Chesapeake Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesapeake Energy Bundle

Uncover the strategic brilliance behind Chesapeake Energy's marketing efforts, examining how their product offerings, pricing structures, distribution channels, and promotional campaigns create a powerful market presence. This in-depth analysis provides actionable insights for anyone looking to understand and replicate successful marketing strategies.

Go beyond the surface-level understanding of Chesapeake Energy's approach. Access a comprehensive, ready-to-use 4Ps Marketing Mix Analysis that details their product innovation, pricing tactics, place in the market, and promotional execution. Ideal for business professionals, students, and consultants seeking strategic advantages.

Product

Chesapeake Energy, now operating as Expand Energy, focuses on the production of crude oil, natural gas, and natural gas liquids (NGLs). These are extracted from onshore unconventional reservoirs across the United States, forming the core of their product offering. Their strategy centers on optimizing production from key basins like the Marcellus and Haynesville.

The company's product slate directly fuels numerous industries, from power generation to petrochemicals. For instance, in the first quarter of 2024, Chesapeake Energy reported total production of approximately 3.0 billion cubic feet equivalent per day (Bcfe/d), with natural gas comprising the majority of this output.

Unconventional reservoir development is the bedrock of Chesapeake Energy's product strategy. They specialize in unlocking resources from challenging shale formations using sophisticated techniques like horizontal drilling and hydraulic fracturing. This focus allows them to produce a consistent volume of high-quality natural gas and oil.

Chesapeake's commitment to operational excellence in these complex extraction processes directly impacts their product output. In 2024, the company continued to refine its drilling and completion efficiencies, aiming to maximize resource recovery while minimizing costs.

Their expertise in unconventional plays means they are adept at managing the technical intricacies of shale production, ensuring a reliable supply of hydrocarbons. This technological prowess is key to maintaining their competitive edge in the energy market.

Chesapeake Energy's commitment to Responsible Sourced Gas (RSG) certification for its entire portfolio serves as a significant product differentiator. This certification underscores their dedication to high environmental, social, and governance (ESG) standards, a crucial factor for today's energy market.

The RSG certification signifies tangible achievements, such as reduced greenhouse gas (GHG) and methane emissions intensity. For instance, Chesapeake reported a methane intensity of 0.07% in 2023, well below industry averages and regulatory targets, enhancing the appeal of their natural gas to environmentally conscious buyers.

This focus on responsible production elevates the value proposition of Chesapeake's natural gas, particularly in markets that increasingly demand lower-carbon energy solutions. It directly addresses growing investor and consumer preferences for sustainable energy sources, positioning them favorably in a competitive landscape.

Strategic Asset Portfolio

Chesapeake Energy's strategic asset portfolio forms the bedrock of its product offering, featuring a robust collection of assets primarily located in key U.S. basins. This strategic positioning grants the company significant flexibility and resilience, enabling effective navigation through fluctuating market conditions. For instance, as of the first quarter of 2024, Chesapeake reported a daily production of approximately 3.7 billion cubic feet equivalent (Bcfe) per day, showcasing the scale of its operations.

The company leverages this extensive portfolio to meticulously manage production levels and optimize capital allocation. This approach is designed to build and maintain productive capacity, ready to be ramped up efficiently when market demand strengthens. This forward-looking strategy is crucial for capitalizing on future growth opportunities in the energy sector.

The recent merger with Southwest Energy, completed in the first half of 2024, has significantly amplified this strategic advantage. This integration has created a premier natural gas asset base, consolidating operations and enhancing economies of scale. This combined entity is poised to be a leading producer in the Haynesville and Marcellus shale plays, further solidifying its market position.

Key aspects of Chesapeake's asset portfolio strategy include:

- Geographic Concentration: Focus on premier U.S. basins like the Haynesville and Marcellus for operational efficiency and cost advantages.

- Production Flexibility: Ability to adjust production volumes in response to market signals and demand fluctuations.

- Capital Allocation Optimization: Strategic deployment of capital to maximize returns and enhance long-term asset value.

- Merger Synergies: Integration of acquired assets to create a more robust and competitive natural gas production platform.

LNG Market Exposure

Chesapeake Energy is strategically increasing its exposure to global liquefied natural gas (LNG) markets. This move is designed to broaden its customer base and tap into the rising international demand for natural gas. By securing these agreements, Chesapeake is looking beyond its traditional domestic sales, aiming for a more expansive market presence and potentially better pricing for its production.

This product strategy is evident in Chesapeake's recent activities. For instance, in late 2023 and early 2024, the company has been actively negotiating and finalizing agreements that link a portion of its natural gas output to international LNG buyers. These long-term contracts are crucial for ensuring consistent demand and realizing the value of its extensive natural gas reserves in a global context.

Key aspects of Chesapeake's LNG market exposure include:

- Diversification of Revenue Streams: Reducing reliance on the domestic market by accessing international buyers.

- Capitalizing on Global Demand: Leveraging the projected growth in LNG consumption worldwide, particularly in Asia and Europe.

- Securing Long-Term Contracts: Establishing sale and purchase agreements that provide price stability and volume commitments.

- Enhanced Price Realization: Potentially achieving higher prices by participating in global energy markets, which can be influenced by factors different from domestic supply and demand dynamics.

Chesapeake Energy's product offering centers on the production of natural gas, crude oil, and natural gas liquids (NGLs) from unconventional onshore reservoirs across the United States. Their strategy emphasizes optimizing production from key basins like the Marcellus and Haynesville. The company's commitment to Responsible Sourced Gas (RSG) certification, with a reported methane intensity of 0.07% in 2023, serves as a significant product differentiator, appealing to environmentally conscious buyers.

The merger with Southwest Energy in early 2024 has significantly expanded Chesapeake's natural gas asset base, creating a premier platform with enhanced economies of scale. This consolidation positions them as a leading producer in the Haynesville and Marcellus plays. Their product strategy also includes increasing exposure to global liquefied natural gas (LNG) markets through long-term contracts to diversify revenue and capitalize on rising international demand.

Chesapeake Energy's total production in Q1 2024 was approximately 3.0 billion cubic feet equivalent per day (Bcfe/d), with natural gas forming the majority. The company is strategically expanding its reach into global LNG markets, aiming to broaden its customer base and tap into rising international demand. This strategy is supported by recent agreements linking a portion of its natural gas output to international LNG buyers, ensuring consistent demand and value realization.

| Product Segment | Q1 2024 Production (Bcfe/d) | Key Differentiator | Market Focus |

|---|---|---|---|

| Natural Gas | ~2.7 (approx. 90% of total) | Responsible Sourced Gas (RSG) Certification, Low Methane Intensity (0.07% in 2023) | Domestic, Global LNG |

| Crude Oil | ~0.3 (approx. 10% of total) | Operational efficiency in unconventional plays | Domestic |

| Natural Gas Liquids (NGLs) | Included in total production | Synergies from integrated production | Domestic |

What is included in the product

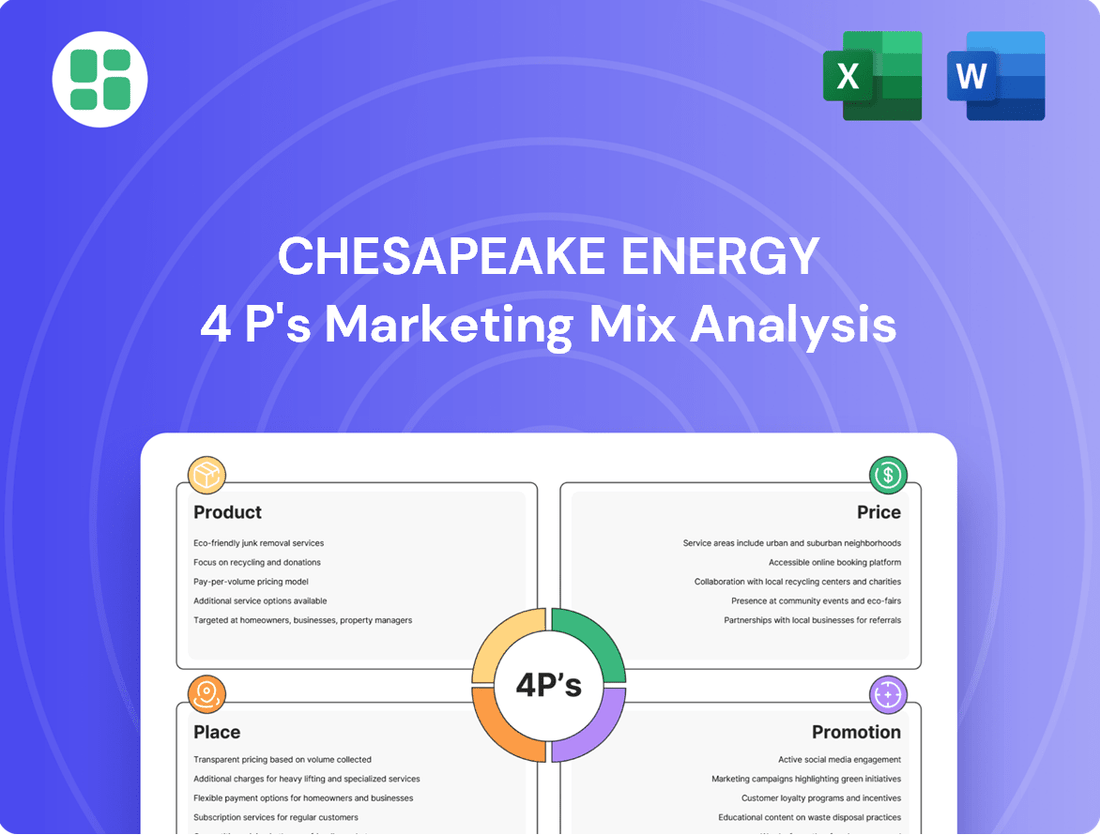

This analysis provides a comprehensive examination of Chesapeake Energy's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics to reveal their market positioning and competitive approach.

It offers a detailed, data-driven overview of Chesapeake Energy's marketing mix, perfect for understanding their operational strategies and for benchmarking against industry best practices.

This analysis simplifies Chesapeake Energy's 4Ps marketing mix, offering a clear roadmap to address customer pain points and drive strategic growth.

Place

Chesapeake Energy's core operations are anchored in key onshore U.S. basins, primarily the Marcellus and Haynesville shale plays. These locations are vital for their abundant natural gas and oil reserves, forming the bedrock of the company's extraction efforts.

The strategic focus on these basins enables Chesapeake to leverage optimized infrastructure and achieve operational efficiencies. As of early 2024, the Haynesville basin alone continues to be a significant contributor, with production levels remaining robust, underscoring its importance to the company's supply chain.

Chesapeake Energy's extensive pipeline and gathering infrastructure is critical for moving its natural gas and oil from wells to processing facilities and ultimately to market. This network ensures efficient delivery of their products, a key component of their overall marketing strategy.

In 2023, Chesapeake continued to invest in optimizing its midstream assets, recognizing their importance for capital efficiency and market access. The company's commitment to this infrastructure underpins its ability to reliably supply customers and capitalize on market opportunities.

Chesapeake Energy's natural gas distribution network is anchored by critical market hubs such as the Henry Hub, a primary benchmark for U.S. natural gas prices. This strategic placement facilitates efficient delivery to major consumption centers across the nation.

Following its 2024 merger with Southwestern Energy, Chesapeake significantly expanded its reach, enhancing access to high-demand domestic markets. This integration strengthens its ability to serve utilities, industrial clients, and other key purchasers of natural gas.

The company's infrastructure is designed for optimal flow, ensuring product availability at crucial delivery points. This logistical advantage is vital for meeting the consistent energy needs of its diverse customer base.

LNG Export Facilities

Chesapeake Energy is strategically expanding its market reach by securing access to liquefied natural gas (LNG) export facilities, a key component of its long-term distribution strategy. This move allows them to tap into global demand for natural gas, extending their 'place' beyond the domestic U.S. market to international buyers.

These arrangements are crucial for delivering Chesapeake's natural gas to overseas markets. By partnering with LNG terminals and traders, the company ensures efficient and reliable access to global consumers. This is particularly important given the projected growth in global LNG demand.

- Global LNG Demand Growth: Projections indicate a significant increase in global LNG demand, with estimates suggesting it could reach over 600 million metric tons per annum (MTPA) by 2030, presenting a substantial opportunity for exporters like Chesapeake.

- Export Terminal Capacity: The U.S. has seen substantial growth in its LNG export capacity, with several new terminals coming online or expanding in recent years, enhancing the infrastructure available for companies like Chesapeake. For instance, Venture Global's Calcasieu Pass facility began operations in 2022, adding significant export capacity.

- Strategic Partnerships: Chesapeake is actively pursuing agreements with LNG terminal operators and trading companies to secure long-term capacity and market access, optimizing its ability to serve international clients.

Strategic Production Deferral

Chesapeake Energy has strategically deferred bringing new wells online, a tactic to manage product availability in the face of market oversupply and depressed commodity prices. This approach builds a valuable inventory of drilled but uncompleted (DUC) wells, offering flexibility.

By delaying turn-in-lines (TILs), Chesapeake effectively controls when its production enters the market. This preserves the long-term value of its resources, ensuring they are brought online when demand is stronger and prices are more favorable. This creates a responsive productive capacity ready to be activated as market conditions improve.

For instance, in early 2024, Chesapeake maintained a significant backlog of DUC wells, allowing them to adjust their output rapidly. This strategy is crucial for optimizing profitability in the volatile natural gas market.

- Strategic Deferral: Chesapeake manages its production schedule to align with market demand.

- DUC Well Inventory: Building a reserve of drilled but uncompleted wells provides operational flexibility.

- Resource Value Preservation: Delaying production protects asset value during periods of low prices.

- Responsive Capacity: The ability to quickly activate deferred wells allows for adaptation to market shifts.

Chesapeake Energy's place strategy centers on its strategically located U.S. onshore assets, particularly the Marcellus and Haynesville shale plays, which are rich in natural gas and oil reserves. This geographic advantage is amplified by an extensive network of pipelines and gathering systems, ensuring efficient product movement from extraction sites to market hubs like the Henry Hub. Following its 2024 merger with Southwestern Energy, the company's market reach has significantly expanded, bolstering its capacity to serve domestic demand and increasing its access to global markets via LNG export facilities.

| Asset Location | Key Infrastructure | Market Access | Strategic Advantage |

|---|---|---|---|

| Marcellus & Haynesville Shale Plays | Extensive pipeline and gathering network | Henry Hub, U.S. domestic markets | Abundant reserves, optimized logistics |

| Post-Merger (Southwestern Energy) | Enhanced domestic reach | Increased access to high-demand markets | Expanded customer base, greater supply reliability |

| Global LNG Export Facilities | Partnerships with terminals and traders | International markets | Tap into global demand growth (projected >600 MTPA by 2030) |

What You See Is What You Get

Chesapeake Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Chesapeake Energy's 4 P's (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Chesapeake Energy’s promotion strategy heavily emphasizes transparent and consistent communication with the financial community. This includes regular earnings calls, detailed financial reports, and investor presentations, all designed to showcase operational performance and financial health.

These efforts aim to build investor confidence and attract capital, a strategy that proved effective in 2024. For instance, Chesapeake reported strong free cash flow generation, exceeding expectations and demonstrating the success of their investor relations approach in a dynamic market.

Chesapeake Energy leverages its detailed sustainability and ESG reporting as a key promotional element. By transparently sharing progress on emission reduction, safety improvements, and community involvement, the company highlights its dedication to responsible energy practices, a crucial factor for environmentally conscious investors and stakeholders.

Chesapeake Energy actively manages its corporate communications and public relations to cultivate a favorable public perception and communicate its strategic direction. This involves disseminating information through press releases detailing financial performance, significant mergers, and operational achievements, all designed to uphold a positive brand image and keep stakeholders informed about critical company updates.

A prime example of their strategic communication efforts is the recent rebranding to Expand Energy, a significant initiative aimed at reshaping its identity and market positioning. This transition signals a forward-looking approach and a commitment to evolving within the energy sector, reflecting broader industry shifts and company aspirations.

Industry Engagement and Thought Leadership

Chesapeake Energy actively engages in industry forums, showcasing its expertise on energy markets and operational excellence. This participation, including contributions to associations and discussions on natural gas's role in the energy transition, solidifies its image as a thought leader and responsible player in the oil and gas industry. For instance, in 2023, Chesapeake's CEO frequently shared insights into evolving market dynamics, impacting investor sentiment and strategic planning.

Their commitment to thought leadership extends to fostering crucial partnerships and influencing policy debates. By presenting their perspectives at key industry events, Chesapeake aims to shape the narrative around energy development and sustainability. This proactive approach is vital for navigating the complex regulatory and market landscapes, especially as the global energy mix continues to evolve.

- Industry Conferences: Participation in events like CERAWeek provides a platform for sharing insights on natural gas supply and demand forecasts.

- Association Involvement: Membership in organizations such as the American Petroleum Institute (API) allows Chesapeake to contribute to industry best practices and policy advocacy.

- CEO Commentary: In 2024, Chesapeake's CEO has been vocal about the strategic importance of natural gas in achieving both energy security and emissions reduction goals, influencing market perceptions.

- Partnership Development: Industry engagement facilitates collaborations that can lead to new technologies and operational efficiencies, enhancing their market position.

Strategic Merger Announcements and Synergies

The strategic merger announcement and subsequent completion with Southwestern Energy in 2024 served as a pivotal promotional event for Chesapeake Energy. This move effectively communicated the formation of a larger, more robust natural gas entity, aiming to capture market attention and investor interest.

Messaging surrounding the merger consistently highlighted the anticipated synergies, which were projected to unlock significant value. These included operational efficiencies, cost savings, and an expanded geographic footprint, all designed to bolster the company's competitive position.

The combined entity, now operating under the name Chesapeake Energy, emphasized its strengthened financial profile and enhanced market reach as key benefits. This narrative aimed to build confidence among shareholders, creditors, and customers, positioning the company for future growth and stability.

- Merger Completion: The merger officially closed in the second half of 2024, creating a combined entity with significant production and reserves.

- Synergy Projections: Initial projections indicated over $1 billion in run-rate synergies, primarily from operational efficiencies and G&A reductions.

- Market Position: The combined company became one of the largest natural gas producers in the United States, enhancing its market influence and bargaining power.

- Financial Strength: The merger was expected to improve credit metrics and provide greater financial flexibility for capital allocation and debt management.

Chesapeake Energy's promotional efforts in 2024 and early 2025 centered on its strategic merger with Southwestern Energy, a move designed to solidify its position as a leading U.S. natural gas producer.

The company consistently communicated the anticipated benefits of this merger, projecting over $1 billion in run-rate synergies, primarily through operational efficiencies and reduced general and administrative costs.

This strategic combination, completed in the latter half of 2024, significantly enhanced Chesapeake's market presence and financial profile, aiming to attract investor confidence and capital.

Chesapeake also leveraged its robust ESG reporting as a promotional tool, highlighting its commitment to emissions reduction and safe operations, which resonated with environmentally conscious investors.

| Promotional Focus | Key Activities | Data/Impact (2024-2025) |

|---|---|---|

| Merger with Southwestern Energy | Announcements, investor calls, synergy communication | Completed H2 2024; projected >$1B in synergies |

| Financial Transparency | Earnings calls, detailed reports, investor presentations | Strong free cash flow generation exceeding expectations |

| ESG & Sustainability | Public reporting on emissions, safety, community | Attracting environmentally conscious investors |

| Thought Leadership | Industry conferences (e.g., CERAWeek), CEO commentary | CEO emphasizing natural gas for energy security & emissions reduction |

Price

Chesapeake Energy's revenue is directly tied to the fluctuating prices of natural gas, oil, and natural gas liquids. These prices are set by broad market forces, not by the company itself.

In early 2024, the Henry Hub natural gas price, a key benchmark, averaged around $2.50 per million British thermal units (MMBtu), experiencing downward pressure from ample supply. Similarly, West Texas Intermediate (WTI) crude oil prices hovered in the $70-$80 per barrel range, influenced by global demand outlooks and OPEC+ production decisions.

This means Chesapeake acts as a price-taker, meaning it must accept the prevailing market rates for its products, making its financial performance highly sensitive to external market volatility driven by supply, demand, and geopolitical events.

Chesapeake Energy's capital expenditure management is a key lever in shaping its cost structure and profitability. By strategically controlling spending, the company directly influences its breakeven costs, which in turn impacts its ability to set competitive prices. For instance, in 2023, Chesapeake reported capital expenditures of approximately $2.6 billion, a figure that allows for significant investment in efficient production while maintaining cost discipline.

Reducing capital spending and boosting operational efficiency are central to Chesapeake's strategy for lowering production expenses. This focus on efficiency directly enhances free cash flow generation. This improved cash flow is critical for maintaining competitiveness, especially during periods of volatile or low commodity prices, ensuring the company can weather market downturns effectively.

Chesapeake Energy utilizes hedging strategies to manage the inherent volatility of natural gas and oil prices, aiming for more stable and predictable cash flows. By entering into derivative contracts, the company locks in future sales prices for a portion of its production, offering a crucial layer of downside protection.

For instance, as of the first quarter of 2024, Chesapeake had hedged approximately 75% of its projected natural gas production for the remainder of the year, with an average realized price of $2.75 per million British thermal units (MMBtu). This disciplined approach is vital for revenue stabilization and supporting consistent shareholder returns.

Shareholder Return Framework

Chesapeake Energy's pricing strategy is directly tied to its shareholder return framework, meaning how they price their products impacts their ability to pay dividends and buy back stock. For instance, in the first quarter of 2024, Chesapeake announced a quarterly dividend of $0.33 per share and continued its share repurchase program, demonstrating a commitment to returning capital. This focus on shareholder value is a critical element for investors evaluating the company's financial health and future prospects.

The company's ability to generate consistent cash flow is the bedrock of this shareholder return strategy. This cash flow generation is heavily influenced by fluctuating commodity prices, such as natural gas and oil, as well as the company's success in managing its operational costs. Chesapeake's performance in these areas directly translates into the financial capacity to reward its shareholders.

- Dividend Payouts: In Q1 2024, Chesapeake declared a dividend of $0.33 per share, reflecting cash flow generated from its operations.

- Share Repurchases: The company actively engages in share buybacks, reducing the number of outstanding shares and potentially increasing earnings per share.

- Commodity Price Impact: Higher natural gas prices, like those seen in early 2024, generally enhance Chesapeake's cash flow and its capacity for shareholder returns.

- Cost Management: Efficient operational cost control is crucial for maximizing free cash flow available for dividends and buybacks.

Cost Efficiency and Breakeven Optimization

Chesapeake Energy's pricing strategy is deeply rooted in achieving exceptional cost efficiency, a critical factor in optimizing their breakeven points. By concentrating on operational improvements, they aim to produce oil and gas at a lower cost per barrel or per unit of natural gas. This focus on efficiency directly impacts their ability to set competitive prices and remain profitable even during periods of market volatility.

Key areas of focus for cost reduction include:

- Optimized Well Designs: Implementing advanced engineering for well completions to maximize resource extraction and minimize upfront costs.

- Drilling Performance Improvements: Leveraging technology and best practices to reduce the time and resources required for each well.

- Saltwater Disposal Cost Reduction: Finding more economical methods for managing produced water, a significant operational expense.

In 2024, Chesapeake reported a significant reduction in their all-in breakeven costs, aiming to maintain a breakeven wellhead price for natural gas below $2.50 per million British thermal units (MMBtu) across their key operating regions. This aggressive cost management allows them to maintain a competitive edge and ensure financial stability through fluctuating commodity price cycles.

Chesapeake Energy's pricing is dictated by market forces, making it a price-taker. For instance, in early 2024, natural gas prices at the Henry Hub averaged around $2.50 per MMBtu, while WTI crude oil traded between $70-$80 per barrel, directly impacting Chesapeake's revenue streams.

The company's strategy focuses on reducing all-in breakeven costs, aiming for natural gas wellhead prices below $2.50 per MMBtu in 2024. This cost efficiency is vital for profitability and competitive pricing in a volatile market.

Hedging plays a crucial role, with approximately 75% of projected 2024 natural gas production hedged at an average price of $2.75 per MMBtu as of Q1 2024, providing a buffer against price declines.

Ultimately, Chesapeake's pricing directly influences its ability to return capital to shareholders, as seen in its Q1 2024 dividend of $0.33 per share, a direct result of its operational performance and commodity price realization.

| Metric | Value (Early 2024) | Impact on Pricing |

|---|---|---|

| Henry Hub Natural Gas Price | ~$2.50/MMBtu | Sets benchmark for Chesapeake's gas sales. |

| WTI Crude Oil Price | $70-$80/barrel | Influences pricing for Chesapeake's oil production. |

| Hedging (Natural Gas) | ~75% of 2024 production at $2.75/MMBtu | Secures a minimum price, impacting realized revenue. |

| All-in Breakeven Cost Target (Gas) | Below $2.50/MMBtu | Determines profitability at various market prices. |

4P's Marketing Mix Analysis Data Sources

Our Chesapeake Energy 4P analysis leverages a comprehensive blend of public financial disclosures, including SEC filings and investor presentations, alongside industry-specific reports and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.