Chesapeake Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesapeake Energy Bundle

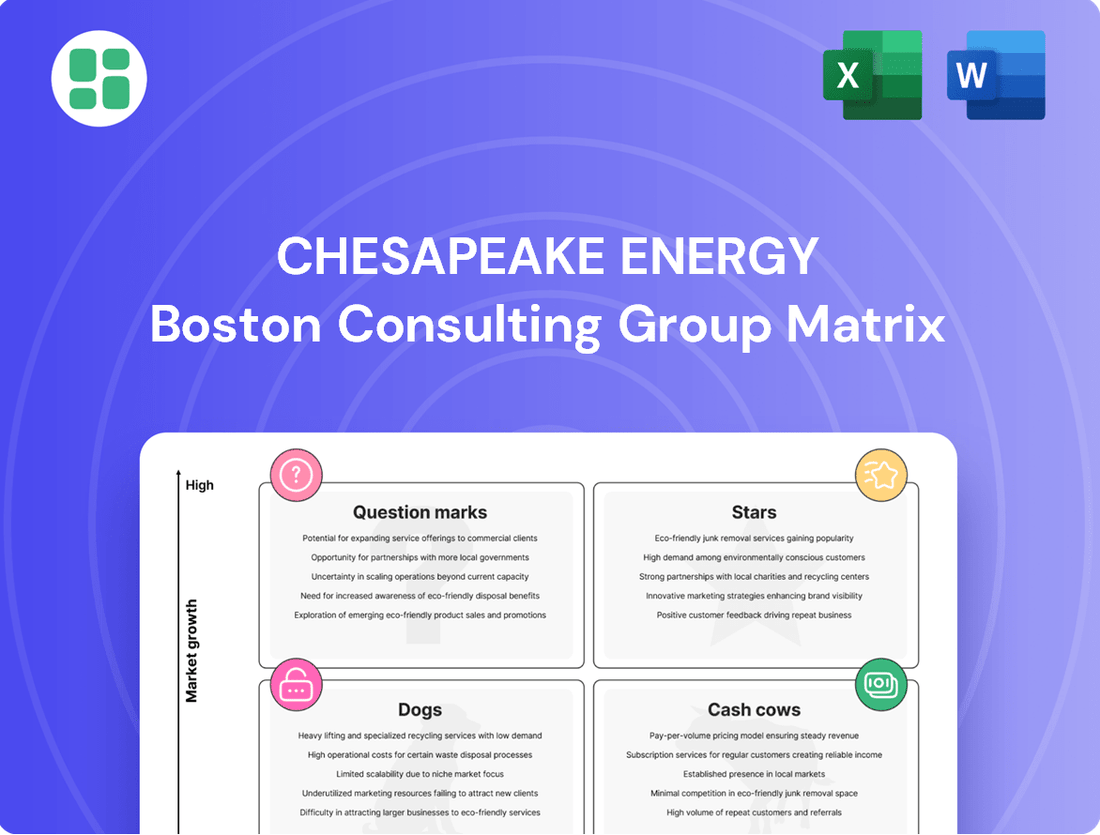

Curious about Chesapeake Energy's strategic product portfolio? This preview offers a glimpse into how their offerings might be categorized within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

To truly grasp their competitive positioning and unlock actionable strategies for growth and resource allocation, you need the full picture. Purchase the complete BCG Matrix report for a detailed quadrant-by-quadrant breakdown, data-backed recommendations, and a clear roadmap to informed investment decisions.

Stars

The merger of Chesapeake Energy and Southwestern Energy, creating Expand Energy, has solidified its position as the largest U.S. natural gas producer. This strategic move consolidates a vast natural gas portfolio, anticipating significant market share gains in a sector expected to grow, especially with rising liquefied natural gas (LNG) demand. For context, in 2024, the U.S. is a leading exporter of LNG, a trend expected to accelerate.

Chesapeake Energy, now operating as Expand Energy, is strategically leveraging the anticipated surge in global natural gas demand, projected to accelerate from 2025. This growth is primarily fueled by the expansion of Liquefied Natural Gas (LNG) export infrastructure, creating a significant opportunity for the company.

The company has proactively entered into long-term LNG Sale and Purchase Agreements. These agreements are designed to ensure a substantial portion of Chesapeake's natural gas production is linked to more favorable international pricing benchmarks, enhancing its revenue potential.

The Marcellus Shale is a cornerstone of Chesapeake Energy's operations, contributing over 50% of its total natural gas output. This region is distinguished by its exceptionally low production costs and stable, slower decline rates compared to other shale plays.

This efficiency and vast resource endowment firmly place the Marcellus Shale in the 'star' category within the BCG matrix. Its robust performance positions Chesapeake to capitalize on any future upticks in natural gas demand, aiming to expand its market dominance.

As of early 2024, Chesapeake's Marcellus operations consistently deliver some of the lowest breakeven costs in the industry, often cited below $2.00 per million British thermal units (MMBtu). This cost advantage is critical for maintaining profitability and competitive positioning.

Haynesville Shale Strategic Capacity

The Haynesville Shale represents a significant strategic asset for Chesapeake Energy, boasting substantial production and considerable untapped capacity. While its operational costs are generally higher than those in the Marcellus Shale, ongoing initiatives are focused on optimizing midstream infrastructure and enhancing drilling productivity. These efforts are designed to unlock greater efficiency and cost-effectiveness, preparing the Haynesville for accelerated growth as market dynamics become more favorable.

Chesapeake's strategic focus on the Haynesville in 2024 includes targeted investments aimed at debottlenecking existing midstream capacity. This is crucial for ensuring that produced volumes can reach market efficiently, thereby improving the overall economics of the play. Furthermore, advancements in drilling and completion technologies are being implemented to reduce well costs and increase initial production rates, directly addressing the higher cost structure.

- Haynesville Production Contribution: In the first quarter of 2024, Chesapeake's Haynesville operations contributed approximately 1.5 billion cubic feet equivalent per day (Bcfe/d) to its total production.

- Midstream Debottlenecking: Chesapeake has been actively working to increase firm transportation capacity out of the Haynesville, aiming to add an estimated 0.5 Bcfe/d of capacity by the end of 2024.

- Drilling Efficiency Gains: The company reported a 10% reduction in average well cycle times in the Haynesville during the first half of 2024 compared to the previous year.

- Cost Structure Improvement: Chesapeake's target for average Haynesville well costs in 2024 is set at approximately $7.5 million, a reduction from previous years, reflecting efficiency improvements.

Operational Efficiency and Cost Leadership

Chesapeake Energy is a prime example of a company excelling in operational efficiency, a key component of the BCG matrix's "Stars" category. Their focus on longer laterals and refined well designs has demonstrably boosted capital efficiency. For instance, in 2024, Chesapeake reported a continued trend of improved drilling and completion times, contributing to a lower per-barrel cost structure.

This operational prowess translates directly into cost leadership. By optimizing saltwater disposal and other operational aspects, Chesapeake lowers its breakeven costs, making its production highly competitive. In 2024, the company's ability to maintain strong production levels even with fluctuating commodity prices underscored this cost advantage.

- Improved Capital Efficiency: Chesapeake consistently enhances its capital efficiency through innovations like longer lateral wells and optimized well designs, as seen in their 2024 operational reports.

- Lower Breakeven Costs: Operational excellence, including advanced saltwater disposal techniques, allows Chesapeake to achieve lower breakeven costs, enhancing its competitiveness.

- Market Share Capture: The company's cost leadership positions it to capture greater market share during periods of heightened demand, a strategy evident in their 2024 market positioning.

Chesapeake Energy's Marcellus Shale operations are a clear "Star" in the BCG matrix. This region offers exceptionally low production costs, with breakeven costs often below $2.00 per MMBtu as of early 2024. The Marcellus accounts for over half of Chesapeake's natural gas output, demonstrating its high market share and strong growth potential in a sector benefiting from rising LNG demand.

The company's operational efficiency, including longer laterals and optimized well designs, directly contributes to its "Star" status. This focus on capital efficiency, evident in improved drilling times in 2024, translates into cost leadership. Chesapeake's ability to maintain strong production and capture market share, even with fluctuating prices, highlights the Marcellus's position as a high-growth, high-market-share asset.

The Marcellus Shale is a cornerstone of Chesapeake Energy's operations, contributing over 50% of its total natural gas output. This region is distinguished by its exceptionally low production costs and stable, slower decline rates compared to other shale plays. As of early 2024, Chesapeake's Marcellus operations consistently deliver some of the lowest breakeven costs in the industry, often cited below $2.00 per million British thermal units (MMBtu). This cost advantage is critical for maintaining profitability and competitive positioning.

| Shale Play | BCG Category | Key Performance Indicators (Early 2024) | Strategic Importance |

| Marcellus Shale | Star | Production: >50% of total output; Breakeven Costs: <$2.00/MMBtu; Low Decline Rates | High growth potential, cost leadership, strong market share |

What is included in the product

This BCG Matrix overview for Chesapeake Energy identifies strategic opportunities for investment in Stars and Question Marks, while managing Cash Cows and divesting Dogs.

The Chesapeake Energy BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

Chesapeake Energy, now operating as Expand Energy, demonstrates a strong capacity for consistent free cash flow generation. This robust cash flow is vital for the company's strategic objectives, including significant debt reduction and providing returns to shareholders.

Even amidst fluctuating market conditions, Chesapeake's established and productive asset base continues to be a reliable source of substantial cash. This ongoing financial strength clearly defines its position as a cash cow within the BCG Matrix framework.

For instance, in the first quarter of 2024, Chesapeake Energy reported adjusted EBITDA of approximately $1.5 billion, underscoring its ability to generate significant cash from its operations. This consistent performance is a key indicator of its cash cow status.

Chesapeake Energy's commitment to disciplined capital allocation is a cornerstone of its strategy, particularly evident in its 2024 capital expenditure plans. The company intends to reduce its spending, prioritizing the maintenance of existing productive capacity over expansive growth initiatives, especially in a market characterized by ample supply.

This focused approach is designed to maximize cash generation from its already robust and efficient asset base. For instance, Chesapeake reported in its 2023 annual report that its capital expenditures were approximately $3.5 billion, and for 2024, the company has indicated a planned reduction, signaling a clear emphasis on efficiency and cash flow generation from its core operations.

Chesapeake Energy's Marcellus and Haynesville shale plays are prime examples of Cash Cows. Despite market-induced production curtailments in 2024, these mature basins continue to generate significant profits. Their advantage lies in exceptionally low operating costs and highly efficient extraction methods, ensuring strong margins and consistent cash flow generation.

Shareholder Returns Program

Chesapeake Energy's shareholder returns program highlights its strong cash flow generation, a key characteristic of a cash cow. Since 2021, the company has returned approximately $3.5 billion to shareholders through a combination of dividends and buybacks.

This consistent capital allocation strategy underscores the stability and profitability of its core operations. The program includes both base and variable dividends, demonstrating a commitment to rewarding investors.

- $3.5 billion returned to shareholders since 2021.

- Base and variable dividends are key components of the program.

- Share repurchases further enhance shareholder value.

- Consistent capital returns signal robust cash cow status.

Strong Balance Sheet Management

Chesapeake Energy's commitment to strong balance sheet management is a key characteristic of its Cash Cow status. The company has set an ambitious goal of reducing its net debt by $1 billion in 2025, following its merger. This focus on deleveraging strengthens its financial resilience.

A robust balance sheet, underpinned by consistent cash flow generation, enables Chesapeake Energy to navigate fluctuating market conditions effectively. This financial health means the company can maintain its operations and pursue strategic initiatives without relying heavily on external funding, a hallmark of a mature and stable business.

- Debt Reduction Target: $1 billion net debt reduction planned for 2025 post-merger.

- Financial Stability: Healthy balance sheet provides a cushion against market volatility.

- Operational Sustainability: Stable cash flows support ongoing operations without excessive external financing.

Chesapeake Energy's mature, low-cost basins like the Marcellus and Haynesville are prime examples of its cash cow assets. These operations consistently generate substantial free cash flow, even with strategic production curtailments in 2024.

This strong cash generation supports significant debt reduction and shareholder returns, with approximately $3.5 billion returned since 2021. The company plans a $1 billion net debt reduction in 2025, further solidifying its financial health.

Chesapeake's disciplined capital allocation in 2024, focusing on maintaining existing capacity rather than aggressive growth, maximizes cash flow from its efficient asset base.

The company's commitment to shareholder rewards, including base and variable dividends and share repurchases, highlights the stability and profitability characteristic of its cash cow status.

| Metric | Q1 2024 | 2023 | 2024 Outlook |

| Adjusted EBITDA | ~$1.5 billion | N/A | N/A |

| Capital Expenditures | N/A | ~$3.5 billion | Reduced from 2023 |

| Shareholder Returns (Since 2021) | N/A | ~$3.5 billion | Ongoing |

| Net Debt Reduction Target (2025) | N/A | N/A | $1 billion |

What You’re Viewing Is Included

Chesapeake Energy BCG Matrix

The Chesapeake Energy BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This analysis provides a clear strategic overview of Chesapeake's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share. The detailed breakdown within this report is designed for immediate application in your business planning and strategic decision-making.

Dogs

Chesapeake Energy’s divestiture of its Eagle Ford oil assets in 2023 marked a strategic shift, moving the company towards a pure-play natural gas focus. These oil assets, no longer aligned with Chesapeake's core long-term natural gas strategy, are best categorized as ‘dogs’ within the BCG matrix framework. The company’s decision to exit these operations reflects a deliberate effort to streamline its asset portfolio and enhance strategic focus on its more promising natural gas ventures.

Chesapeake Energy's non-core, high-cost legacy assets, often found outside its primary Marcellus and Haynesville shale plays, are categorized as dogs in the BCG Matrix. These assets may exhibit higher operational expenses or declining production rates, making them less attractive for continued investment. For instance, in 2024, Chesapeake continued its strategic divestiture of non-core acreage, aiming to streamline operations and improve capital allocation towards its more profitable ventures.

Chesapeake Energy's portfolio includes certain mature natural gas fields, particularly in legacy shale plays, that are experiencing natural production declines. These areas, while historically significant, are now characterized by higher lifting costs and lower reserve potential compared to the company's core focus areas.

For instance, some of the older Haynesville Shale acreage might fall into this category, where the economics of continued, substantial reinvestment are less compelling. Chesapeake's strategic capital allocation prioritizes growth and efficiency in its more promising assets, like the Eagle Ford and the Marcellus, rather than sustaining production in these declining regions.

Inefficient or Underperforming Operations

While Chesapeake Energy is known for its operational prowess, certain wells or business segments might fall into the 'dog' category if they consistently drain cash without a clear path to profitability. These underperforming assets would be prime candidates for divestiture or even abandonment.

In 2024, for instance, a hypothetical underperforming natural gas well in a less productive basin might have shown negative cash flow, consuming capital for maintenance and operations without generating sufficient returns. Such assets, if they lack strategic importance or potential for revitalization, align with the characteristics of a dog in the BCG matrix.

- Underperforming Assets: Wells or operational units that consistently generate negative cash flow.

- Lack of Growth Prospects: Segments with limited potential for future revenue or production increases.

- Divestiture Candidates: Assets that are candidates for sale to free up capital for more promising ventures.

Minimal Exposure to Non-Strategic Liquids

Chesapeake Energy's strategic pivot to a pure natural gas producer means any remaining non-strategic natural gas liquids (NGLs) could be categorized as a 'dog' in the BCG Matrix. These NGLs, often byproducts of gas extraction, may have low market growth and low relative market share for Chesapeake, given their divestiture of oil assets. For instance, in 2023, Chesapeake completed the sale of its oil assets, solidifying its focus on natural gas.

This minimal exposure to NGLs means they likely represent a small fraction of the company's overall revenue and operational focus. While NGLs can offer diversification, if their contribution is insignificant and lacks strategic alignment with Chesapeake's core natural gas business, they fit the 'dog' profile.

- Low Market Share: Non-strategic NGL production has a minimal share of the overall NGL market for Chesapeake.

- Low Market Growth: The specific NGLs not central to Chesapeake's strategy likely operate in low-growth segments.

- Divestiture Impact: The sale of oil assets indicates a strategic move away from diversified hydrocarbon production, further marginalizing non-core NGLs.

- Revenue Contribution: These NGLs contribute minimally to Chesapeake's total revenue, making them a low priority.

Chesapeake Energy's 'dogs' are assets with low market share and low growth potential, often legacy operations or non-core products. These segments drain resources without significant future returns. For example, some older, high-cost natural gas wells in less productive basins, or minimal exposure to certain natural gas liquids (NGLs) after the 2023 oil asset divestiture, fit this description. The company actively manages these by divesting or deprioritizing them to focus capital on core, high-growth natural gas plays.

| Asset Category | BCG Classification | Characteristics | Example for Chesapeake Energy (2023-2024) | Strategic Implication |

| Legacy Natural Gas Wells | Dog | Low production, high lifting costs, declining reserves | Older Haynesville Shale acreage with reduced economic viability for new investment | Candidates for divestiture or reduced capital allocation |

| Non-Strategic NGLs | Dog | Low market growth, minimal revenue contribution, not core to strategy | Byproducts of gas extraction not central to the pure-play natural gas focus post-oil asset sale | Likely to be divested or minimized |

| Underperforming Operational Units | Dog | Consistent negative cash flow, lack of growth prospects | Hypothetical wells in less productive basins showing negative cash flow in 2024 | Drain capital; prime candidates for divestiture or abandonment |

Question Marks

Chesapeake Energy strategically maintains a significant inventory of Drilled but Uncompleted (DUC) wells, alongside deferred turn-in-line (TIL) wells. This practice allows them to hold back production from wells that are drilled and ready for completion, primarily in response to current low natural gas prices. These DUCs and deferred TILs can be viewed as ‘question marks’ in a BCG matrix context, as they represent assets requiring future capital expenditure to bring online.

The potential for these wells is substantial; they are poised to become ‘stars’ when market conditions, specifically natural gas demand and pricing, improve. As of early 2024, Chesapeake’s operational focus has been on managing this inventory efficiently, ready to ramp up production swiftly as economic incentives materialize. This strategic positioning provides flexibility and a cost-effective way to respond to market upturns.

Chesapeake Energy is actively exploring new pathways to deliver its natural gas to a wider range of customers, aiming to diversify beyond existing agreements. This includes a significant push to expand its liquefied natural gas (LNG) strategy, looking for opportunities beyond its current contractual commitments.

These initiatives to secure new market access and contracts are crucial for future growth. However, they also come with considerable risks and require substantial upfront capital investment, placing them squarely in the question mark category of the BCG matrix.

Following its significant merger with Southwestern Energy in early 2024, Chesapeake Energy is likely to adopt a cautious stance on major acquisitions. However, any future strategic moves into nascent oil and gas basins or entirely new energy sectors would fall into the question mark category of the BCG matrix. These ventures, while offering high growth potential, also present considerable integration challenges and substantial capital requirements, demanding careful evaluation.

For instance, if Chesapeake were to explore opportunities in the burgeoning geothermal energy market or invest in advanced carbon capture technologies, these would be classic question marks. Such investments in 2024 would require significant upfront capital, potentially diverting resources from existing, more stable operations, and their success would hinge on market adoption and technological maturity.

Exploratory Drilling in Emerging Plays

Exploratory drilling in emerging plays for Chesapeake Energy (Expand Energy) would fall under the question mark category in the BCG Matrix. These ventures represent significant investments with unpredictable outcomes, demanding substantial capital outlay and carrying a high risk of failure. However, they also offer the potential for substantial future growth and market share if successful.

For instance, in 2024, the natural gas industry continues to see exploration in new basins, though capital discipline remains a key focus. Companies are carefully evaluating prospects based on geological data, infrastructure availability, and projected economics. The success rate of exploratory wells can vary widely, with some plays yielding prolific reserves while others prove uneconomical.

- High Risk, High Reward Potential: Emerging plays offer the chance to discover significant reserves, but also carry the risk of dry holes or uneconomic production.

- Significant Upfront Capital: These projects require substantial investment in seismic surveys, lease acquisitions, and initial drilling before any revenue is generated.

- Uncertain Success Rates: Unlike established plays, the geological characteristics and production potential of new areas are less understood, leading to higher uncertainty.

- Future Growth Engine: Successful exploration in new plays can secure future production and cash flow, becoming the next generation of core assets.

Technological Advancements for Enhanced Recovery

Chesapeake Energy's investments in cutting-edge technologies for enhanced oil and gas recovery, particularly those in their nascent stages, represent classic question marks within the BCG framework. These initiatives are characterized by significant upfront capital expenditure for research, development, and pilot programs.

For instance, the company's exploration into advanced hydraulic fracturing techniques, such as those utilizing novel fluid compositions or optimized proppant delivery systems, falls into this category. While promising for boosting output from mature fields or accessing previously uneconomical reserves, their commercial viability and scalability are still under rigorous evaluation. In 2024, Chesapeake Energy allocated a notable portion of its capital budget to these experimental technologies, aiming to unlock greater production efficiency.

- Advanced Fracking Fluids: Research into biodegradable or lower-impact fluid formulations to improve reservoir contact and reduce environmental footprint.

- AI-Driven Reservoir Modeling: Implementing artificial intelligence to predict optimal well placement and stimulation parameters, enhancing recovery rates.

- Subsurface Sensor Networks: Deploying real-time monitoring systems to gain deeper insights into reservoir behavior during and after production.

- Carbon Capture Utilization and Storage (CCUS) Integration: Piloting technologies to capture CO2 emissions from operations, potentially creating new revenue streams and reducing environmental impact.

Chesapeake Energy's significant inventory of Drilled but Uncompleted (DUC) wells and deferred turn-in-line (TIL) wells, held back due to low natural gas prices, are prime examples of 'question marks.' These assets require future capital investment to become productive, with their potential to transform into 'stars' hinging on improved market conditions.

The company's strategic push into new markets, particularly its expanded liquefied natural gas (LNG) strategy, also falls into this category. These initiatives demand substantial upfront capital and carry inherent risks, but they are critical for diversifying revenue streams and securing future growth, especially as the company navigates post-merger integration in 2024.

Investments in nascent technologies for enhanced oil and gas recovery, such as advanced hydraulic fracturing techniques and AI-driven reservoir modeling, are also classic question marks. These ventures, while promising for increased efficiency and unlocking new reserves, require significant R&D and pilot program funding, with their ultimate commercial success still under evaluation in 2024.

Exploratory drilling in emerging oil and gas basins represents another key question mark for Chesapeake. These ventures, while offering the potential for substantial future growth, are capital-intensive and carry a high degree of uncertainty regarding success rates and economic viability, even with a focus on capital discipline in 2024.

BCG Matrix Data Sources

Our Chesapeake Energy BCG Matrix is built on comprehensive data, including financial filings, market research reports, and industry growth forecasts.