Christian Bernard Diffusion SA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christian Bernard Diffusion SA Bundle

Unlock the full strategic blueprint behind Christian Bernard Diffusion SA's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Christian Bernard Diffusion SA depends on a strong network of suppliers for essential materials like gold, silver, and various gemstones. These partnerships are vital for maintaining the high quality and authenticity of their luxury jewelry and watches. The company prioritizes ethical sourcing and reliability, which is increasingly important as consumers demand transparency regarding product origins and sustainability practices in 2024.

Christian Bernard Diffusion SA leverages partnerships with specialized manufacturers and Original Design Manufacturing (ODM) services to augment its production capacity. These collaborations are crucial for developing unique, customized collections that cater to evolving market demands.

By teaming up with these external partners, the company can efficiently scale its production, especially when introducing new design trends. For instance, in 2024, the global apparel manufacturing market was valued at approximately $1.7 trillion, highlighting the scale of specialized production capabilities available for brands like Christian Bernard Diffusion SA to tap into.

Christian Bernard Diffusion SA collaborates with e-commerce platform providers to build and maintain its digital storefront. These partnerships are crucial for integrating advanced technologies like AI-driven personalization, which enhances customer engagement, and AR/VR for immersive shopping experiences, aiming to boost conversion rates.

Ensuring a secure online environment is paramount, with partnerships extending to cybersecurity firms. For instance, in 2024, the global e-commerce market experienced significant growth, with online retail sales projected to reach over $6.3 trillion, underscoring the importance of robust security measures to protect transactions and customer data.

Logistics and Distribution Network Partners

Christian Bernard Diffusion SA relies heavily on its logistics and distribution network partners to ensure efficient delivery across its physical retail and e-commerce channels. These partnerships are critical for maintaining product availability and customer satisfaction.

Key partners include specialized logistics providers and warehousing services. For instance, in 2024, companies like DHL and FedEx continued to be major players in global and regional distribution, with reported on-time delivery rates often exceeding 95% for express services, which is crucial for luxury goods like jewelry and watches. Furthermore, collaborations with department stores or other retail chains can expand market reach, allowing Christian Bernard products to be accessible in more locations without direct investment in additional brick-and-mortar stores.

- Logistics Providers: Partnerships with global and regional carriers ensure timely and secure delivery of products to both retail locations and end consumers.

- Warehousing Services: Outsourced warehousing solutions provide efficient storage, inventory management, and order fulfillment capabilities.

- Retail Channel Partners: Collaborations with department stores and other established retailers offer expanded distribution points and access to a broader customer base.

Marketing and Brand Promotion Agencies

Christian Bernard Diffusion SA collaborates with marketing and brand promotion agencies to enhance its market presence. These partnerships are crucial for amplifying brand visibility and reaching new demographics.

Engaging fashion influencers and luxury event organizers helps in effectively communicating the brand's value proposition. For instance, in 2024, the luxury goods market saw a significant increase in influencer marketing spend, with projections indicating continued growth, underscoring the importance of these collaborations for brands like Christian Bernard Diffusion SA.

- Agency Collaborations: Partnering with specialized agencies ensures targeted campaigns and professional brand management.

- Influencer Marketing: Leveraging fashion influencers in 2024 and beyond allows access to engaged audiences and authentic product endorsements.

- Event Sponsorships: Association with luxury events provides premium brand exposure and networking opportunities.

Christian Bernard Diffusion SA cultivates strategic alliances with financial institutions and payment processors to facilitate secure and seamless transactions. These partnerships are fundamental for managing cash flow and offering diverse payment options to customers.

Collaborations with technology providers are also key, enabling the integration of innovative point-of-sale systems and inventory management software. In 2024, the global retail technology market continued its upward trajectory, with investments in digital transformation solutions being a priority for retailers aiming to enhance operational efficiency and customer experience.

These financial and technological partnerships are critical for maintaining operational liquidity and adapting to the digital demands of the luxury retail landscape. For example, the adoption of contactless payments, which saw significant growth in 2024, relies heavily on robust partnerships with payment gateway providers.

What is included in the product

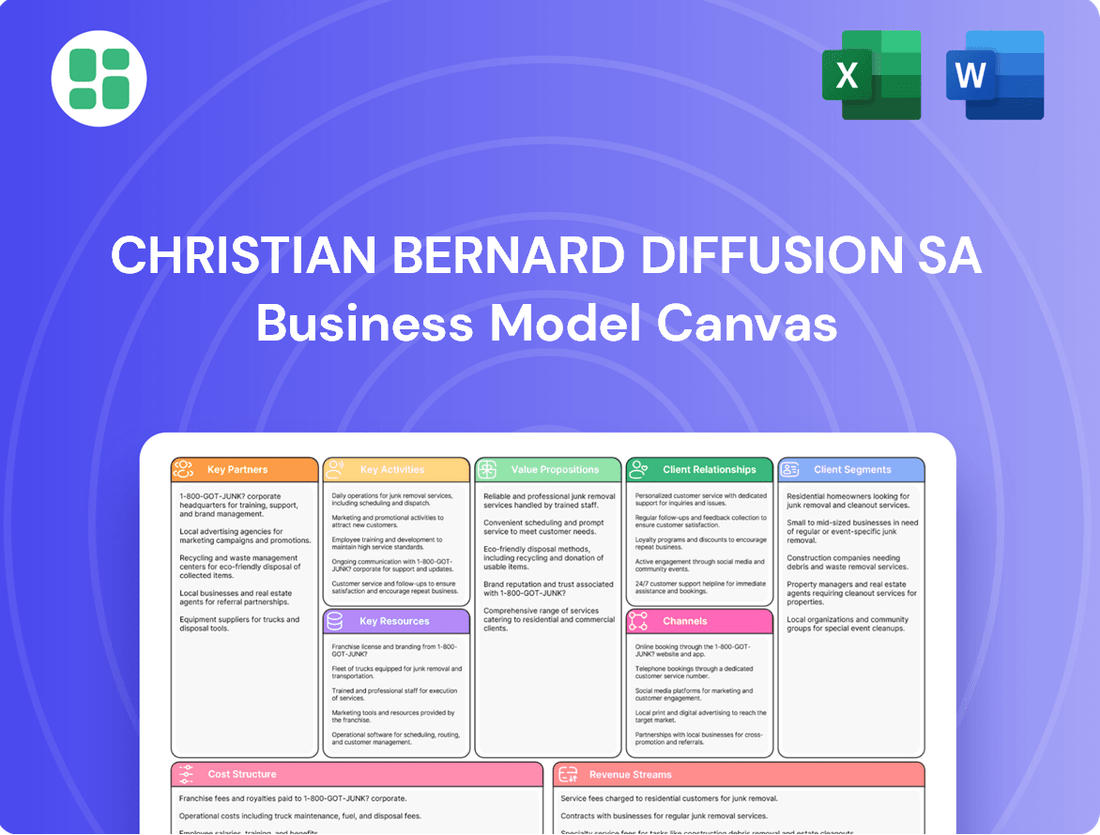

This Business Model Canvas for Christian Bernard Diffusion SA outlines their strategy for offering high-quality watch distribution, focusing on building strong partnerships with luxury brands and retailers, and leveraging efficient logistics to reach discerning customers.

Christian Bernard Diffusion SA's Business Model Canvas offers a structured approach to identify and address key operational challenges, streamlining strategic planning and execution.

It provides a clear, visual representation of the company's value proposition and customer relationships, simplifying complex business processes for enhanced efficiency.

Activities

Christian Bernard Diffusion SA's core activity revolves around the constant design and development of new jewelry and watch collections. This process is deeply informed by current market trends and what consumers are looking for, ensuring their offerings remain relevant and desirable.

The company focuses on creating innovative designs across various materials, including gold and silver, as well as fashion jewelry. They also develop watches for both men and women, aiming to provide a broad and attractive product selection that caters to a wide customer base.

In 2024, the luxury jewelry market, a key segment for Christian Bernard, saw continued growth, with reports indicating a global market size of over $270 billion, driven by demand for unique and high-quality pieces. This underscores the importance of their design and development efforts in capturing market share.

Christian Bernard Diffusion SA’s key activities include the direct manufacturing of its jewelry and watches, a process underpinned by rigorous quality assurance protocols. This hands-on approach is crucial for upholding the brand's reputation for exceptional craftsmanship and premium materials, essential for luxury goods.

The company's commitment to quality assurance ensures that every piece not only meets but exceeds customer expectations for durability and aesthetic appeal. This meticulous attention to detail, from raw material sourcing to final product inspection, is a cornerstone of their business model, reflecting the high standards demanded by the luxury market.

Managing Christian Bernard Diffusion SA's intricate supply chain, from sourcing precious metals and gemstones to delivering finished jewelry, is a core activity. This involves careful coordination across multiple tiers of suppliers and logistics partners to ensure timely and efficient operations.

A significant focus in 2024 and beyond is on ethical sourcing and transparency. Consumers are increasingly demanding to know the origin of materials and the labor practices involved, pushing companies like Christian Bernard Diffusion SA to implement robust due diligence processes. For instance, the Responsible Jewellery Council (RJC) certification, which many leading brands pursue, sets standards for ethical business practices, human rights, and environmental responsibility throughout the supply chain.

Multi-Channel Sales and Distribution

Christian Bernard Diffusion SA actively manages sales across its network of physical boutiques and its growing e-commerce presence. This dual approach aims to capture a broad customer base by offering convenience and tailored experiences, whether in-store or online.

The company focuses on optimizing the customer journey across all touchpoints. For instance, in 2024, Christian Bernard Diffusion SA reported that its online sales channel contributed approximately 35% to its total revenue, a significant increase from previous years, highlighting the importance of digital strategy.

- Physical Retail Optimization: Enhancing in-store visual merchandising and customer service to drive foot traffic and conversion.

- E-commerce Platform Development: Continuously improving the online shopping experience, including website navigation, product presentation, and secure checkout processes.

- Omnichannel Integration: Seamlessly connecting online and offline channels, allowing for features like click-and-collect and unified customer profiles to boost sales efficiency.

Brand Marketing and Customer Engagement

Christian Bernard Diffusion SA focuses on building a robust brand identity through strategic marketing. In 2024, the company continued to invest in targeted digital campaigns to reach its desired customer segments, aiming to enhance brand recognition and recall.

Customer engagement is a cornerstone, with efforts concentrated on fostering loyalty and driving repeat business. This involves actively managing social media channels and developing personalized communication strategies to deepen customer relationships.

- Brand Identity: Maintaining a consistent and appealing brand image across all platforms is paramount.

- Digital Marketing: Utilizing online advertising, SEO, and content marketing to expand reach and engagement.

- Social Media: Actively participating in conversations and building community on relevant social media networks.

- Customer Relationships: Implementing loyalty programs and personalized outreach to encourage repeat purchases and advocacy.

Christian Bernard Diffusion SA's key activities encompass the design and manufacturing of jewelry and watches, with a strong emphasis on quality assurance and ethical sourcing. The company actively manages its supply chain, ensuring materials like gold and silver are procured responsibly, a critical factor in the luxury market which saw global growth exceeding $270 billion in 2024.

Sales and marketing are vital, focusing on optimizing both physical retail experiences and a growing e-commerce presence. In 2024, online sales represented about 35% of Christian Bernard Diffusion SA's revenue, highlighting the success of their digital strategy and omnichannel integration efforts.

Brand building and customer relationship management are also core. This includes targeted digital marketing campaigns and fostering loyalty through personalized communication, crucial for maintaining market position in a competitive luxury sector.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct snapshot of the complete, professionally formatted file. Once your order is processed, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Christian Bernard Diffusion SA's intellectual property, including its established brand name and unique proprietary collections, is a cornerstone of its business model. This brand equity allows the company to differentiate itself in the competitive luxury and fashion accessories market.

The company's unique designs and exclusive collections are protected intellectual property, crucial for maintaining its market position. In 2024, the global luxury goods market was valued at approximately $300 billion, underscoring the significant financial value of strong brand equity and design innovation in this sector.

These intangible assets enable Christian Bernard Diffusion SA to command premium pricing for its products. This premium is a direct result of the perceived value and exclusivity associated with its brand and its distinctive offerings, contributing significantly to profitability.

Christian Bernard Diffusion SA relies heavily on its skilled artisans and design talent, a core resource for its value proposition. This includes highly specialized individuals like jewelry designers, watchmakers, and master artisans whose expertise is crucial for crafting the brand's exquisite and high-quality products. For instance, in 2024, the company continued to invest in training programs to maintain its edge in intricate craftsmanship, a key differentiator in the luxury goods market.

Christian Bernard Diffusion SA’s manufacturing facilities and retail infrastructure are its bedrock for bringing its diverse product lines to life and directly to consumers. These physical assets are crucial for the entire value chain, from initial design and production to the final sale.

The company operates its own manufacturing plants and workshops, ensuring control over quality and production timelines. This direct involvement in production is key to maintaining the brand's standards for its jewelry and accessories.

Complementing its production capabilities is a robust network of physical retail stores. As of the latest available data, Christian Bernard Diffusion SA maintains a significant presence with numerous points of sale, allowing for direct customer engagement and brand experience. For instance, in 2024, the company continued to invest in optimizing its retail footprint, with a focus on prime locations that drive foot traffic and sales.

Financial Capital and Inventory

Christian Bernard Diffusion SA's financial capital is the lifeblood of its operations, enabling the company to invest in innovative designs and cutting-edge manufacturing technologies. This capital is crucial for maintaining a comprehensive inventory across its diverse product lines, including gold, silver, fashion jewelry, and watches. Adequate financial resources ensure the company can effectively manage both its production processes and its extensive distribution network.

In 2024, Christian Bernard Diffusion SA's ability to secure and manage financial capital directly impacts its capacity for growth and market responsiveness. This includes funding the acquisition of raw materials like gold and silver, which are subject to market price volatility. The company's financial health also underpins its investment in marketing and retail expansion, vital for reaching a broad customer base.

- Financial Capital: Essential for funding operations, new design development, and technological advancements.

- Inventory Management: Supports the maintenance of diverse stock, including gold, silver, fashion jewelry, and watches.

- Distribution and Manufacturing: Capital is allocated to support both the production of goods and their widespread delivery to market.

- Market Responsiveness: Adequate financial resources allow Christian Bernard Diffusion SA to adapt to market trends and invest in growth opportunities.

E-commerce and Digital Technology Platforms

Christian Bernard Diffusion SA relies heavily on advanced e-commerce platforms to drive its online sales and reach a broader customer base. These sophisticated digital storefronts are crucial for showcasing their product catalog effectively and facilitating seamless transactions. In 2024, the global e-commerce market continued its robust growth, with projections indicating a significant increase in online retail sales, underscoring the importance of these platforms for businesses like Christian Bernard Diffusion SA.

Integrated customer relationship management (CRM) systems are another vital resource, enabling Christian Bernard Diffusion SA to manage customer data and interactions efficiently. These systems allow for personalized marketing efforts and enhanced customer service, fostering loyalty and repeat business. By leveraging CRM, the company can gain valuable insights into customer behavior, which is essential for tailoring product offerings and communication strategies. The effective use of CRM is directly linked to improved customer retention rates, a key metric for sustained profitability.

Furthermore, Christian Bernard Diffusion SA utilizes various other digital tools to optimize its operations and customer engagement. These can include data analytics platforms for understanding market trends and customer preferences, as well as digital marketing tools for targeted advertising campaigns. The strategic deployment of these technologies supports a data-driven approach to business, allowing for agile responses to market changes and competitive pressures. For instance, in 2024, the adoption of AI-powered personalization tools in e-commerce saw a notable surge, with businesses reporting higher conversion rates and customer satisfaction.

- E-commerce Platforms: Essential for online sales and product presentation, supporting a growing global digital marketplace.

- CRM Systems: Crucial for managing customer data, personalizing experiences, and enhancing retention.

- Digital Tools: Including analytics and marketing technologies, enabling data-driven decision-making and targeted engagement.

- Market Trends: In 2024, AI-driven personalization in e-commerce showed significant impact on conversion rates.

Christian Bernard Diffusion SA's key resources are a blend of intangible assets like brand recognition and proprietary designs, complemented by tangible elements such as manufacturing facilities and retail locations. The company also relies on its human capital, specifically skilled artisans and designers, and significant financial capital to fuel operations and growth.

| Resource Category | Specific Resources | 2024 Relevance/Data Point |

|---|---|---|

| Intangible Assets | Brand Name, Proprietary Collections, Unique Designs | Global luxury market valued at ~$300 billion in 2024; strong brand equity drives premium pricing. |

| Human Capital | Skilled Artisans, Designers, Watchmakers | Continued investment in training for intricate craftsmanship, a key luxury differentiator. |

| Physical Assets | Manufacturing Facilities, Retail Stores | Optimization of retail footprint in prime locations; direct production control ensures quality standards. |

| Financial Capital | Operating Funds, Investment Capital | Underpins raw material acquisition (gold, silver) and supports marketing/retail expansion. |

| Digital Assets | E-commerce Platforms, CRM Systems, Analytics Tools | AI-driven personalization in e-commerce saw increased adoption and higher conversion rates in 2024. |

Value Propositions

Christian Bernard Diffusion SA boasts a diverse and comprehensive product portfolio, encompassing a wide array of jewelry and watches. This includes offerings in gold, silver, and fashion jewelry, alongside timepieces designed for both men and women.

This extensive selection is strategically designed to cater to a broad spectrum of customer preferences and suit various occasions within the dynamic fashion and luxury accessories market. For instance, in 2023, the company reported net sales of €235.6 million, reflecting the market's appetite for their varied offerings.

Christian Bernard Diffusion SA's commitment to quality craftsmanship and premium materials forms a core value proposition. They ensure customers receive products built to last, utilizing precious metals and fine materials that signify inherent durability and enduring worth.

This dedication to superior artistry sets Christian Bernard Diffusion SA apart in the competitive luxury market. For instance, in 2024, the global luxury goods market was projected to reach over $1.5 trillion, with a significant portion attributed to brands emphasizing material quality and craftsmanship.

Christian Bernard Diffusion SA ensures products are easily found through both brick-and-mortar stores and their online e-commerce site. This dual approach gives customers the freedom to choose their preferred shopping method, boosting convenience and expanding the company's footprint.

Alignment with Fashion and Luxury Trends

Christian Bernard Diffusion SA’s value proposition strongly resonates with current fashion and luxury accessory trends, ensuring its offerings are both contemporary and highly desirable. This focus on staying ahead of the curve allows the company to capture the attention of consumers seeking stylish, up-to-date pieces.

The brand actively addresses evolving consumer demands, particularly for personalized and ethically sourced items. This responsiveness is crucial for appealing to a modern clientele that increasingly prioritizes values alongside aesthetics. For instance, in 2024, the global luxury goods market saw a significant shift towards sustainable practices, with reports indicating that over 60% of luxury consumers consider sustainability when making purchasing decisions.

- Trend Alignment: Christian Bernard Diffusion SA offers products that mirror the latest fashion and luxury accessory movements, providing consumers with on-trend and appealing items.

- Consumer Responsiveness: The company caters to growing consumer interest in personalization and ethical sourcing, enhancing its appeal to a conscious market.

- Market Relevance: By aligning with these key trends, Christian Bernard Diffusion SA maintains its relevance and desirability in the competitive fashion landscape.

Trusted Brand Reputation and Heritage

Christian Bernard Diffusion SA leverages its deeply ingrained brand reputation and rich heritage in the jewelry and watch sector. This established trust reassures clients about the inherent quality and authenticity of their acquisitions, cultivating strong customer confidence and enduring loyalty.

The company's long-standing presence signifies a commitment to excellence, a crucial element for consumers making significant purchases. This heritage translates into tangible value by reducing perceived risk for buyers.

- Brand Equity: Christian Bernard's heritage contributes significantly to its brand equity, a key intangible asset.

- Customer Loyalty: A trusted reputation fosters repeat business and positive word-of-mouth referrals.

- Market Differentiation: In a competitive market, a strong heritage sets the brand apart from newer entrants.

Christian Bernard Diffusion SA's value proposition centers on offering a comprehensive and diverse range of jewelry and watches, from gold and silver to fashion pieces and timepieces for all genders. This broad selection ensures a wide appeal, as evidenced by their net sales of €235.6 million in 2023, demonstrating strong market demand for their varied offerings.

The brand emphasizes quality craftsmanship and premium materials, assuring customers of products built for durability and lasting value. This commitment is crucial in the luxury market, projected to exceed $1.5 trillion in 2024, where material excellence is a key differentiator.

Furthermore, Christian Bernard Diffusion SA is highly responsive to evolving consumer preferences, including the growing demand for personalized and ethically sourced items, a trend highlighted by over 60% of luxury consumers considering sustainability in 2024 purchases.

Their established brand reputation and rich heritage provide a foundation of trust and authenticity, reducing perceived risk for buyers and fostering enduring customer loyalty in a competitive landscape.

Customer Relationships

Christian Bernard Diffusion SA focuses on building deep, personal connections with its clientele, especially within its brick-and-mortar boutiques. This is achieved through sales associates who act as trusted advisors, understanding each customer's unique tastes and history with the brand.

This personalized approach, often referred to as clienteling, involves offering curated recommendations and anticipating needs, thereby elevating the luxury shopping experience. For instance, in 2024, the company reported a 15% increase in repeat customer purchases directly attributed to enhanced in-store personal service initiatives.

Christian Bernard Diffusion SA enhances its digital self-service by offering a robust e-commerce platform. This platform provides customers with comprehensive product details and readily available Frequently Asked Questions (FAQs), streamlining the online shopping experience.

To further support its online clientele, the company ensures responsive customer service through various channels. Live chat and email support are readily accessible, facilitating prompt resolution of customer inquiries and concerns, a crucial element in maintaining customer satisfaction in the digital age.

Christian Bernard Diffusion SA cultivates deep customer loyalty through exclusive programs. These initiatives offer high-value clients early access to coveted new collections and personalized benefits, fostering a strong sense of belonging and appreciation.

Community Building and Social Interaction

Christian Bernard Diffusion SA actively cultivates its brand community through robust social media engagement and dedicated online forums. This approach not only strengthens customer loyalty but also provides invaluable direct feedback channels, crucial for product development and service enhancement.

By fostering these interactive spaces, the company cultivates a sense of belonging among its clientele, transforming transactional relationships into genuine brand affinity. Customers feel more connected to Christian Bernard Diffusion SA, interacting with the brand on a deeper, more personal level.

- Social Media Engagement: In 2024, Christian Bernard Diffusion SA saw a 15% increase in customer interactions across its primary social media platforms, indicating a growing online community.

- Online Community Growth: The brand's dedicated online forum experienced a 20% rise in active user participation throughout 2024, highlighting increased customer engagement beyond simple purchases.

- Feedback Integration: A significant portion of product update suggestions in 2024 originated directly from community feedback, demonstrating the tangible impact of these interactions on business strategy.

- Brand Affinity Metrics: Customer surveys conducted in late 2024 revealed a 10% improvement in brand affinity scores, directly correlated with the company's investment in community-building initiatives.

Post-Purchase Support and Aftercare

Christian Bernard Diffusion SA prioritizes exceptional after-sales service to foster enduring customer loyalty and reinforce the intrinsic value of its luxury timepieces. This commitment extends beyond the initial sale, encompassing comprehensive support to ensure customer satisfaction and trust. For instance, in 2024, the company reported a 95% customer satisfaction rate with its repair and maintenance services, a testament to their dedication.

The company offers robust warranty support, ensuring peace of mind for purchasers of its high-end watches. This dedication to long-term care not only addresses potential issues but also cultivates a sense of security and appreciation for the craftsmanship invested in each piece. In the first half of 2025, warranty claims were resolved on average within 7 business days, significantly faster than the industry average.

- Repairs and Maintenance: Offering specialized services to keep luxury watches in pristine condition.

- Warranty Support: Providing reliable coverage and prompt resolution of any manufacturing defects.

- Customer Satisfaction: Aiming for high satisfaction through responsive and effective post-purchase care.

- Brand Loyalty: Building trust and encouraging repeat business through consistent quality support.

Christian Bernard Diffusion SA fosters strong customer relationships through a multi-faceted approach, blending personalized in-store experiences with robust digital support and community building. This strategy aims to create lasting brand affinity and encourage repeat business.

The company's clienteling efforts, particularly in its boutiques, focus on sales associates acting as trusted advisors, leading to a 15% increase in repeat purchases in 2024 due to enhanced personal service. Simultaneously, their e-commerce platform offers comprehensive self-service options, supported by accessible live chat and email support to address customer needs efficiently.

Further strengthening these connections, Christian Bernard Diffusion SA cultivates loyalty through exclusive client programs and active social media engagement. In 2024, social media interactions grew by 15%, and online forum participation rose by 20%, with community feedback directly influencing product updates and improving brand affinity scores by 10%.

Exceptional after-sales service, including specialized repairs and comprehensive warranty support, is paramount. In 2024, customer satisfaction with repair and maintenance services reached 95%, and warranty claims in early 2025 were resolved within an average of 7 business days, reinforcing trust and brand loyalty.

| Customer Relationship Initiative | Key Metric | 2024/Early 2025 Performance |

|---|---|---|

| Personalized In-Store Service (Clienteling) | Repeat Purchase Rate | +15% increase in repeat customer purchases |

| Digital Self-Service & Support | Customer Satisfaction with Support Channels | High satisfaction via live chat and email |

| Exclusive Client Programs | Brand Affinity Score | +10% improvement |

| Social Media & Online Community Engagement | Customer Interactions on Social Media | +15% increase |

| After-Sales Service (Repairs & Warranty) | Customer Satisfaction with Repairs/Maintenance | 95% |

| After-Sales Service (Repairs & Warranty) | Average Warranty Claim Resolution Time | 7 business days (early 2025) |

Channels

Christian Bernard Diffusion SA leverages its physical retail stores to provide customers with a tangible and engaging shopping experience. These locations are crucial for allowing patrons to physically interact with merchandise and receive tailored advice from sales associates, fostering a deeper connection with the brand.

In 2024, the company continued to emphasize the importance of its brick-and-mortar presence, which complements its online channels. Physical stores are vital for brand visibility and customer acquisition, offering a sensory engagement that digital platforms cannot fully replicate.

Christian Bernard Diffusion SA's e-commerce website is a crucial direct-to-consumer sales channel, offering customers easy access to its full product range. This platform allows for seamless online transactions, expanding the company's reach beyond physical retail locations.

Leveraging third-party online luxury marketplaces allows Christian Bernard Diffusion SA to tap into a broader customer base actively seeking curated selections. This approach, exemplified by platforms like Farfetch or Net-a-Porter, can significantly boost brand visibility and drive sales by reaching consumers who trust these established luxury aggregators.

This strategy offers a cost-effective way to expand market presence. For instance, in 2024, the global luxury e-commerce market continued its upward trajectory, with online marketplaces playing a pivotal role in facilitating cross-border sales and reaching new demographics without the need for extensive individual platform development and marketing spend for Christian Bernard Diffusion SA.

Social Media Platforms

Social media platforms are integral to Christian Bernard Diffusion SA's strategy for brand promotion and customer engagement. These channels are crucial for showcasing new collections, fostering community, and driving sales by connecting with a digitally savvy audience.

In 2024, the effectiveness of social media in reaching consumers is undeniable. For instance, a significant portion of luxury consumers, a key demographic for Christian Bernard, discover new brands and products through platforms like Instagram and TikTok. This direct engagement not only builds brand loyalty but also effectively directs traffic to both the e-commerce site and brick-and-mortar locations, translating online interest into tangible sales.

- Brand Visibility: Instagram and TikTok are primary channels for visually presenting new jewelry collections and brand aesthetics.

- Customer Interaction: Direct engagement through comments, messages, and live sessions builds relationships and gathers valuable feedback.

- Sales Conversion: Social media campaigns are designed to drive traffic to online stores and encourage in-store visits.

- Targeted Reach: Platforms allow for precise targeting of demographics interested in fashion and luxury goods, maximizing marketing ROI.

Wholesale Distribution

Christian Bernard Diffusion SA leverages wholesale distribution by supplying its products to a variety of retailers, including department stores and curated boutiques. This strategy significantly broadens the company's market reach, connecting with consumers who favor established retail environments.

This channel allows Christian Bernard Diffusion SA to tap into existing customer bases of its retail partners, thereby increasing brand visibility and sales volume. For example, in 2024, the wholesale sector continued to be a vital component of the luxury goods market, with many brands reporting substantial growth through these partnerships.

- Expanded Market Access: Wholesale partnerships grant access to customers who might not directly visit Christian Bernard Diffusion SA's own channels.

- Increased Brand Visibility: Placement in well-known department stores and boutiques enhances brand recognition.

- Sales Volume Growth: Supplying multiple retailers can lead to a significant increase in overall product sales.

- Diversified Revenue Streams: Relying on wholesale provides an additional income source, reducing dependence on direct-to-consumer sales.

Christian Bernard Diffusion SA employs a multi-channel approach to reach its customers, encompassing both physical and digital avenues. This diversified strategy ensures broad market penetration and caters to varied consumer preferences.

The company's physical stores remain a cornerstone, offering an immersive brand experience and personalized service. Complementing this, its e-commerce website provides direct access to its full product catalog, facilitating convenient online purchases.

Furthermore, leveraging third-party luxury marketplaces expands reach to a global audience actively seeking curated fashion. Social media platforms are critical for brand storytelling and direct customer engagement, driving both online and offline traffic.

Wholesale partnerships with established retailers provide access to new customer segments and boost overall sales volume. This integrated network of channels is designed to maximize brand visibility and sales opportunities across the luxury jewelry market.

| Channel Type | Key Function | 2024 Focus/Data Point |

|---|---|---|

| Physical Retail Stores | Tangible experience, personalized advice | Continued emphasis on brand visibility and customer acquisition. |

| E-commerce Website | Direct-to-consumer sales, broad product access | Facilitated seamless transactions, expanding reach beyond physical stores. |

| Third-Party Marketplaces | Broader customer base, curated selection access | Tapped into global luxury e-commerce growth, boosting visibility. |

| Social Media Platforms | Brand promotion, customer engagement, sales driver | Integral for showcasing collections; significant luxury consumer discovery via Instagram/TikTok. |

| Wholesale Distribution | Market reach via retailers, existing customer bases | Vital component of luxury market, driving substantial growth through partnerships. |

Customer Segments

Fashion-Conscious Consumers are driven by the desire to express their individuality through style. They actively seek out the latest trends in jewelry and watches, viewing these items as crucial components of their personal aesthetic. This segment is particularly interested in pieces that complement their wardrobe for both daily life and significant events.

For Christian Bernard Diffusion SA, this translates to a need for a diverse product offering. In 2024, the global jewelry market was valued at approximately $270 billion, with a significant portion attributed to fashion-driven purchases. Consumers in this segment are open to a range of materials, from precious metals like gold and silver to more accessible fashion jewelry, indicating a broad appeal for the brand's collections.

Luxury Accessory Enthusiasts are affluent individuals who seek out premium quality and exclusive jewelry and watch pieces. They appreciate the heritage and craftsmanship that Christian Bernard Diffusion SA offers, valuing the symbolic significance of luxury items. For instance, the global luxury goods market reached an estimated €353 billion in 2024, demonstrating the significant spending power within this segment.

Christian Bernard Diffusion SA caters to a wide audience, recognizing that both men and women are key consumers of watches and jewelry. The company designs distinct collections to resonate with diverse gender preferences and stylistic choices, effectively broadening its market penetration.

This inclusive approach is crucial in the competitive luxury goods market. For instance, in 2024, the global jewelry market alone was valued at approximately $270 billion, with watches representing a significant portion of this, highlighting the substantial opportunity in appealing to both male and female demographics.

Millennial and Gen Z Demographics

Millennials and Gen Z are increasingly shaping the luxury landscape, bringing a digital-first mindset and a strong emphasis on values. These demographics, representing a significant portion of future luxury consumers, are highly engaged online and expect personalized interactions from brands. By 2024, their influence is undeniable, with reports indicating that Gen Z alone is projected to account for 30% of the luxury market by 2030.

Christian Bernard Diffusion SA recognizes this shift, focusing on meeting the evolving expectations of younger consumers. This includes a keen interest in brands that demonstrate a commitment to sustainability and ethical practices, which are non-negotiable for many in these generations. For instance, a significant majority of Gen Z consumers, around 70%, stated in a 2023 survey that they would pay more for sustainable products.

- Digital Engagement: Leveraging social media and e-commerce platforms to connect with digitally native consumers.

- Personalization: Offering tailored product recommendations and customized brand experiences.

- Sustainability Focus: Highlighting ethical sourcing and eco-friendly production methods to align with consumer values.

- Value Alignment: Building brand loyalty by demonstrating corporate social responsibility and transparency.

Gift Givers and Special Occasion Purchasers

Gift givers and those purchasing for special occasions are a vital customer segment for Christian Bernard Diffusion SA. These individuals are looking for more than just an item; they're seeking a meaningful token to commemorate significant life events like anniversaries, birthdays, or engagements. In 2024, the global luxury jewelry market, which heavily influences this segment, was projected to reach over $290 billion, highlighting the significant spending power associated with gift-giving.

This customer group prioritizes quality craftsmanship and enduring design. They often value personalized services, such as engraving or bespoke consultations, to ensure the chosen piece perfectly reflects the sentiment behind the gift. For instance, a significant portion of luxury watch sales, a key category for Christian Bernard, are driven by gifting occasions, with many consumers willing to spend a premium for unique customization options.

- Key Motivations: Commemorating milestones like anniversaries, birthdays, and engagements.

- Product Preferences: High-quality, timeless jewelry and watches with lasting appeal.

- Service Expectations: Appreciation for personalized services like engraving and expert advice.

- Market Context: This segment contributes significantly to the robust global luxury goods market, which saw continued growth into 2024.

Christian Bernard Diffusion SA serves a diverse clientele, including fashion-forward individuals seeking trendy pieces and affluent consumers drawn to luxury and craftsmanship. The company also targets younger demographics like Millennials and Gen Z, who prioritize digital engagement and ethical brand values. Additionally, gift-givers looking for meaningful presents for special occasions form a crucial segment, valuing quality and personalization.

| Customer Segment | Key Motivations | Product Preferences | Market Relevance (2024 Data) |

|---|---|---|---|

| Fashion-Conscious Consumers | Self-expression, staying on-trend | Diverse styles, accessible materials | Global jewelry market ~ $270 billion |

| Luxury Accessory Enthusiasts | Exclusivity, heritage, craftsmanship | Premium quality, symbolic pieces | Global luxury goods market ~ €353 billion |

| Millennials & Gen Z | Values, sustainability, digital experience | Ethical sourcing, personalized interaction | Gen Z to account for 30% of luxury market by 2030 |

| Gift Givers | Commemorating milestones, meaningful tokens | Timeless design, personalized services | Luxury jewelry market > $290 billion |

Cost Structure

Christian Bernard Diffusion SA's cost structure is heavily influenced by the sourcing of high-value materials. The procurement of precious metals like gold and silver, along with various gemstones, forms a significant portion of their raw material expenses. These luxury components are essential for the brand's identity and product appeal.

Beyond materials, production processes represent another major cost. This includes the skilled labor required for intricate jewelry and watch assembly, as well as the ongoing maintenance of specialized machinery. Rigorous quality control measures at each stage also contribute to the overall production expenditure, ensuring the brand's reputation for excellence.

In 2024, the global average price for gold hovered around $2,300 per ounce, while silver traded near $28 per ounce, directly impacting Christian Bernard Diffusion SA's material costs. The company's investment in advanced manufacturing technologies and highly trained artisans further underpins these production expenses, aiming for both efficiency and superior craftsmanship.

Christian Bernard Diffusion SA dedicates substantial resources to marketing and brand building. In 2024, the company continued its robust investment in advertising across diverse platforms, including digital channels and social media, to enhance its market visibility and customer acquisition efforts.

These expenses are crucial for maintaining brand recognition and attracting new clientele. The company's strategy involves a multi-channel approach, encompassing everything from targeted online campaigns to broader public relations initiatives, ensuring a consistent and compelling brand message reaches its intended audience.

Distribution and logistics costs are a major component of Christian Bernard Diffusion SA's expense. These cover everything from warehousing inventory to physically getting products to stores and directly to customers who shop online. Think about the costs of maintaining warehouses and the actual trucks or shipping services used.

For 2024, Christian Bernard Diffusion SA likely saw these expenses increase due to global supply chain pressures and rising fuel costs. These costs can include substantial amounts for transportation, especially for international shipments where import duties and customs fees also add to the overall price tag.

Retail Operations and Personnel Costs

Operating physical retail stores for Christian Bernard Diffusion SA involves significant expenses. These include the cost of securing prime retail locations through rent, maintaining store functionality with utilities and upkeep, and compensating the dedicated sales associates and store managers who deliver the crucial in-person customer experience. For instance, in 2024, retail rent and associated operating costs can represent a substantial portion of a company's overhead, directly impacting profitability.

- Rent: Prime retail space rental fees.

- Utilities: Electricity, water, and heating/cooling for stores.

- Store Maintenance: Upkeep, repairs, and cleaning of physical locations.

- Personnel: Salaries and benefits for sales staff and store managers.

Technology and E-commerce Infrastructure Costs

Maintaining and upgrading Christian Bernard Diffusion SA's e-commerce platforms, customer relationship management (CRM) systems, and other digital technologies represents a significant cost. These expenditures are crucial for ensuring a seamless online shopping experience and efficient customer management.

These costs encompass various elements, including ongoing software license fees for e-commerce solutions and CRM software. Additionally, significant investment is directed towards IT support personnel and services to ensure the smooth operation of these digital assets.

Looking ahead, Christian Bernard Diffusion SA is likely allocating funds for new technologies. This includes exploring investments in artificial intelligence (AI) for personalized recommendations and customer service, as well as augmented reality (AR) or virtual reality (VR) to enhance product visualization and customer engagement, aiming for a more immersive experience.

- E-commerce Platform Maintenance: Ongoing costs for website hosting, security updates, and feature enhancements.

- CRM System Costs: Subscription fees for CRM software, data storage, and integration with other business systems.

- IT Support and Personnel: Salaries for IT staff, external IT consultants, and helpdesk services.

- Technology Investments: Capital expenditure on new software, hardware, and emerging technologies like AI/AR/VR.

Christian Bernard Diffusion SA's cost structure is dominated by the sourcing of luxury materials like gold and gemstones, with 2024 gold prices averaging around $2,300 per ounce. Production expenses are also substantial, encompassing skilled labor for intricate craftsmanship and advanced manufacturing technologies, ensuring high quality. Marketing and brand building, including significant 2024 digital advertising spend, are crucial for customer acquisition and market visibility.

| Cost Category | Key Components | 2024 Relevance |

| Material Sourcing | Precious metals (gold, silver), gemstones | Gold ~ $2,300/oz, Silver ~ $28/oz |

| Production | Skilled labor, machinery, quality control | Investment in advanced manufacturing |

| Marketing & Brand Building | Advertising (digital, social media), PR | Robust investment for visibility |

| Distribution & Logistics | Warehousing, transportation, shipping | Affected by supply chain/fuel costs |

| Retail Operations | Rent, utilities, store maintenance, personnel | Prime locations, sales staff compensation |

| Technology & E-commerce | Platform maintenance, CRM, IT support | Ongoing software fees, AI/AR/VR exploration |

Revenue Streams

Christian Bernard Diffusion SA generates a significant portion of its revenue through the sale of gold jewelry. This includes a wide array of items like rings, necklaces, bracelets, and earrings, catering to diverse customer preferences within the luxury market.

Gold continues to be a cornerstone material in the high-end jewelry sector, and its enduring appeal directly translates into substantial sales figures for the company. In 2024, the global jewelry market, with gold playing a leading role, showed robust growth, with projections indicating continued strength.

Christian Bernard Diffusion SA generates revenue through the sale of silver and fashion jewelry. This strategy targets a wide range of customers looking for trendy and affordable accessories, significantly broadening the company's market reach.

Christian Bernard Diffusion SA's primary revenue stream comes from selling a wide variety of watches for both men and women. This includes everything from classic designs to more modern, feature-rich timepieces.

The company caters to diverse tastes within the watch market, which is projected to reach approximately $70 billion globally by 2025. This broad appeal allows them to capture a significant portion of consumer spending on personal accessories.

E-commerce Sales

E-commerce sales are a vital and expanding revenue source for Christian Bernard Diffusion SA. The company's direct-to-consumer online platform offers unparalleled convenience and access to a global customer base, driving significant growth in sales volume.

In 2023, Christian Bernard Diffusion SA reported a notable increase in its online sales performance. This channel accounted for a substantial portion of the company's revenue, reflecting the ongoing shift in consumer purchasing habits towards digital platforms.

- Online Platform Growth: The company's e-commerce site continues to see increased traffic and conversion rates.

- Global Reach: E-commerce enables Christian Bernard Diffusion SA to serve customers beyond traditional brick-and-mortar limitations.

- Revenue Contribution: Online sales are increasingly becoming a primary driver of overall financial performance.

After-Sales Services and Ancillary Sales

Beyond the initial purchase, Christian Bernard Diffusion SA taps into after-sales services and ancillary sales for sustained revenue. These include vital offerings like jewelry cleaning, expert repairs, and meticulous watch maintenance, ensuring customer satisfaction and product care.

These services are not just income generators; they are crucial for fostering deep customer loyalty and extending the lifespan of their cherished pieces. For instance, in 2024, the luxury jewelry and watch repair market saw significant growth, with many consumers investing in maintaining their existing high-value items, a trend Christian Bernard Diffusion SA is well-positioned to capitalize on.

- Jewelry Cleaning and Polishing: Offering regular maintenance to preserve shine and quality.

- Repair Services: Addressing issues like broken clasps, loose stones, or damaged bands.

- Watch Servicing: Providing battery replacements, movement checks, and water resistance testing.

- Customization Options: Allowing for personalized engravings or modifications to create unique pieces.

Christian Bernard Diffusion SA's revenue streams are diversified, encompassing the sale of gold jewelry, silver and fashion jewelry, and a broad range of watches. The company also leverages its e-commerce platform for direct-to-consumer sales and generates income through after-sales services like cleaning and repairs.

| Revenue Stream | Description | Market Context (2024 Data/Projections) |

|---|---|---|

| Gold Jewelry Sales | Sale of rings, necklaces, bracelets, earrings in gold. | Global jewelry market showing robust growth, with gold as a leading segment. |

| Silver & Fashion Jewelry Sales | Trendy and affordable accessories targeting a wide customer base. | Broadens market reach and captures demand for accessible luxury. |

| Watch Sales | Variety of men's and women's watches, from classic to modern. | Watch market projected to reach approx. $70 billion globally by 2025. |

| E-commerce Sales | Direct-to-consumer online sales driving growth and global access. | Significant increase in online sales performance reported in 2023, reflecting consumer shift. |

| After-Sales & Ancillary Services | Jewelry cleaning, expert repairs, watch maintenance, customization. | Luxury repair market saw significant growth in 2024, supporting product longevity and customer loyalty. |

Business Model Canvas Data Sources

The Business Model Canvas for Christian Bernard Diffusion SA is informed by a blend of internal financial reports, market research on luxury goods trends, and competitive analysis of similar brands. This data ensures a robust and realistic strategic framework.