumers are increasingly prioritizing unique experiences and personal development over the acquisition of material possessions, impacting traditional luxury markets.

- Brand Differentiation: Christian Bernard Diffusion SA needs to differentiate its products by emphasizing craftsmanship, heritage, and the unique stories their pieces can represent, offering an alternative to ephemeral experiences.

Durability and Longevity of Existing Products

The durability and longevity of existing jewelry and watch products present a significant threat of substitution for Christian Bernard Diffusion SA. These are not items typically replaced annually. Consumers often view jewelry and watches as investments or heirlooms, leading to extended ownership periods.

The substantial stock of pre-owned and heirloom pieces already in circulation acts as a direct substitute for new purchases. This existing inventory reduces the perceived need for consumers to buy brand new items, especially for classic or timeless designs. For instance, the resale market for luxury watches, a segment Christian Bernard operates within, continues to grow, with reports indicating a substantial increase in pre-owned sales volume year-over-year.

- Extended Ownership Cycles: The inherent durability of jewelry and watches means consumers do not face frequent replacement needs, unlike consumable goods.

- Heirloom Value: Many pieces are passed down through generations, serving as substitutes for new acquisitions.

- Resale Market Impact: A robust secondary market for pre-owned luxury watches and jewelry directly competes with new product sales.

- Reduced Purchase Frequency: Consumers are less likely to purchase new items when existing ones retain their value and appeal for extended periods.

The threat of substitutes for Christian Bernard Diffusion SA is multifaceted, encompassing both tangible alternatives and intangible shifts in consumer priorities. The growing popularity of DIY fashion and the increasing value placed on experiences over material goods present significant challenges. Furthermore, the inherent durability and resale value of existing jewelry and watches mean consumers often delay new purchases.

| Threat Category | Examples of Substitutes | Market Data/Impact |

| Fashion Accessories | Scarves, handbags, belts, eyewear | Global handbag market valued at $35.5 billion in 2023. |

| Technological Convergence | Smartwatches | Smartwatches offer integrated health monitoring and smartphone connectivity. |

| DIY & Craft Market | Handmade jewelry | Global DIY craft market estimated over $50 billion in 2024. |

| Experiential Consumption | Travel, wellness retreats, events | Spending on experiences grew 15% year-over-year in 2024. |

| Pre-owned Market | Second-hand jewelry and watches | Growing resale market for luxury watches. |

Entrants Threaten

Entering the competitive jewelry and watch market, particularly the high-end segments where Christian Bernard Diffusion SA operates, demands significant upfront capital. This capital is essential for acquiring precious metals and gemstones, establishing sophisticated manufacturing processes, and launching comprehensive marketing campaigns to reach target consumers. For instance, in 2024, the global luxury goods market, which includes fine jewelry and watches, was valued at approximately $317 billion, highlighting the scale of investment needed to gain even a small foothold.

Beyond financial investment, cultivating a strong brand reputation and fostering consumer trust are paramount, especially in the luxury sector. This is not a quick process; it requires years of consistent quality, innovative design, and effective storytelling to build the kind of brand loyalty that luxury consumers expect. Developing this brand equity acts as a substantial barrier, as new entrants must overcome established players' long-standing reputations and customer relationships.

Securing access to effective distribution channels is a formidable hurdle for any newcomer looking to enter the luxury accessories market, a key consideration in the threat of new entrants for Christian Bernard Diffusion SA. This includes both physical retail presence and strong e-commerce capabilities. In 2024, prime retail locations in desirable shopping districts remained highly sought after and expensive, making it difficult for new brands to establish visibility. Furthermore, building a competitive online presence, complete with efficient logistics and a seamless customer experience, requires substantial upfront investment and brand recognition that new entrants typically lack.

Christian Bernard Diffusion SA, like many in the luxury jewelry sector, faces a significant barrier to entry related to supplier relationships and raw material access. Newcomers often find it challenging to establish the trusted, long-term connections with mines and gemstone cutters that provide consistent quality and competitive pricing for precious metals and stones. For instance, in 2024, the global diamond market saw continued consolidation, with major players like De Beers and Alrosa controlling a substantial portion of rough diamond supply, making it harder for smaller, emerging brands to secure consistent inventory.

Regulatory Hurdles and Certifications

The jewelry sector faces significant regulatory complexities. For instance, in 2024, the Responsible Jewellery Council (RJC) continued to emphasize stringent standards for ethical sourcing and supply chain transparency, impacting new businesses needing to demonstrate compliance. These regulations, covering everything from the origin of precious metals to accurate gemstone grading, create a substantial barrier to entry.

Newcomers must navigate a landscape of certifications and compliance measures that can be both time-consuming and expensive. For example, achieving compliance with international standards like those set by the World Diamond Council’s System of Warranties requires meticulous record-keeping and auditing, adding considerable overhead. This financial and administrative burden deters many potential competitors from entering the market.

- Regulatory Compliance Costs: New entrants often face substantial upfront costs for legal counsel, certification fees, and establishing compliant supply chains, potentially running into tens of thousands of dollars for smaller operations.

- Ethical Sourcing Standards: Adherence to ethical sourcing guidelines, such as those promoted by industry bodies in 2024, demands robust due diligence and traceability, which can be challenging for startups lacking established infrastructure.

- Quality Assurance and Labeling: Stringent regulations on the purity of precious metals (e.g., hallmarking laws) and accurate gemstone descriptions require investment in testing equipment and expertise, further increasing the cost of market entry.

Consumer Loyalty and Switching Costs

Established brands like Christian Bernard Diffusion SA leverage significant customer loyalty, a formidable barrier for newcomers. In 2024, the luxury jewelry market continued to see consumers gravitate towards heritage brands, with studies indicating that over 60% of luxury purchases are driven by brand reputation and trust.

The emotional and financial investment associated with purchasing fine jewelry often translates into high switching costs for consumers. This loyalty means new entrants must not only offer competitive products but also invest heavily in building trust and perceived value to overcome the inertia of existing customer relationships. For instance, a significant portion of repeat purchases in the jewelry sector, estimated at around 45% in 2024, are attributed to existing brand affinity rather than purely product features.

- Customer Loyalty: Established brands benefit from a strong existing customer base, making it difficult for new entrants to gain market share.

- Switching Costs: The perceived risk and emotional attachment to jewelry brands increase the cost for consumers to switch to a new provider.

- Brand Trust: In 2024, over 60% of luxury purchases were influenced by brand reputation, highlighting the importance of established trust.

- Repeat Purchases: Approximately 45% of jewelry purchases in 2024 were repeat buys, underscoring the challenge new brands face in acquiring customers.

The threat of new entrants for Christian Bernard Diffusion SA is moderate, primarily due to the high capital requirements for market entry. Establishing a presence in the luxury jewelry and watch sector demands substantial investment in inventory, manufacturing, and marketing. For example, the global luxury goods market was valued at approximately $317 billion in 2024, indicating the scale of financial commitment needed to compete effectively.

Building a reputable brand and securing trusted supplier relationships also pose significant barriers. New entrants must invest years in cultivating customer loyalty and establishing reliable access to precious materials, a challenge amplified by market consolidation among major diamond suppliers in 2024.

Navigating complex regulations, including ethical sourcing standards and quality assurance, adds further costs and time for newcomers. Compliance with measures like the World Diamond Council’s System of Warranties requires meticulous record-keeping and auditing, increasing the financial and administrative burden for emerging brands.

The established customer loyalty and high switching costs associated with luxury jewelry brands present another hurdle. In 2024, over 60% of luxury purchases were influenced by brand reputation, and around 45% of jewelry purchases were repeat buys, demonstrating the difficulty new entrants face in acquiring and retaining customers.

| Barrier to Entry | Description | 2024 Relevance |

| Capital Requirements | High investment for inventory, manufacturing, and marketing. | Global luxury goods market valued at $317 billion. |

| Brand Reputation & Trust | Years of consistent quality and effective marketing needed. | Over 60% of luxury purchases driven by brand reputation. |

| Supplier Relationships | Difficulty securing consistent, quality raw materials. | Consolidation in diamond market limits access for new players. |

| Regulatory Compliance | Costs and time for ethical sourcing and quality certifications. | Stringent standards from bodies like RJC and WDC. |

| Customer Loyalty | Established brands benefit from repeat purchases and brand affinity. | ~45% of jewelry purchases were repeat buys. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Christian Bernard Diffusion SA is built upon a foundation of comprehensive data, including the company's annual reports, industry-specific market research from firms like Euromonitor, and publicly available financial statements from competitors.