China Unicom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

China Unicom, a telecom giant, navigates a dynamic market with significant strengths in its vast network infrastructure and a growing 5G user base. However, it faces intense competition and evolving technological demands.

Want the full story behind China Unicom's market position, its competitive advantages, and the challenges it must overcome? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

China Unicom's position as a major state-owned enterprise is a significant strength. This status provides a bedrock of stability and ensures robust government backing, crucial for its role in building national digital infrastructure. For instance, in 2024, the Chinese government continued to emphasize digital transformation, directly benefiting state-backed telecom providers like China Unicom in their infrastructure build-out initiatives.

This government support translates into strategic alignment with national objectives, such as the 'Digital China' initiative. It also grants China Unicom access to substantial resources, enabling large-scale projects and investments. This backing is vital for competing in capital-intensive areas like 5G and future 6G development, where significant upfront investment is required.

China Unicom boasts a remarkably comprehensive and diversified service portfolio. This includes everything from the latest 5G and emerging 5G-A mobile technologies to robust fixed-line broadband, traditional telephone services, and extensive data communications.

The company also provides a wide array of internet value-added services and tailored enterprise solutions, demonstrating its ability to serve a broad customer base. This wide offering helps ensure revenue stability and creates significant opportunities for cross-selling to both individual consumers and large corporate clients.

China Unicom boasts an extensive network infrastructure, a key strength. By the close of 2024, the company operates over two million shared 5G base stations, representing more than 40% of the global total. This significant footprint positions them at the forefront of mobile connectivity.

The company is aggressively pursuing 5G-Advanced (5G-A) deployment. Their strategic plan aims for 5G-A coverage in over 300 cities by the end of 2025. This forward-looking approach ensures they are well-prepared to support the evolving demands of next-generation digital services and applications.

Aggressive Investment and Leadership in AI and Digital Transformation

China Unicom is demonstrating aggressive leadership in the AI and digital transformation space. The company plans a significant 28% increase in its computing power expenditure for 2025, aiming to achieve 45 EFLOPS of computing power by the close of that year. This substantial investment underscores their commitment to building robust infrastructure for AI development.

Further solidifying its position, China Unicom is actively constructing large-scale intelligent computing centers. These facilities are crucial for supporting the development and deployment of advanced AI solutions. The company is also focused on creating industry-specific AI models, catering to the unique needs of various sectors and driving digital transformation across the economy.

Key strengths in this area include:

- Significant Investment in AI Infrastructure: A planned 28% increase in computing power expenditure for 2025, targeting 45 EFLOPS by year-end.

- Development of Intelligent Computing Centers: Building large-scale facilities to support advanced AI operations.

- Focus on Industry-Specific AI Models: Creating tailored AI solutions to drive digital transformation across different sectors.

Consistent Financial Performance and Growing Digital Business Revenue

China Unicom has showcased robust financial health, with its operating revenue experiencing consistent growth. For the first three quarters of 2024, the company reported a significant increase in profit attributable to equity shareholders, underscoring its operational efficiency and market position.

The company's strategic pivot towards digital services is yielding impressive results. Its Computing and Digital Smart Applications (CDSA) segment, encompassing cloud and intelligent computing, has emerged as a key growth driver. This diversification is crucial, moving beyond traditional telecom services.

- Consistent Revenue Growth: China Unicom's operating revenue has shown a steady upward trend.

- Profitability Improvement: Profit attributable to equity shareholders increased year-on-year in the first three quarters of 2024.

- Digital Business Expansion: The CDSA segment, including cloud and intelligent computing, demonstrates strong growth.

- Revenue Diversification: Success in digital services reduces reliance on traditional connectivity revenue.

China Unicom's status as a major state-owned enterprise is a significant strength, ensuring government backing and stability for national digital infrastructure projects. This alignment with national initiatives like Digital China provides access to substantial resources for capital-intensive investments in 5G and future 6G technologies.

The company possesses a comprehensive and diversified service portfolio, spanning 5G, 5G-A, broadband, and enterprise solutions, which supports revenue stability and cross-selling opportunities.

China Unicom commands an extensive network infrastructure, operating over two million shared 5G base stations by the end of 2024. They are also aggressively deploying 5G-A, with plans for coverage in over 300 cities by the end of 2025, positioning them for next-generation digital services.

The company is a leader in AI and digital transformation, planning a 28% increase in computing power expenditure for 2025 to reach 45 EFLOPS, and is constructing large-scale intelligent computing centers.

China Unicom has demonstrated robust financial health with consistent revenue growth and improved profitability in the first three quarters of 2024, driven by its expanding digital services segment.

| Metric | 2024 (Q1-Q3) | Target 2025 |

|---|---|---|

| 5G Base Stations | > 2 million | N/A |

| 5G-A City Coverage | N/A | > 300 cities |

| Computing Power | N/A | 45 EFLOPS |

| Computing Power Expenditure Increase | N/A | 28% |

What is included in the product

Delivers a strategic overview of China Unicom’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address China Unicom's competitive challenges and leverage its market position.

Weaknesses

China Unicom faces significant challenges from its domestic rivals, China Mobile and China Telecom, which are also state-owned and command substantial market share. This intense competition often results in aggressive pricing strategies, putting downward pressure on average revenue per user (ARPU) across the industry.

As a massive state-owned enterprise, China Unicom might grapple with bureaucratic hurdles. This can translate into slower decision-making and a reduced ability to pivot quickly, a distinct disadvantage when competing with more agile, privately-owned tech firms. For instance, in 2023, while China Unicom reported a net profit of RMB 22.7 billion, its operational agility is inherently constrained by its structure.

China Unicom's significant reliance on government policies presents a key weakness. As a state-controlled entity, its strategic decisions and operational framework are intrinsically tied to directives from Beijing. For instance, the government's push for 5G infrastructure development has been a major driver, but any shift in national priorities could necessitate rapid strategic pivots.

Changes in the regulatory environment pose another challenge. New regulations concerning data privacy, pricing, or market access can directly affect China Unicom's revenue streams and operational costs. The telecommunications sector in China is highly regulated, and evolving policies, such as those related to network neutrality or competition, can create uncertainty and impact profitability.

Furthermore, government initiatives, while often beneficial, can also dictate investment priorities that may not align perfectly with market-driven opportunities. For example, the emphasis on rural broadband expansion, while socially important, might require significant capital expenditure with longer-term or lower returns compared to urban 5G deployment. This can influence the company's financial flexibility and its ability to pursue purely commercial objectives.

Profitability Pressures in Core Connectivity Business

China Unicom's core connectivity and communications (CC) business, while still a revenue driver, faces profitability pressures. This segment experienced a more modest growth rate compared to newer digital services, indicating challenges in a saturated market. For instance, in the first half of 2024, while overall revenue saw an increase, the CC segment's growth lagged behind the expansion in cloud and data services.

Several factors contribute to this weakness:

- Market Saturation: The traditional mobile and broadband markets in China are highly developed, leading to intense competition and limited room for significant price increases or subscriber acquisition.

- Pricing Competition: Aggressive pricing strategies among major carriers put downward pressure on Average Revenue Per User (ARPU) for basic connectivity services.

- Shifting Consumer Demand: As consumers increasingly adopt digital services and value-added offerings, the standalone value proposition of basic connectivity diminishes, impacting its profitability.

Challenges in Global Market Share Expansion

Expanding China Unicom's global market share presents significant hurdles, even with strategic international partnerships. Established global telecommunications giants possess deep-rooted infrastructure and extensive customer bases, making it difficult for new entrants to gain substantial traction. Geopolitical considerations and varying regulatory environments across different countries also add layers of complexity to international expansion efforts.

By 2025, achieving a significant leap in global market share will be an uphill battle. For instance, in the first half of 2024, China Unicom's international business revenue represented a smaller portion of its total compared to domestic operations, highlighting the scale of the challenge. Overcoming the dominance of incumbent players and navigating diverse international market dynamics will require sustained investment and innovative strategies.

- Intense Competition: Established global operators like AT&T, Verizon, and Vodafone have a strong presence and brand recognition, making it hard for China Unicom to capture significant market share.

- Geopolitical Factors: Trade tensions and varying national security regulations in key markets can impede market entry and operational expansion for Chinese companies.

- Regulatory Hurdles: Different countries have unique licensing requirements, spectrum allocation policies, and data privacy laws that can slow down or complicate global growth.

- Infrastructure Investment: Building out the necessary network infrastructure in new international markets requires substantial capital expenditure and time.

China Unicom's core connectivity business faces profitability challenges due to market saturation and intense price competition, leading to lower average revenue per user. Shifting consumer demand towards digital services further erodes the standalone value of basic connectivity. For example, in the first half of 2024, the growth rate of its traditional connectivity segment lagged behind its cloud and data services.

What You See Is What You Get

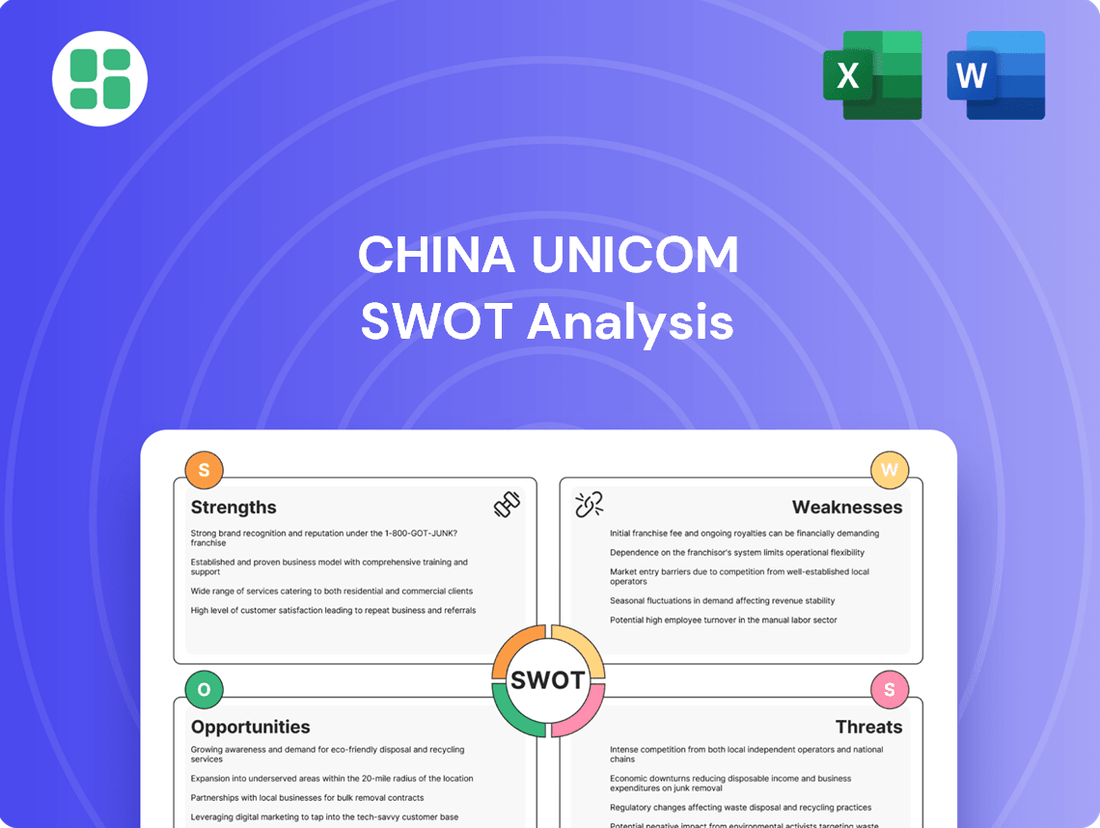

China Unicom SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual China Unicom SWOT analysis, detailing its strengths, weaknesses, opportunities, and threats. The full, comprehensive report, including actionable insights, is unlocked upon purchase.

Opportunities

The evolution to 5G-Advanced (5G-A) opens up substantial monetization avenues for China Unicom, moving beyond simple data transmission to specialized services. This includes high-value applications in the Internet of Things (IoT), the industrial internet, and the development of smart city infrastructure, all of which demand the enhanced capabilities of 5G-A.

China Unicom's strategic investment in industry-specific solutions and AI integration, exemplified by its ‘Xinghuo’ and ‘Baichuan’ initiatives, positions it to capitalize on these emerging markets. For instance, the company is actively developing AI-powered applications for sectors like manufacturing and healthcare, aiming to generate new revenue streams as 5G-A deployment accelerates through 2024 and into 2025.

The increasing demand for cloud services, big data analytics, artificial intelligence, and tailored digital solutions presents a significant opportunity for China Unicom's Computing and Digital Smart Applications (CDSA) business. This aligns with the broader trend of enterprise digital transformation, a market poised for substantial expansion.

China Unicom's strategic focus on bolstering its computing power and its ambition to evolve into a technology services provider, especially within the intelligent computing domain, positions it well to capitalize on this demand. By enhancing its capabilities in these areas, the company can aim to secure a larger portion of the enterprise digital transformation market.

For instance, China Unicom's commitment to intelligent computing is evident in its ongoing investments. In 2024, the company highlighted its significant expansion in computing power, aiming to support the burgeoning needs of various industries. This strategic investment is crucial for capturing market share in the rapidly growing digital solutions sector.

China Unicom is actively integrating Artificial Intelligence into its network operations. This AI-driven approach aims for self-configuring, self-optimizing, and self-healing network capabilities, which is projected to significantly boost operational efficiency and improve the overall user experience for its subscribers.

The company is also pioneering new commercial avenues through AI. By developing advanced AI agents and platforms, such as its 'Yuanjing Wanwu' initiative, China Unicom is positioned to offer flexible, comprehensive AI services to its customer base, unlocking substantial new revenue streams and market opportunities.

Strategic Partnerships and Ecosystem Development

Strategic partnerships are crucial for China Unicom's growth. Collaborating with tech leaders such as Huawei not only fuels innovation but also strengthens its position in the evolving telecommunications landscape. This synergy allows for the development of a comprehensive device ecosystem, ensuring a wider range of compatible products and services for its customers.

Participation in global initiatives like GSMA Open Gateway provides China Unicom with access to cutting-edge technologies and best practices. This engagement helps accelerate the development of new solutions, such as enhanced network capabilities and digital services, thereby expanding its market reach and overall service offerings. Such collaborations are vital for staying competitive in the fast-paced digital economy.

By leveraging external expertise through these partnerships, China Unicom can efficiently develop and deploy advanced technologies. This approach allows the company to focus on its core competencies while benefiting from the specialized knowledge of its partners. For instance, in 2024, China Unicom actively explored 5G-Advanced network enhancements, a field where partnerships with equipment vendors are paramount.

- Accelerated Innovation: Partnerships with technology giants like Huawei drive the development of next-generation network solutions and services.

- Ecosystem Building: Collaborations foster a robust device and application ecosystem, enhancing customer choice and service integration.

- Market Expansion: Leveraging external expertise and participating in global initiatives like GSMA Open Gateway broadens China Unicom's market reach and technological capabilities.

Increased Demand for Digital Transformation Across Industries and Public Sector

China Unicom is well-positioned to capitalize on the widespread digital transformation initiatives across China's economy. The government's emphasis on digitizing sectors like education, healthcare, transportation, and even rural development presents a significant growth avenue for the company's digital solutions and enterprise services.

The company's strategic focus on integrating 5G technology with the Industrial Internet, often referred to as '5G + Industrial Internet,' directly supports these national objectives. Furthermore, China Unicom's development of digital village platforms aligns perfectly with the national rural revitalization strategy, creating a substantial market for its offerings.

- Market Growth: The digital transformation market in China is expanding rapidly, with significant investments anticipated in 2024 and 2025.

- Government Support: National policies actively encourage digital adoption, creating a favorable environment for companies like China Unicom.

- Synergy: China Unicom's existing infrastructure and service development in areas like 5G and industrial internet directly address the needs of this digital push.

The evolution to 5G-Advanced (5G-A) presents significant opportunities for China Unicom to generate new revenue beyond basic data services, particularly in areas like the Internet of Things (IoT) and smart city development. The company's investment in AI and industry-specific solutions, such as its 'Xinghuo' and 'Baichuan' initiatives, positions it to benefit from the accelerating 5G-A deployment through 2024 and 2025, tapping into markets like manufacturing and healthcare.

China Unicom's expansion in computing power and its shift towards becoming a technology services provider, especially in intelligent computing, allows it to capture a larger share of the growing enterprise digital transformation market. This is supported by national digital initiatives that drive demand for cloud services, big data, and AI. For instance, in 2024, the company significantly boosted its computing capacity to meet increasing industry needs.

Strategic partnerships are key for China Unicom's innovation and market reach, enabling the development of advanced network solutions and a comprehensive device ecosystem. Collaborations with tech leaders and participation in global forums like GSMA Open Gateway are vital for staying competitive and expanding service offerings in the dynamic digital economy. These alliances allow for efficient technology deployment, such as the 5G-Advanced network enhancements explored in 2024.

China Unicom is strategically aligned with China's national digital transformation goals, particularly through its 5G integration with the Industrial Internet and its development of digital village platforms. This focus directly addresses government priorities for digitizing sectors like education, healthcare, and rural development, creating substantial growth opportunities for its digital solutions and enterprise services, with strong market growth anticipated through 2025.

Threats

China Unicom faces significant threats from intensifying price competition, exacerbated by market saturation in traditional mobile services. This competitive environment, particularly among the three major Chinese telecom operators, is likely to drive sustained price wars. For instance, in the first half of 2024, the telecom industry saw a continued push for lower-priced data plans, directly impacting ARPU.

This aggressive pricing strategy directly erodes Average Revenue Per User (ARPU), a key profitability metric. As more users migrate to bundled or discounted plans, the revenue generated per subscriber declines, putting pressure on China Unicom's overall profit margins. The ongoing trend suggests that this ARPU erosion will remain a persistent challenge throughout 2024 and into 2025, requiring strategic adjustments to maintain financial health.

The relentless pace of technological evolution, exemplified by the rapid development of satellite communication networks and the emergence of wireless standards beyond 5G-Advanced, presents a significant challenge. For instance, the increasing availability of low-Earth orbit satellite internet services could directly compete with traditional terrestrial broadband offerings, impacting China Unicom's market share.

China Unicom must continually invest in and adapt to these disruptive innovations, such as advancements in AI-driven network management and the rollout of future wireless generations like 6G, which is already seeing early research and development. Failure to keep pace could render its existing infrastructure and service portfolio outdated, diminishing its competitive edge in the dynamic telecommunications landscape.

Changes in government regulations, such as stricter data privacy laws like China's Personal Information Protection Law (PIPL) and evolving cybersecurity policies, present a significant hurdle for China Unicom. These regulations can increase compliance costs and potentially limit how the company operates and expands its services, particularly in areas involving cross-border data flows. For instance, the ongoing scrutiny of data handling practices by regulators globally could impact China Unicom's international partnerships and service offerings.

Geopolitical tensions, especially those involving China and Western nations, pose a threat to China Unicom's global ambitions and its access to critical technologies. Trade disputes and sanctions could disrupt supply chains for essential network equipment and slow down the company's international expansion plans, affecting its ability to compete on a global scale. The company's reliance on foreign technology suppliers for certain advanced network components remains a vulnerability in this environment.

Economic Slowdown and Impact on Consumer/Enterprise Spending

China's economic growth has shown signs of moderation, with the IMF projecting a 4.6% GDP growth for 2024, a slight decrease from previous years. This slowdown poses a threat to China Unicom by potentially reducing consumer disposable income, which could lead to decreased spending on premium mobile plans and value-added services.

Furthermore, enterprises and government entities facing budget constraints may scale back investments in digital transformation initiatives. This directly impacts China Unicom's enterprise segment, which relies on corporate spending for cloud services and dedicated network solutions. For instance, if businesses delay upgrading their IT infrastructure due to economic uncertainty, China Unicom's revenue from these crucial areas could stagnate.

- Reduced Consumer Spending: A 1% dip in disposable income could translate to millions of fewer upgrades or new subscriptions for mobile services.

- Delayed Enterprise Investments: Corporate IT budgets, which saw significant growth in digital transformation in prior years, might contract, impacting cloud and 5G adoption.

- Impact on 5G Expansion: Government incentives for 5G infrastructure development could be reallocated if economic priorities shift, slowing network build-out and service uptake.

Cybersecurity and Data Privacy Concerns

As a leading telecommunications and digital services provider, China Unicom faces significant risks from evolving cyber threats. The increasing sophistication of these attacks, coupled with stringent data privacy regulations like China's Personal Information Protection Law (PIPL), necessitates ongoing, substantial investment in robust security infrastructure. Failure to adequately protect customer data could lead to severe operational disruptions and significant reputational damage.

Key concerns include:

- Target for Sophisticated Attacks: China Unicom's vast network and customer base make it an attractive target for state-sponsored and criminal hacking groups seeking to disrupt services or steal sensitive data.

- Regulatory Compliance Costs: Adhering to PIPL and other data privacy mandates, which came into full effect in November 2021, requires continuous upgrades to data handling and protection systems, adding to operational expenses.

- Reputational Risk: A major data breach could erode customer trust, leading to subscriber churn and impacting future revenue streams. For instance, reports in early 2024 highlighted ongoing vulnerabilities in digital platforms across various sectors, underscoring the persistent threat landscape.

Intensifying price competition, particularly among China's major telecom operators, directly pressures China Unicom's Average Revenue Per User (ARPU). This trend, evident in the first half of 2024 with aggressive data plan pricing, is expected to continue, impacting profitability. Technological advancements, such as satellite internet and future wireless standards, also pose a threat by potentially making existing infrastructure obsolete if China Unicom fails to adapt and invest.

Evolving government regulations, including stricter data privacy laws like China's PIPL, increase compliance costs and could limit operational flexibility. Geopolitical tensions also threaten global ambitions and access to critical technologies, potentially disrupting supply chains and hindering international expansion. A moderated economic growth forecast for China in 2024, around 4.6% according to the IMF, could reduce consumer spending on premium services and slow enterprise investment in digital transformation, impacting revenue from both segments.

| Threat Category | Specific Risk | Impact on China Unicom | Data/Example (2024-2025) |

| Competitive Pressure | Price Wars & ARPU Erosion | Reduced profitability and revenue growth | Continued aggressive pricing on data plans in H1 2024 impacting ARPU. |

| Technological Disruption | Emergence of new technologies (e.g., LEO satellites, 6G) | Risk of infrastructure obsolescence and loss of competitive edge | Early R&D for 6G is underway, requiring significant future investment. |

| Regulatory Environment | Stricter Data Privacy & Cybersecurity Policies | Increased compliance costs, potential operational limitations | PIPL compliance necessitates ongoing system upgrades. |

| Geopolitical Factors | Trade Disputes & Sanctions | Supply chain disruptions, hindered international expansion | Reliance on foreign suppliers for advanced network equipment. |

| Economic Slowdown | Reduced Consumer & Enterprise Spending | Lower demand for premium services and digital transformation projects | IMF projects 4.6% GDP growth for China in 2024, a moderation. |

SWOT Analysis Data Sources

This SWOT analysis for China Unicom is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry forecasts, ensuring a data-driven and accurate assessment.