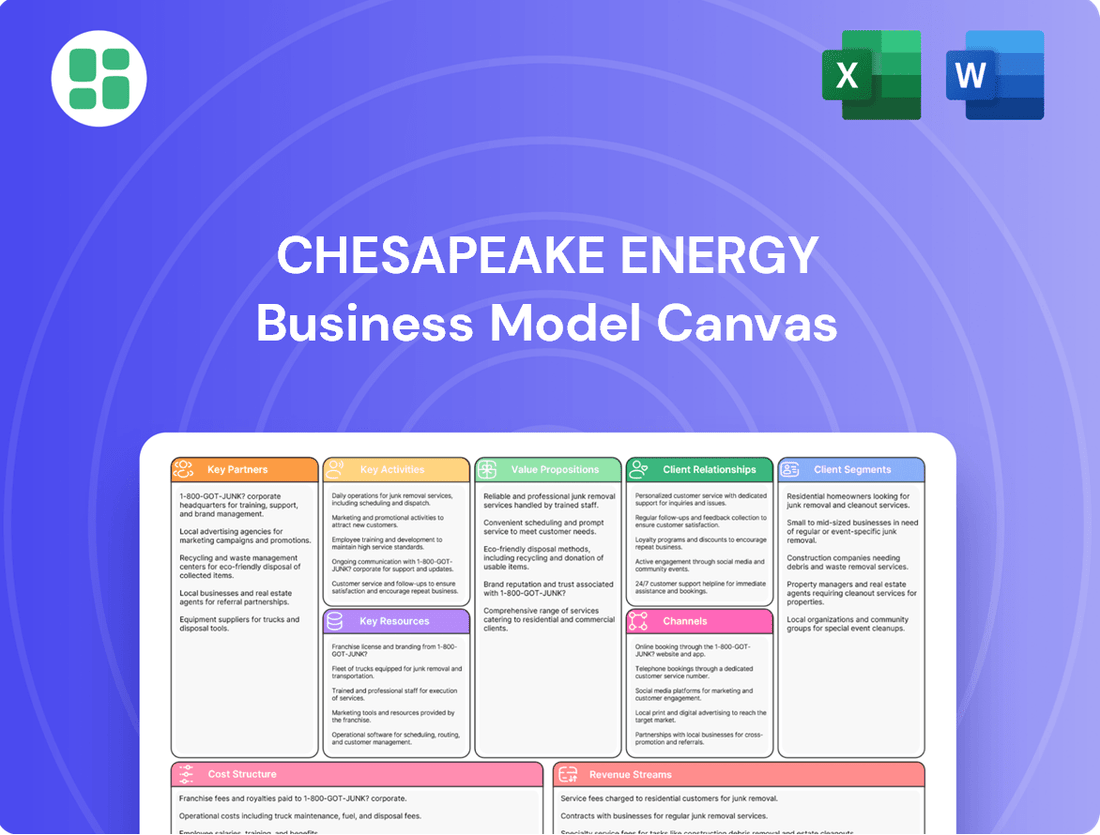

Chesapeake Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesapeake Energy Bundle

Unlock the strategic blueprint of Chesapeake Energy's business model. This detailed canvas dissects how they create and deliver value in the energy sector, from key resources to customer relationships. Discover their competitive advantages and revenue streams.

Dive into the core of Chesapeake Energy's operations with our comprehensive Business Model Canvas. Understand their customer segments, value propositions, and key partnerships that drive their success. This is your key to actionable insights.

Ready to analyze Chesapeake Energy's winning strategy? Our full Business Model Canvas provides a clear, section-by-section breakdown of their entire business. Download now to gain a competitive edge.

Partnerships

Chesapeake Energy's strategic merger with Southwestern Energy, now operating as Expand Energy, positions it as the largest U.S. natural gas producer. This union leverages complementary assets in the Marcellus and Haynesville shales, bolstering market reach.

The combined entity anticipates significant annual cost and capital synergies, projected to be around $400 million. This strategic alignment aims to enhance operational efficiency and shareholder value through expanded market access and improved production capabilities.

Chesapeake Energy, now operating as Expand Energy, relies heavily on partnerships with midstream and infrastructure companies. These collaborations are essential for the efficient transportation and processing of its crude oil, natural gas, and natural gas liquids. For example, in 2024, Chesapeake continued to leverage its extensive midstream network to move production from its core operating areas, ensuring timely delivery to various market hubs.

These strategic alliances enable Chesapeake to manage the complex logistics of getting hydrocarbons from the wellhead to end-users. By working with midstream providers, the company can optimize gathering systems, processing facilities, and long-haul transportation networks, thereby reducing operational costs and enhancing market access. This integrated approach helps mitigate the inherent logistical challenges in the energy supply chain.

Chesapeake Energy heavily depends on specialized third-party drilling and completion service providers for its exploration, development, and production operations. These crucial partnerships grant Chesapeake access to advanced drilling rigs, hydraulic fracturing capabilities, and other vital equipment and specialized expertise necessary for efficient resource extraction.

In 2024, the energy sector saw significant demand for these services, impacting cost structures and availability. Maintaining robust relationships with top-tier service providers is paramount for Chesapeake to ensure operational efficiency, cost control, and a strong safety record, directly influencing their ability to meet production targets and manage expenses effectively.

Landowners and Mineral Rights Holders

Chesapeake Energy’s business model heavily relies on securing access to valuable natural gas and oil reserves. Their key partnerships with landowners and mineral rights holders are absolutely crucial for this. Think of it as the foundation upon which their entire exploration and production strategy is built.

These relationships are formalized through leasing agreements. Chesapeake pays these partners for the right to explore and extract resources from their land. In return, landowners and mineral rights holders receive royalty payments, which are a share of the revenue generated from the extracted resources. This symbiotic relationship allows Chesapeake to acquire the necessary acreage to operate.

Responsible engagement with these stakeholders is a cornerstone of Chesapeake's operational approach. This includes transparent communication and fair compensation, ensuring long-term viability and positive community relations. For instance, in 2024, Chesapeake continued to focus on building trust through consistent engagement across its operating regions.

- Leasing Agreements: Chesapeake secures rights to explore and produce from privately owned land.

- Royalty Payments: Landowners and mineral rights holders receive a percentage of revenue from produced resources.

- Access to Reserves: These partnerships are fundamental for gaining access to onshore unconventional reservoirs in the U.S.

- Operational Strategy: Responsible engagement fosters trust and ensures continued access to production acreage.

LNG Offtakers and Developers

Chesapeake Energy is actively building key partnerships with LNG offtakers and developers to solidify its position in the U.S. LNG export market. These relationships are fundamental to securing long-term demand for its natural gas production.

Notable collaborations include agreements with Delfin LNG and Gunvor, major players in the global LNG trade. These Sale and Purchase Agreements (SPAs) are crucial for guaranteeing future sales volumes and providing Chesapeake with direct access to international markets.

These strategic alliances are vital for Chesapeake to leverage the increasing global demand for natural gas and to diversify its revenue streams beyond domestic markets. For instance, in 2024, Chesapeake continued to advance its strategy to participate in the LNG value chain, aiming to capture premium pricing for its production.

- LNG Export Market Expansion: Chesapeake is strategically positioning itself to capitalize on the growing U.S. LNG export opportunities.

- Key Offtaker Agreements: Long-term Sale and Purchase Agreements (SPAs) are being established with major LNG developers and offtakers like Delfin LNG and Gunvor.

- Securing Future Demand: These partnerships are designed to guarantee future demand for Chesapeake's natural gas production.

- International Market Access: The agreements provide critical access to international markets, diversifying revenue and capturing global demand trends.

Chesapeake Energy's key partnerships are vital for its operational success and market positioning. These include collaborations with midstream companies for transportation and processing, specialized service providers for drilling and completion, and landowners for reserve access. Furthermore, strategic alliances with LNG offtakers are crucial for expanding into the global export market.

In 2024, Chesapeake continued to solidify its relationships with midstream infrastructure providers, ensuring efficient transport of its substantial natural gas output. The company also maintained strong ties with drilling and completion service firms, critical for maintaining production levels and managing operational costs in a competitive market. These partnerships are foundational to Chesapeake's ability to extract and deliver energy resources reliably.

| Partnership Type | Key Partners/Examples | 2024 Significance |

| Midstream & Infrastructure | Various pipeline and processing companies | Ensured efficient transportation and market access for production. |

| Drilling & Completion Services | Specialized third-party service providers | Provided access to essential equipment and expertise for resource extraction. |

| Landowners & Mineral Rights Holders | Private landowners, mineral rights owners | Secured access to valuable onshore unconventional reserves through leasing agreements. |

| LNG offtakers & Developers | Delfin LNG, Gunvor | Facilitated market access for natural gas exports and secured future demand. |

What is included in the product

This Business Model Canvas for Chesapeake Energy outlines their strategy for natural gas and oil exploration and production, focusing on efficient extraction and cost management to deliver value to investors and meet energy demands.

The Chesapeake Energy Business Model Canvas offers a clear, visual representation of their operations, simplifying complex strategies for easier understanding and adaptation.

It serves as a powerful tool to pinpoint and address inefficiencies within their energy production and distribution processes.

Activities

Chesapeake Energy is deeply involved in acquiring new land and exploring unconventional oil and gas deposits within the United States. This strategic move focuses on pinpointing and securing valuable geological areas that hold potential for future production, aiming to bolster their resource base.

The company is actively expanding its operational presence in key shale plays, notably the Marcellus and Haynesville regions. This expansion is crucial for maintaining and growing their production capacity, leveraging their expertise in these prolific unconventional reservoirs.

In 2024, Chesapeake continued its strategic acreage acquisition efforts, focusing on high-quality, low-cost opportunities that complement their existing asset base. This proactive approach to land acquisition is fundamental to their long-term growth strategy and securing future drilling inventory.

Chesapeake Energy's key activities revolve around developing its oil and natural gas reserves and then producing these resources. This means drilling new wells, getting them ready for production, and extracting hydrocarbons efficiently.

In 2024, Chesapeake continued to focus on optimizing its production. For example, the company strategically deferred some well completions, a move designed to better match its output with market conditions and improve how effectively it uses its capital.

Chesapeake Energy actively manages and optimizes its extensive asset portfolio to boost cash flow generation. This strategic focus involves smart capital deployment, aggressive cost management, and continuous improvements in operational effectiveness across its key operating regions, such as the Haynesville and the Eagle Ford.

The company prioritizes driving capital efficiencies, a key element in its strategy to ensure robust free cash flow. For instance, in the first quarter of 2024, Chesapeake reported a production of approximately 3.2 billion cubic feet equivalent per day (Bcfe/d), demonstrating its operational scale and the ongoing efforts to maximize output from its existing reserves.

Maintaining a strong balance sheet is paramount, and asset optimization plays a crucial role in achieving this financial stability. Chesapeake's commitment to operational excellence and disciplined capital allocation aims to enhance shareholder value while navigating the dynamic energy market.

Environmental, Social, and Governance (ESG) Management

Chesapeake Energy's key activities in Environmental, Social, and Governance (ESG) management focus on responsible operations. This includes significant efforts to lower greenhouse gas (GHG) emissions, with a particular emphasis on methane reduction, and maintaining stringent safety standards across all its operations.

The company actively reports on its sustainability progress through annual reports. In 2023, Chesapeake announced achieving its interim climate targets, demonstrating a tangible commitment to environmental stewardship.

A significant aspect of their ESG strategy is ensuring responsible sourcing. By 2023, Chesapeake achieved 100% independent Responsibly Sourced Gas (RSG) certification for its entire portfolio, a testament to their dedication to sustainable natural gas production.

- GHG Emission Reduction: Chesapeake is actively working to reduce its environmental footprint, particularly concerning methane emissions.

- Safety First: Ensuring safe operations is a paramount activity, safeguarding both employees and the environment.

- Transparency and Reporting: The company publishes annual sustainability reports to communicate its ESG performance and progress.

- Responsible Sourcing: Chesapeake has achieved 100% RSG certification across its portfolio, highlighting its commitment to ethical and sustainable practices.

Market Strategy and Sales

Chesapeake Energy actively shapes its market strategy by securing long-term contracts, a move that provides revenue stability and predictability. This approach is crucial for optimizing the value of each unit of natural gas sold, especially as the company positions itself for anticipated demand growth.

The company leverages its extensive access to diverse sales points, including pipelines and export facilities, to maximize its market reach and revenue per unit. This strategic positioning is particularly important for capitalizing on increasing demand for liquefied natural gas (LNG) exports, a key growth area for the natural gas market.

Chesapeake's market strategy is designed to ensure reliable delivery of natural gas to both domestic and international customers. This reliability is a key differentiator, fostering strong customer relationships and supporting consistent demand for its products.

- Long-Term Contracts: Chesapeake prioritizes long-term agreements to ensure stable revenue streams and predictable sales volumes.

- Market Access: The company utilizes its broad access to various sales points, including pipelines and LNG terminals, to optimize sales and revenue.

- Demand Anticipation: Chesapeake strategically positions itself to meet anticipated increases in natural gas demand, particularly driven by LNG exports.

- Reliable Delivery: A core tenet of their strategy is the dependable supply of natural gas to both domestic and international consumers.

Chesapeake Energy's key activities center on the efficient extraction and sale of oil and natural gas. This involves drilling and completing wells, optimizing production from existing assets, and actively managing its leasehold and mineral interests. A significant part of their strategy in 2024 involved enhancing capital efficiency and maintaining a strong balance sheet through disciplined spending and operational improvements.

The company also places a strong emphasis on environmental stewardship and responsible operations. This includes aggressive methane emission reduction targets and ensuring the responsible sourcing of its natural gas production. In 2023, Chesapeake achieved 100% independent Responsibly Sourced Gas (RSG) certification for its entire portfolio, underscoring its commitment to sustainability.

Market strategy is driven by securing long-term contracts and leveraging broad market access, including LNG export facilities, to maximize revenue and ensure reliable delivery. This approach aims to capitalize on growing demand for natural gas, both domestically and internationally.

| Key Activity | Description | 2024 Focus/Data Points |

|---|---|---|

| Exploration & Production | Acquiring land, drilling, and extracting oil and natural gas. | Continued focus on high-quality acreage acquisition. Production averaged approximately 3.2 Bcfe/d in Q1 2024. |

| Operational Optimization | Improving efficiency and managing assets to boost cash flow. | Strategic deferral of well completions to match market conditions; driving capital efficiencies. |

| ESG Management | Reducing environmental impact and ensuring responsible operations. | 100% RSG certification achieved by 2023; ongoing methane emission reduction efforts. |

| Market Strategy | Securing contracts and maximizing market reach for product sales. | Prioritizing long-term contracts and leveraging access to LNG export facilities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Chesapeake Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the comprehensive analysis that will be yours to use. Upon completing your order, you will gain full access to this same professionally structured and detailed Business Model Canvas, ready for your strategic planning.

Resources

Chesapeake Energy's core physical assets are its vast land holdings and proven reserves within premier U.S. unconventional oil and gas plays, notably the Marcellus and Haynesville shale formations. These holdings are the bedrock of their production capabilities for oil, natural gas, and natural gas liquids.

The strategic merger with Southwestern Energy in 2024 was a pivotal event, substantially bolstering Chesapeake's asset base and establishing it as a leading natural gas producer. This consolidation created an unmatched portfolio of natural gas reserves and production capacity across the United States.

Chesapeake Energy leverages significant financial resources, including access to capital markets and credit facilities, to fund its extensive operations. In the first quarter of 2024, the company reported approximately $1.5 billion in cash and cash equivalents, underscoring its robust liquidity.

The company's strategy emphasizes a strong balance sheet and robust free cash flow generation, which is crucial for reinvestment and shareholder returns. For the full year 2023, Chesapeake generated over $2.5 billion in operating cash flow, a testament to its financial strength.

This financial foundation enables substantial capital expenditures for both ongoing development projects and potential strategic acquisitions. Chesapeake's commitment to returning capital to shareholders, through dividends and share repurchases, is directly supported by its consistent financial performance.

Chesapeake Energy's business model relies heavily on its dedicated and innovative employee base, including skilled geologists, engineers, operational staff, and management. This human capital is crucial for navigating the complexities of the energy sector.

The company's workforce possesses deep expertise in unconventional drilling and completion techniques, which are fundamental to its operational success. A strong culture emphasizing operational excellence and safety further enhances their performance and the company's overall efficiency.

Employee retention and continuous development are prioritized by Chesapeake Energy, recognizing their importance for sustained growth and maintaining a competitive edge. This focus ensures the company can adapt to evolving industry demands and technological advancements.

Advanced Technology and Data

Chesapeake Energy leverages proprietary geological data and advanced seismic imaging as core intellectual assets. This allows for a deeper understanding of complex underground formations, crucial for efficient resource extraction.

The company's investment in cutting-edge drilling and completion technologies, such as extended lateral lengths and meticulously optimized well designs, directly translates to improved capital efficiency. For instance, in 2024, Chesapeake reported a significant reduction in well costs per lateral foot, a direct benefit of these technological advancements.

- Proprietary Geological Data: Enables precise reservoir characterization.

- Advanced Seismic Imaging: Improves subsurface visualization for better drilling decisions.

- Longer Laterals: Maximizes contact with the reservoir rock, increasing production potential.

- Optimized Well Designs: Enhances recovery rates and reduces operational inefficiencies.

Infrastructure Access and Logistics

Chesapeake Energy's access to an extensive network of pipelines, processing plants, and other midstream infrastructure is a vital resource. This allows them to efficiently bring their produced hydrocarbons to market. In 2024, the company continued to leverage its significant midstream footprint, which is crucial for operational efficiency and market reach.

The company's strategy centers on achieving expansive access to premium markets. This means not only having the physical infrastructure but also the flexibility to move capital and operating practices seamlessly across different basins. This adaptability helps Chesapeake capitalize on regional demand and pricing opportunities.

This robust infrastructure is key to ensuring reliable delivery of their products. It also plays a significant role in mitigating the impact of price volatility. For example, by having diverse market outlets and efficient transportation, Chesapeake can better manage the fluctuations inherent in the energy sector.

- Extensive Midstream Network: Access to pipelines and processing facilities is a core asset.

- Market Access and Flexibility: Aims for broad reach into premium markets and operational adaptability across basins.

- Reliability and Risk Mitigation: Infrastructure supports consistent delivery and helps buffer against price swings.

Chesapeake Energy's key resources are its substantial leasehold acreage and proved reserves in prime U.S. shale plays, particularly the Marcellus and Haynesville. The 2024 Southwestern Energy merger significantly expanded this asset base, solidifying its position as a top natural gas producer with an unparalleled portfolio. Financial strength is also a critical resource, evidenced by approximately $1.5 billion in cash and cash equivalents reported in Q1 2024, enabling robust operations and shareholder returns.

| Key Resource | Description | 2024 Relevance/Data |

| Physical Assets | Leasehold acreage and proved reserves in Marcellus and Haynesville shale. | Post-merger, a leading U.S. natural gas producer. |

| Financial Resources | Access to capital markets, credit facilities, and strong liquidity. | Q1 2024 cash and cash equivalents of ~$1.5 billion. |

| Human Capital | Skilled workforce with expertise in unconventional drilling and operations. | Focus on operational excellence and safety enhances efficiency. |

| Intellectual Property | Proprietary geological data and advanced seismic imaging. | Enables precise reservoir characterization and improved drilling decisions. |

| Infrastructure | Extensive network of pipelines and processing plants. | Facilitates efficient market access and mitigates price volatility. |

Value Propositions

Chesapeake Energy is a key player in supplying vital oil, natural gas, and natural gas liquids, bolstering America's energy independence and satisfying increasing global energy needs. In 2024, the company's focus on efficient production directly supports this mission.

The company prioritizes delivering dependable energy to customers, aligning with the growing trend of markets adopting natural gas for cost-effective power generation. This commitment ensures consumers benefit from a stable and accessible energy source.

Chesapeake's production activities are instrumental in powering a future that is both more affordable and consistently reliable for a wide range of consumers and industries.

Chesapeake Energy's core value proposition for shareholders centers on robust free cash flow generation and the subsequent return of that capital. The company actively pursues operational efficiencies and strategic asset management to maximize its cash-generating capabilities.

In 2024, Chesapeake's commitment to capital discipline and shareholder returns is evident. The company aims to deliver significant free cash flow, which directly translates into enhanced shareholder value through a combination of dividends and share repurchases, rewarding investors across different market conditions.

Chesapeake Energy is deeply committed to responsible and sustainable operations, making environmental, social, and governance (ESG) performance a cornerstone of their business. This focus is not just a statement; it's backed by tangible goals and achievements.

A prime example is their ambitious target of achieving net zero greenhouse gas (GHG) emissions by 2035. They've already made significant strides, meeting interim methane reduction targets, demonstrating a proactive approach to minimizing their environmental footprint. In 2023, Chesapeake reported a 30% reduction in Scope 1 and Scope 2 GHG emissions intensity compared to their 2019 baseline, a testament to their operational improvements.

Furthermore, Chesapeake has taken steps to certify its natural gas as responsibly sourced. This certification provides assurance to stakeholders that the energy produced meets stringent environmental and operational standards. This commitment resonates strongly with investors and consumers who increasingly prioritize sustainability in their energy choices.

Operational Excellence and Capital Efficiency

Chesapeake Energy delivers value through its relentless pursuit of operational excellence, directly translating into enhanced capital efficiency. This focus on doing more with less allows them to achieve lower breakeven costs across their production portfolio.

The company actively optimizes its operations by employing advanced techniques such as longer lateral wells, which significantly increase the productive footprint of each well. Furthermore, diligent management of service costs ensures that capital is deployed as effectively as possible, boosting profitability.

This commitment to efficiency enables Chesapeake to strategically build productive capacity. This capacity is poised for activation, ready to capitalize on favorable market conditions when they arise.

- Operational Excellence: Chesapeake's focus on optimizing well designs and leveraging longer laterals contributes to improved production efficiency.

- Capital Efficiency: By managing service costs effectively, the company lowers its breakeven costs, enhancing the profitability of its operations.

- Strategic Capacity Building: Enhanced efficiency allows Chesapeake to develop productive capacity that can be activated when market conditions are favorable.

- 2024 Performance Indicator: In the first quarter of 2024, Chesapeake reported a production cost of $2.45 per barrel of oil equivalent (boe), demonstrating their ongoing efforts in cost management and operational efficiency.

Strategic Market Positioning and Global Reach

Chesapeake Energy's strategic market positioning, amplified by its merger with Southwestern Energy, allows it to compete on a global stage, extending America's energy influence. This scale is crucial for navigating the complexities of international markets.

The company is actively pursuing growth in LNG export markets. This strategy directly connects U.S. natural gas production with regions experiencing high demand and limited supply, effectively broadening market access for American energy resources.

- Global Market Access: Chesapeake is leveraging its expanded operational footprint to tap into international LNG demand, projected to grow significantly in the coming years.

- Price Volatility Mitigation: By diversifying its customer base through exports, Chesapeake aims to reduce its exposure to domestic price fluctuations, offering more stable revenue streams.

- Enhanced Competitiveness: The merger positions Chesapeake as a more formidable player in the global energy landscape, capable of competing with larger international energy companies.

Chesapeake Energy provides reliable and affordable energy, bolstering national energy security and meeting global demand, especially as natural gas becomes a preferred fuel for power generation.

The company prioritizes shareholder value through strong free cash flow generation and capital returns, evidenced by its 2024 focus on capital discipline and rewarding investors.

Chesapeake is committed to responsible operations, targeting net zero GHG emissions by 2035 and certifying its natural gas as responsibly sourced, reflecting a growing demand for sustainable energy solutions.

Operational excellence, including longer laterals and cost management, drives capital efficiency, allowing Chesapeake to build strategic production capacity ready for market opportunities. In Q1 2024, their production cost was $2.45 per barrel of oil equivalent (boe).

The merger with Southwestern Energy enhances Chesapeake's global competitiveness and market access, particularly in growing LNG export markets, mitigating domestic price volatility.

Customer Relationships

Chesapeake Energy actively cultivates investor relations through quarterly earnings calls, investor days, and comprehensive annual reports, ensuring transparency in financial performance and capital allocation strategies. For instance, in the first quarter of 2024, Chesapeake reported adjusted EBITDA of $1.4 billion, demonstrating a solid financial footing that underpins investor confidence.

The company prioritizes clear communication regarding its capital return plans, including share repurchases and dividends, aiming to keep shareholders informed and aligned with the company's strategic objectives. This consistent engagement fosters trust and supports shareholder value. In 2023, Chesapeake returned approximately $2.1 billion to shareholders through dividends and share repurchases, a key metric for many investors.

Chesapeake Energy cultivates direct relationships with key energy purchasers, including marketers, utility companies, and industrial consumers. This direct engagement is primarily facilitated through long-term sales agreements, which are crucial for securing predictable revenue streams.

These agreements, notably those involving Liquefied Natural Gas (LNG), are designed to mitigate cash flow volatility and guarantee consistent delivery of natural gas to its customers. By entering into these contracts, Chesapeake aims to establish and maintain stable demand for its energy products.

In 2023, Chesapeake reported that approximately 90% of its natural gas production was covered by marketing agreements, with a significant portion being long-term. This strategy underscores their commitment to customer retention and reliable supply chains.

Chesapeake Energy actively fosters community engagement, aiming to build trust through open dialogue about its operations and environmental stewardship. This commitment is vital for maintaining a social license to operate.

Transparent communication is key, with Chesapeake providing updates on its economic contributions and environmental performance to local stakeholders. For instance, in 2024, the company continued its focus on community investment programs across its operating regions.

Regulatory Compliance and Government Relations

Chesapeake Energy actively cultivates relationships with regulatory bodies and government agencies to ensure adherence to environmental and operational standards. This proactive engagement is critical for securing necessary permits, mitigating operational risks, and influencing policy discussions relevant to the energy industry.

By maintaining open communication channels, Chesapeake navigates the complexities of the highly regulated energy sector. For instance, in 2024, the company continued its focus on compliance with EPA regulations, a key aspect of its operational strategy. This commitment allows for smoother operations and risk management.

- Environmental Compliance: Chesapeake’s commitment to environmental stewardship involves ongoing collaboration with agencies like the Environmental Protection Agency (EPA) and state-level environmental departments.

- Permitting and Operations: Obtaining and maintaining permits for drilling and production is a direct result of strong government relations, ensuring operational continuity.

- Policy Influence: Engaging in policy discussions allows Chesapeake to contribute to frameworks that shape the future of energy production and regulation.

- Risk Mitigation: Proactive compliance and communication with regulators help anticipate and address potential regulatory challenges, reducing operational and financial risks.

Partnerships with Service Providers and Suppliers

Chesapeake Energy cultivates essential partnerships with drilling contractors, equipment suppliers, and various service providers. While these are strategic alliances, they also function as direct customer-supplier relationships, crucial for operational execution.

These collaborations are paramount for maintaining high safety standards and driving operational efficiency. In 2024, Chesapeake continued to emphasize these relationships to manage costs effectively across its diverse portfolio of oil and natural gas assets.

- Safety Focus: Chesapeake's partnerships are built on a shared commitment to stringent safety protocols in all field operations.

- Operational Efficiency: Collaborative efforts with service providers aim to optimize drilling and production processes.

- Cost Management: Strong supplier relationships are key to achieving cost efficiencies in a competitive energy market.

- Reliability: Ensuring a reliable supply chain for equipment and services is vital for uninterrupted production.

Chesapeake Energy focuses on maintaining strong investor relations through consistent financial reporting and transparent communication about capital return strategies, such as dividends and share repurchases. In Q1 2024, the company reported adjusted EBITDA of $1.4 billion, reinforcing investor confidence.

Direct engagement with energy purchasers, including marketers and utilities, is key, primarily through long-term sales agreements, especially for LNG. This strategy, with approximately 90% of its 2023 natural gas production under marketing agreements, ensures predictable revenue and stable demand.

Community engagement and open dialogue about operations and environmental stewardship are vital for Chesapeake's social license to operate, with ongoing community investment programs in 2024. Similarly, proactive relationships with regulatory bodies like the EPA ensure compliance and operational continuity.

Essential partnerships with drilling contractors and suppliers are crucial for safety and efficiency, with Chesapeake emphasizing these relationships in 2024 to manage costs effectively. These collaborations ensure a reliable supply chain and optimized production processes.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2023/2024 Data Point |

|---|---|---|---|

| Investors | Direct & Indirect | Quarterly earnings calls, annual reports, capital return communications | $1.4 billion adjusted EBITDA (Q1 2024) |

| Energy Purchasers (Marketers, Utilities) | Direct | Long-term sales agreements (e.g., LNG) | ~90% of 2023 natural gas production under marketing agreements |

| Community | Direct | Open dialogue, environmental stewardship updates, community investment | Continued community investment programs in 2024 |

| Regulatory Bodies | Direct | Proactive compliance, permit acquisition, policy discussions | Continued focus on EPA regulation compliance in 2024 |

| Service Providers (Drilling Contractors, Suppliers) | Direct (Partnerships) | Emphasis on safety, operational efficiency, cost management | Key to managing costs across diverse assets in 2024 |

Channels

Chesapeake Energy's primary channel for getting its natural gas and natural gas liquids (NGLs) to customers is through a vast network of pipelines and midstream processing facilities. This infrastructure is crucial for moving products from where they are produced to where they are needed.

The company relies on a mix of third-party pipelines and its own or jointly owned midstream assets. In 2024, Chesapeake continued to utilize and expand its access to these critical transportation routes, ensuring its production could reach various demand centers across the country.

This extensive network provides Chesapeake with broad market access, allowing it to connect with a diverse range of buyers and optimize the delivery of its commodities. For instance, its Haynesville Shale production often flows through Gulf Coast pipelines to reach liquefied natural gas (LNG) export facilities, a key growth area.

Chesapeake Energy's direct sales to industrial and utility customers form a crucial part of its business model. The company primarily engages with large-scale consumers of natural gas, including manufacturing facilities, power plants, and local utility companies that distribute gas to homes and businesses.

These direct relationships often translate into long-term supply agreements. Such contracts are beneficial as they offer predictable revenue streams and reduce exposure to short-term market volatility. For instance, in 2024, Chesapeake continued to leverage these stable relationships, underpinning its financial performance.

The company's strategy of focusing on domestic natural gas production is particularly well-suited to serving these key end-users. By providing a reliable domestic supply, Chesapeake meets the critical energy needs of industries and utilities across the United States, contributing to energy security and economic activity.

Chesapeake Energy's LNG export facilities are a vital link to global markets, enabling the company to sell its natural gas to developers who then liquefy and ship it overseas. This strategic channel allows Chesapeake to tap into international demand, diversifying its customer base beyond domestic consumption and potentially capturing higher prices. For instance, in 2024, the US continued to be a major global LNG exporter, with significant growth projected as new export terminals come online, directly benefiting companies like Chesapeake that supply the feedstock.

Investor Relations Platforms

Chesapeake Energy leverages several investor relations platforms to disseminate crucial information. These include their official website, which serves as a central hub for financial reports and news, alongside mandatory SEC filings like the 10-K and proxy statements, ensuring regulatory compliance and transparency. For 2024, Chesapeake reported a significant focus on shareholder returns, with substantial capital returned through dividends and share repurchases, reflecting their strategic priorities.

The company also utilizes earnings call webcasts and investor presentations to offer deeper insights into their operational performance and corporate strategies. These channels are vital for communicating key metrics, such as production volumes and cost efficiencies, directly to stakeholders. In the first quarter of 2024, Chesapeake highlighted strong operational execution in the Haynesville shale, contributing to their overall financial results.

- Official Website: Central repository for press releases, financial statements, and investor presentations.

- SEC Filings: Comprehensive reports including 10-K (annual) and 10-Q (quarterly) providing detailed financial and operational data.

- Earnings Calls & Webcasts: Live and archived presentations offering management's perspective on performance and outlook.

- Investor Presentations: Slide decks summarizing key strategic initiatives, financial highlights, and market outlook.

Sustainability Reports and ESG Disclosures

Chesapeake Energy leverages its annual Sustainability Report and other ESG disclosures to transparently communicate its environmental, social, and governance performance. These reports serve as a crucial channel for engaging with investors, regulators, and the public, showcasing the company's dedication to responsible operational practices.

These disclosures provide concrete data on Chesapeake's sustainability initiatives, reinforcing their commitment to environmental stewardship and social responsibility. For instance, in their 2023 ESG report, Chesapeake highlighted a 13% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2019. They also reported investing $100 million in emissions reduction technologies and infrastructure.

- Environmental Performance: Details on emissions reduction, water management, and land conservation efforts.

- Social Responsibility: Information on employee safety, community engagement, and diversity and inclusion.

- Governance Practices: Transparency regarding board oversight, executive compensation, and ethical conduct.

- Stakeholder Engagement: Outlines how Chesapeake addresses feedback and concerns from investors, employees, and communities.

Chesapeake Energy's channels primarily revolve around its extensive pipeline network for transporting natural gas and NGLs. This infrastructure, a mix of owned and third-party assets, ensures products reach demand centers, including crucial Gulf Coast LNG export facilities. Direct sales to industrial and utility customers are also key, often secured through long-term agreements that provide stable revenue.

The company also utilizes its LNG export capabilities to access global markets, diversifying its customer base and capturing international demand. Investor relations are managed through its website, SEC filings, and earnings calls, providing transparency on operational performance and strategic priorities. Furthermore, Chesapeake communicates its ESG efforts through annual sustainability reports, detailing environmental and social initiatives.

Customer Segments

Natural gas marketers and traders are crucial customers for Chesapeake Energy, acting as intermediaries that purchase large volumes of natural gas and natural gas liquids (NGLs) for onward distribution and resale. These entities are vital for ensuring Chesapeake's production reaches diverse end-users across various markets. In 2024, Chesapeake's significant production capacity, particularly in the Haynesville shale, positions it as a primary supplier to these market participants.

Utility companies and power generators represent a cornerstone customer segment for Chesapeake Energy, as they are substantial consumers of natural gas. These entities rely on a consistent supply of natural gas to fuel electricity generation, a critical function for powering homes and businesses. Chesapeake's role in providing this essential commodity directly supports the energy infrastructure that serves millions of end-users.

The power sector's increasing reliance on natural gas for cleaner and more efficient electricity production underscores the strategic importance of this customer base. In 2024, natural gas continued to be a significant fuel source for power generation, with its share in the U.S. electricity generation mix remaining robust, often exceeding 40% depending on market conditions and fuel prices.

Industrial end-users, spanning manufacturing, chemicals, and agriculture, are crucial customers for Chesapeake Energy. These sectors depend heavily on natural gas, not just for powering their operations with process heat, but also as a vital feedstock for producing a wide array of goods. Chesapeake directly serves these large industrial consumers, understanding their need for reliable and cost-effective energy solutions to maintain their competitive edge.

In 2024, the demand for natural gas from industrial sectors remained robust, driven by reshoring initiatives and the expanding use of natural gas in chemical production, such as in the creation of plastics and fertilizers. For instance, U.S. industrial sector consumption of natural gas has seen consistent growth, often representing over 30% of total domestic consumption, underscoring the critical role Chesapeake plays in this segment.

Shareholders and Investors

Shareholders and investors represent a critical customer segment for Chesapeake Energy. The company's business model is fundamentally designed to generate robust financial returns for these stakeholders, encompassing capital appreciation, dividends, and share repurchases. Chesapeake's strategic direction is heavily influenced by the objective of maximizing shareholder value.

In 2024, Chesapeake Energy continued to focus on delivering value to its investors. For instance, the company announced a quarterly cash dividend of $0.17 per share in the first quarter of 2024, reflecting a commitment to returning capital directly to shareholders. Furthermore, share buyback programs remain a key component of their strategy to enhance per-share value.

- Financial Returns: Aiming for capital appreciation, dividends, and share buybacks.

- Strategic Alignment: Company decisions are geared towards maximizing shareholder value.

- Dividend Payouts: Demonstrated commitment through regular cash dividend distributions, such as the $0.17 per share in Q1 2024.

- Share Repurchases: Utilizing buyback programs to boost per-share value and investor returns.

Landowners and Mineral Rights Owners

Landowners and mineral rights owners are key partners for Chesapeake Energy, receiving lease payments and royalties from the company's drilling activities. In 2024, Chesapeake continued to focus on strengthening these relationships, recognizing their importance for ongoing operational access and community support. These stakeholders directly benefit from the economic stimulation provided by Chesapeake's presence and operations in the areas where they hold mineral rights.

Chesapeake's engagement with landowners and mineral rights owners in 2024 emphasized fair compensation and transparent communication. The company's operational success is directly tied to maintaining goodwill with this segment, ensuring continued access to valuable drilling sites. This symbiotic relationship fosters mutual economic benefit, with landowners seeing direct financial returns from their mineral assets.

- Lease Payments: Landowners receive upfront payments for granting Chesapeake the right to explore and drill on their property.

- Royalties: Mineral rights owners are entitled to a percentage of the revenue generated from the oil and natural gas extracted from their land.

- Economic Impact: Chesapeake's operations create local jobs and stimulate economic activity, benefiting landowners and their communities.

- Community Relations: Maintaining positive relationships is vital for securing drilling permits and ensuring social license to operate.

Chesapeake Energy serves a diverse customer base, including natural gas marketers, utility companies, industrial users, and its own shareholders. Each segment relies on Chesapeake for reliable energy supply, operational efficiency, or financial returns. The company's strategy in 2024 focused on meeting the energy demands of these varied groups while prioritizing shareholder value.

The company's commitment to its shareholders is evident in its capital return strategy. In the first quarter of 2024, Chesapeake declared a quarterly cash dividend of $0.17 per share, demonstrating a direct return of value. Share repurchases also remained a key tactic to enhance per-share value, aligning with the goal of maximizing investor returns.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Natural Gas Marketers & Traders | Large volumes for resale | Primary supplier from Haynesville shale |

| Utility Companies & Power Generators | Consistent natural gas supply for electricity | Natural gas share in U.S. power generation remained robust, often exceeding 40% |

| Industrial End-Users | Energy for operations and feedstock | U.S. industrial sector consumption represented over 30% of total domestic consumption |

| Shareholders & Investors | Financial returns (dividends, capital appreciation) | Q1 2024 dividend: $0.17 per share; ongoing share repurchase programs |

Cost Structure

Exploration and Production (E&P) costs are the backbone of Chesapeake Energy's operational expenses, encompassing everything from drilling new wells to keeping existing ones running. These include significant outlays for services like pressure pumping, the cost of materials such as sand, and the daily hire of drilling rigs.

Chesapeake is keenly focused on optimizing these E&P costs, aiming for greater capital efficiency and driving down expenses, particularly by negotiating better terms with oilfield service providers. This proactive cost management is a key strategy for maintaining profitability in a dynamic energy market.

Reflecting this focus, Chesapeake Energy revised its 2024 guidance downwards for both capital expenditures and production expenses, signaling a commitment to cost control and operational streamlining throughout the year.

Chesapeake Energy's cost structure heavily features expenses related to acquiring and maintaining land leases and mineral rights. These are absolutely critical for accessing the unconventional oil and gas reservoirs they target.

These significant costs encompass upfront lease bonuses paid to landowners, ongoing annual rental payments to keep leases active, and royalty payments based on production. For instance, in 2024, the company continued to manage a vast portfolio of acreage, with lease operating expenses being a substantial component of their overall operational costs.

Chesapeake Energy incurs significant expenses for gathering, processing, and transporting its natural gas and oil from production sites to buyers. These costs are critical to their operations and directly impact profitability.

In 2024, these midstream expenses, encompassing pipeline tariffs and processing fees, represent a substantial portion of their overall cost structure. For instance, the company relies heavily on third-party midstream infrastructure, which involves various service charges to move its products to market.

Chesapeake actively manages these costs by seeking efficient delivery routes and negotiating favorable terms with midstream providers. This strategy is designed to maximize the net realized prices for their commodities, ensuring they capture as much value as possible after these essential transportation and processing outlays.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Chesapeake Energy encompass essential overhead like executive salaries, employee benefits, and office supplies. These costs are crucial for maintaining the company's operational backbone.

Chesapeake is actively focused on optimizing these corporate expenditures. A significant driver for this is the ongoing merger with Southwestern Energy, which is expected to unlock substantial synergies and drive G&A efficiencies. For example, in Q1 2024, Chesapeake reported G&A expenses of $174 million, a figure they aim to reduce through integration efforts.

- Salaries and Benefits: Compensation for non-operational staff, including management and administrative teams.

- Office Expenses: Costs associated with maintaining corporate offices, utilities, and supplies.

- Professional Services: Fees for legal, accounting, and consulting services supporting administrative functions.

- Synergy Realization: A key focus is leveraging the Southwestern Energy merger to reduce redundant G&A functions and achieve cost savings, with initial targets suggesting significant reductions in overhead.

Regulatory and Environmental Compliance Costs

Chesapeake Energy faces substantial costs to comply with stringent environmental and safety regulations in the oil and gas sector. These expenses are crucial for maintaining operational integrity and a positive public image. For instance, in 2024, companies in this industry are investing heavily in advanced technologies aimed at minimizing methane emissions and improving overall environmental stewardship.

- Environmental Compliance: Significant capital is allocated to technologies and processes that reduce air and water pollution, ensuring adherence to EPA standards and state-specific regulations.

- Safety Regulations: Investments are made in robust safety protocols, training, and equipment to prevent accidents and protect workers and surrounding communities.

- Monitoring and Reporting: Costs are incurred for continuous monitoring of emissions, operational data, and the preparation of detailed reports for regulatory bodies.

- Voluntary Standards: Chesapeake Energy also incurs costs associated with adhering to voluntary certifications like MiQ (Methane Intensity Quantification) and EO100™, demonstrating a commitment to best practices beyond mandatory requirements.

Chesapeake Energy's cost structure is heavily influenced by its upstream exploration and production activities, including drilling, completion, and equipment. These costs are directly tied to the volume of activity and efficiency of operations.

Midstream expenses, covering the transportation and processing of oil and gas, are also a significant component. Chesapeake actively manages these by optimizing logistics and negotiating with service providers to enhance net realized prices.

General and administrative (G&A) costs, encompassing salaries, benefits, and corporate overhead, are being streamlined, particularly with the ongoing merger with Southwestern Energy, which is projected to yield substantial cost synergies.

Environmental compliance and safety regulations represent another crucial cost area, requiring investments in technology and processes to meet stringent industry standards and voluntary commitments.

| Cost Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Exploration & Production (E&P) | Drilling, completion services, materials (sand), rig hire | Revised 2024 capital expenditures and production expenses guidance downwards for cost control. |

| Lease Operating Expenses | Lease bonuses, rentals, royalties | Management of a vast acreage portfolio with lease operating expenses as a substantial operational cost component. |

| Midstream Costs | Pipeline tariffs, processing fees, transportation charges | Reliance on third-party infrastructure with ongoing service charges to move products to market. |

| General & Administrative (G&A) | Salaries, benefits, office expenses, professional services | Q1 2024 G&A expenses reported at $174 million; focus on synergy realization from Southwestern Energy merger to reduce overhead. |

| Environmental & Safety Compliance | Pollution reduction technologies, safety protocols, monitoring, reporting | Investment in technologies to minimize methane emissions and adherence to voluntary standards like MiQ and EO100™. |

Revenue Streams

Chesapeake Energy's main way of making money is by selling the natural gas it extracts from its unconventional wells. This revenue comes from selling gas to various buyers, including marketers who then resell it, utility companies that power homes and businesses, and industrial clients needing it for manufacturing processes.

The company's deliberate strategy to concentrate on natural gas production, especially from key areas like the Marcellus and Haynesville shale plays, is the engine behind this significant revenue stream. In 2024, Chesapeake reported that natural gas and oil sales volume averaged 3.8 billion cubic feet equivalent per day (Bcfe/d), with natural gas making up a substantial portion of that.

Chesapeake Energy generates significant revenue from selling natural gas liquids (NGLs), which are extracted alongside natural gas. These valuable byproducts, including ethane, propane, and butane, are essential for various industrial processes and chemical manufacturing.

The company's revenue stream is directly influenced by the volume and composition of NGLs produced. For instance, in the first quarter of 2024, Chesapeake reported an average NGL production of 104,000 barrels per day, highlighting the importance of this segment to their overall financial performance.

While Chesapeake Energy has pivoted heavily towards natural gas, the sale of crude oil remains a contributing revenue stream. Their diverse unconventional reservoir assets allow for the production of multiple hydrocarbon types, including oil.

Historically, oil sales represented a larger portion of Chesapeake's income. For instance, in 2023, while natural gas liquids and oil accounted for a smaller percentage compared to natural gas, they still generated billions in revenue, demonstrating their continued relevance.

Revenue from Long-Term LNG Sale and Purchase Agreements

Chesapeake Energy is increasingly leveraging long-term Liquefied Natural Gas (LNG) Sale and Purchase Agreements (SPAs) as a significant revenue driver. This strategy allows them to supply natural gas to LNG export facilities, effectively selling it on a free-on-board basis.

This approach grants Chesapeake direct access to international markets, which often command higher prices compared to domestic markets. For instance, in 2024, the global LNG market experienced robust demand, with benchmark prices like the TTF (Title Transfer Facility) in Europe showing significant fluctuations but generally remaining elevated due to geopolitical factors and supply concerns.

- Diversified Revenue: Long-term LNG SPAs broaden Chesapeake's revenue streams beyond the domestic market.

- International Market Access: Enables participation in global markets, often with premium pricing.

- Reduced Price Volatility: Mitigates exposure to the swings of domestic natural gas prices.

- Strategic Growth: Positions Chesapeake to benefit from the expanding global demand for natural gas.

Marketing and Derivatives Activities

Chesapeake Energy actively markets its produced oil and natural gas, aiming to secure favorable pricing for its output. This marketing arm is crucial for translating their production into actual revenue.

To manage the inherent risk of fluctuating commodity prices, Chesapeake utilizes financial derivatives. These instruments, such as futures and options contracts, are employed to lock in prices and reduce the impact of market volatility on their earnings.

While derivatives can lead to realized gains or losses depending on market movements, their core function for Chesapeake is revenue and cash flow stabilization. This hedging strategy enhances the predictability of their financial performance.

- Marketing of Hydrocarbons: Chesapeake sells its produced oil and natural gas to various customers, generating direct revenue.

- Commodity Price Hedging: The company uses financial derivatives to mitigate the risk of adverse price swings.

- Revenue Stabilization: Derivatives aim to create a more predictable revenue stream, smoothing out the impact of market volatility.

- Cash Flow Predictability: By hedging, Chesapeake improves the visibility and stability of its cash flows, aiding financial planning.

Chesapeake Energy's revenue primarily stems from the sale of natural gas, its core commodity, to a diverse customer base including marketers, utilities, and industrial users. This focus is evident in their production figures, with natural gas constituting the majority of their 3.8 billion cubic feet equivalent per day (Bcfe/d) output in 2024. The company also generates substantial income from the sale of natural gas liquids (NGLs) like ethane and propane, essential for manufacturing, with Q1 2024 NGL production averaging 104,000 barrels per day.

| Revenue Stream | Description | Key Data Point (2024/Recent) |

|---|---|---|

| Natural Gas Sales | Sale of extracted natural gas to various domestic buyers. | Average production of 3.8 Bcfe/d (majority natural gas). |

| Natural Gas Liquids (NGLs) Sales | Sale of byproducts like ethane, propane, and butane. | Average NGL production of 104,000 bpd (Q1 2024). |

| Crude Oil Sales | Sale of crude oil produced from unconventional wells. | Continues to be a relevant, though smaller, revenue contributor. |

| LNG Sales (via SPAs) | Supplying natural gas to LNG export facilities under long-term agreements. | Access to international markets, benefiting from global demand. |

| Marketing & Hedging | Active marketing of hydrocarbons and use of financial derivatives to stabilize prices. | Aims to secure favorable pricing and reduce commodity price volatility. |

Business Model Canvas Data Sources

The Chesapeake Energy Business Model Canvas is informed by a robust blend of internal financial statements, operational data, and extensive market research. This data ensures each component, from key resources to cost structure, is grounded in factual analysis.