Chesapeake Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesapeake Energy Bundle

Navigate the complex external forces shaping Chesapeake Energy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and uncover critical insights to inform your own strategic decisions. Don't get left behind; download the full analysis now and gain a competitive edge.

Political factors

Government energy policy significantly shapes Chesapeake Energy's operating environment. Changes in federal and state regulations, such as incentives for natural gas production or potential restrictions on drilling activities, directly influence the company's strategic planning and profitability. For instance, the Inflation Reduction Act of 2022, while primarily focused on renewables, also includes provisions that could indirectly affect the natural gas market by promoting electrification and potentially reducing demand for fossil fuels over the long term.

The current administration's approach to energy, balancing fossil fuel development with renewable energy expansion, presents both opportunities and challenges for Chesapeake. A supportive stance on natural gas as a transition fuel can provide tailwinds, as seen in the continued demand for LNG exports, which reached record levels in 2023, driven by global energy security concerns. Conversely, increased emphasis on decarbonization and stricter environmental regulations could create headwinds.

Regulatory stability is crucial for Chesapeake's long-term investment decisions. Uncertainty regarding future policies on emissions, methane regulations, or leasing on federal lands can impact the viability of new projects and the company's ability to secure capital. The Environmental Protection Agency's proposed methane rule, expected to be finalized in 2024, could impose new compliance costs on natural gas producers like Chesapeake.

Global geopolitical events significantly influence energy markets. For instance, ongoing conflicts in Eastern Europe and the Middle East continue to create volatility in oil and natural gas prices, impacting Chesapeake's revenue streams. These events can disrupt supply chains and alter demand patterns worldwide.

Trade policies also play a crucial role. While Chesapeake primarily operates onshore in the U.S., its ability to sell natural gas and natural gas liquids (NGLs) internationally can be affected by trade agreements, tariffs, or export restrictions imposed by various nations. For example, changes in LNG export policies could directly influence the global demand for U.S. produced gas.

Chesapeake's focus on domestic operations offers some insulation from direct political risks abroad, but it remains exposed to global price fluctuations. In 2024, the Henry Hub natural gas price has seen significant swings, partly driven by international demand and supply dynamics, underscoring this interconnectedness.

The regulatory landscape for obtaining drilling permits is a critical factor for Chesapeake Energy. The ease or difficulty of securing these permits from both federal and state agencies directly influences the company's capacity to explore and develop new oil and gas reserves. For instance, in 2024, the Bureau of Land Management (BLM) continued to manage federal oil and gas leasing, with permit approval times often extending beyond historical averages due to increased environmental scrutiny.

More stringent environmental reviews and extended approval timelines can lead to significant project delays and escalate operational expenses for Chesapeake. This was evident in certain regions during 2024 where new methane emission regulations, implemented by states like Colorado, required additional compliance measures before drilling could commence, impacting project economics.

Furthermore, the influence of lobbying by environmental organizations can sway political decisions regarding permit issuance or denial. As of early 2025, advocacy groups continue to push for stricter regulations on hydraulic fracturing and carbon emissions, potentially leading to more challenging permitting processes for companies like Chesapeake Energy.

Taxation and Subsidies

Government taxation policies, including corporate income tax rates and severance taxes on extracted resources, significantly impact Chesapeake Energy's profitability. For instance, the U.S. federal corporate income tax rate stands at 21%, a key factor in calculating net earnings. State-specific severance taxes, like those in Oklahoma or Texas, directly reduce revenue from each barrel of oil or cubic foot of natural gas produced, influencing operational decisions.

Changes in subsidies for fossil fuels or the introduction of new carbon taxes could alter the economic viability of certain projects. While direct federal subsidies for oil and gas exploration have evolved, the broader energy landscape is increasingly shaped by incentives for renewable energy, which can indirectly affect the competitive positioning of fossil fuel companies. The fiscal policies of states where Chesapeake operates are particularly relevant, as they often determine the direct tax burden on production activities.

- Federal Corporate Income Tax: The U.S. federal corporate income tax rate is 21%, a baseline for Chesapeake's overall tax liability.

- State Severance Taxes: Rates vary significantly by state; for example, Oklahoma's gross production tax on oil and gas can range from 2% to 7%, directly impacting per-unit profitability.

- Energy Policy Shifts: Evolving government incentives for renewables versus fossil fuels can influence investment decisions and the long-term outlook for natural gas projects.

International Climate Agreements

While Chesapeake Energy primarily operates within the United States, the nation's participation in international climate agreements, like the Paris Agreement, can still shape its operating environment. These global commitments often translate into domestic policy objectives aimed at reducing greenhouse gas emissions. For instance, the US rejoined the Paris Agreement in February 2021, signaling a renewed focus on climate action.

These national targets can indirectly influence Chesapeake by creating market signals and potential regulatory shifts favoring lower-carbon energy sources. This global movement towards decarbonization also affects the long-term demand outlook for natural gas, a key product for Chesapeake.

- US rejoined Paris Agreement in February 2021.

- International agreements can prompt domestic emissions reduction targets.

- Global decarbonization trends impact long-term demand for fossil fuels.

Government energy policies and regulations significantly impact Chesapeake Energy's operations and profitability. The Inflation Reduction Act of 2022, while promoting renewables, could indirectly curb long-term natural gas demand. The U.S. Environmental Protection Agency's proposed methane rule, expected in 2024, will likely increase compliance costs for producers.

Geopolitical events and trade policies also create market volatility. Global energy security concerns continue to drive demand for U.S. LNG exports, benefiting Chesapeake, but international conflicts can disrupt supply chains and prices. The Henry Hub natural gas price in 2024 has reflected these global dynamics.

Permitting processes for drilling are critical, with federal agencies like the BLM facing increased environmental scrutiny, potentially extending approval times. State-level methane regulations also add compliance layers, impacting project economics. Lobbying efforts by environmental groups in early 2025 continue to push for stricter regulations on hydraulic fracturing.

Taxation policies, including the 21% federal corporate income tax and varying state severance taxes, directly affect Chesapeake's net earnings. Shifts in energy subsidies and potential carbon taxes could alter the economic viability of projects, while the U.S. commitment to international climate agreements like the Paris Agreement (rejoined in 2021) signals a push towards lower-carbon energy sources.

What is included in the product

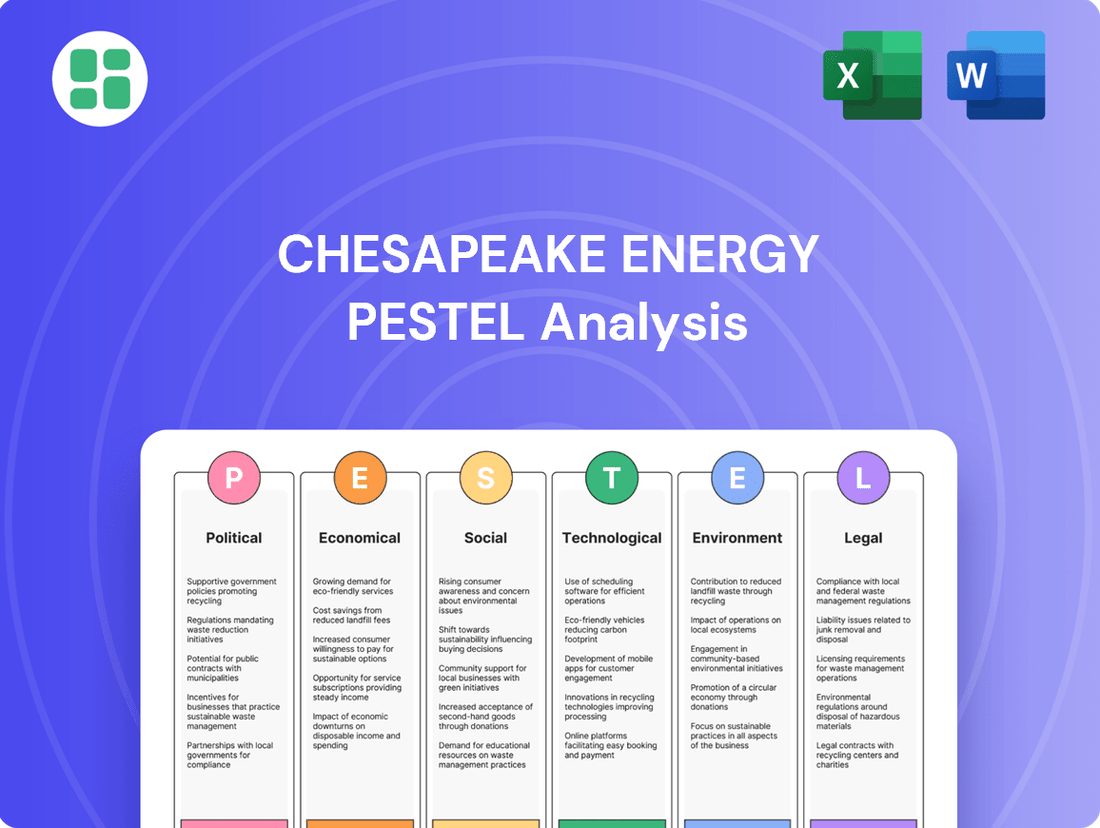

This PESTLE analysis examines the external macro-environmental factors influencing Chesapeake Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Chesapeake Energy's operations.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors affecting Chesapeake Energy's strategic decisions.

Economic factors

Fluctuations in crude oil and natural gas commodity prices represent the most significant economic factor for Chesapeake Energy. These price swings directly impact the company's revenue streams and overall profitability. For instance, if natural gas prices were to drop significantly from their recent averages, Chesapeake's earnings would be negatively affected.

Higher commodity prices generally incentivize Chesapeake to increase its capital expenditures and boost production levels. Conversely, periods of low prices can compel the company to curtail production and potentially write down the value of its assets. The average spot price for West Texas Intermediate (WTI) crude oil hovered around $80-$85 per barrel in early 2024, while Henry Hub natural gas prices saw more volatility, averaging around $2.50-$3.00 per MMBtu.

Chesapeake Energy employs hedging strategies as a critical tool to manage and mitigate the inherent volatility of these commodity prices. These financial instruments help lock in certain price levels for a portion of its production, providing a degree of predictability in revenue even when market prices fluctuate.

Overall economic growth, both domestically and globally, directly fuels industrial and residential energy consumption, significantly impacting the demand for oil and natural gas. A strong economy, for instance, saw the U.S. GDP grow by an estimated 2.5% in 2024, which typically translates to increased energy needs. This higher demand can bolster commodity prices and encourage greater production for companies like Chesapeake Energy.

Conversely, economic slowdowns or recessions tend to curb energy demand, leading to depressed prices and potentially reduced output. For example, if global economic growth forecasts for 2025 are revised downward, it could signal softer demand for Chesapeake's products.

Changes in interest rates directly impact Chesapeake Energy's cost of borrowing for its capital-intensive exploration and production projects. For instance, if the Federal Reserve maintains or increases benchmark interest rates through 2024 and into 2025, Chesapeake's expenses for new debt financing will rise, potentially constraining its ability to fund new drilling or infrastructure development.

Higher interest rates can also increase the burden of servicing Chesapeake's existing debt. This means a larger portion of its revenue might be allocated to interest payments, leaving less for reinvestment in operations or shareholder returns. The cost of capital is a critical factor in the economic viability of energy projects.

Furthermore, Chesapeake's access to capital markets is influenced by broader investor sentiment towards the fossil fuel industry. In 2024 and projections for 2025, a shift towards ESG (Environmental, Social, and Governance) investing could make it more challenging and expensive for companies like Chesapeake to secure financing, even if interest rates themselves remain stable.

Inflation and Cost of Operations

Inflationary pressures directly impact Chesapeake Energy's operational expenses, increasing the cost of essential inputs like drilling equipment, materials, and labor. For instance, the Producer Price Index (PPI) for oil and gas extraction services saw a notable increase in late 2023 and early 2024, reflecting these rising costs.

These elevated operating costs can compress profit margins for Chesapeake, even if commodity prices, such as natural gas and oil, remain strong. Persistent inflation means that without corresponding revenue growth or cost mitigation strategies, profitability can be negatively affected. Supply chain disruptions further amplify these cost pressures, making it harder to secure necessary resources efficiently.

- Rising Input Costs: Inflationary trends in 2024 have driven up the price of specialized drilling equipment and essential materials.

- Labor Expenses: Increased demand for skilled labor in the energy sector has led to higher wage expectations, impacting operational budgets.

- Supply Chain Volatility: Disruptions in global shipping and manufacturing continue to affect the availability and cost of critical components for production.

- Margin Squeeze Potential: If commodity prices do not outpace the rate of cost inflation, Chesapeake Energy's operating margins could face downward pressure.

Currency Exchange Rates

While Chesapeake Energy's operations and revenues are primarily in US dollars, fluctuations in currency exchange rates can indirectly influence its business. Global energy prices, often priced in USD, can be affected by the dollar's strength. A stronger dollar can make U.S. energy exports more costly for foreign purchasers, potentially reducing international demand and consequently impacting global commodity prices, which in turn can affect Chesapeake.

For instance, the US Dollar Index (DXY), which measures the dollar's value against a basket of major currencies, has seen volatility. As of mid-2024, the DXY has shown periods of strength, reflecting global economic conditions and monetary policy. This strength can translate to higher nominal prices for oil and natural gas for countries holding other currencies.

- Impact on Demand: A stronger USD makes US dollar-denominated oil and gas more expensive for buyers using weaker currencies, potentially softening global demand.

- Commodity Pricing: Even though Chesapeake sells in USD, the global benchmark prices for oil and gas are influenced by the dollar's international purchasing power.

- 2024/2025 Outlook: Analysts anticipate continued fluctuations in the DXY throughout 2024 and into 2025, driven by differing interest rate policies and geopolitical events, which will maintain currency risk for energy producers with global market exposure.

The economic landscape significantly shapes Chesapeake Energy's performance, primarily through commodity price volatility and overall economic health. Inflation and interest rates also play crucial roles, affecting operational costs and financing expenses. Currency exchange rates, while indirect, can influence global demand and pricing.

| Economic Factor | Impact on Chesapeake Energy | 2024/2025 Data/Outlook |

|---|---|---|

| Commodity Prices (Oil & Gas) | Directly impacts revenue and profitability. Higher prices incentivize production; lower prices can lead to curtailment. | WTI crude oil averaged $80-$85/bbl in early 2024. Henry Hub natural gas averaged $2.50-$3.00/MMBtu. Forecasts suggest continued price sensitivity. |

| Economic Growth (US & Global) | Drives energy demand. Strong growth increases demand and prices; slowdowns reduce demand and prices. | US GDP estimated to grow 2.5% in 2024. Downward revisions to global growth forecasts in 2025 could signal softer demand. |

| Interest Rates | Affects borrowing costs for capital-intensive projects and servicing existing debt. | Potential for maintained or increased benchmark rates through 2024/2025 could raise financing costs. |

| Inflation | Increases operational expenses for materials, equipment, and labor. | Producer Price Index for oil and gas extraction services saw increases in late 2023/early 2024. Supply chain issues exacerbate cost pressures. |

| Currency Exchange Rates (USD) | Influences global demand for USD-priced energy. A stronger USD can make US exports more expensive. | US Dollar Index (DXY) has shown volatility in mid-2024. Continued fluctuations anticipated through 2024/2025 due to monetary policy and geopolitics. |

What You See Is What You Get

Chesapeake Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chesapeake Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future strategies. Gain valuable insights into the external forces shaping the energy sector and Chesapeake's position within it.

Sociological factors

Public perception of fossil fuels significantly influences Chesapeake Energy's social license to operate. Growing environmental awareness, fueled by climate change concerns, creates societal pressure for a transition away from traditional energy sources. This can manifest as protests against new drilling sites and increased scrutiny from environmentally conscious investors and regulators.

Chesapeake Energy's extensive operations, particularly in shale gas extraction, have a tangible impact on the local communities where they operate. This includes considerations around land use, increased traffic from heavy vehicles, noise pollution, and the potential for environmental effects that can alter the quality of life for residents. For instance, in areas like the Marcellus Shale, communities have experienced significant changes in infrastructure and daily routines due to drilling activity.

Building and maintaining strong community relations are therefore paramount for Chesapeake. Positive engagement with local residents, landowners who lease mineral rights, and indigenous communities is essential for securing social license to operate and obtaining permits for new projects. Failure to do so can lead to operational delays and increased scrutiny, as seen in past instances where community opposition has influenced regulatory decisions.

Proactive community outreach and a commitment to addressing local concerns are vital for Chesapeake's long-term sustainability. This involves transparent communication about operational plans, mitigation strategies for potential impacts, and investment in local development initiatives. For example, companies in the energy sector often contribute to local infrastructure improvements or educational programs as part of their community benefit agreements.

The oil and gas sector, including Chesapeake Energy, faces a critical challenge with the availability of skilled labor. Key roles like petroleum engineers, geologists, and specialized field technicians are in high demand. For instance, the Society of Petroleum Engineers reported in 2024 that the demand for experienced engineers continues to outstrip supply, particularly in specialized areas like reservoir management.

An aging workforce is a significant sociological factor impacting Chesapeake Energy. Many experienced professionals are nearing retirement age, creating a knowledge gap. A 2024 industry survey indicated that over 40% of the current oil and gas workforce is aged 50 or older, raising concerns about succession planning and the continuity of critical expertise.

Competition from other industries for STEM talent further exacerbates labor shortages and drives up wage costs. Younger generations may also perceive the oil and gas industry as less attractive due to environmental concerns or a preference for tech-focused careers. Chesapeake Energy, like its peers, must actively work to improve its industry image and offer competitive compensation and development opportunities to attract and retain emerging talent.

Health and Safety Concerns

Societal expectations for worker safety and public health in industrial operations, especially within the oil and gas industry, are increasingly stringent. Chesapeake Energy, like its peers, faces intense scrutiny regarding its operational safety and environmental impact. A single significant incident can trigger severe reputational damage, leading to heightened regulatory oversight and substantial legal liabilities, impacting investor confidence and future operational permits.

Chesapeake Energy's commitment to safety is not just a compliance issue but a critical component of its social license to operate. In 2023, the company reported a Total Recordable Incident Rate (TRIR) of 0.75, which is below the industry average, demonstrating a focus on mitigating risks. This focus is crucial as public perception of the energy sector can be significantly swayed by safety performance.

To address these concerns, Chesapeake Energy emphasizes robust safety protocols and fostering a strong safety culture throughout its organization. This includes comprehensive training programs, regular safety audits, and the implementation of advanced technologies to monitor and prevent potential hazards. Such measures are vital for maintaining public trust and ensuring sustainable operations in the current regulatory and social climate.

Energy Consumption Patterns and Lifestyle Shifts

Societal trends are significantly reshaping energy consumption. Consumers are increasingly prioritizing energy efficiency and adopting renewable energy sources, which directly impacts the demand for traditional fossil fuels like natural gas. For instance, the U.S. Energy Information Administration (EIA) reported that residential energy consumption per capita has been on a downward trend over the past decade, driven by more efficient appliances and building standards. This shift, coupled with the growing popularity of electric vehicles, could temper long-term demand for oil and gas, posing a strategic challenge for companies like Chesapeake Energy.

These lifestyle shifts are not just a trend; they represent a fundamental change in how people interact with energy. The increasing adoption of electric vehicles is a prime example. By the end of 2024, projections suggest the global EV market could surpass 30 million vehicles, a significant increase from just a few years prior. This transition away from internal combustion engines directly reduces the demand for gasoline and, by extension, crude oil, impacting the market outlook for oil and gas producers.

Furthermore, the push for sustainability extends to home energy use. Many households are investing in solar power and improving insulation, leading to lower overall electricity and heating fuel needs. This growing environmental consciousness influences purchasing decisions and can lead to a reduced reliance on natural gas for heating and power generation. Chesapeake Energy must navigate these evolving consumer preferences to maintain its market position.

- Energy Efficiency Gains: U.S. residential energy intensity improved by approximately 15% between 2010 and 2020, indicating less energy is used per unit of economic output.

- Renewable Energy Growth: In 2023, renewable energy sources accounted for nearly 22% of total U.S. electricity generation, a figure expected to rise.

- EV Market Expansion: Global electric car sales are projected to reach over 15 million units in 2025, a substantial jump from previous years.

- Consumer Preferences: Surveys consistently show a growing percentage of consumers willing to pay more for products and services with a lower environmental impact.

Public perception of fossil fuels is a critical sociological factor for Chesapeake Energy, influencing its social license to operate amid growing climate change concerns. This sentiment translates into pressure for energy transition, potentially leading to protests and increased scrutiny from environmentally conscious investors and regulators.

The availability of a skilled workforce remains a significant challenge, with high demand for roles like petroleum engineers and geologists. For instance, the Society of Petroleum Engineers noted in 2024 that experienced engineer supply continues to lag demand, particularly in specialized areas.

An aging workforce presents a knowledge gap as experienced professionals approach retirement. Industry surveys from 2024 indicated that over 40% of the oil and gas workforce is aged 50 or older, highlighting succession planning needs.

Societal shifts towards energy efficiency and renewables directly impact demand for natural gas. The U.S. EIA reported a downward trend in residential energy consumption per capita, driven by more efficient appliances and building standards.

| Sociological Factor | 2024/2025 Data Point | Impact on Chesapeake Energy |

| Public Environmental Sentiment | Growing consumer preference for sustainable energy solutions. | Increased pressure for transition away from fossil fuels; potential for regulatory and investor scrutiny. |

| Skilled Labor Availability | Shortage of experienced petroleum engineers and geologists. | Challenges in recruitment and retention, potentially driving up labor costs. |

| Workforce Demographics | Over 40% of oil and gas workforce aged 50+ (2024 survey). | Risk of knowledge loss due to retirements; need for robust succession planning. |

| Energy Consumption Trends | U.S. residential energy intensity improved ~15% (2010-2020). | Potential tempering of long-term demand for natural gas due to efficiency and renewables. |

Technological factors

Chesapeake Energy's operational efficiency is significantly boosted by continuous innovation in horizontal drilling and hydraulic fracturing. These advancements allow for greater access to unconventional resources, improving the economics of extraction.

The company's adoption of multi-well pad drilling, a key technological factor, reduces surface disturbance and operational costs. This strategy is crucial for maximizing resource recovery while minimizing environmental impact per well.

In 2024, the U.S. onshore drilling rig count averaged around 620 active rigs, a figure that reflects the industry's ongoing investment in efficient extraction technologies like those employed by Chesapeake.

Chesapeake Energy is leveraging big data analytics and artificial intelligence to enhance its operations. These technologies are crucial for improving seismic interpretation and reservoir modeling, which directly impacts exploration success. For instance, AI-driven tools can analyze vast geological datasets to identify promising drilling locations with greater accuracy.

The application of machine learning in production optimization allows Chesapeake to fine-tune extraction processes. This leads to more efficient resource recovery and reduced operational costs. Predictive maintenance, powered by AI, helps anticipate equipment failures, minimizing downtime and ensuring consistent output. In 2023, companies in the energy sector saw significant efficiency gains through AI implementation, with some reporting up to a 15% reduction in operational expenses.

As environmental pressures mount, the development and commercial viability of Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming critical for natural gas producers like Chesapeake Energy. These advancements directly influence the long-term sustainability and market perception of natural gas.

While Chesapeake isn't directly operating CCUS facilities, widespread adoption of these solutions can bolster natural gas's position as a cleaner energy source. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion for CCUS projects in 2022, signaling significant governmental support and potential market shifts.

Increased investment and research in CCUS can significantly mitigate future regulatory risks associated with carbon emissions for companies in the sector. This technological evolution is a key factor in navigating the evolving energy landscape and ensuring continued market acceptance for natural gas.

Renewable Energy Integration and Hybrid Systems

Technological advancements in renewable energy, such as solar and wind power, are increasingly impacting the energy landscape. While Chesapeake Energy primarily operates in oil and gas, the growing integration of renewables into grid systems could affect the demand for natural gas, which is often used as a baseload or peaker plant fuel. For instance, in 2024, renewable energy sources are projected to account for a significant portion of new power generation capacity additions globally, potentially reducing reliance on natural gas for electricity production.

Hybrid energy systems, combining natural gas with renewables, present a technological avenue that could sustain demand for natural gas. These systems leverage the reliability of natural gas for power generation while incorporating the intermittent nature of renewables. As of early 2025, several pilot projects are demonstrating the effectiveness of such hybrid models in providing stable and cleaner energy solutions.

Chesapeake Energy may also find opportunities to integrate renewable energy into its own operational processes. This could involve utilizing solar or wind power for its drilling sites or processing facilities to reduce its carbon footprint and operational costs. By 2024, many energy companies are investing in on-site renewable generation to improve sustainability metrics and energy efficiency.

- Renewable energy's growing share in power generation: By 2024, renewables are expected to contribute substantially to new global power capacity, potentially impacting natural gas demand.

- Hybrid system potential: Technologies combining natural gas with renewables offer a pathway to maintain natural gas utilization while enhancing grid stability.

- Operational integration: Chesapeake may adopt on-site renewables for its facilities by 2025 to boost efficiency and sustainability.

Automation and Remote Operations

Chesapeake Energy is increasingly leveraging automation across its operations. In 2024, the company continued to invest in technologies that automate drilling rig functions and well site activities, aiming to boost safety and cut costs. This push for automation is expected to yield significant operational efficiencies.

Remote monitoring and control systems are becoming central to Chesapeake's strategy. By enabling fewer personnel to be physically present at well sites, these technologies not only enhance safety but also allow for more precise resource management and faster response times to operational changes. This shift supports a more agile and cost-effective operational framework.

- Enhanced Safety: Automation reduces human exposure to hazardous environments.

- Cost Reduction: Streamlined processes and reduced labor needs lower operational expenditures.

- Improved Efficiency: Automated systems operate with greater precision and consistency.

- Remote Oversight: Advanced monitoring allows for optimized resource allocation and quicker problem-solving.

Chesapeake Energy's technological focus includes advancements in horizontal drilling and hydraulic fracturing, driving efficiency in accessing unconventional resources. The company's adoption of multi-well pad drilling reduces environmental impact and operational costs, a strategy supported by the industry's ongoing investment in efficient extraction technologies, as evidenced by the average U.S. onshore drilling rig count of around 620 active rigs in 2024.

Legal factors

Chesapeake Energy navigates a dense regulatory environment, encompassing federal, state, and local rules for air emissions, water management, waste, and land restoration. For instance, the U.S. Environmental Protection Agency (EPA) has been actively updating methane emission standards for the oil and gas sector, with proposed rules in 2024 aiming for stricter controls. Failure to comply with these, and requirements for permits like Clean Air Act permits, can lead to significant penalties and operational disruptions.

The legal framework surrounding hydraulic fracturing remains a focal point, with ongoing debates and potential regulatory shifts influencing operational practices and costs. In 2024, states like Colorado and New Mexico continued to refine their fracking regulations, focusing on water protection and disclosure. Chesapeake’s ability to secure and maintain necessary permits for its operations, particularly in shale plays, is directly tied to its adherence to these evolving legal standards.

Chesapeake Energy, as an onshore oil and gas producer, is significantly shaped by land use and property rights laws. These regulations govern everything from mineral rights ownership to surface use agreements, directly impacting exploration and production activities. Navigating these complex legal frameworks, including lease negotiations with landowners and adherence to zoning ordinances, is paramount for operational success.

Failure to properly manage land access or address property damage concerns can result in substantial financial penalties and legal challenges. For instance, in 2023, the energy sector saw continued scrutiny on environmental liabilities associated with land use, underscoring the importance of robust legal compliance for companies like Chesapeake.

Chesapeake Energy must strictly adhere to occupational health and safety regulations, primarily those overseen by the Occupational Safety and Health Administration (OSHA), to ensure the well-being of its employees. This includes rigorous compliance with safety standards, meticulous accident reporting, and proactive prevention measures.

Failure to comply can result in substantial penalties, costly lawsuits, and significant damage to Chesapeake Energy's reputation. For instance, OSHA can issue citations with fines that can range from thousands to hundreds of thousands of dollars depending on the severity and nature of the violation. A robust safety record is also a critical factor for maintaining investor confidence, as demonstrated by the market's positive reaction to companies with demonstrably strong safety cultures.

Antitrust and Competition Laws

Chesapeake Energy's strategic moves, like its proposed acquisition of Southwestern Energy for approximately $7.4 billion, face rigorous antitrust scrutiny. Federal agencies, including the Department of Justice and the Federal Trade Commission (FTC), assess these deals to ensure they don't stifle competition or lead to monopolistic practices. This oversight is particularly important in the energy sector, where consolidation can significantly impact market dynamics.

Compliance with antitrust and competition laws is fundamental for Chesapeake. These regulations aim to maintain a level playing field, preventing any single entity from wielding undue market power. For instance, the FTC's review of the Southwestern Energy merger will examine potential impacts on natural gas production and pricing in key regions like the Haynesville Shale.

- Merger Review: The $7.4 billion Southwestern Energy acquisition is undergoing antitrust review by the DOJ and FTC.

- Market Impact: Regulators will assess the deal's effect on competition in natural gas markets, particularly in the Haynesville and Appalachian basins.

- Preventing Monopolies: Antitrust laws are in place to prevent Chesapeake from gaining excessive market share and potentially dictating prices.

- Regulatory Compliance: Adherence to these laws is crucial for the successful completion of major transactions and ongoing business operations.

Contract Law and Commercial Agreements

Chesapeake Energy's operations are underpinned by a vast network of commercial agreements, covering everything from drilling services and equipment acquisition to transportation and the sale of natural gas. Effective contract law is therefore crucial. In 2024, for instance, the energy sector saw increased scrutiny on supply chain contracts, directly impacting companies like Chesapeake. Navigating these complex legal landscapes requires robust expertise in drafting, negotiation, and enforcement to safeguard the company's financial and operational interests.

The implications of contract disputes can be substantial. A breach of contract can result in significant legal expenses and considerable disruption to ongoing projects. For example, a protracted dispute over a transportation agreement could delay product delivery and impact revenue streams. Chesapeake’s reliance on these agreements means that any legal challenges can directly affect its bottom line and operational efficiency.

- Contractual Dependencies: Chesapeake Energy's business model relies on numerous contracts for essential services and sales.

- Legal Risk Management: Expertise in contract law is vital for mitigating financial and operational risks associated with these agreements.

- Impact of Disputes: Breaches of contract can lead to costly litigation and operational disruptions, affecting Chesapeake's performance.

Chesapeake Energy operates under stringent environmental regulations, including those from the EPA concerning methane emissions, with proposed stricter rules in 2024. Compliance with permits, like those under the Clean Air Act, is critical to avoid penalties and operational halts.

The legal landscape for hydraulic fracturing continues to evolve, with states like Colorado and New Mexico refining their rules in 2024 to enhance water protection and transparency. Chesapeake's ability to obtain and maintain permits hinges on its adherence to these changing legal requirements.

Land use and property rights laws significantly impact Chesapeake's exploration and production activities, governing mineral rights and surface use agreements. Navigating these complex legal frameworks, including lease negotiations and zoning adherence, is essential for operational success.

Antitrust laws are a key legal factor, particularly relevant to Chesapeake's proposed $7.4 billion acquisition of Southwestern Energy, which is under review by the DOJ and FTC. This scrutiny aims to prevent monopolistic practices and ensure fair competition in natural gas markets, especially in regions like the Haynesville Shale.

| Legal Area | Key Regulations/Considerations | 2024/2025 Impact |

|---|---|---|

| Environmental | EPA methane emission standards, Clean Air Act permits | Stricter controls proposed, compliance crucial for avoiding penalties. |

| Hydraulic Fracturing | State-specific regulations (e.g., Colorado, New Mexico) on water protection and disclosure | Ongoing refinement of rules impacting operational practices and permitting. |

| Antitrust | DOJ/FTC review of mergers, competition in natural gas markets | $7.4B Southwestern Energy acquisition undergoing scrutiny; market impact assessment. |

Environmental factors

Climate change concerns are intensifying pressure on Chesapeake Energy to curb greenhouse gas emissions, especially methane. The company is under scrutiny for its operational emissions and is expected to establish and meet specific reduction goals. This environmental focus is driving investments in cleaner technologies and sustainable practices to lessen its impact.

Hydraulic fracturing, a core operation for Chesapeake Energy, demands significant water volumes, making water availability and its responsible management paramount environmental concerns. In 2023, the oil and gas industry globally consumed an estimated 210 billion gallons of water for fracking, highlighting the scale of this challenge.

Regions experiencing water stress, which is increasingly common due to climate change and growing demand, can implement restrictions on water usage. This directly impacts Chesapeake's drilling schedules and operational efficiency, potentially increasing costs associated with securing water resources.

Chesapeake Energy must actively manage its water lifecycle, focusing on sourcing, recycling, and responsible disposal. For instance, by increasing water recycling rates, the company can reduce its reliance on freshwater sources and mitigate its environmental footprint, a strategy crucial for regulatory compliance and maintaining its social license to operate.

Chesapeake Energy's operations, such as drilling well pads and building pipelines, naturally disturb land, potentially affecting local wildlife and their habitats. For instance, in 2024, the company continued its focus on responsible land use, aiming to reduce its footprint. This involves careful planning to avoid sensitive areas and implementing measures to lessen the impact on biodiversity.

To address these environmental concerns, Chesapeake Energy is committed to minimizing habitat fragmentation and protecting endangered or threatened species. They are also expected to restore areas impacted by their activities once operations conclude, aligning with growing environmental stewardship expectations and stringent regulatory frameworks that govern the energy sector.

Waste Management and Spills

Chesapeake Energy faces environmental challenges related to the generation of drilling waste and produced water, alongside the inherent risk of spills involving oil, natural gas, or chemicals. These factors present significant environmental hazards that require careful management.

To mitigate these risks, the company must implement rigorous waste disposal methods, comprehensive spill prevention strategies, and swift response protocols. These measures are vital for preventing environmental contamination, avoiding costly regulatory fines, and preserving public confidence.

Responsible waste management remains a critical operational hurdle for Chesapeake. For instance, in 2023, the energy sector as a whole saw increased scrutiny on waste disposal practices, with regulatory bodies like the EPA continuing to enforce stricter guidelines on wastewater management and hazardous material handling.

- Drilling Waste: The volume of drilling muds, cuttings, and other solid byproducts generated requires specialized disposal.

- Produced Water: Managing the large volumes of water brought to the surface during oil and gas extraction is a significant undertaking.

- Spill Risk: The potential for accidental releases of hydrocarbons or operational chemicals necessitates robust containment and emergency response plans.

- Regulatory Compliance: Adherence to environmental regulations, such as those concerning wastewater discharge and hazardous waste transport, is paramount.

Transition to Renewable Energy

The global and domestic push towards renewable energy sources like solar and wind poses a significant long-term environmental challenge for Chesapeake Energy. While natural gas is often viewed as a bridging fuel, the accelerating adoption of renewables could eventually diminish the demand for hydrocarbons.

Chesapeake's strategic planning must account for this evolving energy landscape and potential shifts in market dominance. For instance, by the end of 2023, renewable energy sources accounted for approximately 23% of U.S. electricity generation, a figure projected to rise further. This trend necessitates a proactive approach to adapt to a future where fossil fuels may play a reduced role.

- Global Renewable Energy Growth: The International Energy Agency reported that renewable energy capacity additions reached a record high in 2023, underscoring the accelerating transition.

- Natural Gas as a Transition Fuel: While natural gas offers lower emissions than coal, its long-term viability as a primary energy source is increasingly questioned as renewable technologies mature.

- Market Share Shifts: As renewable energy becomes more cost-competitive and widely adopted, traditional energy companies like Chesapeake face the prospect of declining market share if they do not diversify or innovate.

Chesapeake Energy faces increasing pressure to reduce its environmental footprint, particularly concerning greenhouse gas emissions like methane. The company is investing in cleaner technologies to meet these evolving expectations and regulatory demands.

Water management is critical, as hydraulic fracturing requires substantial water volumes. Regions with water scarcity, exacerbated by climate change, can impose usage restrictions, impacting Chesapeake's operations and costs.

Land disturbance from drilling and infrastructure development necessitates careful planning to minimize impacts on wildlife habitats and biodiversity. Restoration efforts post-operation are also a key environmental consideration.

Managing drilling waste and produced water, along with the inherent risk of spills, demands robust disposal methods and emergency response protocols to prevent contamination and maintain public trust.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chesapeake Energy is built upon a robust foundation of data drawn from official government reports, reputable financial news outlets, and industry-specific publications. We meticulously gather information on regulatory changes, economic indicators, and technological advancements impacting the energy sector.